Said Powell, we’re not in a rush

To cut rates as we try to crush

Remaining inflation

And feel the sensation

Of drawing an inside straight flush

Up next is the CPI data

Though not one on which we fixate-a

The surveys explain

That people remain

Quite certain that we’re doing great-a

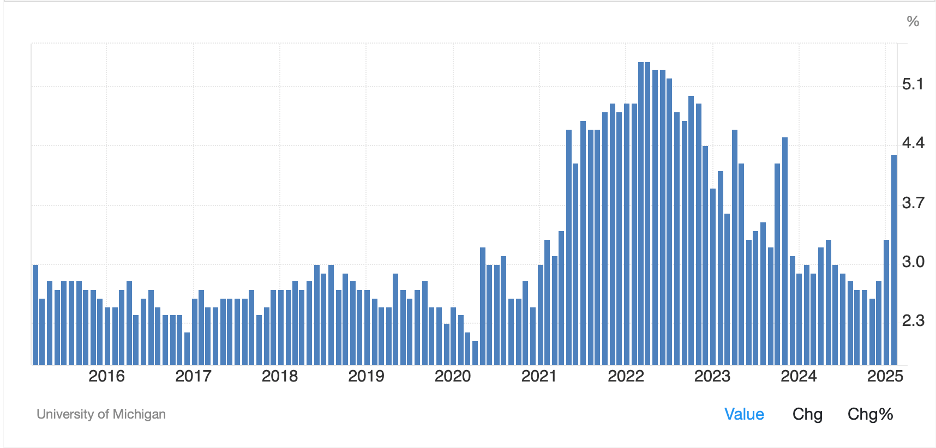

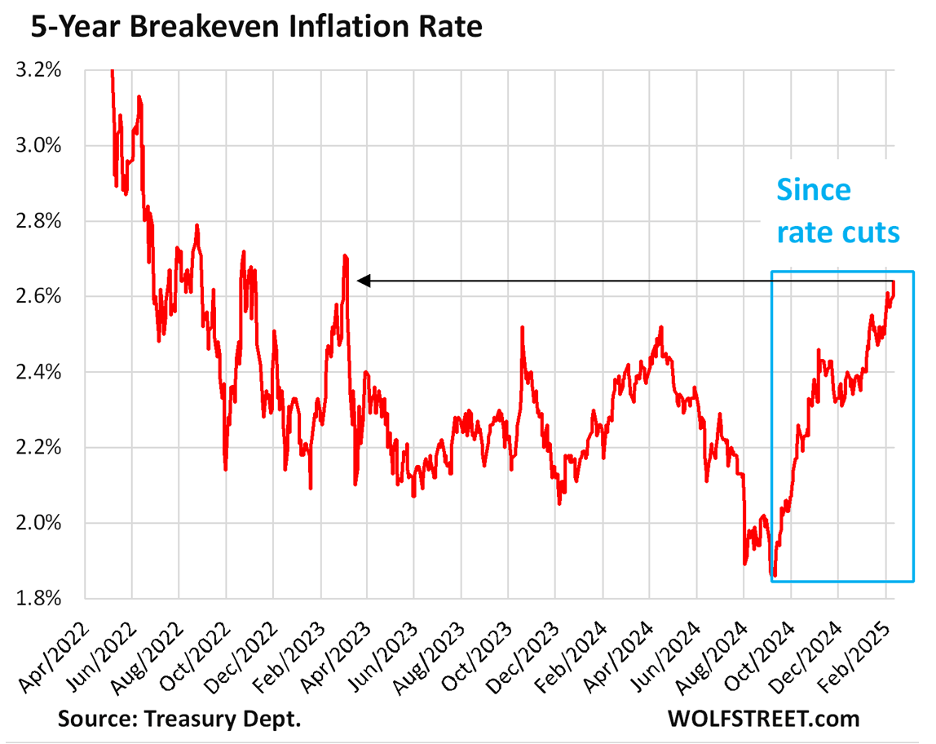

Chairman Powell testified to the Senate Banking Committee yesterday and the key comments were as follows, “Inflation has eased significantly over the past two years but remains somewhat elevated relative to our 2 percent longer-run goal. Total personal consumption expenditures (PCE) prices rose 2.6 percent over the 12 months ending in December, and, excluding the volatile food and energy categories, core PCE prices rose 2.8 percent. Longer-term inflation expectations appear to remain well anchored, as reflected in a broad range of surveys of households, businesses, and forecasters, as well as measures from financial markets.” [Emphasis added.] He followed up, “With our policy stance now significantly less restrictive than it had been and the economy remaining strong, we do not need to be in a hurry to adjust our policy stance. We know that reducing policy restraint too fast or too much could hinder progress on inflation.” This is largely what was expected as virtually every Fed speaker since the last FOMC meeting has said the same thing, there is no rush to further cut rates. Powell did admit that the neutral rate had risen compared to where it was before inflation took off in 2022 but maintains that current policy is still restrictive.

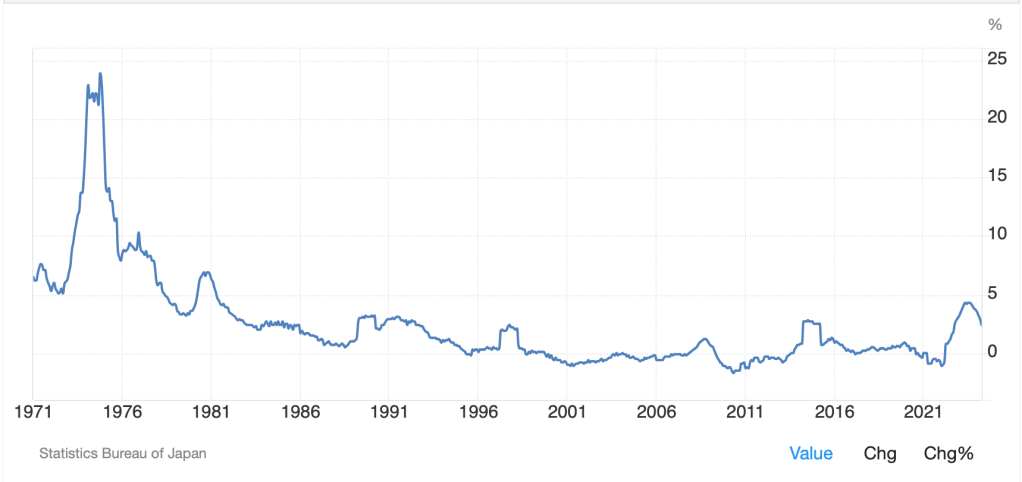

However, let’s examine the highlighted comment above a little more closely. Two things belie that statement as wishful thinking rather than an accurate representation of the current situation. The first is that the most recent survey released from Friday’s Michigan Sentiment surveys, shows that inflation expectations for the next year jumped dramatically, one full percent to 4.3% as per the below chart.

Source: tradingeconomics.com

Looking over the past 10 years of data, that is a pretty disturbing spike, taking us right back to the 2022-23 period when inflation was roaring. In addition to that little jump, it is worth looking at those market measures that Powell frequently mentions. Typically, they are either the 5-year or 10-year breakeven rate. That rate is the difference between the 5-year Treasury yield and the 5-year TIPS yield (or correspondingly the 10-year yields). A quick look at the chart below shows that since the Fed first cut rates in September 2024, the 5-year breakeven rate has risen 78bps to 2.64%. Certainly, looking at the chart, the idea of ‘well anchored’ isn’t the first description I would apply. Perhaps, rocketing higher?

At any rate, it appears quite clear that the Fed is on hold for a while yet as they await both the evolution of the economy and further clarity on President Trump’s policies on tariffs. While there is no doubt that we will continue to hear from various Fed speakers going forward, I maintain that the Fed is not seen as the primary driver in markets right now, rather that is President Trump.

Of course, data will still play a role, just a lesser one I believe, but we cannot ignore the CPI report due this morning. First, remember, the Fed doesn’t focus on CPI, but rather on PCE which is typically released at the end of the month and calculated by the Commerce Department, not the BLS. But the rest of us basically live in CPI land, so we all care. If nothing else, it gives us something to complain about as we look incredulously at the declining numbers despite what we see with our own eyes every time we go shopping.

As it is, here are this morning’s median expectations for the data, headline CPI (+0.3% M/M, 2.9% Y/Y) and core CPI (+0.3% M/M, 3.1% Y/Y). Once again, I believe there is value in taking a longer view of this data for two reasons; first to show that we are not remotely approaching the levels to which we became accustomed prior to the Covid pandemic and government response, and second to highlight that if your null hypothesis is CPI continues to decline, that may not be an appropriate view as we have spent the past 8 months in largely the same place as per the below chart. Too, note the similarity between the Michigan Survey chart above and this one.

Source: tradingeconomics.com

OK, those are really the stories of the day since there have not, yet, been any new tariffs imposed by President Trump, and traders need to focus on something. Let’s take a look at how things behaved overnight.

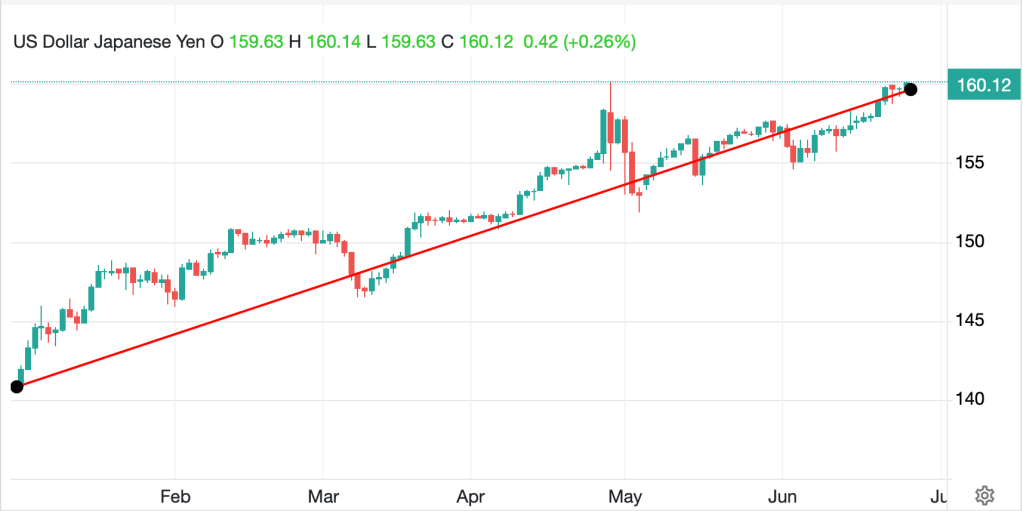

After a mixed US equity session, the strength was in Hong Kong (+2.6%) and China (+1.0%), seemingly on the back of several stories. First is that China is looking at new ways to address the property bubble’s implosion, potentially allocating more support there, as well as this being a reflexive bounce from yesterday’s decline and the story that President’s Xi and Trump have spoken with the hope that things will not get out of hand there. As to Japan, the Nikkei (+0.4%) has edged higher as the yen (-0.7%), despite a lot of talk about higher rates in Japan and the currency being massively undervalued, continues to weaken. In Europe, once again there is limited movement overall with very tiny gains of less than 0.2% the norm although Spain’s IBEX (+0.7%) is the big winner today on some positive earnings results. US futures are little changed at this hour (7:15).

In the bond market, Treasury yields are unchanged this morning, retaining the 4bps they added yesterday, and in Europe, sovereign yields are also little changed with German Bunds (+2bps) the biggest mover in the session. JGB yields did rise 3bps overnight, but that seems to be following US yields as there was precious little new news there.

In the commodity markets, yesterday’s metal market declines are mostly continuing this morning with gold (-0.6%) down again, although still hanging around $2900/oz. Silver has slipped although copper (+0.3%) has arrested its decline. Oil (-1.1%) is giving back some of yesterday’s gains and continues to trade in the middle of its trading range with no real direction. One thing I haven’t highlighted lately is European TTF NatGas prices, which while softer this morning (-1.9%) have risen 15% in the past month as storage levels in Europe are declining to concerning levels and global warming has not resulted in enough warm days for the winter.

Finally, the dollar is mixed away from the yen’s sharp decline with the euro (+0.1%) and CHF (+0.2%) offsetting the AUD (-0.3%) and NOK (-0.5%). It is interesting that many of the financial and trading accounts that I follow on X (nee Twitter) continue to point to JPY and CAD as critical and are anticipating strength in both those currencies imminently. And yet, neither one is showing much tendency to strengthen, at least for the past month or two. I guess we shall see, but if the Fed is going to remain on hold, and especially if more tariffs are coming, I suspect the default direction of the dollar will be higher. As to the EMG bloc, there is virtually nothing happening here, with a mix of gainers and laggards, none of which have moved 0.2% in either direction.

Other than the CPI data, Chairman Powell testifies to the House Financial Services Committee, and we will see EIA oil inventories with a modest build anticipated. We also hear from two other Fed speakers, but again, with Powell in the spotlight, they just don’t matter.

Markets overall are pretty quiet, seemingly waiting for the next shoe to drop. My money is on that shoe coming from the Oval Office, not data or Powell, which means we have no idea what will happen. Stay hedged, but until further notice, I still don’t see a strong case for the dollar to decline.

Good luck

Adf