Said Williams, I really don’t think

Inflation will get us to blink

The jobs situation

Has led the narration

That growth has now started to shrink

But is that assumption correct?

In truth, it’s quite hard to detect

Atlanta’s Fed states

The ‘conomy’s great

And so, rate cuts are circumspect

Friday, John Williams was the latest FOMC member to regale us with his views and left us with the following:

“I view monetary policy as being modestly restrictive, although somewhat less so than before our recent actions. Therefore, I still see room for a further adjustment in the near term to the target range for the federal funds rate to move the stance of policy closer to the range of neutral, thereby maintaining the balance between the achievement of our two goals…

“My assessment is that the downside risks to employment have increased as the labor market has cooled, while the upside risks to inflation have lessened somewhat. Underlying inflation continues to trend downward, absent any evidence of second round effects emanating from tariffs.”

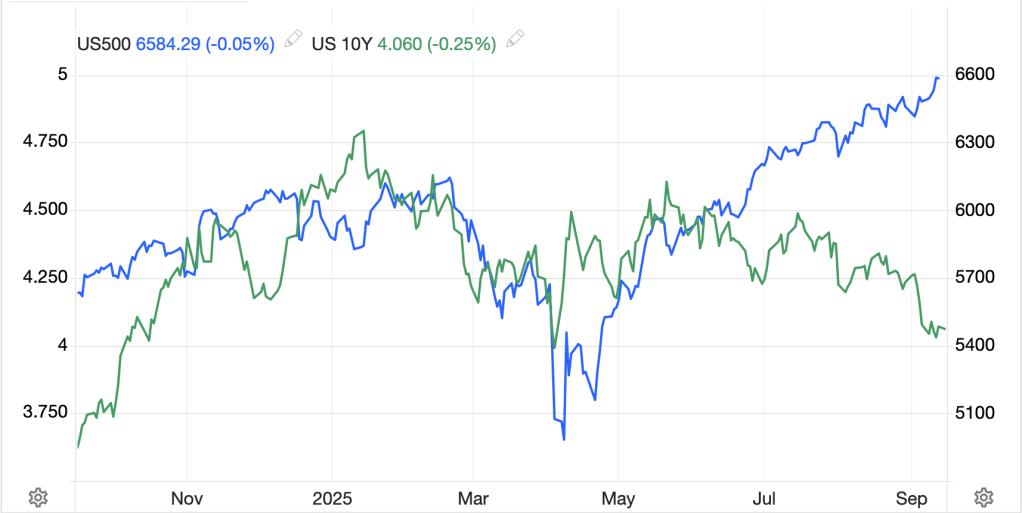

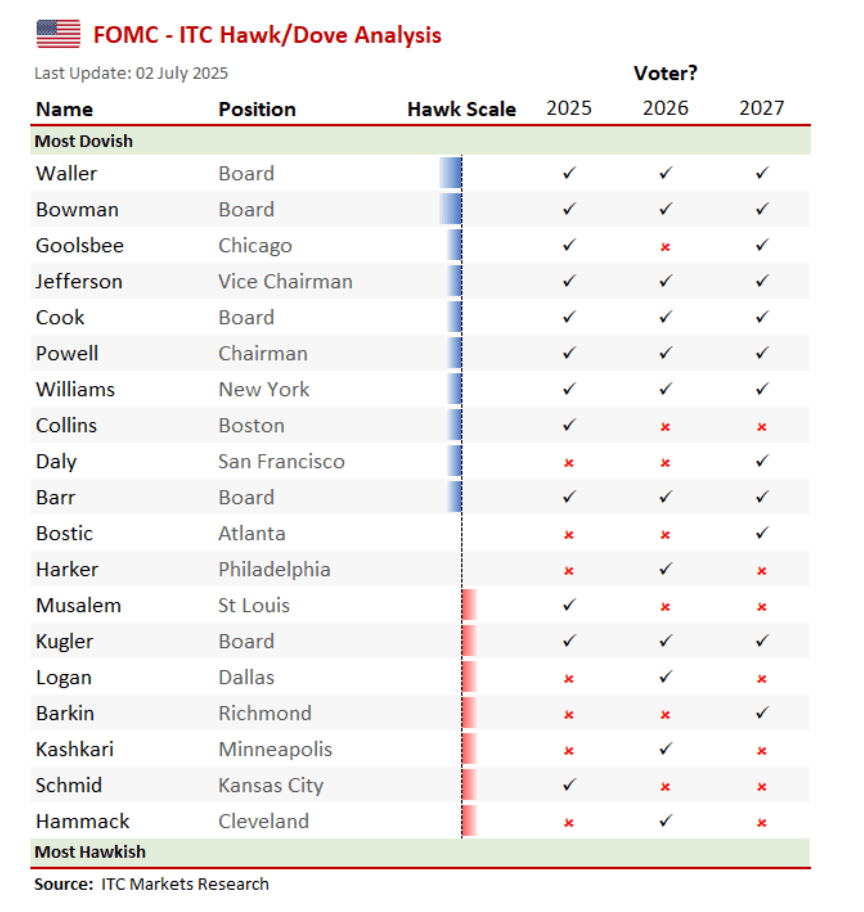

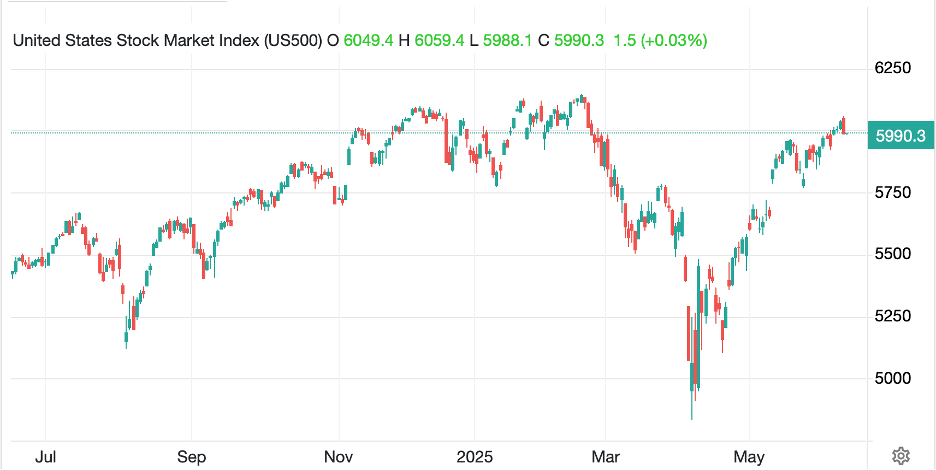

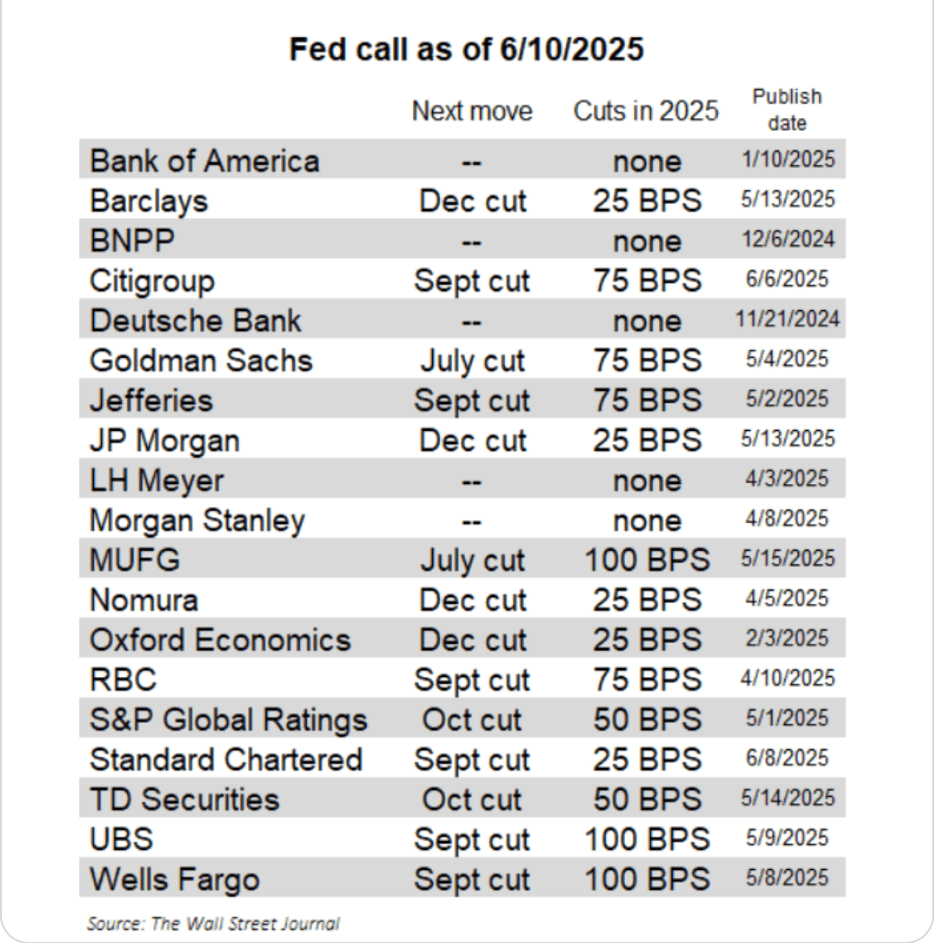

The reason his comments are important is because, not only is he a permanent voting member as NY Fed president, but he is also deemed quite close to Chairman Powell, and the belief is Powell okayed the text, implying Powell is still leaning toward a cut. The Fed funds futures market certainly thinks so as the probability of a cut jumped from 32% on Thursday to 75% this morning. In fact, that seemed to be the driver of the rebound in equity markets on Friday as futures market started their all-day rally right as he spoke at 7:30 in the morning.

Source: tradingeconomics.com

As to the Atlanta Fed’s GDPNow forecast, it ticked higher on Friday and is now sitting at 4.2% for Q3, certainly not synchronous with a major employment crisis.

This week, we will start to get much more information from the BLS and BEA although there is still a huge hole in that output, notably CPI, PCE and GDP. It will likely take several more months before the rhythm of data gets back to the pre-shutdown cadence and more importantly, it offers the same level of completeness that existed back then. I guess the FOMC will have to earn their keep for a while longer.

But Williams triggered a solid risk-on session with equities rallying and Treasury yields slipping, while the dollar held tight. However, I want to touch on one more thing before looking at markets, where the overnight session was rather bland, and that is in reference to a Substack article by Michael Green I read over the weekend that offered a more quantitative approach toward understanding why despite what appears to be solid economic activity, so many people are so unhappy, unhappy enough to believe Socialism is a better choice for the nation going forward.

The essence of the article, which is very well worth reading as he does all the math to prove his points, is that the delineation of poverty in the US (and I suspect in many Western nations) is laughably low. For instance, the current poverty line is $31,200, which we all know is far below livable, while the current family median wage in the US is ~$80,000. Seemingly, most folks should have no problems. But Green does the calculations to show that if a family of 4 earns less than ~$140,000, they are going to struggle, even if they live in a lower cost area, not NYC where you probably need $350,000 to live. Between health care, childcare, housing and food, etc., less than that $140k means you are not only living paycheck to paycheck but falling behind as well.

Read the article, linked above, and afterward, you can get a better appreciation for how Zohran Mamdani was elected Mayor of New York City, promising all sorts of free stuff, even though he has approximately zero chance of delivering any of it.

At any rate, that is background for the week ahead. In Asia, Japan was closed for Workers Day, but Takaichi-san continues to make news regarding her hawkish stance on China. Meanwhile, bourses in the region had a mixes session with some nice gainers (HK +2.0%, Australia +1.3%, Indonesia +1.85%) although the bulk of the rest of the region saw relatively little overall movement, +/-0.2% or so. I guess they didn’t understand the benefits of the Fed potentially cutting rates. 🙃

Meanwhile, in Europe, things are far less interesting with a mix of gainers (Spain +0.5%, Germany +0.3%) and laggards (France -0.3%, Italy -1.1%) and the only notable news released being the German Ifo Expectations which slipped although remain solidly within its recent range. Turning to US futures, at this hour (7:00), they are pointing higher by 0.5%.

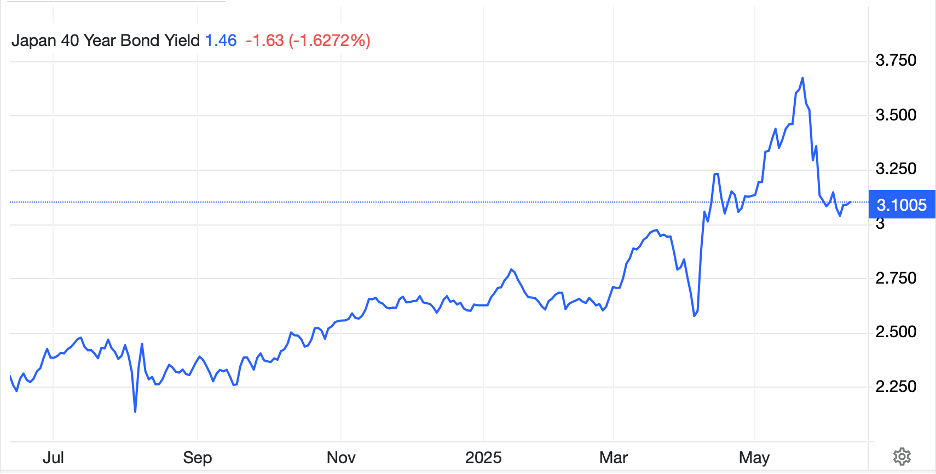

In the bond market, Treasury yields continue to slide, down -2bps this morning and now back at 4.05%. Clearly, the change in sentiment regarding the Fed rate cuts is dragging this yield lower for now. In Europe, sovereign yields are little changed, overall, with some showing a -1bp decline and others completely lifeless. Of course, JGB yields are unchanged given the Tokyo holiday.

In the commodity space, oil (-0.25%) continues to drift lower and the trend remains very much in that direction as can be seen in the chart below. There was a very interesting article by Doomberg on Substack this week, reviewing their call that the idea of peak cheap oil is a myth, and there is a virtually unlimited supply of hydrocarbons available with only the politics preventing more production. (For instance, consider the UK essentially shutting down their North Sea oil production despite being in the midst of a self-inflicted energy crisis with the highest electricity prices in the world. That’s not geology, that’s politics.) But geology shows there is plenty to go around and growing supply will continue to pressure prices lower.

Source: tradingeconomics.com

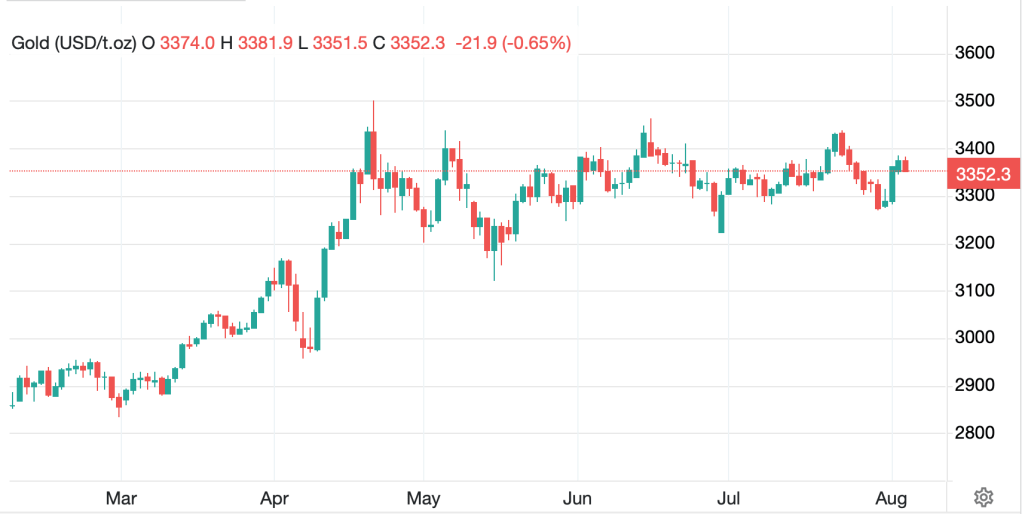

Meanwhile, the metals markets are fairly quiet this morning with gold (+0.25%) and silver (+0.1%) showing far less movement than we have seen of late. The one thing to note is that while both these metals are well off their highs from last month, they both seem to have found a comfortable resting place for now, and nothing about the global macroeconomic situation leads me to believe that the direction is lower from here.

Finally, the dollar is a touch softer this morning with the euro (+0.25%) the largest gainer in the G10 although JPY (-0.3%) remains under pressure overall. However, in the EMG bloc, INR (+0.5%) and the CE3 (HUF +0.4%, CZK +0.4%. PLN +0.5%) are all firmer with many other currencies in this bloc creeping higher by 0.2% or so. Interestingly, the DXY has barely slipped and remains above 100 for now.

This week, we are going to see a lot of the delayed September data come out, so like the NFP report from last week, which was old news, the question is, will we learn anything? But here is a listing to keep in mind:

| Tuesday | Sep Retail Sales | 0.4% |

| -ex autos | 0.4% | |

| Sep PPI | 0.3% (2.7% Y/Y) | |

| -ex food & energy | 0.3% (2.7% Y/Y) | |

| Case Shiller Home Prices | 1.4% | |

| Consumer Confidence | 93.5 | |

| Wednesday | Sep Durable Goods | 0.2% |

| -ex Transport | 0.2% | |

| Initial Claims | 227K | |

| Chicago PMI | 43.8 | |

| Fed’s Beige Book |

Source: tradingeconomics.com

Obviously, Thursday is the Thanksgiving holiday and Friday there is nothing slated to be released. Housing Data, Personal Income and Spending and PCE data are all still up in the air as to when, and what exactly, will be released. The good news is it appears the entire FOMC is taking the week off as no Fed speakers are currently on the calendar.

If I recap what we know, the market remains beholden to the idea that the economy needs a Fed rate cut and was encouraged by Williams’ comments Friday. However, questions about AI accounting methods are being raised and there is a growing split between those looking for an equity correction and those who think the near-future is going to be all roses. From this poet’s perspective, nothing has changed my view that the Fed wants to cut rates, they just need cover to do so, and some softer data will give that cover. But I also look around the world and find almost every other nation is in a worse situation than the US from a macroeconomic perspective, and it is that issue that informs my view that the dollar remains the best of a bad lot. So, while fiat currencies will remain under pressure vs. commodities, I’d rather hold dollars than yen, euros, pesos or pretty much anything else.

Good luck

Adf