The talk of the town is the “Pause”

Which led to much market applause

Though naysayers still

Say Trump’s actions will

Result in bad outcomes…because

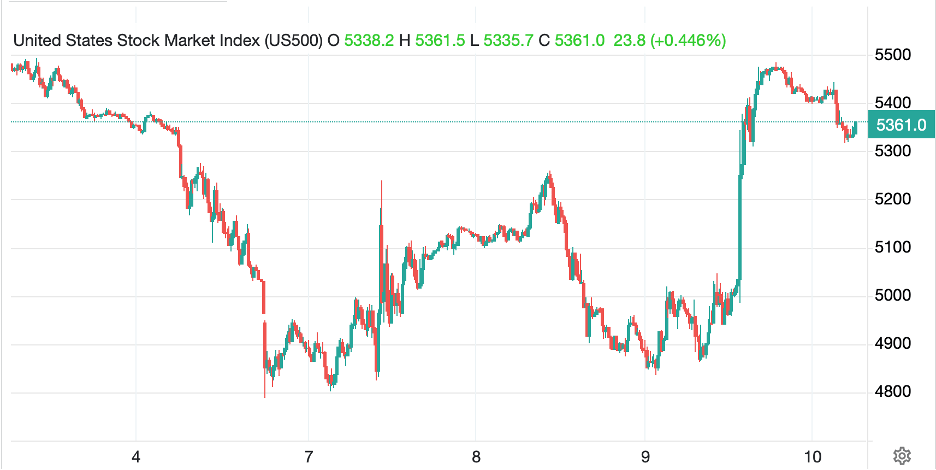

But yesterday saw markets rip

And all those who did buy the dip

Are feeling quite smart

When viewing the chart

Of prices, their own ego trip

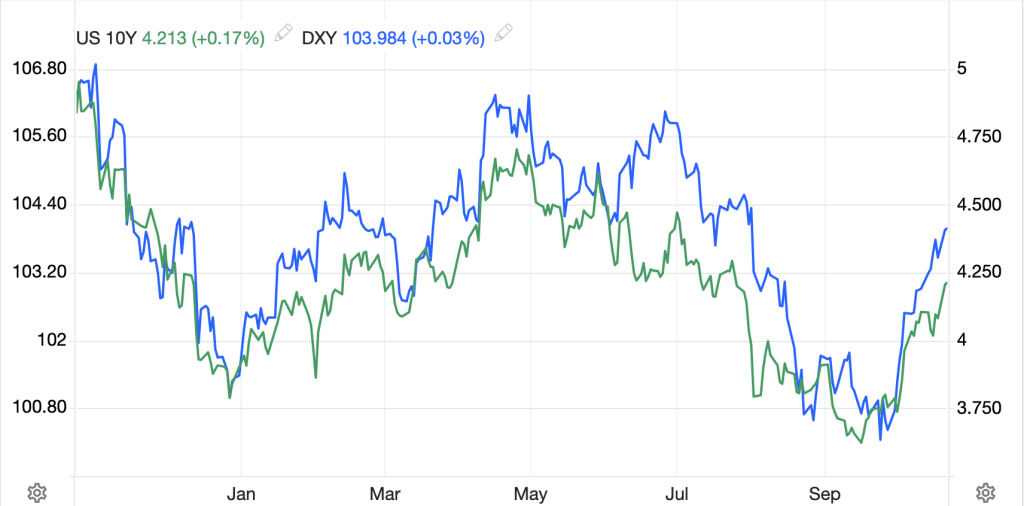

See if you can guess when President Trump posted that there would be a 90-day pause on tariffs for everyone but China.

Source: tradingeconomics.com

By now, you are almost certainly aware that equity markets in the US rebounded massively in the US, with one of the biggest gains on record as the S&P 500 rose 9.5% and the NASDAQ 12.2%. Of course, that merely retraced the bulk of the losses seen since the beginning of the month. In fact, the S&P 500 is still lower by about 200 points since then. Regardless, moods are much brighter today than they were yesterday at this hour. And those equity gains are global.

I’ve seen several interpretations of the sequence of events and like virtually everything these days, it appears to have a partisan bias to people’s views. There are those who claim President Trump could not stand the pressure of a declining stock market and “blinked” in the game of chicken he was playing. There are also those who claim this was part of the strategy all along, essentially moving the Overton Window substantially in his preferred direction and now he is ready to reap the benefits of this move.

Arguably, there is evidence for both sides of this argument and I suggest we will never really know. Remember, Trump is quite comfortable making outlandish pronouncements as he level sets for a negotiation. But he is also quite the realist and while I do not believe he was concerned with his personal or family fortune, recognized that the speed of the pain inflicted could be damaging overall. In the end, it is not clear the rationale matters, the action stands on its own merits.

But remember this, equity valuations were very high before the decline last week, and were still quite high, although obviously less so, after the decline. The rebound put them back in very high territory, especially with equity analysts revising profit forecasts lower on the back of the still 10% tariffs being imposed. A truism is that the biggest rallies in the stock market occur during bear markets. Keep that in mind as you assess risk going forward.

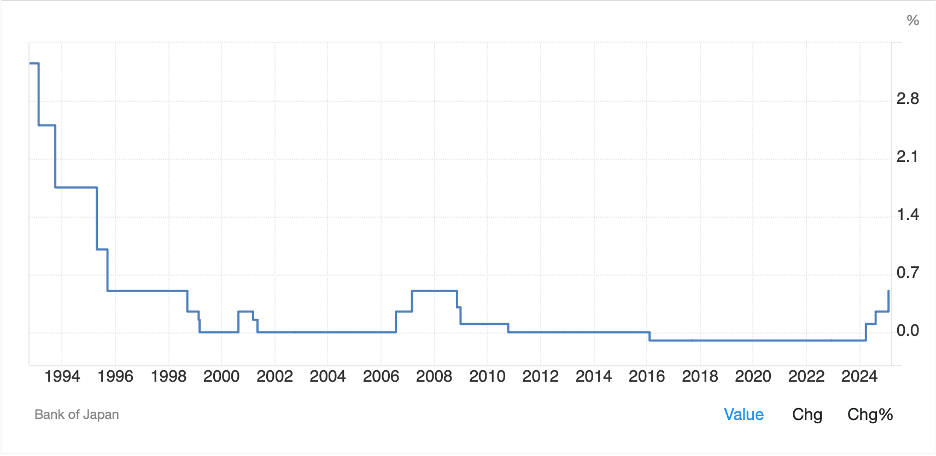

But let us turn our attention to a player who is not getting much attention these days, the Fed. Many questioned the Fed’s rate cuts back in Q4 and attributed the moves to a partisan effort to help VP Harris get elected. Certainly, there is no love lost between Chairman Powell and President Trump. Of late, though, the commentary has focused on patience regarding any further policy ease as the impacts of Trump’s tariff policies are unknown at this stage. Yet, it is not hard to read these comments and get a sense that the Fed is going to work at cross purposes to Mr Trump.

For instance, yesterday, Minneapolis Fed President Neel Kashkari released an essay with the following comments, “Given the paramount importance of keeping long-run inflation expectations anchored and thelikely boost to near-term inflation from tariffs, the bar for cutting rates even in the face of a weakening economyand potentially increased unemployment is higher. The hurdle to change the federal funds rate one way or theother has increased due to tariffs.” While the words here don’t appear partisan per se, Mr Kashkari is one of the most dovish FOMC members and dismissed inflation concerns regularly for a long time. This sudden change is interesting, at the least.

At any rate, the market, which had been pricing a 50% probability of a rate cut next month just a few days ago and a total of at least 4 cuts this year, is back down to a <20% probability of a cut in May and about 3 cuts this year. Truly the pause that refreshes.

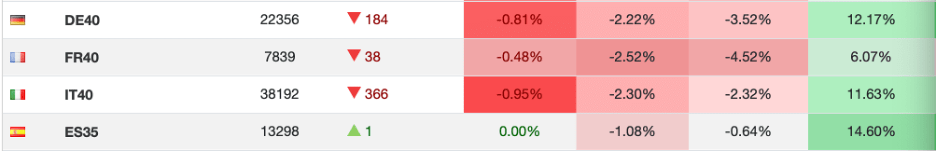

So, let’s look at how other markets responded to the pause. Markets everywhere, including China, rallied last night and this morning, with Tokyo (+9.1%) and Taiwan (+9.2%) leading the way in Asia although gains were universal. Hong Kong (+2.1%) and China (+1.3%) were the laggards with gains between 2.5% and 5.0% the norm. In Europe, too, equities are flying this morning as the threat of much higher tariffs is removed, at least temporarily, with the UK (+4.6%) the laggard and gains between 5.0% and 6.5% the story there. Alas, futures this morning, at 7:00am, are pointing lower by -2.0% or so. Is that profit taking or a harbinger of the day to come?

In the bond market, which has expressly been Trump and Bessent’s main concern, yields are a bit lower this morning, -3bps in 10-year Treasuries. But the story in Europe is confusing to me, or perhaps not. German bunds (+6bps) have seen the largest rise while UK Gilts (-10bps) have seen a sharp decline. Too, Italy (-4bps and Greece (-2bps) have seen yields decline. Could this be an illustration that bunds are a better safe haven than Treasuries? And now that haven status seems less important today, they are being sold off? JGB yields (+9bps) are also rising, perhaps on the same notion. The corroborating evidence is that nobody thinks Gilts are a good investment, so with risk back on, they are in demand given their highest yield in the G10.

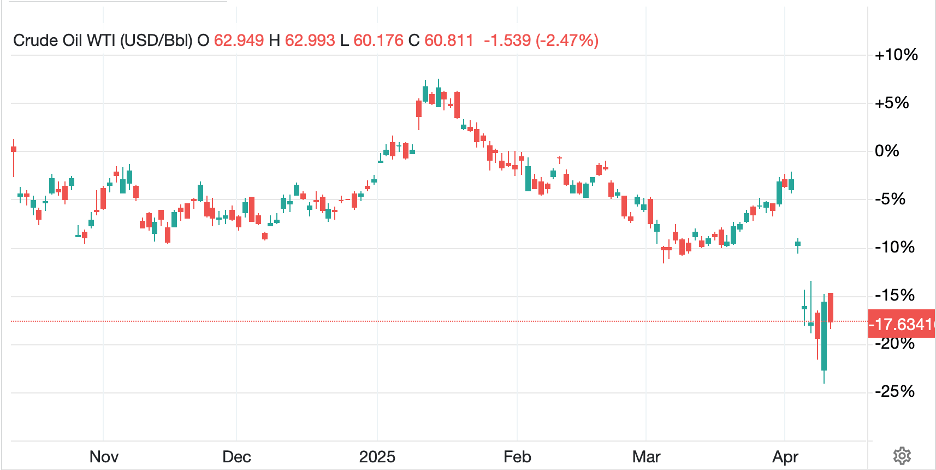

In the commodity markets, oil rebounded sharply alongside equities yesterday although it has slipped 2.4% this morning. I have altered the Y-axis on the chart below to percentages to give an idea of the magnitude of these moves in the past days, especially relative to the past 6 months. Despite being the most liquid commodity market around (both figuratively and literally), it is far less liquid than bonds or FX or even stocks, so as commodities are wont to do, sometimes the moves are breathtaking.

Source: tradingeconomics.com

As to the metals markets, gold (+1.0%) continues its march higher, recovering more than 5% from the lows Tuesday morning. I maintain that much of that selling was margin based, with positions liquidated to cover margin calls in other markets. Now that the panic has passed, demand is likely increased given the new uncertainties. However, both silver (-0.5%) and copper (-1.3%), which rallied sharply yesterday, have slipped back a bit. These are different stories.

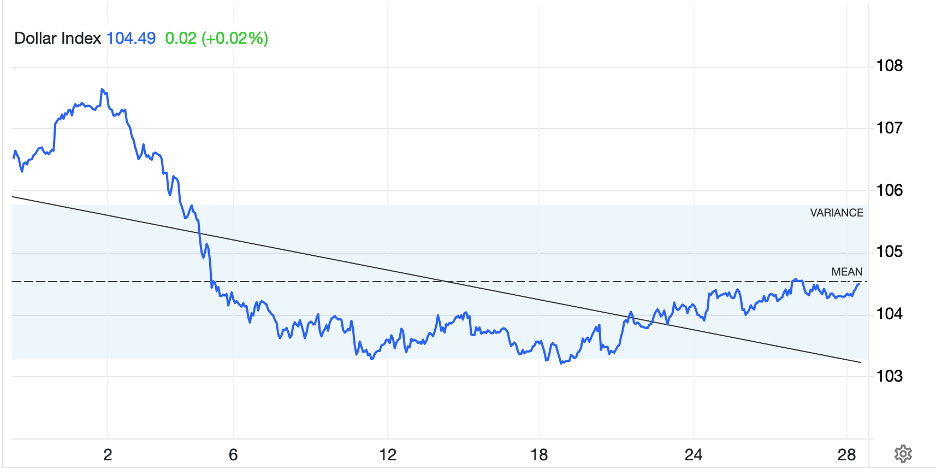

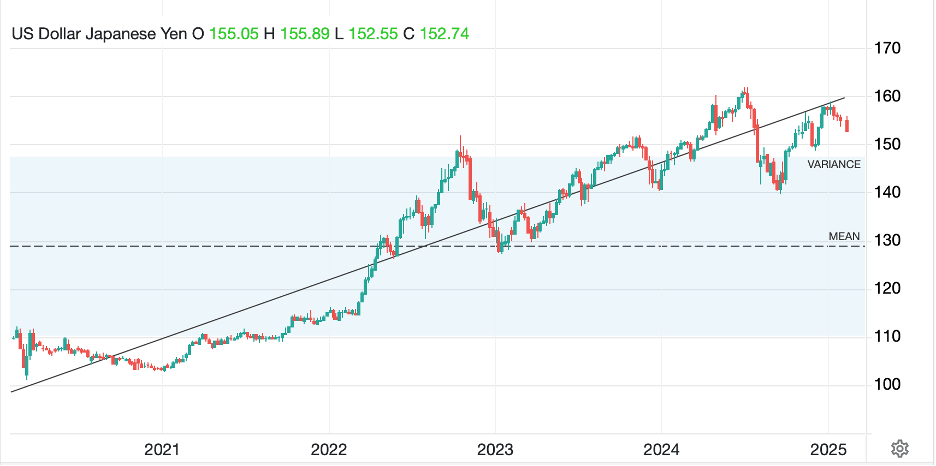

Finally, the dollar is lower this morning, having yo-yoed like every other market on the tariff news. CHF (+1.9%) and JPY (+1.4%) are the big gainers in the G10 although the euro (+1.2%) is having a day as well. However, there are currencies with less pizzazz this morning, notably ZAR (-0.9%), KRW (-0.6%) and MXN (-0.5%), as it remains difficult to know how to proceed going forward. JPMorgan has a global volatility index which is a useful barometer of how things are going. As you can see below, it is not surprising that volatility in this space has also risen sharply.

Once again, I return to the idea that President Trump is the avatar of volatility, and you must always remember that volatility can happen in both directions. While financial assets tend to collapse (yesterday being the exception) when things get out of hand, commodities go the other way as supply interruptions are the big risk. Writ large, volatility simply means a lot of movement.

We finally get some meaningful data this morning with headline CPI (exp 0.1%, 2.6% Y/Y) and Core (0.3%, 3.0% Y/Y) along with the weekly Claims data (Initial 223K, Continuing 1880K). Given all the focus on the tariffs, though, it is not clear to me what this data will imply on a forward-looking basis. As we have seen with the Fed getting sidelined by Mr Trump, his tariff policies have also served to overshadow economic data, at least for now. There are a couple of more Fed speakers and a 30-year bond auction as well. Interestingly, I expect that auction may be the most important outcome of the day. Will there be real demand or are investors shying away?

I expect that over the next few months, tariffs will be discussed on a nation-by-nation basis as new deals are struck. But that will impede any medium-term views on the economy as until we have a much better sense of the end results, it will be difficult to assess things. The upshot is, we may be entering a period where we chop up and down, but don’t go anywhere until the global trade situation is clearer. Volatility with no direction is great for traders, less so for investors. Headline bingo is still the game we are playing.

Good luck and good weekend

Adf