Last night there was, briefly, a peace

This morning, though, that seemed to cease

But worries Iran

From Hormuz, would ban

Most ships, have now greatly decrease(d)

So, markets have turned their attention

To Powell and what he will mention

When he sits before

The Senate once more

Though most seated lack comprehension

Talk about yesterday’s news! While I am pretty confident we have not heard the last of the Iran/Israel conflict, it has dropped off the radar in a NY minute. Last night President Trump announced a cease fire between the two nations and while Israel alleged that Iran already broke the peace, the market has clearly moved on from the erstwhile WWIII concept to WWJS (What Will Jay Say). In that vein, this morning’s WSJ had an articlefrom the Fed whisperer, Nick Timiraos, describing the trials and tribulations of poor Chairman Powell as he tries to fend off those mean words from President Trump.

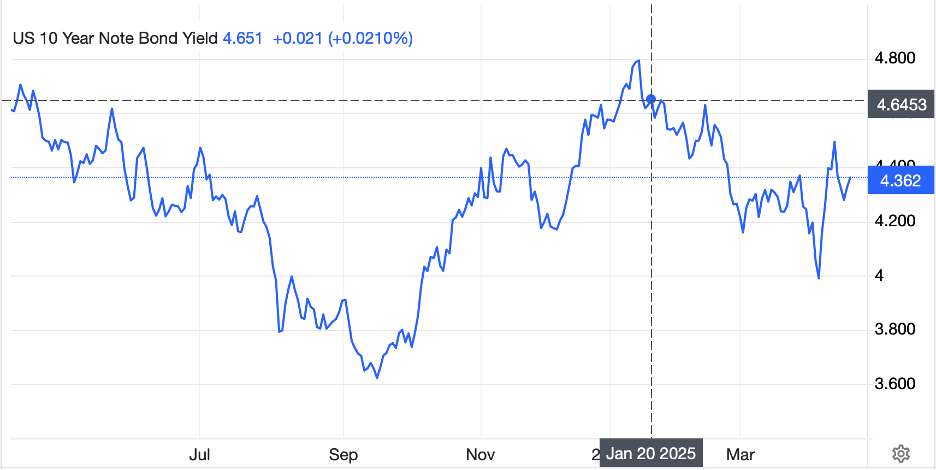

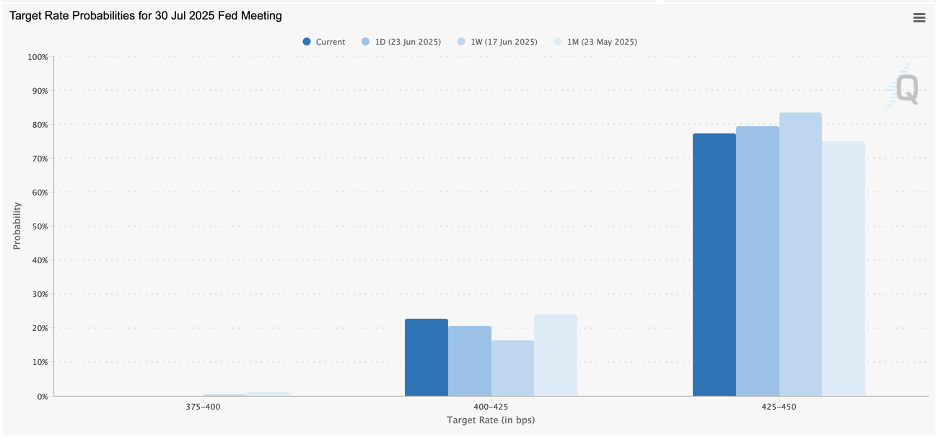

Powell sits down before the Senate Banking Committee this morning, and the House Financial Services Committee tomorrow, ostensibly to describe the state of the economy and the Fed’s current thinking. I have begun to see discussions that two Trump appointed governors, Bowman and Waller, are now interested in potentially cutting the Fed funds rate in July and the futures market has raised the probability of a cut next month to 23%, back to the levels seen a month ago, pre-war and prior to a run of stronger than expected economic data.

Source: cmegroup.com

Frequently mentioned throughout the WSJ article was the idea of Fed independence and how critical that is for monetary policy to be effective. As well, the fact that the comments on rate cuts are from governors Trump appointed, and that is being highlighted in a negative fashion, is further evidence that the Fed remains a highly political, and quite frankly, partisan organization. One cannot look at the rate cuts last autumn ahead of the election, which were certainly not warranted by the data, as anything other than the Fed’s attempt to support VP Harris’s presidential campaign. And when inflation was still quite high, although starting to decline, calls for cuts by Biden appointees Cook and Jefferson, were also likely politically motivated given the still high inflation rate.

In fact, I wonder where Governor’s Cook and Jefferson are today with respect to rate cuts. After all, both have demonstrated dovish biases throughout their tenure at the Fed, but suddenly they are strangely silent on the subject. I’m sure that is not a political bias showing, but rather deeply considered economic analysis. 🙃

I do find it interesting that there is an underlying presumption that the Fed funds rate is always too high, at least for the narrative, although I guess that is because most narrative writers believe strongly in the idea if rates are low, stock prices will rise.

Regardless of the politics, Powell will very likely explain that there is still concern that tariffs could raise prices and while there is the beginning of concern over the labor market, it remains solid and does not warrant rate cuts at this time. Of course, we will also be subject to the preening of all those senators (what is the probability that Senator Van Hollen brings up deportations?) with no useful discussion. It seems unlikely that Chairman Powell will alter his message from the post meeting press conference which remains, patience is a virtue.

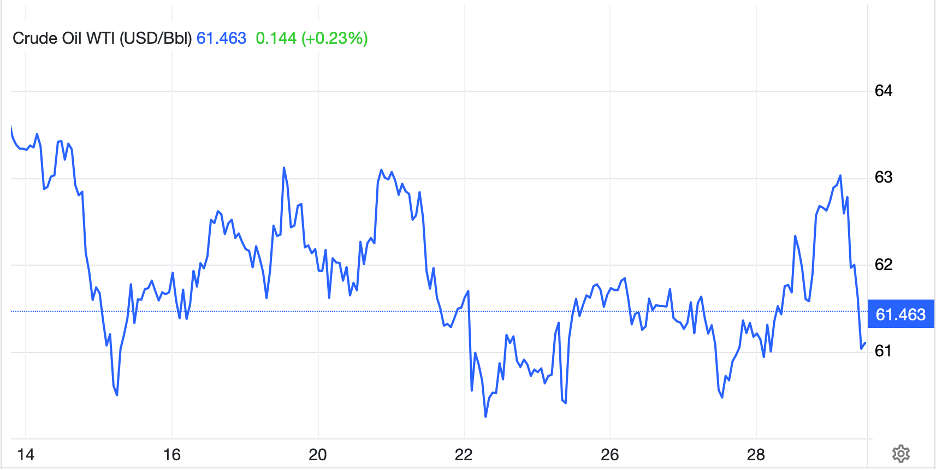

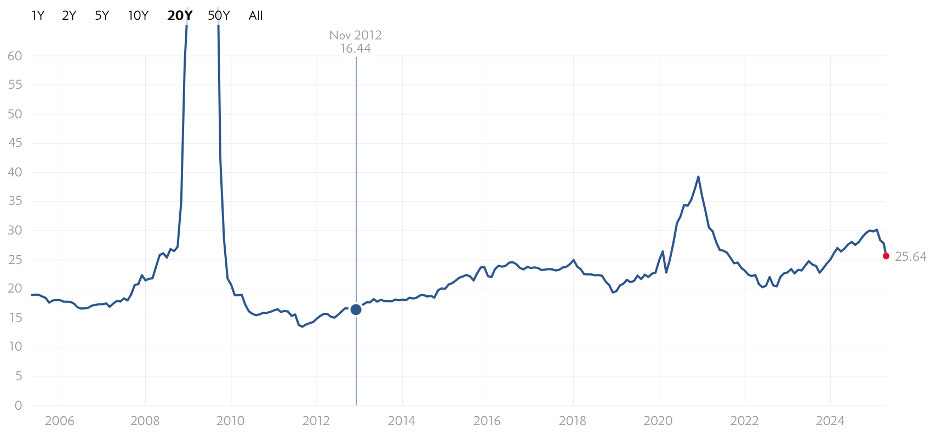

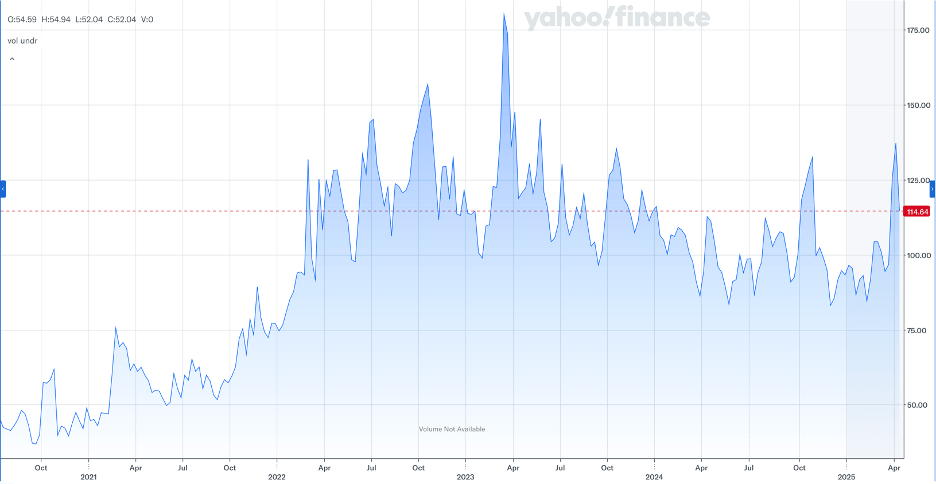

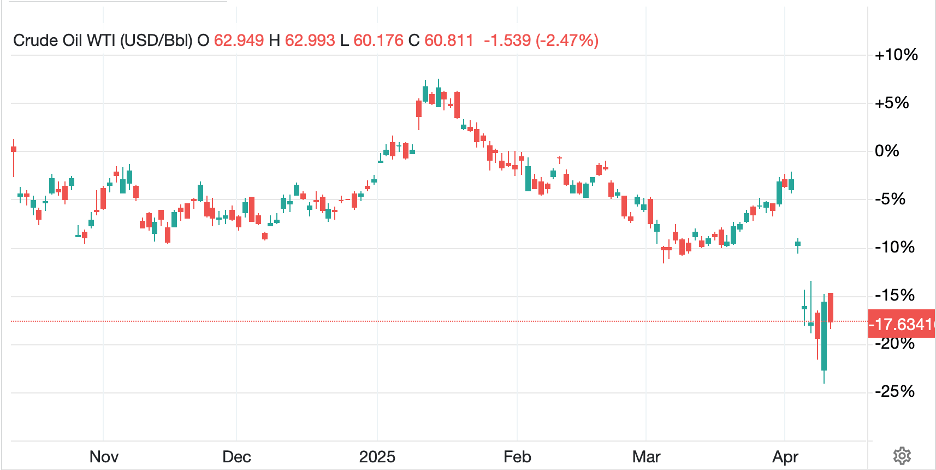

Ok, now that the war has ended, let’s see how markets have behaved. I must start with oil (-3.0% today, -12.0% since yesterday morning) where traders have removed the entire Hormuz closing premium and are now dealing with the fact that there are more than ample supplies around. Recall, OPEC+ continues to increase production, and the macroeconomic narrative remains one of slowing economic activity. Happily, gasoline prices are following oil lower so look for less inflation concerns for next month.

Source: tradingeconomics.com

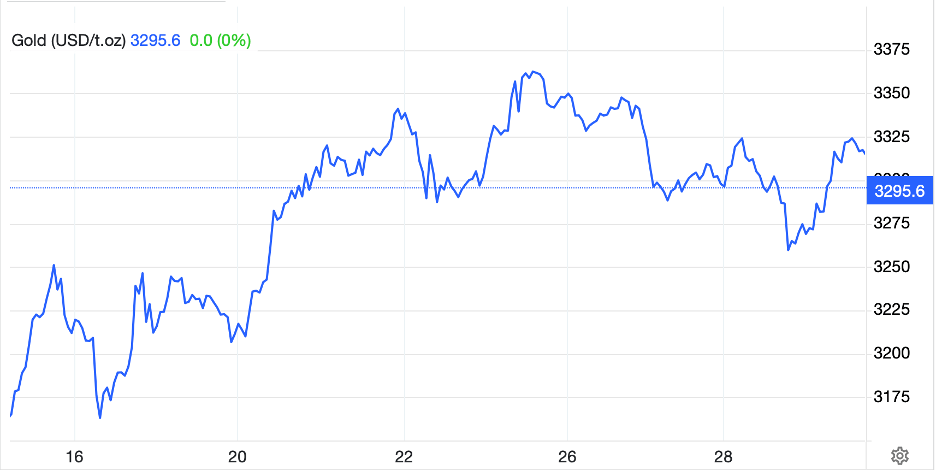

Meanwhile, with war off the table, gold (-1.3%) is no longer in such great demand although silver (unchanged) and copper (+0.7%) continue to find support. Net, my longer-term views remain that oil prices have further to decline while metals prices should grind higher over time.

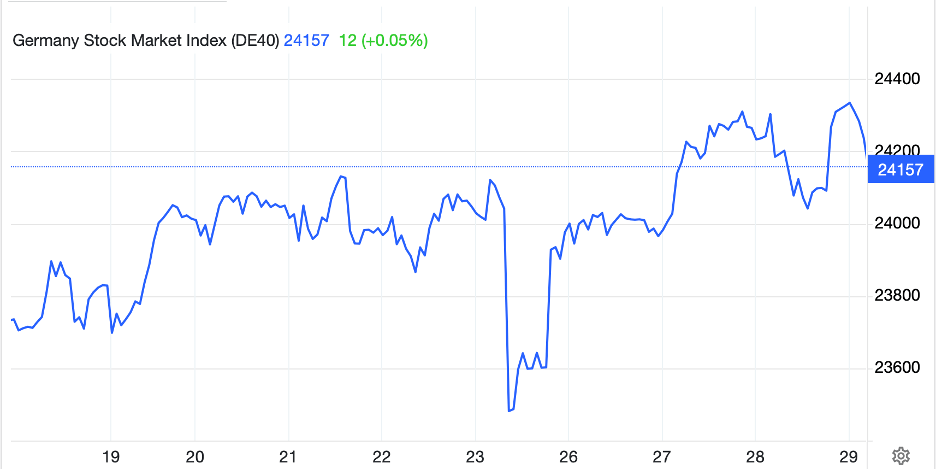

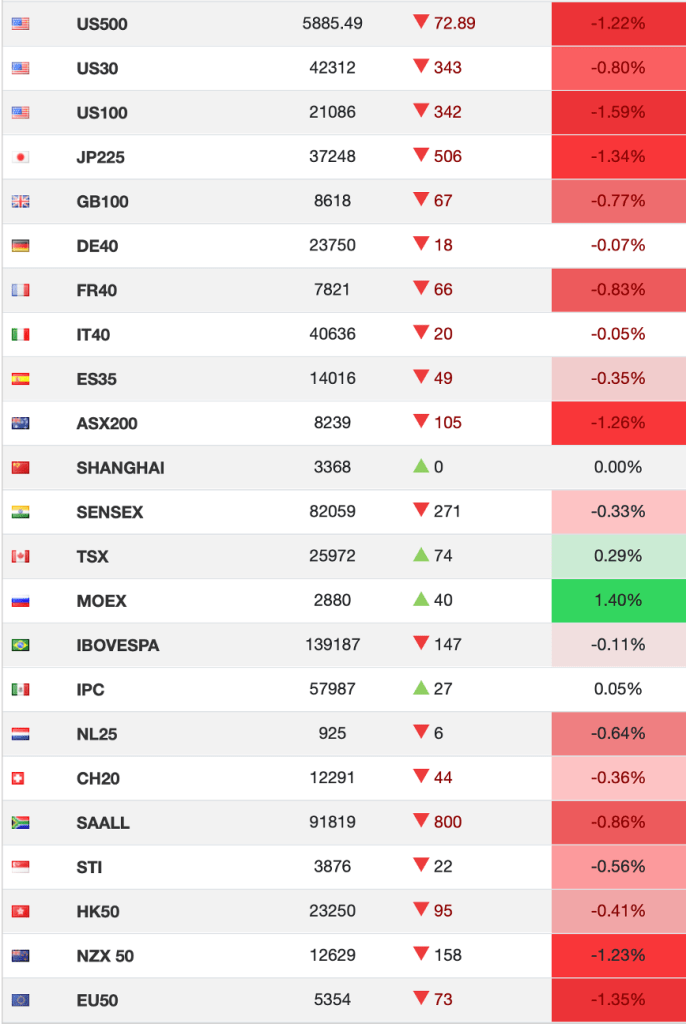

In the equity markets, you have to search long and hard to find a market that didn’t rally overnight or is in the process of doing so this morning. After yesterday’s strong US closing (all three main indices up about 0.9%), Asia (Nikkei +1.1%, Hang Seng +2.1%, CSI 300 +1.2%) rallied sharply with Korea (+3.0%) really popping and only one negative, New Zealand (-0.5%) where local traders cannot seem to get on board with the better news. In Europe, the gains are also substantial (DAX +1.8%, CAC +1.2%, IBEX +1.4%) although the UK (+0.3%) is lagging given the large weighting of energy in the index. US futures are also pointing higher this morning, about 0.8%.

In the bond market, Treasury yields are unchanged this morning after slipping -3bps yesterday, but we are seeing yields rise in Europe (Bunds +5bps, OATs +3bps) after the Germans announced they would be borrowing 20% more this quarter than initially expected to help their rearmament program. I guess investors had a mild bout of indigestion.

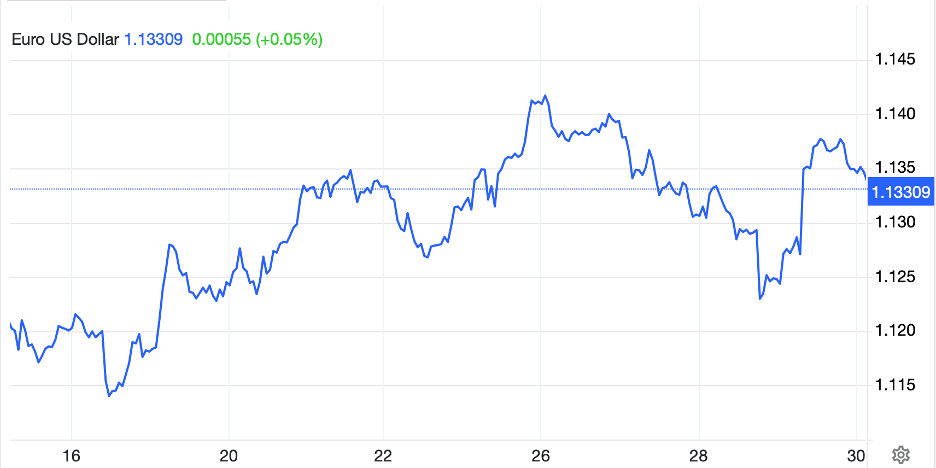

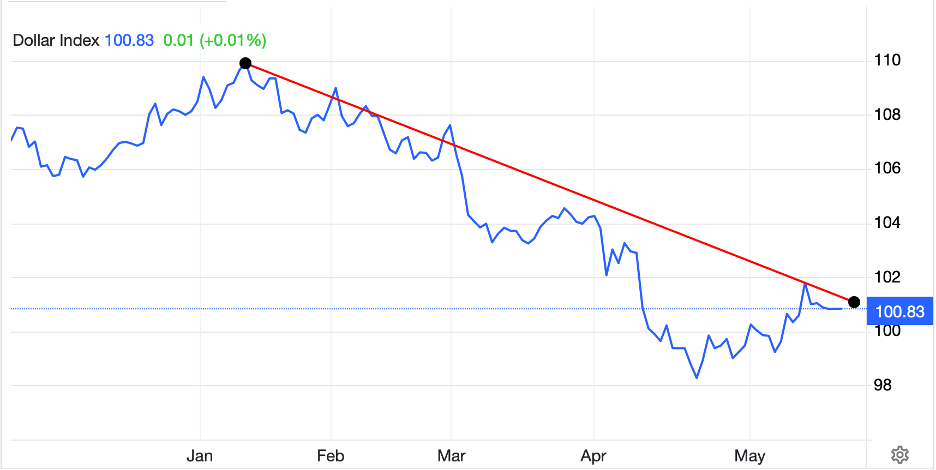

Finally, the dollar, which rallied nicely into yesterday’s NY opening has basically reversed all those gains since then and is back trading near 98 on the DXY. While there are various relative sizes of movement, it is all in the same direction and entirely driven by the Iran/Israel war story. Perhaps we are starting to see some pricing of a Fed rate cut, and if they do act in July, I would expect the dollar to fall, but right now, it feels much more like unwinding the war footing.

On the data front, aside from Chairman Powell at 10:00 this morning, we see Case Shiller Home Prices (exp +4.0%) and Consumer Confidence (100.0). However, I suspect that neither of those will matter very much. The equity market has the bit in its mouth and is looking for reasons to go higher. Any dovish hints by Powell will set that off, as well as undermine the dollar. We shall see.

Good luck

Adf