In China, Xi’s still not persuaded

The actions he’s taken have aided

The ‘conomy’s course

The outcome, perforce

Is access to money’s upgraded

In an otherwise very uninteresting session, the biggest news comes from China where the PBOC cut both the 1yr and 5yr Loan Prime Rates by a more than expected 25bps last night. While PBOC chief Pan Gongsheng did indicate that more cuts were coming, the speed and size of this move are indicative of the fact that worries are growing about the nation’s ability to achieve their “around 5%” GDP growth target. At least the people who will be blamed if they don’t achieve it are starting to get worried!

The interesting thing about this move is the singular lack of impact it had on Chinese markets with the CSI 300 rising a scant 0.25% for the session. Although, perhaps it had more impact than that as the Hang Seng (-1.6%) seemed to express more concern over the need for the move than embrace any potential benefits.

Ultimately, the issue for Xi is that the breakdown of economic activity in China remains unbalanced in a manner that is no longer effective for current global politics. China’s rapid growth since its accession to the WTO in 2001 has been based on, perhaps, the most remarkable mercantile effort in the world’s history. But now, that mercantilist model is no longer politically acceptable to their main markets as the rest of the world has seen a significant political shift toward populism. Populists tend not to be welcoming to foreign made goods (or people for that matter), and so Xi must now recalculate how to continue the growth miracle.

Economists have long explained that China needs to see domestic consumption, currently ~53%, rise closer to Western levels of 65% – 70% in order to stabilize their economy. However, that has been too tall an order thus far. It is far easier in a command economy to command businesses to produce certain amounts of stuff, than it is to command the citizens to consume a certain amount of stuff, especially if the citizens remain shell-shocked over the destruction of their personal wealth as a result of the imploding property bubble. As much as Xi wants to change this equation, it seems clear he doesn’t feel he has the time to wait for the gradual adjustment required, as that might result in much weaker GDP growth. Given that the most important promise he has made, at least tacitly, to his people is that by taking more power he will increase their prosperity, he cannot afford any indication that is not the path on which they are traveling.

My take is that we are going to continue to see more efforts by the Chinese to prop up the economy, but it remains unclear if the fiscal ‘bazooka’ that many in markets have anticipated will ever be fired. History has shown the Chinese are much more comfortable with slow and steady progress, rather than massive changes in policy, at least absent an actual revolution! Ultimately, nothing has changed my view that the ultimate relief valve is for the renminbi to depreciate over time. Xi is fighting that for geopolitical reasons, not for economic ones, but unless or until the domestic situation there changes, I believe that will be the destiny.

Away from the China story, though, there is precious little else of note ongoing, at least in the financial markets. As this is not a political discourse, I will not discuss the election until afterwards as only then will we have an idea of what will actually happen fiscally and economically. Meanwhile, everything else seems status quo.

So, let’s look at the overnight markets. Aside from China and Hong Kong, and following Friday’s very modest rally in the US, the rest of Asia had no broad theme attached. There were gainers (Korea, Australia, New Zealand) and laggards (India, Japan, Singapore) with movements of between 0.5% and 0.75% while the rest of the region saw much lesser activities. In Europe, the mood is dourer with red the only color on the screen ranging from the UK (-0.2%) to virtually all the large continental bourses (CAC, DAX, IBEX) at -0.8%. There has been no data of note to drive this decline except perhaps the fact that the dollar continues to rise, a situation typical of a risk-off environment.

In the bond markets, yields are climbing across the board this morning, a very risk-on perspective. (This is simply more proof that the traditional views of asset performance for big picture risk on or off movements is no longer valid.) At any rate, Treasury yields have risen 4bps while European sovereign bonds have all seen yields jump between 7bps and 8bps. It appears that bond investors are growing somewhat concerned that central banks are going to allow inflation to run hotter than targeted over time as they are desperate to prevent any significant economic downturn. As well, given the Treasury market leads all other bond markets, and US economic data continues to perform, that is a key global yield driver as well.

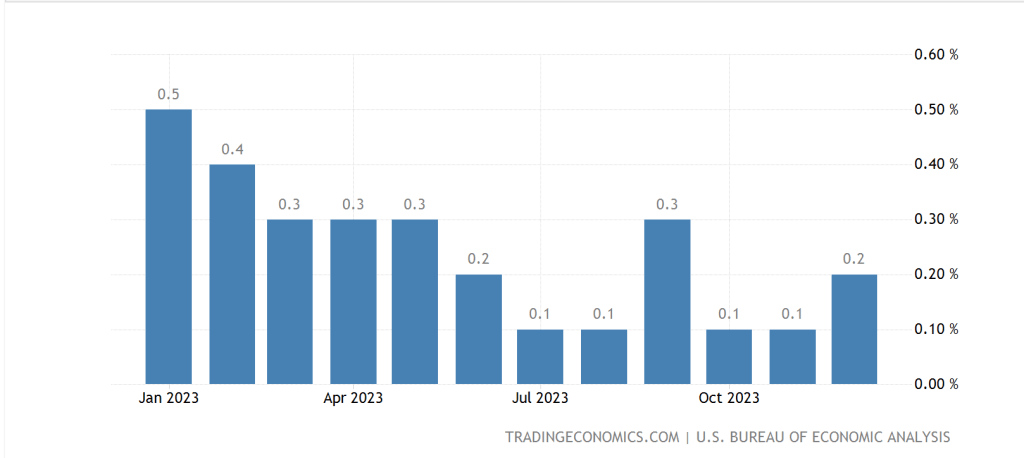

Arguably, the biggest story in markets continues to be the commodities space, specifically metals markets, as once again, and despite today’s dollar strength, we see gold (+0.5%), silver (+1.0%) and copper (+1.1%) rallying with the barbarous relic making yet another set of new all-time highs while silver has broken above a key technical resistance level at $32.00/oz as seen in the chart below.

Source: tradingeconomics.com

One of the reasons I focus on commodities so much is I believe they are telling an important story about the state of the global economy. We have seen a decade of underinvestment in the production of stuff, especially metals, but also energy, as this has been sacrificed on the altar of ESG policies. But the world marches on regardless, and that stuff is necessary to build all the things that people want and are willing to pay for. As they say, the cure for high prices is high prices, meaning high prices are required to increase supply. That is what we are witnessing, I believe, the beginning of high enough prices to encourage the investment required to increase the supply of these critical inputs to the economy. However, given the often decade-long process to get from discovery to production of things like metals, look for these prices to continue to rise as a signal that demand is growing ahead of supply.

As to oil prices, they too, have found legs this morning with a significant bounce (+2.2%) and back above $70/bbl. On the energy front, we are also seeing NatGas rally sharply with gains in both the US and Europe of > 2%.

Finally, the dollar, as I mentioned, is stronger this morning with only NOK (+0.1%) outperforming the greenback in the G10 space as the dollar benefits from rising yields and continued strong growth, at least as measured by the major data points. In the EMG bloc, it is universal with the dollar higher against all comers and the worst performers (KRW -0.75%, HUF -0.7%, MXN -0.3%) in each region continuing their recent trend declines. Until we see a substantive change in the US economic situation, I see no reason for the dollar to fall very far at all.

On the data front, this week brings a lot more Fedspeak than hard data, but this is what we have.

| Today | Leading Indicators | -0.3% |

| Wednesday | Existing Home Sales | 3.9M |

| Thursday | Chicago Fed Nat’l Index | 0.2 |

| Initial Claims | 247K | |

| Continuing Claims | 1865K | |

| Flash PMI Manufacturing | 47.5 | |

| Flash PMI Services | 55.0 | |

| New Home Sales | 720K | |

| Friday | Durable Goods | -0.9% |

| -ex Transport | -0.1% | |

| Michigan Sentiment | 69.3 |

Source: tradingeconomics.com

None of this is all that exciting or likely market moving, but we will be regaled with speeches from seven more FOMC members, both governors and regional presidents. While ordinarily I feel like these comments have limited impact, my take is the market is starting to adjust its views of future Fed actions. After all, the rationale to cut rates is hard to understand if the economic data continues to rise alongside inflation. As of this morning, the market is pricing in a 93% probability of a November cut and a 73% probability of a December one as well. While I agree November is a necessity for them to save face, I think December is a much longer shot than that based on recent data.

With the last two weeks ahead of the election upon us, things are heating up further and most focus will be there. Given the secondary nature of this week’s data, my suspicion is that absent a massive surprise, or a really consistent theme amongst the Fed speakers that rates are going to go a lot lower soon, the dollar is going to continue its recent rebound.

Good luck

Adf