The FX Poet will be in Nashville at the AFP Conference October 21-22, speaking about effective ways to use FX options in a hedging program. Please come to the presentation on Monday at 1:45 in Grand Ballroom C1 if you are there. I would love to meet and speak.

Said Madame Lagarde, we’re “on track”

To make sure inflation gets back

Below two percent

So, we can prevent

A government panic attack

The subsequent news from the East

Is Chinese growth, once more, decreased

Their five-percent goal

Ain’t on cruise control

So, Xi needs more skids to be greased

See if you can find the conundrum in the ECB statement issued yesterday after they cut interest rates 25bps, as expected, taking the Deposit Rate down to 3.25%,. [emphasis added]

“The incoming information on inflation shows that the disinflationary process is well on track. The inflation outlook is also affected by recent downside surprises in indicators of economic activity. Meanwhile, financing conditions remain restrictive.

Inflation is expected to rise in the coming months, before declining to target in the course of next year. Domestic inflation remains high, as wages are still rising at an elevated pace. At the same time, labour cost pressures are set to continue easing gradually, with profits partially buffering their impact on inflation.”

While I realize that I am just an FX guy, and that my education at MIT was far more focused on numbers than words, I cannot help but read the highlighted phrases and be confused how the conclusion of high domestic inflation and expectations for it to rise means the disinflationary process is “well on track.” Of course, it is important to remember that Madame Lagarde is a politician, not an economist nor banker nor any other background familiar with numbers, so perhaps she is the one that doesn’t understand. Either that or as with every politician she is simply lying.

Regardless, as you can see in the chart below, the market response in the wake of the announcement was to sell the euro as interest rate traders priced in a December rate cut as well.

Source: tradingeconomics.com

The juxtaposition of US and Eurozone data remains the key here and as yesterday’s US numbers showed, the long-awaited recession continues to be postponed. It becomes ever more difficult to see how the Fed will justify easing policy in any substantive manner if every economic print beats expectations. (To clarify, Retail Sales printed at 0.4%, 0.5% ex-autos vs. expectations of 0.3% and 0.1% respectively. Philly Fed printed at 10.3 vs. expectations of 3.0 and Initial Claims fell to 241K despite the hurricanes, vs expectations of 260K).

In the end, all this simply reinforces my view that the euro has further to decline going forward. I still like the 1.05 – 1.06 level as a target by year end.

Turning to China, last night they had their monthly data dump and the numbers there continue to point to an economy struggling to gain momentum. (The first, black, number is the September data, the second, green or red, number is the August data.)

Source: tradingeconomics.com

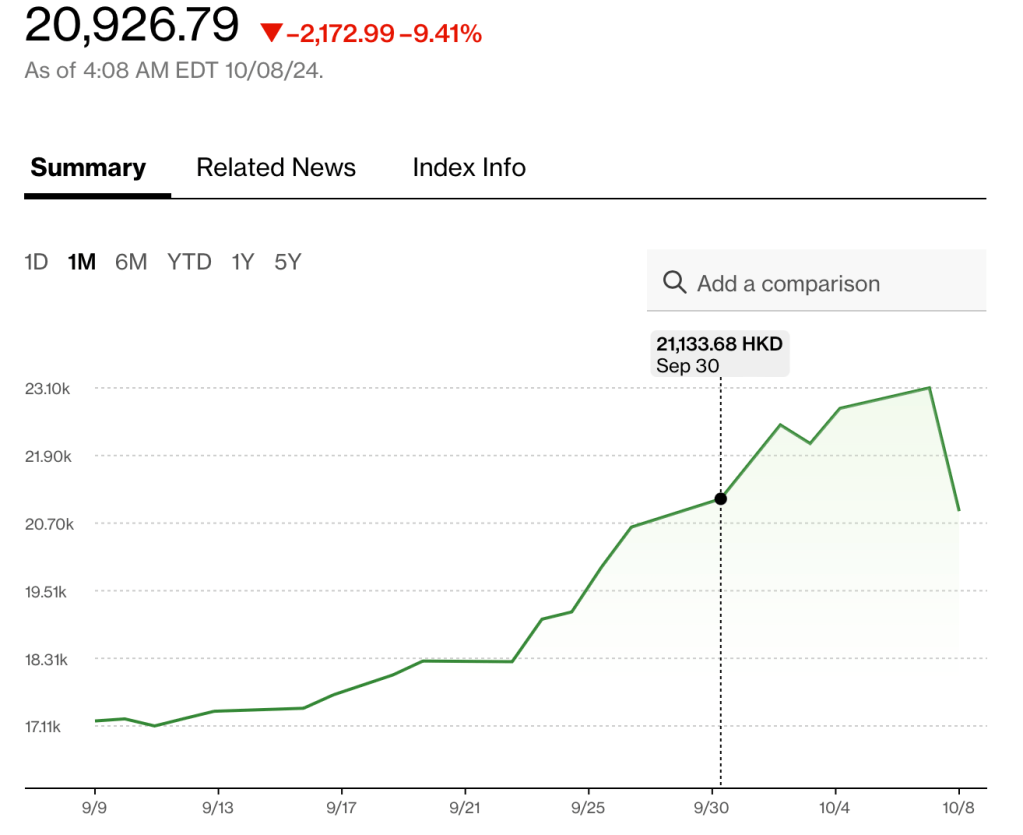

Xi’s 5% target, or even if you use their recent “around 5%’ concept, is getting strained. While Retail Sales there was a positive, the ongoing disintegration of the housing/property market is a major problem. Now, all this data represents activity before the plethora of stimulus measures that have been announced. However, recent equity market performance there, if using as an indicator of the belief that the stimulus was going to be effective, had shown a substantial decline from the early sugar highs back in September immediately following the first stimulus announcements.

With that in mind, PBOC Governor Pan Gongsheng strongly hinted that there would be another interest rate cut next week, as the government struggles to not only convince investors that they have things under control, but to also implement the measures already described. Now, last night, after Pan hinted at the rate cuts, along with other comments regarding the funds allocated to help companies buy back shares, Chinese equity markets rose sharply in the afternoon session, as per the below chart, rising 3.6% on the day.

Source: Bloomberg.com

Once again, I will highlight the irony of the Chinese Communist Party focusing on the epitome of capitalism, the equity market, as a key means of economic improvement and a key signal that they are on the right track.

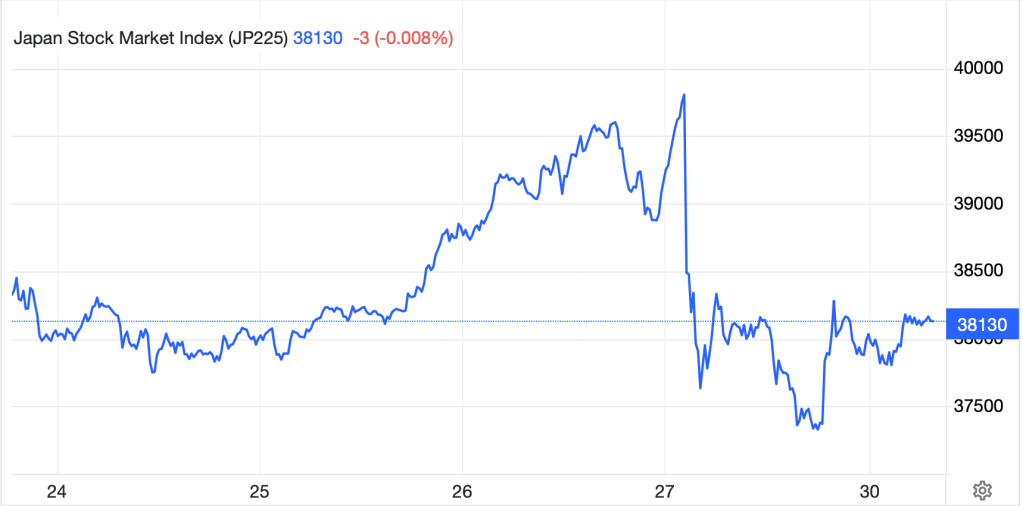

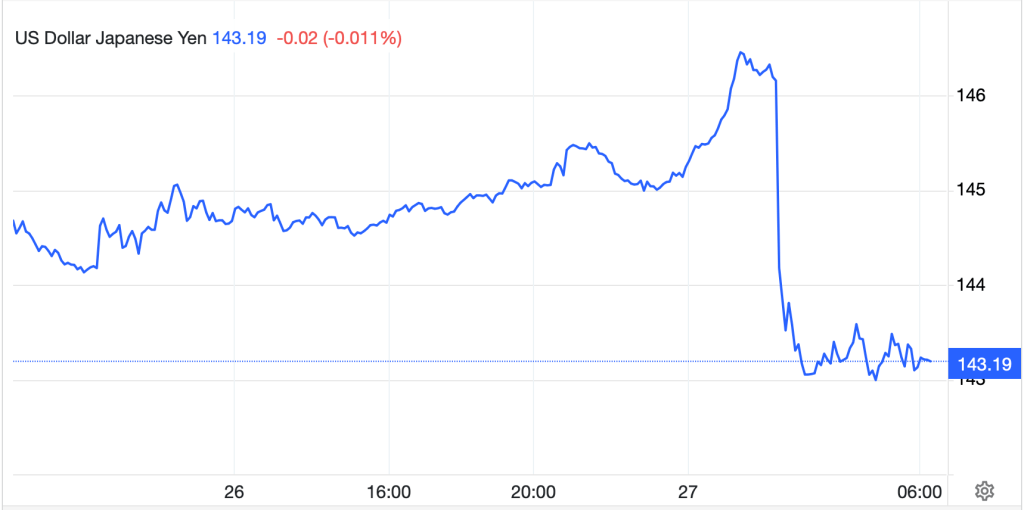

That was really all the big news since I last wrote. Let’s look at the overall market activity. After yesterday’ lackluster US session, Japanese shares (+0.2%) managed to edge a bit higher and Hong Kong (+3.6%) mirrored Chinese mainland shares. The other beneficiary of the Chinese stimulus discussion was Taiwan (+1.9%) but Australia (-0.9%), Korea (-0.6%) and a host of other regional exchanges did not seem to appreciate the effort. In Europe, only the UK (-0.3%) is really under any pressure although the gains on the continent are not terribly impressive with the CAC (+0.5%) the leader at this point. Most other markets there are little changed to slightly higher. As to US futures, at this hour (7:20), they are higher by about 0.25%.

In the bond market, after yesterday’s much stronger than expected US data, Treasury yields jumped 7bps and this morning have edged higher by another 1bp to get back to 4.10%. However, on the continent, sovereign yields this morning are lower by between -2bps and -4bps after yesterday’s ECB action and comments. The one exception here is the UK, where gilt yields are higher by 2bps after UK Retail Sales data printed much stronger than expected at +0.3% in September, vs. -0.3% expected.

In the commodity markets, oil (-0.4%) is modestly lower this morning but really going nowhere for now as evidenced by the chart below. Once the word had come that Israel was not going to target Iranian oil infrastructure and the price fell, it has basically been flat.

Source: tradingeconomics.com

As to the metals complex, gold (+0.6%) continues its ongoing rally and is at yet another new all-time high, above $2700/oz this morning, as demand continues to be present from all segments. However, this morning, all the metals are rallying with silver (+1.0%) and copper (+1.5%) showing even better performance. The combination of continued solid data from the US and hopes for a return to Chinese demand seem to be the drivers.

Finally, the dollar is closing the week on a down note, as traders reduce positions and take profits ahead of the weekend. During the week, the dollar rose against virtually every one of its main counterparts in both the G10 and EMG blocs. Again, the big picture here is that for the dollar, good US economic data is going to continue to benefit the greenback, and we will need to see not just one bad number, but a series of them before the dollar truly suffers.

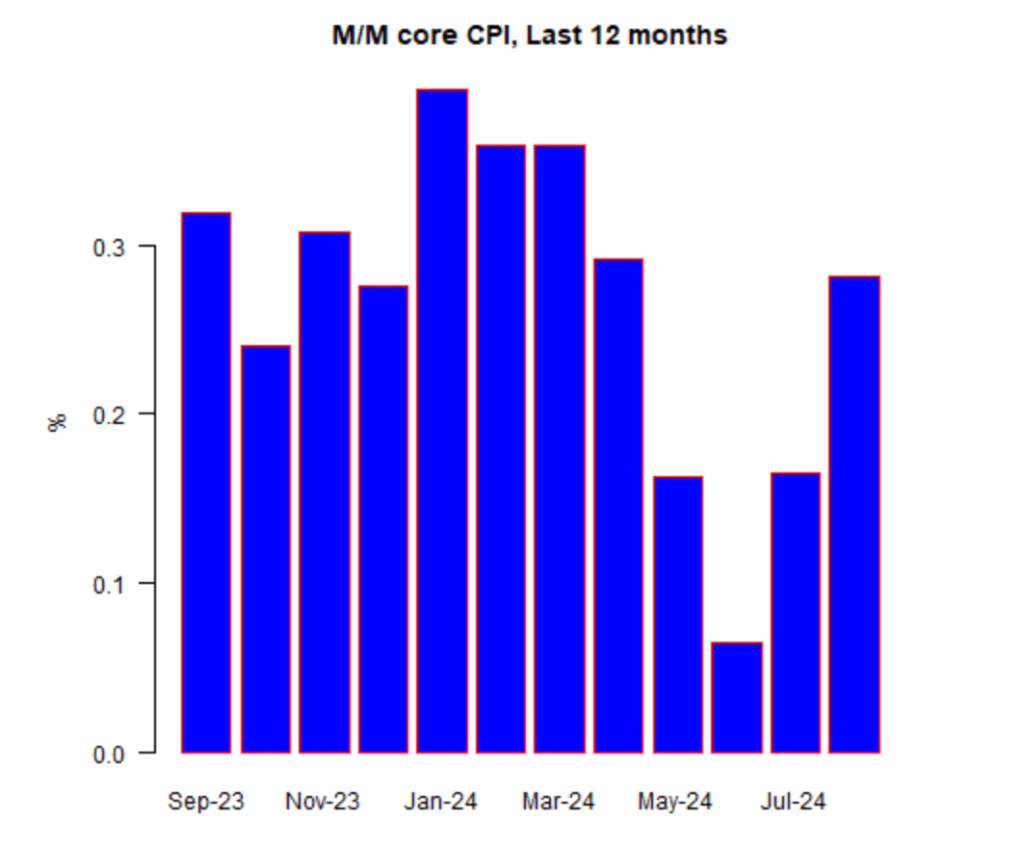

On the data front, we see Housing Starts (exp 1.35M) and Building Permits (1.46M) at 8:30 this morning and then we hear from three more Fed speakers (Bostic, Kashkari and Waller) with Bostic making two appearances. At this stage, despite the strong data, the Fed funds futures market is pricing in a 92% probability of a 25bp cut next month and then a 75% probability of another one in December. I know that Powell seems desperate to cut rates, but if the data continues to show strength, the case to do so is going to be much harder to make. That doesn’t mean he won’t do it, but if he continues down that path, it just means that inflation will return that much sooner.

Good luck and good weekend and reach out if you are in Nashville at the AFP!

Adf