The Fed keeps on spinning the tale

They’re watching like hawks so that they’llBe able to jumpIn case Donald TrumpDoes not look like going to jail

Be able to act

And not be attacked

If ‘flation forecasts start to fail

Twas Bostic’s turn yesterday to

Explain that the policy skew

Is still quite restrictive

Though that’s not predictive

Of what they may finally do

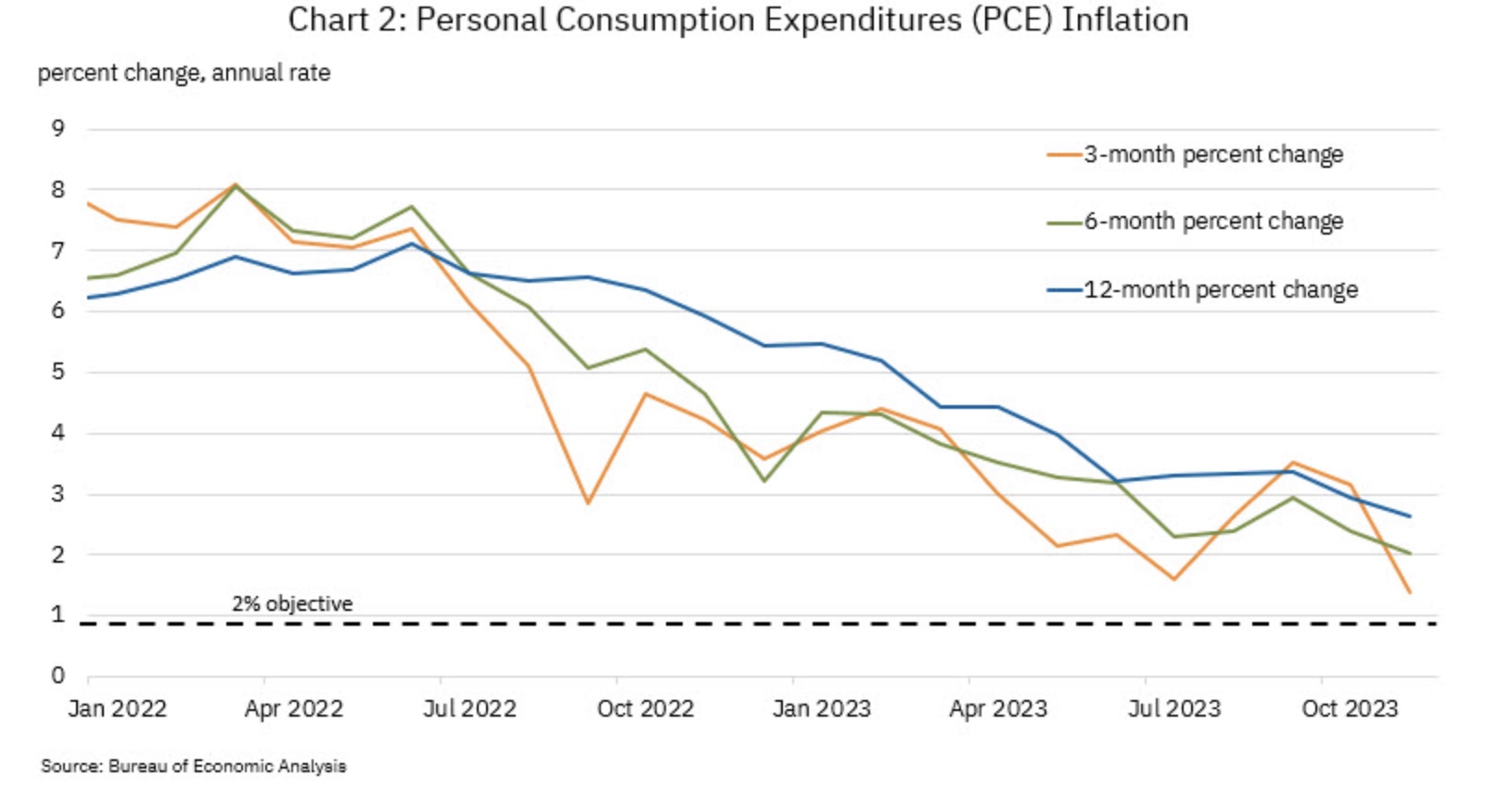

Atlanta Fed President Raphael Bostic was the latest FOMC member to regale us with his views on current policy settings amid two speeches yesterday. The essence of his comments lines up with what we have heard for the past two weeks; policy is sufficiently restrictive to help drive inflation down to their 2% target, but they will be vigilant if that is not the outcome. One of the things that he mentioned, and that has been a really popular chart crime over the past few months, at least for the doves, is he discussed annualizing the most recent three months of PCE data and the most recent 6 months of PCE data as proof that they are doing a good job. In fact, in one of his two presentations, he used the following chart:

Unquestionably, if you look at the orange line, which represents the annualized value of the past 3 months, it shows that PCE is “now” running below their target. But let me ask you a question, looking back to H1 of 2022, when inflation was peaking. Both the 3-month and 6-month changes were well above the annual number at the time. Do any of you remember the focus on those short-term nonsense numbers? Me neither. My point is the only number that matters is the actual annual one as that is their target. Any indication that it is flattening or turning higher, just like the CPI data did earlier this month, is going to put paid to this story. While I have no idea where next week’s data is going to print, we must be wary of the narrative spin on the actual data. If we know one thing about the Fed, by definition, they are reactive. That is what following the data means. If they were predictive, they would move before the data, but they never do that.

So, all this talk of cutting before inflation gets too low is not monetary policy. However, we cannot rule out a cut based on the political implications as they view rate cuts as a way to boost the economy and try to ensure the current president is re-elected rather than the likely Republican candidate gets back in. Alas, for now, we will have to live with the spin. Today we hear from two more Fed speakers, SF’s Mary Daly and Governor Michael Barr. I suspect we will hear exactly the same message from both. Too early for cuts, but they are ready when the time comes.

Meanwhile, across the pond, the preponderance of ECB speakers has been very clear that March is off the table for a rate cut but June seems to be what they see as likely. Here, too, they see the trend as their friend, but inflation readings are still nowhere near their 2.0% target. However, it is clear that the pain of higher rates is having a much larger impact on Europe than on the US as GDP data continues to deteriorate. Germany is in recession and much of the rest of the continent is on its way. The benefit for Madame Lagarde is that the Europeans did not inject nearly as much stimulus during the Covid years as the US, so it is likely the Eurozone economy is following a better-known path. In the end, though, they are very anxious for the Fed to get started as they really want to start cutting rates, I believe, but with inflation still far above target and the Fed still holding on, they would have no rational explanation for their actions.

One last thing to note is CPI in Japan was released last night and it fell to 2.6% headline and 2.3% core. Any idea that the BOJ was going to need to tighten policy in the near-term to fight too high inflation has been dissipating quickly. It turns out that they may have been correct to leave policy unchanged as now they do not need to do anything to be in the right spot. The market response mostly made sense as the yen weakened with the dollar now above 148, while the Nikkei rose another 1.4% and is pushing those recent 30+ year highs. The weird thing, though, was the JGB market which saw yields rally 4bps, back to their highest level in a month. I have been unable to find any solid explanation for this move as certainly it is not fundamental.

Anyway, let’s look at the rest of the overnight session to see how things are feeling as we close the week. After a solid US equity session yesterday, most of Asia had a good go of things with rallies pretty much everywhere except China and Hong Kong. The equity markets in both those nations have been under significant pressure lately and show no signs of turning. While the market is not the economy, President Xi has already called for the end of short sales and is now leaning on domestic institutions to not sell at all. With the property market already in the tank, a rapidly declining stock market is not a good look for the concept of prosperity for all. Europe, though, is modestly higher this morning and US futures are also in the green following yesterday’s session.

In the bond markets, Treasury yields are little changed on the day, but remain above the 4.10% level that some are calling a key technical spot. European sovereigns, though, are all rallying more aggressively with yields falling between 3bps and 7bps despite what are continuous calls for the ECB to maintain tight policy for longer than the market is pricing. Perhaps investors are feeling better about inflation prospects if the ECB holds the line.

After a rally yesterday, oil prices are essentially unchanged this morning. The unrest in the Red Sea continues with the Houthis firing more missiles and fewer and fewer ships willing to transit the area while yesterday’s tit-for-tat Iran-Pakistan missile attacks are now merely history. The fact that oil remains below $74/bbl implies it is not really pricing any possibility of a larger Middle East conflict. That seems pretty hubristic to me as the probabilities seem to be far larger than zero. As to the metals markets, both precious and base metals are firmer this morning in sync with softer yields and a softer dollar.

Speaking of the dollar, while it is ever so slightly lower on a DXY basis this morning, it continues to hold the bulk of its gains for the past month. Versus G10 currencies, the picture is mixed with GBP (-0.2%) underperforming after absolutely abysmal Retail Sales data was released this morning, but the rest of this bloc is higher by about 0.2% or so on average. In the EMG space, the direction is broadly for currency strength, but the movement remains modest at best, on the order of 0.1%-0.3%. In other words, not much is going on here.

On the data front, yesterday brought a mixed picture with Housing data slightly better than expectations, although starts fell compared to last month. Initial Claims printed at 187K, their lowest in a very long time, but Philly Fed was at a worse than expected -10.6, not as bad as Empire State, but still not too bullish! Today brings Michigan Sentiment (exp 70.0) and Existing Home Sales (3.82M) as well as the above-mentioned Fed speakers. After today, the Fed is in their quiet period, so we will have to make up our own minds as to what the data means.

For now, the market seems quite comfortable buying dips and as evidenced by the Fed funds futures market, is still pricing a 55% chance of a March cut. While that probability is shrinking slowly, there are still 6 cuts priced in for the year. At this point, my thesis of the market fighting the Fed for the first half of the year before capitulating to higher inflation prospects and higher yields amid slowing growth remains my best guess. But that is just me. Absent something really surprising from Daly or Barr, I suspect that there will be limited price movement going into the weekend.

Good luck and good weekend

Adf