As Jay and his minions convene

A new man is making the scene

Now, Stephen Miran

A man with a plan

Will help restart Jay’s cash machine

But something that’s happened of late

Is talk of a third Fed mandate

Yes, jobs and inflation

Have been the fixation

But long-term yields need be sedate

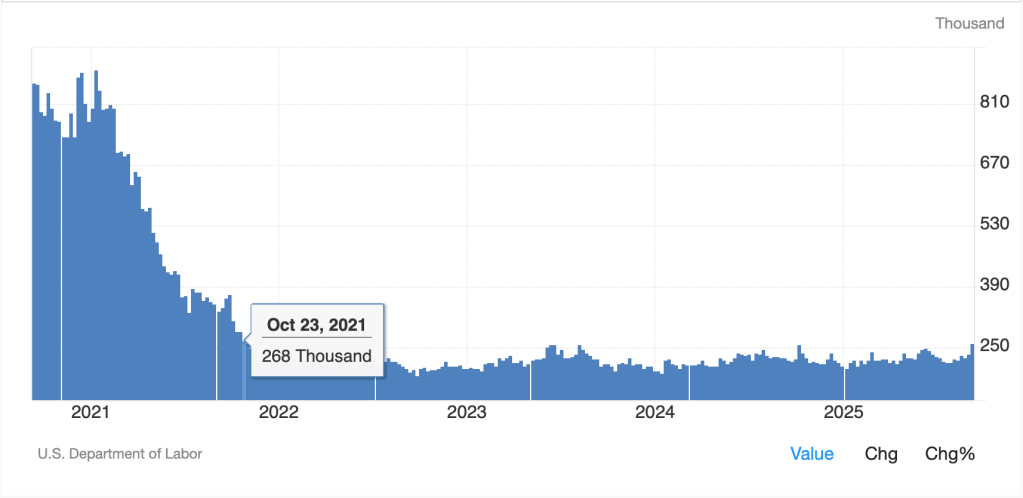

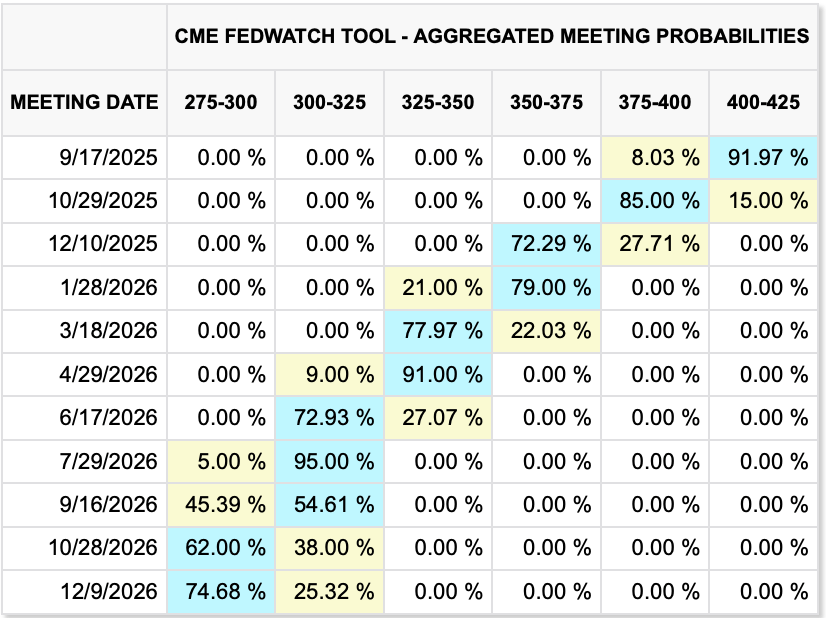

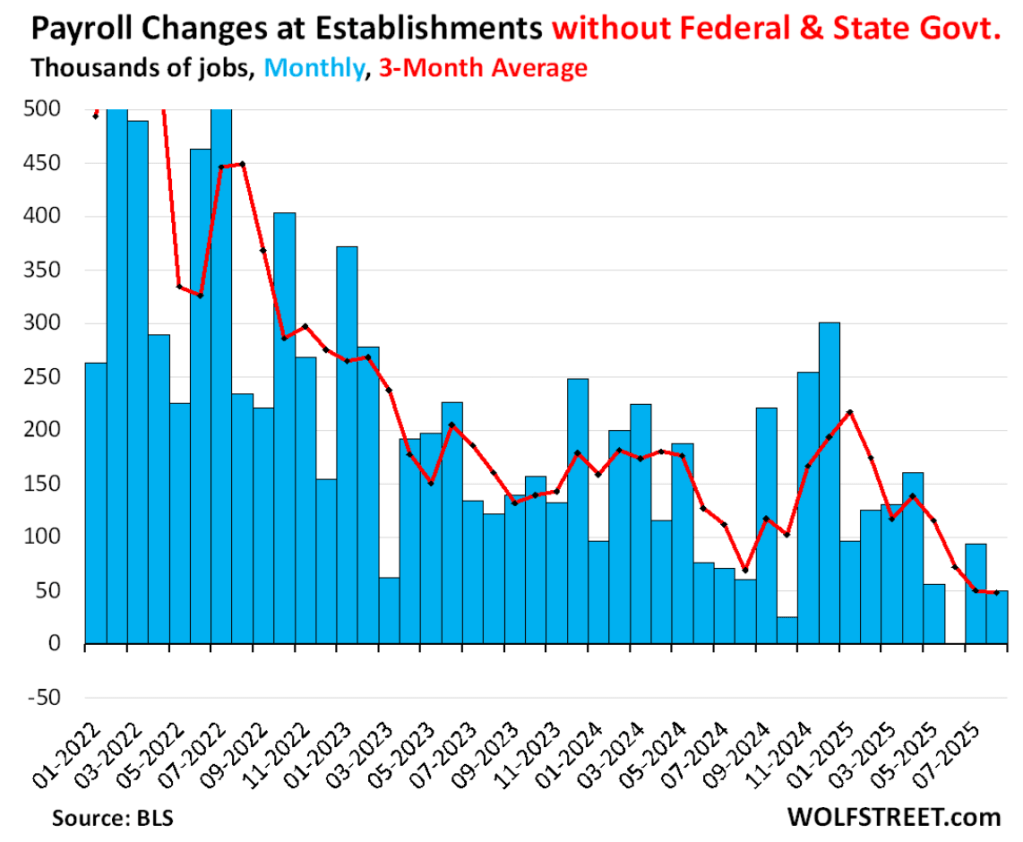

As the FOMC begins their six-weekly meeting this morning, most market participants focus on the so-called ‘dual mandate’ of promoting the goals maximum employment and stable prices. This, of course, is why everybody focuses on the tension between the inflation and unemployment rates and why the recent revisions to the NFP numbers have convinced one and all that a rate cut is coming tomorrow with the only question being its size. But there is a third mandate as is clear from the below text of the Federal Reserve Act, which I have copied directly from federalreserve.gov [emphasis added]:

“Section 2A. Monetary policy objectives

The Board of Governors of the Federal Reserve System and the Federal Open Market Committee shall maintain long run growth of the monetary and credit aggregates commensurate with the economy’s long run potential to increase production, so as to promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates.

[12 USC 225a. As added by act of November 16, 1977 (91 Stat. 1387) and amended by acts of October 27, 1978 (92 Stat. 1897); Aug. 23, 1988 (102 Stat. 1375); and Dec. 27, 2000 (114 Stat. 3028).]”

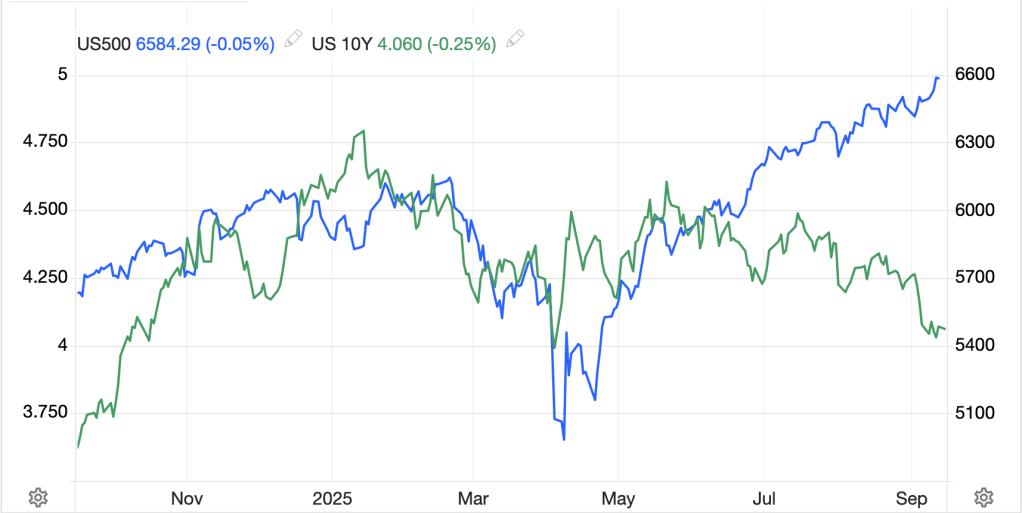

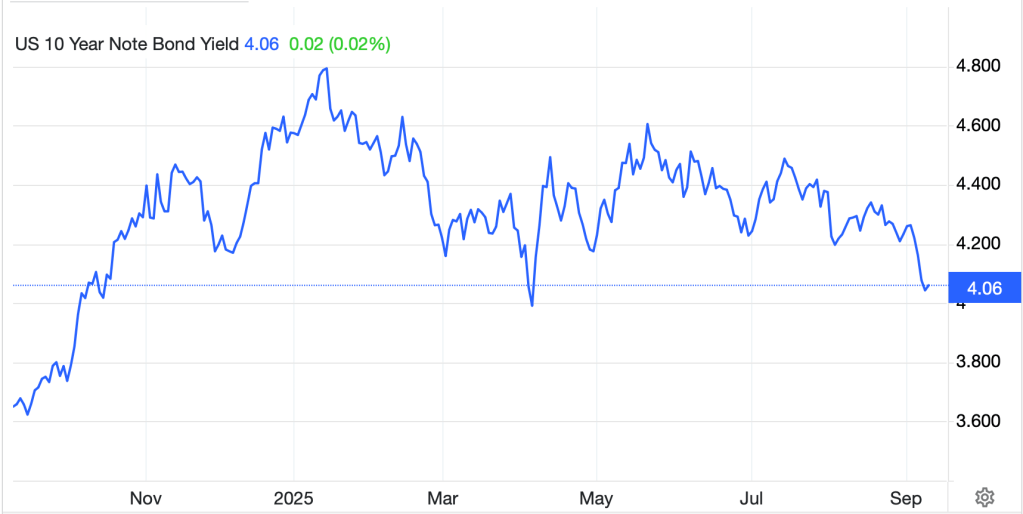

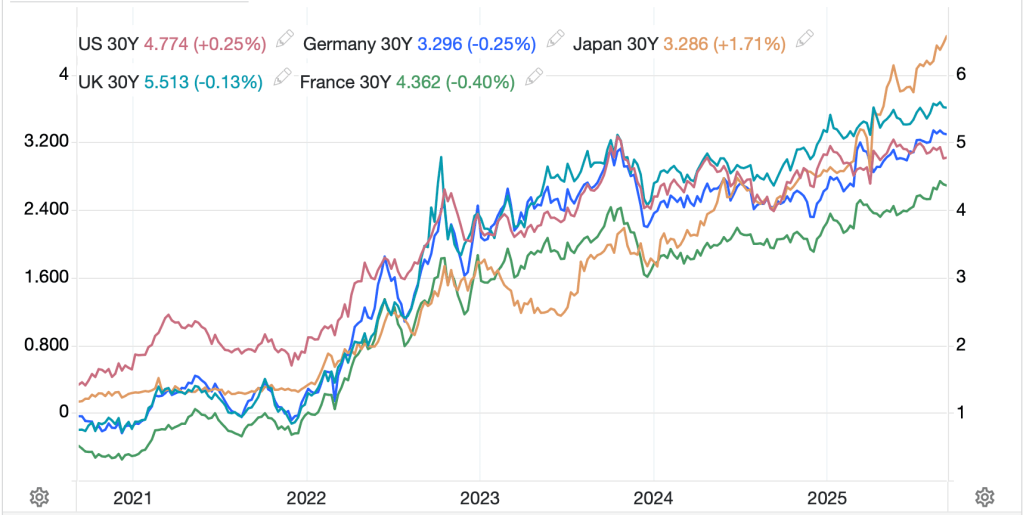

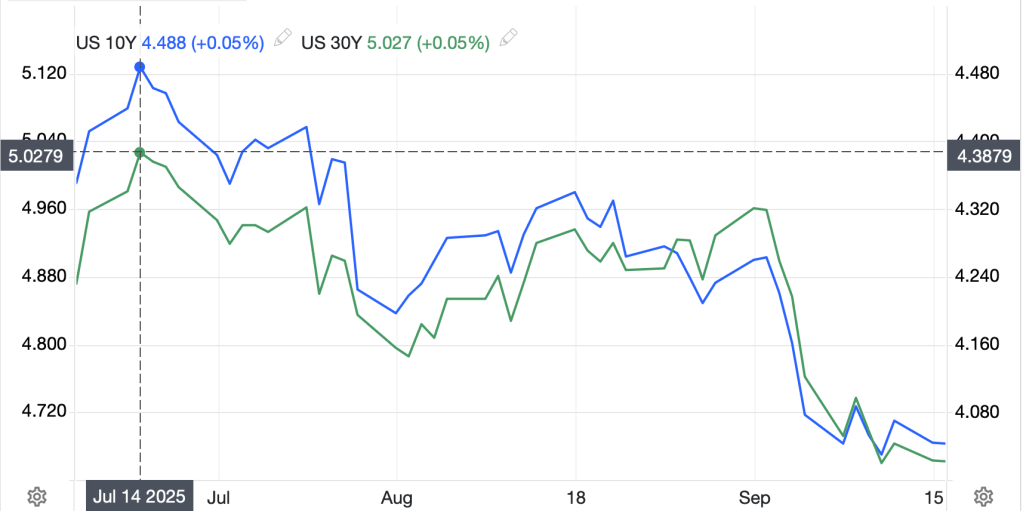

One of the things we have heard consistently from Treasury Secretary Bessent is that he is highly focused on ensuring that longer-term yields do not get too high. Lately, the market has been working to his advantage with both 10-year, and 30-year yields having declined by more than 25bps in the past month. And more than 40bps since mid-July. (Look at the yields listed on the top of the chart below to see their recent peaks, not just the line.)

Source: tradingeconomics.com

Now, with President Trump’s head of the CEA, Stephen Miran getting voted onto the board to fill the seat that had been held by Governor Adriana Kugler, but heretofore vacant, one would think that the tone of the conversation is going to turn more dovish. What makes this so odd is that, by their nature, central bankers are doves and seemingly love to print money, so there should be no hesitation to cut rates further. But…that third mandate opens an entirely different can of worms and brings into play the idea of yield curve control as a way to ensure the Fed “promote(s)…moderate long-term interest rates.”

It was Ben Bernanke, as Chair, who instigated QE during the GFC although he indicated it was an emergency measure. It was Janet Yellen, as Chair, who normalized QE as one of the tools in the toolbox for the Fed to address its dual mandate. I believe the case can be made that newly appointed Governor Miran will begin to bang the drum for the Fed to act to ensure moderate long-term interest rates, and there is no better policy to do that than QE/YCC. Actually, there is a better policy, reduced government spending and less regulation that allows productivity to increase and balances the production-consumption equation, but that is out of the Fed’s hands.

At any rate, we cannot ignore that there could be a subtle change in focus to the statement and perhaps Chairman Powell will discuss this at the press conference. If this has any validity, a big IF, the market impacts would be significant. The dollar would start another leg lower, equities would rise sharply, and commodity prices would rise as well. Bonds, of course, would be held in check regardless of the inflationary consequences. Just something to keep on your bingo card!

Ok, let’s check out the overnight activity. While it was quiet in the US yesterday, we did manage to make more new highs in the S&P 500 as all three major indices were higher. As to Asia, Tokyo (+0.3%) had the same type of session, with modest gains as it takes aim at a new big, round number of 45,000. China (-0.2%) and HK (0.0%) did little although there was a lot of positivity elsewhere in the region with Korea (+1.2%), India, (+0.7%) and Taiwan (+1.1%) leading the way amidst almost all markets, large and small, showing gains. Europe, though, is a different story with red today’s color of the day, as Spain (-0.8%) and Germany (-0.6%) leading the down move despite better-than-expected German ZEW data (37.3 vs. 26.3 expected). One of the things I read this morning was that German auto manufacturers have laid off 125,000 workers in the past 6 weeks. That is a devastating number and bodes ill for German economic activity in the future. As to other European bourses, -0.1% to -0.4% covers the lot. US futures, though, continue to point higher, up 0.3% at this hour (7:30).

In the bond market, Treasury yields are unchanged this morning while European sovereign yields have edged higher by between 1bp and 2bps. It doesn’t feel like investors there are thinking of better growth, but we did hear from several ECB members that while cuts are not impossible during the rest of the year, they are not certain.

In the commodity space, oil (+0.7%) is back in a modest upswing but still has shown no inclination to move outside that trading range of $60/$65. It has been more than a month since that range has been broken and absent a major change in the Russia sanctions situation, where Europe actually stops buying Russian oil (as if!) I see no short-term catalyst on the horizon to change this situation. Clearly, producers are happy enough to produce and sell at this level and demand remains robust.

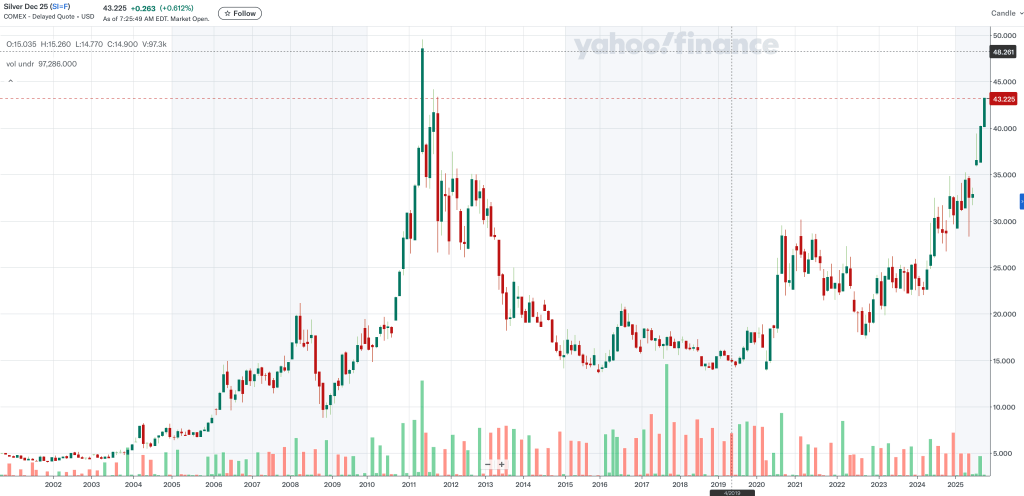

Turning to the metals markets, I discuss gold (+0.4%) a lot, and given it is making historic highs, that makes sense, but silver (+0.4%) has been outperforming gold for the past month and looks ever more like it is going to make a run for its all-time highs of $49.95 set back in January 1980. The more recent peak, set in 2011, of $48.50 looks like it is just days away based on the recent rate of climb.

Source: finance.yahoo.com

Finally, the dollar is under pressure this morning, with the euro (+0.4%) trading above 1.18 again for the first time since July 1st and there is a great deal of discussion as to how it is going to trade back to, and through, 1.20 soon, a level not seen since 2021.

Source: tradingeconomics.com

The narrative is now that the Fed is set to begin cutting rates and the ECB is going to stand pat, the euro will rise. This is true for GBP (+0.3%) as wel, with the Sterling chart largely the same as the euro one above. Here’s the thing. I understand the weak dollar thesis if the Fed gets aggressive, I discussed it above. However, if German manufacturing is contracting that aggressively, and the layoffs numbers are eye opening, can the ECB really stand pat? Similarly, PM Starmer is under enormous, and growing, pressure to resign with the Labour party in the throes of looking to oust him for numerous reasons, not least of which is the economy is struggling. So, please tell me why investors will flock to those currencies. I see the dollar declining, just not as far as most.

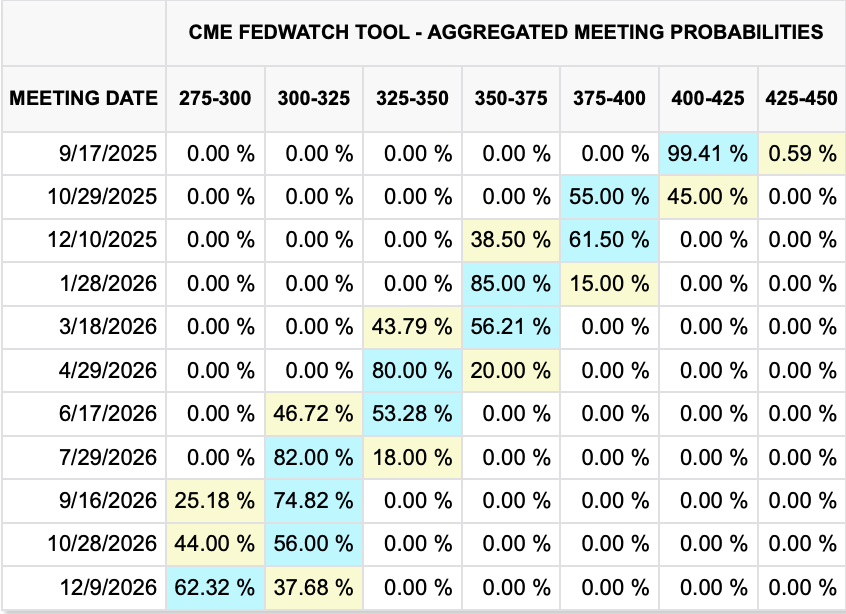

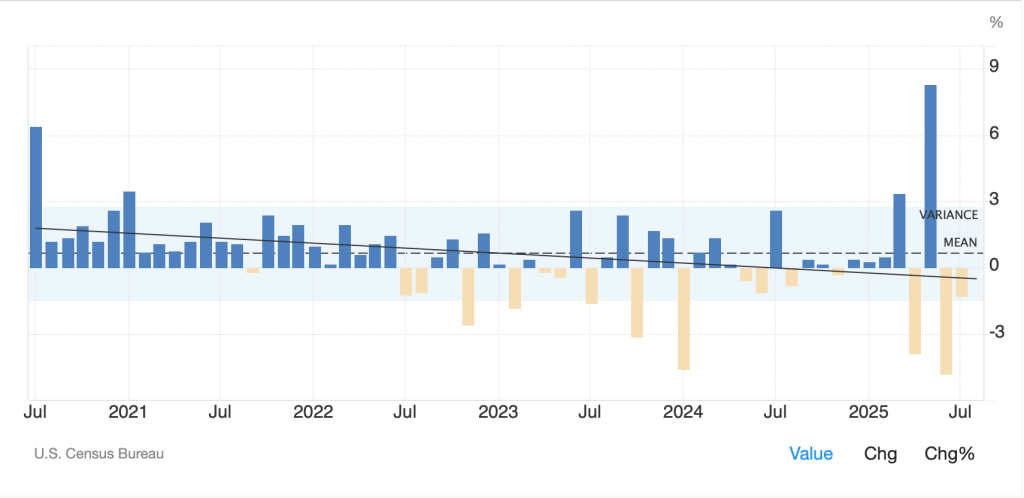

Data this morning brings Retail Sales (exp 0.2%, 0.4% -ex autos) along with IP (-0.1%) and Capacity Utilization (77.4%). However, it is not clear to me that markets will give this data much consideration given the imminence of the FOMC outcome tomorrow. The current futures pricing has just a 4% probability of a 50bp cut. I am waiting for the Timiraos article to see if that changes. Look for it this afternoon.

Good luck

Adf