Confusion continues to reign

O’er markets though pundits will feign

That they understand

The movements at hand

Despite a quite rocky terrain

The speed with which Trump changes views

Can even, the algos, confuse

The pluses, I think

Are traders must shrink

Positions, elsewise pay high dues

For the longest time I believed that the algos were going to usurp all trading activity as their ability to respond to news was so much faster than any human. Certainly, this has been the key to success for major trading firms like Citadel and Virtu Financial. And they have been very successful. I think part of their success has been that we have been in an environment where both implied and actual volatility has declined in a secular manner, so not only could they respond quickly, but they could lever up their positions with impunity as the probability of a large reversal was relatively less.

However, I believe that the algos and their owners may have met their match in Donald Trump. Never before has someone been so powerful and yet so chaotic in his approach to very important things. Many pundits complain that even he doesn’t have a plan when he announces a new policy. But I think that’s his secret, keep everyone else off balance and then he has free reign. Chaos is the goal.

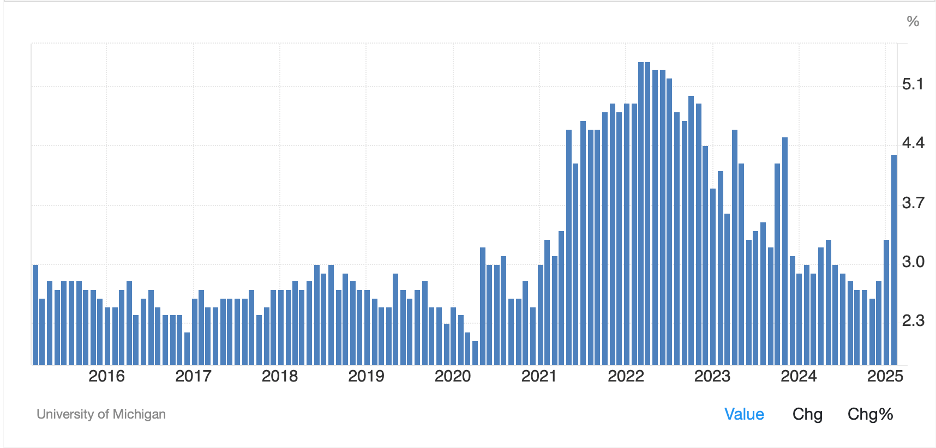

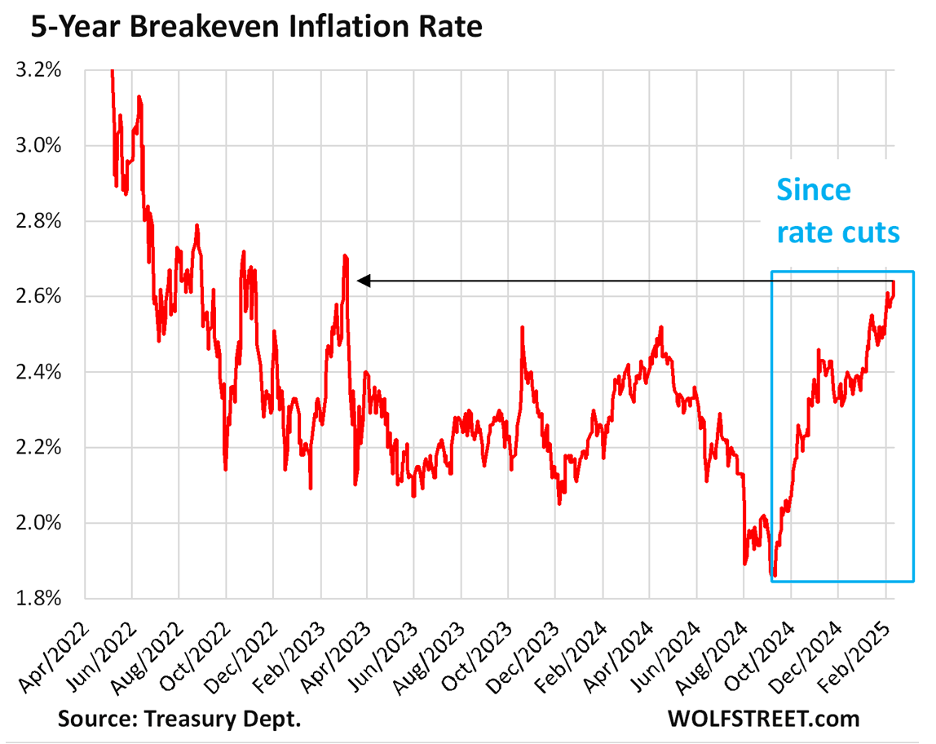

The market impact of this is that basically, for the past three months since shortly after his election, the major asset classes of stocks, bonds and the dollar, have chopped around a lot, but not moved anywhere at all. How can they as nobody seems willing to believe that the end game he has explained; reduced deficits, reduced trade balance, lower inflation and a strong military presence throughout the Western Hemisphere, is going to result from his actions. And in fairness, some of the actions do have a random quality to them. But if we have learned nothing from President Trump’s time in office, including his first term, it is that he is very willing to tell us what he is going to do. It just seems that most folks don’t believe he can do it so don’t take it seriously.

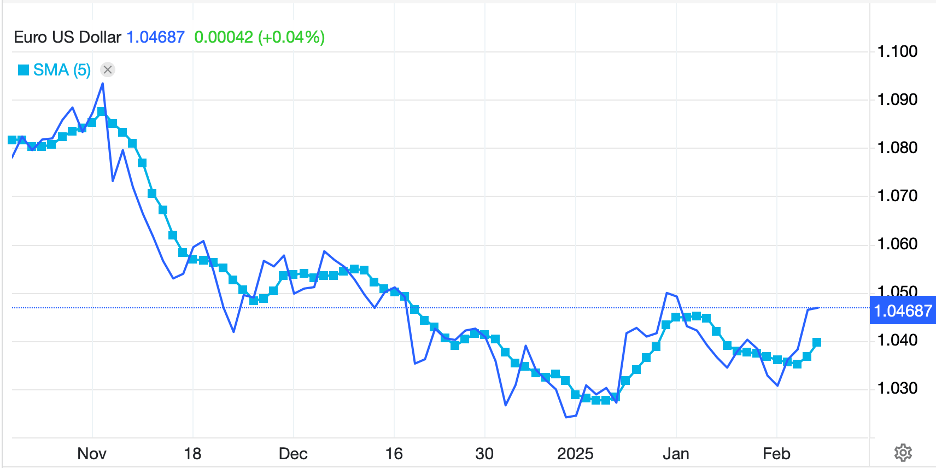

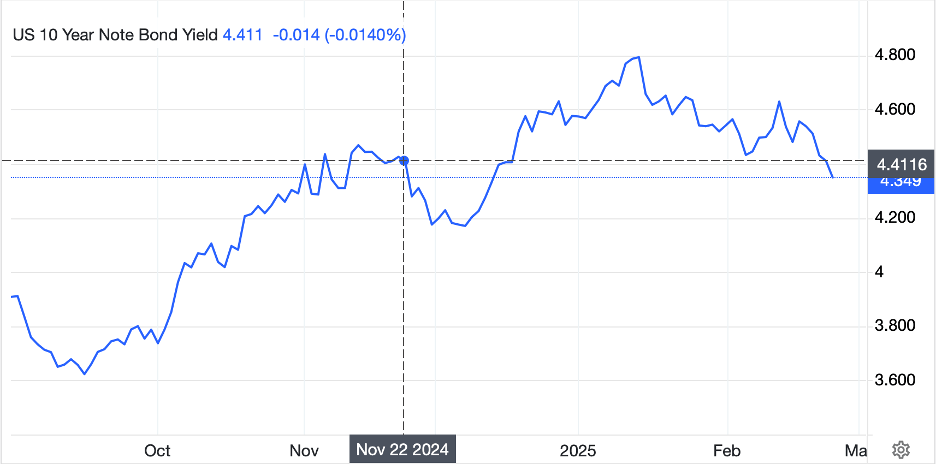

So, let’s look at how markets have behaved in the past three months. The noteworthy result is that the net movement over that period has been virtually nil. Look at the charts below from tradingeconomics.com:

S&P 500

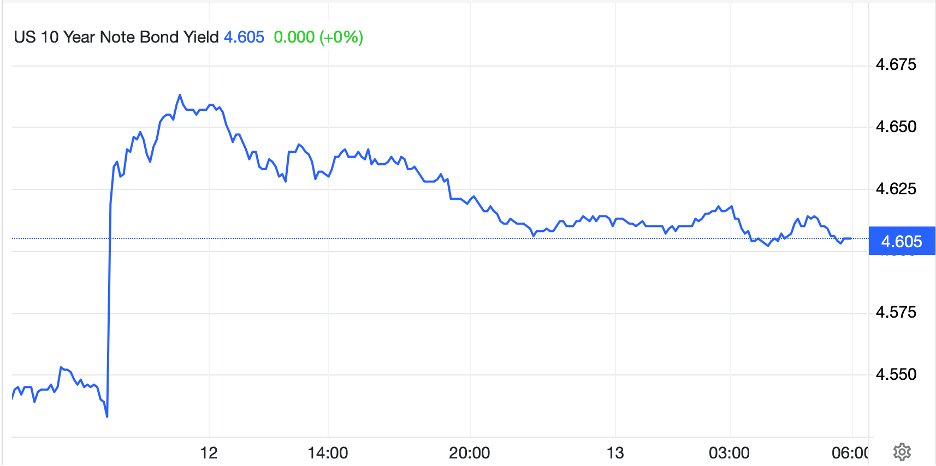

10-Year Treasury

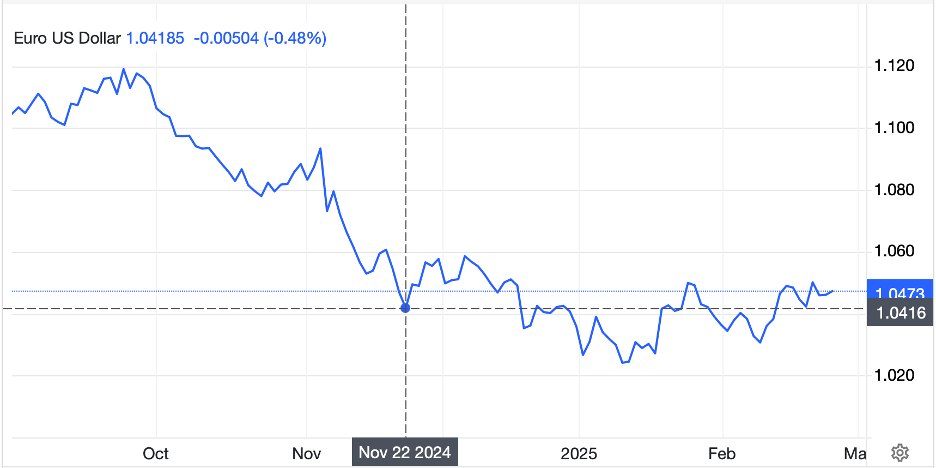

EUR/USD

While all these markets have moved higher and lower in the intervening period, they have not gone anywhere at all. The biggest mover over this time is the euro, which has rallied 0.54% with the other major markets showing far less movement than that.

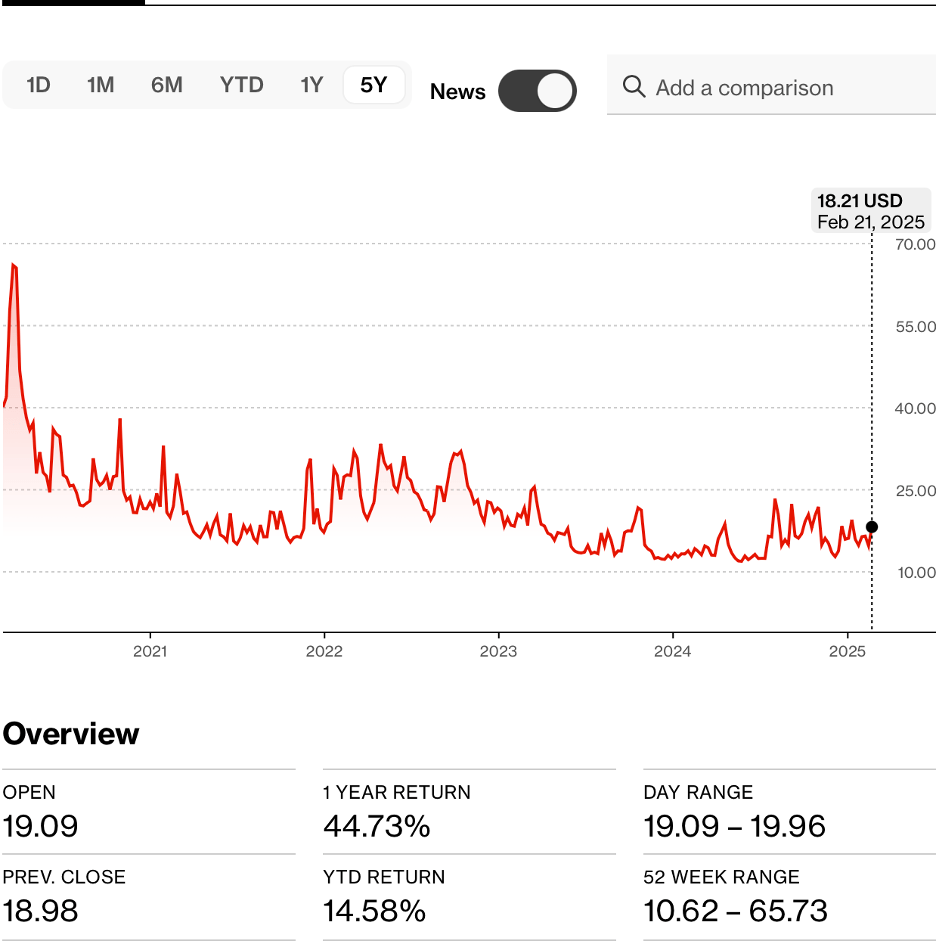

One interesting phenomenon of this price action is that despite significant uncertainty over policy actions by the President and the implications they may have on markets, and even though recent price action can best be described as choppy rather than trend like, the VIX Index remains in the lowest quartile of its long-term range. Certainly, it has risen slightly over the past few weeks, but to my eye, it looks like it is underpricing the chaos yet to come.

Source Bloomberg.com

While I have no clearer idea how things will unfold than anyone else, other than I have a certain amount of faith that the President will achieve many of his goals in one way or another, I am definitely of the belief that volatility is going to be the coin of the realm for quite a while going forward. We have spent the past many years with numerous strategies created to enhance returns via selling volatility, either shorting options or levering up, and that is the trend that seems likely to change going forward. The implication for hedgers is that maintaining hedge ratios while having a plan in place is going to be more important than any time in the past decade or more.

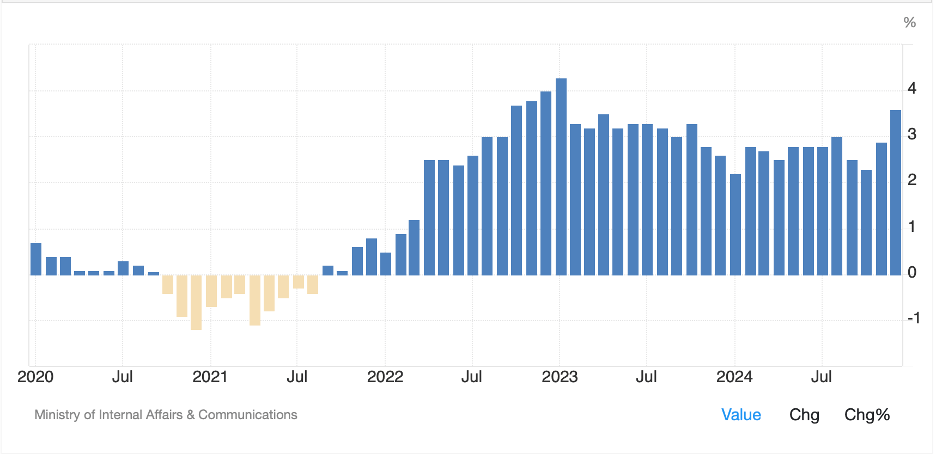

Ok, let’s take a look at how markets did move overnight. Yesterday’s net negative session in the US was followed by similar price action in Asia. Tokyo (-1.4%), Hong Kong (-1.35) and China (-1.1%) all suffered on stories about tariffs and extra efforts by the Trump administration to tighten up export controls on semiconductors. It should be no surprise that virtually every index in Asia followed suit with losses between -0.3% (Singapore) and -2.4% (Indonesia) and everywhere in between. Meanwhile, in Europe, the picture is not as dour as there are a few winners (Spain +0.9% and Italy +0.5%) although the rest of the continent is struggling to break even. The data point that is receiving the most press is Eurozone Negotiated Wage Growth (+4.12%) which rose less than in Q3 and has encouraged many to believe the ECB will be cutting rates next week. Interestingly, Joachim Nagel, Bundesbank president was on the tape telling the rest of the ECB to shut up about their expectations of future rate moves as there is still far too much uncertainty and decisions need to be made on a meeting-by-meeting basis. Apparently, oversharing is a general central bank affliction, not merely a Fed problem. As to US stocks, at this hour (6:50) they are little changed.

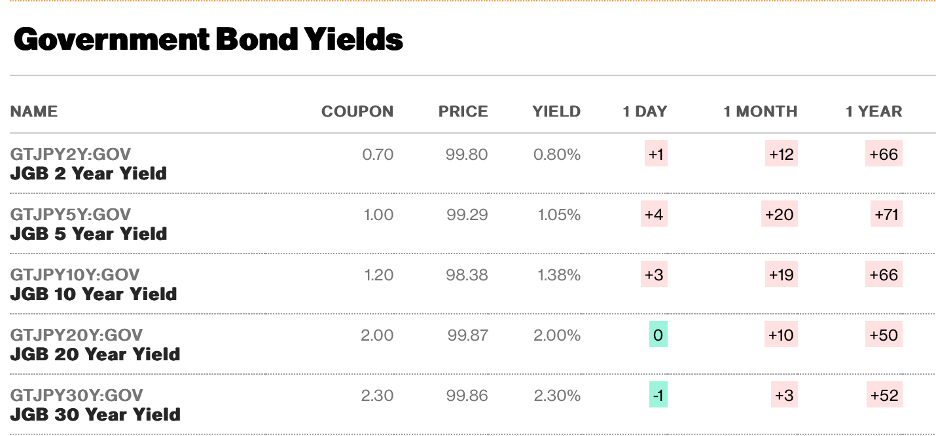

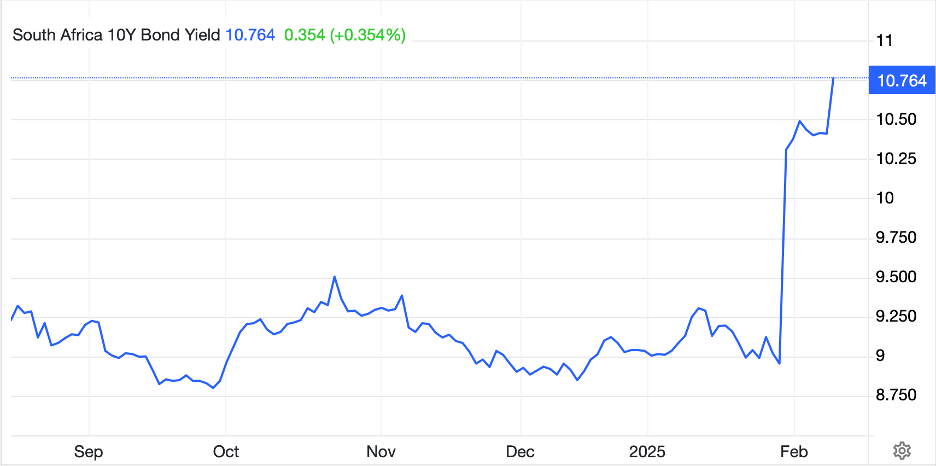

In the bond market, yields continue to slide, at least in the US, with Treasury yields down -6bps this morning and back to levels last seen in December. Apparently, some investors are beginning to believe Secretary Bessent regarding his goal to drive yields lower. As well, he has reconfirmed that there will be no major increase in the issuance of long-dated paper for now. European sovereigns, though, are little changed this morning with only UK gilts (-3bps) showing any movement after the CBI Trades report printed at -23, a bit less bad than expected.

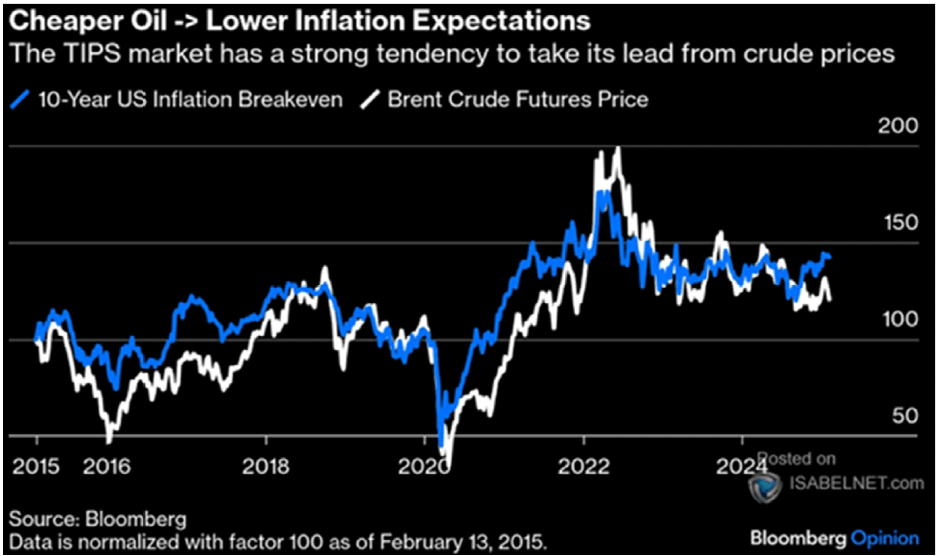

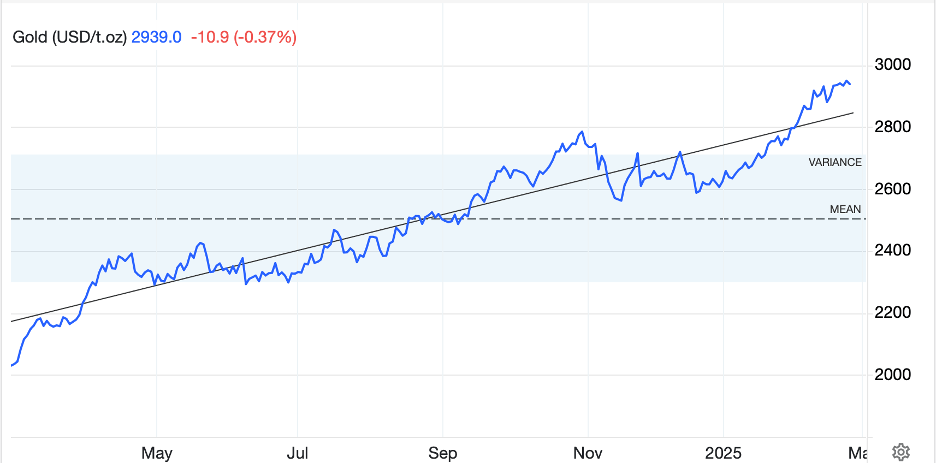

In the commodity markets, oil (-0.15%) is little changed this morning after a very modest rally yesterday. But the reality here is that oil, like other markets, has been in a trading range rather than trending, although my take is that the longer-term view could be a bit lower. Gold (-0.35%), though lower this morning, is the one market that has shown a trend since Trump’s election, and truthfully since well before that as you can see in the chart below.

Source: tradingeconomics.com

Finally, the dollar is a touch softer this morning, with both the euro and pound rising 0.3% alongside the CHF (+0.3%) and JPY (+0.2%). Commodity currencies, though, are less robust with very minor losses seen in MXN, ZAR and CLP. Given the decline in 10-year yields, I am not that surprised at the dollar’s weakness although it is in opposition to the gut reaction that tariffs mean a higher dollar. This is of interest because yesterday President Trump confirmed that the 25% tariffs on Canada and Mexico were going into effect next week. As I explained above, it is very difficult to get a sense of short-term price action here although given the clear intent of the president to improve the competitiveness of US exporters, he would certainly like to see the dollar decline further.

It is very interesting to watch this president reduce the power of the Fed with words and not even have to attack the Chairman like he did in his first term. It will be very interesting to see how Chair Powell responds to the ongoing machinations.

On the data front, this morning brings only the Case-Shiller Home Price Index (exp +4.4%) and Consumer Confidence (102.5). We do hear from two Fed speakers, Barr and Barkin, but as I keep explaining, their words matter less each day. (It must be driving them crazy!)

It is hard to get excited about markets here. There is no directional bias right now and the lack of critical data adds to the lack of information. As well, given the mercurial nature of President Trump’s activities, we are always one tape bomb away from a complete reversal. While I don’t see the dollar collapsing, perhaps the next short-term wave is for further dollar weakness.

Good luck

Adf