A landing that’s soft will require

A joblessness growth multiplier

Demand needs to slide

Enough so hawk-eyed

Fed members, rate cuts can inspire

The thing is, when looking at data

The trend hasn’t been all that great-a

While prices are falling

Growth seems to be stalling

More quickly than Jay’d advocate-a

As we await the onslaught of data starting this morning with ADP Employment and culminating in Friday’s Payroll and Michigan Sentiment reports, I thought it would be worthwhile to try to take a more holistic look at the recent data releases to see if the goldilocks/soft landing narrative makes sense, or if there is a growing probability of a more imposing slowdown in growth, aka a recession.

The problem is, when looking at the past one month’s worth of data, the trend in either direction is not that clear. One of the things that has been true for a while is that there continues to be a dichotomy between the survey data and the hard figures. Survey data has tended toward weakness, with one outlier, the most recent Chicago PMI print at 55.8. But otherwise, ISM data has been quite soft for manufacturing and so-so for services. Looking at the regional Fed surveys, it has been generally much worse with more negative outcomes than positive ones.

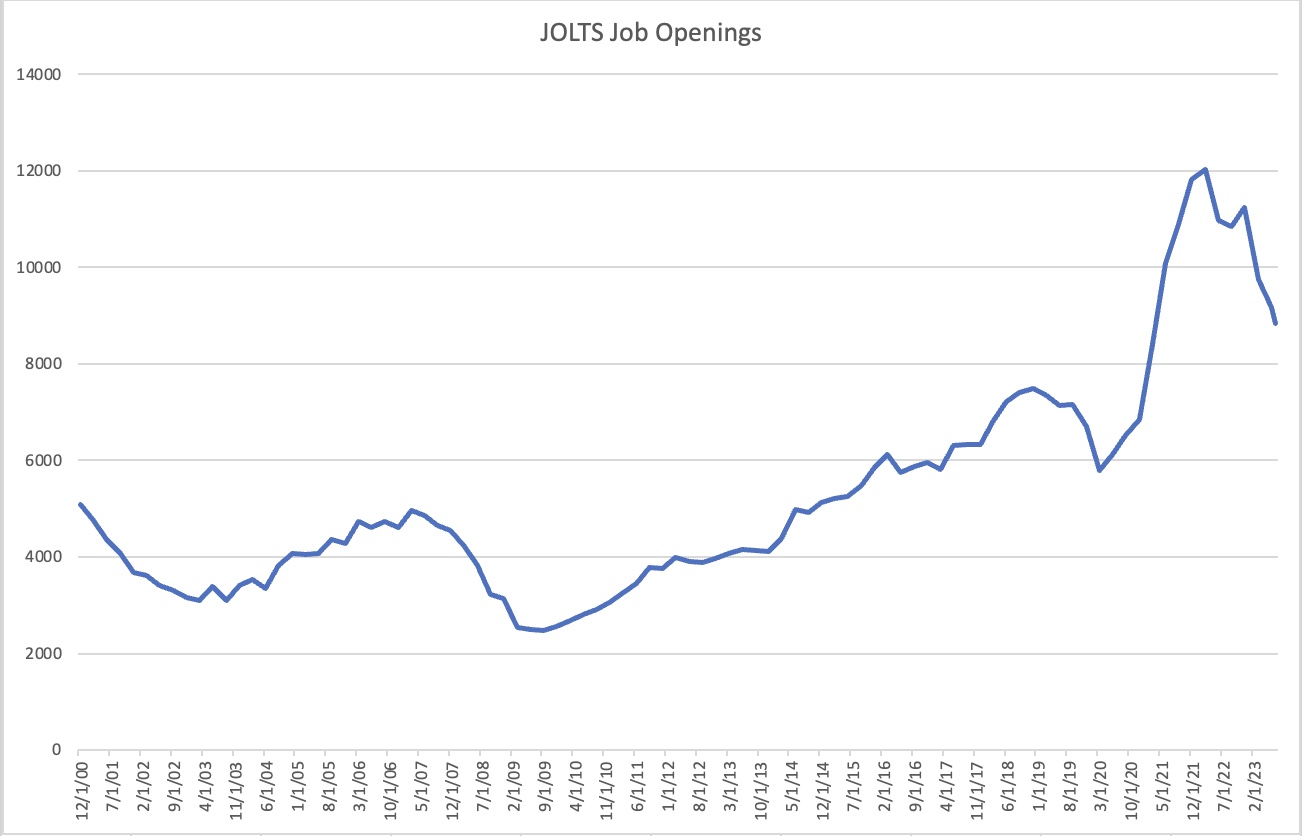

At the same time, we all remember last week’s blowout GDP result for Q3 at 5.2% and we continue to see employment growth, albeit at a slowing pace to what was ongoing last year and earlier this year. Retail Sales finally fell slightly last month, but that is after a string of much stronger than expected prints, arguably why Q3 GDP was so strong. Perhaps the more worrying points are that the Continuing Claims data has started to grow more rapidly, meaning that people are remaining on unemployment insurance for longer and longer periods and yesterday’s JOLTS data was substantially lower than expectations and lower than the November reading. Finally, Durable Goods and Factory Orders have been quite weak.

If I try to add it up, it seems to point to a weaker outcome than a soft-landing with the proper question, will the recession be mild or sharp? Funnily enough I think the data highlights the Biden administration’s ‘messaging’ problem. Surveys are generally quite negative and now hard data seems to be rolling over. That is clearly not the story that a president running for re-election is seeking to tell.

All this begs the question, how will the Fed respond? And here’s the deal, at least in this poet’s view; the current market pricing of upwards of 125 basis points of rate cuts through 2024 is not the most likely outcome. Rather, I continue to strongly believe that we will see either very little movement, as higher for longer maintains, or we will see 300-350bps of cuts as a full-blown recession becomes evident.

To complete the exercise, let’s game out how markets may behave in those two situations. If the Fed holds to its guns and maintains the current policy stance with Fed funds at 5.50% and QT ongoing, risk assets seem likely to have problems going forward. It is quite easy to believe that the key driver to last month’s massive equity rally was the pricing of easier monetary policy to support the economy, and by extension profitability and the stock market. So, if the Fed does not accommodate this view, at some point investors and traders are going to need to reevaluate the pricing of their holdings and we could see a sharp decline in equities. As well, this would likely result in a further inversion in the yield curve as expectations for a future recession would grow. On the commodity front, this ought to weigh on both the energy and metals complexes even further than their current pricing. Recall, I have been highlighting that the commodities markets seem to be the only ones pricing in a recession. As to the dollar, in this scenario I expect to see it regain its strength as the rest of the world will be sliding into recession regardless of the US outcome, so rate cuts will be on the table for the ECB, BOE, BOC, and PBOC.

Alternatively, the economic situation in the US could well deteriorate far more rapidly than the current goldilocks set believes. In fact, I believe that is what it will take to get the much larger rate cuts that everybody seems to be pining for. But ask yourself, do you really want rate cuts because economic activity is collapsing? That seems a tough time to be snapping up risk assets. In fact, historically, equity market declines through recessions occur while the central bank is cutting rates. Be careful what you wish for here.

But, to finish the scenario analysis, much weaker economic data (think negative NFP as a first step along with Unemployment at 4.5%) will almost certainly result in cyclically declining inflation data and a dramatic fall in demand. So, equity markets would be under pressure everywhere. meanwhile, the normalization of the yield curve would finally occur with the front end falling far faster than the back. In the commodity markets, I think precious metals will outperform as real rates tumble and safety is sought. However, industrial metals would decline and likely so would energy prices, both driving inflation lower. As to the dollar, this is much trickier. At this point, I would argue the Eurozone is ahead of the US in the economic down wave and so will also be cutting rates. The dollar’s performance will be a product of the relative policy response and I suspect will result in a very choppy market. At least against G10 currencies. Versus its EMG counterparts, I suspect the dollar will significantly underperform absent a global recession.

But enough daydreaming, let’s take a look at the overnight session. From an equity perspective, yesterday’s late rally in the US, getting things back close to unchanged, was followed by strength in Asia, notably in Japan (Nikkei +2.0%) but also across the board with India’s Sensex making yet more new all-time highs, and modest strength in Europe despite some weak German Factory Orders data. Or perhaps because of that as traders grow their belief the ECB is going to start cutting rates soon. US futures are edging higher at this hour (7:00), but only by 0.2% or so.

In the bond market, after a day where yields fell sharply, this morning we are seeing a slight bounce with Treasury yields backing up by 3bps and European sovereign yields edging higher by between 1bp and 3bps. The European bond market is clearly of the opinion that the ECB is done hiking with that confirmation coming from the Schnabel comments yesterday morning. Now, the only question is when they start to cut. Something else to note is that JGB yields have fallen 3bps this morning and are essentially back at levels seen in early September before the BOJ’s latest comments about the 1% cap being a guideline, not a hard cap. Perhaps the argument that the BOJ was going to normalize its policy was a bit premature.

On the commodity front, oil prices continue to slide, down another 0.7% this morning and nearly 8% this week. While this is great for when we go to fill up the gas tank, it is a harbinger of a weaker economy going forward, which may not be so great overall. Gold prices have stabilized and are still above $2000/oz and we are also seeing stabilization in the base metals prices right now.

Finally, the dollar, which rallied nicely yesterday, and in fact has been climbing for the past week, is little changed this morning stabilizing with the euro below 1.08 and USDJPY above 147. There continues to be a narrative that is calling for the dollar’s demise, and in fact, I understand the idea based on the belief that the Fed is turning easy. But for right now, it is also becoming clear that the rest of the world’s central banks are rolling over on their policy tightening and given the lack of a strong interest rate incentive, plus the fact that a weaker global economy will send investors looking for safe havens, the dollar is likely to maintain its recent strength, if not strengthen further going forward. In order to see a substantial dollar decline, IMHO, we will need to see the US enter a sharp recession without the rest of the world following in our footsteps. As I see that to be an unlikely outcome, my guess is we have seen the bottom of the dollar for the foreseeable future.

On the data front, we start today with the ADP Employment (exp 130K) and also see the Trade Balance (-$64.2B), Nonfarm Productivity (4.9%) and Unit Labor Costs (-0.9%). From North of the Border, at 10:00 we see the Ivey PMI (their ISM data, expected at 54.2) and the BOC interest rate decision where there is no change expected and there is no press conference either.

I really wanted to get bearish on the dollar and felt that way when we heard Fed Governor Waller talk about rate cuts, but lately, the news from everywhere is negative and I just don’t see the dollar suffering in this situation. Stable, yes; falling no.

Good luck

Adf