With President Trump on the road

The market has heard a boatload

Of ideas and plans

Including Iran’s

Return to a more normal mode

There’s talk of a nuclear deal

Audacious, if it’s truly real

Instead of enriching

While everyone’s bitching

A partnership deal they would seal

One is never disappointed with the tone of the overnight news when President Trump is traveling. Between his flair for the dramatic and his desire to conclude deals, it seems like there is always something surprising when we awake each morning. This morning is no different.

While the mainstream media has been harping on the audacity of Qatar gifting a “flying palace” to the US for President Trump to use as Boeing’s delivery of the newest Air Force One is something like 10 years behind schedule, Mr Trump has indicated he is quite keen to make a deal with Iran that would bring them back into the fold of good neighbor nations. Ostensibly, Iran has suggested that they work with the Saudis, Emiratis and the US to enrich uranium together in order to develop nuclear power in the Middle East. As the Saudis and Emiratis have already expressed interest in building more nuclear power plants, it is not a stretch for them. But bringing Iran into the fold, so that enrichment activities are done jointly, and therefore can be closely overseen by the US and Saudi Arabia, would be a remarkable outcome.

The JCPOA deal signed by President Obama was a nullifying deal, one that was designed to prevent an activity, the enrichment of uranium to the required concentrations sufficient to build a bomb. But this is an encompassing deal, one that would join erstwhile enemies into a partnership to jointly produce uranium sufficiently enriched for nuclear power, without pushing toward weapons grade material. Now, this would be a remarkable change in attitude in Tehran as the theocracy there has basically made the end of the US and Israel their motto ever since 1979 and the revolution that brought them to power. But things are tough in Iran right now and the funny thing about power is that those who hold it are really reluctant to let go. It would not be unprecedented for a nation’s leadership to reverse course completely in order to maintain their grip, and it is also not hard to believe that a softer tone would be welcome in Iran by the populace.

Regardless, this is a bold and audacious idea, but one that could just work. Now, we should all care not simply because anything that could lead to less terrorism and destruction is an unalloyed good, but because the impact on the global economy would be significant, namely, the price of oil is likely to decline further. A deal like this is likely to include the end of restrictions on Iranian oil sales, or at least a dramatic reduction in those restrictions. While Iran has been producing and selling oil all along this would change the tone of the oil market with another major player now actively looking to expand production and sales. (After all, the Iranian economy is desperate and the ability to generate more revenue without restrictions would be an extraordinary carrot for the mullahs.)

With this in mind, it should be no surprise that the price of oil (-3.65%) has fallen sharply today, and the real question is just how low it can go. A look at the chart shows that the trend has been lower for the past year although it seems to have found a temporary bottom just above $56/bbl.

Source: tradingeconomics.com

I have maintained for the past year and a half that the ‘peak cheap oil’ thesis has been faulty and that there is plenty of the stuff around with political, not geological restrictions the driving force toward higher prices. This is Exhibit A on the political restriction case. President Trump is quite keen to see oil prices lower as it suits both the inflation story in the US as well as offers a significant advantage to US manufacturing facilities with access to cheap energy. I would guess this was not on anyone’s bingo card before today but must now be taken seriously as a potential outcome. While I’m not an oil trader, I suspect we will test, and break, through those lows just above $56 in the coming weeks and find a new home closer to $50/bbl.

This is such an extraordinary story, I could not ignore it. But as an aside, President Trump also mentioned that India has allegedly offered to cut their tariff rates on US goods to 0.0%! I don’t know if that would be reciprocal, and that has not yet been verified by India, but again, it demonstrates that many of the things we believed to be true regarding international relations are not carved in stone.

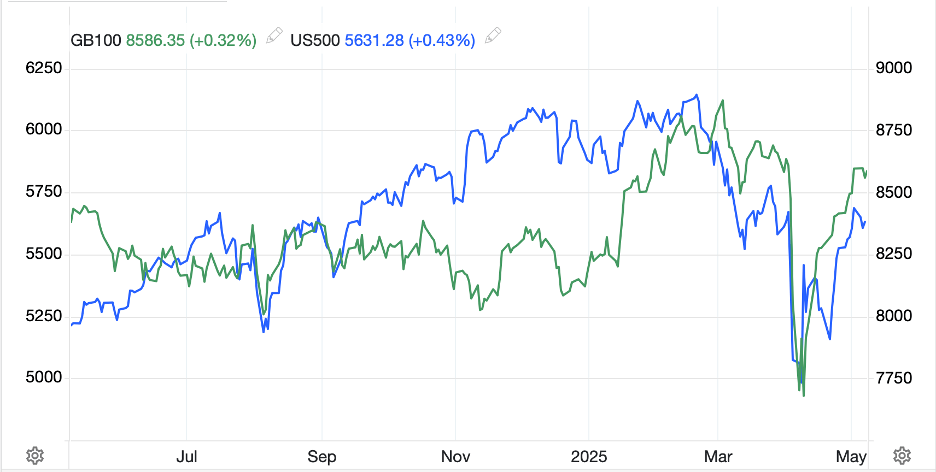

Ok, let’s look at how markets are absorbing these latest surprises. Yesterday’s price action could best be described as dull, with US equity markets doing little all day, although the NASDAQ managed to edge higher into the close. In Asia overnight, the major markets (Japan -0.9%, China -0.9% and Hong Kong -0.8%) all came under pressure although there doesn’t appear to have been a particular story. There were no new trade related comments, so I sense that the recent uptick just saw some profit-taking. Elsewhere in Asia, the biggest winner was India (+1.5%) and then it was a mixed bag. In Europe, equity markets have done very little overall after Eurozone data showed GDP activity was more disappointing than first reported with Q1’s second estimate down to 0.3%. As to US futures, at this hour (7:10), they are pointing lower by about -0.4% or so across the board.

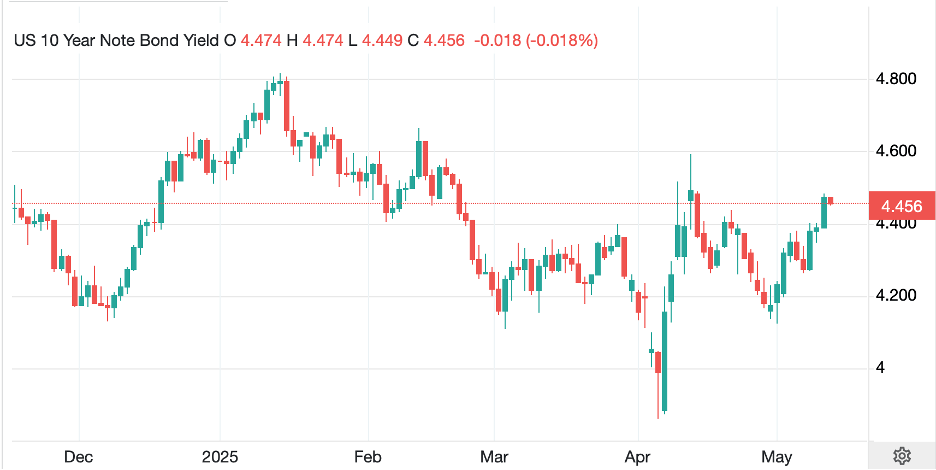

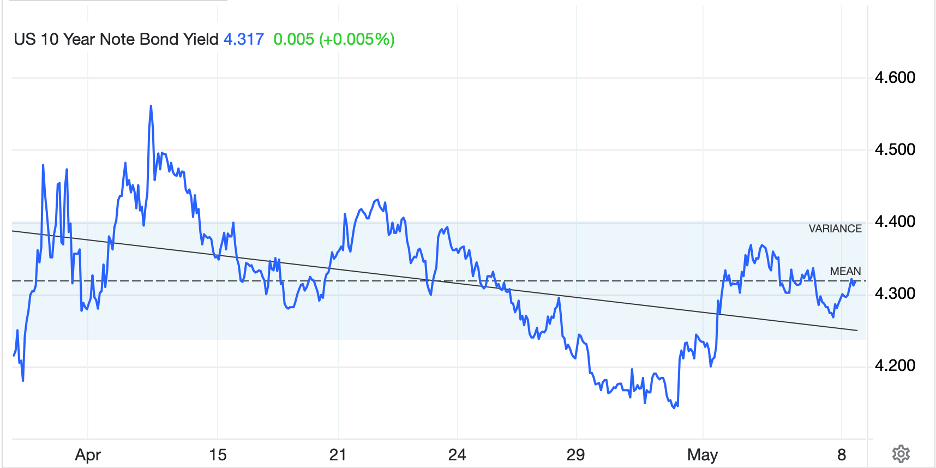

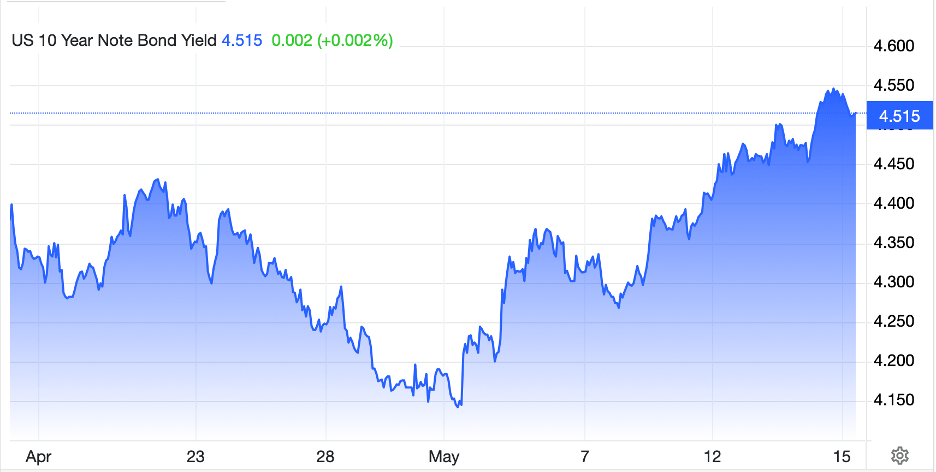

In the bond market, Treasury yields, which have been climbing relentlessly all month as per the below chart, have backed off -2bps this morning, but 10-year yields are still above 4.50%, a level Mr Bessent is clearly unhappy with. But today’s price action has also seen European sovereign yields slide a similar amount, with the softer Eurozone growth one of the reasons here as well.

Source: tradingeconomics.com

Turning to the metals markets, the shine is off gold (-0.2%) which has fallen more than 4% in the past week, although remains well above $3100/oz. It seems that much of the fear that drove the price higher is being removed from the markets by the constant updates of trade and peace deals that we hear regularly. It remains to be seen if this lasts, and how the Fed will ultimately behave, but for now, fear is fading.

Finally, the dollar is a touch softer overall, but not universally so. In the G10, the euro (+0.2%) and pound (+0.2%) are both edging higher with UK data looking a tad better compared to that modest weakness in Eurozone data. But the yen (+0.6%) and CHF (+0.5%) are both nicely higher as there continues to be a strong belief that President Trump is seeking the dollar to decline in value. In the EMG bloc KRW (+0.7%) and ZAR (+0.8%) are the leaders with most of the rest of the bloc making very modest gains on the order of 0.2% or less. It appears that the dollar has decoupled from the US rate picture for the time being. I wonder if it is presaging lower US rates, or if this relationship is going to change for a longer time going forward. We will need to watch this closely.

On the data front, there is a bunch this morning as well as comments from Chairman Powell at 8:40.

| Initial Claims | 229K |

| Continuing Claims | 1890K |

| Retail Sales | 0.0% |

| -ex autos | 0.3% |

| PPI | 0.2% (2.5% Y/Y) |

| -ex food & energy | 0.3% (3.1% Y/Y) |

| Empire State Manufacturing | -10 |

| Philly Fed Manufacturing | -11 |

| IP | 0.2% |

| Capacity Utilization | 77.8% |

Source: tradingeconomics.com

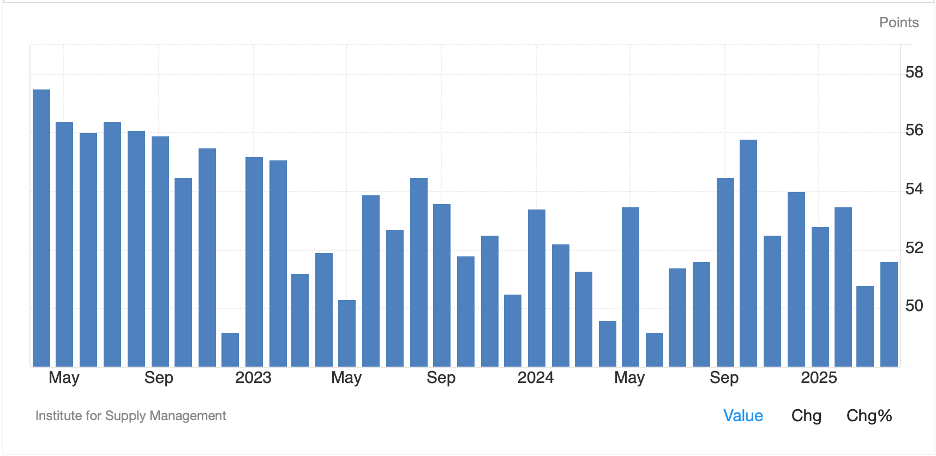

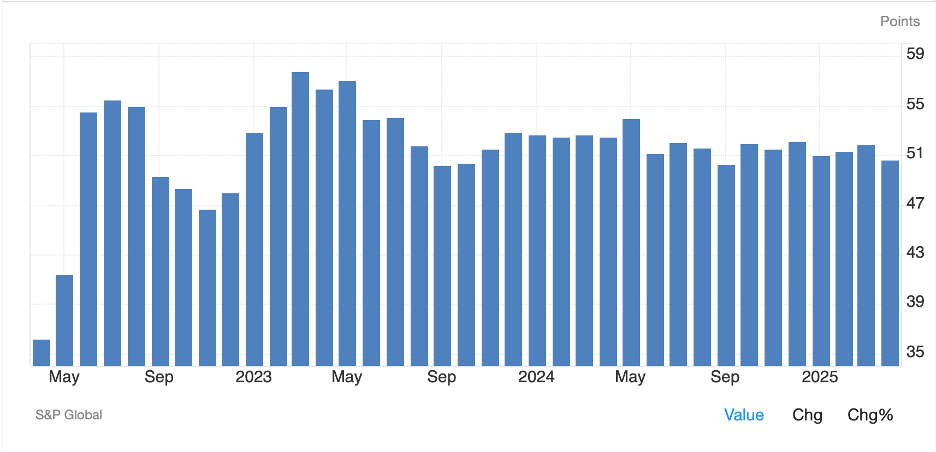

I don’t see PPI as having much impact, but Retail Sales will get some discussion as will the manufacturing indices as weakness there will help the negative narrative that some are trying to portray. Net, though, the story seems likely to continue to be the announcements of deals as they come in. It is not clear to me that they will all be net positives, and I believe that much positivity has already been absorbed so we will need to see data that backs up the narrative and that could take a few quarters. In the meantime, my lower dollar thesis seems to fit better today. That’s my story and I’m sticking to it!

Good luck

Adf