The yen continues

To grind ever so slowly

To oblivion

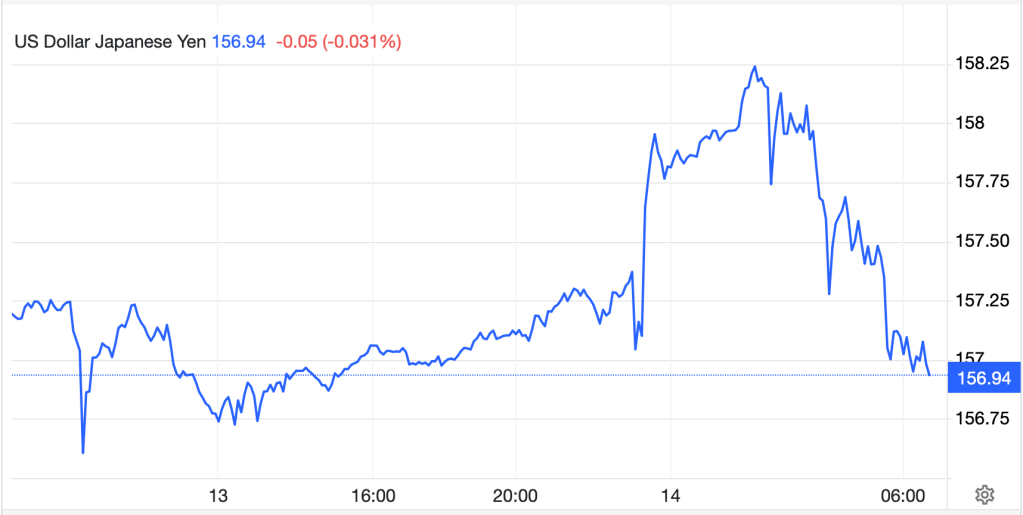

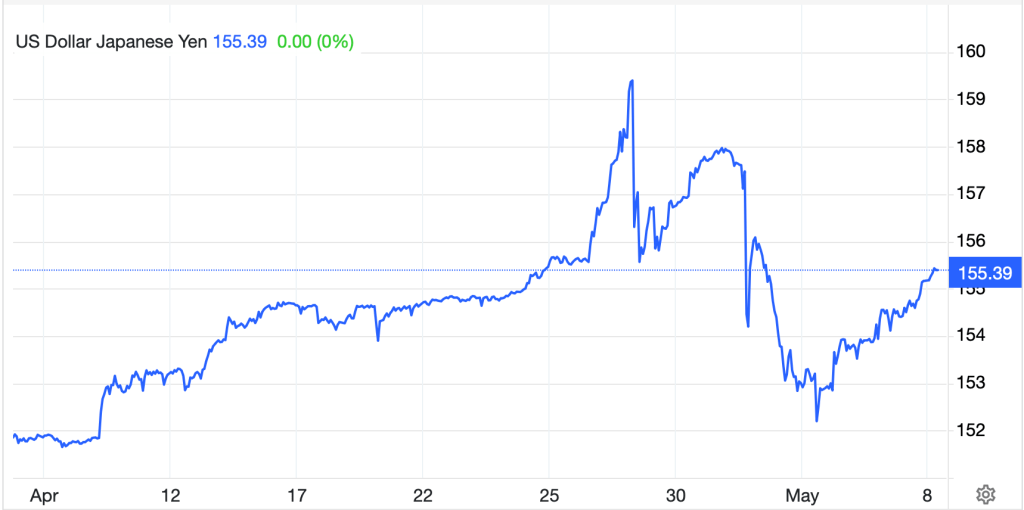

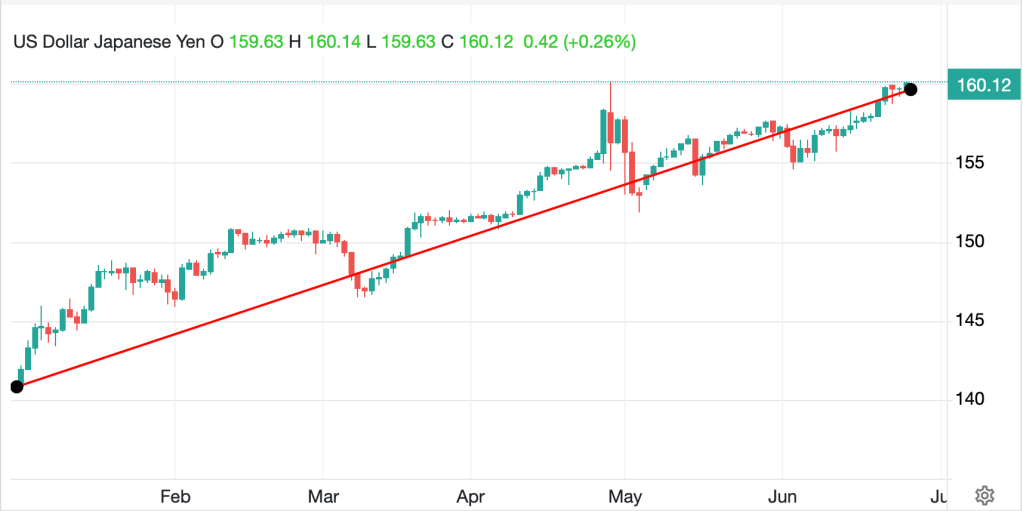

Well, for all those who were either concerned or anxiously awaiting USDJPY’s move to and above 160, we got there early this morning, and the world has not ended. Not only that, but there is no sign of the BOJ/MOF, nor do I believe will there be for a while yet. As I explained on Monday, history has shown, and the MOF has been explicit, that they are far more concerned with the pace of any movement in the currency, rather than the specific level at which it trades. So this much more gradual decline in the yen, while potentially somewhat uncomfortable given its possible impact on inflation going forward, is just not alarming. You can expect to hear Kanda-san or Suzuki-san reply when asked about the currency that they are watching it closely and prefer a stable currency, but I believe they are fairly relaxed about the situation this morning.

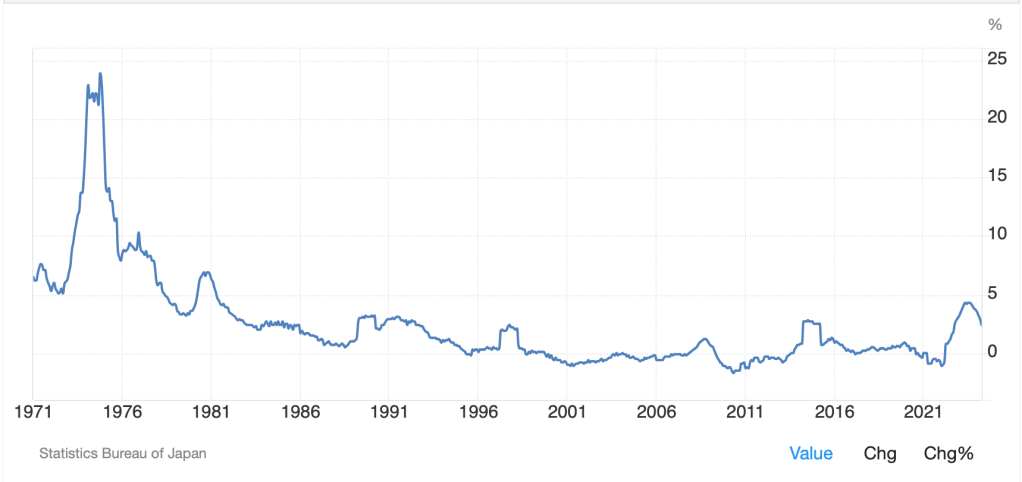

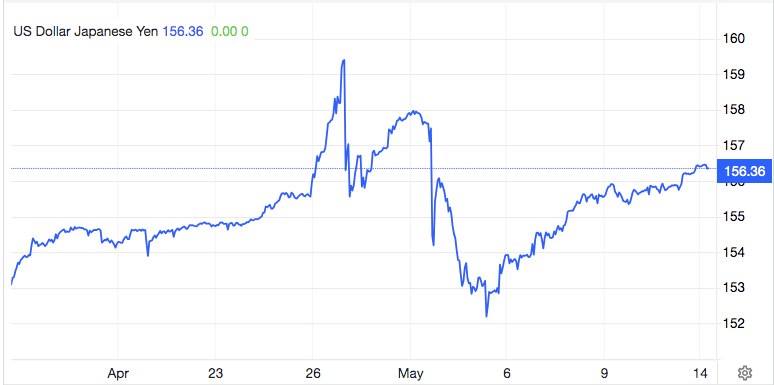

A look at the chart below from tradingeconomics.com shows the trend has been steady all year (which given the interest rate differential between the two currencies makes perfect sense) and that only when things accelerated back at the end of April did it generate enough concern for the MOF to act. If we see another sharp movement like that, you can look for another round of intervention. But, at the current pace, likely all we will get is some commentary about stable movement and vigilance.

Source: tradingeconomics.com

While many worldwide want to think

Inflation is starting to shrink

The data released

Shows it has increased

Down Under with Quebec in sync

With all eyes on Friday’s PCE data as a harbinger of the next Fed activity, it is worthwhile, I think, to mention what we have just seen from two other G10 nations regarding their inflation situation. Starting north of the border, you may recall that earlier this month the Bank of Canada cut their base rate by 25bps in anticipation of achieving their 2% target given the prior direction of travel of their CPI statistics. Oops! Yesterday revealed that both the headline and core readings rose a much higher than forecast 0.6% in May, bringing the annual readings to 2.9% and 1.8% respectively. As well, they focus on the Trimmed-Mean annual number, which also surprisingly rose to 2.9%. now, one month does not a trend make, but Governor Macklem may have some ‘splainin’ to do the next time he speaks. It is possible that inflation has not turned the corner after all.

Meanwhile, Down Under, the RBA must be feeling a bit better as they have maintained a more hawkish stance overall, arguably the most hawkish of any G10 member, and last night’s CPI reading of 4.0%, a 0.4% rise from the April data and 0.2% higher than forecast, is a reminder that inflation can be difficult to conquer for all central banks. Since December, the readings Down Under had been in the low 3’s and many pundits were anticipating that the next leg was lower there as well. Oops again!

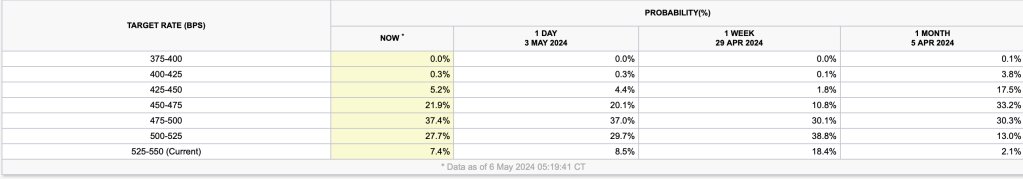

With this in mind, it can be no surprise that the two Fed speakers yesterday, Bowman and Cook were both leaning toward the hawkish end of the spectrum. In fact, Bowman even raised the possibility of future rate hikes as follows [emphasis added], “Reducing our policy rate too soon or too quickly could result in a rebound in inflation, requiring further future policy rate increases to return inflation to 2% over the longer run.” At the same time (well actually, 2 hours earlier) Governor Cook did explain she sees rate cuts coming, just not the timing. To wit, “With significant progress on inflation and the labor market cooling gradually, at some point it will be appropriate to reduce the level of policy restriction to maintain a healthy balance in the economy. The timing of any such adjustment will depend on how economic data evolve and what they imply for the economic outlook and balance of risks.”

It strikes me that no matter how you parse these comments, right now, there is no indication that pretty much anybody on the FOMC is considering rate cuts soon. Futures markets have not really changed their pricing lately with a 10% probability of a July move and a 64% probability of a September cut. However, one interesting tidbit is that in the SOFR futures options market, there has been a very substantial position building in March 2025 97.75 SOFR calls. For these to pay off, Fed funds would need to fall about 300bps between now and March, far more than is discussed or priced right now. While this could certainly be a position hedge of some sort, it does have many tongues wagging.

Ok, a review of the overnight session shows that we are still amid the summer doldrums overall, with some movement in markets, but nothing very dramatic and no real trends developing. In Asia, the Nikkei (+1.25%) rallied on the back of the weak yen and is back approaching the 40K level, although a look at the chart shows simply choppy price action with no direction. Hong Kong was flat, Shanghai (+0.65%) rose and Australia (-0.7%) fell on the back of that inflation data and the realization that the RBA is not cutting rates anytime soon. In Europe, the movement has been weaker, rather than stronger, with French (-0.55%) and Spanish (-0.4%) shares both softer although German and UK shares are essentially unchanged today. Finally, US futures are mixed with small gains for the NASDAQ and S&P while DJIA futures are following through on yesterday’s index declines.

In the bond markets, higher yields are the order of the day with Treasuries and virtually all of Europe higher by 3bps. Overnight, JGBs saw a similar rise in yields which has now taken the 10yr yield there back above that 1.00% pivot. The outlier here is Australia, which given the CPI data there, not surprisingly saw yields jump more, in this case by 11bps.

In the commodity markets, oil (+0.6%) is rebounding from yesterday’s modest declines which came about after API inventory data showed a modest build instead of the expected decline. Gold (-0.4%) is under pressure along with most metals on the back of the dollar’s strength today. In fact, my sense is the dollar is the driver right now.

So, speaking of the greenback, the only G10 currency to make a gain this morning is AUD (+0.15%) based on the higher yields Down Under. Otherwise, the rest of the space is weaker between -0.2% and -0.5% with SEK the laggard. In the EMG space, there is only one currency managing to hold its own, ZAR (+0.5%), which looks more like a trading bounce than a fundamental shift as there has been no data and no news yet on the political front regarding President Ramaphosa’s cabinet appointments. Otherwise, the noteworthy move is that USDCNY has breached 7.30 for the first time since November as the pressure of higher US rates and an overall stronger dollar are too much to prevent continued weakness in the renminbi.

The only data this morning is New Home Sales (exp 640K) and the EIA oil inventories, which while important for the price of oil generally don’t have a macro impact otherwise. As well, there are no Fed speakers on the calendar, but I cannot believe that at least one of them will want to hit the airways somehow.

So, the dollar has legs this morning and unless we get pushback that inflation is falling more clearly, I suspect that yields and the dollar will remain well bid. It doesn’t feel like there is something that can change opinions due today. Tomorrow and Friday, though, have that opportunity, so we shall see.

Good luck

Adf