The Minutes explained that the Fed

Is confident, looking ahead

They’ve conquered inflation

Although its duration

May last longer than they had said

They still think their policy’s tight

And truthfully, they may be right

But if they are not

And ‘flation’s still hot

They might find themselves in a plight

Below are a couple of key passages from the FOMC Minutes which show that the Fed continues to put on a game face when it comes to their performance. Although some participants have begun to hedge their bets, it is clear the majority of the committee remains convinced that despite the broad inaccuracies of their models over the past forty four years, they are still on track to achieve their objectives.

“Participants anticipated that if the data came in about as expected, with inflation continuing to move down sustainably to 2% and the economy remaining near maximum employment, it would likely be appropriate to move gradually toward a more neutral stance of policy over time.”

“Participants indicated that they remained confident that inflation was moving sustainably toward 2%, although a couple noted the possibility that the process could take longer than previously expected.” [emphasis added]

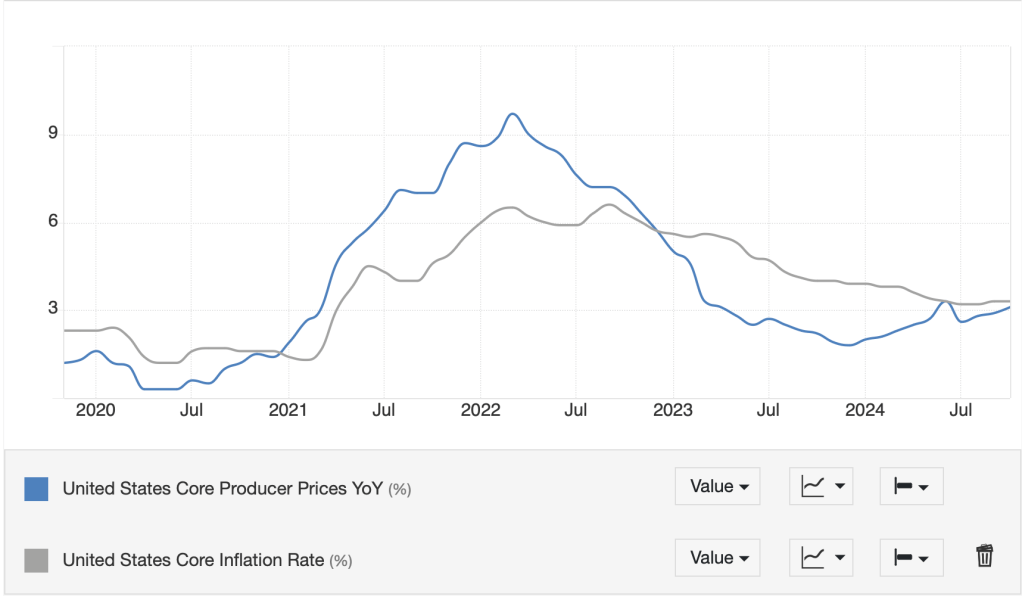

And this morning, they will get to see if their confidence has been rewarded with the release of the October PCE data (exp 0.2%, 2.3% Y/Y headline; 0.3%, 2.8% Y/Y core). One of the tell-tale signs that they are losing confidence is there has been more discussion about the vagaries of where exactly the neutral rate lies as evidenced by the following comment.

“Many participants observed that uncertainties concerning the level of the neutral rate of interest complicated the assessment of the degree of restrictiveness of monetary policy and, in their view, made it appropriate to reduce policy restraint gradually.”

Once upon a time, the Fed was the undisputed master of markets, and their actions and words were the key drivers of prices across all asset classes. However, not dissimilar to what we have seen occur regarding other mainstream institutions and their loss in respect, the same is happening at the Marriner Eccles Building I believe. Chairman Powell, he of transitory inflation fame, is a far cry from the Maestro, Alan Greenspan, let alone Saint Volcker, and my observation is that more and more market participants listen to, but do not heed, the Fed’s words.

My read is the Fed has it in their mind that they need to continue to cut rates because the committee members have not lived through periods when interest rates were at current levels for any extended length of time. They still fervently believe that their policy is restrictive, despite all the evidence to the contrary (record high stock prices and GDP expanding above potential) and so seem afraid that if they don’t cut rates they will be blamed for a recession. I would argue the market interpretation of the Minutes was dovish as shown by the Fed funds futures market increasing the probability of a December cut to 66%. Remember, Monday it was 52%. My cynical view is the reason Powell wants to cut is his friends in the Private Equity space are suffering and he wants to help, because really, given both the inflation and economic activity data, it does not appear a cut is warranted.

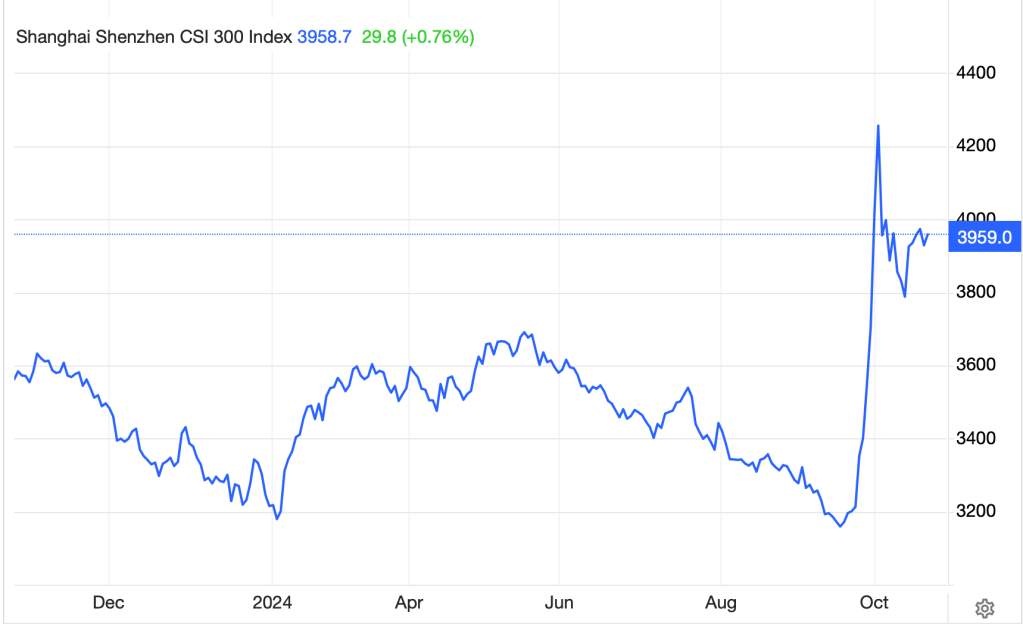

Turning our attention elsewhere, there is a story going round that China is preparing to fire that bazooka this time…for real. At least that’s what I keep reading on X, and certainly, Chinese equity markets rallied on something (CSI 300 +1.75%, Hang Seng +2.3%), but I cannot find a news story explaining any of it. Were there comments from Xi or Li Qiang? If so, I have not seen them. While Chinese assets have underperformed lately, that seems to have been a response to the Trump announcements of even more tariff-minded economic cabinet members. And the currency is essentially unchanged this morning, hanging just above that 7.25 level vs. the dollar which has served as a cap for the past decade. (see below).

Source: tradingeconomics.com

Keep in mind that the consensus view is if Trump imposes tariffs, the renminbi will weaken enough to offset them very quickly. Arguably, the dollar’s strength since September, when it briefly traded below 7.00, is a response to first, Trump’s improving prospects to win, and then once he won, his cabinet selections. Will CNY really decline 5% if tariffs are imposed? That seems an awful lot, but I guess it’s possible. It strikes me that hedgers should be looking at CNY puts to manage their risk here.

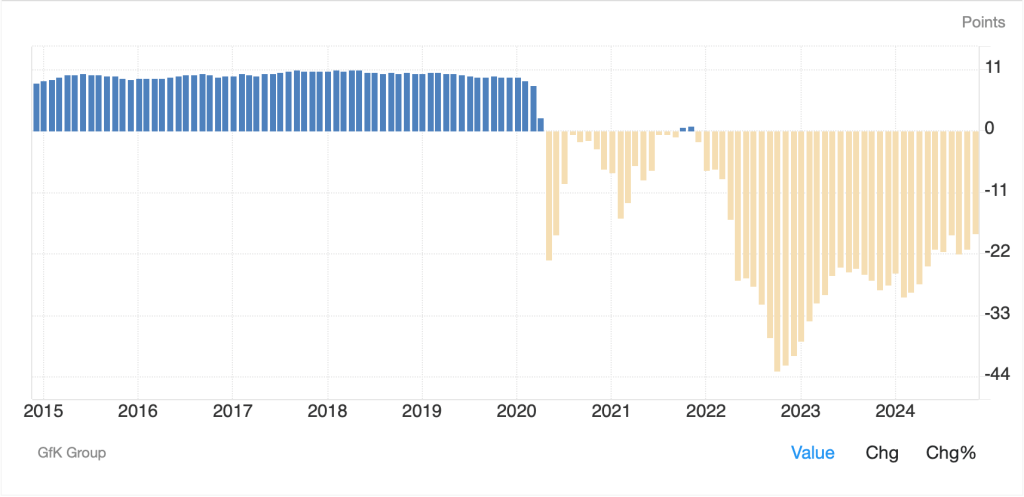

Finally, a look at Europe shows that the dysfunction on the continent seems to be accelerating. France is the latest target as the current government is hanging on by a thread with growing expectations that Marine Le Pen’s RN party is going to call for a confidence vote and topple it. As well, there are growing calls for President Macron to resign as he has clearly lost control. They are currently running a 6% fiscal deficit (just like the US although without the benefit of the world’s reserve currency) and they already have the highest tax burden in Europe. With Germany sinking further into its own morass (GfK Consumer Confidence fell to -23.3 and continues to show a nation lacking belief in its future. Just look at the longer-term chart of this indicator below:

Source: tradingeconomics.com

While Covid was obviously a problem, things seemed to be getting back toward normal until Russia’s invasion of Ukraine in early 2022 sent energy prices higher and laid bare the insanity of their Energiewende policy. As industry flees the country and politics focuses on the immigration issues ignited by Angela Merkel’s open borders policy, people there truly have little hope that things will get better.

I cannot look at the situation in both Germany and France, with both nations struggling mightily and conclude anything other than the ECB is going to be cutting rates more aggressively going forward. Combining that with the ongoing belief that Trump’s policies are going to be dollar positive overall, it seems that the euro has much further to decline. Do not be surprised to see it break parity sometime early in 2025.

Ok, ahead of the Thanksgiving holiday, let’s look at other markets. In addition to the gains in Chinese shares, Australia (+0.6%) and New Zealand (+0.7%) had a good session with the latter buoyed by the RBNZ cutting rates the expected 50bps. However, Japan (-0.8%) was under pressure as the yen (+1.1%) rallied strongly on rumors that the BOJ is getting set to hike rates next month, a bit of a change from the previous viewpoint. In Europe, the CAC (-1.25%) is the laggard as investors are watching French OATs slide in price (rise in yields) relative to their German Bund counterparts and worrying that if the government does fall, there is no way for things to work without the RN involved. But the DAX (-0.6%) is also softer as is the rest of the continent. Only the UK (0.0%) is holding up this morning. meanwhile, at this hour (7:10), US futures are pointing slightly lower, just -0.15% or so.

In the bond market, Treasury yields (-4bps) continue to slide as investors are going all-in on the idea that proposed Treasury Secretary Bessent will be able to solve the intractable problems current Secretary Yellen is leaving him. This decline is helping European sovereign yields slide as well, as they decline between -1bp and -3bps. However, a quick look at the chart below shows the above-mentioned Bund-OAT story and how that spread is the widest it has been in many years.

Source: tradingeconomics.com

In the commodity space, oil (+0.2%) is settling in just below $70/bbl as it becomes clear that OPEC+ is not going to be raising production anytime soon. NatGas (-4.8%) has suffered this morning on warmer weather in Europe, but the situation there remains dicey at best, and I think this has further to run. In metals markets, gold (+0.8%) is continuing to rebound from Monday’s wipeout, having recouped about half of the move, and we are also seeing strength in silver and copper on the China stimulus story.

Finally, the dollar is under pressure again this morning with the yen and NZD (+1.1%) leading the way although the euro (+0.3%) and pound (+0.3%) are having solid sessions as well. In the EMG bloc, MXN (-0.3%) continues to be pressured by the tariff talk although much of the rest of the bloc is following the euro’s lead and edging higher. My sense here is that there are quite a few crosscurrents pushing the dollar around so on any given day, it is hard to tell what will happen. However, I still am looking for eventual further dollar strength, especially given the Fed seems to be far less likely to cut aggressively.

On the data front, yesterday’s new Home Sales were horrific, falling -17.3% and indicating the housing market is beginning to struggle. I think that is one of the reasons the rate cut probability rose. As to the rest of today’s data beyond PCE we see the following:

| Personal Income | 0.3% |

| Personal Spending | 0.3% |

| Q2 GDP | 2.8% |

| Durable Goods | 0.5% |

| -ex Transport | 0.2% |

| Initial Claims | 216K |

| Continuing Claims | 1910K |

| Goods Trade Balance | -$99.9B |

| Chicago PMI | 44.0 |

Source: tradingeconomics.com

With the holiday, there are no Fed speakers scheduled and Friday, exchanges are only open for a half-day. There continues to be a very positive vibe overall, with retail investors the most bullish they have ever been according to several banking surveys. As well, there continues to be a positive vibe from the Trump cabinet picks which has many people expecting great things. As I said yesterday, I hope they are correct.

My concerns go back to the fact that I just don’t see inflation declining like the Fed projects and that is going to have some negative market impacts along the way. The one inflation positive is that I see oil prices with the opportunity to fall further, although demand for NatGas should keep that market underpinned. As to the dollar, I’m still looking for a reason to sell it and none has been presented.

There will be no poetry on Friday so please have a wonderful Thanksgiving holiday and we get to see how things play out come Monday.

Good luck and good weekend

Adf