The temperature’s rising on trade

As China, rare earths, did blockade

It seems they believe

That they can achieve

A triumph with cards that they’ve played

Investors worldwide are now feeling

Concern as old theses are reeling

This new world now shows

It’s capital flows

And trust, which is why gold’s appealing

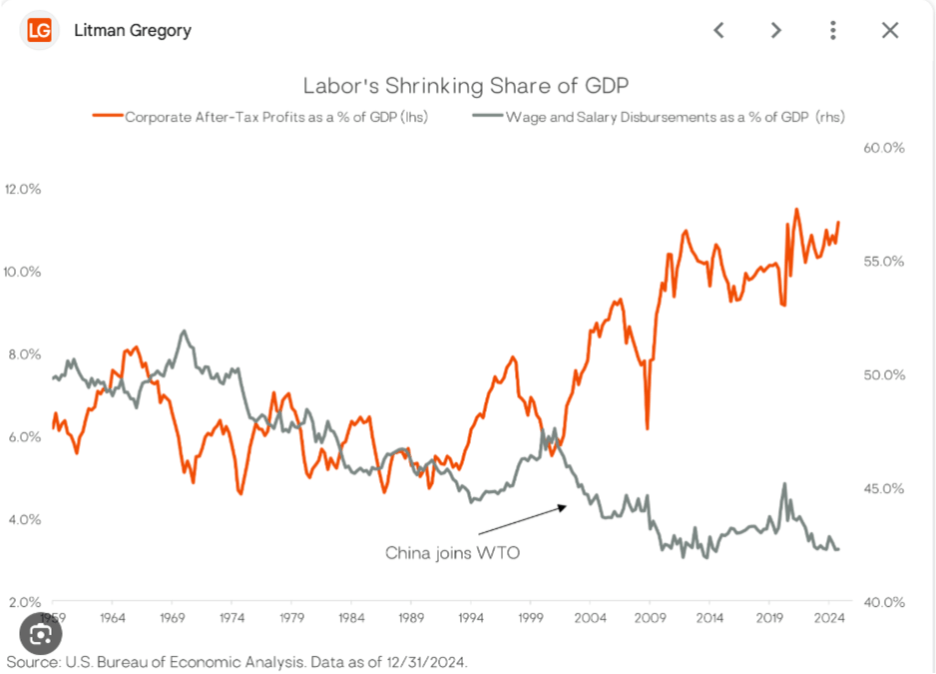

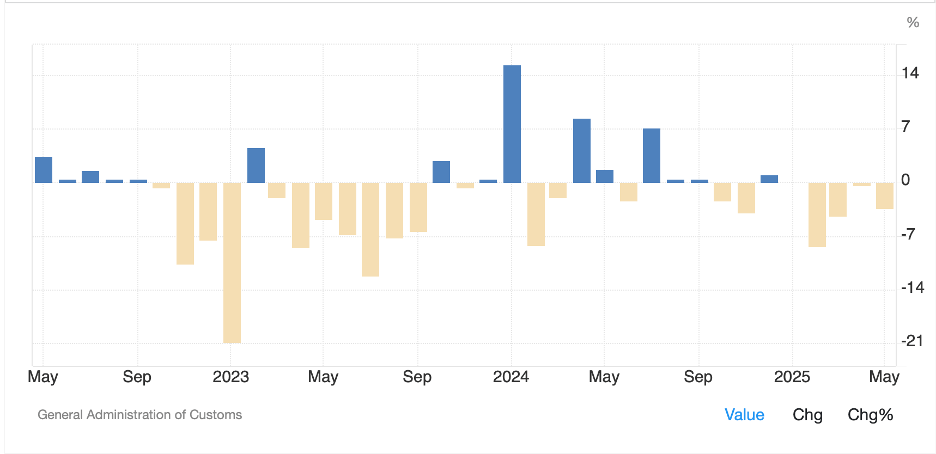

Escalation in the trade war between the US and China is clearly the top story. There are a growing number of analysts who believe that currently, China may have the upper hand in this battle given the recent history of deindustrialization in the US and the West. Obviously, rare earth minerals, which are critical to manufacturing everything from magnets to weapons, and semiconductors, are China’s big play. They believe this is the bottleneck that will force the US and the West to back down and accept their terms. The Chinese have spent decades developing the supply chain infrastructure for just this situation while the West blithely ignored potential risks of this nature and either sought lower costs or virtue signals.

Before discussing the market take, there is one area where China lacks capacity and will find themselves greatly impaired, ultra-pure silicon that is used to manufacture semiconductors. The global supply is almost entirely made in Japan, Germany and the US, and without it, Chinese semiconductor manufacturing will encounter significant problems. So don’t count the West out yet.

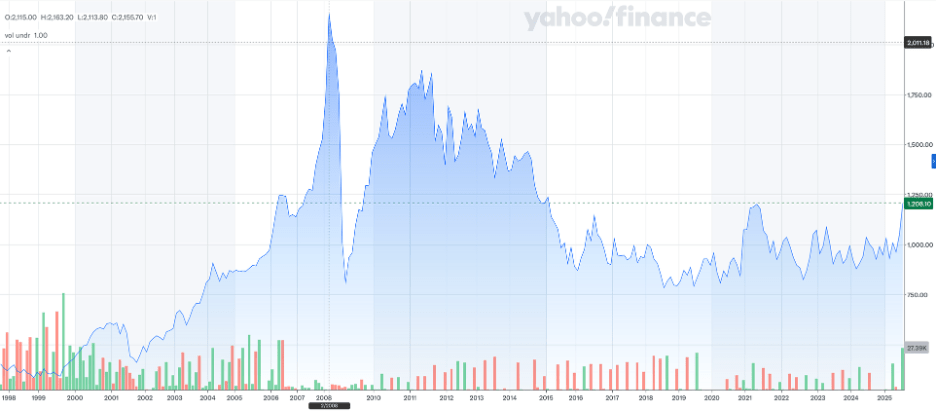

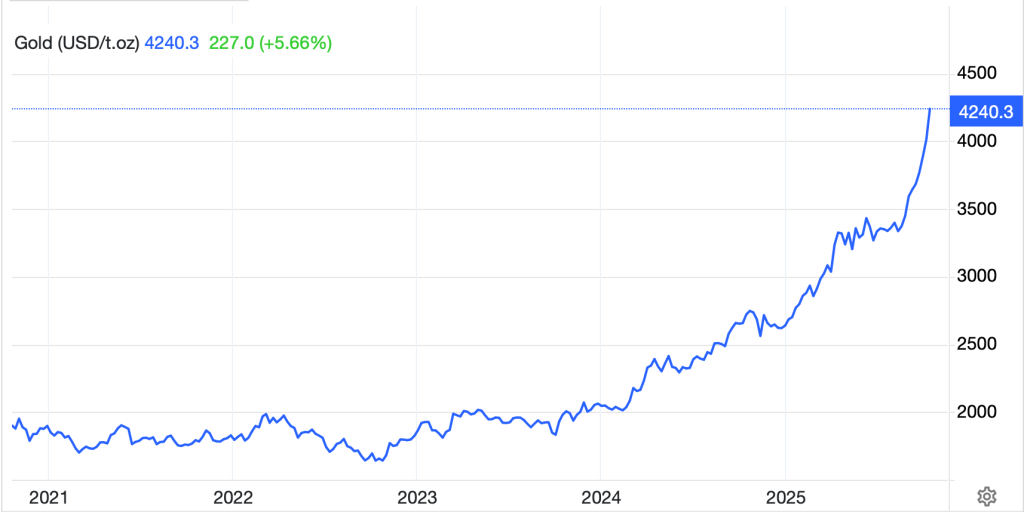

Anyway, the interesting question is why have equity markets continued to behave so well in the face of this growing bifurcation in the global economy? After all, it is clear why gold (+0.75%) continues to rise as central banks around the world continue to buy the barbarous relic for their reserves while individual investors are starting to jump on board if for no other reason than the price has been rising dramatically. (As an aside, the gold price chart can fairly be called parabolic at this point, and history has shown that parabolic rallies don’t last forever and reverse course dramatically.)

Source: tradingeconomics.com

But equity prices are alleged to represent the discounted value of estimated future cash flows, and those are certainly not parabolic. Of course, there is something that has been rising rapidly that feeds directly into financial markets, and that is liquidity. Consider the process by which money is created; it is lent into existence by banks and used to purchase either financial or real assets. The greater the amount of money that is created, the more upward pressure that exists for asset prices (as well as retail prices). This is the essence of the idea that inflation is the result of too much money chasing too few goods.

Turning to the IIF for its latest statistics, it shows, as you can see in the chart below, that global liquidity continues to rise, and there is nothing to indicate this rise is going to slow down. The chart below shows global debt across all sectors (government and private) has reached $337.8 trillion at the end of Q2 2025, which is 324% of global GDP. If you are wondering why asset prices continue to rise in the face of increased global macroeconomic risks, look no further than this chart.

And if you think about the fact that literally every major nation around the world, whether developed or EMG, is running a public budget deficit, this number is only going to grow further. It is very difficult to make the case for a reversal unless this liquidity starts to dry up. And the one thing central bankers around the world have figured out is that they cannot turn off the liquidity flow without causing severe problems. As to CPI inflation, some portion of this liquidity will continue to seep into prices paid for things other than securities and financial assets. Ironically, if President Trump succeeds in dramatically reducing the budget and trade deficits, the impact on global financial markets would be quite severely negative. This is the best reason to assume it will never happen…by choice.

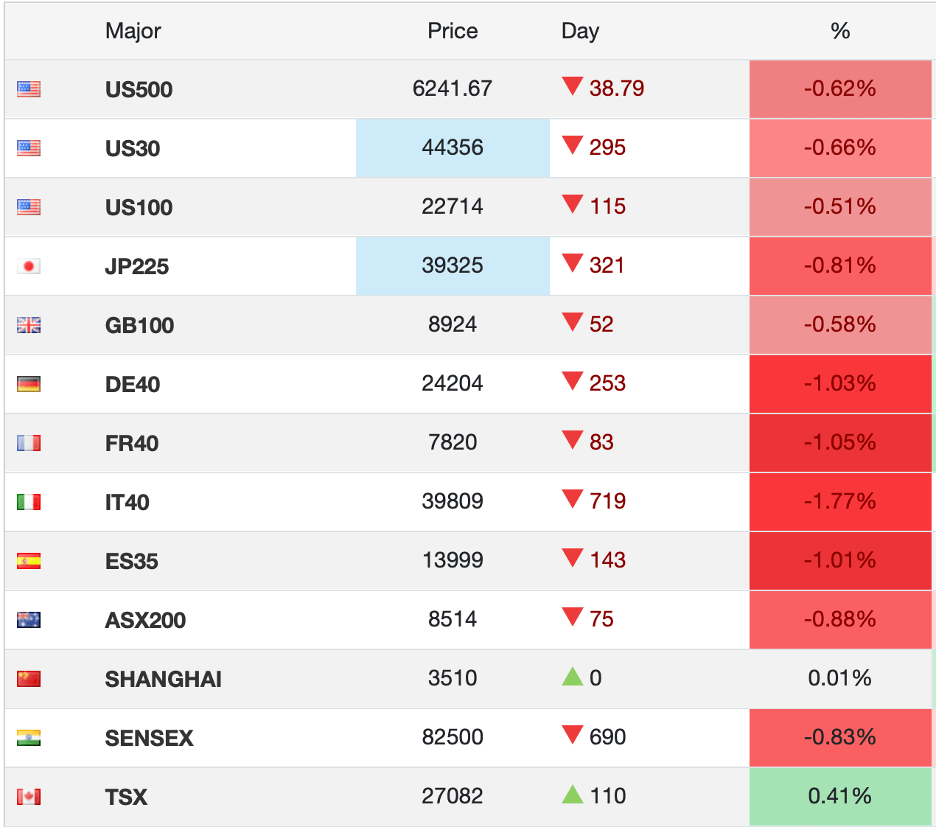

In the meantime, this is the world in which we live, and financial markets are subject to these flows so let’s see how they behaved overnight. After yesterday’s modest gains in the US markets, Tokyo (+1.3%) continued its recent rally despite a growing concern that Takaichi-san will not become the first female PM in Japan as all the opposition parties seem to be coming together simply to prevent that outcome, rather than because they share a grand vision. HK (-0.1%) and China (+0.25%) had lackluster sessions as the trade war will not help either of their economies either, while the rest of the region had a strong session across Korea (+2.5%), India (+1.0%), Taiwan (+1.4%), Australia (+0.9%) and Indonesia (+0.9%). One would almost think things are great there!

As to Europe, France (+0.75%) is the leader today as PM LeCornu survived a no-confidence vote by agreeing not to raise the retirement age from 62 to 64 despite this being seen as President Macron’s crowning achievement. (I cannot help but look at public finances around the world and see that something is going to break down, and probably pretty soon. Promises to continue spending while economic activity stagnates are destined to collapse. Of course, the $64 trillion question is, when?). As to the rest of Europe, equity markets are little changed, +/- 0.15% or less. At this hour (7:40) US futures are pointing nicely higher though, about 0.5% across the board.

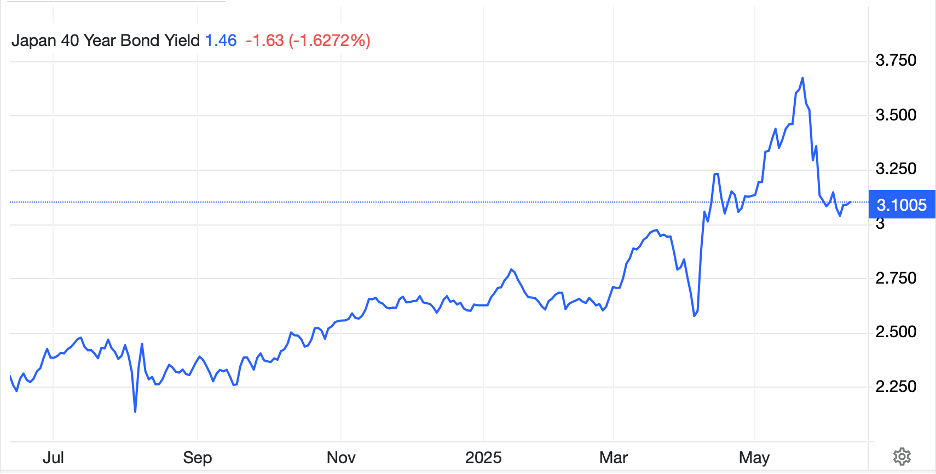

In the bond market, the place where the growth in liquidity should be felt most acutely, there is no obvious concern by investors at this stage. Yields across the board in the US and Europe are essentially unchanged in the session and there was no movement overnight in JGBs. It feels as though the entire situation is becoming more precarious for investors, but thus far, no real cracks are visible. However, you can be sure that if they start to develop, we will see the next wave of QE to support these markets.

Away from gold, this morning silver (+0.1%) and copper (-0.1%) are little changed although platinum (+0.7%) is working to keep up with both of the better-known precious metals and doing a pretty good job of it. Oil (+0.9%) is bouncing off recent lows but remains below $60/bbl and seems to have lost the interest of most pundits and traders, at least for now.

Finally, the dollar continues to edge lower, with most G10 currencies a touch higher (GBP +0.2%, SEK +0.2%, NOK +0.3%, EUR +0.05%) although the yen (-0.15%) and CHF (-0.2%) are both slipping slightly. But the reality is there has been no noteworthy movement here. Even in the EMG bloc, movement is 0.2% or less virtually across the board this morning. The dollar is an afterthought today.

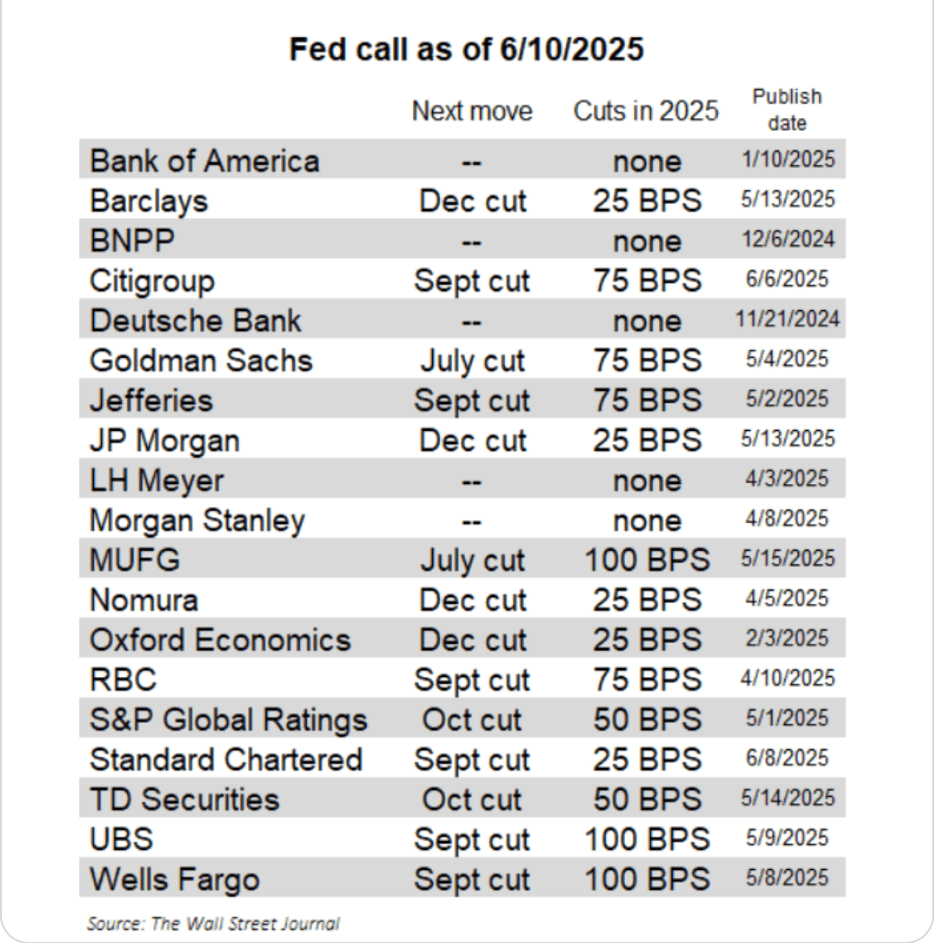

On the data front, Philly Fed (exp 10.0) is the only data release with some positive thoughts after yesterday’s Empire State Manufacturing Index rose a much better than expected 10.7. We also hear from a whole bunch more Fed speakers (Barkin, Barr, Miran, Waller, Bowman) as the IMF / World Bank meetings continue. Yesterday, to nobody’s surprise, Mr Miran said that rates needed to be lower to address growing uncertainties in the economy. I suspect he will repeat himself this morning. But the market is already pricing two cuts for this year, and absent concrete data that the economy is falling off a cliff, it is hard to make the case for any more (if that much) given inflation’s stickiness.

The world is a messy place. Debt and leverage are the key drivers in markets and will continue to be until they are deemed too large. However, it is in nobody’s interest to make that determination, not investors nor governments. This could go on for a while.

Good luck

adf