Katayama said

“A strong sense of urgency”

Informs our views now

Source: tradingeconomics.com

But this is the first step in their typical seven step plan before intervention. And I get it, the combination of Chairman Powell suddenly sounding hawkish on Wednesday afternoon, telling us a December rate cut was not a foregone conclusion and the BOJ continuing to sit on its hands despite inflation running at 2.9%, the 42nd consecutive month (see below) that it has been above their 2.0% target (sound familiar?), indicates that the current policy stances will likely lead to further dollar strength vs. the yen.

Source: tradingeconomics.com

There is something of an irony in the current situation in Japan. Recall that for years, the Japanese economy was in a major funk, with deflation the norm, not inflation, as government after government issued massive amounts of debt to try to spend their way to growth. In fact, Shinzo Abe was elected in 2012, his second stint as PM, based on his three arrows plan to reinflate the economy because things were perceived so poorly. If you look at the chart below, which takes a longer-term view of Japanese inflation, prior to 2022, the two positive spikes between 1992 and 2022 were the result of a hike in the Japanese VAT (they call it the Goods and Services Tax) which raised prices. In fact, during that 30-year period, the average annual CPI was 0.25%. And the Japanese government was desperate to raise that inflation rate. Of course, we know what HL Mencken warned us; be careful what you wish for, you just may get it…good and hard. I have a sense the Japanese government understands that warning now.

Data source: worldbank.org

Net, it is hard to make a case that the yen is going to reverse course soon. For receivables/asset hedgers, keep that in mind. At least the points are in your favor!

So, now that a trade deal’s agreed

Can China reverse from stall speed?

The data last night

Sure gave Xi a fright

More stimulus is what they need!

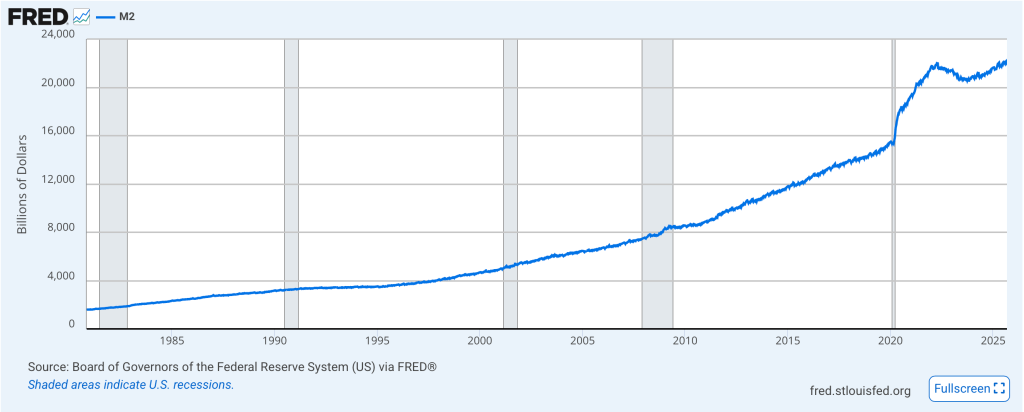

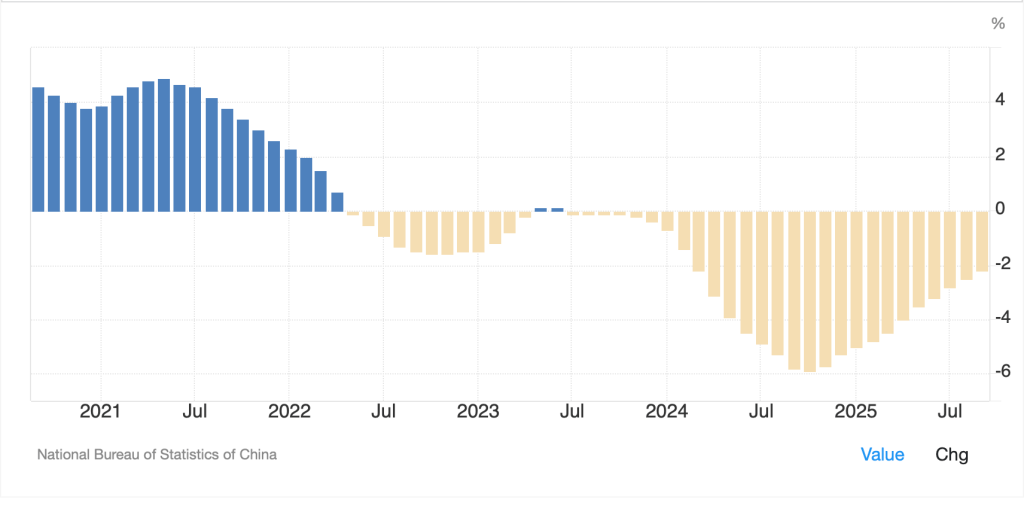

The other noteworthy macro story was Chinese PMI data coming in weaker than expected with the Manufacturing number falling to 49.0, vs 49.8 last month, with all the subcategories (foreign sales, new orders, employment and selling prices) contracting as well. The Chinese mercantilist model continues to struggle amid widespread efforts by most developed nations to prevent the Chinese from dumping goods into their own economies via tariffs and restrictions. The result is that Chinese companies are fighting on price, hence the deflationary situation there as too many goods are chasing not enough demand (money).

There have been many stories lately about how the Chinese have the upper hand in their negotiations with the US, and several news outlets had stories this morning about how the US got the worst of the deal just agreed between Trump and Xi. As well, this poet has not been to China for a very long time, so my observations are from afar. However, things in China do not appear to be going swimmingly. While there continues to be talk, and hope, that the government there is going to stimulate domestic consumer spending, that has been the story for the past 3 or 4 years and it has yet to occur in any effective manner. The structural imbalances in China remain problematic as so many people relied upon their real estate investments as their nest egg and the real estate bubble continues to deflate 3 years after the initial shock. Chinese debt remains extremely high and is growing, and while they certainly produce a lot of stuff, if other nations are reluctant to buy that stuff, that production is not very efficient for economic growth.

Many analysts continue to describe the US-China situation as China is playing chess while the US is playing checkers, implying the Chinese are thinking years ahead. If that is so, please explain the one-child policy and the decimation of their demographics. Just sayin.

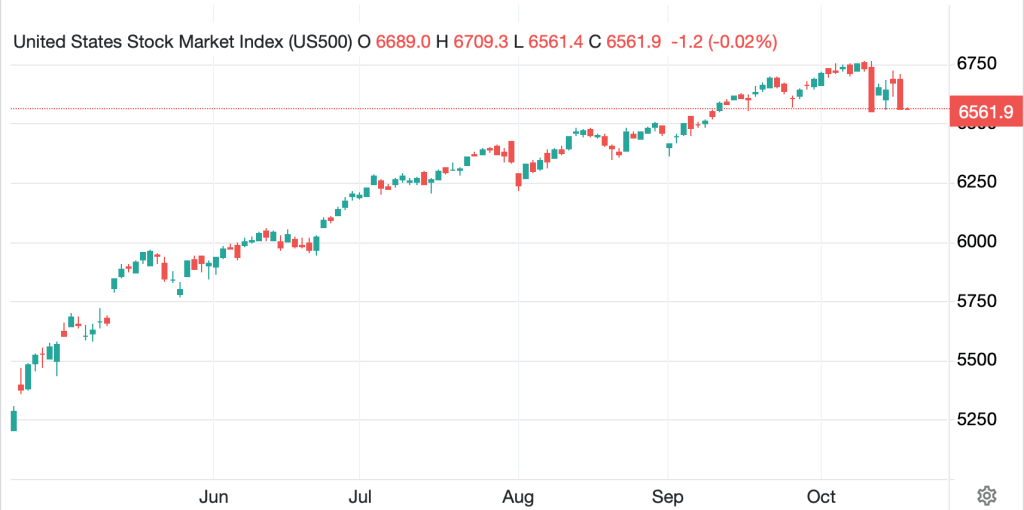

Ok, let’s look at markets overnight. While yesterday’s US markets were blah, at best, strong earnings from Amazon and Apple has futures rocking this morning with NASDAQ higher by 1.3% at this hour (7:40). Those earnings, plus the euphoria over the Trade deal with the US sent Japanese shares (+2.1%) to another new all-time high which dragged along Korea (+0.5%) and New Zealand (+0.6%) but that was all. The rest of Asia was under pressure as the weak Chinese PMI data weighed on both HK (-1.4%) and mainland (-1.5%) indices and that bled to virtually every other market. Meanwhile, European bourses are all somewhat lower as well, albeit not dramatically so, as the tech euphoria doesn’t really apply here. So, declines between -0.1% (Spain) and -0.4% (UK) are the order of the day.

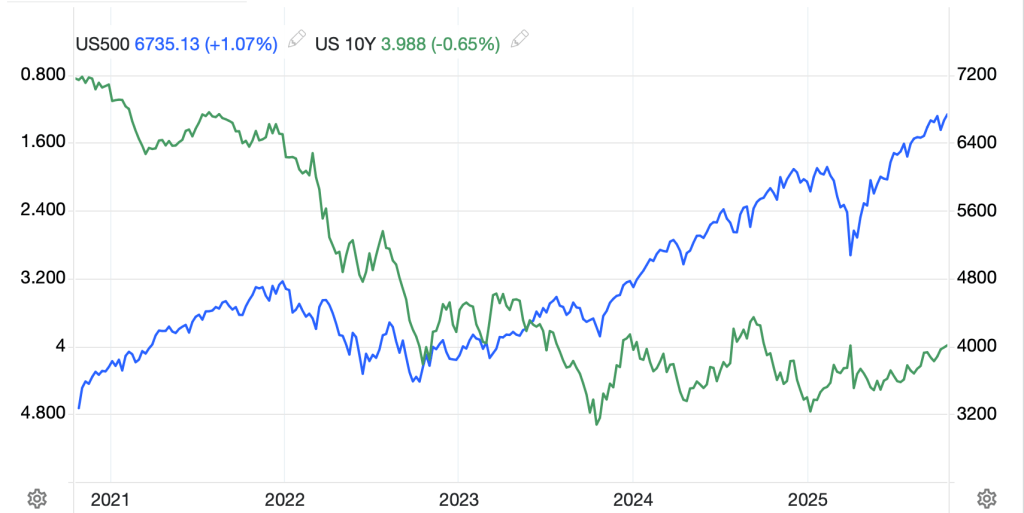

In the bond markets, yields have essentially been unchanged since the FOMC response with treasury yields edging 1bp higher this morning, now at 4.10%, while European sovereign yields are either unchanged or 1bp higher. The ECB was a nothingburger, as expected, and going forward, all eyes will be on the data to see if any stances need change.

The commodity markets continue to be the place of most excitement with choppiness the rule. Oil (-0.25%) is a touch softer this morning but continues to hover around the $60/bbl level. I’m not sure what will get it moving, but right now, neither war nor peace seems to matter. Regime change in Venezuela maybe?

Source: tradingeconomics.com

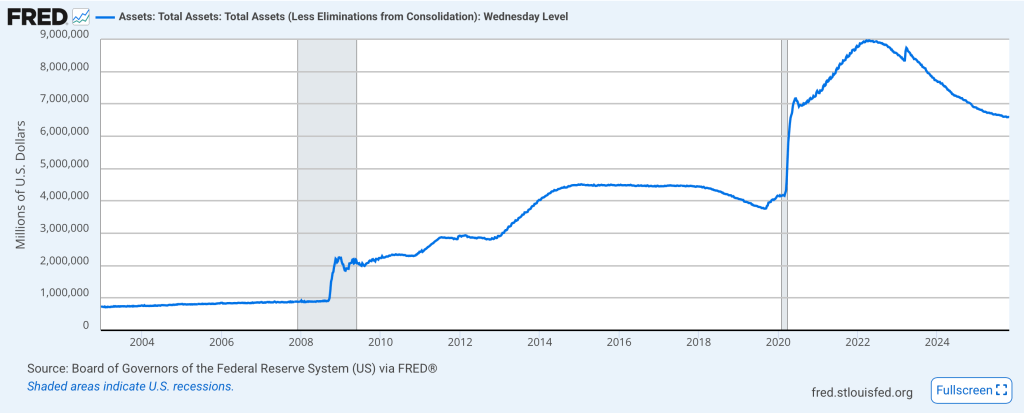

In the metals markets, volatility is still the norm with gold (-0.45%) lower this morning after a nice rebound yesterday and currently trading just above $4000/oz. Silver and copper are unchanged this morning with platinum (-0.9%) following gold. However, regardless of the recent market chop, the charts for all these metals remain distinctly bullish and the theme of debased fiat currencies is still alive. Run it hot is still the US playbook, and that is going to support all commodity prices.

Finally, the dollar, after another step higher yesterday, is little changed this morning. Both the euro and yen are unchanged and the rest of the G10 has slipped by between -0.1% and -0.2%. In truth, today’s outlier is ZAR (-0.4%). Now, let’s look at two ZAR charts, the past year and the long term, which tell very different stories. In fact, it is important to remember that this is often the case, not merely a rand situation. First, the past year shows the rand with a strengthening trend as per the below from tradingeconomics.com. That spike was the response to Liberation Day.

But now, let’s look at a longer-term chart of the rand, showing the past 21 years.

Source: finance.yahoo.com

Like most emerging market currencies, the rand has been steadily depreciating vs. the dollar for decades. It’s not that we haven’t seen a few periods of modest strength, but always remember that in the big picture, most EMG currency’s slide over time. This is merely one example, and it is a BRICS currency. The demise of the dollar remains a long way into the future.

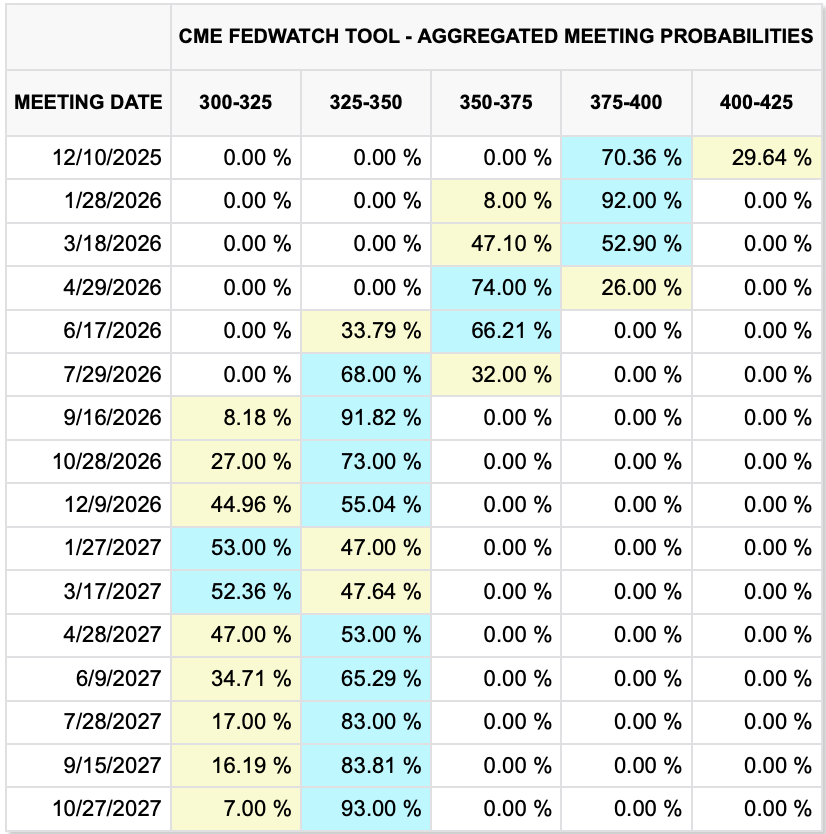

On the data front, Chicago PMI (exp 42.3) is the only release, and we hear from three more Fed speakers. It appears every FOMC member wants to get their view into the press as quickly as possible since there seem to be so many differing views. In the end, I continue to think the Fed cuts in December, and nothing has changed. But for now, there is less certainty as this morning, the probability of a cut is down to 66%. I guess we’ll see. But regardless, I still like the dollar for now.

Good luck and good weekend

Adf