In Europe, the largest of nations

Is faltering at its foundations

The ‘conomy’s sagging

And tongues are now wagging

‘Bout voting and great expectations

Alas for the good German folk

The government’s turned far too woke

Their energy views

Have caused them the blues

And soon they may realize they’re broke

With elections clearly on almost everybody’s mind, it can be no surprise that the crumbling government in Germany has also finally accepted their fate and called for a confidence vote to be held on December 16 which, when Chancellor Olaf Scholz loses (it is virtually guaranteed), will lead to a general election on February 23, 2025. As has happened in literally every election held thus far in 2024, the incumbents are set to be tossed out. The problems that have arisen in Europe, with Germany being ground zero, is that the declarations by the mainstream parties to avoid working with the right-wing parties that have garnered approximately 25% of the population’s support almost everywhere, means that the traditional parties cannot create working coalitions that make any sense. After all, the German government that is collapsing was a combination of the Center-left Social Democrats, the far-left Greens and the free market FDP. That was always destined to fail so perhaps the fact it took so long is what should be noted.

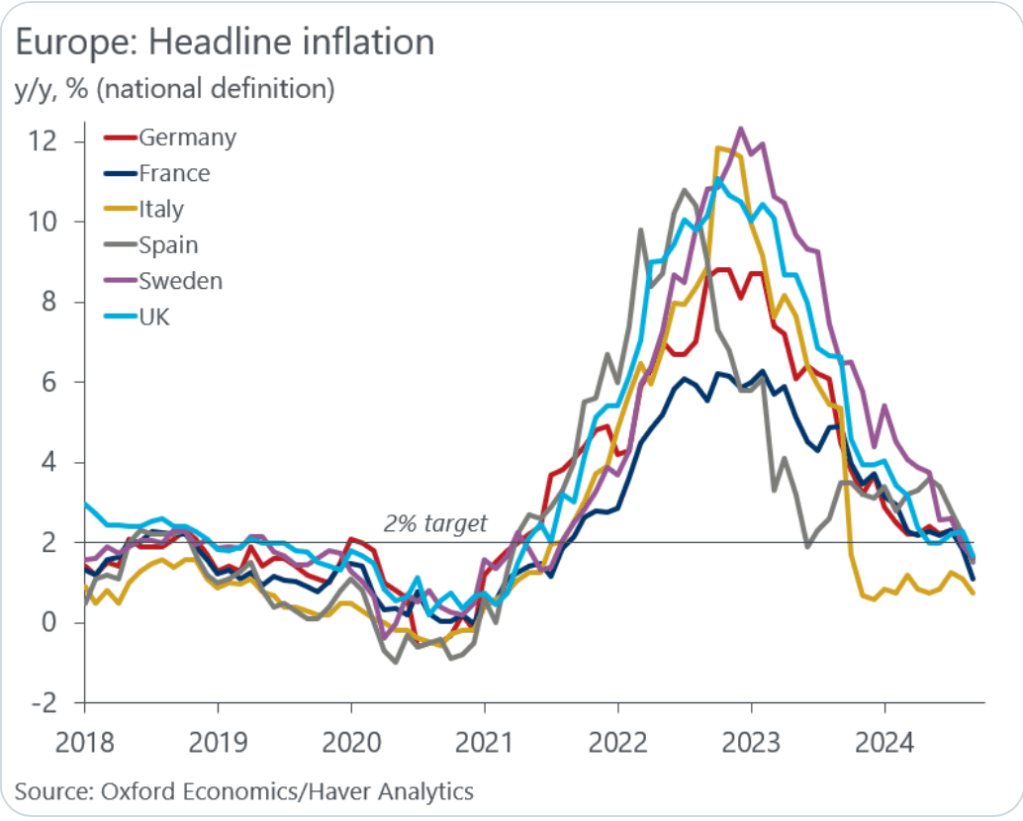

At any rate, it is not hard to understand why the people of Germany are unhappy given the economic situation there. The economy hasn’t grown in more than two years, basically stagnating, while inflation continues to run above 2%. Meanwhile, energy prices have risen sharply as a consequence of their Energiewende policy; the nation’s attempt to achieve net zero CO2 emissions. However, not only did they shutter their nuclear generating fleet, the most stable source of CO2 free electricity, they decided that wind and solar were the way forward. Given that there are, on average, between 1600 and 1700 hours of sunshine annually (4.3 to 4.5 hours per day), that seemed like a bad bet. The results cannot be surprising as Germany energy costs are amongst the highest in the world. The below chart shows electricity prices around the world.

Source: statista.com

If you want a good reason as to why incumbent governments around the world are falling, you don’t have to look much further than this. Meanwhile, this morning brought the German ZEW Economic Sentiment Index which printed at 7.4, well below both last month and expectations. As well, the Current Conditions Index fell to -91.4, which while not the lowest ever, certainly indicates concern given -100 is the end of the scale.

I’m sure you won’t be surprised to note that the euro (-0.4%) has fallen further this morning amid a broad-based dollar rally, that German stocks (DAX -0.8%) are falling and German bund yields (-2bps) are also falling as it becomes ever clearer that the ECB is going to need to cut rates more aggressively than previously anticipated. Perhaps the story of Bayer Chemical today, where their earnings fell 26% and the stock has fallen 11% to a level not seen since 2009, is a marker. Just like Volkswagen, they are set to cut costs (i.e., fire people) further. Germany is having a rough go, and if they continue to perform like this, Europe will have a hard time going forward.

So, while the media in the US continues to focus on President-elect Trump and his activities as he fills out his cabinet posts and other government roles, elsewhere around the world, governments are trying to figure out how to respond to the changes coming here.

In that vein, the COP 29 Climate Conference is currently ongoing in Baku, Azerbaijan (a major oil drilling city) but finding much less press than previous versions. As well, the attendee list has shrunk, especially from governments around the world. This appears to be another consequence of the shift in voting preferences. In fact, I expect that over the next four years, the number of discussions on climate will decline substantially.

Perhaps the best place to observe how things are changing is China, as they now find themselves in the crosshairs of Trump’s policy changes and they know it. The question is how they will respond with their own policies. Recall, last week there were great hopes that we would finally see that big bazooka of fiscal stimulus and it was never fired. Recent surveys of analysts, while continuing to hope for that elusive stimulus, now see a greater chance of Xi allowing the CNY to decline more rapidly to offset the impacts of tariffs. This is something that I have expressed for a long time, that the CNY will be the relief valve for the Chinese economy as it comes under pressure. Certainly, the market seems to be on board with this thesis as evidenced by the CNY’s movement since the election. I expect there is further to run here.

Source: tradingeconomics.com

Ok, between Germany and China, those were the big stories away from the Trump cabinet watch. Let’s see how markets behaved overnight in the wake of yet another set of record high closings in the US yesterday. Despite the yen’s weakness, the Nikkei (-0.4%) was under pressure, although nothing like the pressure seen in China (Hang Seng -2.8%, CSI 300 -1.1%) or even elsewhere in Asia (Korea -1.9%, India -1.0%, Taiwan -2.3%) with pretty much the entire region in the red. Of course, the same is true in Europe with all the major bourses under pressure (CAC -1.3%, FTSE 100 -1.0%) alongside the DAX’s decline. As to US futures, at this hour (7:15) they are essentially unchanged as we await a series of five more Fed speeches.

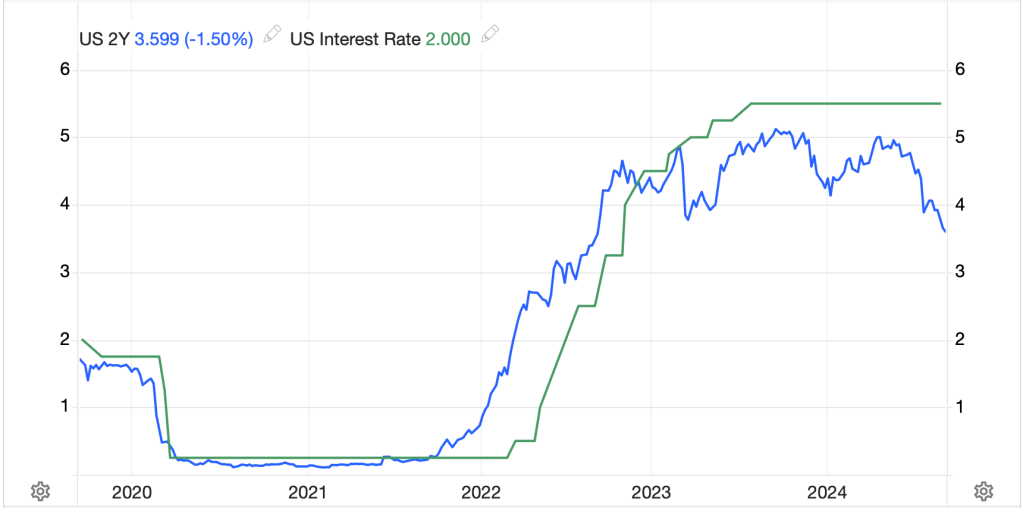

In the bond market, Treasury yields (+6bps) are rising as it appears the 4.30% level is acting as a trading floor now that we have seen moves above it. However, as mentioned above, the weaker economic prospects in Europe have seen yields across the continent soften between -1bp and -2bps. Futures markets are now pricing more rate cuts by the ECB over the next year than the Fed although both are pricing about the same probability of a cut in December. I think the direction of travel is less Fed cutting and more ECB cutting and that will not help the euro.

In the commodity markets, the rout in the metals markets continues with both precious (Au -0.8%, Ag -1.0%) and industrial (Cu -2.0%, Al -0.8%) finding no love. In fairness, these had all seen very substantial rallies since the beginning of the year, so much of this is profit-taking, although there are those who believe that Trump will be able to arrest the constant rise in US debt issuance. I’m not so sure about that. As to oil (+0.6%) it has found a temporary bottom for now, but I do expect that it will continue to see pressure lower.

Finally, the dollar is king today, higher against every one of its counterparts in both the G10 and EMG blocs. In the G10, the movement is almost uniform with most currencies declining between -0.4% and -0.5% although CHF (-0.1%) is trying to hang on. In the EMG bloc, there are some larger declines (ZAR -0.8%, CZK -0.9%, HUF -0.9%) while LATAM currencies are lower by -0.5% and we saw similar movements in Asia overnight, -0.5% declines or so. Again, it is difficult to make a case, at least in the near term, for the dollar to decline very far. Keep that in mind when considering your hedges.

On the data front, the NFIB Small Business Optimism Index was released earlier at a better than expected 93.7, roughly the same as the July reading and potentially heading back toward the 2022 levels obtained during the recovery from the covid shutdowns. I expect the election results had some part in this move. Otherwise, its Fed speakers and we wait for tomorrow’s CPI. All signs continue to point to a positive view in the US and a stronger dollar going forward. Parity in the euro is on the cards before long.

Good luck

Adf