On Friday, the story was gold

And PMs, which everyone sold

The question now asked

Is, has the peak passed?

Or will it still rise twentyfold?

The funny thing, though, is that stocks

While weak coming out of the blocks

Reversed course and rose

Right into the close

T’was like Bessent sold from Ft Knox!

(PMs = precious metals)

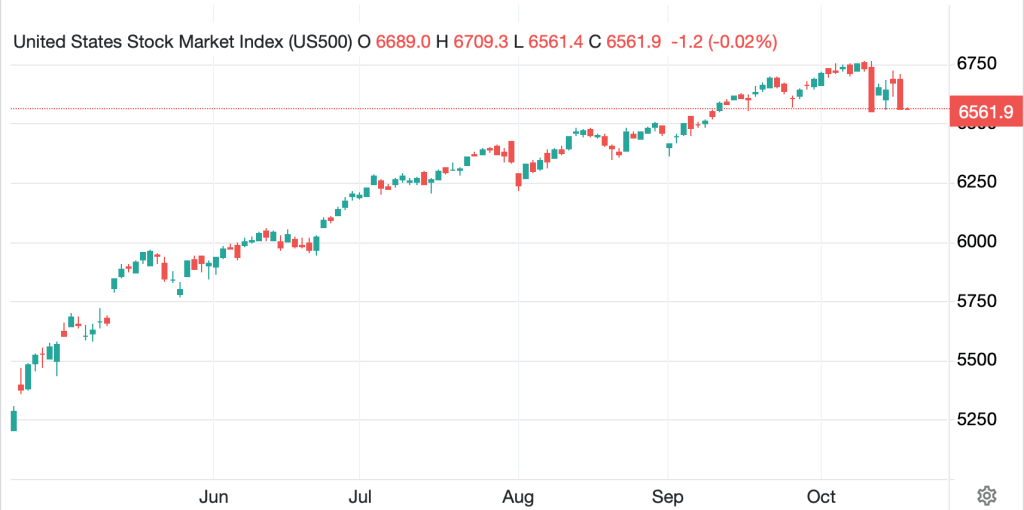

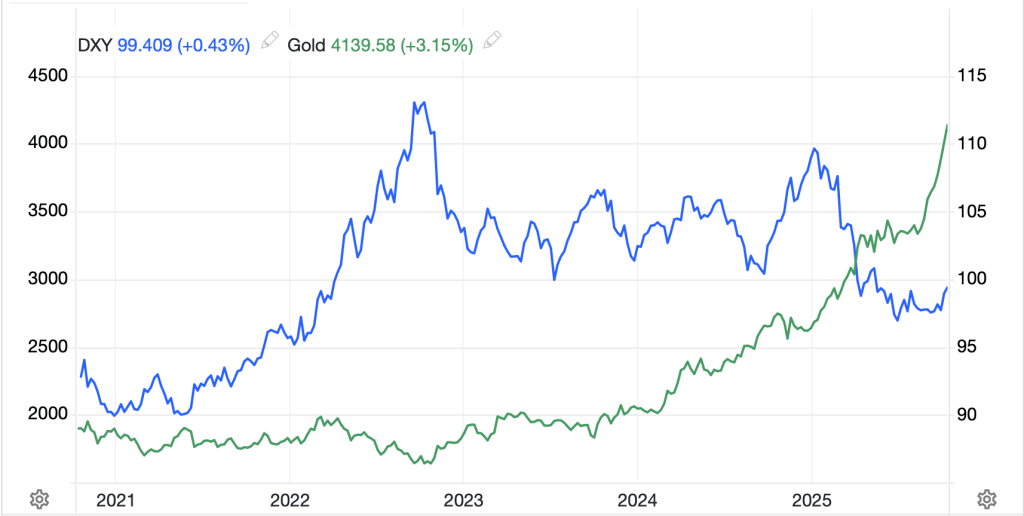

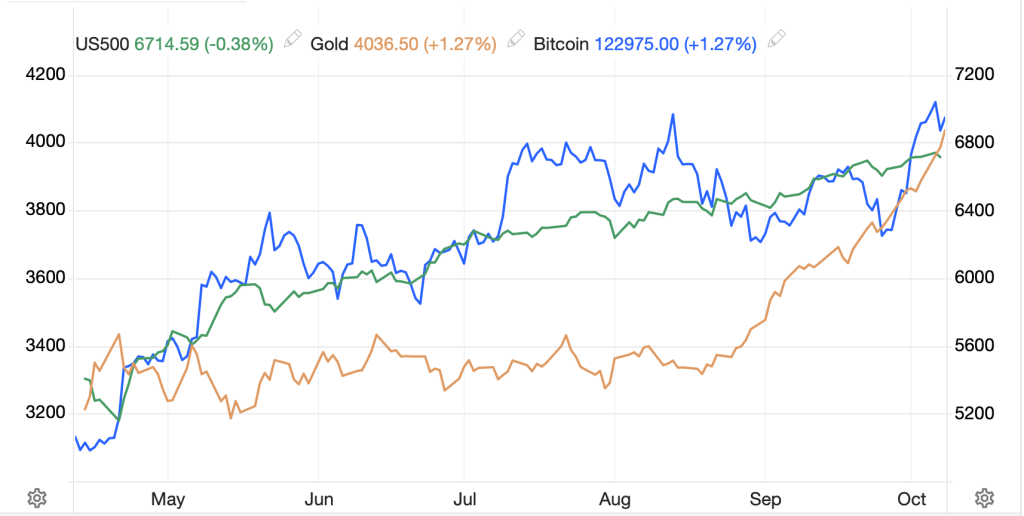

The world felt like it was ending on Friday as the early price action showed all the asset classes that have been rallying dramatically, notably gold and stocks, falling sharply. But a funny thing happened on the way to the close. While gold stopped declining, it had no rebound whatsoever, yet the equity market rallied sharply late in the session to close in positive territory. The below chart (taken Sunday evening) shows that the two assets tracked each other pretty closely right up until lunchtime Thursday and then diverged sharply.

Source: tradingeconomics.com

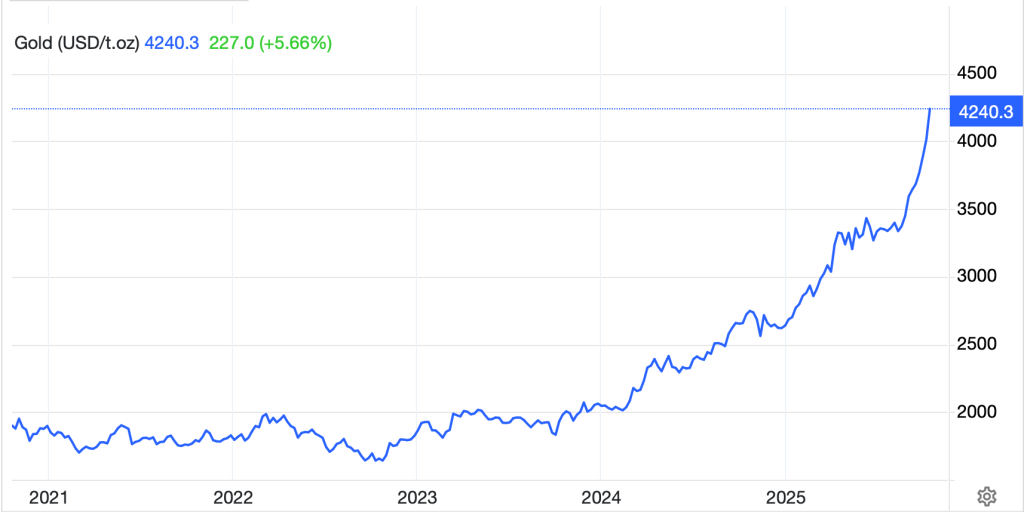

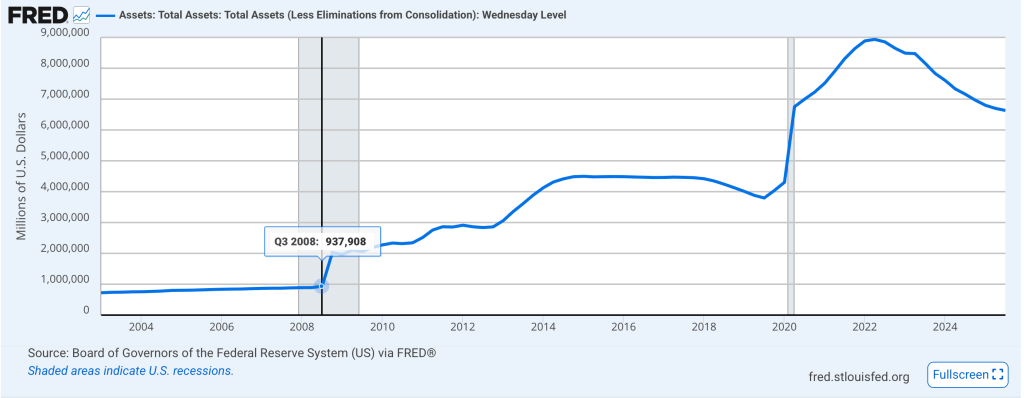

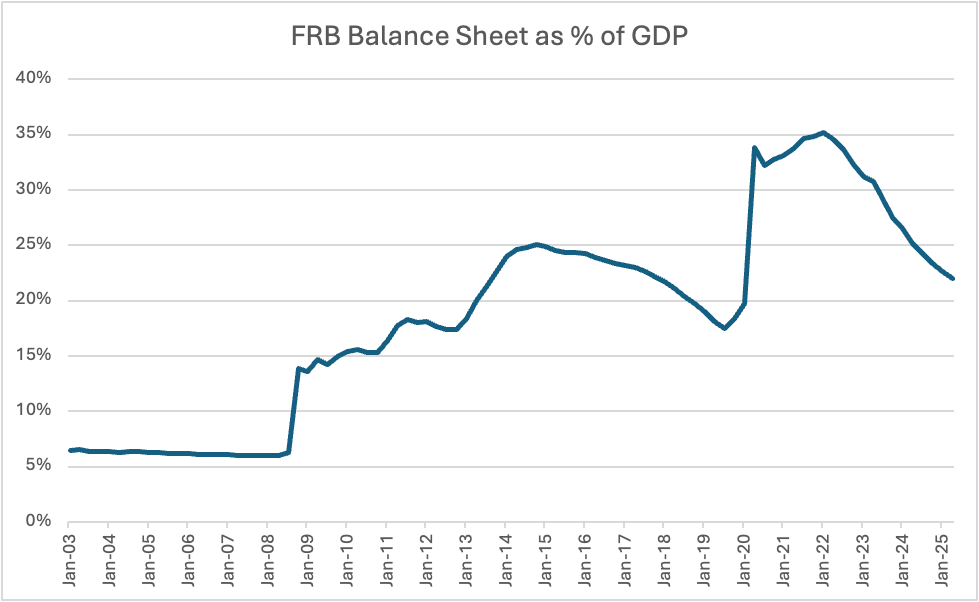

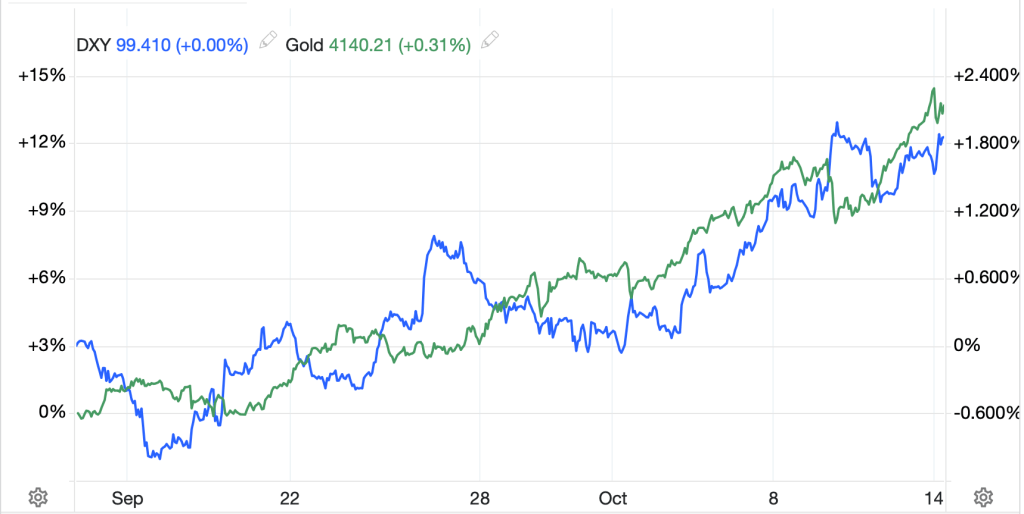

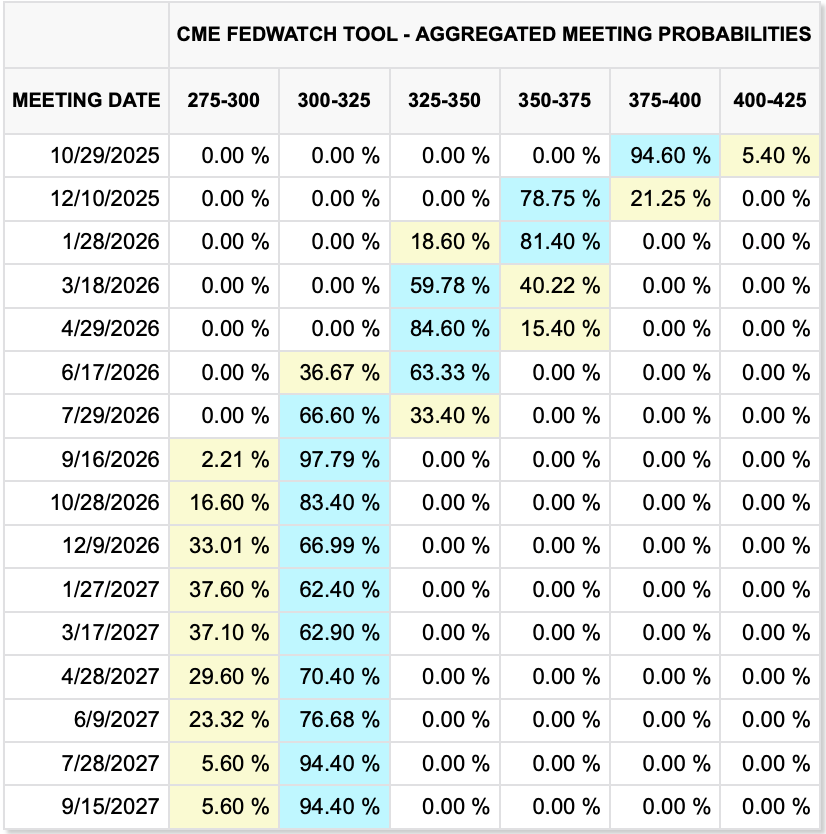

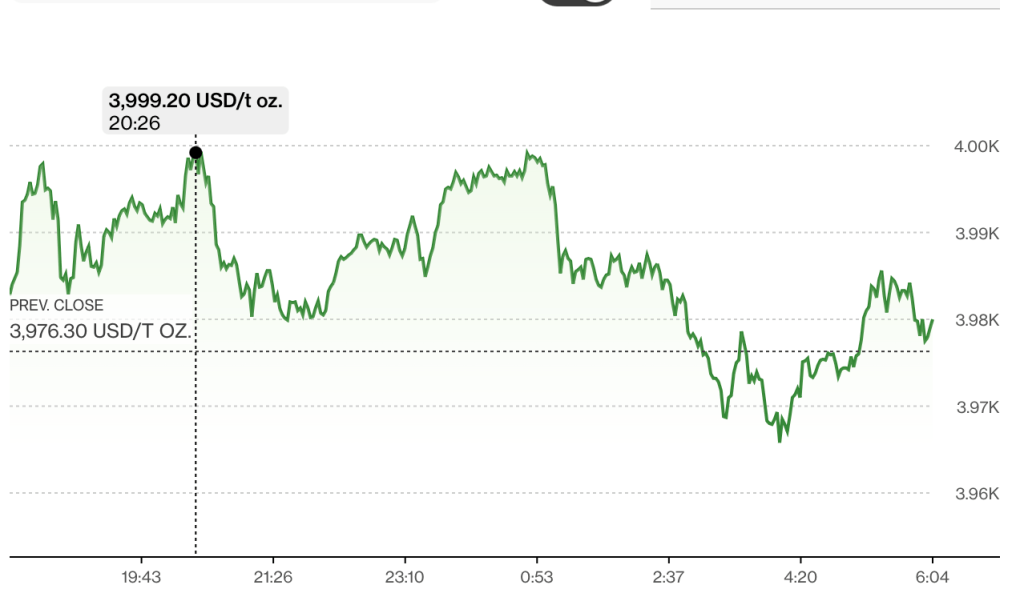

While there continues to be an overwhelming amount of news stories that may have an impact, I believe Occam’s Razor would indicate the most likely reason that gold sold off so dramatically, slipping more than 2%, is that the rally had gone parabolic and a series of option expirations on Friday forced some real position changes. My take is this was some profit taking and despite the decline, the bull market trend remains strong and there is no reason to believe this move is over. After all, there has been nothing to indicate that inflation is going to be contained, nor that fiscal spending will be significantly cut, and Chairman Powell has pretty much promised another rate cut in 10 days. Look for the correlation, which regained some vibrancy late Friday, to reassert itself going forward.

However, the activity in the other precious metals cannot be ignored, as gold was the least dramatic. My friend JJ (Alyosha’s Market Vibes) explained that the story was silver driven as an extremely large number of SLV (the Silver ETF) call options were expiring on Friday and there were many machinations by the market makers to prevent too many from being in the money. Read his piece above for the details, but I would argue none of these machinations change the underlying precious metals thesis.

Takaichi-san

Seems to have found a partner

History’s waiting

From Japan, the word is that Sanae Takaichi and the LDP have convinced the Japan Innovation Party to join in a governing coalition and that, in fact, Ms Takaichi will become the first female Prime Minister in Japan. This was seen very favorably by Japanese equity markets with the Nikkei gapping higher on its open overnight and rallying 3.4% on the session. I guess investors are excited by her run it hot plans, and given a governing majority, she should be able to implement those plans. I suppose that given run it hot is the global consensus of policymakers right now, we shouldn’t be surprised. FYI, the rally since the April Liberation Day decline has been just over 60%, but I’m sure there is no bubble here.🙄

Source: tradingeconomics.com

In China, this week Xi will meet

With leaders, and though he won’t Tweet

They’ll conjure a plan

For growth, if they can

Success though, will be no mean feat

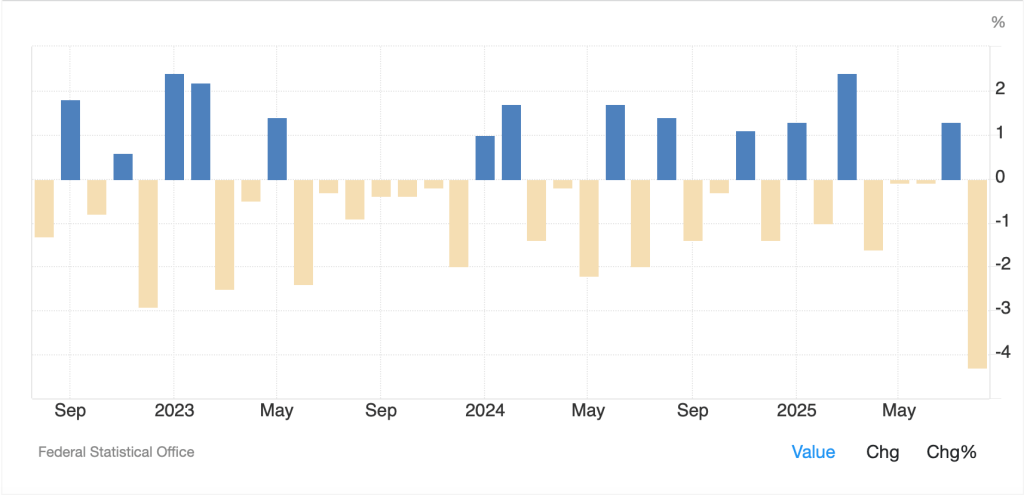

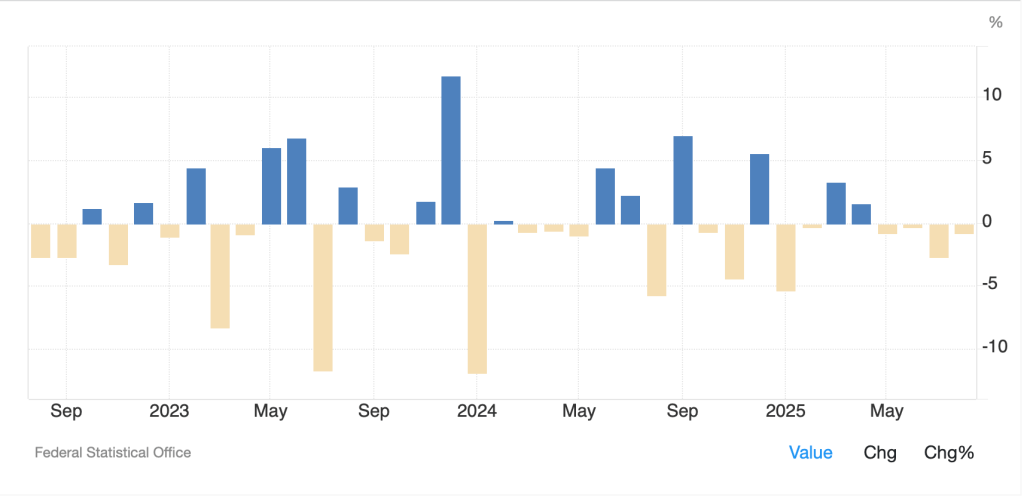

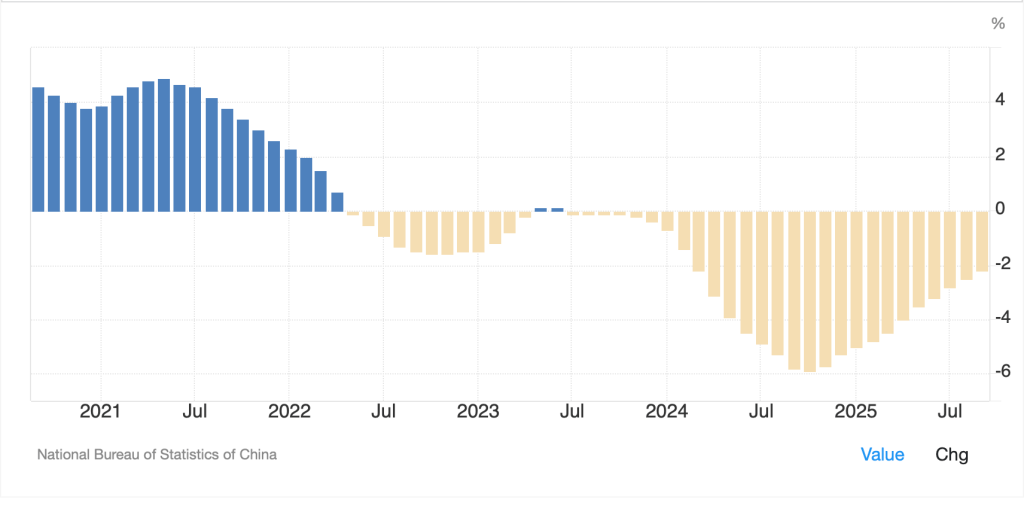

Finally, Chinese data was released overnight showing that GDP growth fell to 4.8% Y/Y in Q3 as Retail Sales remain relatively sluggish and Fixed Asset Investment (a euphemism for housing) continues to decline, falling -0.5%. In fairness, housing prices, though they fell -2.2% across 70 major cities, have seen the rate of decline slow, but as you can see from the chart below, those prices have been falling for 3 ½ years. it is not surprising that the people there feel less wealthy and correspondingly spend less as housing was sold as their retirement nest egg and represents some 25% of the economy.

Source: tradingeconomics.com

The Fourth Plenum is this week, which is the meeting where Xi and the CCP determine the next five-year plan. There is much hope that they will focus on supporting domestic consumption, but history has shown that is not their strong suit. Rather, the economic model they know is mercantilism, and I suspect that will still dominate the process going forward. However, Chinese shares (CSI 300 +0.5%, HK +2.4%) responded positively to hopes that the US-Chinese trade situation will be ameliorated when President’s Xi and Trump meet next week. Apparently, Secretary Bessent and Premier Li are due to meet this week as a preliminary to that meeting.

So, with all that in mind, let’s see how things so far unmentioned played out overnight. it should be no surprise that given the rallies in both Japan and China, the rest of the region performed well with Korea (+1.75%), India +(0.5%) and Taiwan (+1.4%) indicative of the price action. Only Singapore (-0.6%) showed any contrariness although there were no obvious reasons for the move. In Europe, we have also seen some real positive movement with the DAX (+1.3%) and IBEX (+1.5%) performing quite well on relief that the US-China, and by extension global, trade situation seemed set to improve. However, in Paris, the CAC (0.0%) has lagged on news that BNP Paribas has been fined >$20 million on its alleged complicity in Sudan atrocities two decades ago dragging the entire French banking sector down with them. As to US futures, at this hour (7:10) they are pointing higher by about 0.2%.

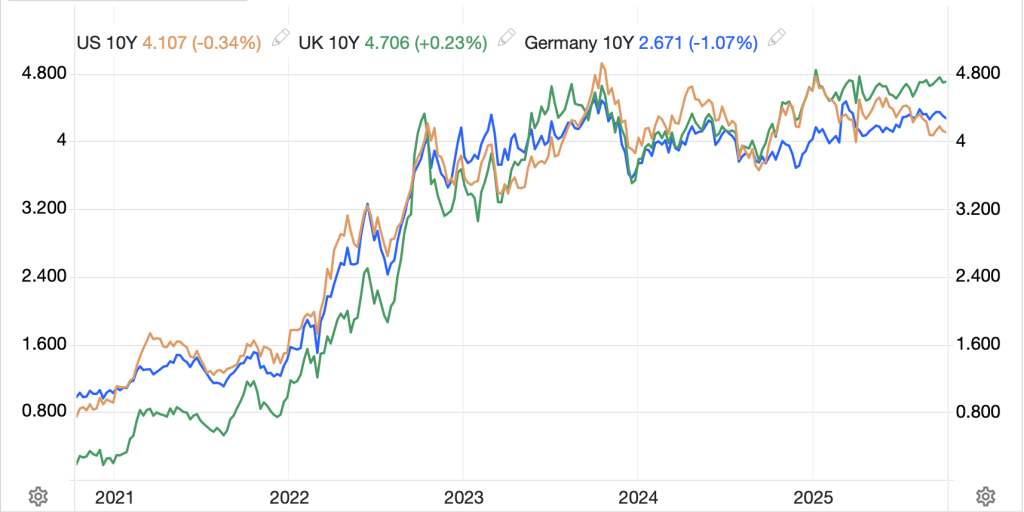

In the bond market, yields are unchanged in the Treasury market, with the 10-year sitting at 4.01% while European sovereign yields have edged higher by 1bp, except France (+3bps). Ostensibly, the story is the reduced trade tensions have investors leaving the ‘haven’ of bonds and getting back into equity markets. Overnight, JGB yields rose 4bps as the news that Takaichi-san seemed set to become PM has bond investors there a bit nervous given her unfunded spending plans.

In the commodity markets, oil (-1.0%) continues to slide and is now testing the post Liberation Day lows seen in April. Looking at the chart below, it is hard to get too bullish, and I suspect we will see lower prices going forward for the near term.

Source: tradingeconomics.com

As to the metals markets, gold (+0.2%) is choppy, but clearly has found short-term support after Friday’s decline while silver (-0.25%) and Platinum (-1.0%) are both still under modest pressure, although nothing like Friday’s moves. If Friday’s story was all about the option expiries in SLV, which is quite viable, I don’t expect much more downside and the underlying bullish thesis is likely to reassert itself.

Finally, nobody seems to care about the FX markets these days. The dollar has edged slightly higher this morning but as we have consistently seen for the past several weeks, daily movement is on the order 0.1% or 0.2%, and the big picture is the dollar is not a focus right now. If we use the euro as our proxy, you can see that since June, it has basically been unchanged. The rally from the first part of the year has ended for now, and I continue to suspect that absent a significant dovish turn by the Fed, it is likely over.

Source: tradingeconomics.com

On the data front, with the government still shut down, the only data point we will see is CPI on Friday (exp +0.4%, 3.1% Headline; +0.3%, 3.1% Core). As well, the Fed is in their quiet period so we won’t have any distractions there. That means that FX markets will be beholden to risk moves and trade comments, but for now, I don’t see much movement on the horizon.

Good luck

Adf