Both sides in the trade war appear

To want nothing more than to steer

The narrative toward

A place where each scored

Political points, crystal clear

But markets, which yesterday felt

The problems would soon, away, melt

Are nervous today

And cannot allay

Their fear losses will not be quelled

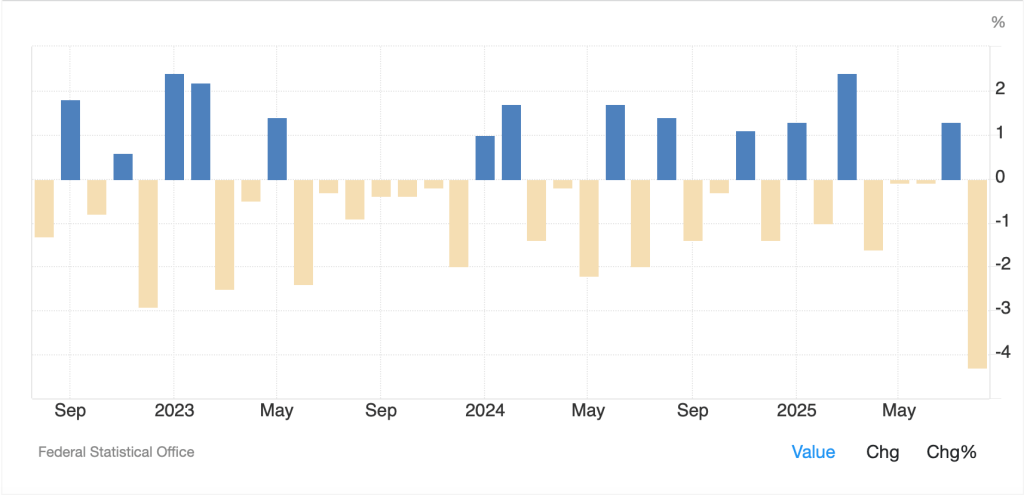

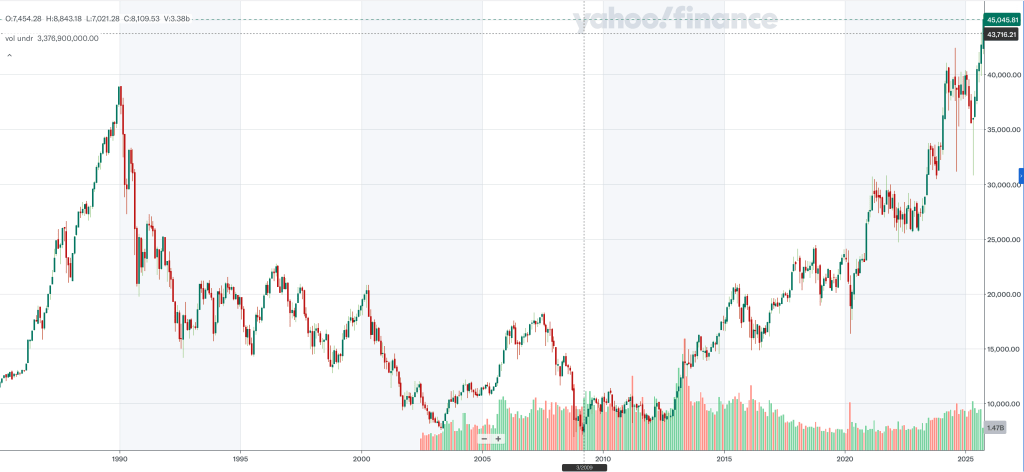

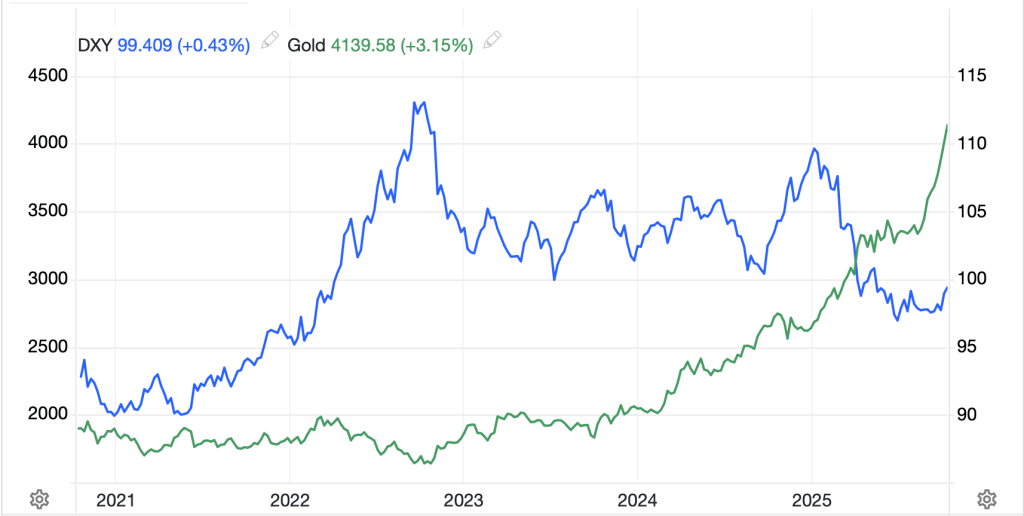

It is becoming more difficult to discuss markets writ large as we have seen some historic relationships fall apart over the past 6 months. For instance, the idea that both gold (and all precious metals) and the dollar would rise simultaneously is hard for old-timers like me to understand. In ordinary times, the two had a very different relationship as gold was, essentially, just another currency. If you look at the two charts below from tradingeconomics.com, you can see a longer-term chart that demonstrates, at best, independent behavior, and while the magnitudes of the movements are somewhat different, you can see that as the dollar peaked in late 2022, gold was bottoming and there is a general inverse correlation.

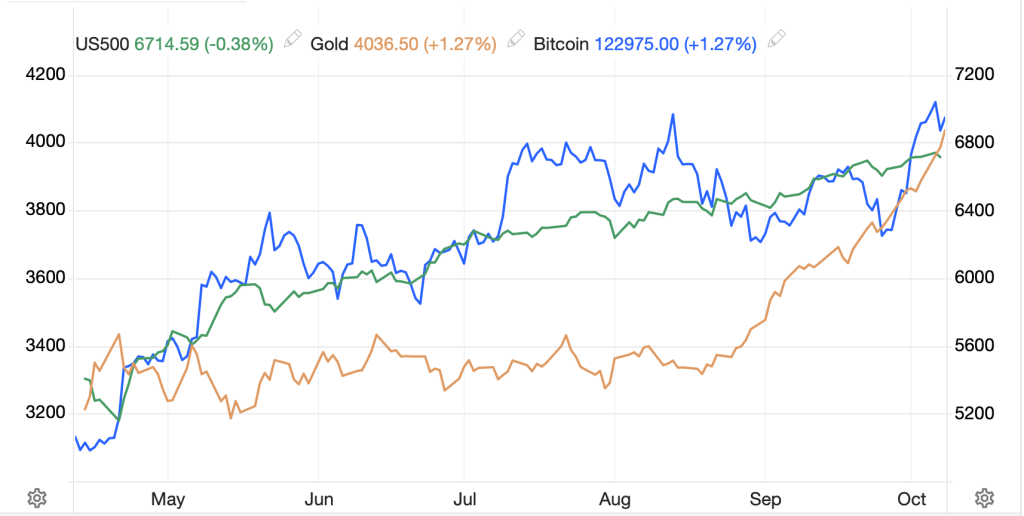

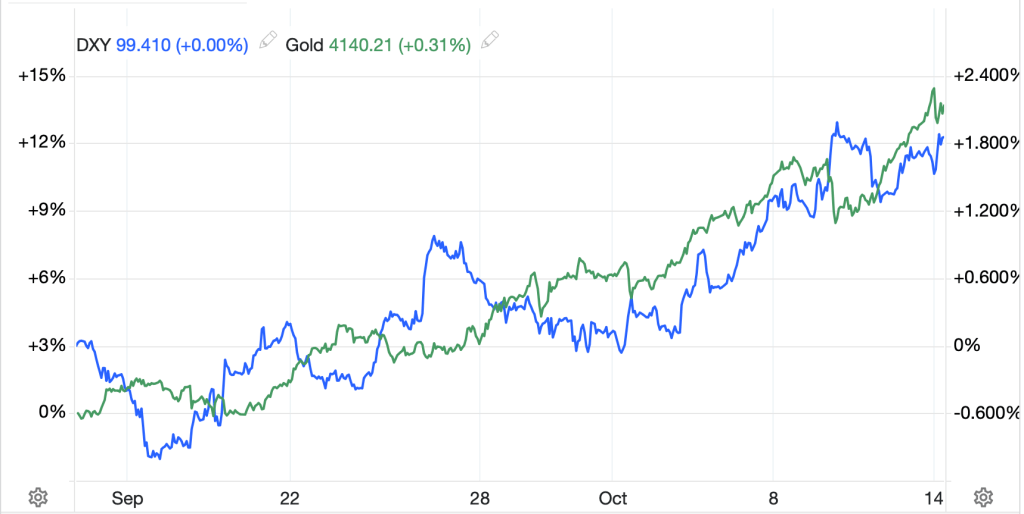

However, over the past month, that story is completely different as evidenced by this chart (which is based on percentage moves):

The other day I mentioned the debasement trade, the idea that investors were scooping up gold and bitcoin because they didn’t want to hold dollars. However, it is harder to make that case about dollars, although fiat in general may be a different story.

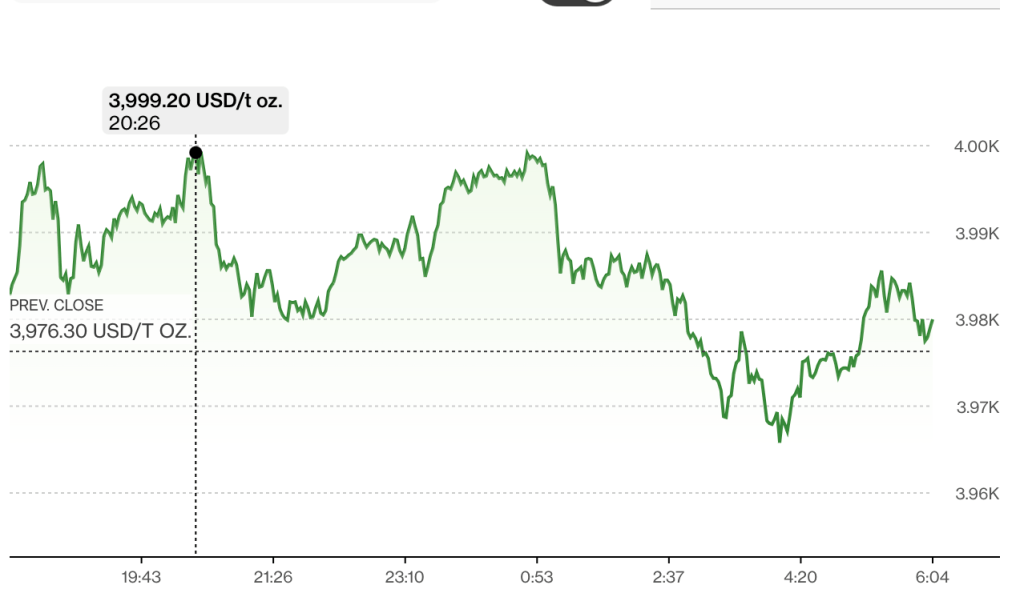

I highlight this because I use the term ‘markets’ all the time as a generic concept, but lately, I need more specificity, I think. So, Friday, when there appeared to be a sudden escalation in the trade war between China and the US, equity markets fell sharply, precious metals rallied, and bonds rallied while the dollar edged lower. Yesterday, with the bond market closed, and a concerted effort by both sides to claim nothing had changed and that Presidents Trump and Xi would still be meeting at the ASEAN conference in two weeks, equity markets rebounded sharply, precious metals continued to rally, and the dollar rebounded. Bringing us up to date now, equity markets are back under pressure (it appears that the trade situation is still an issue), precious metals are still rallying alongside the dollar, and as the bond market reopens, it, too, is rallying with yields slipping -3bps to 4.00%.

Some of this doesn’t make much sense, but I will try to address things, at least broadly speaking. The constant across these moves has been precious metals rallying and I believe there are two stories working together here. There is a fundamental story where central banks and, increasingly, individual investors are buying gold as they are seeking safe havens in an increasingly uncertain world. Silver and platinum both benefit from this, as well as ongoing industrial demand, especially from the technology sphere. But there is also a serious short squeeze unfolding in both the gold and silver markets as there is a mismatch between inventories held on exchanges and demand for physical metal.

In the leadup to Liberation Day, you may remember the story of a huge inflow of gold and silver to the COMEX in the US ahead of feared tariffs on precious metals imports, although those tariffs never materialized. However, all that metal sits in COMEX vaults today and is likely hedged with short futures contracts. Meanwhile, London has a shortage of available metal and owners of LME contracts are seeking delivery, thus pushing the shorts to buy back at ever higher prices. My friend JJ (Market Vibes on Substack) made the point there is a big difference between a bubble and a short squeeze, and a squeeze can go on much longer depending on the size of the short relative to the market’s overall size. I think that’s what we are currently witnessing in both gold and silver.

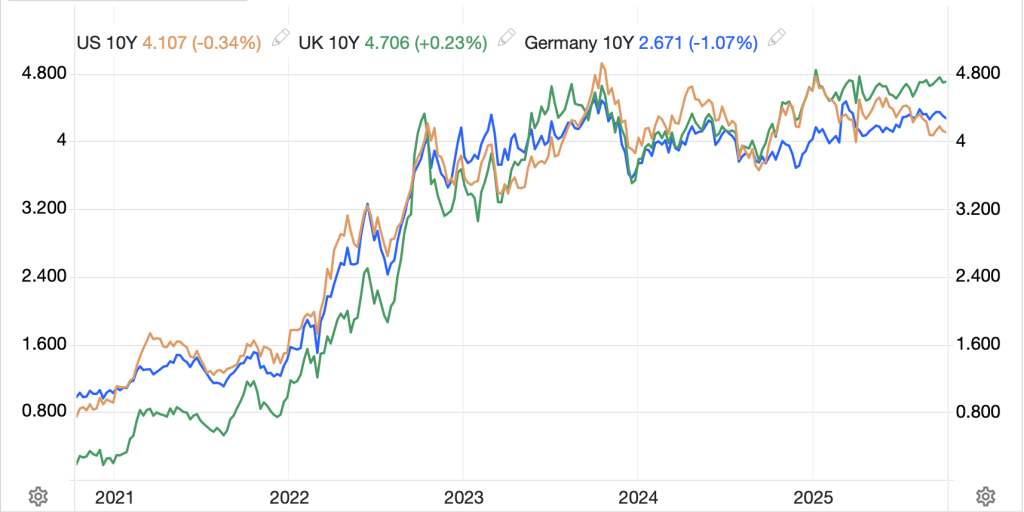

As to the debasement trade idea, there are two things that call this theory into question, the dollar’s continued rebound and the bond market’s rally driving yields lower. Arguably, the key concern in debasement is a dramatic increase in inflation, something I also fear. But if that is the fear, how is it that bond yields, which are entirely reliant on pricing future inflation, are declining. And that is what they have been doing since the beginning of the year, with 10-year yields falling ~80bps, and in truth, having gone nowhere since late 2022.

Source: tradingeconomics.com

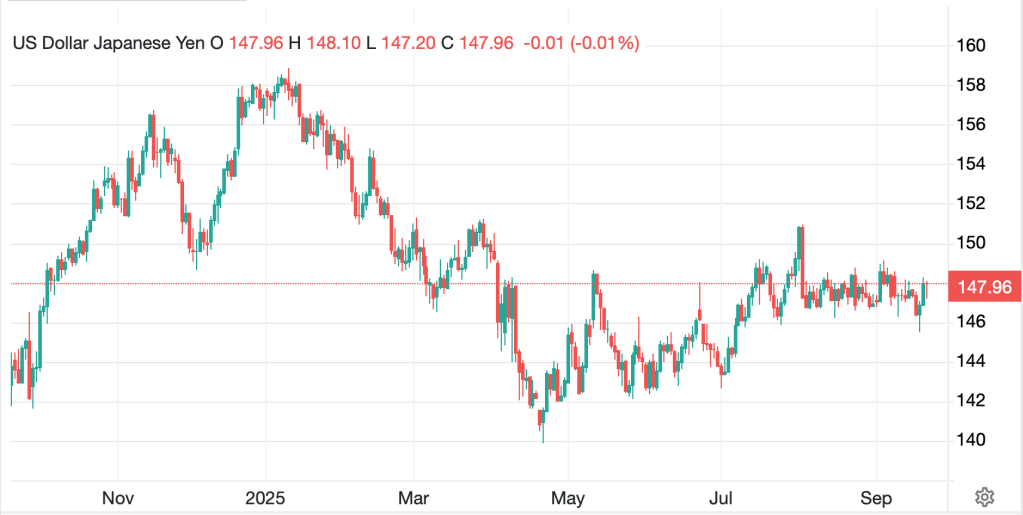

Meanwhile, the dollar, which did decline in the first half of the year, looks very much like it is forming a base here. It is certainly not in a serious decline as evidenced by the chart below.

Source: tradingeconomics.com

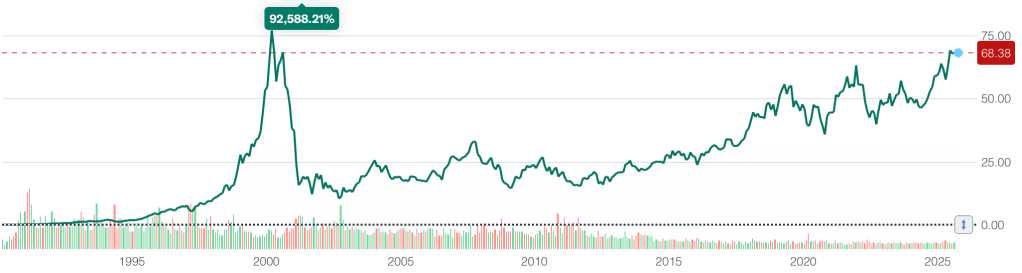

What about equity markets? Well, they have much that goes on away from macroeconomic issues, such as company earnings and more sector specific events, although the macro can have an impact. We all know the AI story has been THE driver of the equity rally this year, really the past 2+ years, pushing everything else aside. However, the trade tiff between China and the US, and growing around the world (the Netherlands just expropriated a Chinese owned chip company!) is highly focused on the AI story, and if trade is severely impacted, especially in chips and technology, that does not bode well for the drivers of the equity rally. Whether that results in a rotation into other companies or a wholesale liquidation is far less clear.

This morning, for instance, all European bourses are lower (DAX -1.6%, CAC -1.3%, FTSE 100 -0.6%, IBEX -0.6%) and overnight we saw significant weakness on Japan’s reopening (-2.6%) as well as China (-1.2%) and HK (-1.7%). Too, US futures are lower across the board at this hour (7:15) by -1.0% or so. The indication is that a rotation is not the story, rather a reduction of risk. Of course, we could easily see more comments from both China and the White House (who are meeting at the IMF meetings in Washington right now) that things have de-escalated and turn the whole ship back around. It should be no surprise that the VIX is rallying.

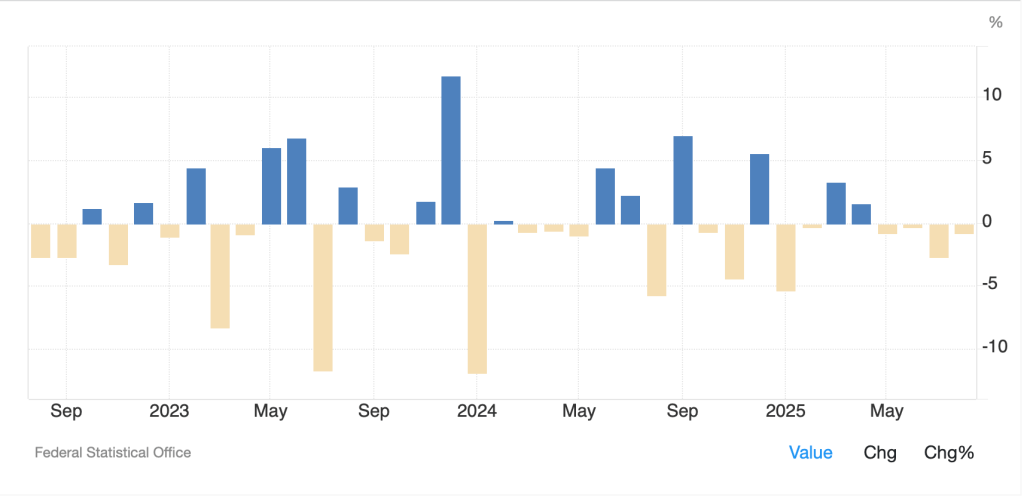

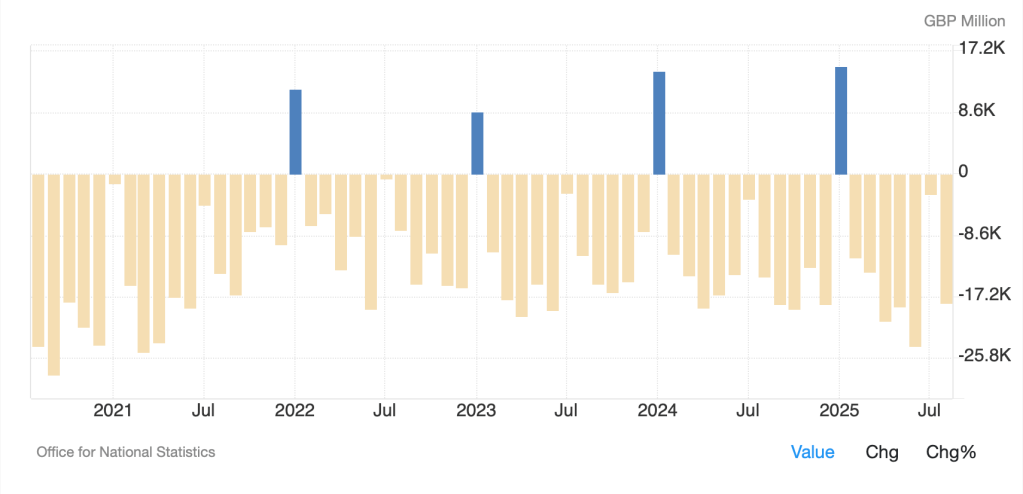

As to bonds, European sovereign yields have fallen by between -3bps and -4bps across the continent while UK gilts (-7bps) have fallen further after employment data there showed the Unemployment Rate ticked up to 4.8% unexpectedly while there were job losses as well. In fact, looking at the chart below of Payroll Changes over the past three years, the trend seems pretty clear!

Source: tradingeconomics.com

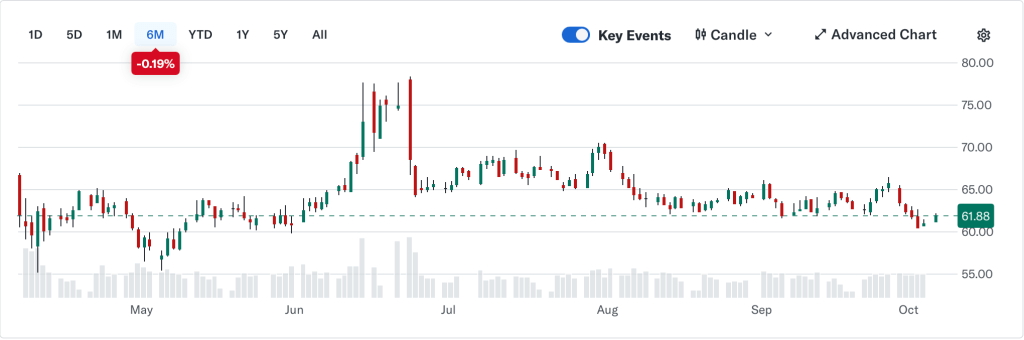

Those UK employment figures also weighed on the pound (-0.45%) which is declining in line with most of the G10 bloc (NOK -1.1%, AUD -0.9%, NZD -0.5%) although the yen (+0.25%) is bucking the trend, perhaps because of its haven status. NOK is suffering from oil’s (-2.2%) sharp decline after the IEA, once again, said there would be a supply surplus, although their forecasts have been wrong, and consistently overestimating supply and underestimating demand, for the past decade.

As to the EMG bloc, despite the rally in precious metals, both ZAR (-0.9%) and MXN (-0.8%) are under pressure as is KRW (-0.6%) after the story that China is imposing restrictions on Korean ship builders in the US that are helping America try to reverse the decimation of our shipbuilding industry.

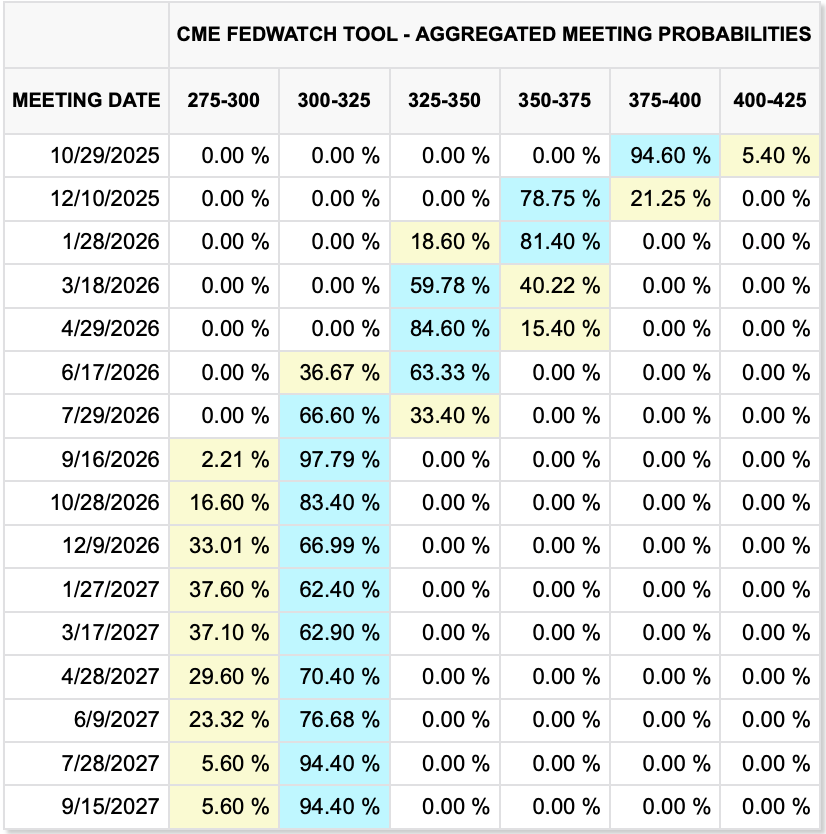

Trying to recap all that is happening, fear is pervasive across investors of all stripes. The hunt for havens continues and absent a more lasting trade truce between the US and China, something I think will be very difficult to achieve, volatility is likely to be the dominant feature in all markets. In the end, though, there is no evidence that the dollar is being ‘dumped’ in any manner and while gold and precious metals may continue to rally, given 2 Fed rate cuts are already priced in for the rest of the year, we will need something completely outside the box to see the dollar fall in any meaningful manner, I believe. For hedgers, markets like these are why you remain hedged!

Good luck

Adf