On Friday, the Moody’s brain trust

At last said it’s time to adjust

America’s debt

As we start to fret

That it’s too large and might combust

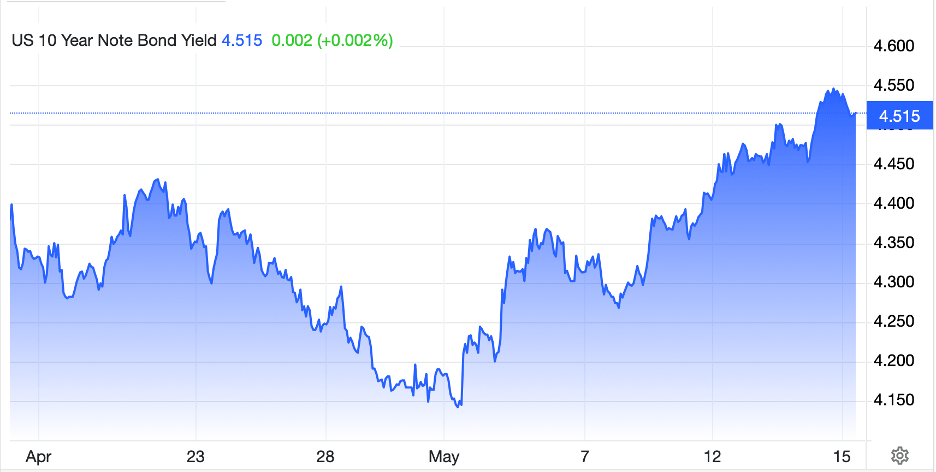

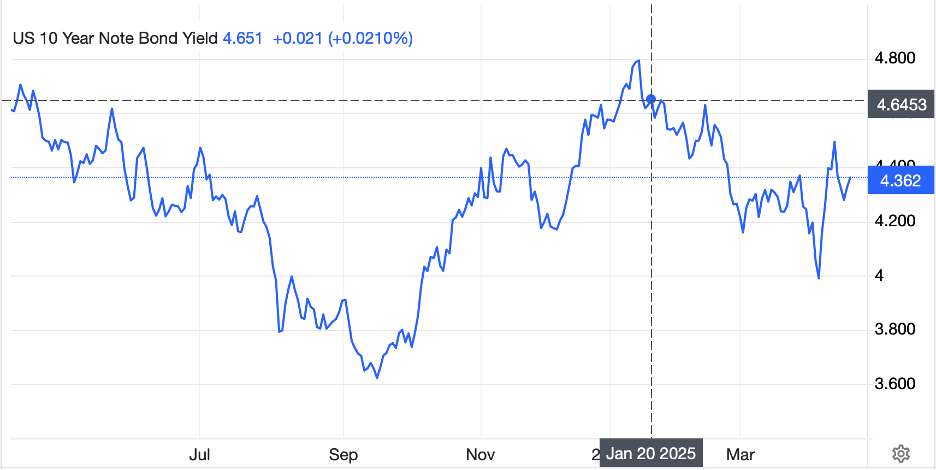

So, Treasury yields are now higher

As pundits explain things are dire

But elsewhere, as well

Seems bonds are a sell

As governments set cash on fire

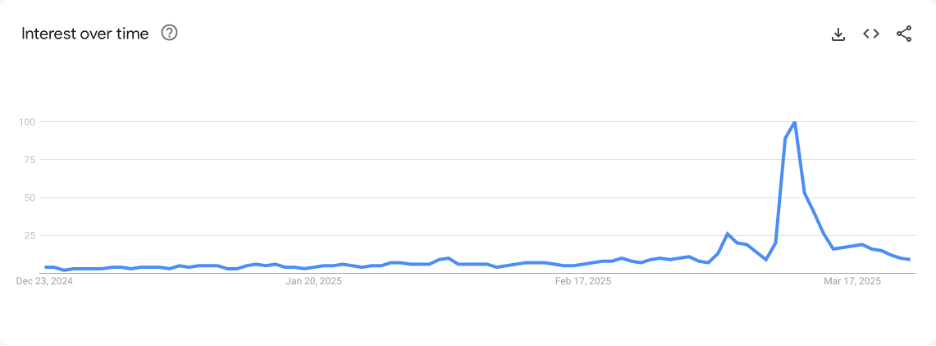

Arguably, the biggest story of the weekend happened late Friday evening as Moody’s became the third, and final, ratings agency to downgrade US government debt to Aa1 from Aaa. S&P did the deed back in 2011 and Fitch in 2023. The weekend was filled with analyses of the two prior incidents and how markets responded to both of those while trying to analogize those moves to today. In a nutshell, the first move in both 2011 and 2023 was for stocks to fall and bonds to rally with the dollar falling. However, in both of those instances, those initial moves reversed over the course of the ensuing months such that within a year, markets had pretty much reversed those moves, and in some cases significantly outperformed, the situation prior to the downgrade.

Looking at Moody’s press release, they were careful to blame this on successive US administrations, so not putting the entire blame on President Trump, but in the end, it is hard to ignore that the nation’s fiscal statistics regarding debt/GDP and debt coverage are substantially worse than that of other nations that maintain a Aaa rating. As well, their underlying assumption is that there will be no changes in the current trajectory of deficits and so no reason to believe things can change.

The most popular weekend game was to try to estimate how things would play out this time although given the starting conditions are so different in the economy, I would contend past performance is no guarantee of future outcomes. In this poet’s eyes, it is not clear to me that it will have a long-term material impact on any market. We have already been hearing a great deal about how Treasuries are no longer the safe haven they were in the past. I guarantee you that institutions looking for a haven were not relying solely on Moody’s Aaa rating for comfort. In addition, given a key demand for Treasuries is as collateral in the financial markets, and the Aa1 rating is just as effective as a Aaa rating from a regulatory risk perspective, I see no changes coming

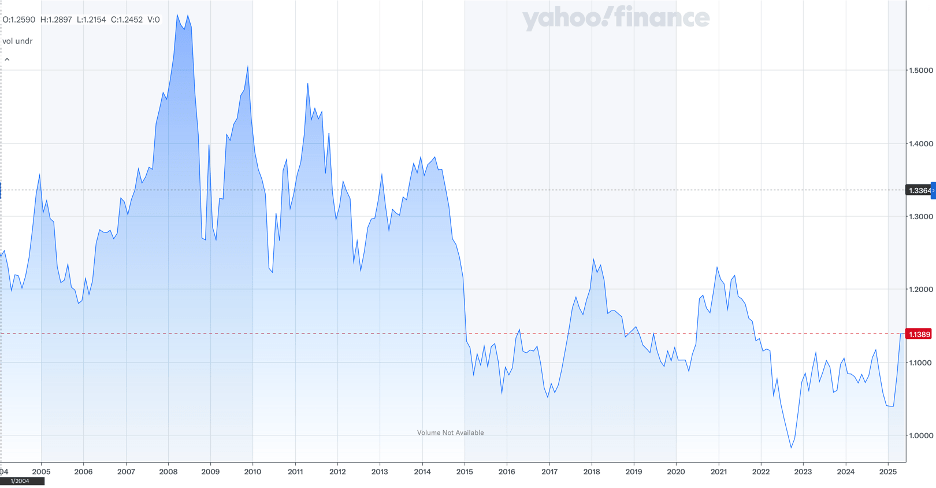

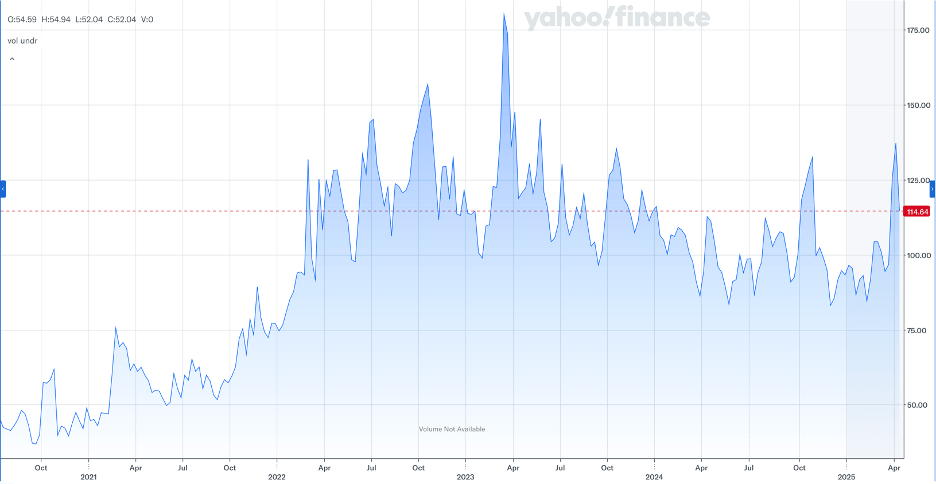

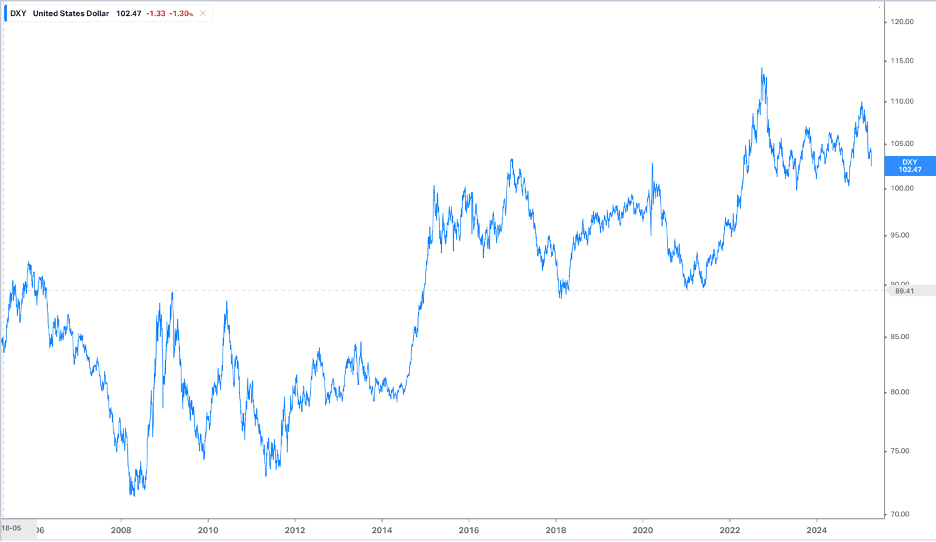

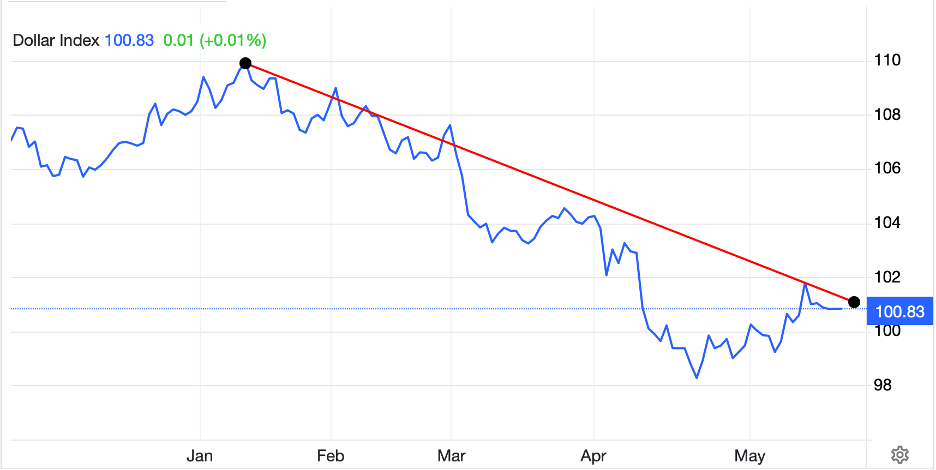

As to equities, I see no substantive impact on the horizon. The equity market remains over richly valued and if it were to decline, I don’t think fingers could point to this action. Finally, the dollar has been declining since the beginning of the year and remains in a downtrend. Using the DXY as our proxy, if the dollar falls further, should we really be surprised?

source tradingeconomics.com

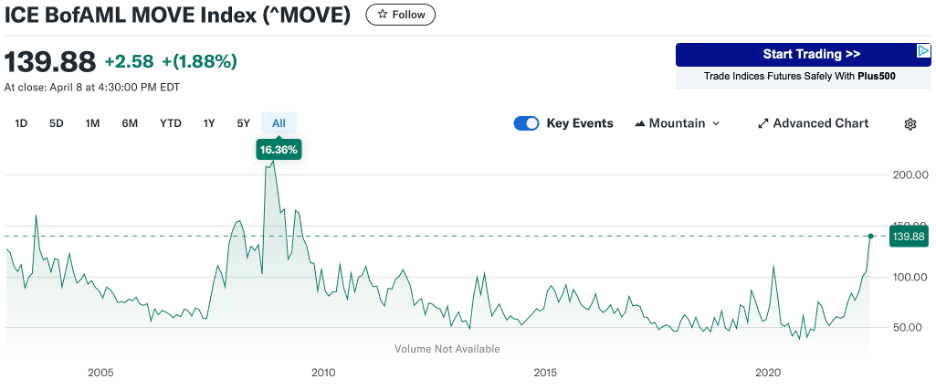

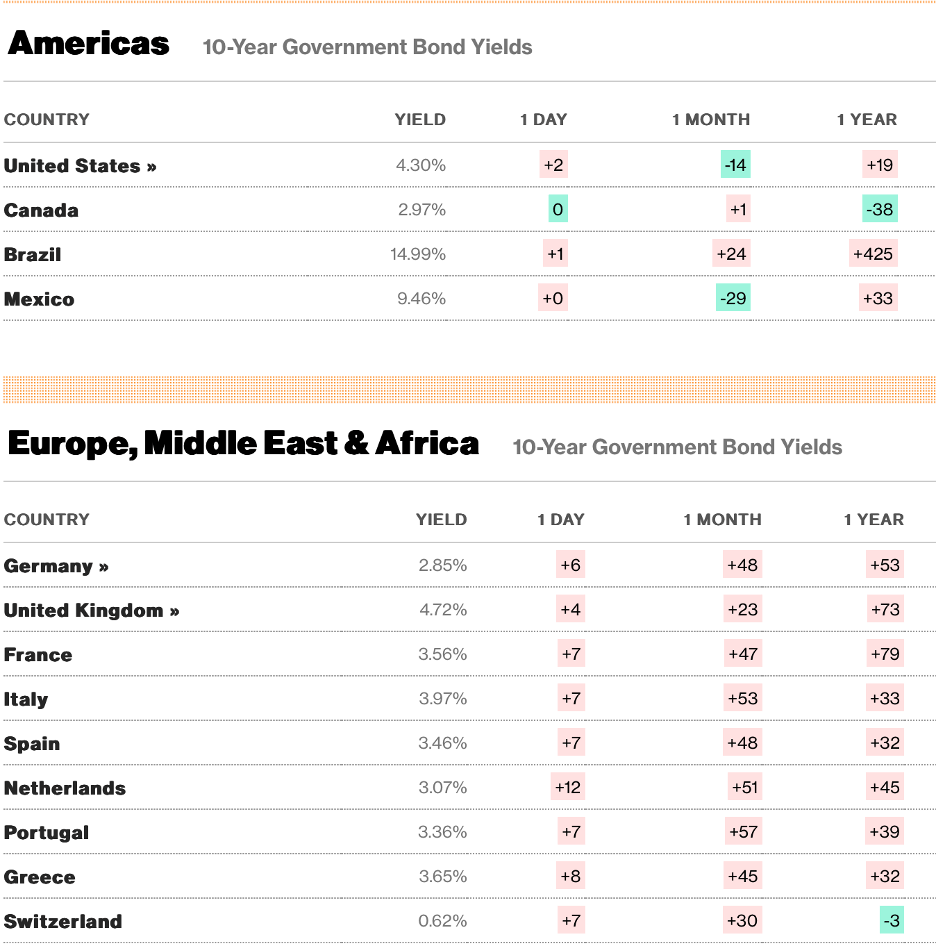

To summarize, expect lots more hyperbole on the subject, especially as many analysts and pundits will try to paint this as a failure of the Trump administration. And while bond yields may rise further, as they are this morning, given the fact that yields are rising everywhere around the world, despite no other nations being downgraded, this is clearly not the only driver.

In fact, one could make the case that bond yields are rising around the world because, like the US, nations all over are talking about adding fiscal stimulus to their policy mix. After all, have we not been assured that Europe is going to borrow €1 trillion or more to rearm themselves? That is not coming out of tax revenue, that is a pure addition to the debt load. As well, is not a key part of the ‘US will suffer more than China in the tariff wars’ story based on the idea that China will stimulate the domestic economy and increase consumption (more on that below)? That, too, will be increased borrowing. I might go so far as to say that the increased borrowing globally to increase fiscal stimulus will lead to higher nominal GDP growth everywhere along with higher inflation. I guess we will all learn how things play out together.

Ok, so now that we have a sense of THE big story, let’s see how markets behaved elsewhere. I thought that today, particularly, it would be useful to see how bond markets around the world have behaved in the wake of the Moody’s news. Below is a screenshot from Bloomberg this morning. note that every major market that is open has seen bonds sell off and I’m pretty confident that Canada’s at the very least, will do so when they wake up. Ironically, the European commission came out this morning and reduced their forecasts for GDP growth and inflation this year and next and still European sovereign yields are higher. I have a feeling that this news is not as impactful as some would have you believe.

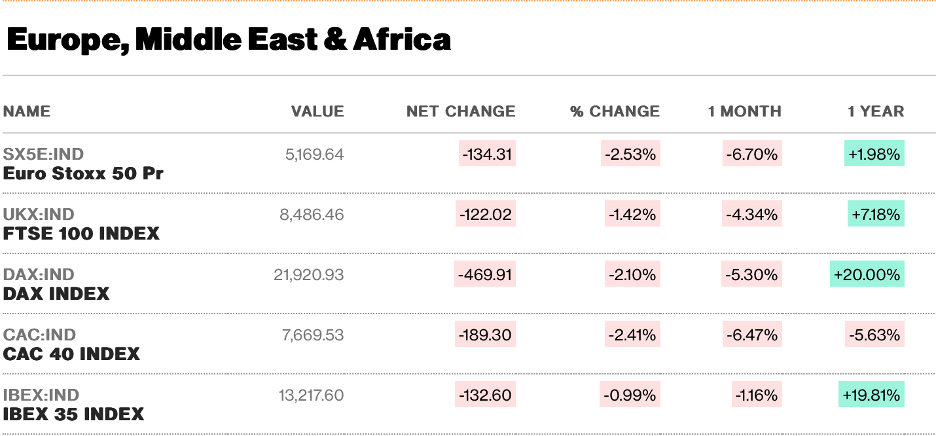

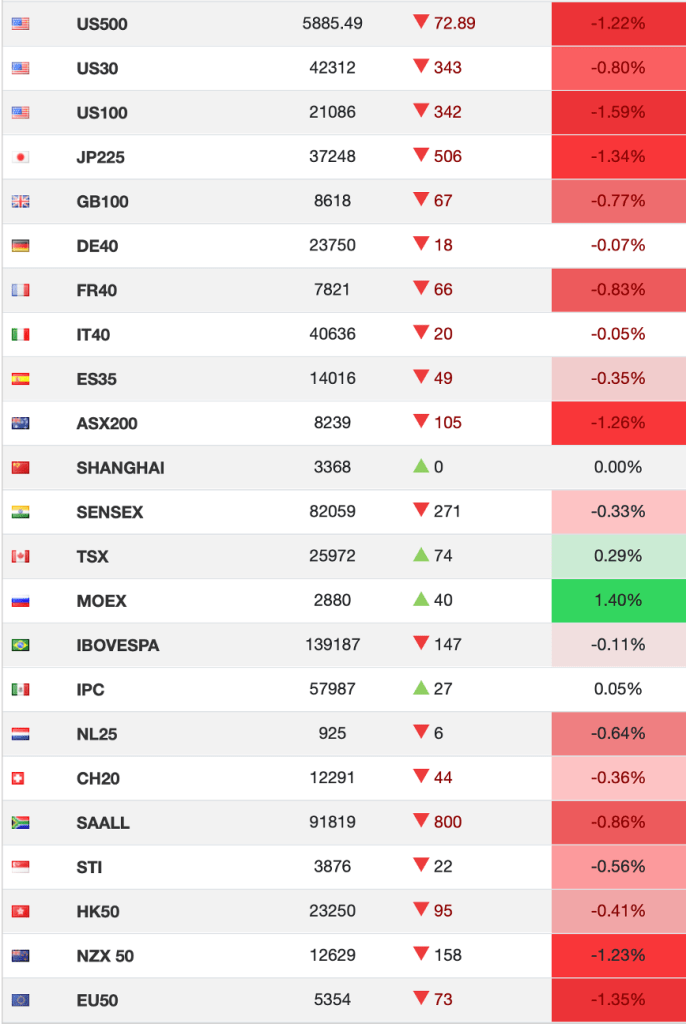

Turning to equity markets, Friday’s US rally is ancient history given the change in the narrative. And as you can see below from the tradingeconomics.com page, every major market is softer this morning (those are US futures) with only Russia’s MOEX rising, hardly a major market. Again, it appears the fallout from the ratings cut is either far more widespread, or not a part of the picture at all. It seems you could make the case that if European growth is going to underperform previous expectations, equity markets there should underperform as well. The other two green arrows are Canada and Mexico, neither of which is open as of 6:30 this morning.

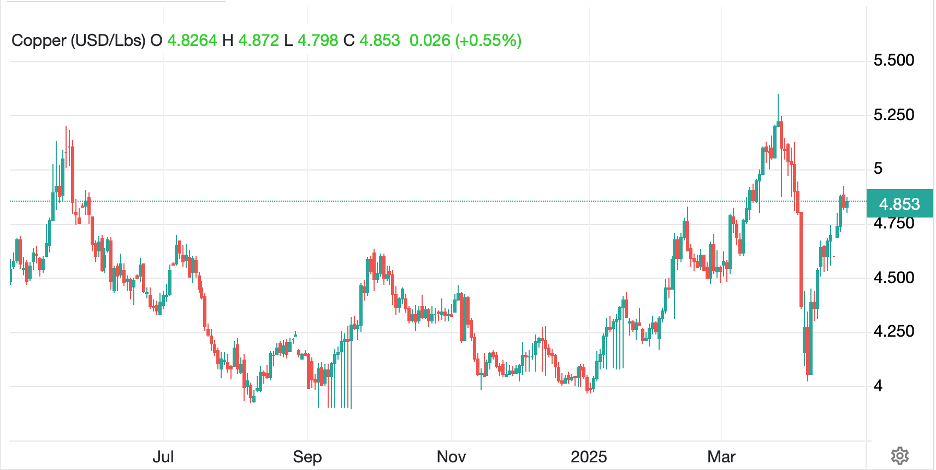

Commodity markets are the ones that make the most sense this morning as oil (-1.3%) is under pressure, arguably on a weaker demand picture after softer Chinese data was released overnight. While the timing of the impacts of the trade war is unsettled, there is certainly no evidence that China is aggressively stimulating its economy. This was very clear from the decline in Retail Sales, Fixed Asset Investment and IP, although the latter at least beat expectations. But the idea that China is changing the nature of their economy to a more consumption focused one is not yet evident. Meanwhile, metals markets are all firmer this morning with gold (+1.2%) leading the way, arguably as a response to the ratings downgrade. This has dragged both silver (+0.9%) and copper (+1.0%) along for the ride. It is not hard to imagine that sovereign investors see the merit in owning storable commodities like metals in lieu of Treasuries, at least at the margin. But also, given the dollar’s weakness, a rally in metals is not surprise.

Speaking of the dollar’s weakness, that is the strong theme of the day along with higher yields across the board. Right now, the euro (+1.0%) and SEK (+1.0%) are leading the way higher although the pound (+0.9%) is also doing well. Perhaps this has to do with the trade agreement signed between the UK and EU reversing some of the Brexit outcomes at least regarding food and fishing, although not regarding regulations or immigration. JPY (+0.6%) is also rallying as is KRW (+0.75%) and THB (+0.9%) as there is a continuing narrative that stronger Asian currencies will be part of the trade negotiations. Finally, Eastern European currencies are having a good day (RON +2.3%, HUF +1.8%, CZK +1.2%, PLN +1.0%) after the Romanians finally elected a president that was approved by the EU. Yes, they had to nullify the first election and then ban that candidate from running again, but this is how democracy works!

On the data front, there is very little hard data to be released this week, although it appears every member of the FOMC will be on the tape ahead of the Memorial Day weekend. Perhaps they are starting to feel ignored and want to get their message out more aggressively.

| Today | Leading Indicators | -0.9% |

| Thursday | Initial Claims | 230K |

| Continuing Claims | 1890K | |

| Flash Manufacturing PMI | 50.5 | |

| Flash Services PMI | 51.5 | |

| Existing Home Sales | 4.1M | |

| Friday | New Home Sales | 690K |

Source: tradingeconomics.com

Actually, as I count, there are three members, Barr, Bowman and Waller who will not be speaking this week, although Chairman Powell doesn’t speak until next Sunday afternoon. In the end, the narrative is going to focus on the ratings cut for a little while, at least for as long as equity markets are under pressure along with the dollar. However, when that turns, and I am sure it will, there will be a search for the next big thing. I have not forgotten about the potential large-scale changes I discussed on Friday, and I am still trying to work potential scenarios out there, but for now, that is not the markets’ focus. Certainly, for now, I see no reason for the dollar to gain much strength.

Good luck

Adf