Last Friday it certainly seemed

The bears had achieved what they’d dreamed

Most bulls were in hell

As stock markets fell

While bears felt that they’d been redeemed

But since then, the narrative’s turned

And short-sellers all have been burned

In fact, round our sphere

Investors all cheer

For Jay to cut rates, Fed hawks spurned

The holiday spirit is alive and well this morning, and in truth has been all week. And not just in the US, but around the world. Literally, I am hard-pressed to find a stock market that has declined in the past twenty-four hours, with most on multi-day rallies. And so, I must wonder, has everything really gotten that much better in the world?

A quick tour around the world of problems extant includes:

- Russia/Ukraine war

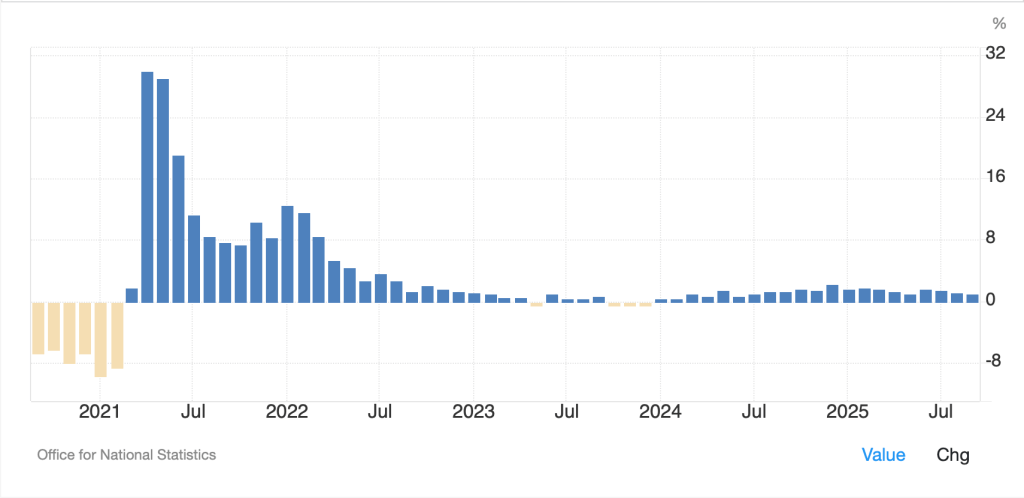

- Chinese property deflation

- Net zero insanity

- TDS

- K-shaped economies

- Rise of Socialism

- Excessive global debt/leverage

- Cost of living

I’m sure there are others, but I just wanted to touch on a few and try to figure out why investors have turned so positive. After all, a look at the S&P 500 chart below shows that we are less than 2% from the historic highs set back on October 29th.

Source: tradingeconomics.com

So, let’s run through the list.

- The war in Ukraine continues apace, although we cannot ignore the uptick in ostensible peace talks that have been occurring in the past week. I’m game to accept those talks as a positive.

- The Chinese economy continues to overproduce amid weakening domestic demand as property prices show no signs of bottoming. This is one of the major reasons for the massive global imbalances we have experienced over the past two decades and President Xi has basically proven that they only model he understands is mercantilism. With President Trump addressing that directly, this will continue to generate uncertainty and volatility, so there will be up days, but also plenty of down ones.

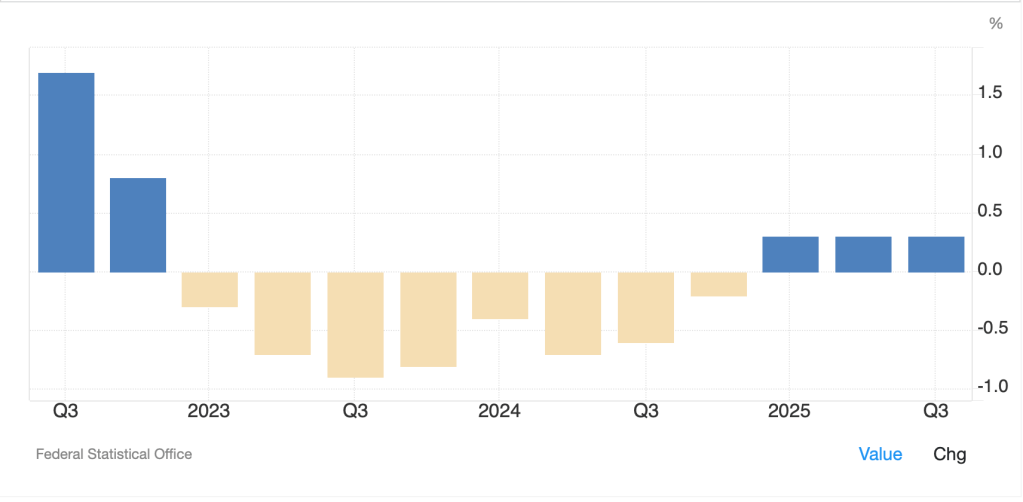

- The ongoing waste of resources in this Quixotic effort, especially by the Europeans will serve only to further depress their economies while adding debt to pay for their ill-advised policies. As long as this continues, Europe will be poorer in the future and that doesn’t bode well for their equity markets.

- Nothing will change TDS but its bifurcation of the population, and not just the US but globally, is likely to be a net negative for everything.

- The K-shaped economy is a major problem, and not one restricted to the US. As long as this remains the case, it will breed social unrest, as we continue to see, and have encouraged policies that have proven time and again to be disastrous, but sound good to those in the bottom leg of the K, i.e. Socialism. I assure you, Socialism will not enhance market capitalization.

- See above

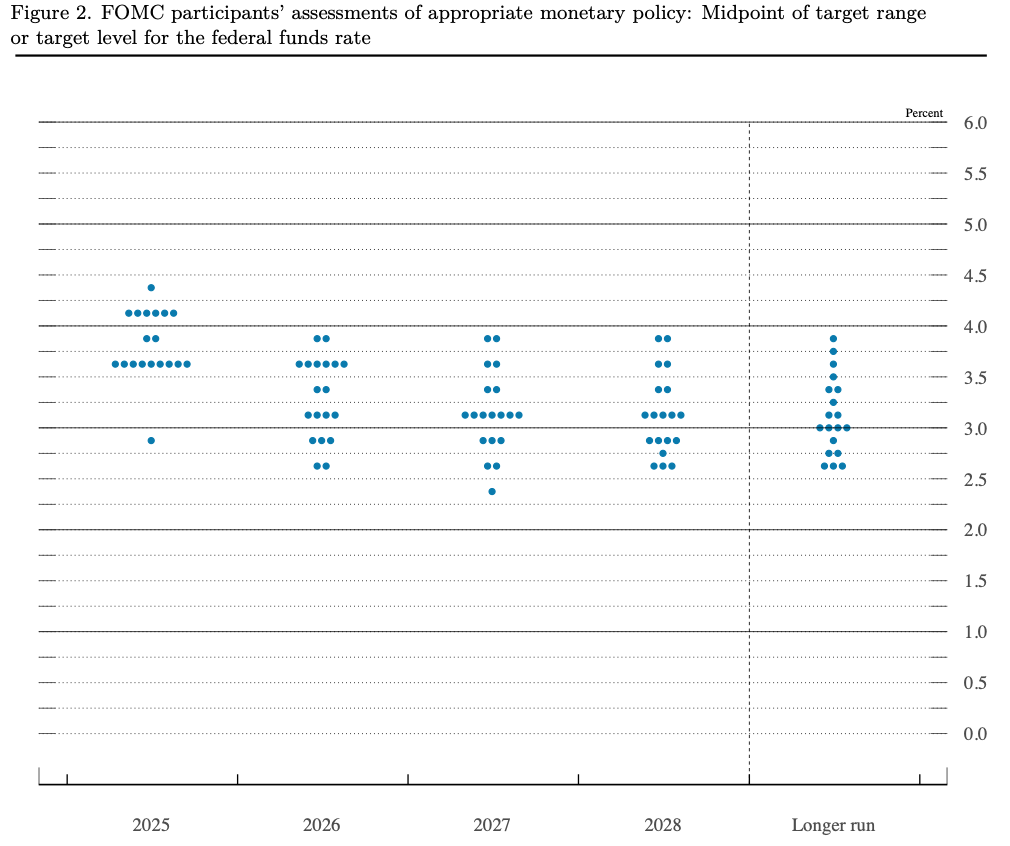

- The global debt problem continues to hang over the global economy like the Sword of Damocles, ready to decimate economies with just the right (wrong?) catalyst. Of course, this is why rate cuts are so favored, and QE more so, but while those may be solutions for government accounts, they will simply exacerbate the last on this list

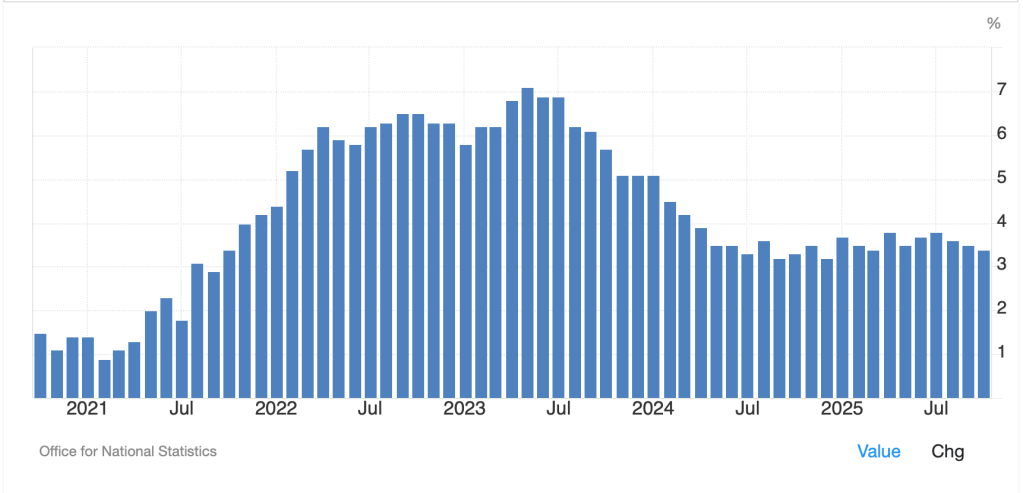

- I specifically point to the cost of living since the economists’ concept of inflation, the rate of change of prices, is irrelevant to most people. The price level is the key, and there is no world where the price level will decline absent a major depression, which is why run it hot is the favored plan. If growth can be raised sufficiently so that people believe life is affordable again, it will alleviate the K-shaped problem as well as the socialism problem. But that is a big IF.

And yet, as you can see from this screenshot from Bloomberg.com, as I type, every market is in the green.

My conclusion is that either investors have grown to believe that the key short-term problems, like Russia/Ukraine will be effectively addressed, or under the guise of YOLO, they are all in on AI and the stock market and see it as the only way forward. I wish I could be so sanguine, but then I am just an old misanthrope. I hope they are right!

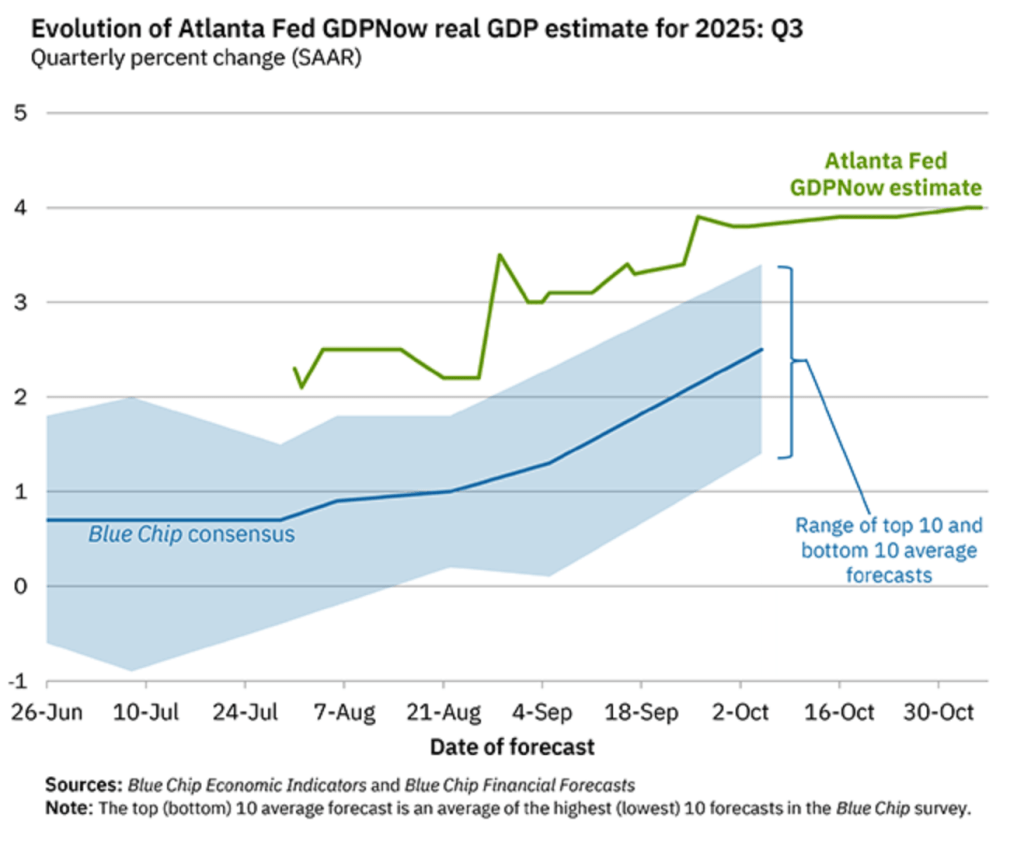

Ok, well, absent any real new news, and leading up to the Thanksgiving holiday here in the US, market signals are telling me everything is right with the world. You see the equity markets above, and US futures are higher as well at this hour (7:30), albeit only about 0.2%.

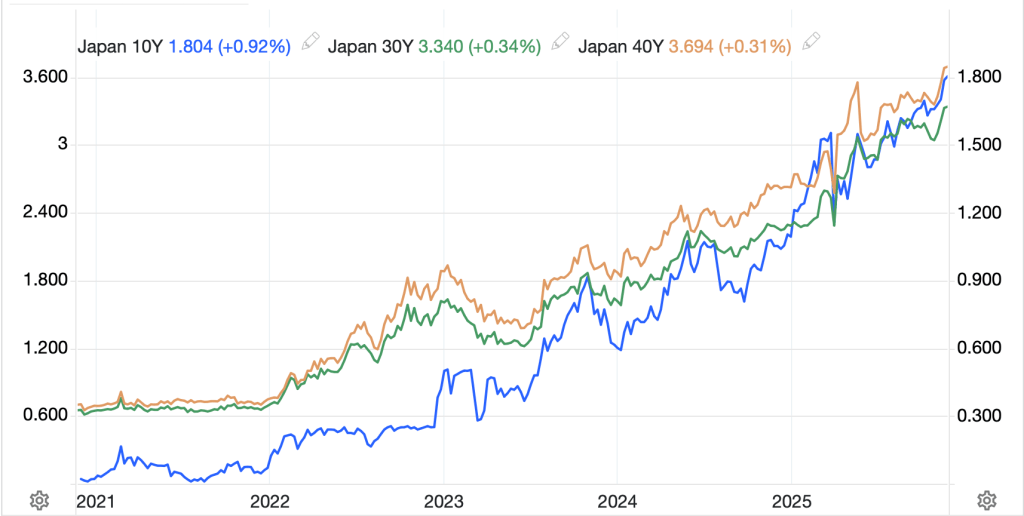

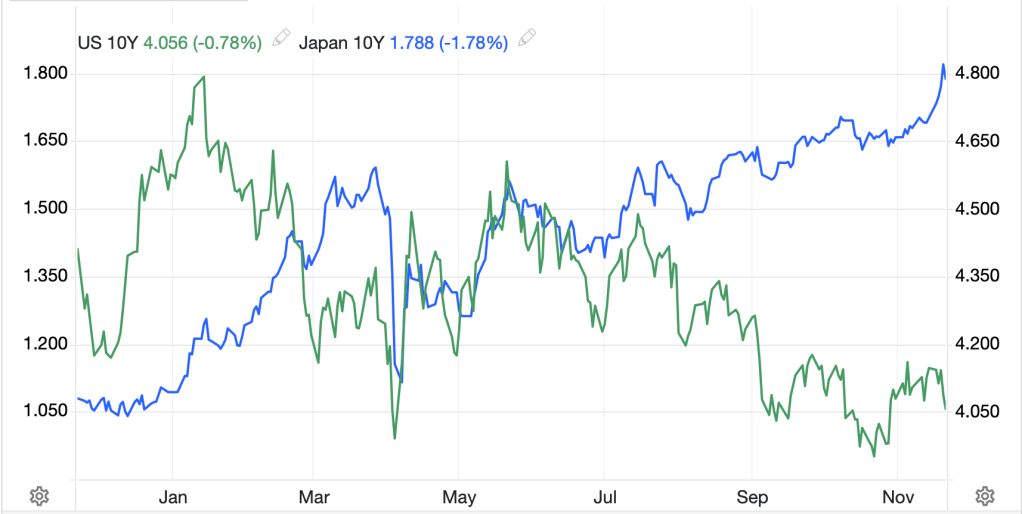

In the meantime, with risk in such demand, it is no surprise that bond yields are edging higher with Treasuries +2bps, after trading below 4.0% during yesterday’s session on a weak ADP weekly employment report (-13.5K) as well as PPI data that seemed less concerning. European sovereign yields have all edged higher by 1bp this morning, again synchronous with risk on, and JGB yields also edged higher by 1bp after the government there explained they would be borrowing ¥11.5 trillion (~$73.5 billion) in extra debt to fund Takaichi-san’s supplementary budget. The big outlier is Australia, where AGBs rose 10bps after CPI rose a hotter than expected 3.8% in October, not only putting paid any thoughts of a further rate cut but bringing rate hikes back into view.

In the commodity markets, oil (-0.2%) continues to slide lower, now below $58/bbl, and following its recent trend as per the below tradingeconomics.com chart.

Javier Blas, the widely respected Bloomberg oil analyst, put out an op-ed this morning explaining that he saw higher oil prices in the future. That is at odds with my view, but I have linked it here so you can help determine if his reasons make sense. I believe he underestimates both the impact of technology making it ever cheaper to get oil, and the political incentives to drill for more of the stuff by those nations that have it. Net zero will not survive much longer in my view.

In the metals markets, prospects for lower interest rates have helped encourage further buying and this morning we see the entire complex higher (Au +0.7%, Ag +1.5%, Cu +1.3%, Pt +1.0%). To the extent that the leverage story remains, and governments are going to continue to print money to pay their debts, metals prices across both precious and base, should continue to appreciate in price.

Finally, the dollar, which slipped a bit yesterday, is mixed this morning. the yen (-0.3%) is sliding along with KRW (-0.6%), but really, there seem to be more gainers than that. The biggest mover was NZD (+0.8%) after the RBNZ cut its base rate, as expected, but indicated the cutting cycle is over. AUD (+0.3%) has also rallied on that inflation report. I haven’t focused much on the renminbi (+0.1%) lately, largely because the daily movement is typically small, but if you look at the chart below, you can see that the trend has been steady all year, with CNY appreciating nearly 4% since the beginning of the year. There are many analyses that indicate the renminbi is massively undervalued, so perhaps this is part of the trade deal with the US. But it will be difficult for Xi to countenance too much strength as it will negatively impact his mercantilist policies.

Source: tradingeconomics.com

Lastly, the pound is gyrating this morning as Chancellor Rachel Reeves offers her budget. The highlights are a larger than expected fiscal buffer of £22 billion achieved by raising taxes by more than £29.8 billion on gambling and real estate. However, the recent history of tax hikes in the UK, as they try to tax the wealthy, is that the wealthy simply leave and the result is tax deficits. Maybe it really is different this time!

And that’s what we have going into the weekend. Data today brings September Durable Goods (exp 0.3%, 0.2% ex transport), Initial Claims (225K), Continuing Claims (1975K) and Chicago PMI (44.3). I see no reason for this recent rebound to end as clearly everybody is feeling good into the holiday. As I highlighted above, there remain myriad problems around, none of which will be solved soon, but apparently, that doesn’t matter. So go with it!

There will be no poetry tomorrow or Friday so Monday, we will see how things have evolved.

Good luck and have a great holiday weekend

Adf