As summer meanders along

No market is weak, nor’s it strong

But traders keep trading

With hope masquerading

As knowledge, though they know they’re wrong

The question is what sort of news

Can catalyze changes in views?

Seems rate cuts will not

And peace had its shot

Dear readers, just what would you choose?

My friend JJ (he writes the Market Vibes note) made a profound comment that described the current situation so well, I think it is worth repeating:

“It is not that the news and fundamentals are uninteresting or unimportant. They are. But vol control has anesthetized every future, ETF, equity, and FX market, and the managers of it are making trillions on it. Therefore, it is likely this narcolepsy won’t end for a while.”

A point he has been making of late, and one with which I cannot argue, is that everything that is not algorithmic is dumb money as the algos drive it all. And it is a fair point. Market activity has ground to a halt, and while I have no proof, I would estimate it is even quieter than the typical year’s summer doldrums. That seems remarkable given the panoply of news stories that exist and in other times would have had a major market impact. Consider, war and peace in Ukraine, massive changes in federal regulations and administration priorities, and remarkable electoral shifts around the world, yet none of it matters. Consider this chart of the US 10-year Treasury:

Source: tradingeconomics.com

The yield, which most afficionados agree is critical to not just US, but global, financial markets and activity, has largely traded between 4.0% and 4.5% since well before Mr Trump was elected. The one thing that cannot be said is that the Trump administration has been boring. More has happened on the fiscal front in the past six months than in entire presidential terms and yet yields are essentially unchanged since November 5th when Trump was elected.

JJ’s view is the massive increase in the use of options by retail traders has become the driving force. Retail buys options, paying premium which decays away and that value accrues to the market making algorithms. The amounts of premium are huge, in the $trillions, and it is a straightforward business model that reaps huge rewards, so a lack of movement is the goal. I cannot argue with that either.

However, the one thing I have learned over my too many years in the market is that no matter how smart you are, no matter how well you have considered the potential outcomes, reality will be different, and at some point, there will be a tipping point to change the market dynamic. After all, Covid was not expected, nor even more importantly, the government responses to it which is what drove the market volatility. I am pretty sure there is another true black swan out there, something nobody is discussing as it currently seems irrelevant or impossible, but which will alter the game.

I spent my trading career learning to manage risks while running a global FX options business, trying to profit, but more importantly preventing the huge drawdowns that end careers. I spent my sales career trying to help my clients understand their FX risks and learn to mitigate them in the most cost-effective manner possible. What I learned over that 40+ years is that while risks sometimes seem unimportant, or unimaginable, they exist. Do not mistake the current state for the future state. Things will change, although how I cannot currently imagine.

With that as preamble, let’s look at just how little things are moving. Stocks did nothing in the US yesterday and movement overnight in Asia was lackluster as well (Nikkei -0.4%, Hang Seng -0.2%, CSI 300 -0.4%). As I wrote above, there is just not that much that is exciting investors right now. Europe, however, seems to be taking a positive stance on the Oval Office meeting with many of their leaders as perhaps peace in Ukraine, if it is coming, will be helpful for the continent. Ostensibly, Presidents Trump and Putin discussed a closer economic relationship between the US and Russia, which if that came to pass, would undoubtedly rearrange some things in markets, largely to the benefit of Europe. As to US futures, they are unchanged this morning, again.

Bond markets in Europe are exactly unchanged across the board, so much so that you would expect it was a holiday there. Treasury yields have edged lower by -1bp, but as I explained above, are simply range trading.

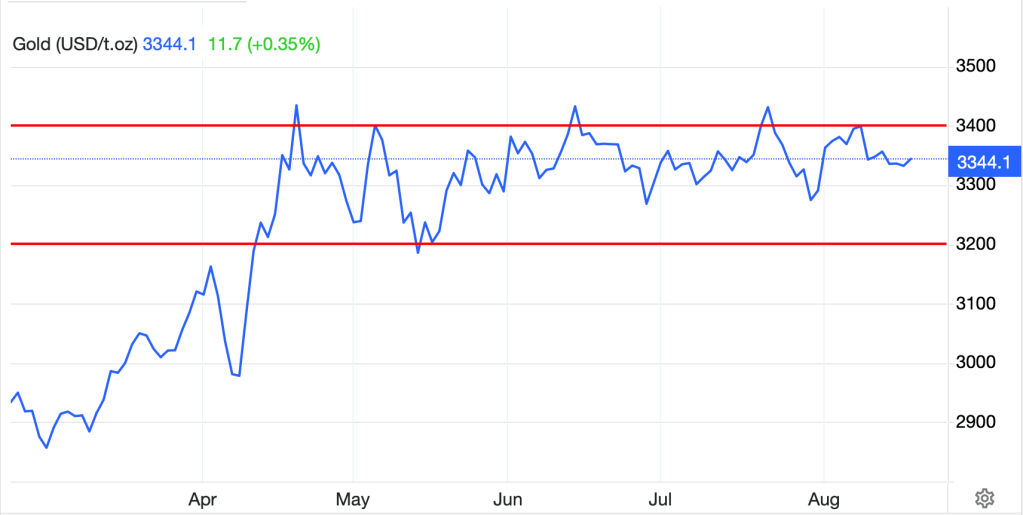

I would argue the commodity markets are where there is the most potential for movement going forward as any type of US-Russian economic détente would almost certainly reduce oil prices substantially. And, coincidentally, WTI (-1.25%) is falling this morning as hopes for a direct meeting between Putin and Zelensky, and with it the end of the war, are increasing. Weirdly, gold (+0.35%) is not declining on that news, despite the idea that gold represents a haven against war. Perhaps gold represents a haven against money supply growth, which if there is an economic détente, you can be sure will increase. As to the other metals, very little movement there either. In the vein of the lack of activity, perhaps the below gold chart is even a better descriptor of just how little activity has been going on since spring.

Source: tradingeconomics.com

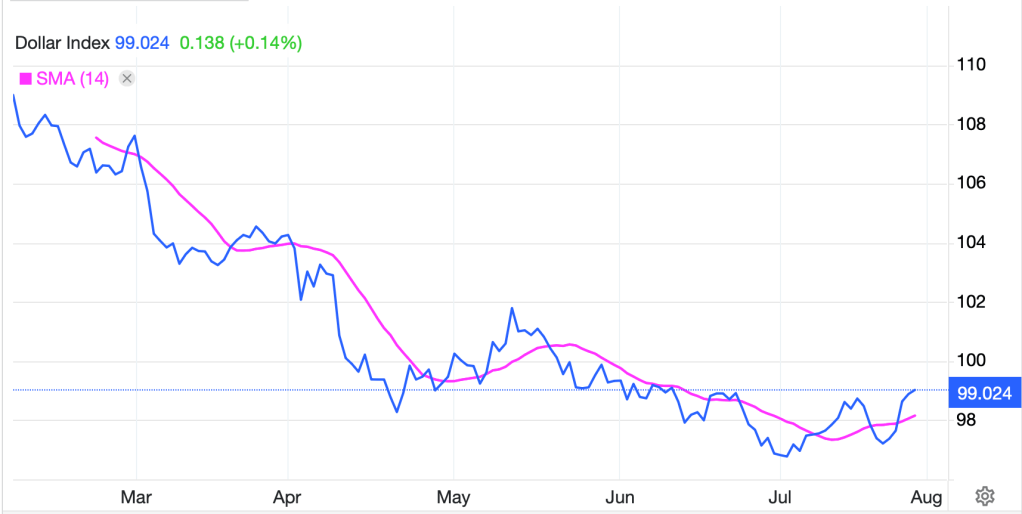

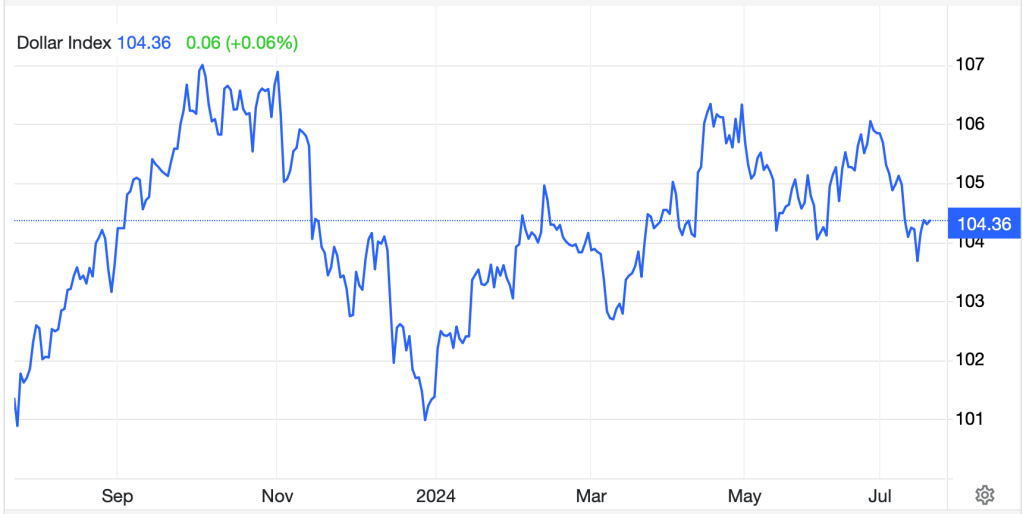

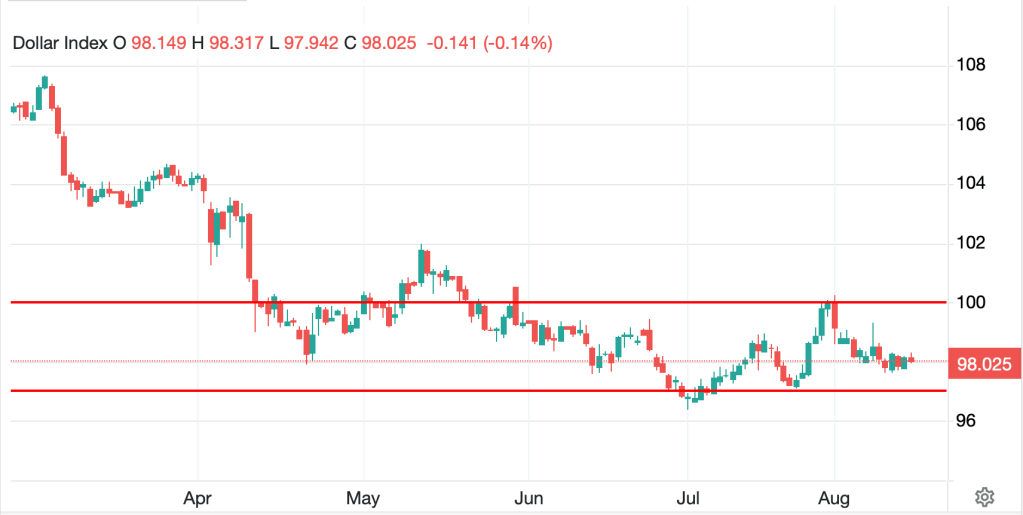

Finally, the dollar is a touch softer this morning, but it, too, remains rangebound. While much has been made of its weakness in the first half of the year, as though that calendar period had some special significance (it doesn’t), here too, things have simply ground to a halt. Using the dollar index (DXY) as our proxy, you can see that this market, too, has done nothing for months.

Source: tradingeconomics.com

Whether it’s G10 or EMG currencies, the movement remains desultory at best, and catatonic may be a better description.

So, let’s look at the data this week that will precede Chairman Powell’s speech Friday morning.

| Today | Housing Starts | 1.30M |

| Building Permits | 1.39M | |

| Wednesday | FOMC Minutes | |

| Thursday | Initial Claims | 226K |

| Continuing Claims | 1960K | |

| Philly Fed | 6.0 | |

| Flash Manufacturing PMI | 49.5 | |

| Flash Services PMI | 53.7 | |

| Existing Home Sales | 3.91M | |

| Leading Indicators | -0.1% | |

| Friday | Powell Speech |

Source: tradingeconomics.com

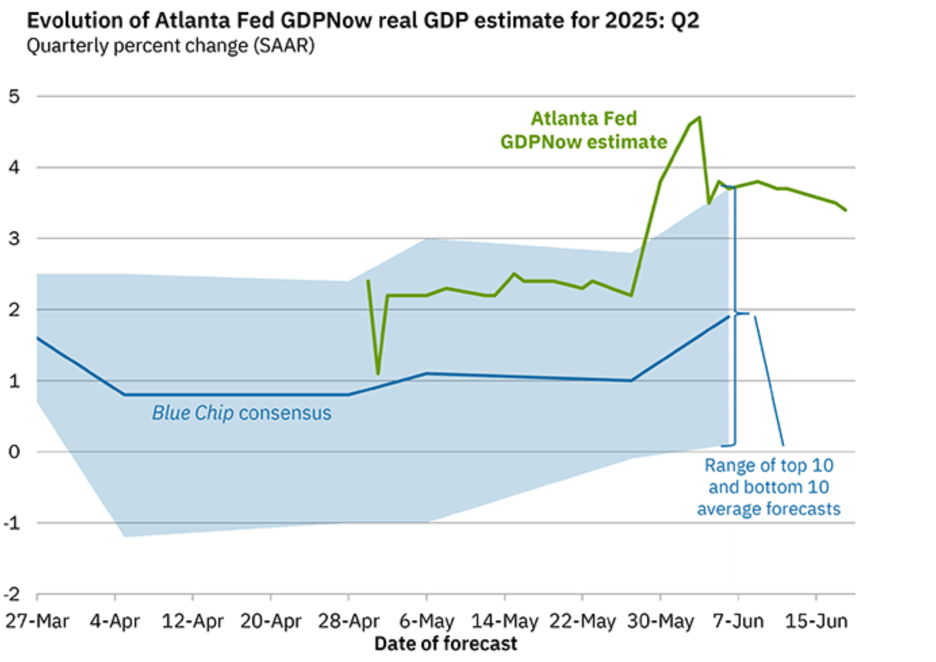

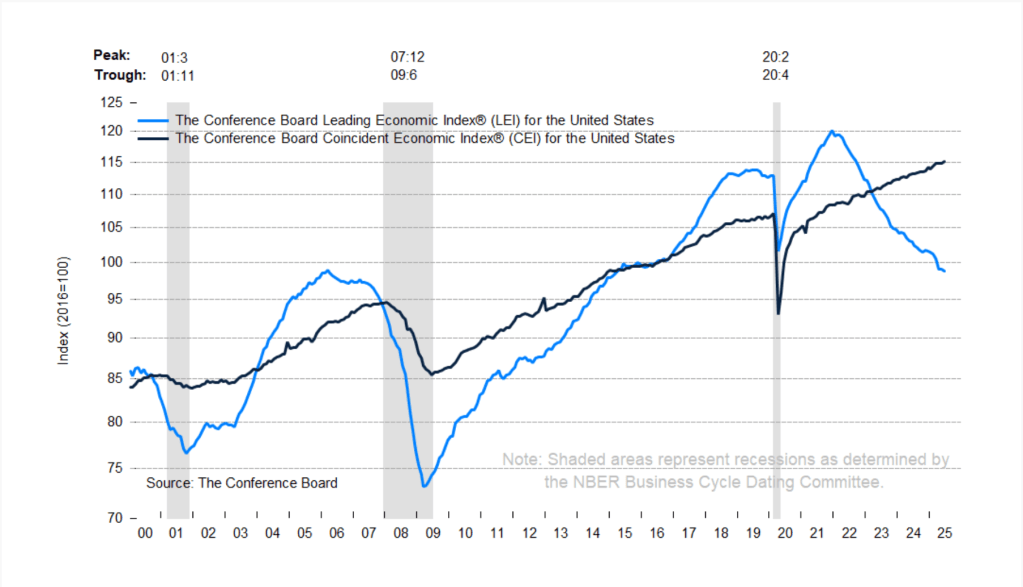

I think it is worthwhile to consider why we look at the Leading Indicators. The original design was that it tracked a series of indicators that historically had presaged economic activity. Ahead of recessions, these indicators turned lower and so it seemed a pretty good fit. However, as you can see from the below chart from conference-board.org, the creators of the index, since 2021, when the index turned lower, it has been completely out of sync with the economy’s outcome.

As I have repeatedly written, models that were created pre-Covid, and many pre-GFC, simply no longer have any relevance to today’s reality.

On the whole, the most likely outcome today, like every day lately, is limited movement in either direction. While I am sure a black swan exists, he is currently hibernating.

Good luck

Adf