The headline today’s NFP

As pundits will try to agree

On whether the Fed

When looking ahead

Will like what it is that they see

But, too, the Supreme Court is due

To rule whether tariffs imbue

Too potent a force

For Trump, to endorse

Or whether they’ll let them go through

As the session begins in NY, markets have been relatively quiet as traders and algorithms await the NFP data this morning. Recall, Wednesday’s ADP number was a touch softer than forecast, but still, at 41K, back to a positive reading. Forecasts this morning are as follows:

| Nonfarm Payrolls | 60K |

| Private Payrolls | 64K |

| Manufacturing Payrolls | -5K |

| Unemployment Rate | 4.5% |

| Average Hourly Earnings | 0.3% (3.6% y/Y) |

| Average Weekly Hours | 34.3 |

| Participation Rate | 62.6% |

| Housing Starts | 1.33M |

| Building Permits | 1.35M |

| Michigan Sentiment | 53.5 |

Source: trading economics.com

Regarding this data point, there are two things to remember. First, last month Chairman Powell explained that he and the Fed were coming to the belief that the official data was overstating reality by upwards of 60K jobs due to concerns over the birth/death portion of the model. That is the factor the BLS includes to estimate the number of new businesses started vs. old ones closed in any given month. Historically, at economic inflection points, it tends to overstate things when the economy is starting to slow and understate when it is turning up.

The second thing is that given the changes in the population from the administration’s immigration policy, with net immigration having fallen to zero recently, the number of new jobs required to maintain solid economic growth is much lower than what we have all become used to, which in the past was seen as 150K – 200K. So, 60K, or even 40K, may be plenty of new jobs to absorb the growth in the labor market, which will come from people re-entering the market who had previously quit looking for a job.

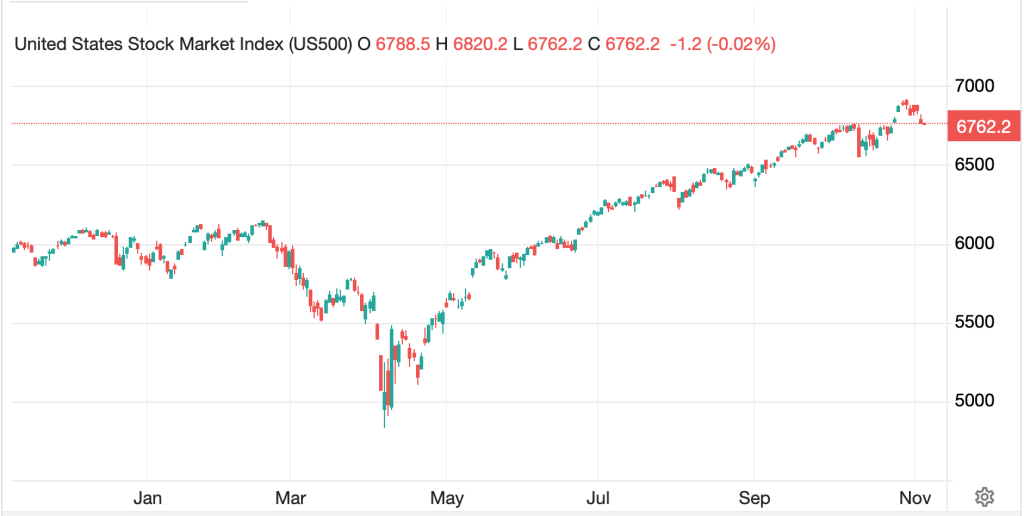

The ancillary data, like ADP and the employment pieces of ISM were both stronger in December than November, so my take is, the estimates are probably reasonable. I have no strong insight into why it would be dramatically different at this point. The question is, how will markets respond? My take is this could well be a ‘good news is bad’ situation where a strong print will see pressure on bonds and stocks as the market reduces its probability of a Fed rate cut (currently 14% for January, 45% for March) even further. The dollar would benefit, as would oil on the demand story, but I think metals will do little as that story is not growth oriented. A weak number would see the opposite.

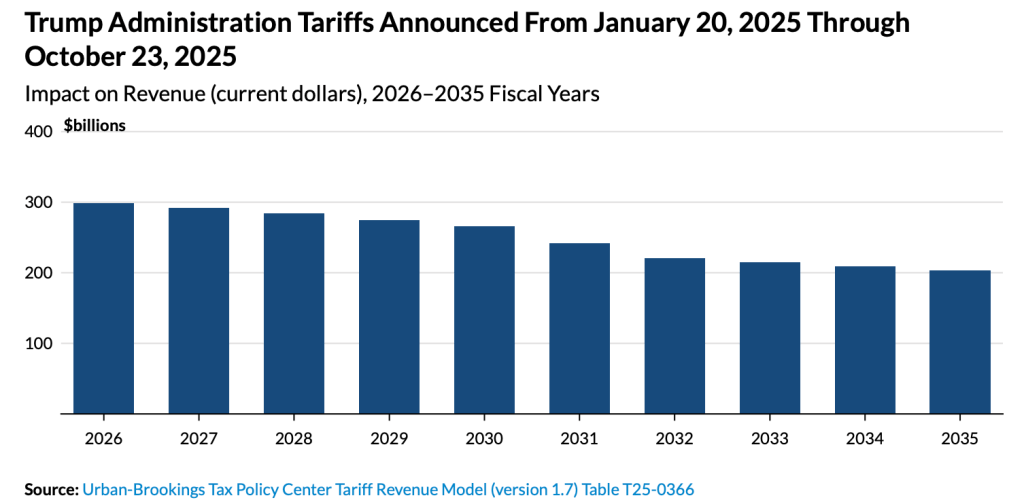

Of course, the other big potential news today is the Supreme Court ruling on the legality of Trump’s tariffs. The odds markets are at ~70% they will overturn them, but there is the question of whether it will require the government to repay the tariffs or simply stop them. As well, most of them will be able to be reimposed via different current laws, so net, while a blow to the administration I don’t believe it will have a major long-term impact with repayment the biggest concern. This particular issue is far too esoteric for a simple poet to prognosticate.

And those are the market stories of note, although we cannot ignore the growing protests in Iran as videos show buildings burning in Tehran and there is word that the Mullahs are at the airport, which if true tells me that the regime is on the edge. While this would be a great victory for the people of Iran, it would also have a dramatic impact on oil markets and specifically on China. While sanctions could well be lifted, thus depressing the price as more comes to market, China currently benefits from buying sanctioned oil at a massive discount, and that discount would disappear.

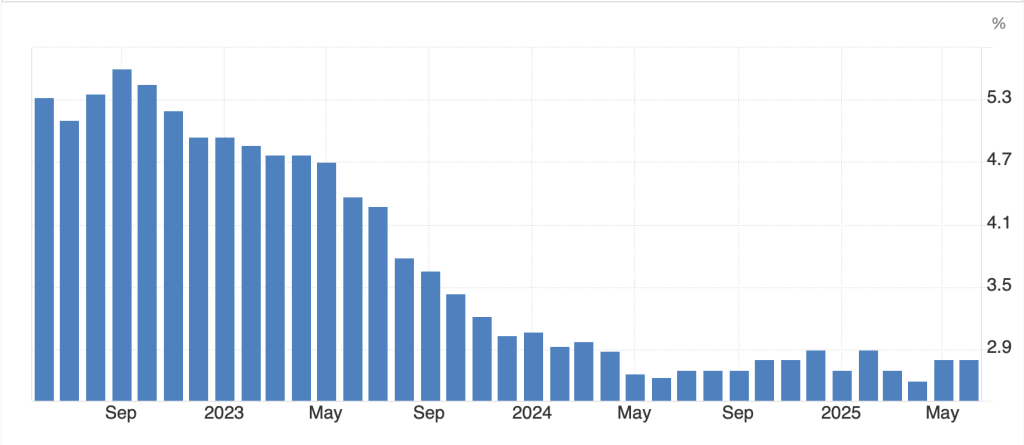

As we await all the news, let’s review the overnight activity. A mixed US session was followed by strength in Tokyo (+1.6%) as the Japanese government surprised one and all by reporting a stronger 30-year JGB auction than anticipated as well as an uptick in spending by households. Too, nominal GDP growth has been outpacing deficit growth driving the net debt ratio lower, exactly what the US is seeking to do. As to the rest of the region, both China (+0.45%) and HK (+0.3%) managed gains, as did Korea and Malaysia but India (-0.7%) continues to lag as it has all year. Data from China showed inflation fell less than expected, although the Y/Y number remains at just 0.8%.

In Europe, gains are also the norm with France (+0.9%) leading the way with both the UK (+0.55%) and Germany (+0.4%) having solid sessions. Retail Sales data from the Eurozone was firmer than expected at 2.3%, a rare positive outcome, but showing some support. As to the US futures market, at this hour (7:30) all three major indices are higher by about 0.15%.

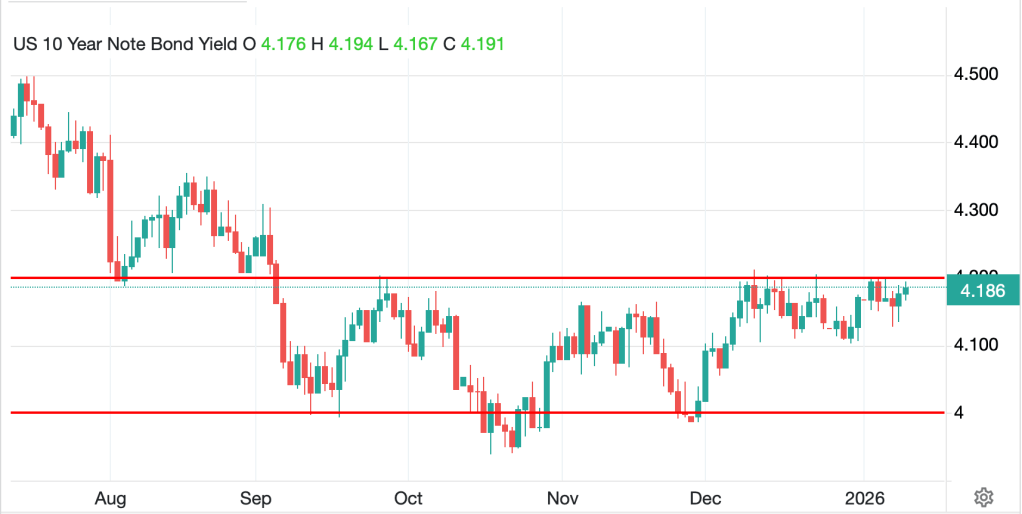

In the bond market, while yields have edged higher by 2bps this morning, as you can see from the chart below, they remain within, albeit at the top, of the recent 4.0% – 4.2% trading range.

Source: tradingeconomics.com

The most interesting data point from yesterday was the dramatic decline in the Trade deficit, which fell to -$29B, its lowest level since 2009. Recall that a long-time issue has been the twin deficits, with the budget and trade deficits linked closely. I wonder, are we going to see Trump’s efforts at reducing government’s size and reach result in a smaller budget deficit? Most pundits dismiss this idea, but I’m not so sure. As to the rest of the world, European sovereigns are essentially unchanged this morning as investors everywhere await the US data and tariff ruling.

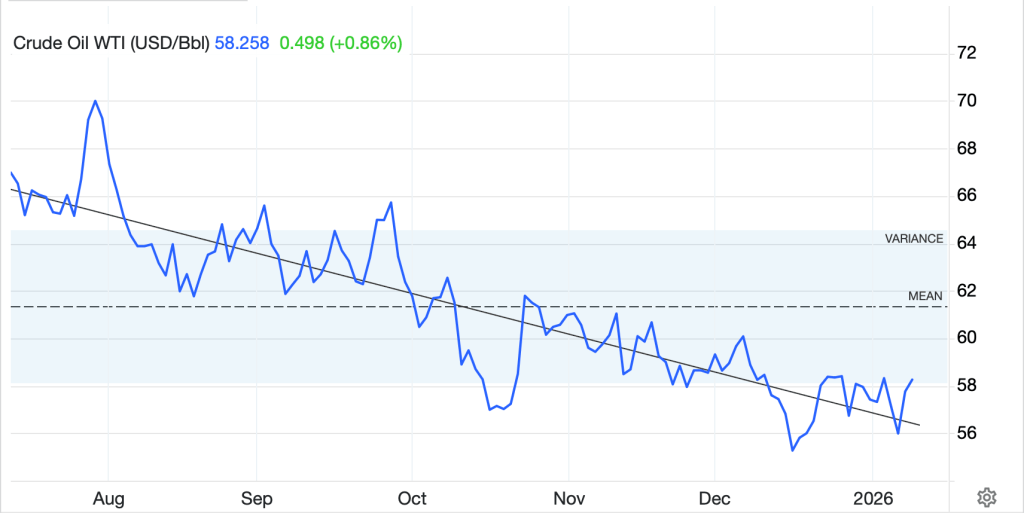

In the commodity markets, oil (+0.9%) is creeping higher but remains in its downward trend.

Source: tradingeconomics.com

Wednesday, we saw a large draw in crude inventories abut a massive build in both gasoline and distillates which feels mildly bearish. The narrative is the Iran story is getting people nervous for potential short-term disruption, but I remain overall bearish for now. As to the metals markets, gold (-0.3%) is slipping after having recovered early morning losses yesterday and finishing higher, while silver (+0.6%) is still bouncing along with copper (+1.8%) and platinum (+0.4%). Metals are in demand and supply is short. Price here have further to rise I believe.

Finally, the dollar continues to rebound off its recent lows with the DXY back to 99 again this morning. it has rallied in 11 of the past 13 sessions, not typical price action for a trading vehicle that is in decline.

Source: tradingeconomics.com

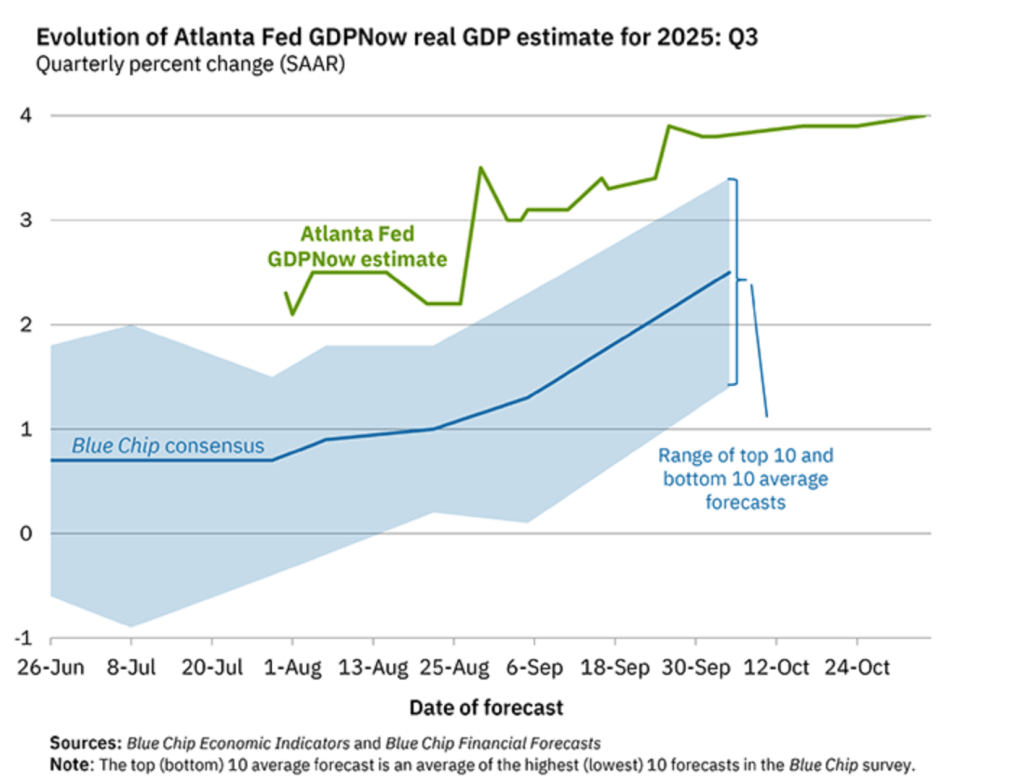

In fact, the greenback is firmer against virtually all its G10 and EMG counterparts this morning with the largest declines seen in JPY (-0.5%), KRW (-0.5%) and NZD (-0.5%) with others typically sliding between -0.1% and -0.3%. again, it is hard to watch recent price action and see impending weakness. We will need to see much weaker US data to change my view. And along those lines, the Atlanta Fed’s GDPNow number just jumped to 5.4% for Q4 after the Trade data yesterday, again, atypical of further weakness in this sector.

And that’s really all as we covered data up top. To me, the wild cards are Iran and the USSC. While I do believe the regime will fall in Iran (they just shut down the internet to try to prevent a further uprising) my take on the Supremes is they may stop further tariffs but will not force repayment. Net, that won’t change much at all and given the prediction markets are pricing a 70% probability of an end to tariffs, if it happens, it’s already in the price!

Good luck and good weekend

adf