Colombia tried to prevent

Deportees, who homeward were sent

But Trump’s strong response

Meant that in a nonce

Gustavo, his knee quickly bent

Meanwhile, all the talk of AI

This weekend has pundits awry

The Chinese DeepSeek

Could very well wreak

Much havoc in stocks priced sky-high

If there was any doubt that things were going to be different under a Trump administration than virtually any previous administration, even his first term, they were dispelled this weekend. By now you will all have heard the story of the Colombian president, Gustavo Petro (he of the 26% local approval rating) and his refusal to allow two US C-17 military transports filled with Colombian deportees, land in Bogota. Apparently, when Trump was informed while playing golf, after birdieing the 3rd hole, he tweeted that the US would immediately impose 25% tariffs on everything Colombia exports to the US, rising to 50% in one week if this policy was not changed. By the time he finished the 6th hole, President Petro reversed his policy and even offered the Colombian presidential plane to come and pick up the deportees.

While the golf portion of the story is amusing, the lesson to the rest of the world is that President Trump is very serious about his electoral promises, and he will utilize the entire might of the US government to achieve his goals. For smaller nations with little power and leverage, it means that toeing the line is the only solution. For larger nations, it certainly is a wakeup call to the idea that the US attitude toward international relations has dramatically changed. As Machiavelli explained, it is better to be feared than loved, and it seems abundantly clear that President Trump understands that.

Perhaps the biggest takeaway from this situation, though, is that the US government is no longer the slow-moving behemoth to which it had evolved over the past decades. The rest of the world is going to find itself needing to respond very quickly to things that in the past were sent to committees for study and review but now are decided instantly. If you want to understand why I believe volatility is set to increase across all asset classes, this is the crux of the issue.

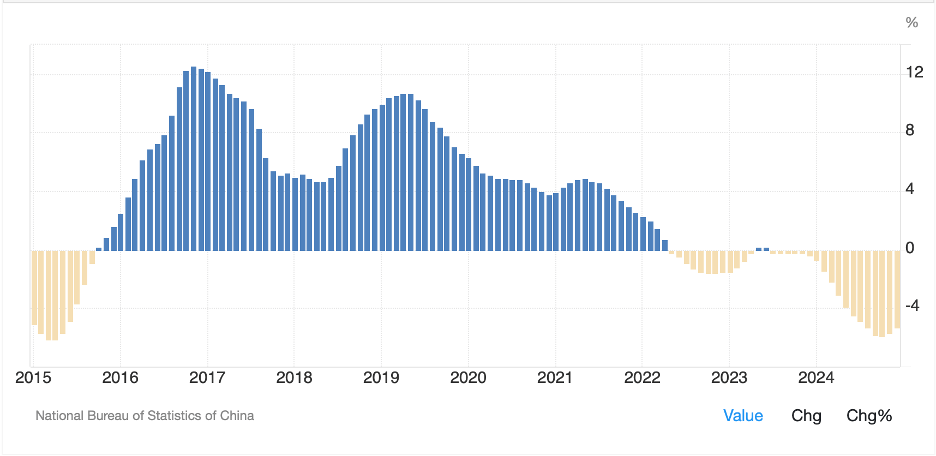

Turning to the tech world, the buzz is all about DeepSeek, which is a Chinese AI model that allegedly outperforms OpenAI’s top model, or performs just as well, although it costs a fraction of what OpenAI and others (Microsoft, Google, etc.) spent to train the model and it uses far less advanced chips which are also much less expensive and less power hungry. Because this is all a new story, it remains unclear if DeepSeek will be an effective replacement for the others, or if it excels in only one or two areas and still lags elsewhere.

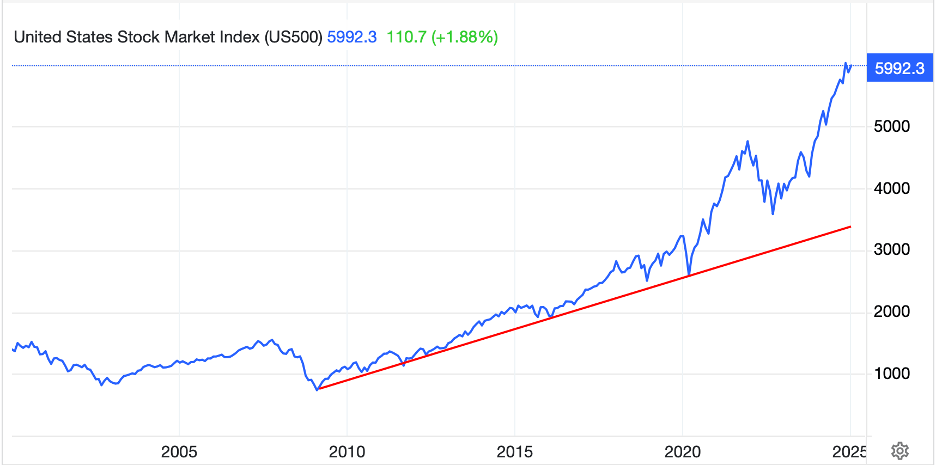

But the market impact has been instantaneous and dramatic. At this hour (6:00am), the NASDAQ (-4.5%) is leading US equity markets lower with the S&P (-2.4%) along for the ride. Nvidia (-10.6% in premarket trading) is leading the way, but I suspect that this news will be negative for the entire US tech sector. After all, it was certainly priced at premium levels.

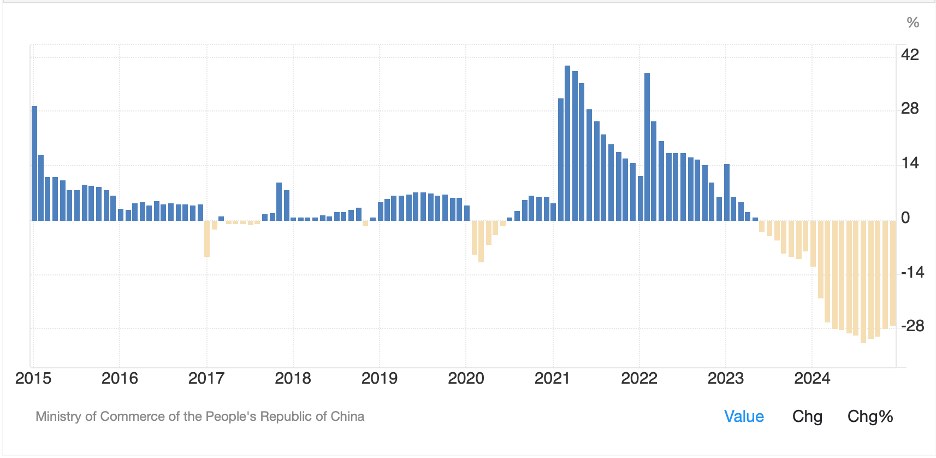

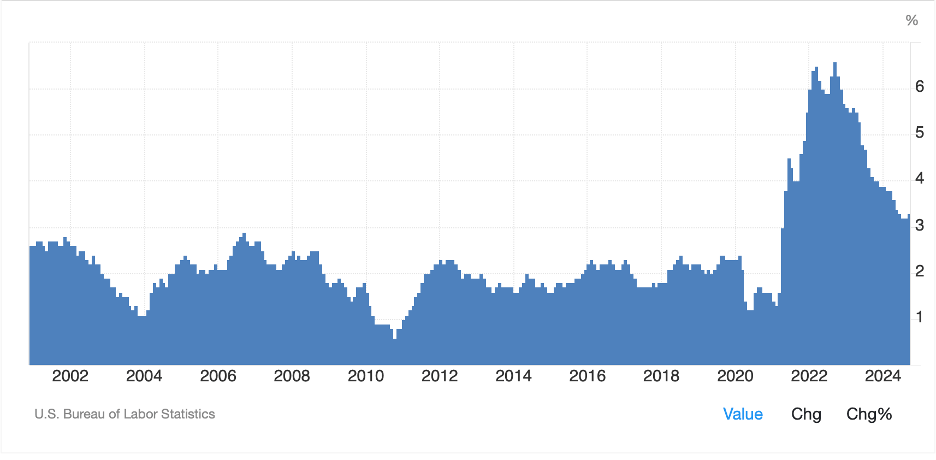

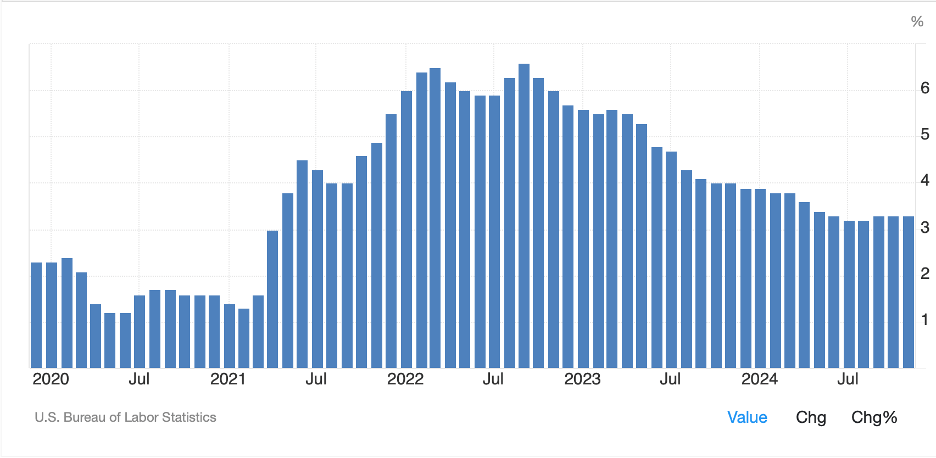

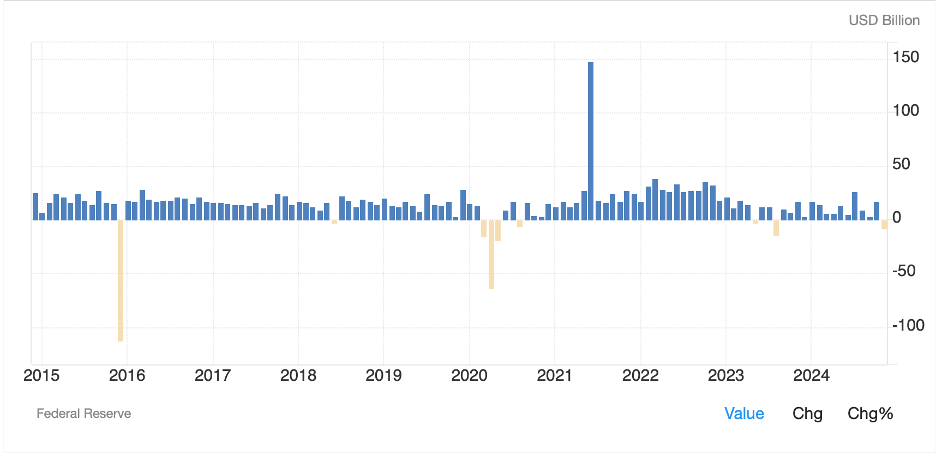

Source: tradingeconomics.com

In the short term, I expect we are going to hear a lot more analysis of why this is a game changing event and how the future that was so clear just last week is now cloudy. However, while this will almost certainly take the shine off the megacap tech companies for a while, I think it would be a mistake to dismiss their futures because of this. Two things in their favor are they still have virtually infinite resources, and they have dramatically large installed networks which means that changing things will be very difficult. While their equity prices can decline a lot, it doesn’t mean their businesses are going to collapse.

PS, spare a thought for the impact on the energy sector here as well. One of the narratives that has been fed lately is that all this AI will require gobs of power that will need a lot more power production. It was a key feature of the Uranium story as nuclear is seen as one of the few sources capable of delivering the reliable power necessary. I suspect that this part of the narrative will need to adjust as well if the AI story has actually changed. But keep in mind that with efficiency comes more demand, so perhaps this is just a temporary downdraft. Again, volatility is the name of the game.

Ok, let’s see how these stories have impacted the rest of the world. With all the news over the weekend, you may not recall that US equity markets edged lower on Friday. Well, Asian markets were mixed overnight with the Nikkei (-0.9%) following the US, although also reacting to the fact that the yen (+1.3%) rallied sharply as well. Meanwhile, Hong Kong (+0.7%) managed to gain while mainland Chinese shares (-0.4%) certainly showed no benefit from the changing attitudes in tech. Elsewhere in the region, Korea (+0.9%) and Taiwan (+1.0%) rallied while India (-1.1%) and Indonesia (-0.9%) fell and the rest of the region batted back and forth. In Europe, red is the dominant color, likely on the generally weak US performance although there are no European tech companies of note (perhaps ASML). But the DAX (-1.2%) is leading the way down followed by the CAC (-0.9%) and the bulk of the rest of the continent and the UK. Let’s just say that equities are not in favor this morning.

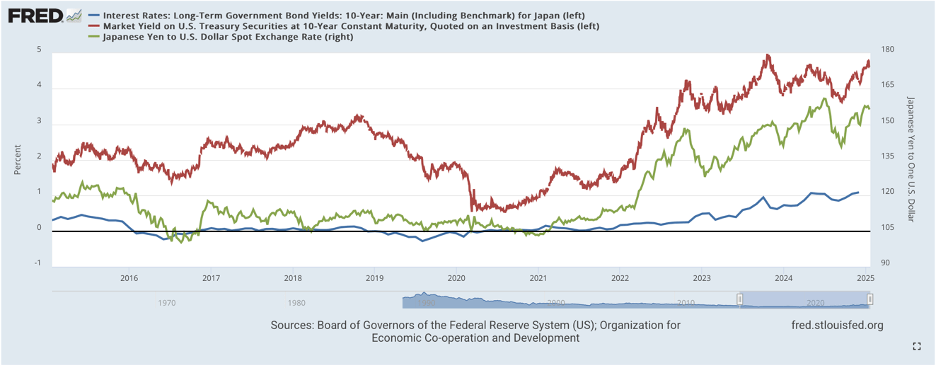

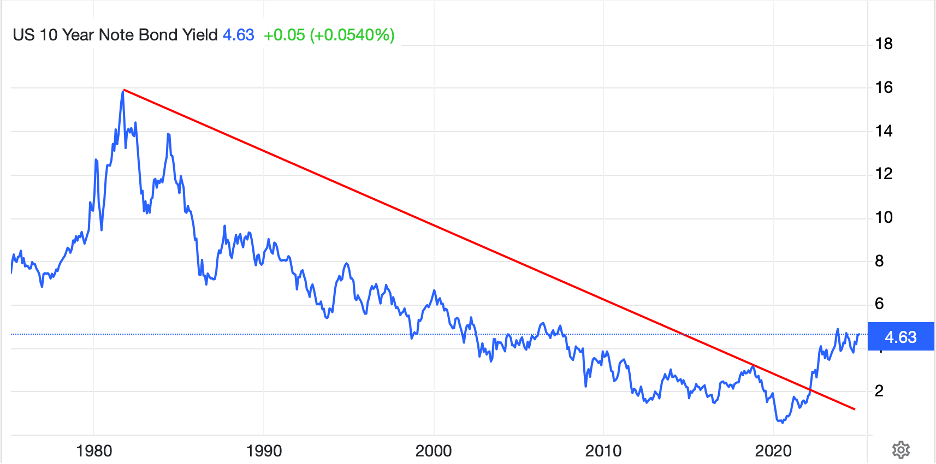

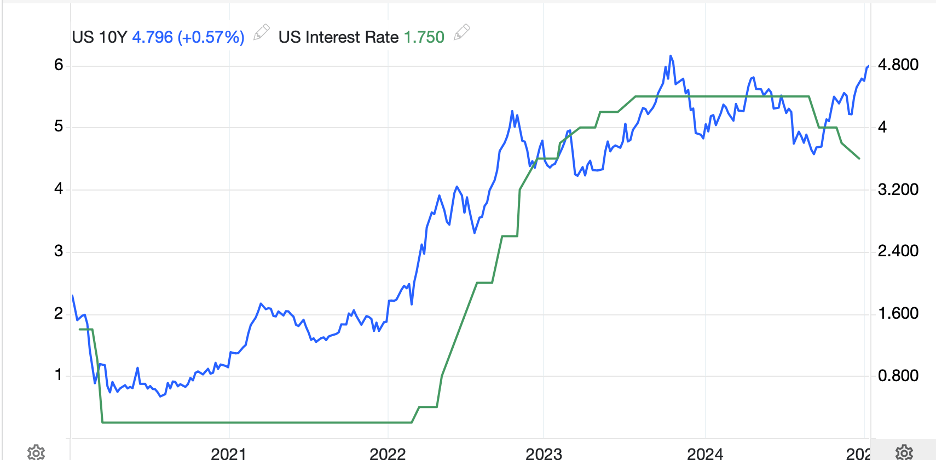

However, what we are seeing is a major bond market rally as Treasury yields (-12bps) tumble as risk is very definitely off. European sovereign yields are also lower, by between -5bps and -7bps, and JGB yields (-2bps) also slipped, although relative to the rest of the world, they held up pretty well. Interestingly, with all the talk about DeepSeek and the impact on the tech community, there has been virtually no discussion about the myriad central bank meetings this week, including, of course, the Fed on Wednesday where the market still sees no chance of a rate cut.

Commodity markets are relatively calm this morning as oil (-0.6%) is a touch lower although there has been no news of note. The background story is that President Trump and Saudi Arabia’s Mohammed bin Salman are talking about increasing production to drive oil prices lower, but that remains more rumor than anything else. As the polar vortex has passed, and forecasts are for warmer weather, NatGas (-6.2%) is sliding. In the metals markets, very little movement is ongoing as traders try to determine what all the new news means.

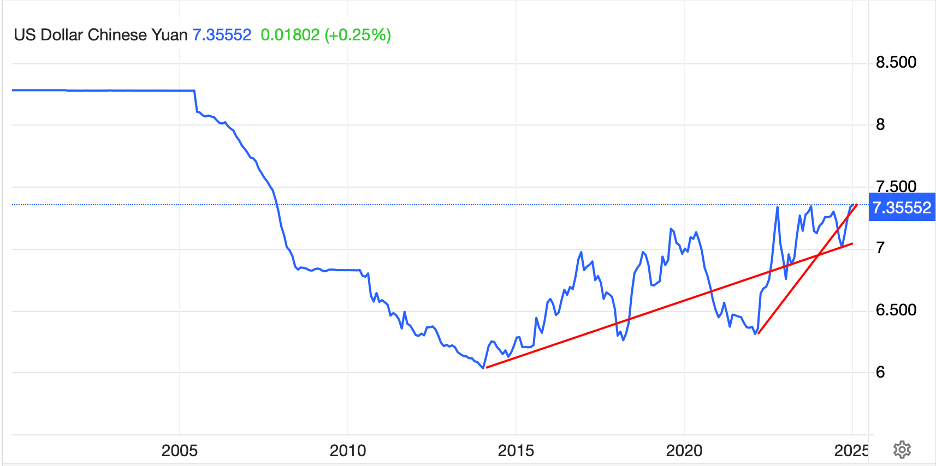

Finally, the dollar is under some pressure this morning despite the risk off attitude that prevails. I suppose it is because one of the recent drivers of the dollar’s strength has been the insatiable demand for the megacap tech stocks. It seems that for now, that demand has been satiated. So, the yen is behaving in its traditional safe haven role, as is the CHF (+0.85%) but the euro (+0.15%) and pound (+0.15%) are both a touch higher. That said, we are definitely seeing emerging market currencies under pressure as they have nothing to do with tech and everything to do with the very obvious change in attitude regarding how the US is going to deal with smaller nations that don’t accede to US demands, especially regarding immigration. So, MXN (-1.0%), COP (-1.1%), ZAR (-1.4%) and BRL (-0.6%) are all under significant pressure. CE4 currencies, though, are not in the line of fire, so are little changed this morning.

On the data front, remarkably, it almost seems an afterthought given what we just saw this weekend, but along with the Fed, BOC and ECB, we get PCE on Friday.

| Today | New Home Sales | 670K |

| Tuesday | Consumer Confidence | 106.0 |

| Wednesday | Bank of Canada Rate Decision | 3.0% (current 3.25%) |

| FOMC Rate Decision | 4..5% (current 4.5%) | |

| Thursday | ECB Rate Decision | 2.75% (current 3.0%) |

| Initial Claims | 220K | |

| Continuing Claims | 1885K | |

| Q4 GDP | 2.8% | |

| Friday | Personal Income | 0.4% |

| Personal Spending | 0.5% | |

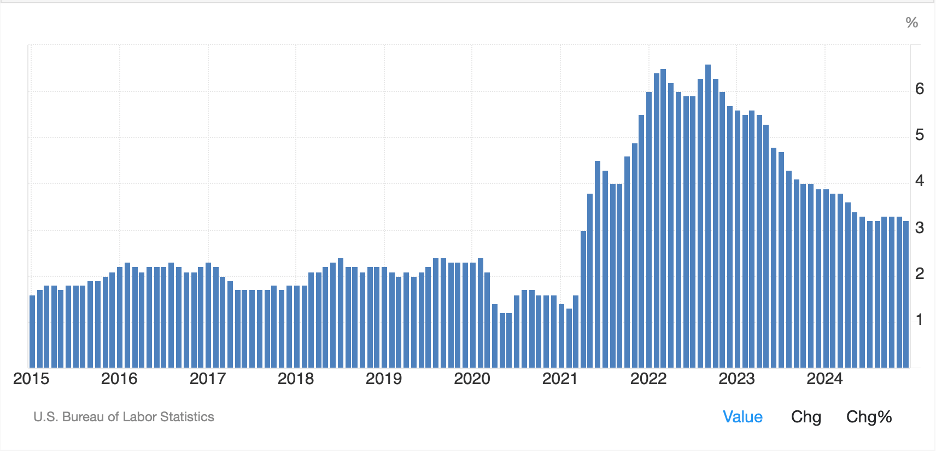

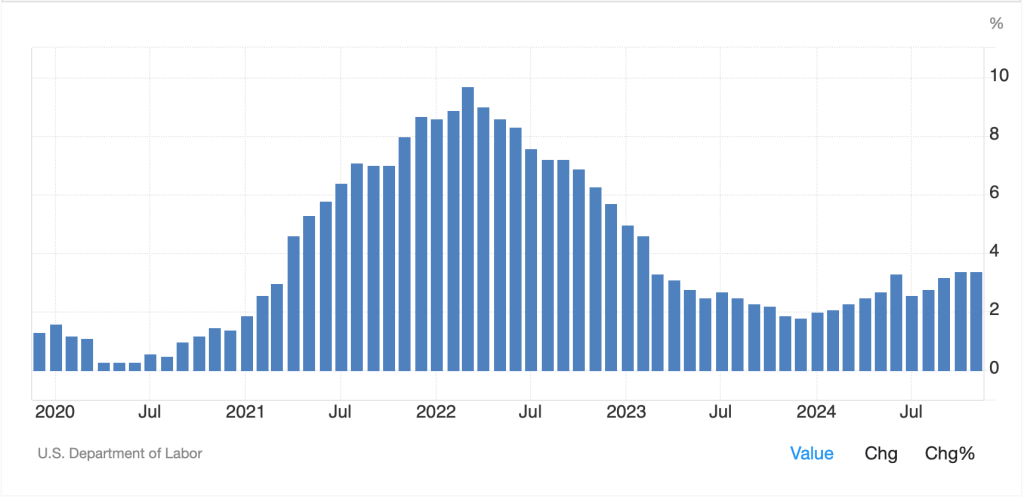

| PCE | 0.3% (2.6% Y/Y) | |

| Core PCE | 0.2% (2.8% Y/Y) | |

| Chicago PMI | 40.0 |

Source: tradingeconomics.com

At this point, the central bank story is background noise, not the major theme, but by Wednesday I expect that all eyes will be on Chairman Powell as he describes the Fed’s thoughts at the press conference. Of course, that assumes that there are no other political earthquakes, which may not be a very good assumption these days. I think we are in a seismic zone for now.

As to the dollar, if DeepSeek really is an Nvidia killer, then it is not hard to derive a scenario that says, US equity markets are going to decline, along with growth expectations. The Fed will cut more aggressively, and the dollar will start to really fall as well. I’m not forecasting that, just highlighting a possible, if not likely, scenario in the event the world believes the AI story is not going to be as expensive and profitable for the Mag7 as they thought last week. Once again, the key is to hedge your risks, because as you learned this weekend, things change, and they can change quickly!

Good luck

Adf