In Spain, electricity failed

In Canada, Carney prevailed

But markets don’t care

As movement’s quite spare

It seems many traders have bailed

But problems, worldwide, still abound

Though right now, they’re in the background

There’s far too much debt

And still a real threat

That no true solutions are found

The two biggest stories of the past twenty-four hours were clearly the national scale blackout in Spain and Portugal yesterday, and the slim victory for Mark Carney in Canada, where the Liberal Party appears to have a plurality, but not a majority, and will oversee a minority government.

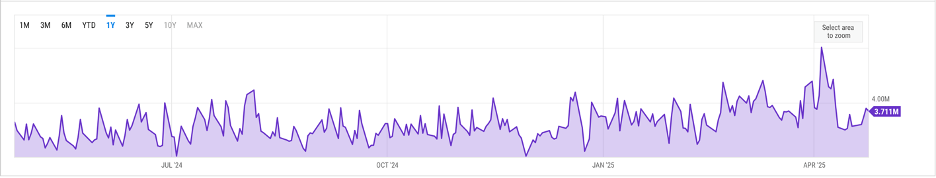

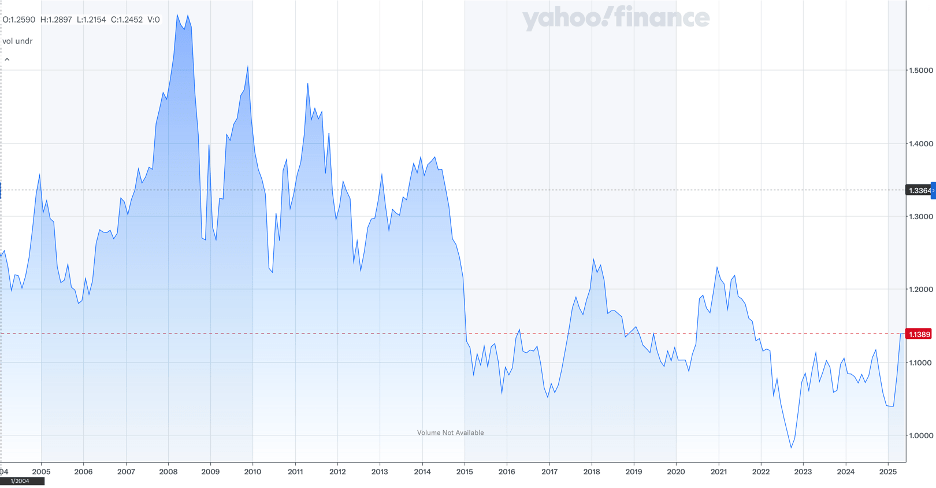

Touching on the second story first, in truth there is not much to discuss. Much has been made of the vote being an anti-Trump statement with the idea that Carney is better placed to defend Canada from President Trump’s (imagined) predations. However, given the lack of a majority government, it is not clear how effective this line of reasoning will prove. As there is no futures market for the TSX, we really don’t have a sense yet of how the Canadian equity market will greet the news. Yesterday’s modest gains of 0.35% amid a general atmosphere of modest gains doesn’t really tell much of a tale. As to CAD (-0.1% today), a quick look at the past week shows it has done nothing even in the wake of the news. (see below). My take is this is a nothingburger event, a perfect description for Mark Carney, a nothingburger of a politician.

Source: tradingeconomics.com

As to the story about Spain’s electricity, I think it may be more instructive on two levels. The first is as a warning to the risks inherent of powering your electric grid with more than 25% – 30% intermittent, renewable energy sources like wind and solar. It is somewhat ironic that just twelve days prior to the blackout, Spain’s entire electricity requirement was met by solar, wind and hydro power, the Green dream. Alas, here we are now and while no answers have yet been forthcoming, and I assume the media will downplay any blame on too much renewable power, virtually every engineering study has shown that once a grid has more than that 25% renewables, it tends towards instability. This issue will be argued by both sides for a while, although as always, physics will be the final arbiter.

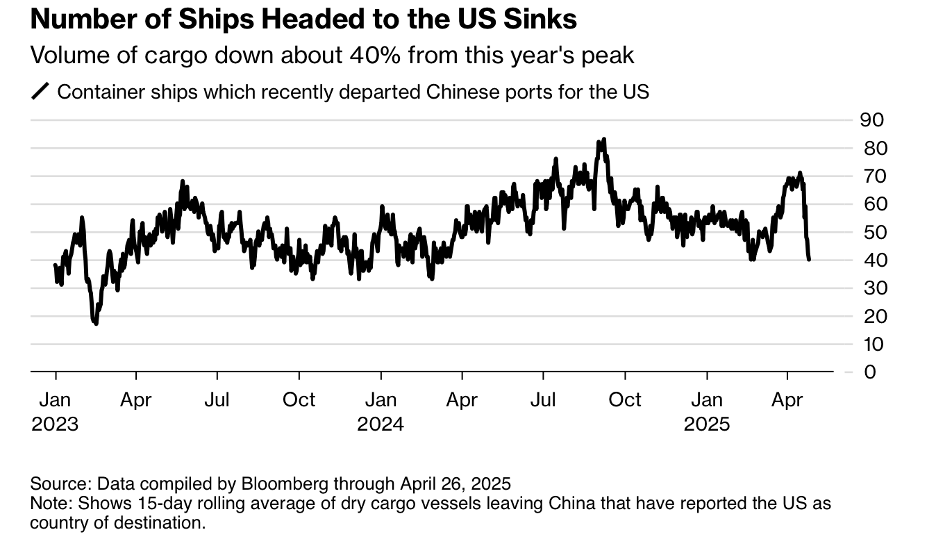

But I have to wonder if the sudden failure of the electric grid is an omen of sorts, for what may be happening in global markets. If we analogize global supply chains to the electrical grid, over the course of the past 50 years, we have seen the world create a massively complex web of trade with raw materials, intermediate goods and final products all crisscrossing the world. There have been myriad benefits to all involved with real per capita economic benefits abounding, and for everybody reading this note, the ability to essentially buy whatever you want/need with limited interference and trouble. Certainly, the availability of everyday necessities like food and clothing is widespread.

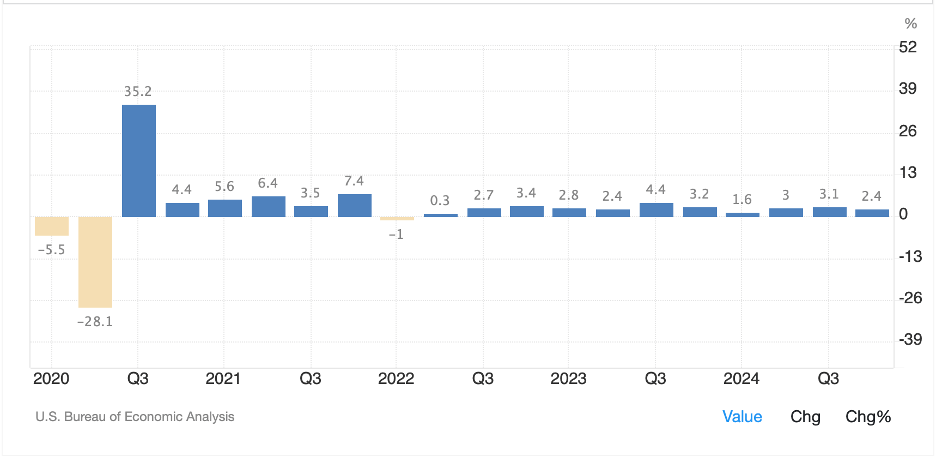

However, underpinning that bounty were two networks. The first being the obvious one, the supply chains which since Covid have been much discussed by the punditry. But the second, which gets far less notice is the network of debt that is issued around the world by governments and companies, as well as taken on by individuals, and that has grown to be more than 3x the entire global economic output. While we most often read about the US government debt which is quickly approaching $37 trillion, total global debt is much greater than that. In fact, at this point, the debt market is not about issuing new debt to fund new investment, rather it is almost entirely a refinancing mechanism.

It is this latter issue that should concern us all. What happens if, one day, the ability to refinance some of that debt, whether US Treasuries, German bunds or Chinese government bonds, has a hiccup of some sort? A failed US Treasury auction, where the Fed is required to purchase bonds, or a power outage in a key financial center that prevents trades from being confirmed/settled and moneys not moving as expected, or some other force majeure type event that disrupts the current smooth functioning of global debt markets.

Frankly, the combination of the changes being wrought by President Trump to the global economy, where globalization is giving way to mercantilism, and the significant weight of global debt that hangs over the global economy and is given very little thought seems a potentially volatile mix.

Ironically, as much as I have lately been describing how the Fed’s role seems to have diminished, in the event that something upsets this apple cart, the Fed will be the only game in town. While this is not a today event, it is something we must not forget.

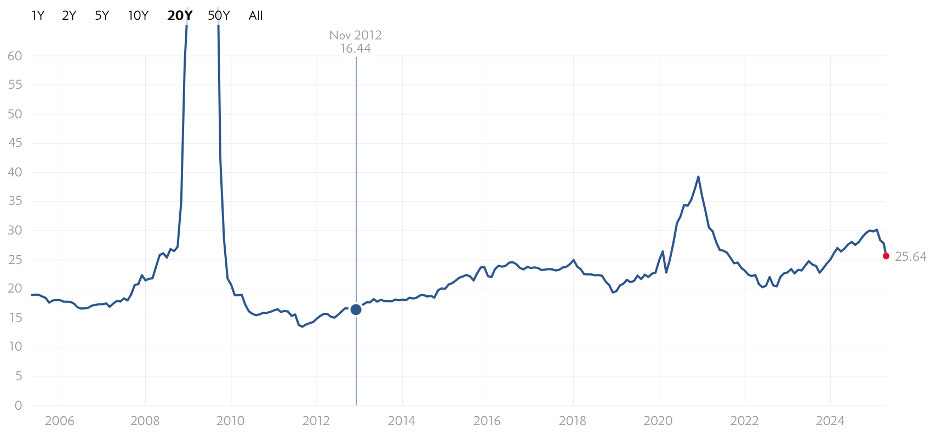

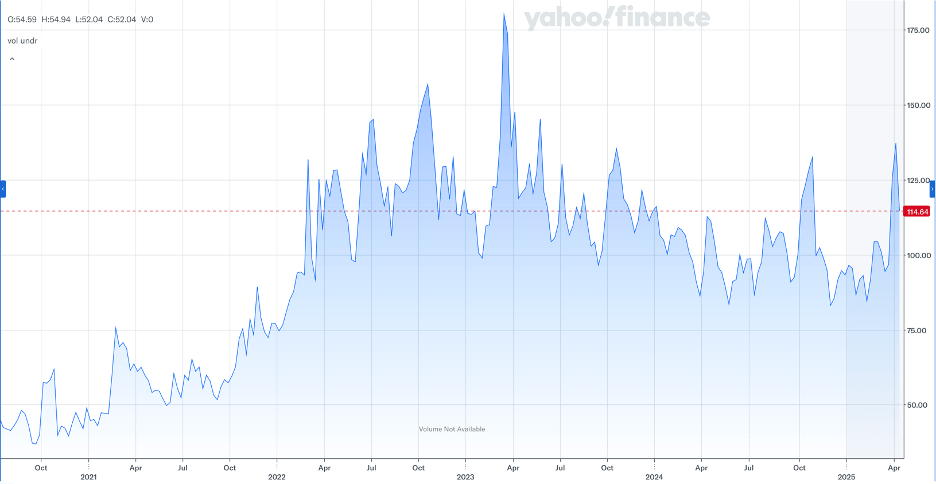

I apologize for my little diatribe, but with so little ongoing in markets, and the parallel to the Spanish electrical grid, it seemed timely. Let’s look at markets. Asian equity markets were mixed with the main markets very quiet but a couple of 1% gainers (Australia, Taiwan and Korea) although the rest of the region was +/- 0.3% or less. Too, volumes were quite lethargic. In Europe, it should be no surprise that Spain (-0.8%) is the laggard today as the first economists’ to opine on the impact of the blackout said it could be a hit of as much as 0.5% of GDP. Germany (+0.6%) is the other side of the coin after the GfK Consumer Confidence reading came out at a better than expected -20.6. Now, maybe it’s just me, but if I look at the past 5 years’ worth of this index, it is difficult to get excited about German economic prospects.

Source: tradingeconomics.com

Yes, this was a better reading, but either the people of Germany are manic depressive, or the index is indicative of major structural problems in the country. Maybe a bit of both. As to US futures, at this hour (7:10) they are basically unchanged after being basically unchanged yesterday.

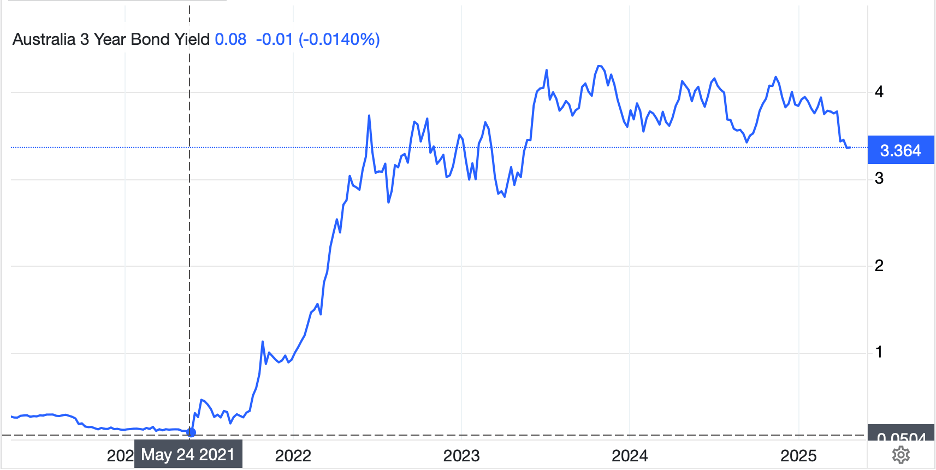

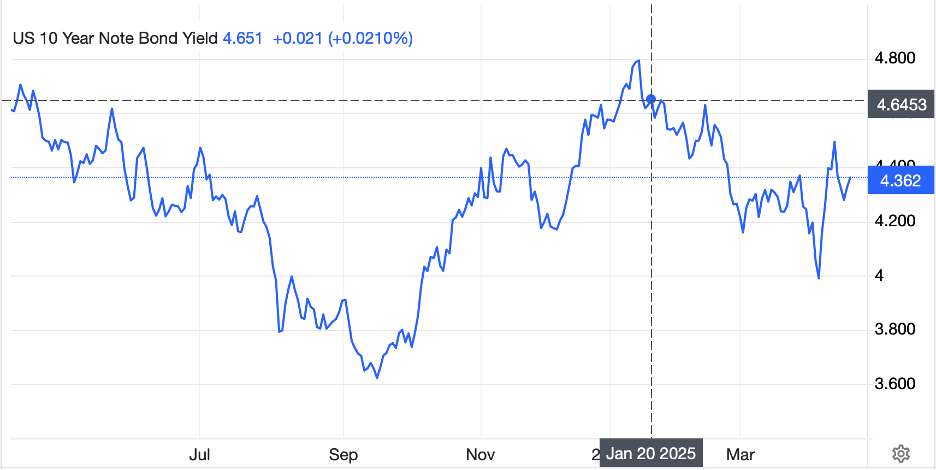

In the bond market, Treasury yields have bounced 2bps this morning after touching their lowest level in 3 weeks yesterday. European sovereign yields, though, are all softer by 1bp to 2bps this morning as comments from ECB members seem to highlight more rate cuts as Europe achieves their inflation target and are now getting concerned they will fall below the 2.0% rate.

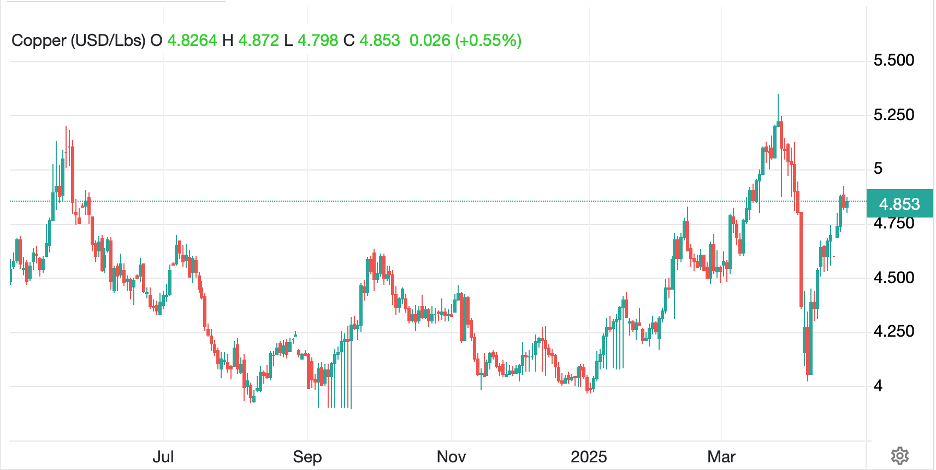

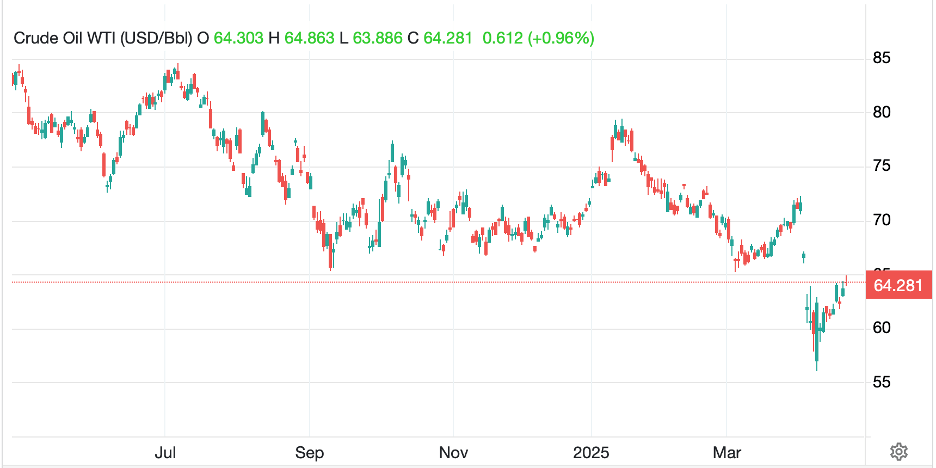

In the commodity markets, oil (-1.7%) is under pressure this morning ostensibly on a combination of concerns over slowing growth and little movement in the US-China trade talks as well as a report that Kazakhstan is pushing up output and other OPEC+ members are talking about increasing production further when they meet next week. Meanwhile, gold (-0.75%), which rallied back to unchanged in NY yesterday is once again finding sellers at its recent trading pivot of $3340ish (H/T Alyosha). However, gold’s slide has not impacted either silver (+0.4%) or copper (+0.9%) at least so far in the session.

Finally, the dollar is firmer, largely across the board, this morning. The euro (-0.3%), pound (-0.4%), JPY (-0.4%) and CHF (-0.6%) are all under some pressure, perhaps profit taking. But in truth, other than INR (+0.15%) the rest of the major currencies, both G10 and EMG, are all softer vs. the greenback. I guess the dollar’s demise will need to wait at least one more day.

On the data front, the Goods Trade Balance (exp -$146B), Case Shiller Home Prices (4.7%) and JOLTs Job Openings (7.48M) are the main numbers, although we also see Consumer Confidence (87.5). But with no Fed discussions much more crucial data on Thursday (GDP, PCE) and Friday (NFP) it seems that today is setting up for not much excitement.

In fact, lack of excitement seems the best description of markets right now. I don’t know what the next catalyst will be to change things, but absent peace in one of the wars, kinetic or trade, or another force majeure event, it feels like range trading is the order of the day for a while. My big picture view of a slowly declining dollar is still intact, but day-to-day, it’s hard to see much right now.

Good luck

Adf