The narrative writers are failing

To keep their perspectives prevailing

They want to blame Trump

But if there’s no slump

They’ll find themselves gnashing and wailing

Economists have the same trouble

‘Cause most of their models are rubble

The change that’s been wrought

Requires more thought

Than counting on one more Fed bubble

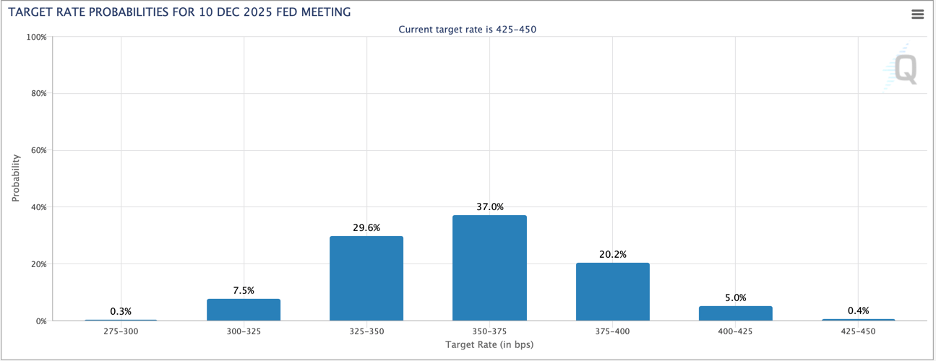

Investors seem to be growing unhappier by the day as so many traditional signals regarding market movement no longer appear to work. Nothing describes this better, I think, than the fact that forecasts for 10-year Treasury yields by major banks are so widely disparate. While JPMorgan is calling for 5.00% by the end of the year, Morgan Stanley sees 2.75% by then. What’s the right position to take advantage of that type of knowledge and foresight?

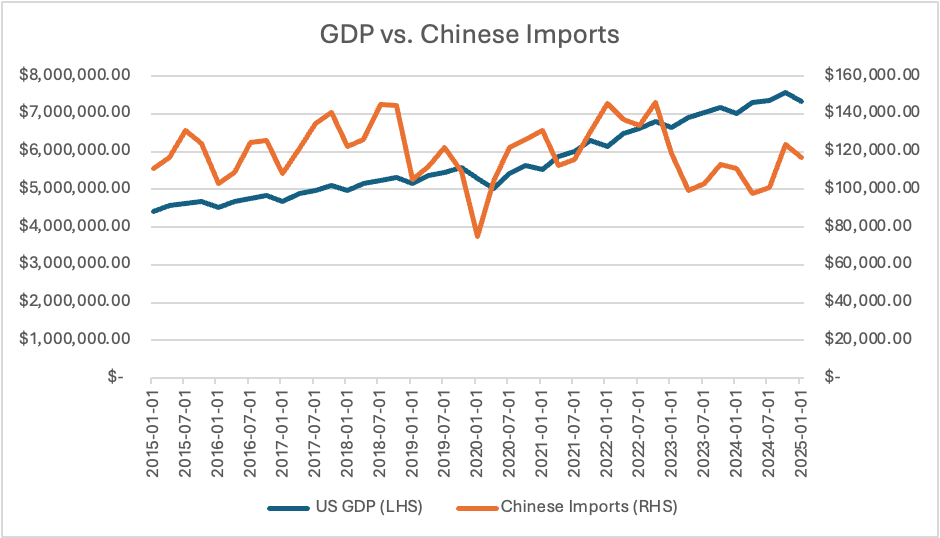

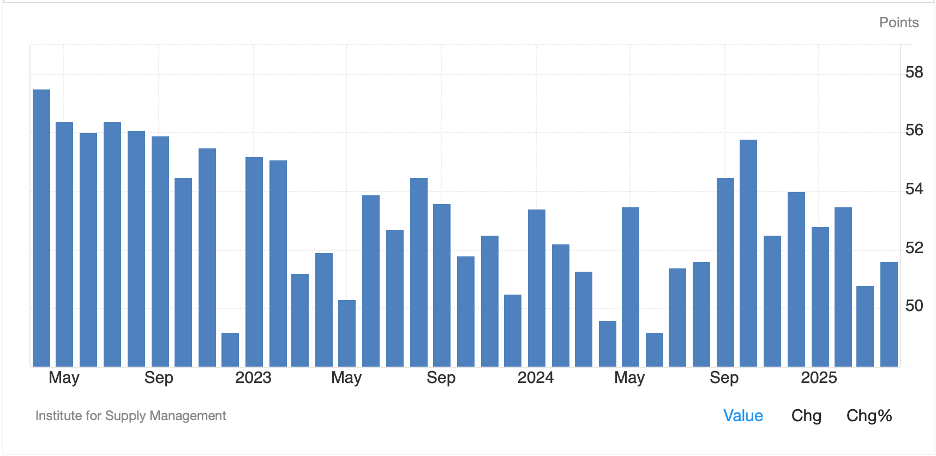

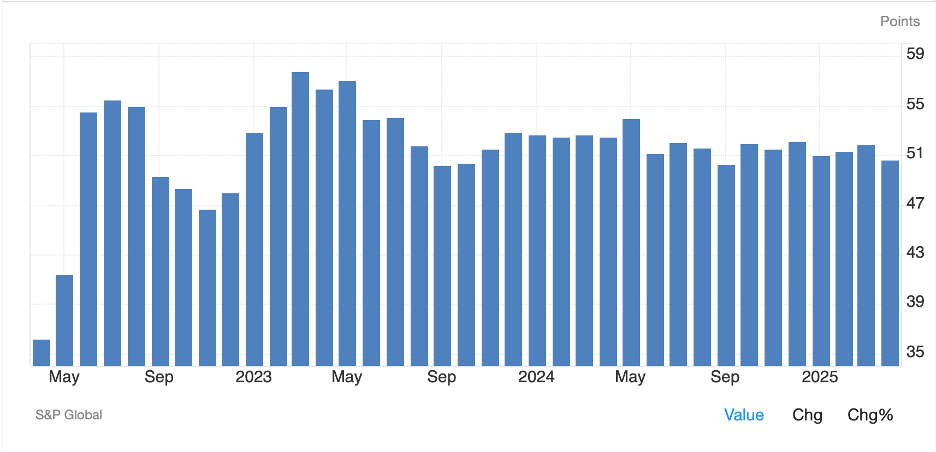

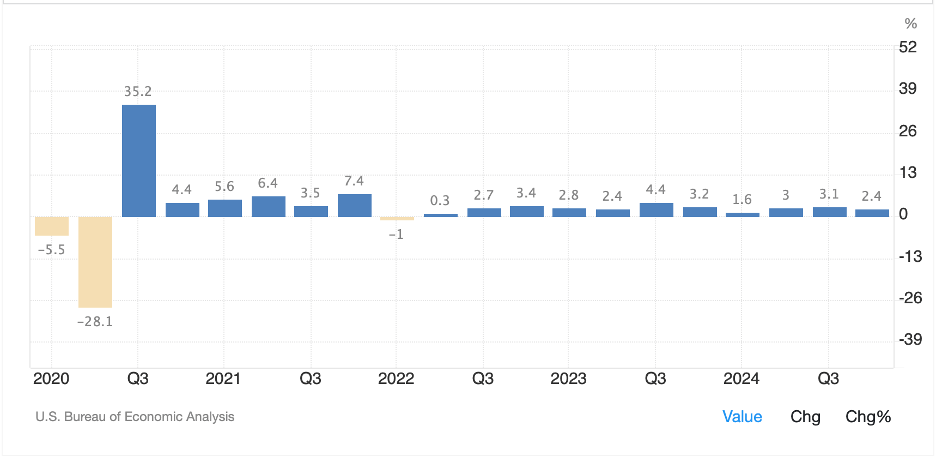

One of the most confusing things over the past months, has been the growing dichotomy between soft, survey data and hard numbers. But even here, it is worth calling into question what we are learning. For instance, this week we will see the NFP data along with the overall employment report. That data comes from the establishment survey. It seems that just 10 years ago, more than 60% of companies reported their hiring data. Now, that is down to ~43%. Does that number have the same predictive or explanatory power that it once did? It doesn’t seem so.

Too, if we consider the Michigan Sentiment data, it has become completely corrupted by the political angle, with the current situation being Democrats answering the survey anticipate high inflation and weak growth while Republicans see the opposite. Is that actually telling us anything useful from an economic perspective let alone a market perspective? (see charts below from sca.isr.unmich.edu)

But this phenomenon is not merely a survey issue, it is an analysis issue. At this point, I would contend there are essentially zero analysts of the US economy (poets included) who do not have a political bias built into their analysis and forecasts. Consider that if you are in a good mood generally, then your own perspective on things tends to be brighter than if you are in a bad mood. Well, expand that on a political basis to, if you are a Democrat, President Trump has been defined as the essence of evil and therefore your viewpoint will see all potential outcomes as bad. If you’re a Republican, you will see much better potential. It is who we are and has always been the case, but it appears a combination of President Trump and social media has pushed this issue to heretofore unseen extremes.

There are two problems with this. First, for most consumers of financial information, the decision matrix is opaque. Who should you believe? But perhaps more concerningly, as evidenced by the decline in the response rate to hard data, for policymakers like the Fed and Treasury, what should they believe? Are they receiving accurate readings of the economic realities on the ground? Is the job market as strong (or weak) as currently portrayed? Is the uncertainty in ISM data a result of political bias? And if politics is an issue in these situations, who is to say that answers to questions will be fact-based rather than crafted to present a political viewpoint?

I would contend that the reason the narrative is breaking down everywhere is that the willingness of investors, as well as the proverbial man on the street, to listen to pronouncements from on high has diminished greatly. After all, the mainstream media, which had always been the purveyor of the narrative, or at least its main amplifier, has lost its luster. Or perhaps, they have lost all their credibility. Independent media, whether on X, Substack or simply blogs that are posted all over the internet, have demonstrated far more clarity and accuracy of situations than anything coming from the NYT, WSJ, BBG or WaPo, let alone the TV “news” programs.

We are on our own to determine what is actually happening in the world, and that is true of how markets will perform going forward. I have frequently written that volatility is going to be higher going forward across all markets. President Trump is the avatar of volatility. As someone whose formative years in trading were in the mid 80’s, when inflation was high, and Paul Volcker never said a word to anyone about what the Fed was doing (and even better, nobody even knew who the other FOMC members were), the best way to thrive is to maintain modest positions with limited leverage. The time of ZIRP and NIRP will be seen as the aberration it was. As it fades, so, too, will the ability to maintain highly levered positions because any large move can be existential.

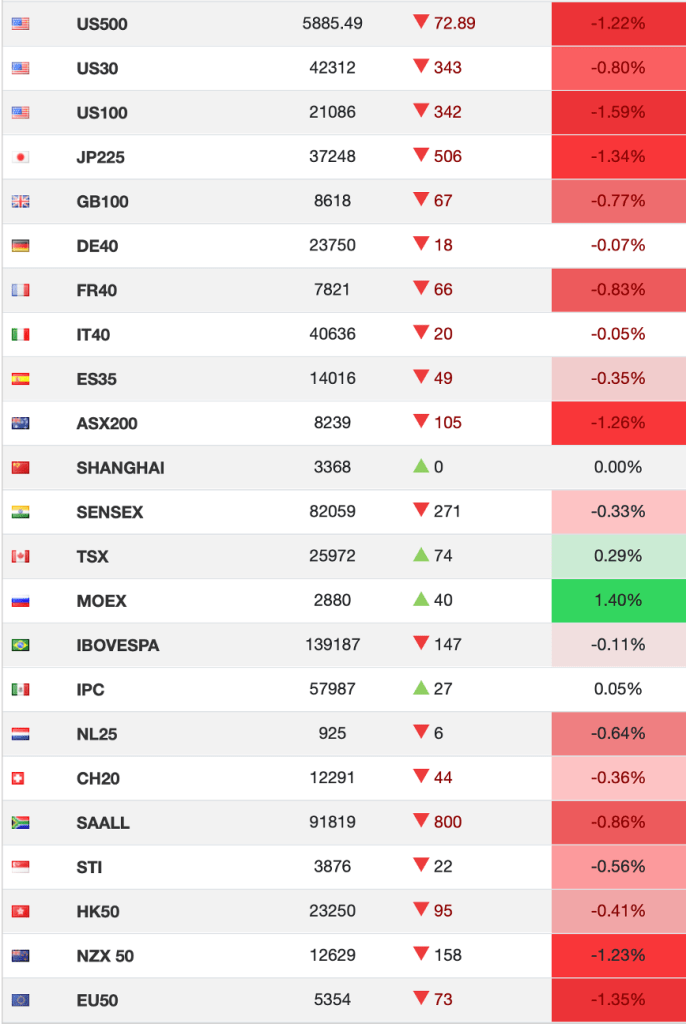

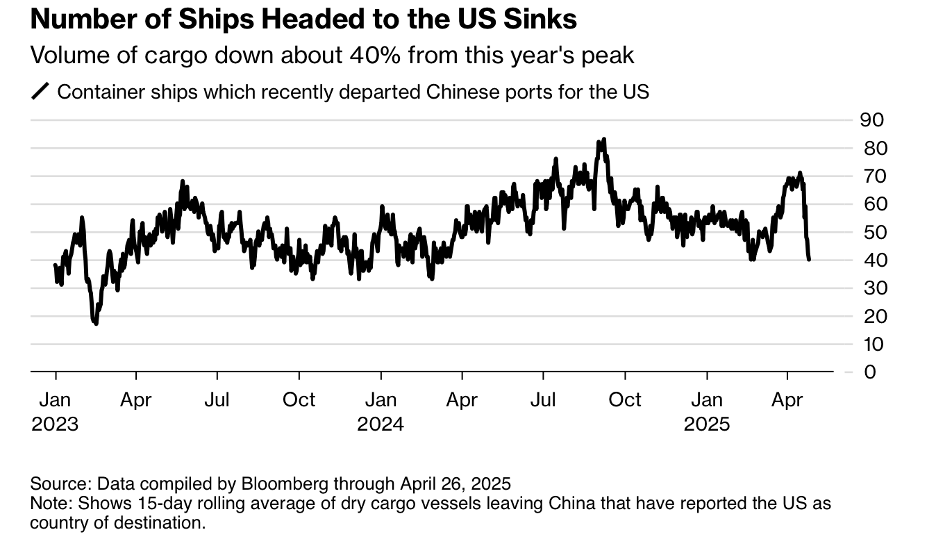

With that cheery opening, let’s take a look at what has happened overnight. Friday’s US session was not very noteworthy with mixed data leading to mixed results but no real movement. Alas, things have taken a turn lower since then. Asian markets were weaker overnight (Nikkei -1.3%, Hang Seng -0.6%, CSI 300 -0.5%) with most other regional markets having a rough go of things as well. Concerns over further tariffs by the US (steel tariffs have been raised to 50%) and claims by both sides of the US – China trade debate claiming the other side has already breached the temporary truce have weighed on sentiment overall. Meanwhile, PMI data from the region was less than inspiring with China, Korea, Japan and Indonesia all showing sub 50 readings for Manufacturing surveys.

In Europe, equity markets are also generally softer (DAX -0.5%, CAC -0.7%) although the FTSE 100 (0.0%) has managed to buck the trend after data this morning showed Housing Prices firmed along side Credit growth. As investors await the US ISM/PMI data, futures are pointing lower across the board, currently down around -0.4% at 7:15.

In the bond market, yields all around the world are backing up with Treasuries (+3bps) bouncing off the lows seen on Friday, although remaining below 4.50%, while European sovereigns have climbed between 3bps and 4bps across the board. JGB’s overnight (+2bps) also rose, although the back end of that curve saw yields slip a few bps. It seems the world isn’t ending quite yet, although there does not seem to be any cure for government spending and debt issuance anywhere in the world.

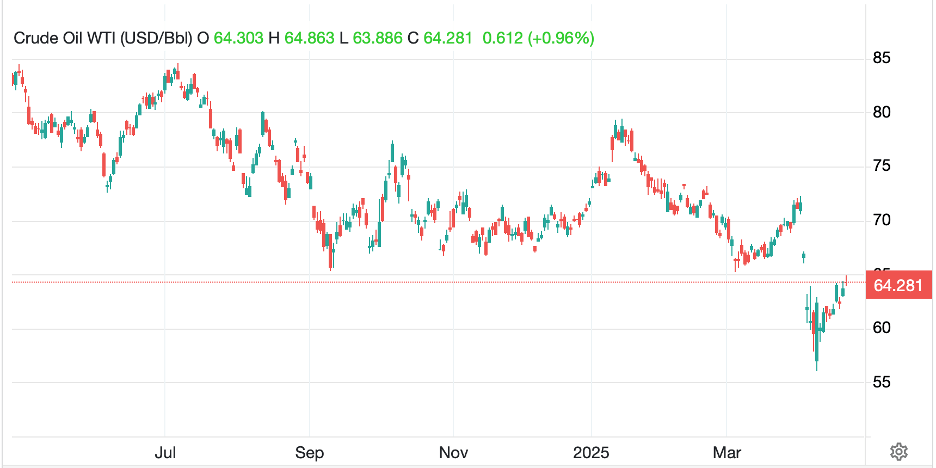

Commodity prices, though, are on the move as it appears investors are interested in acquiring stuff that hurts if you drop it on your foot. Gold (+1.85%), silver (+0.9%) and copper (+3.6%) are all in demand this morning, the latter ostensibly benefitting from fears that the US will impose more tariffs on other metals thus driving prices higher. But the real beneficiary overnight has been oil (+4.0%) which rose on the back of an intensification of the Russia – Ukraine war as well as the idea that OPEC+ ‘only’ raised production by 411K barrels/day, less than the whisper numbers of twice that amount. As I watch the situation in Ukraine, it appears to have the hallmarks of an imminent peace process as both sides are pulling out all the stops to gain whatever advantage they can ahead of the ceasefire and both recognizing that the ceasefire is going to come soon. But despite the big jump in the price of WTI, you cannot look at the chart below and expect a breakout in either direction. If I were trading this, I would be more likely to fade the rally than jump on board the rise.

Source: tradingeconomics.com

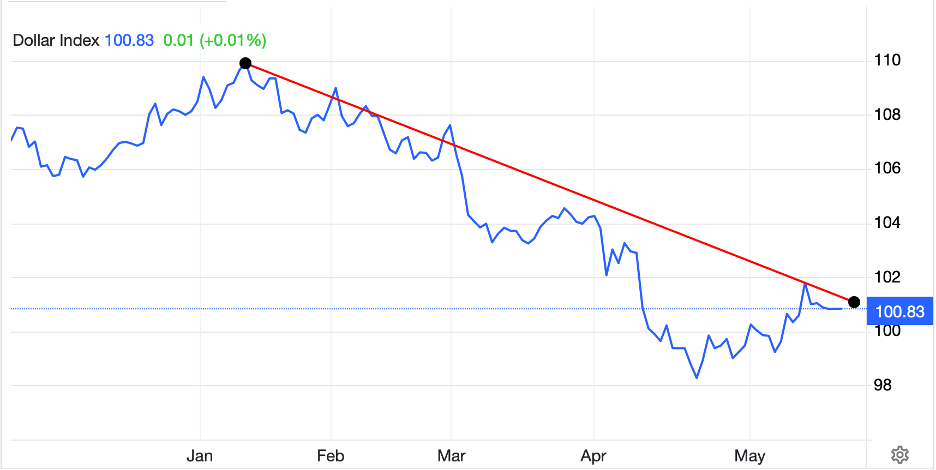

Finally, the dollar is under the gun this morning, falling against pretty much all its major counterparts. Both the euro (+0.7%) and pound (+0.6%) are having strong sessions although JPY (+1.0%) and NOK (+1.3%) are leading the way in the G10. NOK is obviously benefitting from oil’s rally, while there remains an underlying belief that Japanese investors are slowing their international investments and bringing money home. Now, the ECB meets this week and is widely anticipated to be cutting rates 25bps, but my take is, today is a dollar hatred day, not a euro love day. As to the EMG bloc, gains are evident across regions with CZK and HUF (both +1.0%) demonstrating their beta to the euro although PLN (+0.5%) is lagging after the presidential election there disappointed the elites with the Right leaning candidate winning the job and likely frustrating Brussels in their attempts to widen the war in Ukraine. In Asia, CNY (+0.1%) was relatively quiet but KRW (+0.5%), IDR (+0.8%) and THB (+0.9%) all benefitted from that broad dollar weakness. So, too, did MXN (+0.65%) although BRL has not participated.

There is plenty of data this week culminating in the payroll report on Friday.

| Today | ISM Manufacturing | 49.5 |

| ISM Prices Paid | 70.2 | |

| Construction Spending | 0.3% | |

| Tuesday | JOLTS Job Openings | 7.1M |

| Factory Orders | -3.0% | |

| -ex Transport | 0.2% | |

| Wednesday | ADP Employment | 115K |

| BOC Rate Decision | 2.75% (current 2.75%) | |

| ISM Services | 52.0 | |

| Fed’s Beige Book | ||

| Thursday | ECB Rate Decision | 2.00% (current -2.25%) |

| Initial Claims | 235K | |

| Continuing Claims | 1910K | |

| Trade Balance | -$94.0B | |

| Nonfarm Productivity | -0.7% | |

| Unit Labor Costs | 5.7% | |

| Friday | Nonfarm Payrolls | 130K |

| Private Payrolls | 120K | |

| Manufacturing Payrolls | -1K | |

| Unemployment Rate | 4.2% | |

| Average Hourly Earnings | 0.3% (3.7% Y/Y) | |

| Average Weekly Hours | 34.3 | |

| Participation Rate | 62.6% | |

| Consumer Credit | $10.85B |

Source: tradingeconomics.com

In addition, we hear from four more Fed speakers over five venues. The thing about this is they continue to discuss patience as the driving force, except for Governor Waller, who explained overnight that he could see rate cuts if inflation stays low almost regardless of the other data.

The trade story remains the topic of most importance in most eyes it seems, although it remains a mystery where things will wind up. The narrative is lost for all the reasons above, but I will say that it appears risk aversion is today’s theme. The new part is that the dollar is considered a risk asset.

Good luck

Adf