While data continues to print

It doesn’t give much of a hint

To where things are going

Unless you’re all-knowing

And even then, you need to squint

The reason for this situation

Is passive flows constant inflation

No matter the news

Or anyone’s views

The target funds need their proration

The hardest thing about macroeconomic analysis is trying to discern whether it has any impact on market movement. For the bulk of my career, my observation was that while there were always periods when flows dominated fundamentals, they were short-lived periods and eventually those fundamentals returned to dominance in price action. This was true in equity markets, where earnings were the long-term driver, outlasting short-term bouts or particular manias and this was true in FX markets, where economic performance and the ensuing interest rate differentials were the key long-term driver of exchange rates. Bond markets were virtually always a reflection of inflation expectations, at least government bond markets and commodities were simple products of supply and demand of the physical stuff.

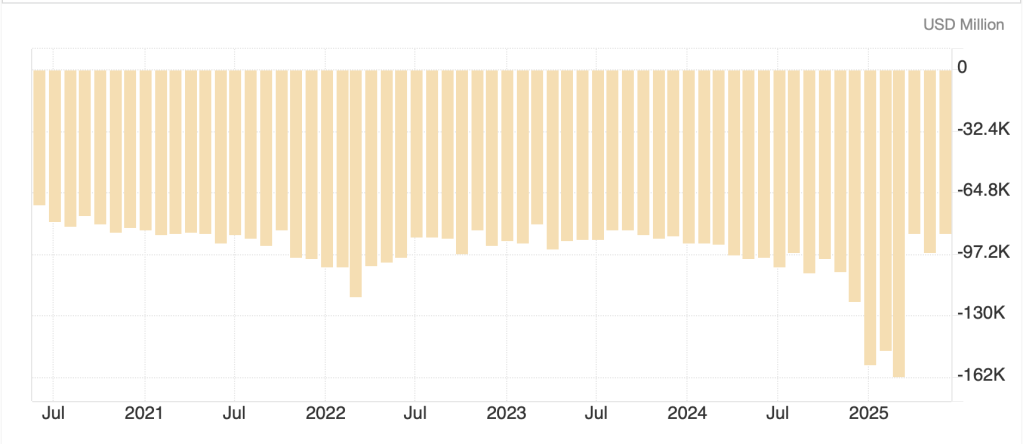

Alas, since the GFC, and more importantly, the global central bank response to the GFC, flooding financial markets with massive amounts of liquidity, G10 economies have become increasingly finanicialized to the point where the underlying fundamentals have less and less impact and funds flows are the driving force. The below chart I have created from FRED data shows the ratio of M2 relative to GDP. For decades, this ratio hovered between 53% and 60%, chopping back and forth with the ebbs and flows of the economy during recessions and expansions. But the GFC changed things dramatically and then the pandemic and its ensuing response put financialization on steroids.

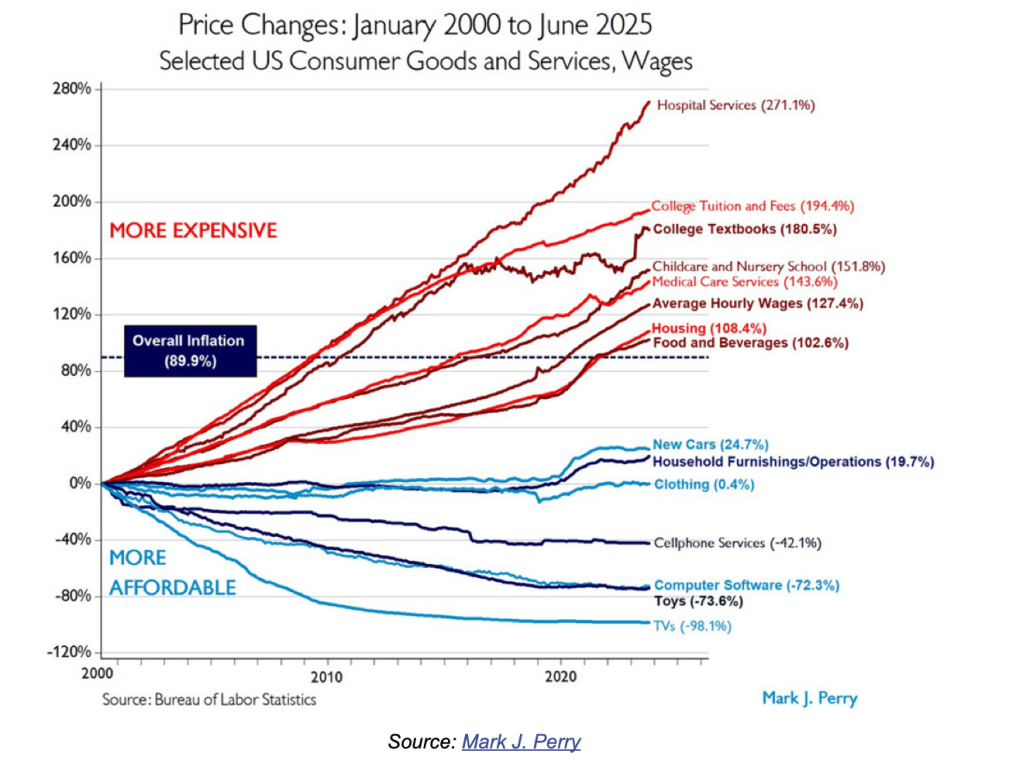

By 2011, this ratio hit 60% for the first time since 1965, and it has never looked back. The result is that there is ever more money sloshing around the economy looking for a home with the best return. This is part and parcel as to why we have seen both massive asset price inflation as well as consumer price inflation, too much money chasing too few goods. And this is the underlying facet in why funds flows, whether between asset classes or between nations, are the new driving force of market price action. Michael Green (@profplum99 on X) has done the most, and most impressive, work on the rise of passive investing, which is a direct consequence of this financialization. The upshot is, as long as money comes into the system (your semi-monthly 401K flows are the largest) they continue to buy stocks regardless of anything fundamental. And as almost all of it is capitalization weighted, they buy the Mag7 and maybe some other bits and bobs. It doesn’t matter about fundamentals; it only matters how much they have to buy.

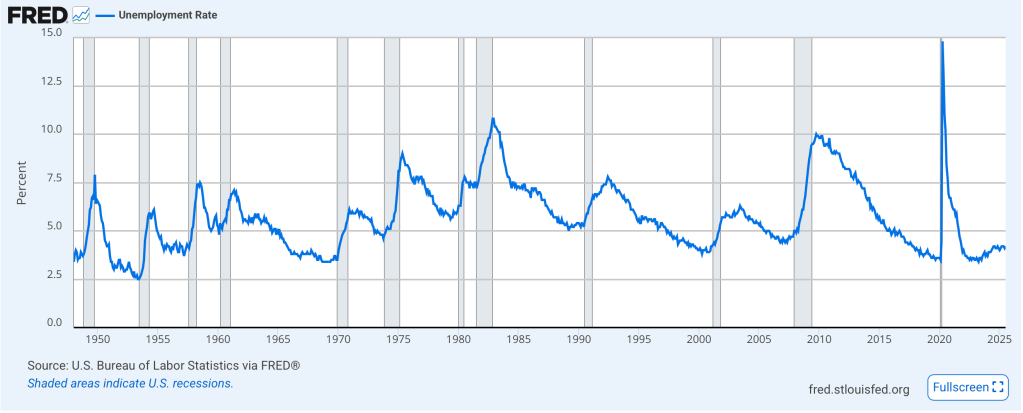

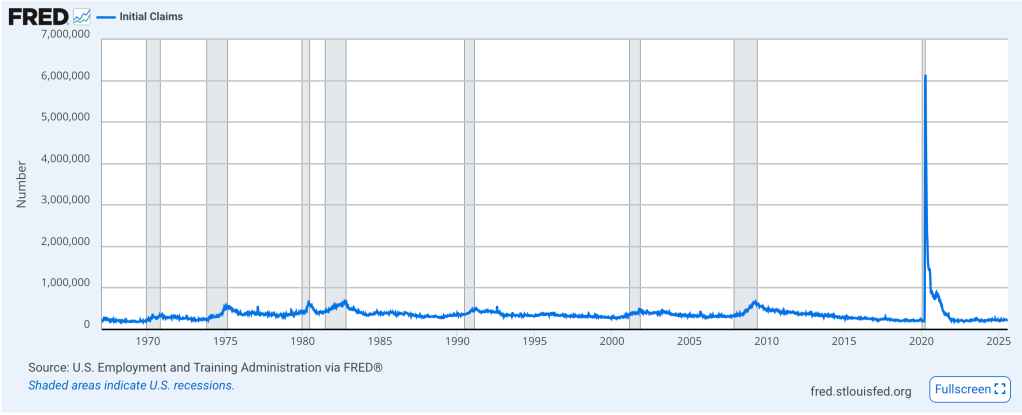

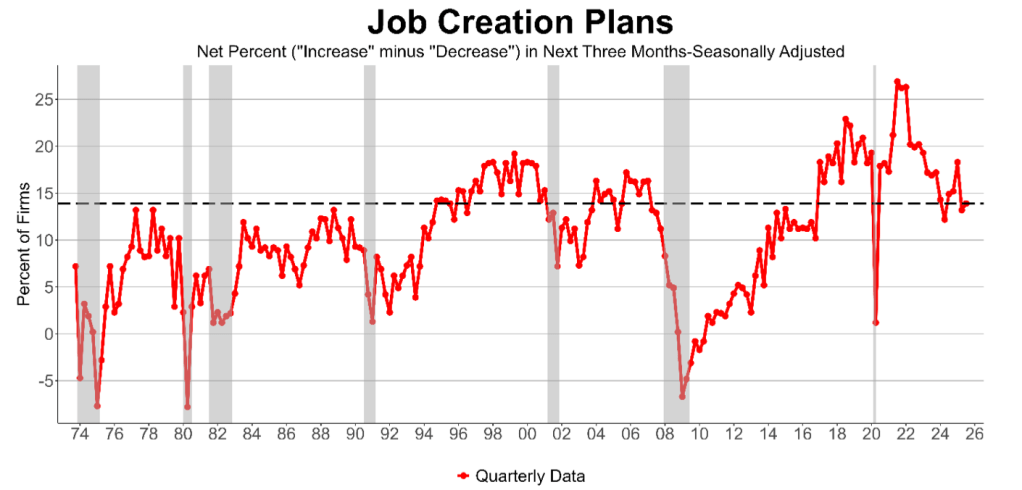

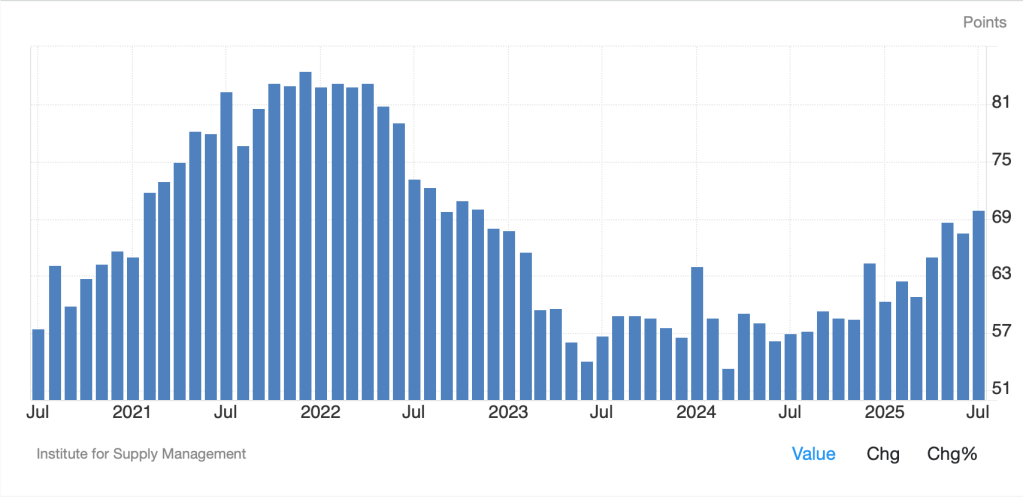

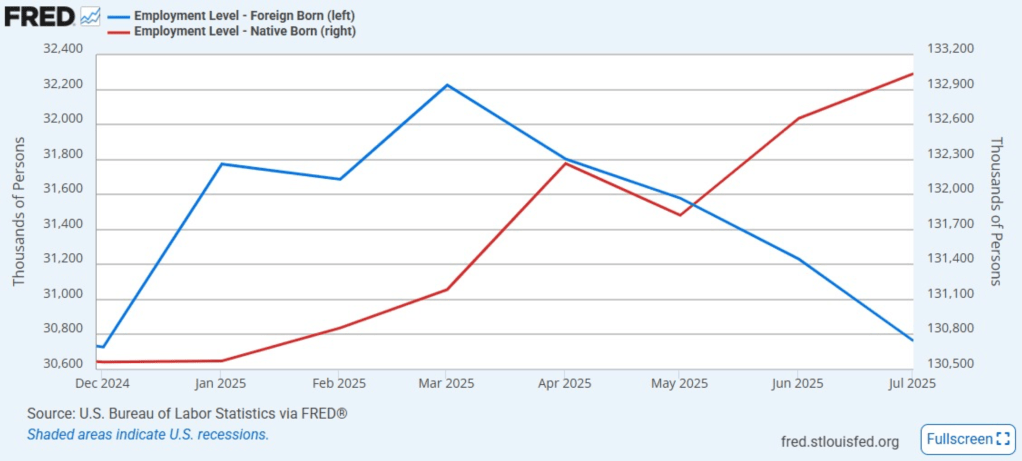

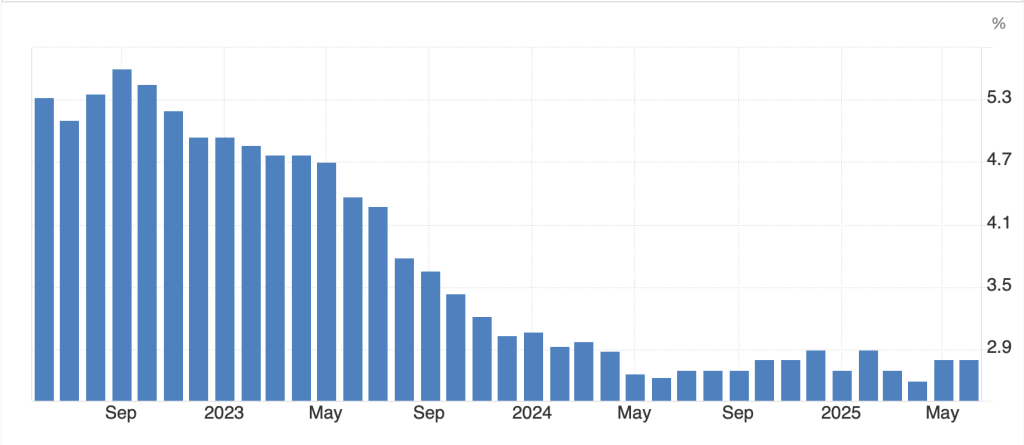

So, with that caveat as to why fundamental macro analysis has been doing so poorly lately, a look at the data tells us…nothing really. As I wrote yesterday, the two main blocs of the economy, goods production and services production, are out of sync, with marginal strength in services outweighing marginal weakness in goods production and resulting in slow growth. Whether you look at the employment situation, the ISM data or the inflation data, none of it points in a consistent and strong direction.

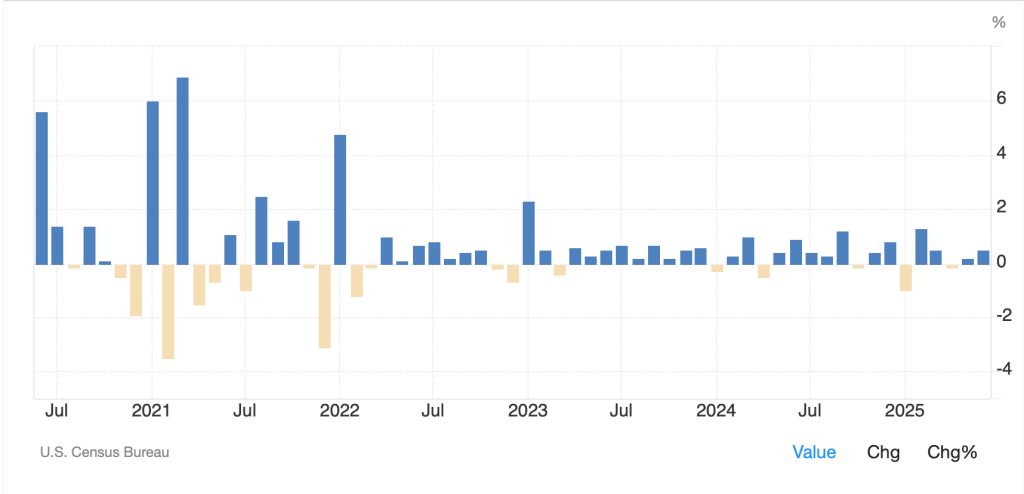

For instance, yesterday’s productivity and Labor cost data were better than expected, far better than last quarter’s and pointing to an improved growth outcome. However, if we look at the past five years of this data, we can see that labor costs have grown dramatically faster than productivity as per the below chart (ULC in grey, Productivity in blue).

Source: tradingeconomics.com

Looking at this, it is no surprise that price inflation has risen so much, given labor’s impact on prices. But, again, this is merely another impact of the massive flow of money into the economy over the past 15 years.

Virtually every piece of data we get has been significantly impacted by this financialization which is one reason that previous econometric models, built prior to the GFC, no longer offer effective analysis. The system is very different. I continue to believe that over time, fundamentals will reassert themselves, but that belief structure is under increased pressure. Perhaps YOLO and BTFD are the future, at least until our AI overlords come into their own and enslave the human population.

In the meantime, let’s look at what happened overnight. Yesterday’s mixed, and relatively dull, US session was followed by a mixed session in Asia with Tokyo (+1.85%) soaring on news that there were going to be adjustments, in Japan’s favor as well as rebates, to the tariff schedule. However, both the Hang Seng (-0.9%) and CSI 300 (-0.3%) saw no such love from either the Trump administration or investors. As to the rest of the region, red (Korea, Australia, India, Thailand, Singapore) was more common than green (Malaysia). Apparently, tariff adjustments are not universal. In Europe, both Spain (+0.8%) and Italy (+0.8%) are having solid sessions but they are alone in that with the other major bourses (DAX 0.0%, FTSE 100 0.0%, CAC +0.2%) not taking part in the fun. US futures, at this hour (7:30) are higher by about 0.4%.

Bond markets, meanwhile, are sleeping through the final day of the week, with Treasury yields unchanged on the day and European sovereign yields having edged higher by just 1bp across the board. It seems, nobody cares right now. After all, it is August and most of Europe is on vacation anyway.

Commodity markets are showing oil (+0.6%) bouncing off its recent lows, but this seems more about trading activity than fundamental changes. Perhaps there will be a Russia-Ukraine peace, but it is certainly not clear. Trump’s tariffs on India for continuing to buy Russian oil are also having an impact, but as I showed yesterday, I believe the trend remains modestly lower. Gold (-0.3%) is currently lower but has been extremely choppy as you can see from the 5-minute chart below

Source: tradingeconomics.com

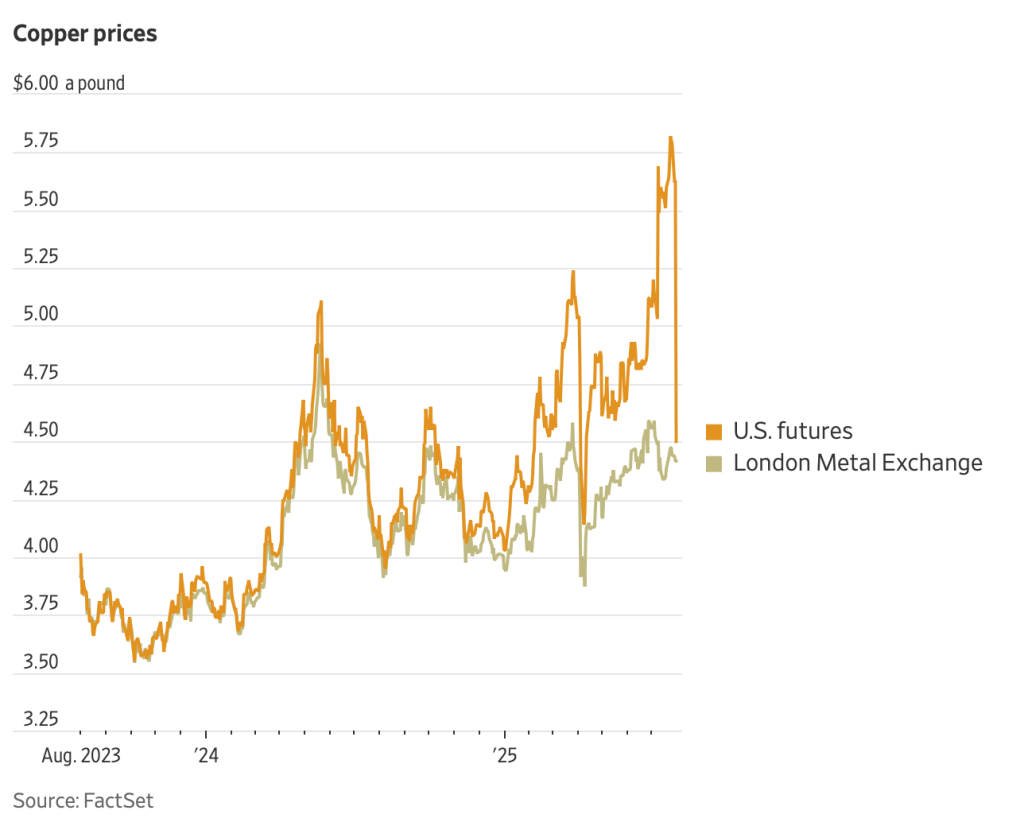

This is a market where supply and demand dynamics have been impacted by both tariffs and the interplay between financialized markets (i.e. paper gold or futures) and the actual metal. There are many theories as to different players trying to manipulate the price either higher (the Trump administration in order to revalue Ft Knox holdings) or lower (the ‘cabal’ of banks that have ostensibly been preventing the price from rising according to the gold bug conspiracy theorists). Recently, there has apparently been less central bank demand, but that can return at any time based on political decisions. I continue to believe that it is an important part of any portfolio, but it should be tucked away and forgotten in that vein. As to the other metals, they are little changed this morning.

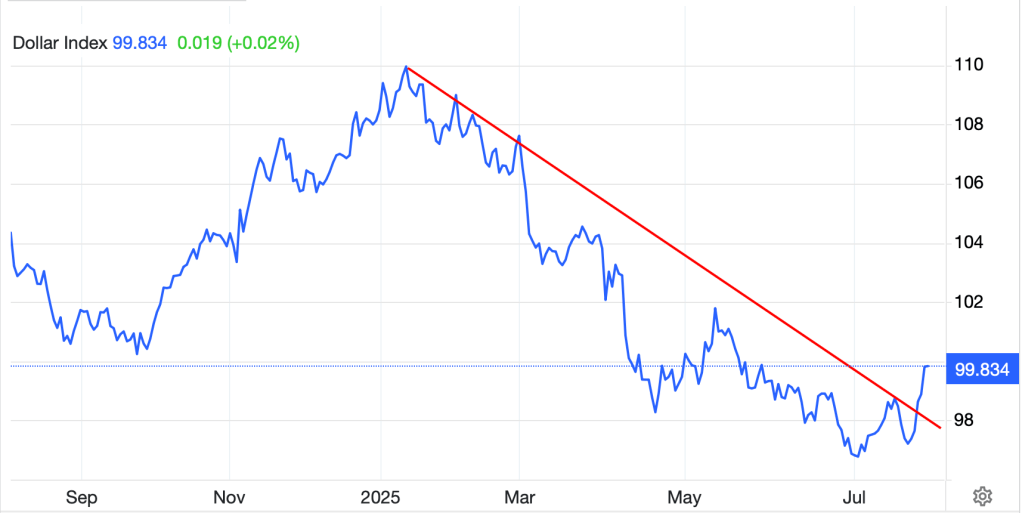

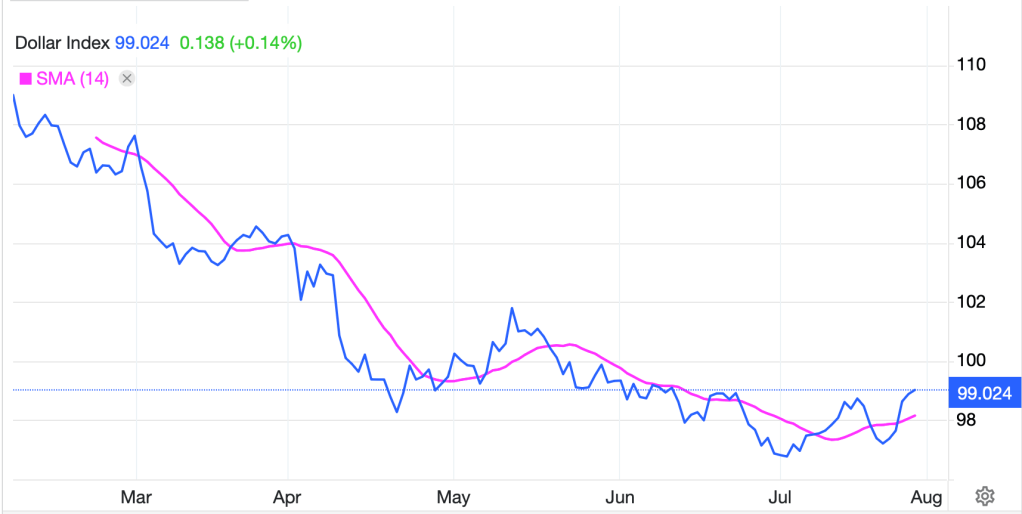

Finally, the dollar is stronger this morning, as the euro (-0.3%) and yen (-0.65%) are both under pressure and leading the way. In fact, virtually every G10 currency is weaker (CAD is unchanged) and yet the DXY seems to be weaker as well. Something is amiss there. Meanwhile, EMG currencies are mostly down on the session with KRW (-0.5%) the laggard, but weakness in INR (-0.2%), PLN (-0.25%) and CZK (-0.25%).

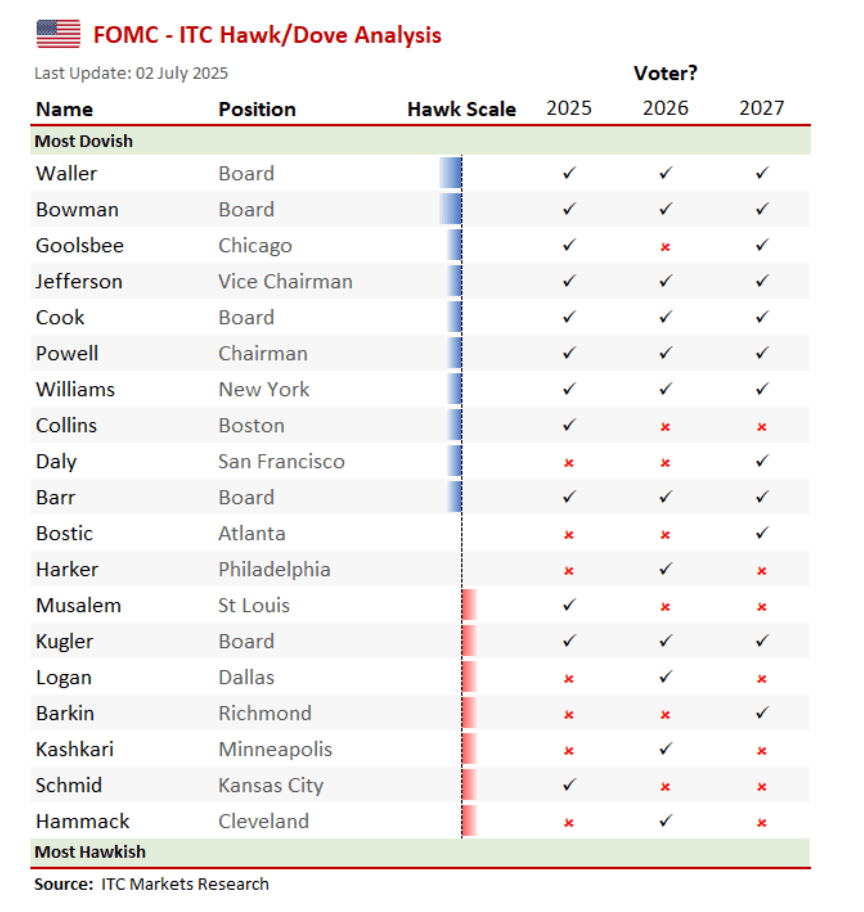

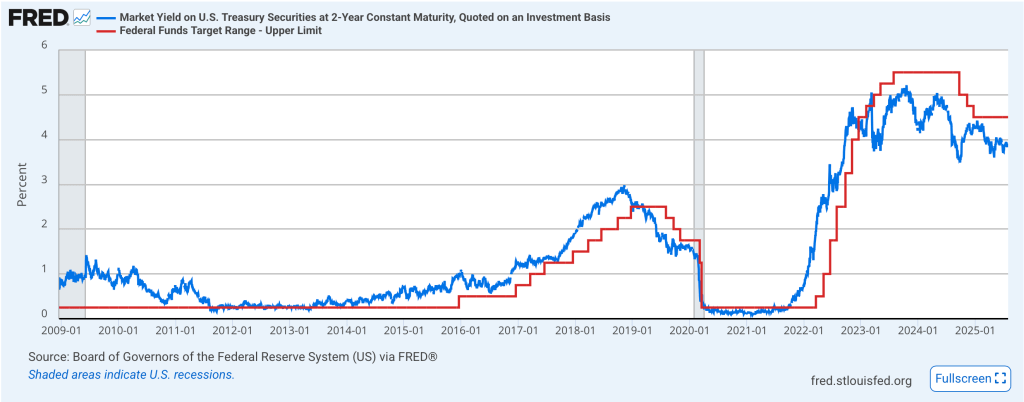

On the data front, there is none today. Yesterday, Atlanta Fed president Bostic explained his view that only one rate cut was likely this year, which is not what we have been hearing from other FOMC members. Obviously, there is still uncertainty at the Fed, but they also have more than a month to decide. Today, we hear from KC Fed president Alberto Musalem, one of the more hawkish members, so it will be interesting to see if he has changed his tune.

I would contend that confusion is the driving force in markets because data markers are not pointing in one direction nor are Fed speakers. But it is a Friday in August so I suspect it will be a quieter day as traders look to escape to the beach for the weekend. This morning’s trends, a higher dollar and higher stock prices, seem likely to prevail for the day.

Good luck and good weekend

Adf