Apparently, back in the day

Investors and CEOs say

The future was clear

But now they all fear

Uncertainty is in their way

So, they will now clearly explain

When earnings and profits do wane

That they’re not to blame

Instead, they now claim

It’s Trump’s fault, that man is our bane

I’m having some difficulty understanding a number of the concerns about which I read every day as more and more corporate executives and investment managers have suddenly found a new scapegoat, uncertainty. Apparently, I missed the time when the future was certain, as I have no recollection of that at all. Perhaps you remember. If so, could you remind me please?

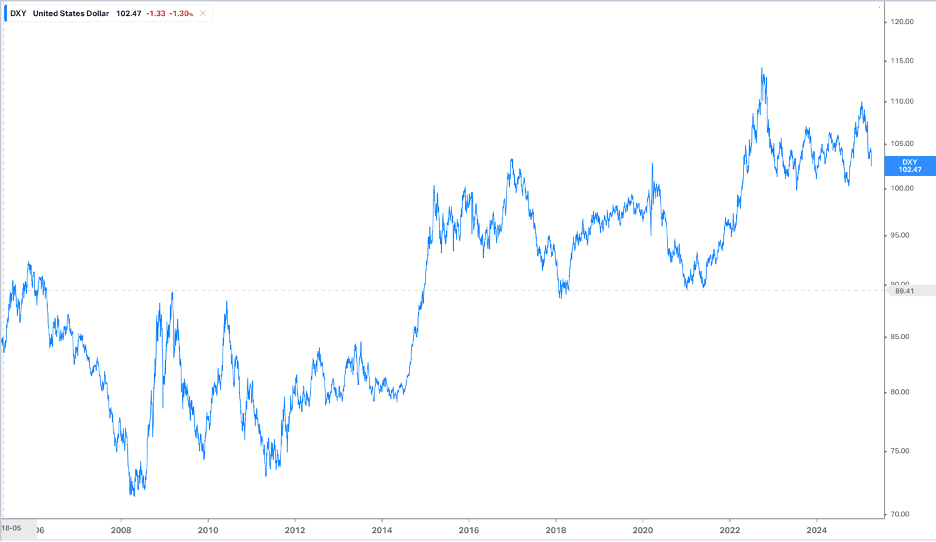

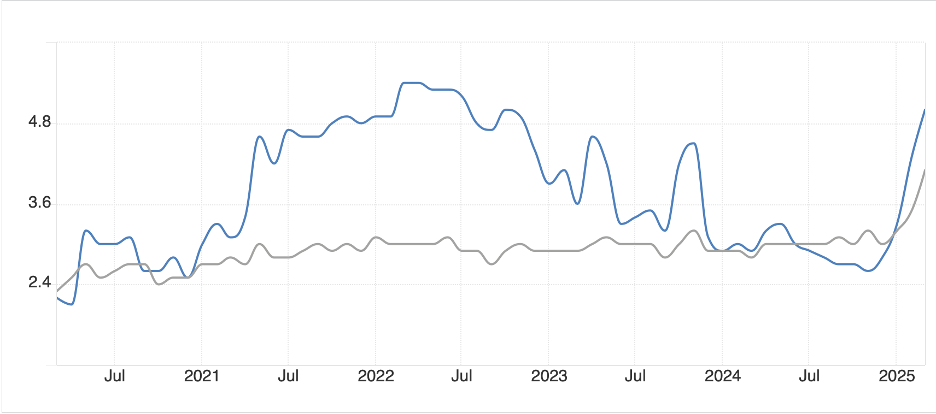

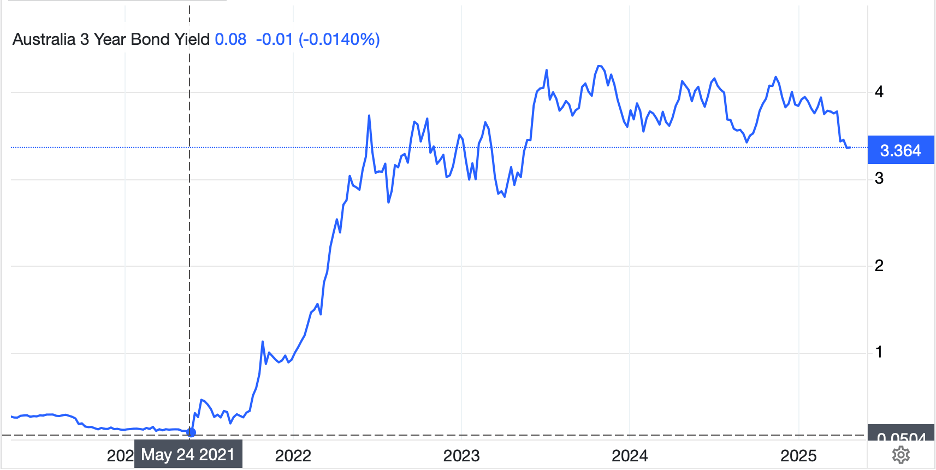

For instance, I remember the certitude of the comments from the RBA back in April 2021 that interest rates would remain lower for longer, and that it would be at least three years before they would need to raise interest rates. I also remember, as the graph below demonstrates, that certainty was misplaced as less than two months after those comments, the RBA started raising interest rates despite the clear directive they would not need to do so for years.

Source: tradingeconomics.com

While this is just one example, in my experience, certainty is not part of the mix when running a business or a portfolio of assets or a position in any financial market. So imagine my surprise when reading Bloomberg this morning and finding that suddenly, the world is awash in uncertainty. Has it ever not been the case? Pretty much once you get beyond the laws of physics or mathematics, it strikes me that certainty in the future just doesn’t exist. (Even at 4Imprint). Nonetheless, uncertainty because of President Trump’s trade policies is the latest rationale for every problem at every company right now. In truth, I suspect that many executives are quite happy with this as the Covid excuse was wearing thin.

In the markets, too, uncertainty is the favored excuse for underperformance as how can anyone manage money with tape bombs constantly appearing. Powell is a loser one day to I’m not going to fire Powell the next. Tariffs are forever to a 90-day pause. And of course, there are many other political stories that have limited impact on markets but seem to change regularly. While this gets back to my view that President Trump is the avatar of volatility, I seem to recall long before President Trump that there were numerous presidential statements that had major market impacts. My point is, nothing has really changed folks, other than the media dislikes this president more than any other in my lifetime so amplifies anything they think makes him look bad.

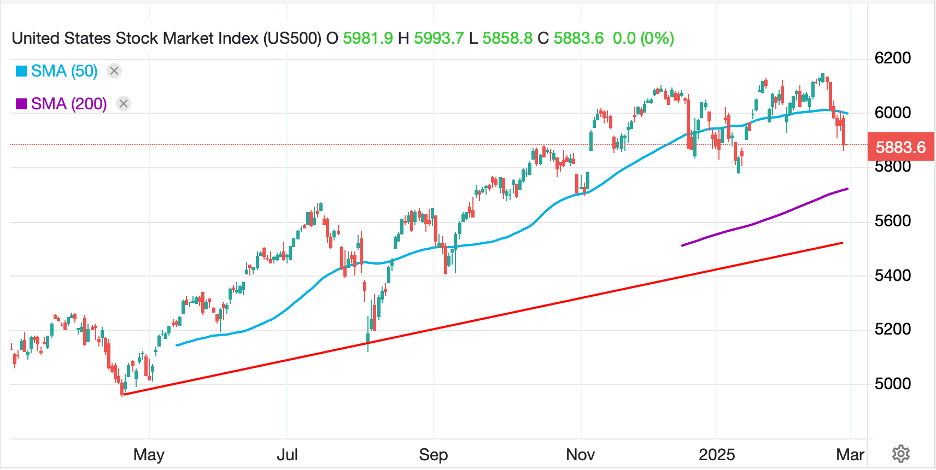

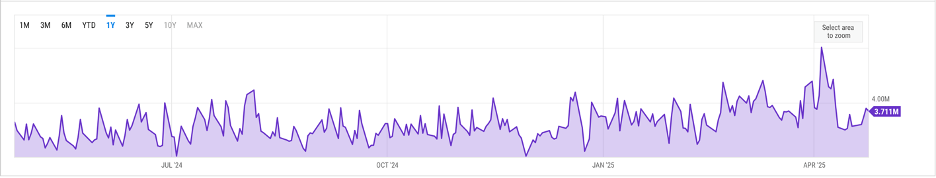

However, the one thing about which we cannot be surprised is that trading activity is waning, at least compared to what we saw since Trump’s inauguration. Volumes of activity on the exchanges are sliding (see chart of S&P 500 volume below from ycharts.com) which makes perfect sense in a volatile and uncertain market.

Now, as per the above, I would contend that the future is always uncertain. Rather the real culprit here is volatility. My take is that the future is going to continue to be volatile which implies, to me at least, that trading activity is going to remain on the low side and with it, liquidity for those who have significant real flows to transact. It’s funny, volatility begets lower volumes, and lower volumes beget volatility due to reduced liquidity. I’m not sure what it will take to break us from this cycle, but I have a sense that it will be with us for a while.

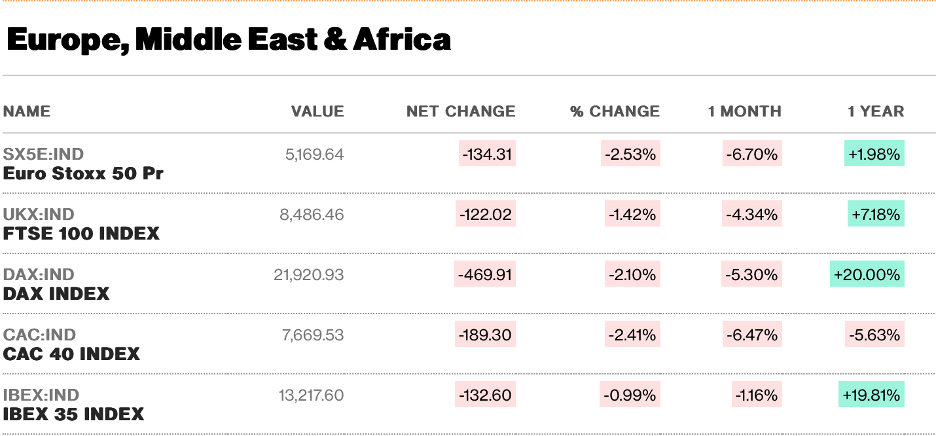

With that in mind, let’s see what happened overnight. Yesterday’s strength in the US was followed by strength in Tokyo (+1.9%) although both China (+0.1%) and Hong Kong (+0.3%) didn’t really participate. Interestingly, this morning I read that China was exempting a number of imports from the US from tariffs as apparently, it was hurting their businesses so severely it could cause closures. Elsewhere in Asia, the picture was mixed although there were more gainers (Korea, Taiwan, Philippines, Thailand) than laggards (India, Singapore). I do believe the tariff story is impacting these markets more than any as they are directly in the line of fire.

Meanwhile, in Europe, most markets are firmer this morning (DAX +0.6%, CAC +0.4%, IBEX +0.9%) but the UK (-0.1%) is lagging despite much stronger than expected Retail Sales data there this morning. As to US futures, at this hour (7:00) they are pointing lower by about -0.35%.

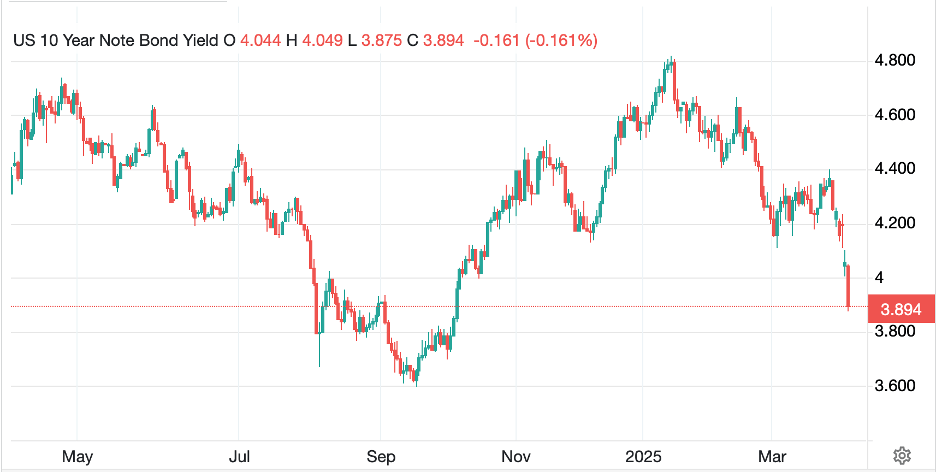

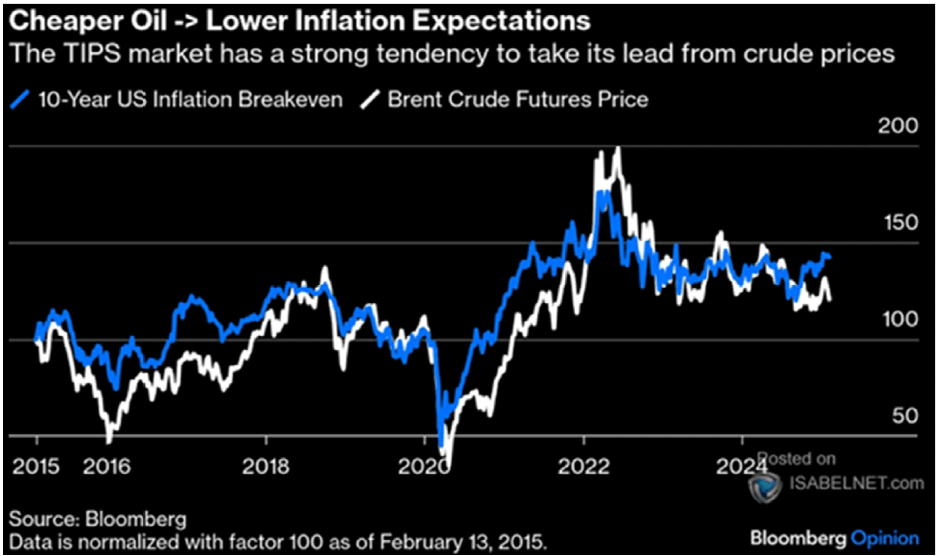

In the bond market, Treasury yields continue to slide, down another -3bps this morning although Europe is moving in the opposite direction, with yields climbing between 2bps and 3bps in the session. It’s odd because I continue to hear about European growth forecasts being cut and the ECB preparing for more rate cuts while the talk around the markets is that the US is going to see inflation from the tariffs. Today’s bond moves don’t really speak to those narratives, but it is just one day. I need to mention JGB yields, which rose 3bps overnight after Tokyo CPI came in 2 ticks hotter than forecast at both headline and core levels.

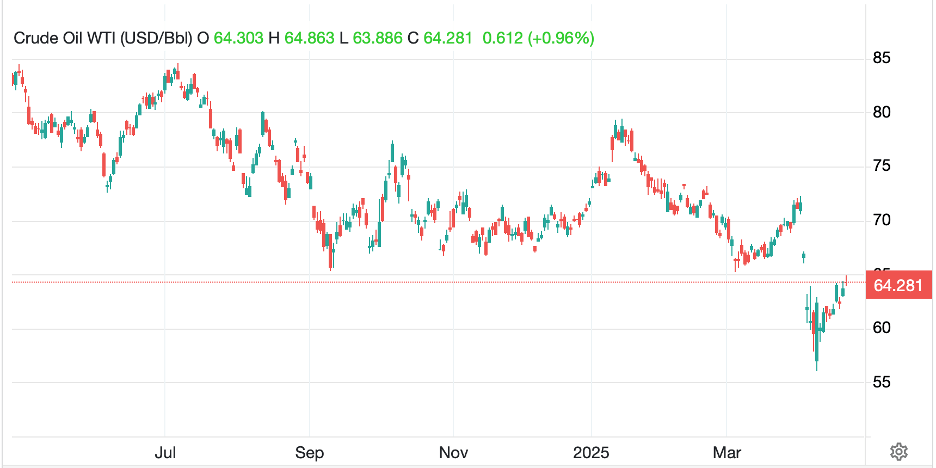

In the commodity markets, oil (-1.2%) is slipping again and has consistently demonstrated it is unable to make any dent in the major price gap above the market. To close that gap, WTI will need to rally more than $8/bbl from current levels, something I just don’t see happening in the current environment. That would require a war in Iran I think. As to metals, yesterday’s gold rally has been reversed (-1.5%) and today it is impacting both silver (-0.75%) and copper (-2.1%) as is the stronger dollar it seems.

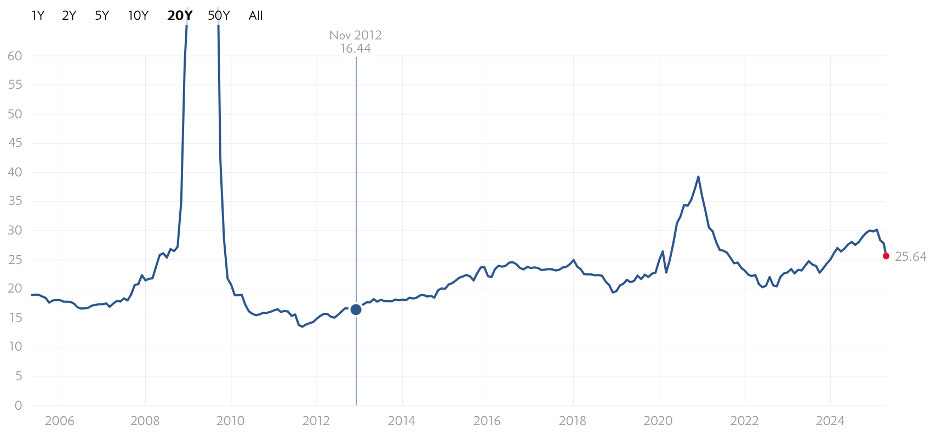

Speaking of the dollar, Monday’s narrative that the dollar was about to collapse will need at least another day to come to fruition as it is modestly higher again this morning. looking at the DXY as a proxy, it is trading just below 100, a level that many are watching closely. A quick look at the chart below shows this is the third time in the past two years it has traded to this level, although the first of those times it broke through. Of course, it was much lower just a couple years earlier.

Source: tradingeconomics.com

Today’s dollar strength is modest but broad-based with only CLP (+0.6%) higher this morning which makes absolutely no sense given copper’s slide today. The worst performer is SEK (-0.8%) but given it has been the best performer YTD amongst the G10, perhaps this is just corrective. Otherwise, we are looking at movements on the order of 0.25% to 0.45% across the board.

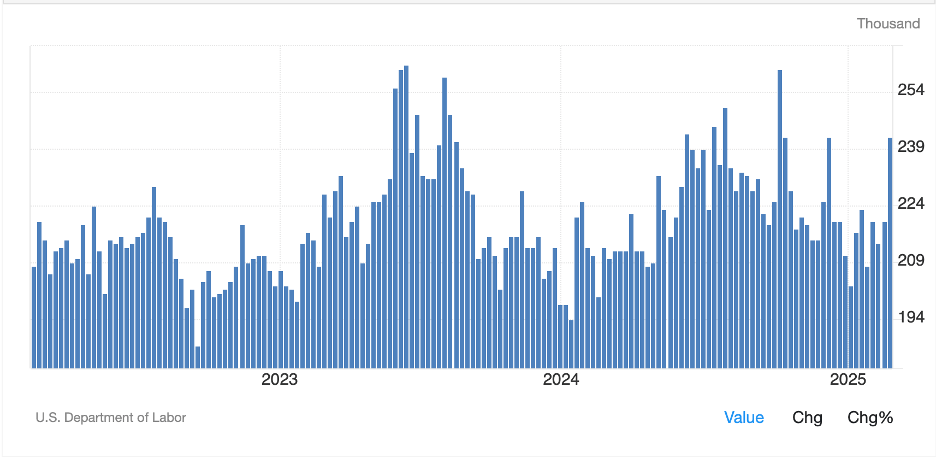

The only data this morning is Michigan Sentiment (exp 50.8). We continue to see a dichotomy between the ‘hard’ data, Claims, NFP, CPI, Factory Orders, and the ‘soft’ data, Michigan Sentiment, PMI, inflation expectations with the former holding in well while the latter weakens. Many analysts believe that recession is coming our way by summer, but these same analysts have been predicting the recession for the past 3 years. The one thing about the US economy is that it is extraordinarily resilient despite all the things governments try to do to disrupt it. I understand the concern, at least if you watch/read the news, but I have a sense that many people across the nation do not really do that. While I believe that equity valuations remain too high to be sustainable, it is not clear to me that the economy is heading into a recession at this time. As to the dollar, I wouldn’t write its obituary just yet, although I do think it will soften further over time.

Good luck and good weekend

Adf