The CPI data delighted

Investors, who in a shortsighted

Response bought the bond

Of which they’re now fond

And did so in, time, expedited

But does this response make much sense?

Or is it just way too intense?

I’d offer the latter

Although that may shatter

The narrative’s current pretense

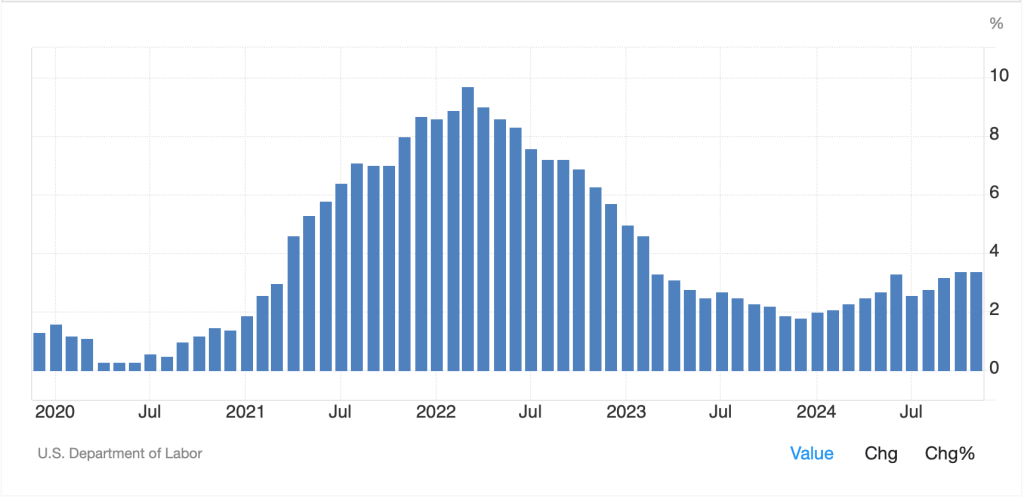

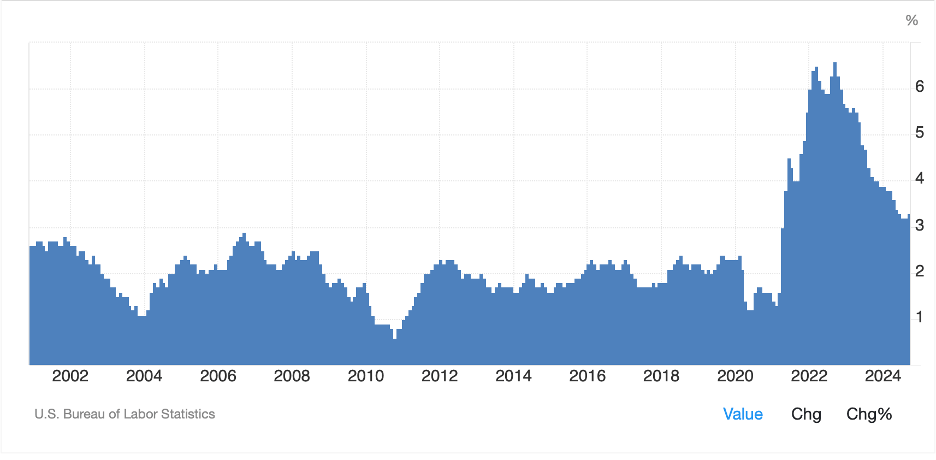

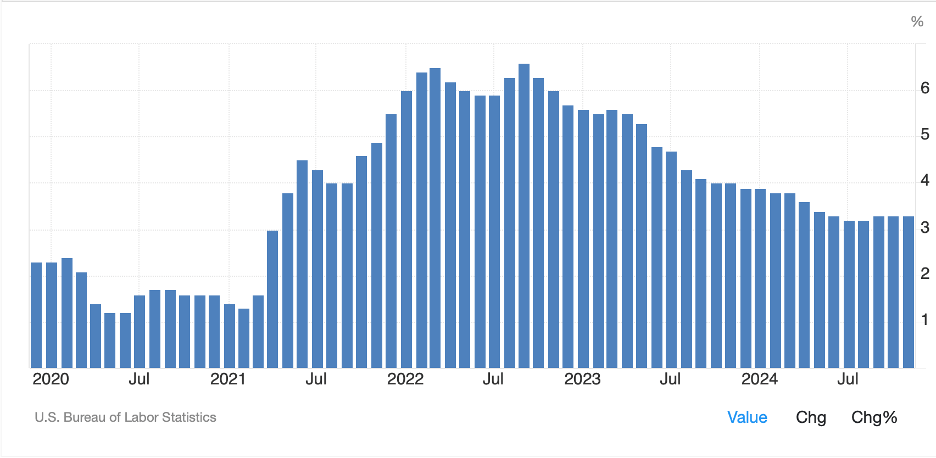

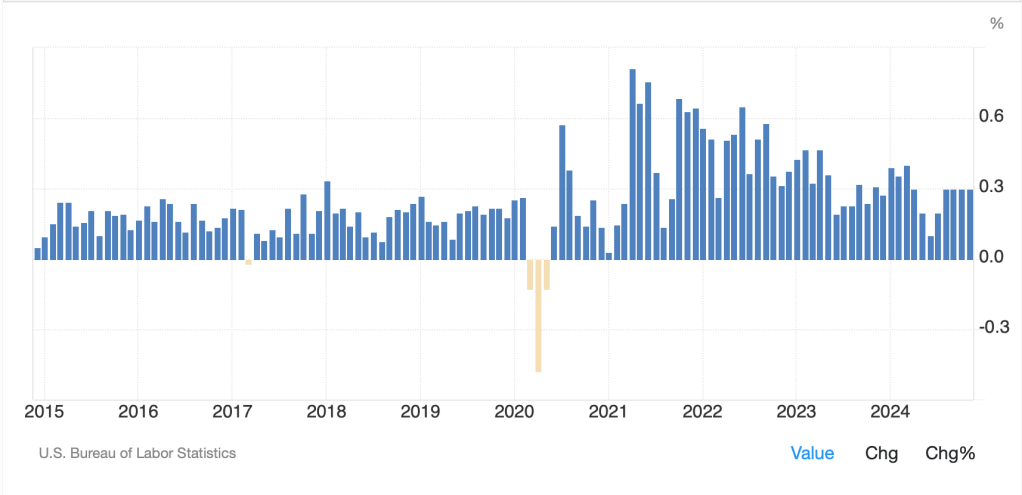

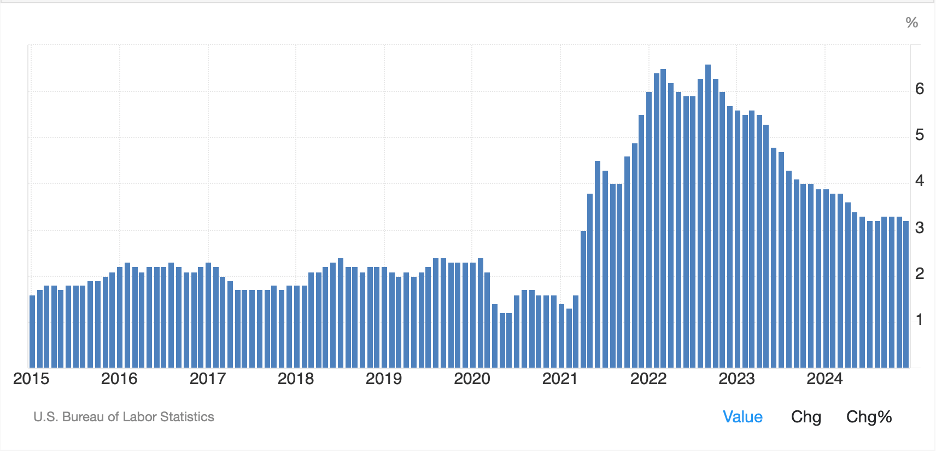

Leading up to yesterday’s CPI data, it appeared to me that despite a better (lower) than expected set of PPI readings on Tuesday, the market was still wary about inflation and concerned that if the recent trend of stubbornly sticky CPI prints continued, the Fed would soon change their tune about further rate cuts. Heading into the release, the median expectations were for a 0.3% rise in the headline rate and a 0.2% rise in the core rate for the month of December which translated into Y/Y numbers of 2.9%% and 3.3% respectively. At least those were the widely reported expectations based on surveys.

However, in this day and age, the precision of those outcomes seems to be lacking, and many analysts look at the underlying indices prepared by the BLS and calculate the numbers out several more decimal places. This is one way in which analysts can claim to be looking under the hood, and it can, at times, demonstrate that a headline number, which is rounded to the first decimal place, may misrepresent the magnitude of any change. I would submit that is what we saw yesterday, where the headline rate rose to the expected 2.9% despite a 0.4% monthly print, but the core rate was only 3.24% higher, which rounded down to 3.2% on the report. Voila! Suddenly we had confirmation that inflation was falling, and the Fed was right back on track to cut rates again.

Source: tradingeconomics.com

Now, I cannot look at the above chart of core CPI and take away that the rate of inflation is clearly heading back to 2% as the Fed claims to be the case. But don’t just take my word for it. On matters inflation I always refer to Mike Ashton (@inflation_guy) who has a better grasp on this stuff than anyone I know or read. As he points out in his note yesterday, 3.5% is the new 2.0% and that did not change after yesterday’s data.

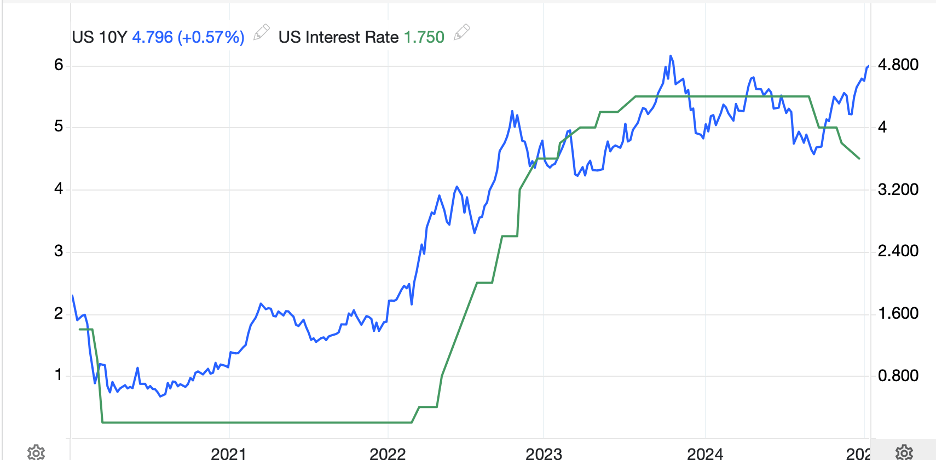

However, markets and investors did not see it that way and the response was impressive. Treasury yields tumbled 13bps and took all European sovereign yields down by a similar amount, equity markets exploded higher with the NASDAQ soaring 2.5% and generally, the investment world is now in nirvana. Growth remains robust but that pesky inflation is no longer a problem, thus the Fed can continue cutting rates to support equity prices even further. At least that’s what the current narrative is.

Remember all that concern over Treasury yields? Just kidding! Inflation is dying and Trump’s tariffs are not really a problem and… fill in your favorite rationale for remaining bullish on risk assets. I guess this is where my skepticism comes to bear. I do not believe yesterday’s data reset the clock on anything, at least not in the medium and long term.

Before I move on to the overnight, there is one other thesis which I read about regarding the recent (prior to yesterday) global bond market sell-off which has some elements of truth, although the timing is unclear to me. It seems that if you look at the timing of the recent slide in bond markets, it occurred almost immediately after the fires in LA started and were realized to be out of control. This thesis is that insurers, who initially were believed to be on the hook for $20 billion (although that has recently been raised to >$100 billion) recognized they would need cash and started selling their most liquid assets, namely Treasuries and US equities. In fact, this thesis was focused on Japanese insurers, the three largest of which have significant exposure to California property, and how they were also selling JGB’s aggressively. Now, the price action before yesterday was certainly consistent with that thesis, but correlation and causality are not the same thing. If this is an important underlying driver, I would expect that there is more pressure to come on bond markets as almost certainly, most insurance companies don’t respond that quickly to claims that have not yet even been filed.

Ok, let’s see how the rest of the world responded to the end of inflation as we know it yesterday’s CPI data. Japanese equities (+0.3%) showed only a modest gain, perhaps those Japanese insurers were still out selling, or perhaps the fact that the yen (+0.3%) is continuing to grind higher has held back the Nikkei. Hong Kong (+1.25%) stocks had a good day as did almost every other Asian market with the US inflation / Fed rate cuts story seemingly the driver. The one market that did not participate was China (+0.1%) which managed only an anemic rally. In Europe, the picture is mixed as the CAC (+2.0%) is roaring while the DAX (+0.2%) and IBEX (-0.4%) are both lagging as is the FTSE 100 (+0.65%). The French are embracing the Fed story and assuming luxury goods will be back in demand although the rest of the continent is having trouble shaking off the weak overall economic data. In the UK, GDP was released this morning at 1.0% Y/Y after just a 0.1% gain in November, slower than expected and adding pressure to the Starmer government who seems at a loss as to how to address the slowing economy. As to US futures, at this hour (7:30) they are pointing slightly higher, about 0.2%.

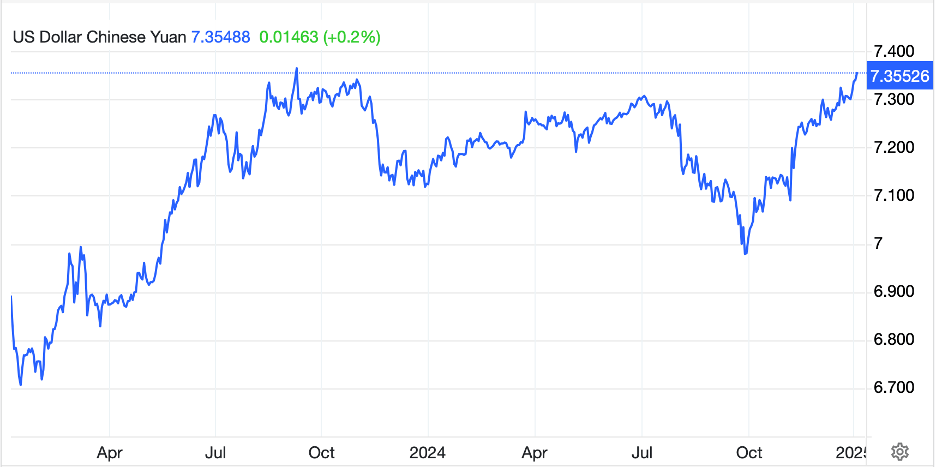

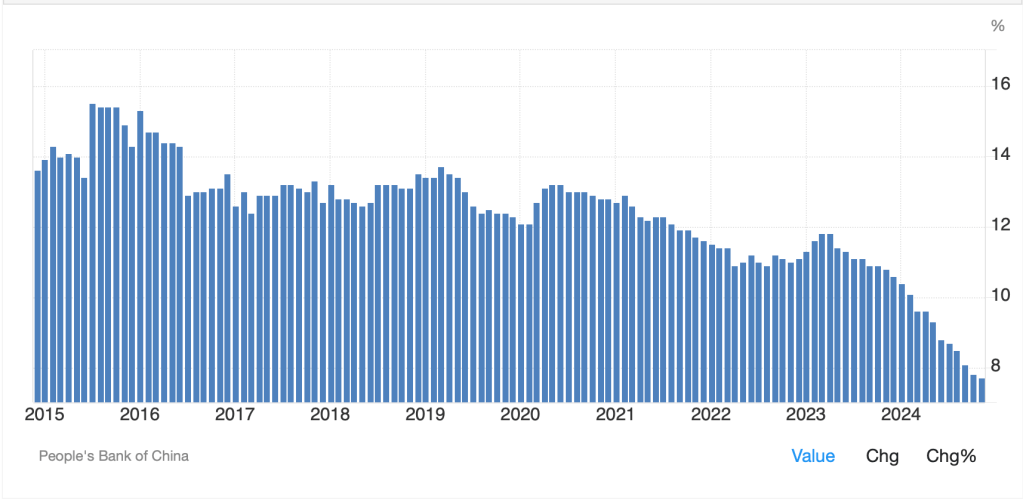

In the bond market, after yesterday’s impressive rally, it is no surprise that there is consolidation across the board with Treasury yields higher by 2bps and similar gains seen across the continent. Overnight, Asian government bond markets reacted to the Treasury rally with large gains (yield declines) across the board. Even JGB yields fell 4bps. The one market that didn’t move was China, where yields remain at 1.65% just above their recent historic lows.

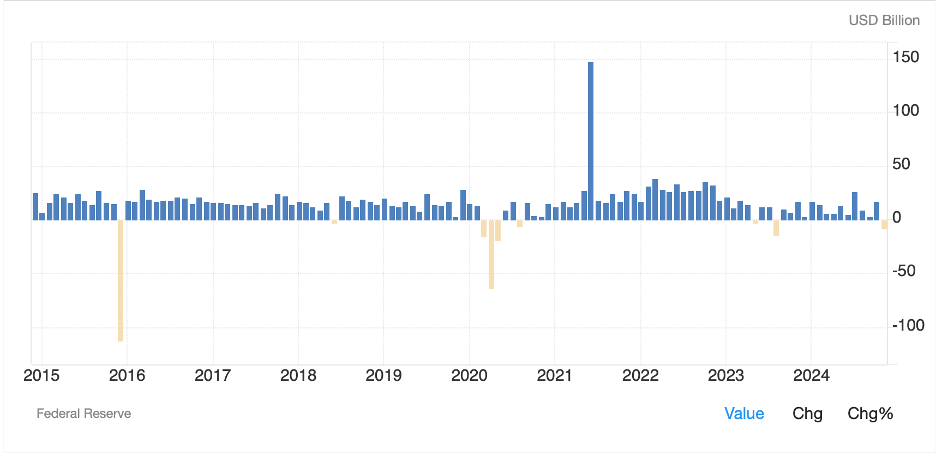

In the commodity markets, oil (-1.0%) is backing off yesterday’s rally which saw WTI trade above $80/bbl for the first time since July as despite ongoing inventory builds in the US, and ostensibly peace in the Middle East, the market remains focused on the latest sanctions on Russia’s shadow tanker fleet and the likely inability of Russia (and Iran) to export as much as 2.5 million barrels/day going forward. NatGas (+0.75%) remains as volatile as ever and given the polar vortex that seems set to settle over the US for the next two weeks, I expect will remain well bid. On the metals side of things, yesterday’s rally across the board is being followed with modest gains this morning (Au +0.3%) as the barbarous relic now sits slightly above $2700/oz.

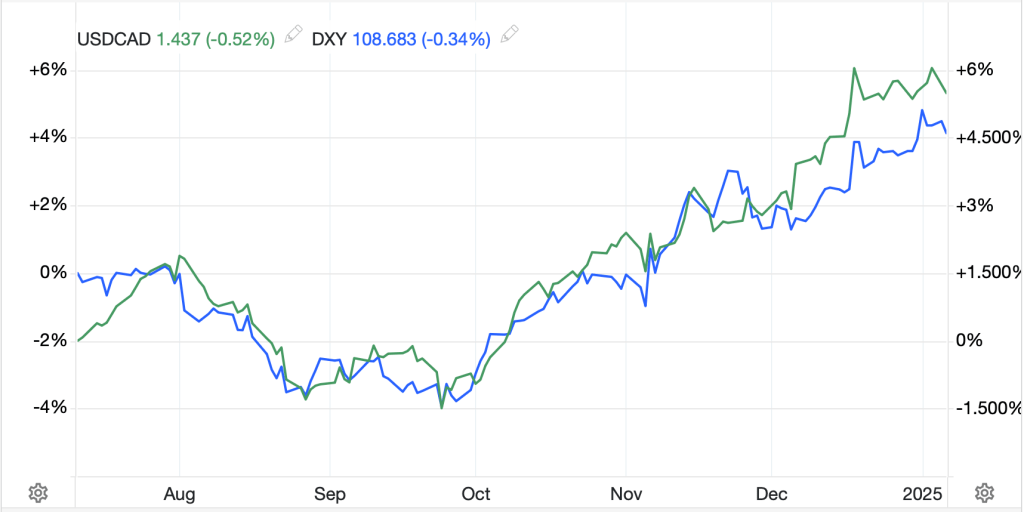

Finally, the dollar doesn’t seem to be following the correct trajectory lately as although there was a spike lower after the CPI print yesterday, it was recouped within a few hours, and we have held at that level ever since. In fact, this morning we are seeing broader strength as the euro (-0.2%), pound (-0.4%) and AUD (-0.5%) are all leaking and we are seeing weakness in EMG (MXN -0.6%, ZAR -0.6%) as well. My take is that the bond market, which had gotten quite short on a leveraged basis, washed out a bunch of positions yesterday and we are likely to see yields creep higher on the bigger picture supply issues going forward. For now, this is going to continue to underpin the dollar.

On the data front, this morning opens with Retail Sales (exp 0.6%, 0.4% -ex autos) and Initial (210K) and Continuing (1870K) Claims. We also see Philly Fed (-5.0) to round out the data. There are no Fed speakers today, although in what cannot be a surprise, the three who spoke yesterday jumped all over the CPI print and reaffirmed their view that 2% was not only in sight, but imminent! As well, today we hear from Scott Bessent, Trump’s pick to head the Treasury so that will be quite interesting. In released remarks ahead of the hearings, he focused on the importance of the dollar remaining the world’s reserve currency, although did not explicitly say he would like to see it weaken as well. The one thing I know is that he is so much smarter than every member of the Senate Finance committee, that it will be amusing to watch them try to take him down.

And that’s really it for now. If Retail Sales are very strong, look for equities to see that as another boost in sentiment, but a weak number will just rev up the Fed cutting story. Right now, the narrative is all is well, and risk assets are going higher. I hope they are right; I fear they are not.

Good luck

Adf