The only things that really matter

Are stock prices frequently shatter

Their previous high

And rise to the sky

Like too much yeast got in the batter

And though prices move up and down

While traders both grin and they frown

The long term has shown

The ‘conomy’s grown

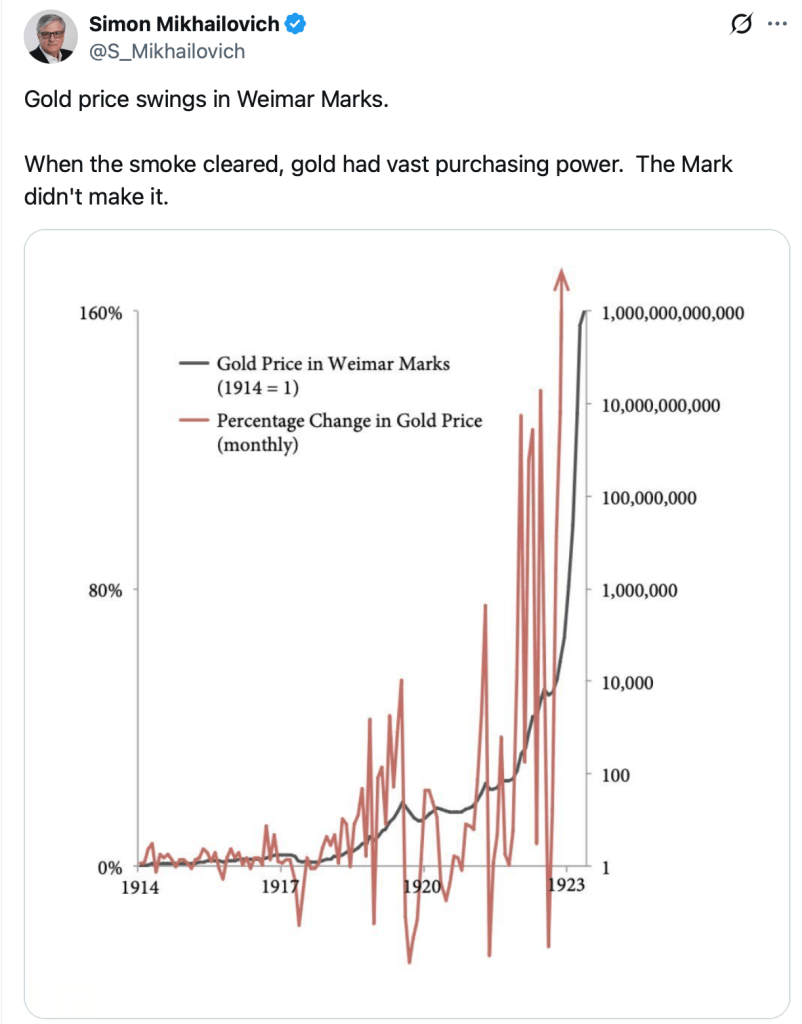

Though lately, tis gold’s worn the crown

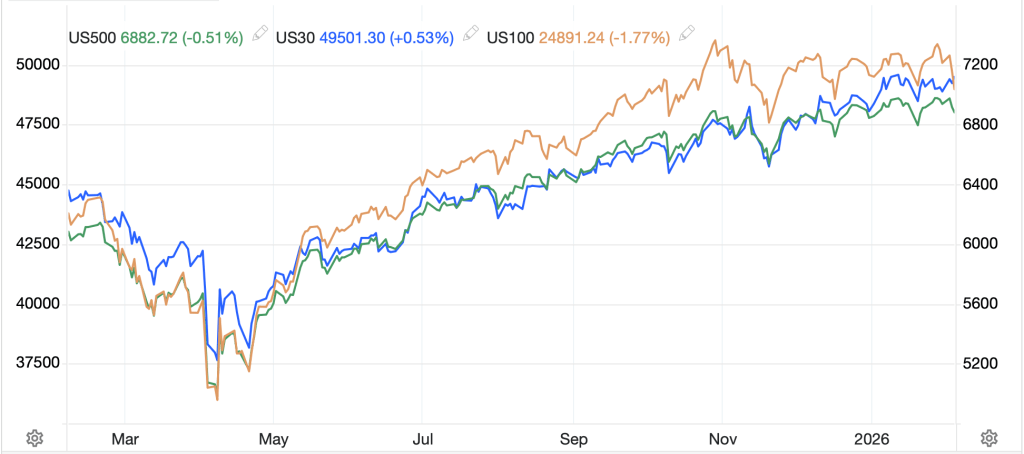

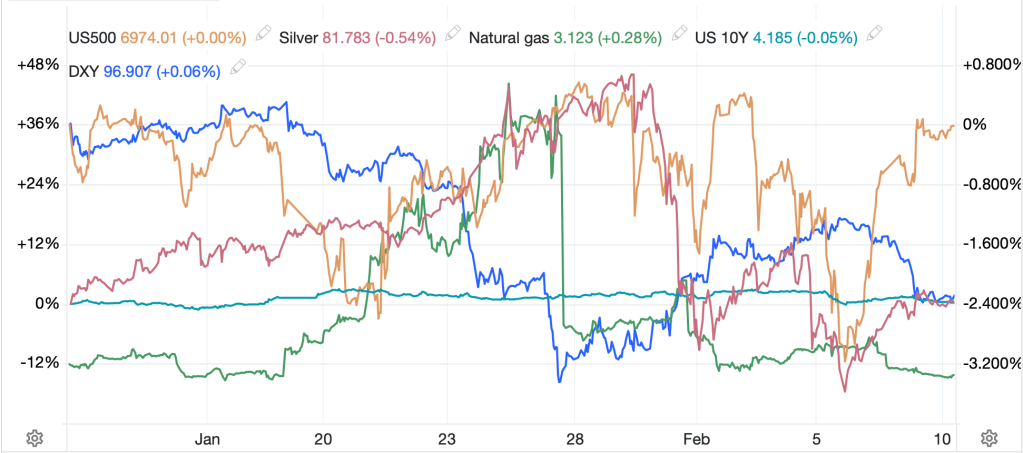

As I wrote last week, markets have a difficult time maintaining excessively high levels of volatility for any extended period of time as traders simply get tired and effectively check out. Now, we have had some impressive volatility lately, whether in stocks, silver or natural gas, to name three and as can be seen in the chart below.

Source: tradingeconomics.com

But a closer look at the chart tells an interesting story, despite a huge amount of movement in the past month, the net movement for the S&P 500, Silver, Natural Gas and the 10-year Treasury, has been essentially zero. If you dig through this chart, the only net movement has been the dollar’s roughly 2% decline.

That is an interesting tale, I think. Perhaps Macbeth said it best though, “It is a tale told by an idiot, full of sound and fury, signifying nothing.” What exactly is the significance of the remarkable volatility we have seen over the past month across numerous markets?

If we review the past month’s activities, the most notable market event was the announcement of Kevin Warsh as the next Fed chair, and the initial assumption that he is much more hawkish than market participants had previously anticipated. It remains to be seen if that is the case, especially since we are still months away from any confirmation hearings and his eventual swearing in, but that was certainly the initial narrative. It was blamed for a sharp decline in equities as well as precious metals, although both are essentially unchanged over the past 30 days.

At least NatGas made sense given the significant cold and winter storms that hit much of the US and northern Europe, but those, too, have passed, and prices are back to where they were prior to the more extreme weather.

Maybe the most interesting thing is that bond yields are basically unchanged despite the Warsh announcement. It would not have been surprising to see a significant move there given Warsh’s ostensible hawkishness, but that was not the case.

My point is that markets move for many reasons. Occasionally, there is a clear catalyst (Japan’s Nikkei responding positively to PM Takaichi’s landslide victory comes to mind), but more often than not, the narrative writers seek to explain price action after the fact while covering up their previous forecasting mistakes. I, too, am guilty of this at times, which is the reason I try to step back and take a broader, longer-term view of market movement to get underlying causes. As I no longer sit on a trading desk, I am not privy to the day-to-day tick activity, and frankly, even then, unless it was happening at my bank, I would still be in the dark.

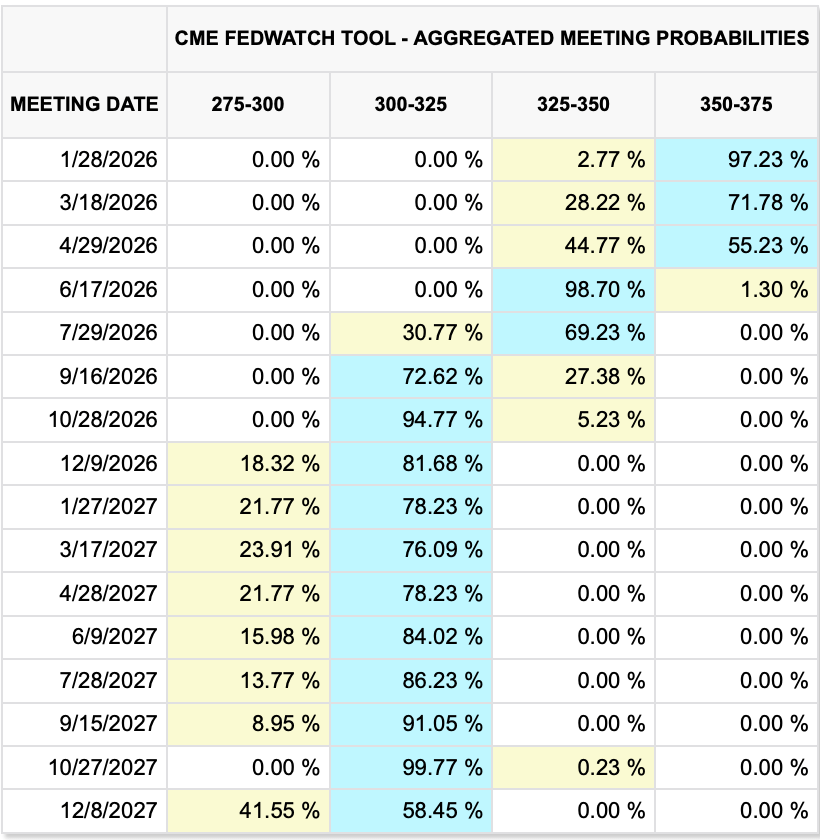

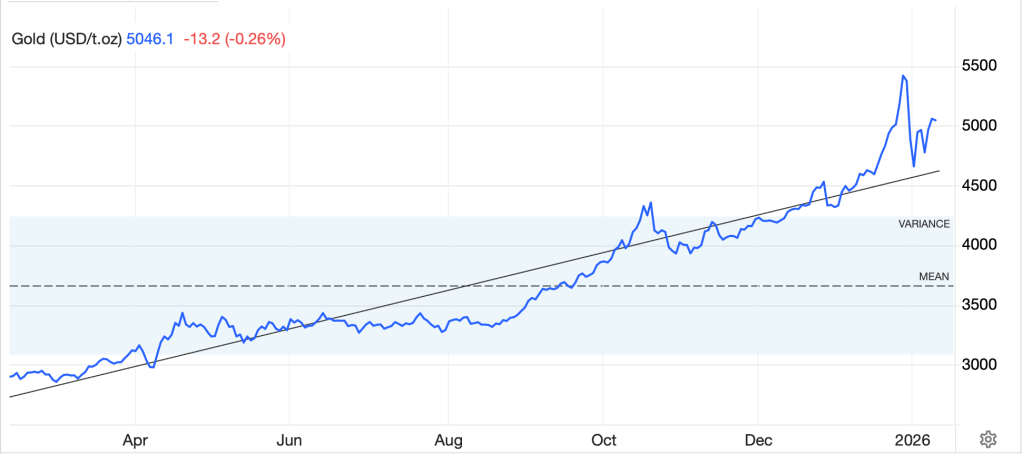

To conclude, the strongest trends, which remain the precious metals, continue, although prices are back closer to the long-term trend than the parabolic heights seen 10 days ago as you can see in the below chart. In fact, I don’t think we have had any changes in the underlying story, but the extreme market volatility is likely to be done for a while going forward.

Source: tradingeconomics.com

Which takes us to overnight market behavior. While Tokyo (+2.3%) is still ripping higher on the Takaichi election news, only Taiwan (+2.1%) and the Philippines (+2.0%) are keeping pace with the rest of the region much less impressed, (China +0.1%, HK +0.6%, Australia 0.0%). To my point, nothing has changed. In Europe, too, price activity is fairly muted (France +0.4%, Germany +0.1%, Spain +0.2%, UK -0.2%) as there has been no news of note either economically or politically. The most interesting data point was Norwegian inflation which came in much hotter than expected at 3.6% and has traders thinking the Norgesbank may be set to tighten again. This has helped NOK (+0.6%) which is the leading gainer in the FX markets this morning. As to US futures, at this hour (7:20), they are very modestly higher, just 0.15% or so across the board.

In the bond market, yields are backing off everywhere, with Treasury yields lower by -3bps, and European sovereigns lower by -1bp to -2bps across the board. The exception, of course, is Norway (+8bps). Perhaps, more interestingly JGB yields (-5bps) are slipping despite (because of?) Takaichi’s landslide victory. Recall, heading into the election, expectations were for aggressive fiscal expansion and borrowing to pay for it. However, Katayama-san, the FinMin has been explicit that they were going to be borrowing at the short end of the market, 1yr to 5yrs, so perhaps it is no surprise that the 10yr yield is slipping. With that in mind, though 5yr JGB yields also fell last night, down -3bps, although shorter dated paper was unchanged. I have not read of any analysts complaining that Japan is turning into an emerging market because they are funding themselves with short-dated paper, although when the US does it, apparently it is the end of the world.

Turning to commodities, oil (0.0%) continues to get tossed around on the Iran story, with no certainty as to whether a deal will be done or the US will attack. Apparently, Israeli PM Netanyahu is meeting with President Trump tomorrow to register his opinions on the subject. The interesting thing in this market is that the ‘peak oil demand’ narrative, which has been pushed by the climate set as occurring in the next year or two, has been pushed back to 2050 by the IEA as they take reality into account. That may encourage more drilling, but that’s just my guess and as I’m an FX guy, what do I really know?

As to the precious metals, after a couple of days rebounding, this morning, the sector is modestly softer (Au -0.3%, Ag -1.6%, Pt -1.2%) although as per the chart above, the trend remains higher across all these metals.

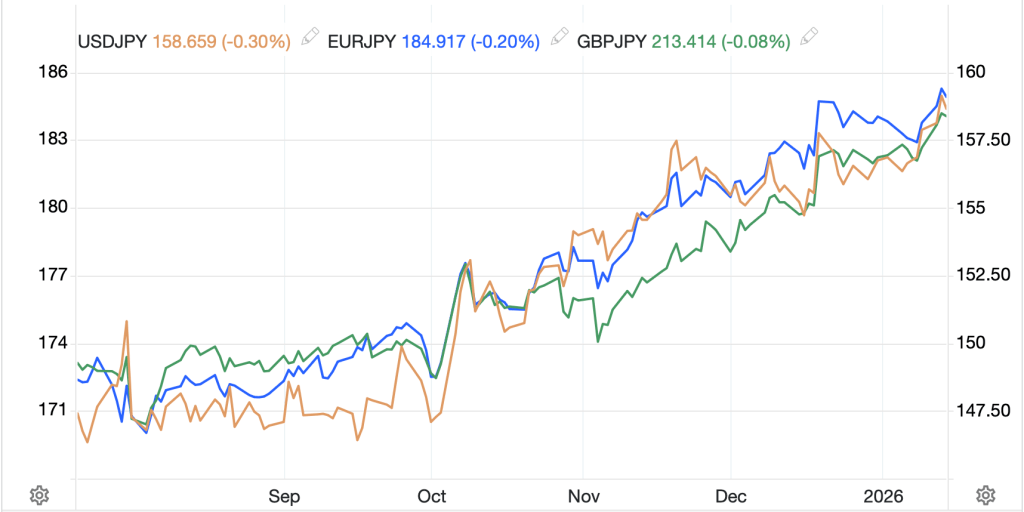

Finally, the dollar, which has fallen the past two days, has stabilized and is mostly higher (save for NOK mentioned above) with most currencies softer by about -0.15 or -0.2%. The other exception of note here is JPY (+0.5%) as there has been a lot of jawboning by the MOF there to prevent a rash of weakness. However, it is difficult for me to look at the JPY chart below and discern a major reversal is coming. I believe that the MOF wants to keep that 160 level as a dollar ceiling without spending any money if they can, but the problem with jawboning is that it loses its efficacy fairly quickly. However, if they drive yields higher on shorter dated paper, perhaps that will attract more inflows, although given how low they currently are (2yr 1.29%, 5yr 1.69%) I think they have a long way to go before they become attractive to international investors.

Source: tradingeconomics.com

On the data front, NFIB Small Business Optimism fell to 99.3, a bit disappointing, and now we await the following: Retail Sales (exp 0.4%, 0.3% -ex autos) and the Employment Cost Index (0.8%). We also hear from two more Fed speakers, Logan and Hammack, but I don’t see the Fed, other than Warsh, being that critical right now.

And that’s really it for today. My take is we are unlikely to see dramatic movement in any market so hedgers should take advantage of the reduced price volatility. But otherwise, sometimes, there is just not that much to do.

Good luck

Adf