While tariffs are widely decried

By analysts, they are worldwide

But Trump’s latest scheme

To some, seems extreme

As license fees are codified

So, tech names, who’ve, taxes, deflected

Are now likely to be subjected

To payment of fees

To sell overseas

And revenues will be collected

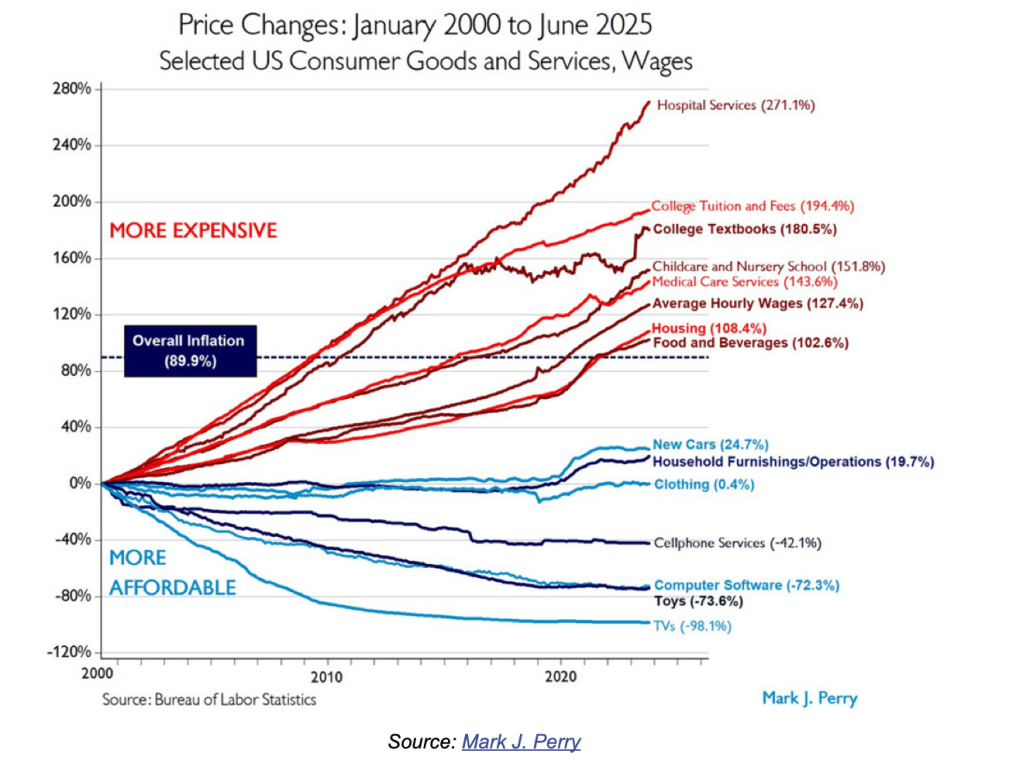

One thing you can never say about President Trump is that he lacks innovative ideas. Consider one of the biggest complaints over the past decades regarding US corporations; the fact that the tech companies (and drug companies) have been so effective at avoiding paying taxes based on the way they have gamed utilized the tax code and international treaties. And this was not a partisan complaint as both sides of the aisle were constantly frustrated by large companies’ ability to not pay their “fair share” as it is often described.

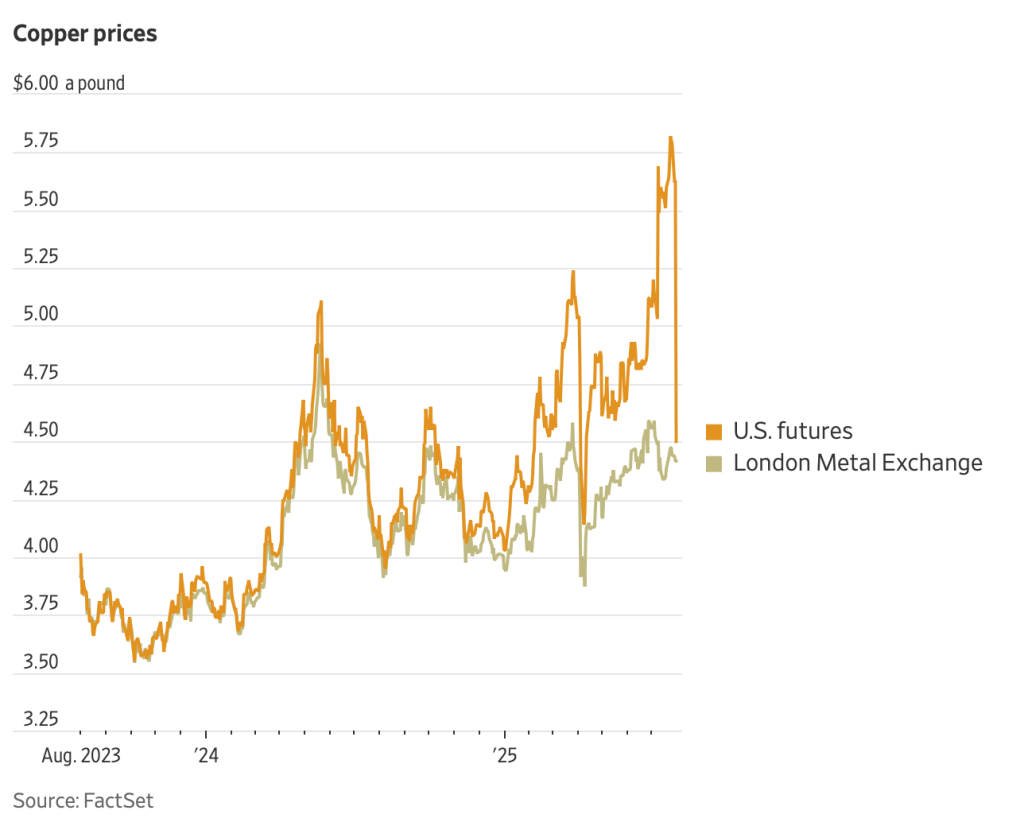

It appears that President Trump has come up with a solution for this, charging a licensing fee for companies to sell overseas. The big news over the weekend was that Nvidia and AMD are both going to pay a licensing fee of 15% of REVENUE on sales of chips to China. In the case of Nvidia, that is anticipated to be some $2.5 billion with somewhat smaller numbers for AMD. This is an excellent description of the process by @Kobeissiletter on X.

I have often expressed the view that corporate taxation, if we are going to have it, ought not be on profits but on revenue. Corporations are expert at reducing taxable income, maintaining a staff of lawyers and accountants to do just that. But gaming top line revenues is much harder. This gambit by President Trump is moving things in that direction. And remarkably, given these license fees are for exports, it ought to be outside the consumer price chain in the US completely.

There is an article in the WSJ this morning titled, “The US Marches Toward State Capitalism With American Characteristics,” which outlines, and mildly complains, about the changes in the way the US government is dealing with the private sector under President Trump. It discusses the purchase of 15% of MP Materials, the only US based miner/processor of rare earth minerals, and it discusses these license fees all under the guise of implying this is a bad direction. And I completely understand that idea as governments tend to be terrible stewards of capital. However, 25 years of Chinese unfettered access to Western markets while they have skirted the rules codified by the WTO have resulted in some significant national security challenges that can no longer be ignored. Full marks to President Trump for creative methods to address these challenges, despite the wailing and teeth gnashing of economists.

But other than that story, as well as the ongoing back and forth regarding potential peace talks in the Russia-Ukraine war, not all that much has happened overnight. For a change, markets are behaving like it is the summer doldrums, so perhaps we should be thankful for the respite. As such, let’s take a look at how things have done and what we can anticipate this week with CPI and Retail Sales set to be released.

Friday’s US equity rally combined with the news that Nvidia and AMD will be able to export some chips to China saw modest gains there (+0.4%) and in Hong Kong (+0.2%) even though another major property company in China, China South City Holdings Ltd., is being forced into liquidation. The property situation in China will continue to weigh on the economy there and given property investment was long seen as most Chinese families’ retirement nest egg, will undermine consumption for years. Elsewhere in the region, there were more gainers (India, Indonesia, Malaysia, Australia, New Zealand, Taiwan) than laggards (Thailand, Philippines) with Japan closed for Mountain Day, a relatively new holiday, and other markets little changed.

In Europe, though, screens are modestly red with losses on the order of -0.35% across the CAC, DAX and IBEX amid general uncertainties regarding the future economic direction and a lack of earnings positives. At this hour (7:00), US futures are slightly higher, by 0.2%.

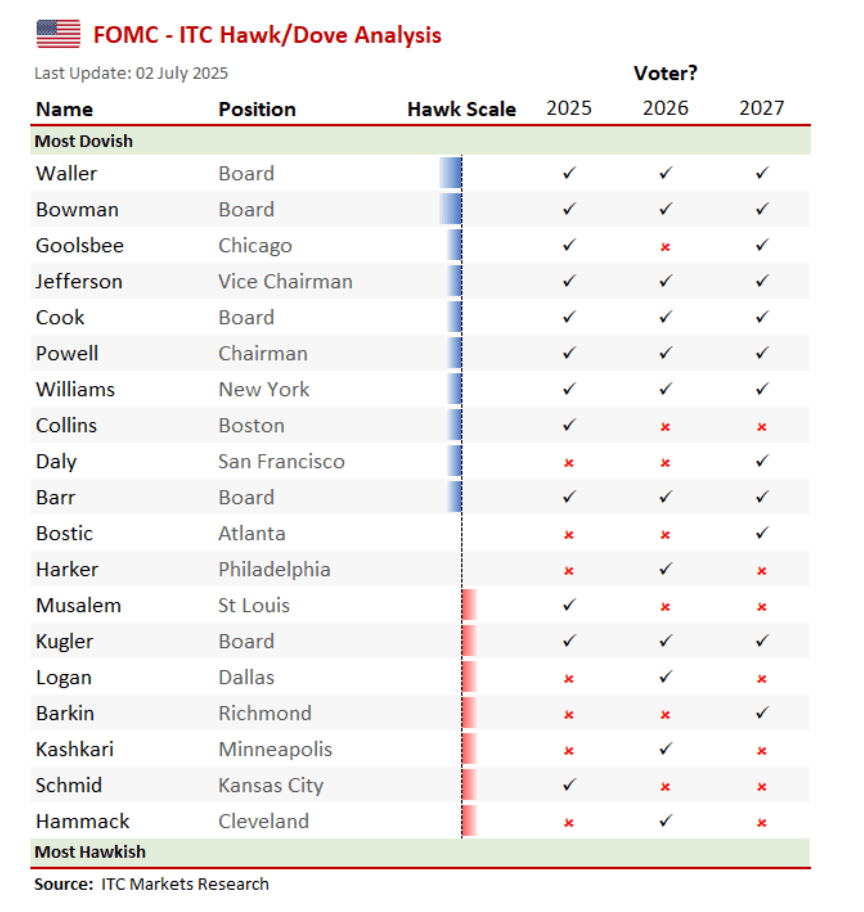

In the bond market, after last week’s auctions have been absorbed, Treasury yields have edged lower this morning, down -2bps, despite Fed funds futures’ probability of that September rate cut slipping to 88% from Friday’s 93%. In fact, Fed Governor Bowman reiterated over the weekend that she would be voting for a cut at each of the three meetings left this year. European sovereigns though are little changed, with some having seen yields edge higher by 1bp, as this appears to be a truly lackluster summer day.

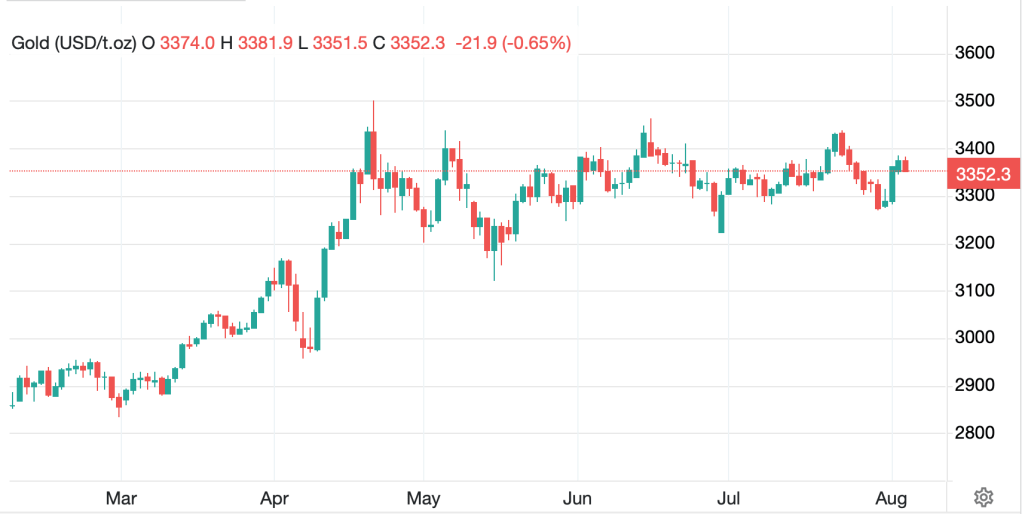

Commodities are the only market that is seeing any movement of note, and it is not oil (+0.2%) which has been trading either side of unchanged since last night. Rather, gold (-1.2%) is suffering this morning as you can see on the chart below as the promise of a potential peace in Ukraine seems to be removing some need for its haven status. Of course, the thing to really note about the gold market is just how choppy trading has been as conflicting narratives continue to impinge on price movement.

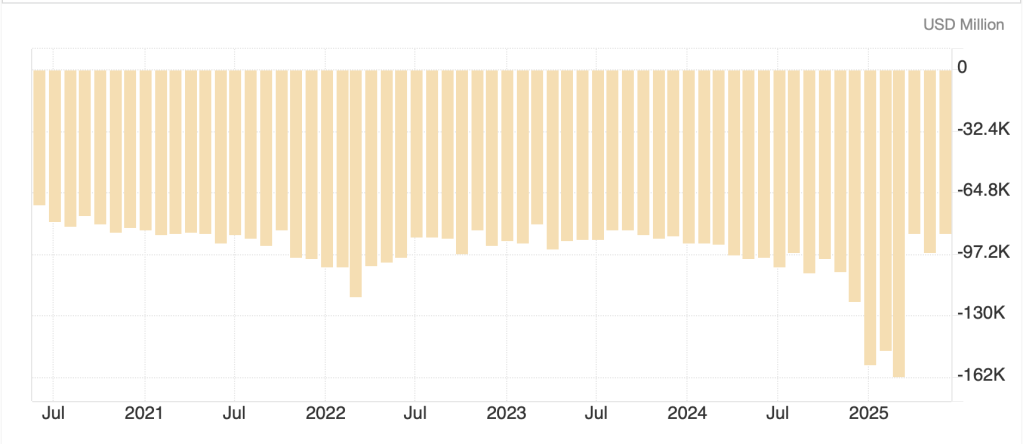

Source: tradingeconomics.com

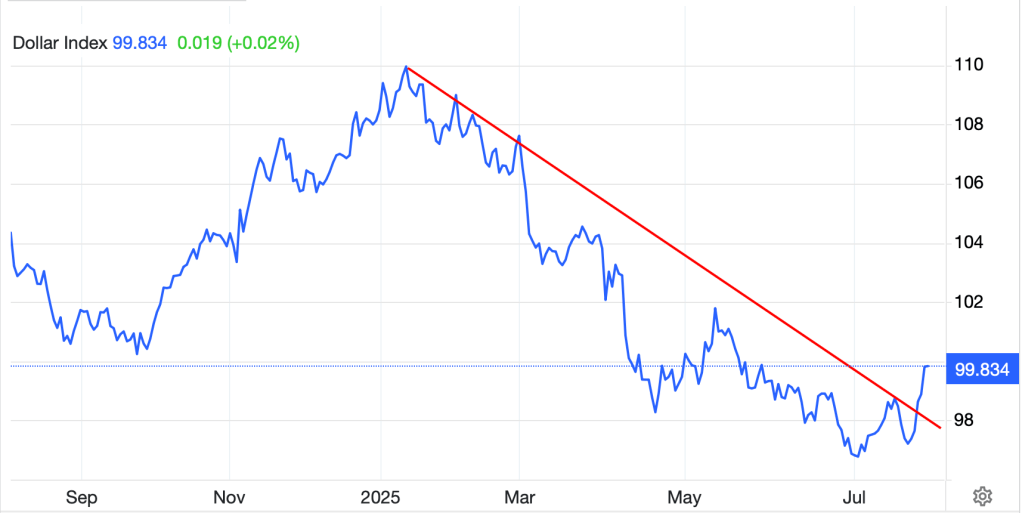

This decline has pulled down both silver (-1.4%) and copper (-0.95%) with all this happening despite virtually no movement in the FX markets.

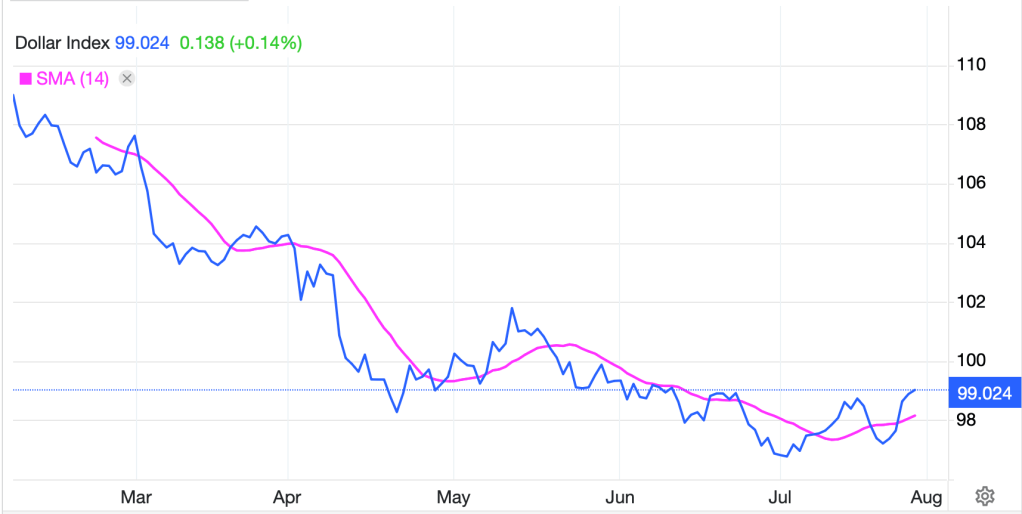

Turning to the dollar, one is hard pressed to find any substantial movement in either G10 or EMG currencies. The true outlier this morning is NOK (+0.4%) but otherwise, +/- 0.1% or less is the best description of the price action. This is what a summer market really looks like!

On the data front, we do get some important information as follows:

| Tuesday | RBA Rate Decision | 3.60% (current 3.85%) |

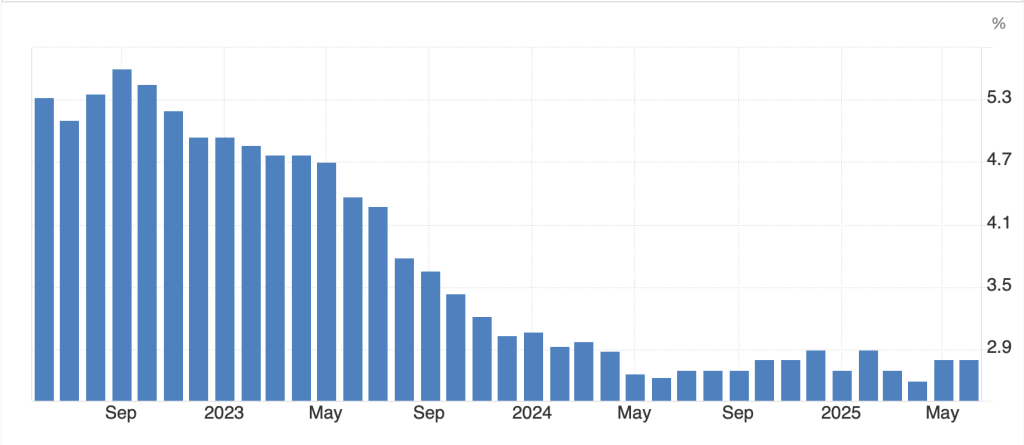

| CPI | 0.2% (2.8% Y/Y) | |

| Ex food & energy | 0.3% (3.0% Y/Y) | |

| Monthly Budget Statement | -$140B | |

| Thursday | PPI | 0.2% (2.5% Y/Y) |

| Ex food & energy | 0.2% (2.9% Y/Y) | |

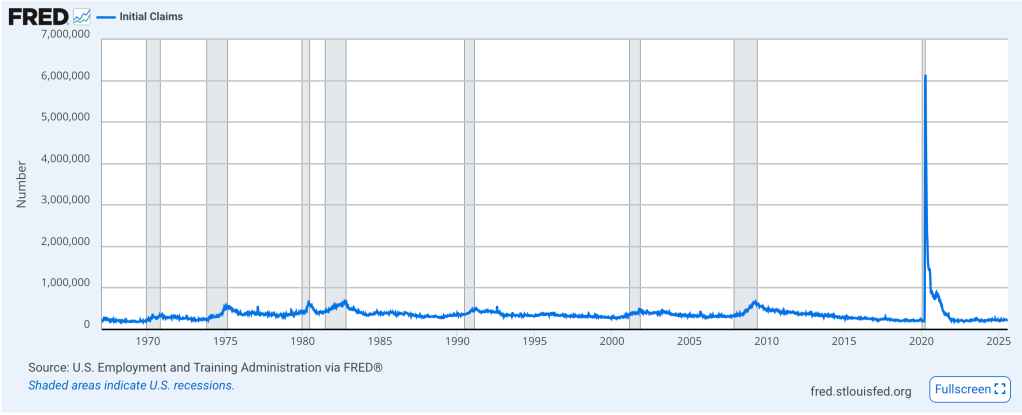

| Initial Claims | 226K | |

| Continuing Claims | 1960K | |

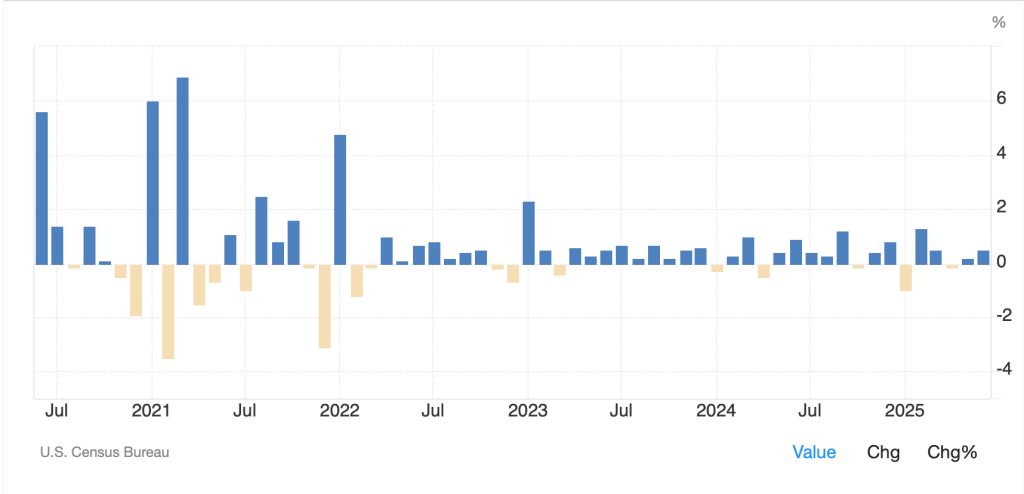

| Friday | Retail Sales | 0.5% |

| Ex Autos | 0.3% | |

| IP | 0.0% | |

| Capacity Utilization | 77.6% | |

| Michigan Sentiment | 62.0 |

Source: tradingeconomics.com

With all the hoopla about the firing of Ms McEnterfar at BLS, you can be sure that there will be lots of discussion on the CPI data regardless of the outcome. However, as the Inflation Guy pointed out last week, imputing the bottom 30% of items in the basket, which represent something on the order of 2.5% of the total price impact, is likely to have no impact whatsoever. We also hear from a bunch of Fed speakers, four to be exact, although Richmond Fed President Barkin will regale us twice. Now that there are more calls for a September cut, it will be interesting to see who remains patient and who is ready to move.

And that’s all there is today. It is hard to get excited about too much movement given the lack of obvious catalysts. Of course, one never knows what will emanate from the White House but look for a quiet one, I think.

Good luck

Adf