So, NFP data was wrong

Which many have said all along

Perhaps it was proper

For Trump to just drop her

Creating McTarfer’s swan song

Remarkably, though, no one cared

And equity markets ain’t scared

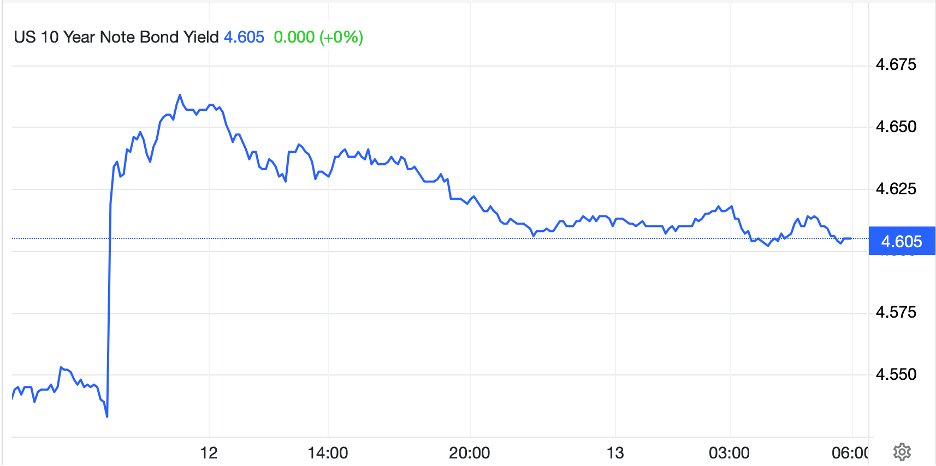

While Treasury yields

Edged higher, it feels

That 50bps is now prepared

Like a dog with a bone, I cannot give up the NFP story even though the market clearly didn’t care about the adjustment or had fully priced it in before the release. In fact, it seems investors, or algos at least, welcomed the fact that the number was so large as it seems to make the case for a 50 basis point cut next week that much stronger. Certainly, Chairman Powell will have difficult saying that starting a cut cycle with 50bps would be inappropriate given his more politically driven efforts a year ago.

But one final word on this subject is worthwhile I believe, and that is; why does the market pay so much attention to this particular data point? Consider the following: according to the BLS, current total employment in the US is approximately 159,540,000. In fact, that number has been above 150 million since January 2019, although Covid managed to impact that for a few months before it was quickly regained.

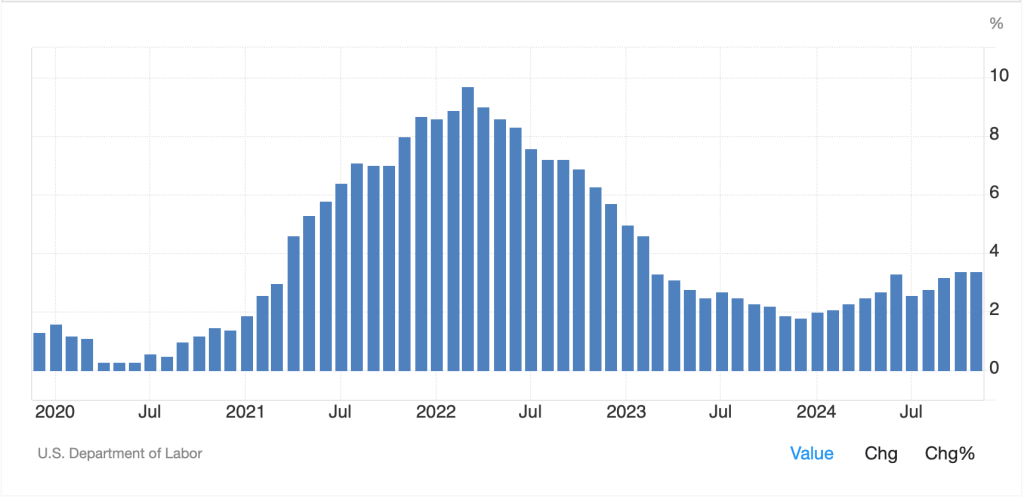

Now, NFP has averaged ~125K since they started keeping records in 1939 with a median reading of 160K. To modernize the data, since 2000 it has averaged ~93K with a median of 154K. Consider what that means with respect to the total labor force. Ostensibly, the most important economic data point of each month represents, on average, 0.06% of the working population. Additionally, that number is subject to massive revisions both on a monthly basis, and then, as we saw yesterday, there is another annual revision. I don’t know if Ms. McEntarfer was good at her job or not, but it is not unreasonable to consider that the payrolls data, as currently calculated, does not really represent anything other than statistical noise. I prepared the below chart to help you visualize how close to zero the NFP number is relative to the working population. Absent the Covid spike, I would argue that the information that this datapoint delivers, especially in the past 25 years, also approaches zero.

Data FRED database, calculations @fx_poet

You may recall the angst with which the firing of Ms McEntarfer was met, and given President Trump’s penchant for overstating certain things, it certainly had a bad look about it. But the evidence seems to point to the fact that the data is not only suspect, given its revision history, but essentially inconsequential relative to the economy. The fact that the Fed is making policy decisions based on changes in the economy that represent less than 0.1% of the working population, and half that amount of the general population, may be the much larger scandal here.

Remember, a 4th Turning is all about tearing down old institutions because they no longer are fit for purpose and building new ones to gain trust. Perhaps NFP as THE monthly number is an institution whose time has passed, and investors (and the Fed) need to find other data to help them evaluate the current economic situation. Of course, the algos love a single number to which they can be programmed and respond instantaneously, so if NFP loses its cachet, and algos lose some of their power, it would be better for us all, except maybe Ken Griffin and Larry Fink!

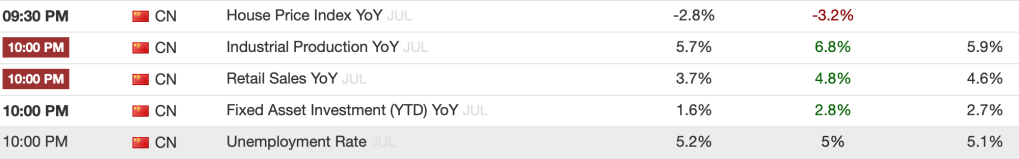

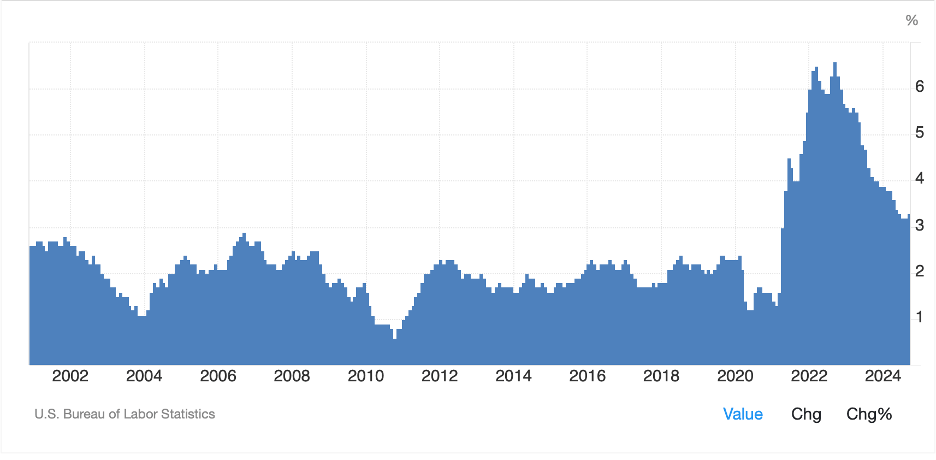

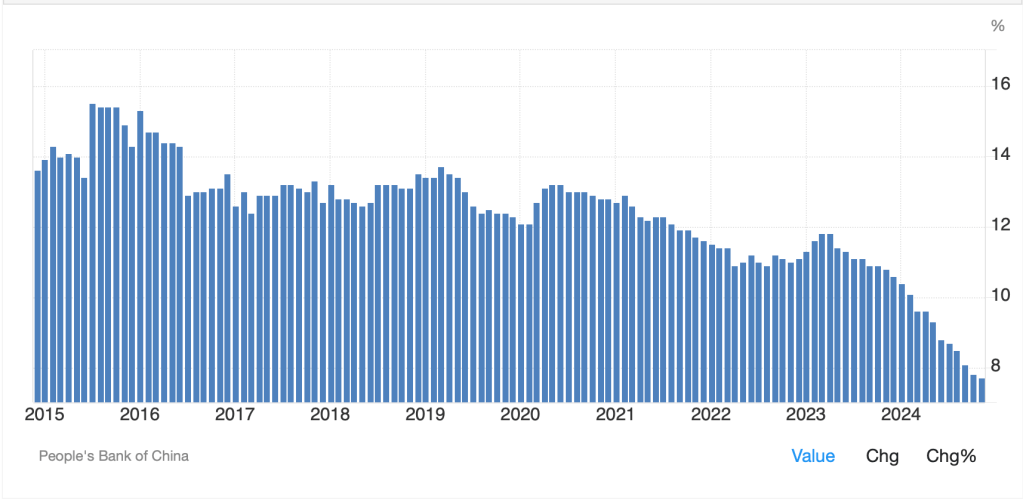

Otherwise, the overnight market offered very little new information. Chinese inflation data continues to show an economy in deflation with the Y/Y result of -0.4% being worse than expected and the 5th negative outcome in the past seven months. Looking at the chart below, it is becoming clearer that President Xi, despite flowery words about consumption, has no idea how to stimulate domestic activity other than the mercantilist model to which China subscribes. Now, they overproduce stuff and since the imposition of higher tariffs by the US on Chinese goods, it seems more of that stuff is hanging around at home and driving prices down. Alas, it seems not enough Chinese want the things they manufacture, hence steadily declining prices. While it is a different problem than in the US, it is a problem nonetheless for President Xi.

Source: tradingeconomics.com

And with that, let’s head to the market activity. Yesterday’s US rally was followed by strength all around the world as it appears everybody is excited about the prospects of the FOMC cutting rates by 50bps next week. While the Fed funds futures market has barely moved, currently pricing just an 8.2% probability of that move, I am hard pressed to conclude that the rest of the economic and earnings data is so good that equities should be rallying for any other reason.

Anyway, Japan (+0.9%), China (+0.2%), HK (+1.0%), Korea (+1.7%), India (+0.4%) and Taiwan (+1.4%) are pretty definitive proof that everybody is all-in on a 50bp cut by the Fed. In fact, the worst performer in Asia, Thailand (0.0%) was merely flat on the day. Turning to Europe, here, too, green is today’s color with Spain (+1.3%), France (+0.6%), Germany (+0.2%) and the UK (+0.5%) all rising nicely. Domestic issues, which abound throughout Europe, are inconsequential this morning. and don’t worry, US futures are higher by 0.35% this morning as well.

In the bond market, while yields edged up yesterday a few basis points, this morning they are essentially unchanged across the board in the US, Europe and Japan. Worries about excessive deficits have been set aside. A major protest in France today is not impacting markets at all. Word that the BOJ will consider tightening policy (as if!) despite the political uncertainty has had no impact. Perhaps we have achieved that long sought equilibrium in rates! 🤣

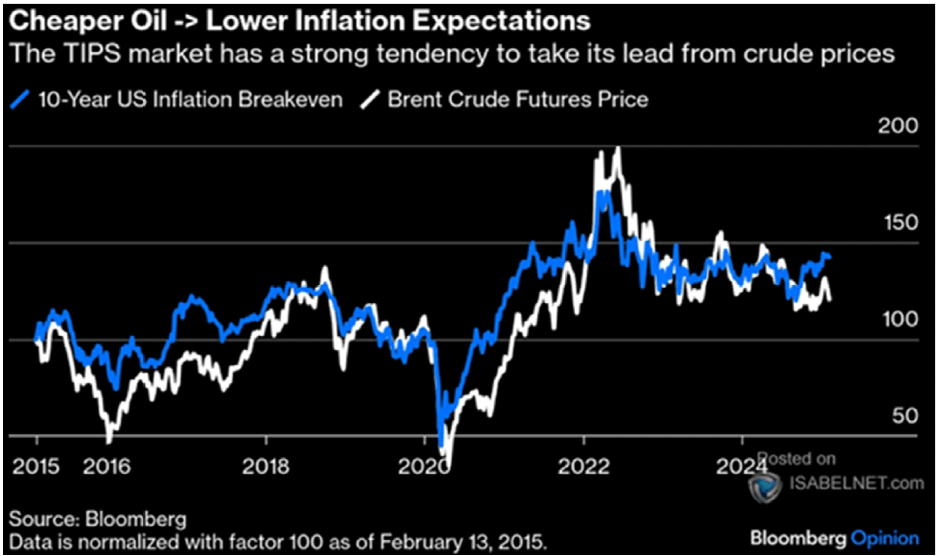

In the commodity space, oil (+1.1%) rallied after the Israeli attempt to eliminate Hamas leadership in Qatar yesterday ruffled many feathers and was seen as a potential escalation in Middle East conflicts. But, at $63.30/bbl, WTI remains firmly in the middle of its recent trading range as per the below chart.

Source: tradingeconomics.com

But you know what is not in the middle of its trading range, in fact the only thing with a real trend right now? That’s right, gold. A quick look at the below chart from tradingeconomics.com helps you understand why so many market pundits, if not investors, are excited about continued gains here. Calls for $4000/oz and more by early next year are increasing. As to the other metals, silver and platinum are following gold higher this morning although copper is unchanged.

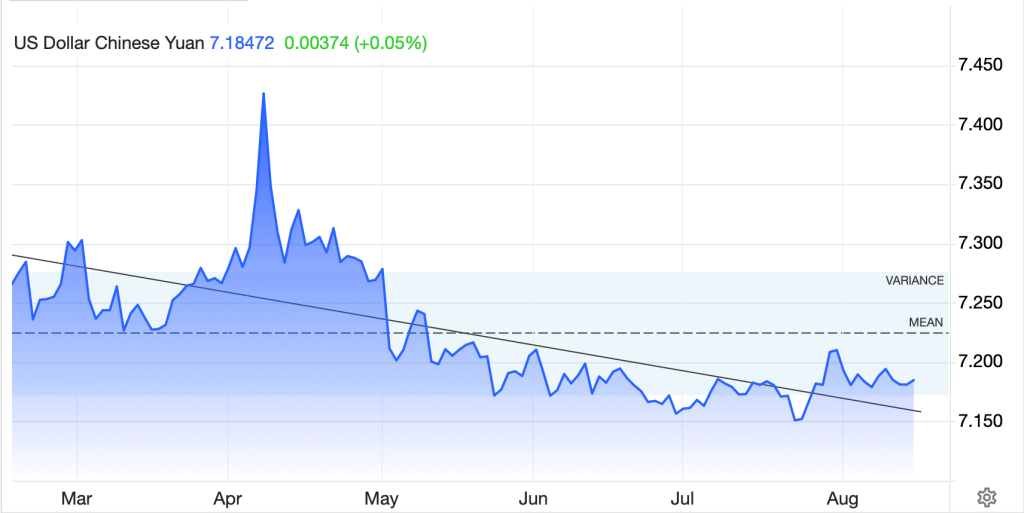

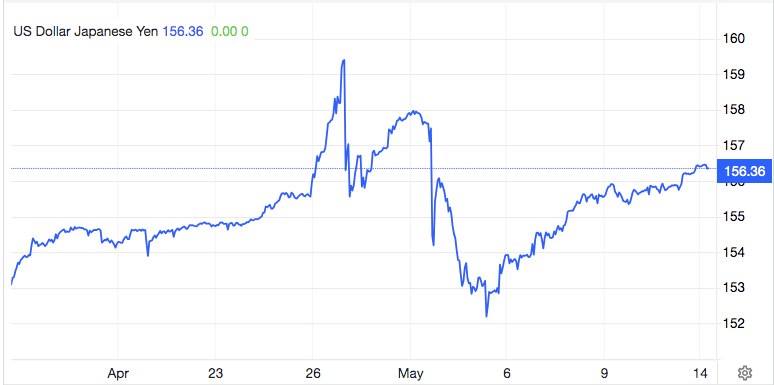

Finally, the dollar is little changed vs. most major currencies with the euro and pound having moved 0.1% or less than the close and the same with JPY, CAD, CHF and MXN. In fact, the biggest mover this morning is NOK (+0.5%) which on top of oil’s rally has benefitted from still firm inflation encouraging the idea that the Norges Bank is going to raise rates when they meet next Thursday. If they hike after the Fed cuts 50bps, the krone will likely see further strength, at least in the short run.

On the data front this morning, PPI (exp 0.3%, 3.3% Y/Y; 0.3%, 3.5% Y/Y core) is the key release and then the EIA oil inventory data is released at 10:30 with a modest draw expected. As we remain in the quiet period, no Fed speakers are slated, so the algos will have to live with the PPI data or any other stories they can find.

If the inflation data this week stays quiescent, I think 50bps is likely next week as the employment situation, despite my comments above, will still be seen in a negative light and I think Powell will feel forced to move. Plus, if Stephen Miran is added to the board this week, there will be increased pressure for just such an outcome. However, while a Fed aggressively cutting rates should be a dollar negative, I feel like that is becoming the default view, so maybe not so much movement from here. We need another catalyst.

Good luck

Adf