There once was a banker named Jay

Who yesterday, tried to allay

Fears that his building

Was too filled with gilding

But Trump seemed to have final say

The fact that this story’s what leads

The news, when one looks through the feeds

Is proof that there’s nought

Of note to be bought

Or sold, as price action recedes

According to Merriam-Webster, this is the definition of the word frequently bandied about these days, and rightly so.

Market activity is just not very interesting. While there is a new battle brewing on the Thai-Cambodian border, it is unlikely to have much impact on the rest of the world, and the Russia-Ukraine war continues apace, with very little new news. Congress is in recess, sort of, which means new legislation is not imminent. And while the Fed meets next week, just like the ECB and the BOE and the BOJ, no policy changes are imminent. Doldrums indeed.

Which is why the story about President Trump visiting the construction site at the Marriner Eccles Building, the home of the Federal Reserve, has received so much press. And frankly, a quick look at this clip is so descriptive of the current relationship between Trump and Powell it is remarkable.

But frankly, I just don’t see much else to discuss this morning. equity markets in the US have generally been creeping higher, the DJIA excepted, the dollar is doing a slow-motion bounce and bond yields trade within a 5bps range. Yesterday’s jobs data was solid, with both types of claims slipping, while the Flash PMIs showed net strength, although it was entirely Services driven. And it’s Friday, so I won’t take up too much time.

Here’s the overnight review. Asian markets followed the Dow, not the S&P or NASDAQ with Tokyo (-0.9%), Hong Kong (-1.1%) and China (-0.5%) all under pressure. In Japan, there are starting to be more questions asked about whether PM Ishiba can hold on, and if he cannot (my guess is he will go) there is no obvious successor as no party there has any substantial strength. Remember, the populist Sanseito party is a new phenomenon there and really is screwing up their electoral math. As to the rest of the region, only Korea and New Zealand managed any gains, and they were di minimis. Red was the color of the session.

Not surprisingly, that is the story in Europe as well, with most bourses lower on the day (DAX -0.6%, FTSE 100 -0.3%, IBEX -0.5%) although the CAC is essentially unchanged despite LVMH earnings being a little soft. German Ifo data was slightly better than June, but lower than expected and UK Retail Sales were modestly weaker than forecast on every measure. Again, it is hard to get excited here. As to US futures, they are pointing higher by 0.2% at this hour (7:00).

In the bond market, Treasury yields have bounced 2bps from yesterday but are still right around 4.40% while European sovereign yields are higher by 3bps across the board. Apparently, there is residual concern over European spending plans and absent a trade agreement with the US, investors there are not sure what to do.

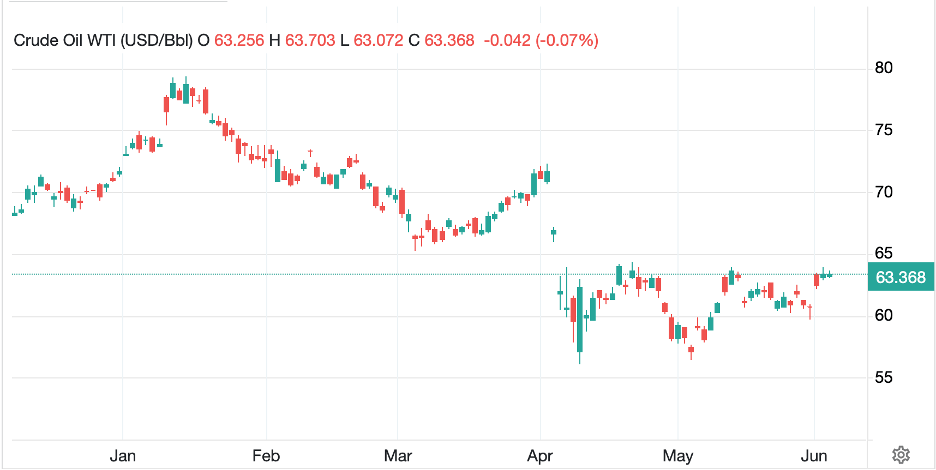

In the commodity markets, oil (+0.4%) is bouncing for a second day, but remains within that recent trading range where we have seen choppy trading but no direction. The gap lower earlier in the week was filled, but it is hard to get excited here about a new trend either.

Source: tradingeconmics.com

Meanwhile, metals markets remain under pressure as we head into the end of the month. They have had a solid rally this month and it looks to me like some profit taking, but this morning gold (-0.7%), silver (-0.8%) and copper (-0.7%) are all under pressure.

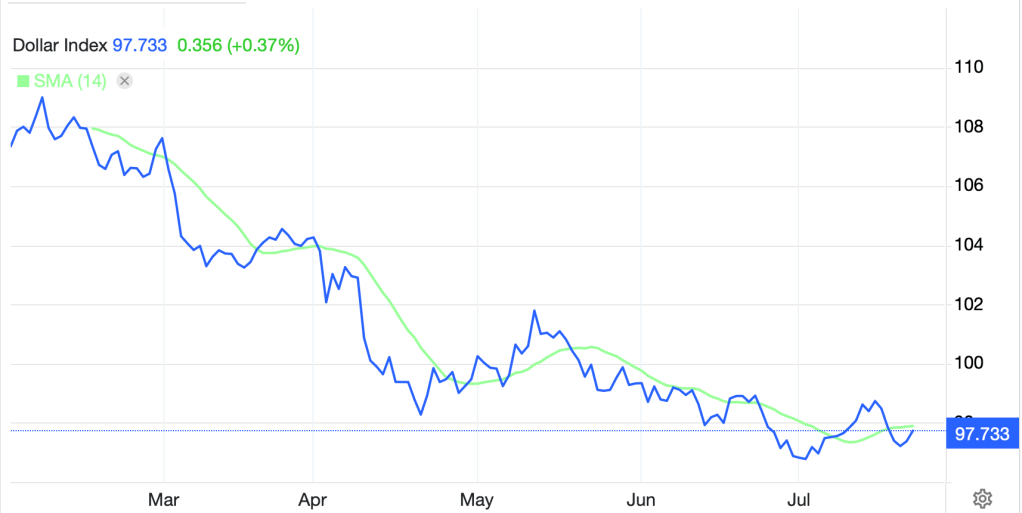

Perhaps one of the reasons that the metals are soft is the dollar is stronger today. I know we continue to hear about the death of the dollar, but as Mark Twain remarked, “the report of [its] death was an exaggeration.” Instead, what we see this morning is a pattern in the DXY that could easily be mistaken for described as a bottoming and we are simply waiting for confirmation.

Source: tradingeconomics.com

Looking at individual currencies, the dollar is firmer against every G10 currency with the euro (-0.25%) and pound (-0.4%) indicative of the magnitude of movement. In the EMG bloc, KRW (-0.6%) and ZAR (-0.7%) are the worst performers, with the latter clearly following precious metals lower while the former is feeling a little heat from the fact that Japan struck a trade deal while South Korea has not yet done so. Otherwise, things are just not that interesting here either.

On the data front, this morning brings Durable Goods (exp -10.8%, 0.1% ex Transports) which tells me that a lot of Boeing deliveries were made last month when Durables rose 16.4%. But otherwise, nothing and no Fed speakers. As I said before, it is a summer Friday, and I suspect that most trading desks will be skeleton staffed by 3:00pm if not earlier.

Good luck and good weekend

Adf