The mood is decidedly glum

In markets, as traders succumb

To views that the world

Is coming unfurled

And fears that the game’s zero-sum

So, stories ‘bout regional banks

With problems are joining the ranks

Of reasons to sell

Ere things go to hell

And why folks are buying Swiss francs

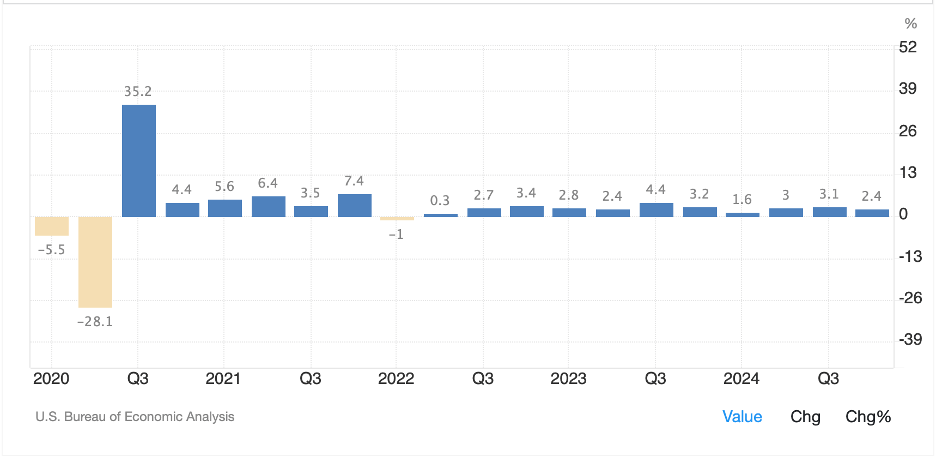

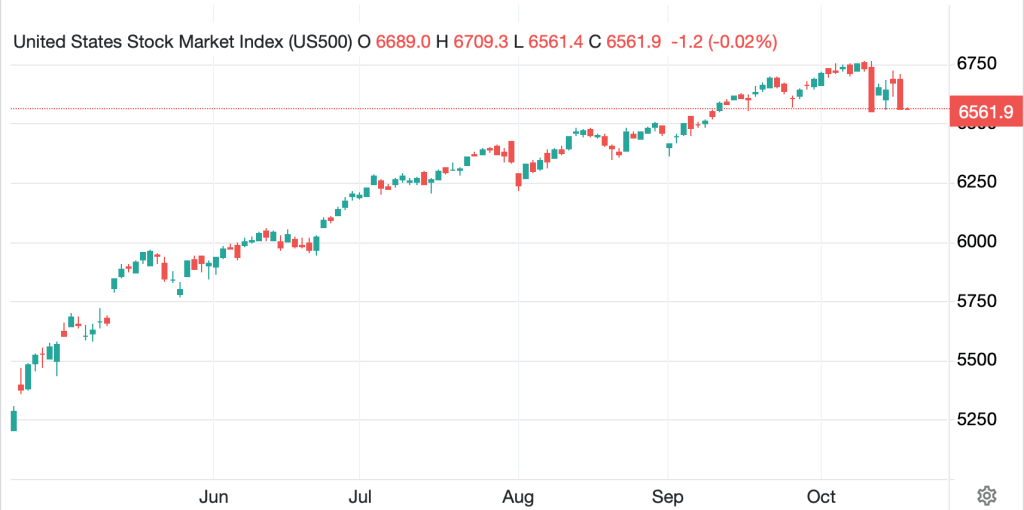

It doesn’t seem that long ago when equity markets were trading at all-time highs, arguably a sign of significant positive attitudes, and yet here we are this morning with equity markets around the world under significant pressure. Of course, the reason it doesn’t feel like it was that long ago is BECAUSE IT WASN’T. In fact, as you can see from the chart below, it was just last week!

Source: tradingeconomics.com

And understand, that even with futures pointing lower by -1.0% this morning, the S&P 500 is only 3% off its highs. That hardly seems like a collapse, but the vibe I am getting is decidedly negative. Certainly, haven assets are in demand this morning with both the yen (+0.5%) and the Swiss franc (+0.45%) rising sharply after bottoming on the same day as the S&P’s top, with both currencies back to their levels from a month ago.

Source: tradingeconomics.com

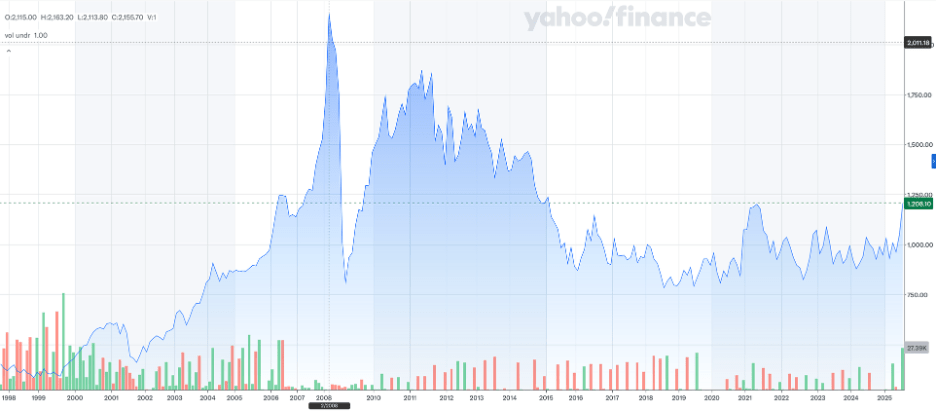

Is the world ending? Probably not today but that doesn’t make it feel any better. After all, we have been living through an unprecedented growth in leverage, with margin debt growing to new record highs every week, despite a backdrop of massive global uncertainty regarding trade, economic activity and kinetic conflict. It is hard to believe that the fact that the FOMC is likely to cut rates by 25bps at the end of the month and again in December was enough to convince investors that future earnings were going to rise dramatically.

But that is where things stand this morning. I must admit I have seen and read more stories about the idea that the AI hype train has run too far and needs to correct, and while that has probably been the case for a while, it is only in the past few days that those stances are becoming public. There has also been an uptick in chatter about bad debt and more insidiously, fraud, that has been underlying some of the recent hype. The First Brands bankruptcy is reverberating and now two regional banks, Zion and Western Alliance, have indicated that some recent loan losses may be tied to fraud. While the amounts in question for the latter two are not enough to be a real problem for either institution, numbering in the $10’s of millions, history has shown that fraud tends to arise when money/lending standards are just too easy, and a sign that the end of good times may be nigh.

Again, it is a big leap to say that because some fraud was uncovered that signals the top. But history has also shown that there is never just one cockroach, and if the lights are coming on, we are likely to see others. While big bank earnings were solid, that was for last quarter. And that’s just the market internal story for one industry.

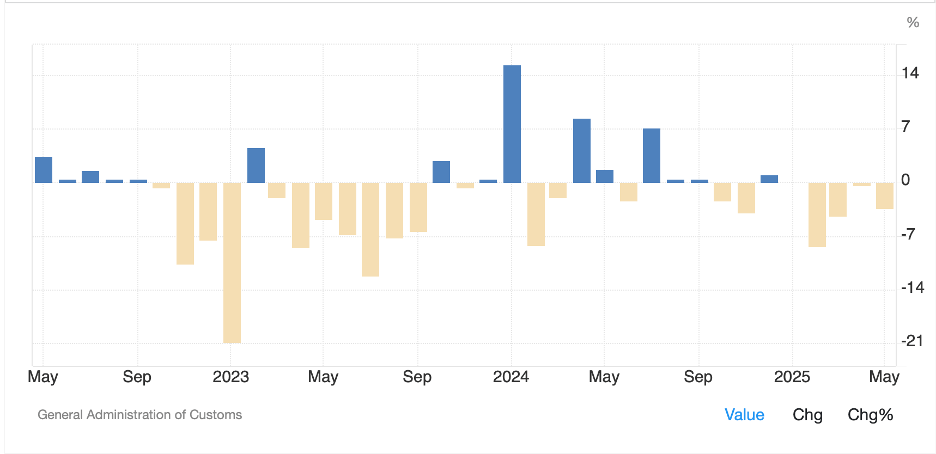

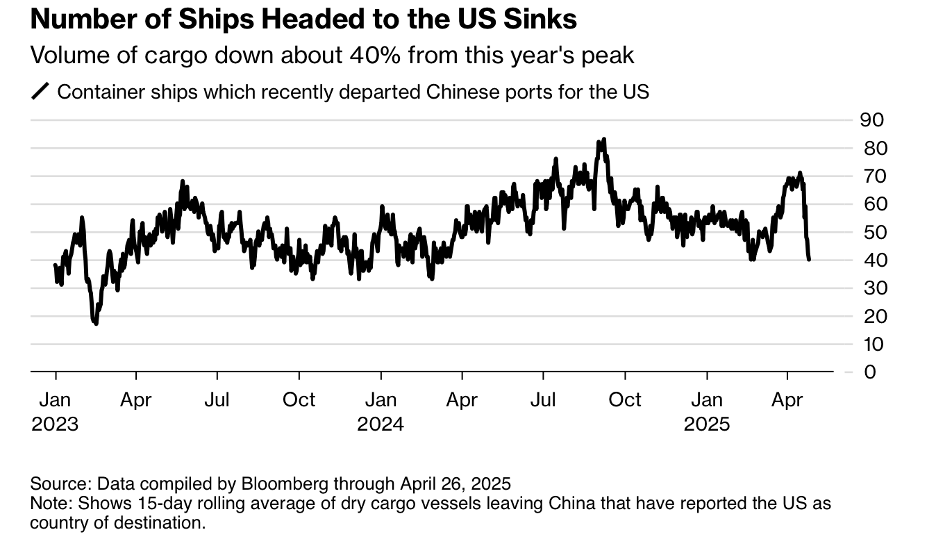

If we add things like concerns over a potential conflict between the US and Venezuela, which is the top article in the WSJthis morning, or the idea that the US may send Tomahawk missiles, with ranges of up to 1500 miles, to Ukraine, it is unlikely to calm any fears. And adding to that we continue to have the government shut down, although I personally tend to think of that as a benefit and since it doesn’t seem to be helping the Democrat party, the MSM stopped covering it, and we have the escalating trade conflict with China. Looking at all the potential problems, it cannot be that surprising that some investors are a bit concerned about things and lightening their exposures. Too, it is a Friday in October, and we have seen some particularly bad outcomes over weekends in October, notably in 1987!

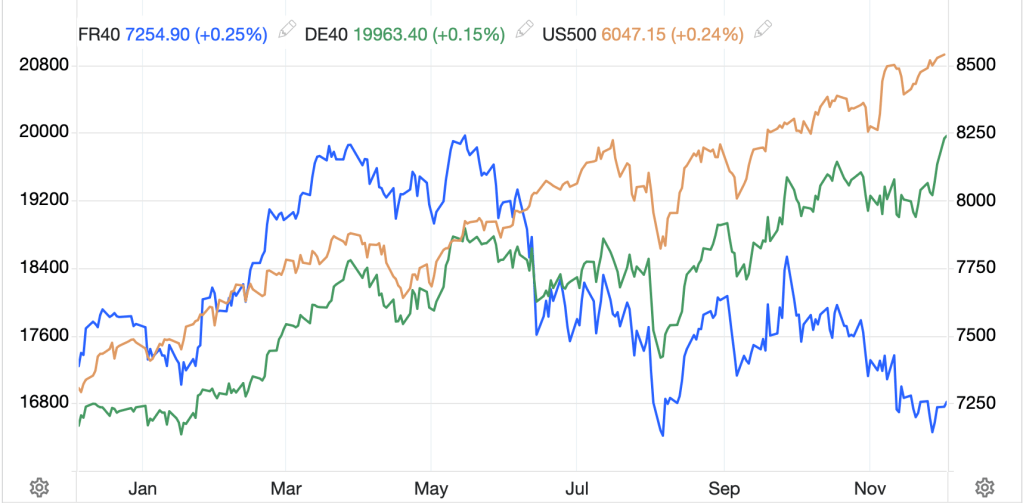

I’m not forecasting anything like that, believe me, just reminding everyone that while history may not repeat, it often rhymes. So, let’s look at the overnight session, which had a decidedly risk-off tone. While the declines in the US markets weren’t that large, they left a bad taste everywhere in Asia with only India (+0.6%) managing to rise on the session. Otherwise, Japan (-1.4%), China (-2.25%), HK (-2.5%), Taiwan (-1.25%), Australia (-0.8%) and virtually all the rest of the markets declined with Korea managing to close unchanged. Fear was rampant, especially in China on the ongoing trade concerns.

In Europe, it should be no surprise that equity markets are also sharply lower led by the DAX (-2.1%) and FTSE 100 (-1.2%) with Paris (-0.7%) and Madrid (-0.95%) also under pressure. The causes here are the same as everywhere, worries that things have gotten ahead of themselves while fears over escalations in both the trade and kinetic conflicts grow. As well, the banking sector here is under pressure as credit concerns grow globally. As to US futures, at this hour (7:15), they have bounced off their worst levels and are lower by just -0.25% to -0.5%.

Bond markets have been a major beneficiary of the growing fear with Treasury yields bouncing just 1bp this morning and sitting just below 4.00% after a -7bp decline yesterday. European sovereign yields also fell sharply yesterday and are finding a near-term bottom as they retrace between 1bp and 2bps higher on the session. If fear is growing, despite all the budget deficits, the default process is to buy bonds!

In the commodity markets, oil (-0.3%) has bounced off its lowest levels of the session which coincide with the lows seen back in April, post Liberation Day. (see tradingeconomics.com chart below). It seems that not only are there economic concerns, but API inventory data showed a surprising build there.

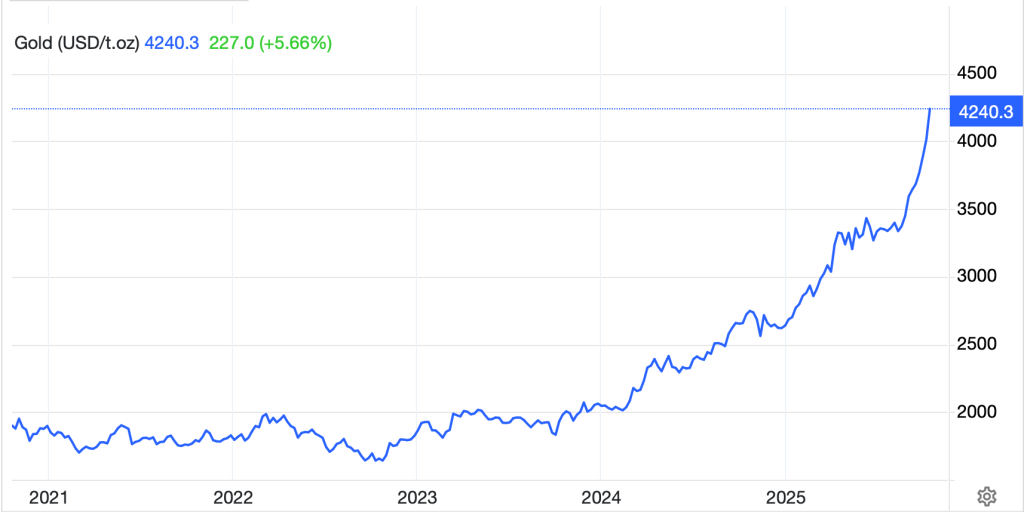

Turning to the metals markets, gold (-0.2%) had a remarkable day yesterday, rising $100/oz, more than 2%, so a little consolidation here can be no surprise. In fact, all the metals saw gains yesterday and are backing off a bit this morning in very volatile, and what appear to be illiquid markets. Looking at the screen, the price is rising and falling $5/oz on a tick. This 5-minute chart shows just how choppy things are.

Source: tradingeconomics.com

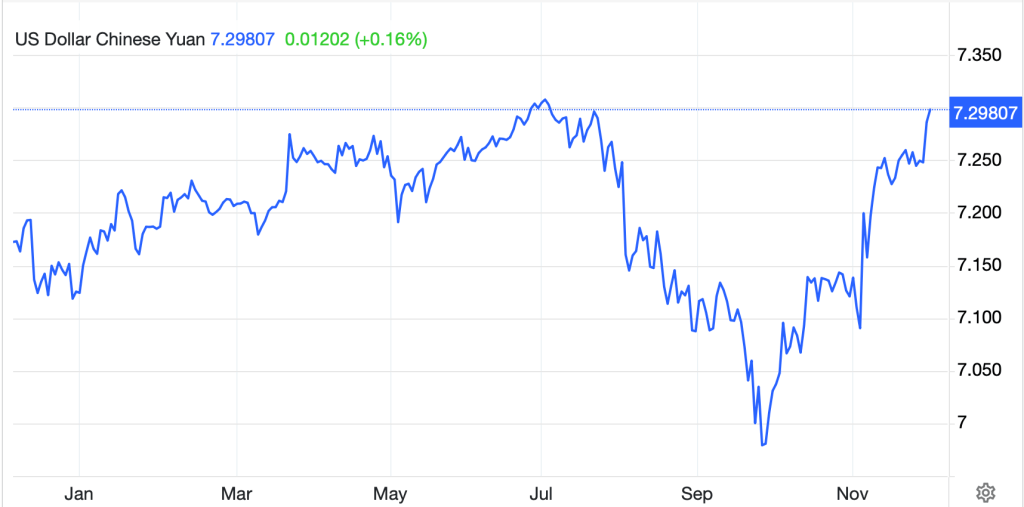

Finally, the dollar is softer, which on the one hand is surprising given its traditional haven status, but on the other hand, given the ongoing decline in yields and the fear pervading markets, is probably not that surprising. Remember, one of the drivers for the dollar is capital flows and if US equity markets decline, we are going to see foreign investors sell, and then likely sell those dollars as well. However, I would take exception with the Bloomberg headline explaining that the dollar is weakening because of Fed rate cut expectations given those expectations have been with us for several weeks. At any rate, the weakness this morning is broad-based, but shallow with the two havens mentioned above the exception and most other currencies gaining 0.1% or 0.2% at most. It seems President Trump has also made a comment about the trade war indicating that the current tariffs are unsustainable and he confirmed he would be meeting President Xi in a few weeks.

And that’s really all there is to end the week. There is no data at all, and the only Fed speaker is KC Fed president Musalem. The general takeaway from the Fedspeak this week is that they are prepared to cut rates but given the lack of data, will not be aggressive.

The world is a messy place. No matter your political views, when viewing markets, it is important to focus on the reality of what is happening. We know that leverage has been growing and helping to drive stock market indices to record highs. We know that gold and other precious metals have been rallying on a combination of central bank (price insensitive) and growing retail buying as fears grow of impending inflation. We have seen several instances of what appears to be lax lending standards, something that historically has led to substantial chaos in markets. The advice I can offer here is maintain position hedges, especially those of you who are corporate risk managers. Yes, volatility has risen a bit, but I assure you, if things really come undone, that will be insignificant compared to the benefit of the hedge.

And with those cheery words, I wish you all

Good luck and a good weekend

Adf