While many have called for stagflation

The ‘stag’ story’s lost its foundation

Q2 turned out great

With growth, three point eight

While ‘flation showed some dissipation

Meanwhile, Mr Trump’s on a roll

As he strives to still reach his goal

It’s tariff redux

On drugs and on trucks

While ‘conomists tally the toll

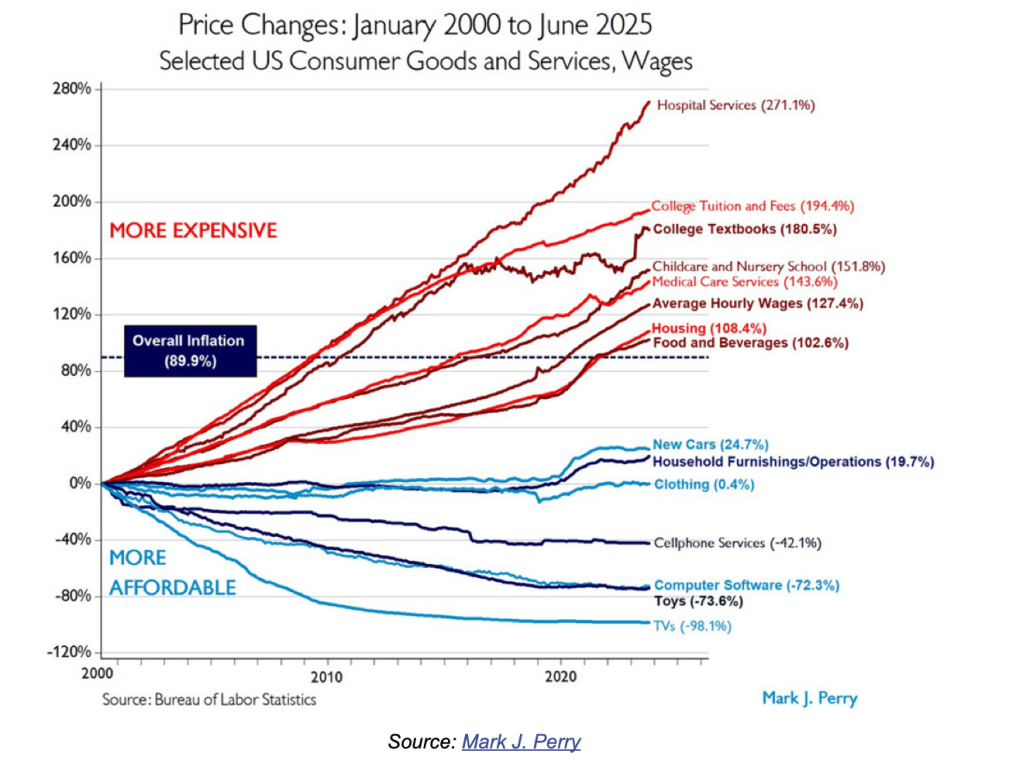

Analysts worldwide have decried President Trump’s policies as setting up to lead the US to stagflation with the result being the dollar would ultimately lose its status as the world’s reserve currency while the economy’s growth fades and prices rise. “Everyone” knew that tariffs were the enemy of sane fiscal and trade policy and would slow growth leading to higher unemployment and inflation while the Fed would be forced to choose which issue to address. In fact, when Q1 GDP was released at -05%, there was virtual glee from the analyst community as they were preening over how prescient they were.

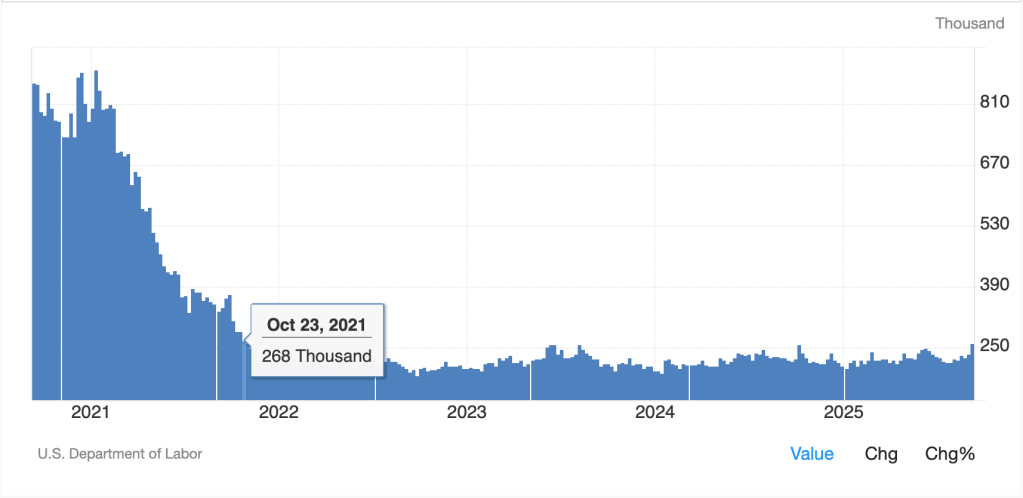

But yesterday, we learned that things may not be as bad as widely hoped proclaimed by the analyst community after all. Q2 GDP was revised up to +3.8% annualized growth, substantially higher than even the first estimate of 3.0% back in July. Not only that, Durable Goods Orders rose 2.9% with the ex-Transport piece rising 0.4% while the BEA’s inflation calculations, also confusingly called PCE rose 2.1%. Initial Claims rose only 218K, well below estimates and indicative that the labor market, while not hot, is not collapsing. Finally, the Goods Trade Balance deficit was a less than expected -$85.5B, certainly not great, but moving in President Trump’s preferred direction.

In truth, that was a pretty strong set of economic data, better than expectations across the entire set of releases, and clearly not helping those trying to write the stagflation narrative. Now, Trump is never one to sit around and so promptly imposed new tariffs on medicines, heavy trucks and kitchen cabinets to try to bring the manufacture of those items back into the US. Whatever your opinion of Trump, you must admit he is consistent in seeking to achieve his goal of returning manufacturing prowess to the US.

Meanwhile, down in Atlanta, their GDPNow Q3 estimate is currently at 3.3%, certainly not indicating a slowing economy.

In fact, if that pans out, it would be only the 14th time this century that there were two consecutive quarters of GDP growth of at least 3.3%, of which 4 of those were in the recovery from the Covid shutdown.

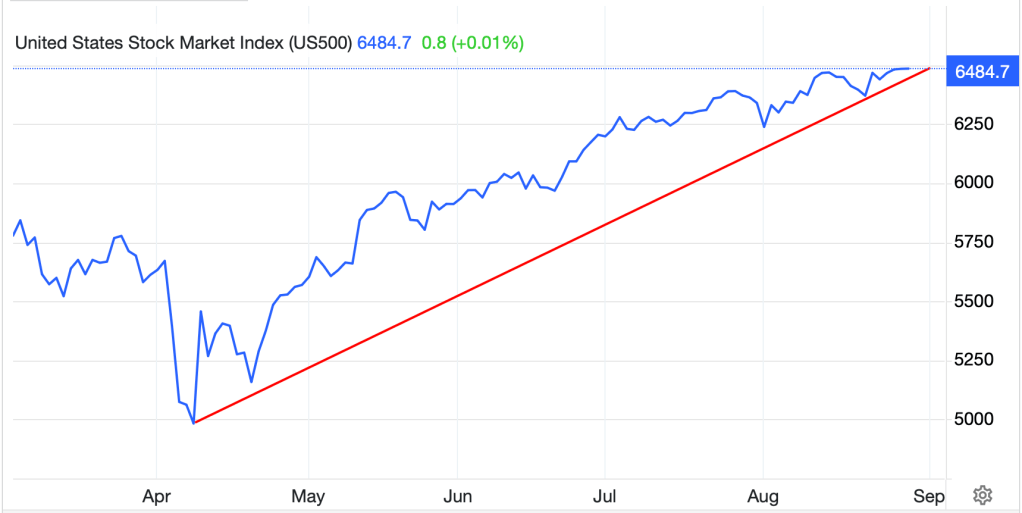

It would be very easy to make the case that the US economy seems to be doing pretty well, at least based on the data releases. I recognize that there is a great deal of angst about, and I have highlighted the asynchronous nature of the economy lately, but what this is telling me is that things may be syncing up in a positive manner.

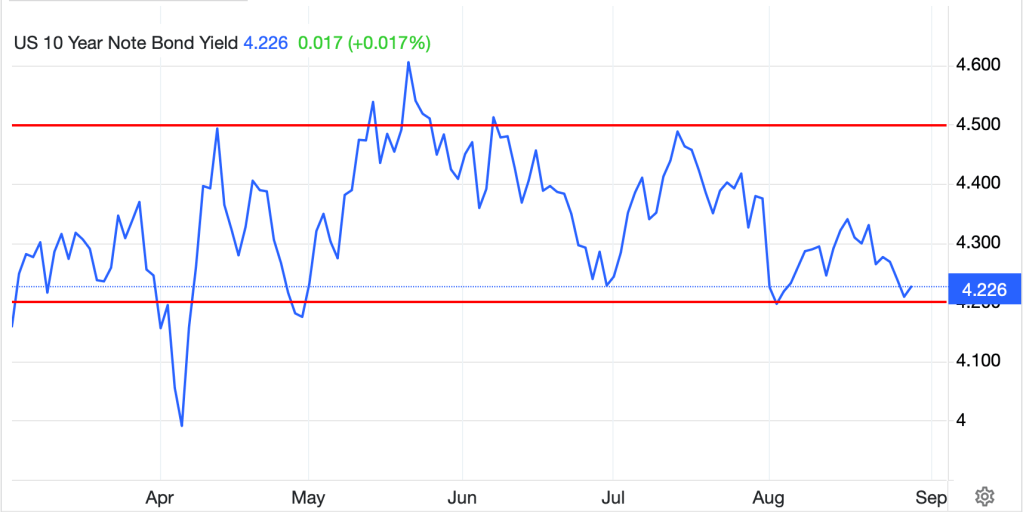

So, what does this mean for markets? Perhaps the first place to look is the Fed funds futures market as so much stock continues to be put into the Fed’s next move. Not surprisingly, earlier exuberance over further rate cuts has faded a bit, with the probability of an October cut slipping to 85%, down about 10 points in the wake of the data, and a total of less than 40bps now priced in for the rest of the year. Recall, it was not that long ago that people were considering 100bps in the last three meetings of the year.

Source: cmegroup.com

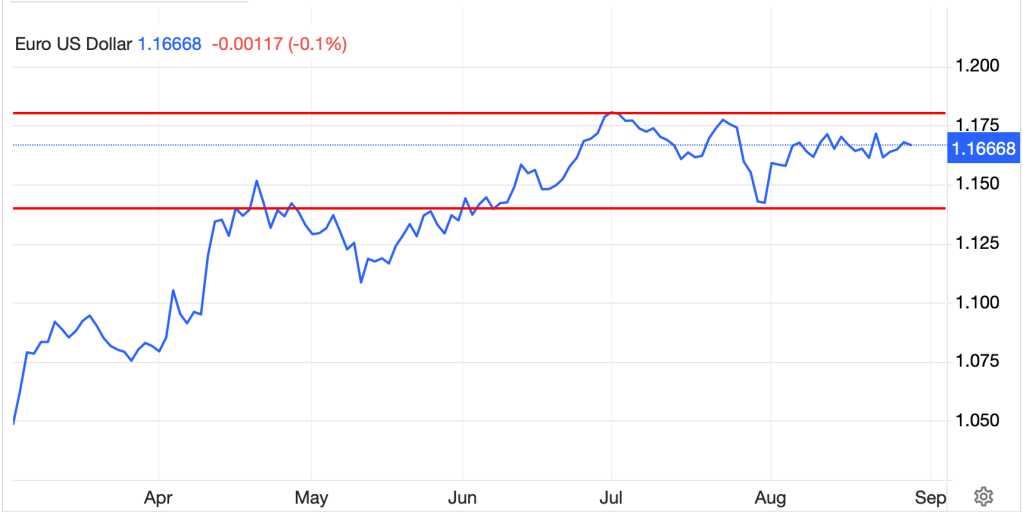

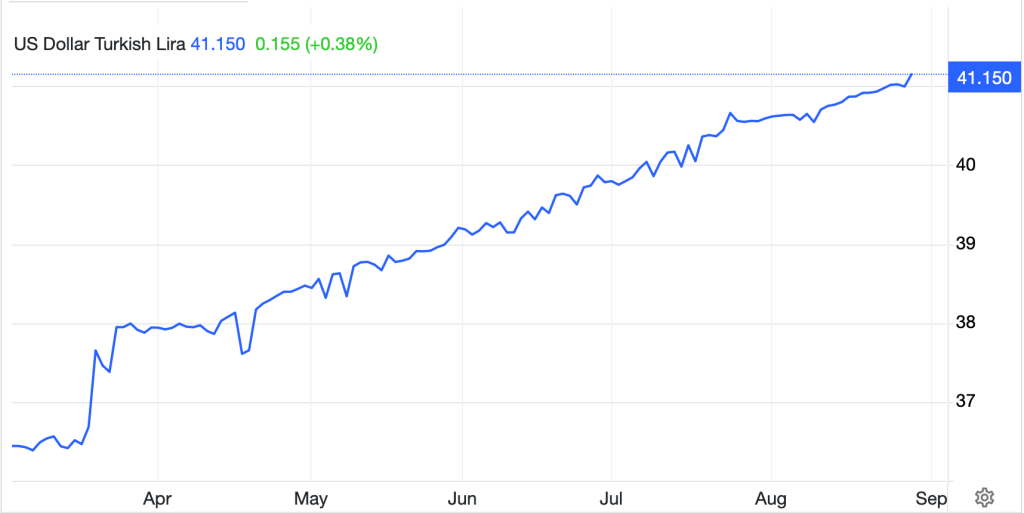

The next place to look is at the foreign exchange markets, where the dollar’s demise has been widely forecast amid changing global politics with many pundits highlighting the idea that the BRICS nations would be moving their business away from dollars. For a long time, I have highlighted that the dollar is currently within a few percent of its long-term average price, neither particularly strong nor weak, and that fears of a collapse were unwarranted. However, I have also recognized that a dovish Fed could easily weaken the dollar for a period of time. Short dollar positions remain large as the leveraged community continues to bet on that outcome, although I have to believe it is getting expensive given they are paying the points to maintain that view.

But if we look at how the dollar has performed over the past several sessions, using the DXY as our proxy, we can see that despite a very modest -0.1% decline overnight, it appears that the dollar may be breaking its medium-term trend line lower as per the chart below from tradingeconomics.com

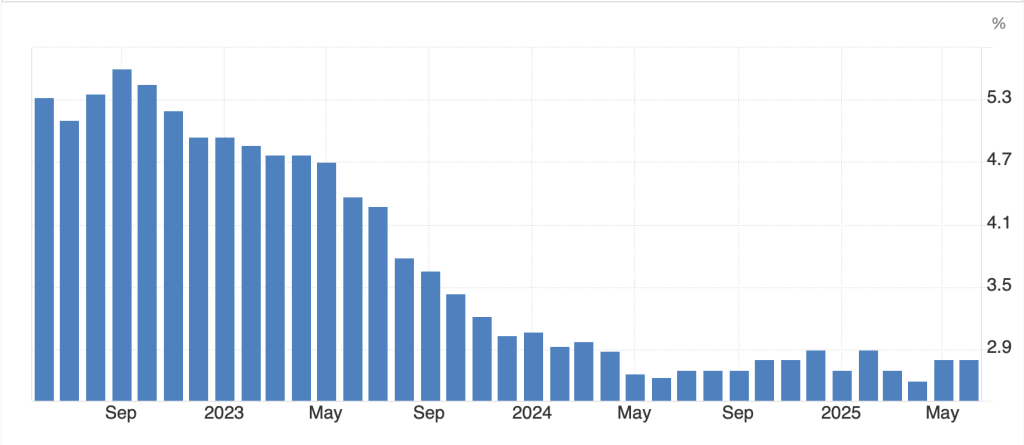

Again, my point is that the idea that the US is facing a catastrophic outcome with a recession due and a collapsing dollar is just not supported by the data or the markets. And here’s an interesting thought from a very smart guy, Mike Nicoletos (@mnicoletos on X) regarding some of the key drivers of the current orthodoxy regarding the dollar, notably the debt and deficit. What if, given the dollar’s overwhelming importance to the world economy, we should be comparing those things to its global scale, not just the domestic scale. If using that framework, as he describes here, the debt ratio falls to 58% and the budget deficit is down to 2.9%, much less worrying and perhaps why markets and analysts are out of sync.

Markets are going to go where they will, but having a solid framework as to how the economy impacts them is a very helpful tool when managing money and risk. Perhaps this needs to be considered overall.

Ok, a really quick tour. Yesterday was the third consecutive down day in the US, although all told, the decline has been less than -2%, so hardly devastating. Asia mostly fell overnight as concerns over both tariffs and a Fed less likely to cut rates weighed on equities there with Japan (-0.9%), China (-1.0%) and HK (-1.35%) all under pressure. The story was worse for other regional bourses with Korea (-2.5%), India (-0.9%) and Taiwan (-1.7%) indicative of the price action.

However, Europe has taken a different route with modest gains across the board (DAX +0.3%, CAC +0.45%, IBEX +0.6%) as investors seem to be looking through the tariff concerns. US futures are also edging higher at this hour (7:45).

In the bond market, Treasury yields have slipped -1bp this morning, and while they remain above the levels seen immediately in the wake of the FOMC last week, they appear to be finding a home at current levels of 4.15% +/-. European sovereigns are all seeing yields slip -3bps this morning as today’s story is focusing on how most developed nations are reducing the amount of long-dated paper they are selling to restrict supply and keep yields down. This has been decried by many since then Treasury Secretary Yellen started this process, but as with most government actions, the expedience of the short-term benefit far outweighs the potential long-term consequences and so everybody jumps on board.

Turning to commodities, oil (-0.1%) is still trading below the top of its range and while it has traded bottom to top this week, there is no sign of a breakout yet. I read yet another explanation yesterday as to why peak oil demand is going to be seen this year, or next year, or soon, which will drive prices lower. While I do think prices eventually slide lower, I take the other side of that supply-demand idea and believe it will come from increased supply (Argentina, Guyana, Brazil, Alaska) rather than reduced demand. In the metals markets, yesterday saw silver (-0.2%) jump nearly 3% to yet another new high for the move as traders set their sights on $50/oz. Meanwhile gold (0.0%) continues to grind higher in a far less flashy manner than either silver or platinum (+10% this week) as regardless of my explanation of relative dollar strength vs. other fiat currencies, against stuff, all fiat remains under pressure.

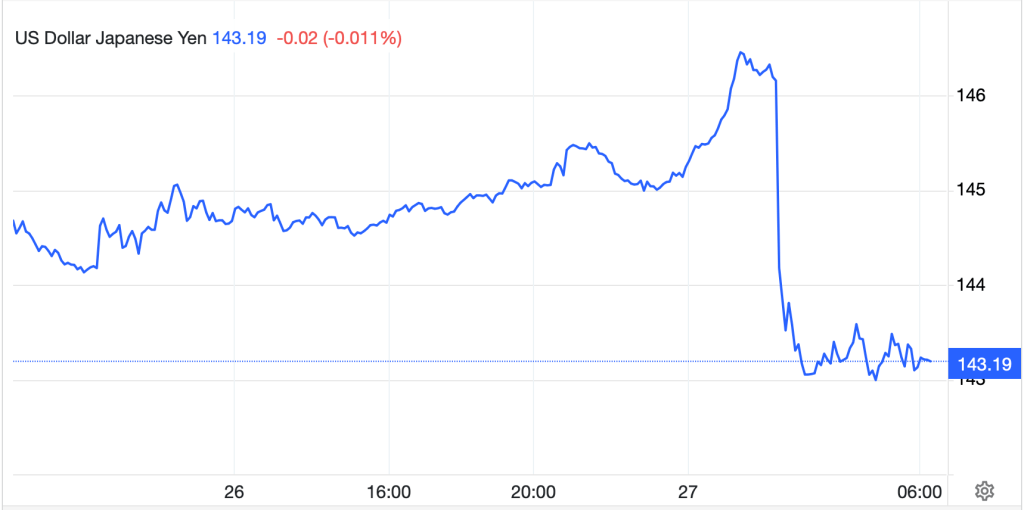

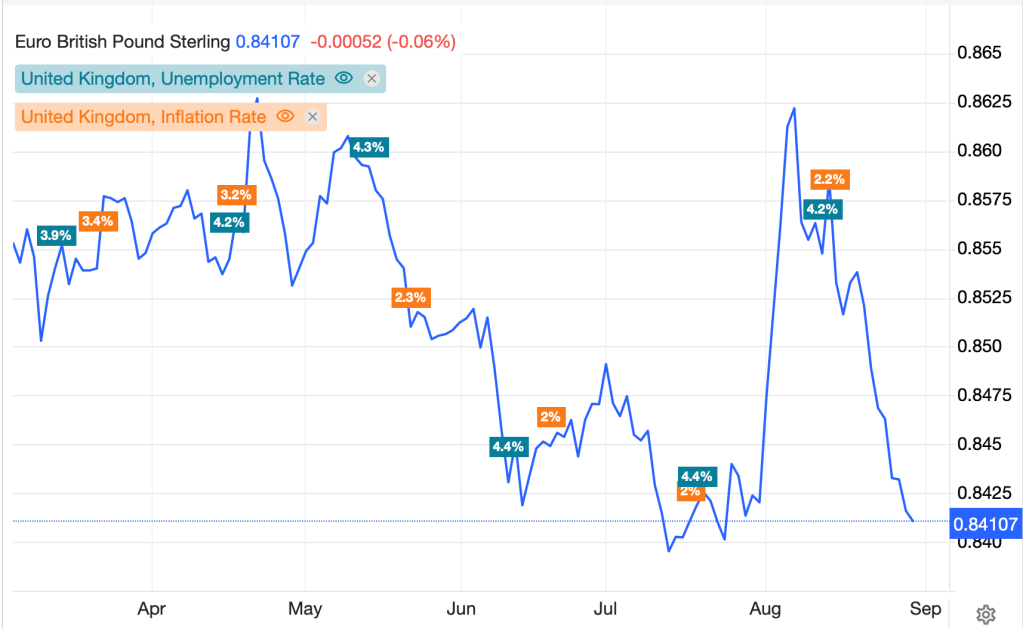

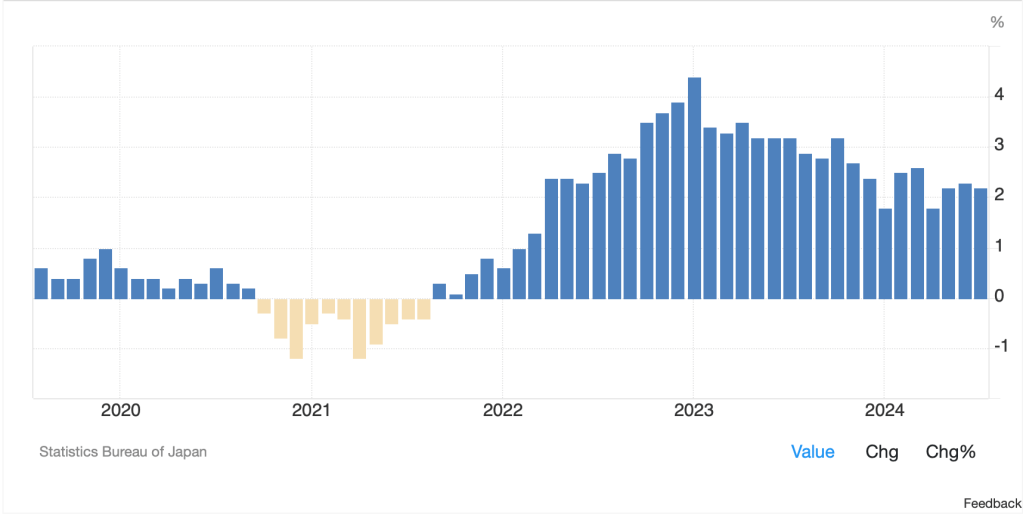

And finally, the dollar after a nice rally yesterday, is consolidating this morning. The currency I really want to watch is the yen, where CPI last night was released at 2.5%, lower than expected and which must be giving Ueda-san pause with respect to the next rate hike. Most analysts are still convinced they will hike in October, but if inflation has stopped rising, will they? I would not be surprised to see USDJPY head well above 150, a level it is fast approaching, over the next month.

On the data front, this morning’s BLS version of PCE (exp 0.3%, 2.7% Y/Y) and Core PCE (0.2%, 2.9% Y/Y) is released at 8:30 along with Personal Income (0.3%) and Personal Spending (0.5%). Then at 10:00, Michigan Sentiment (55.4) is released and somehow, I have a feeling that could be better than forecast. We hear from a bunch more Fed speakers as well although a pattern is emerging that indicates they are ready to cut again next month, at least until they see data that screams stop.

The world is not ending and in fact, may be doing just fine, at least economically. Meanwhile, the dollar is finding its legs so absent a spate of very weak data, I think we may see another 2% or so rebound in the greenback over the next several weeks.

Good luck and good weekend

Adf