It turns out the market ignored

Chair Powell, though many abhorred

The idea the Fed

May soon need to shred

Its views under Damocles’ Sword

So, stocks rose and set more new highs

And bonds ignored all the shrill cries

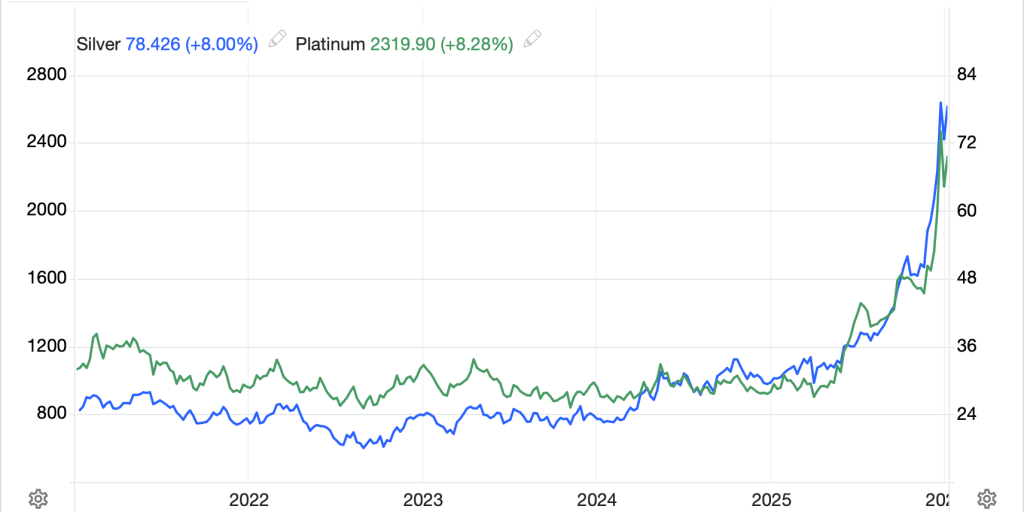

But metals retained

The heights that they gained

How long ere the bears euthanize?

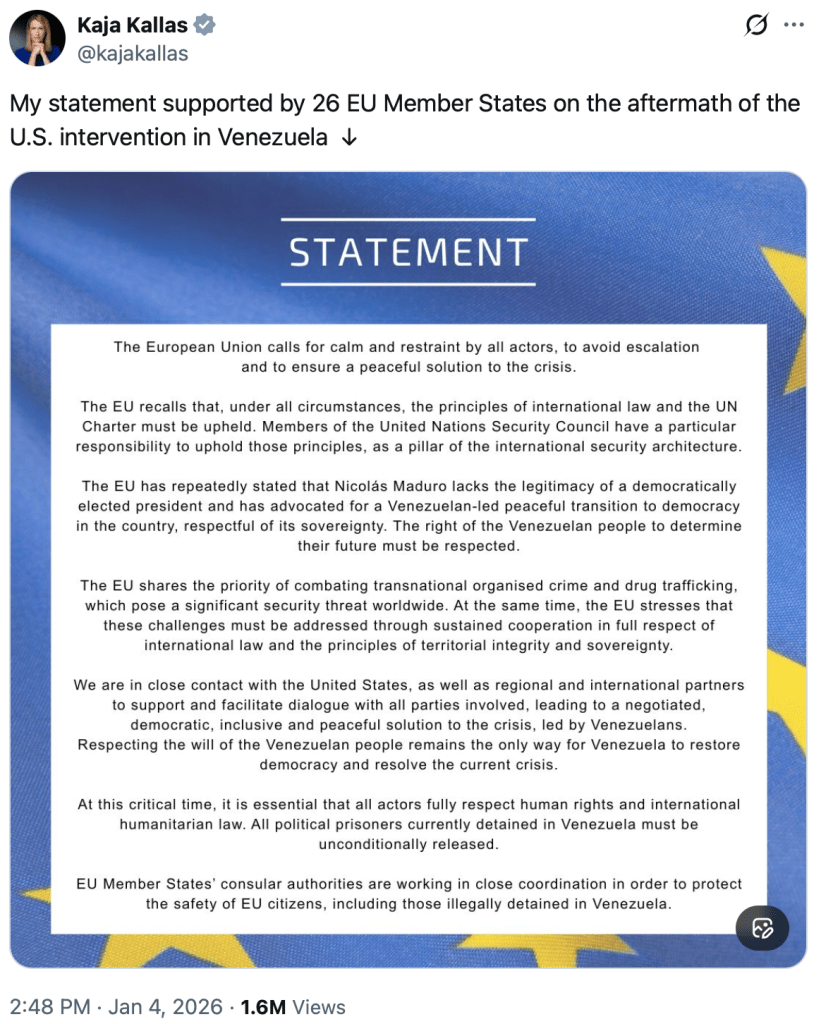

Yesterday, of course, the big news was the Powell video describing the subpoenas that he and the Fed received on Friday. This continues to be seen as an attack on the Fed’s “independence” and the talking heads remain aghast. I couldn’t help but chuckle at 12 current central bankers from around the world putting out a statement that this was a terrible precedent. Consider that most people have no idea who any of the signees are, so they hold no reverence for their views, and the people who do know them, are already in the camp. Of course, I cannot help but remember the statement by 51 former FBI/CIA security apparatus people explaining that Hunter Biden’s laptop had all the earmarks of Russian disinformation. My point is this type of response is not necessarily the unvarnished truth. I wasn’t at the Senate committee meeting and do not recall what he said, if I ever heard it, so am in no position to judge what went on. I guess, that’s what a grand jury is all about, to determine if there are sufficient grounds to go forward with a charge. Again, this is a Washington DC grand jury, who will be biased against anything President Trump’s administration is doing. I put it at 50/50 that any charges are even brought.

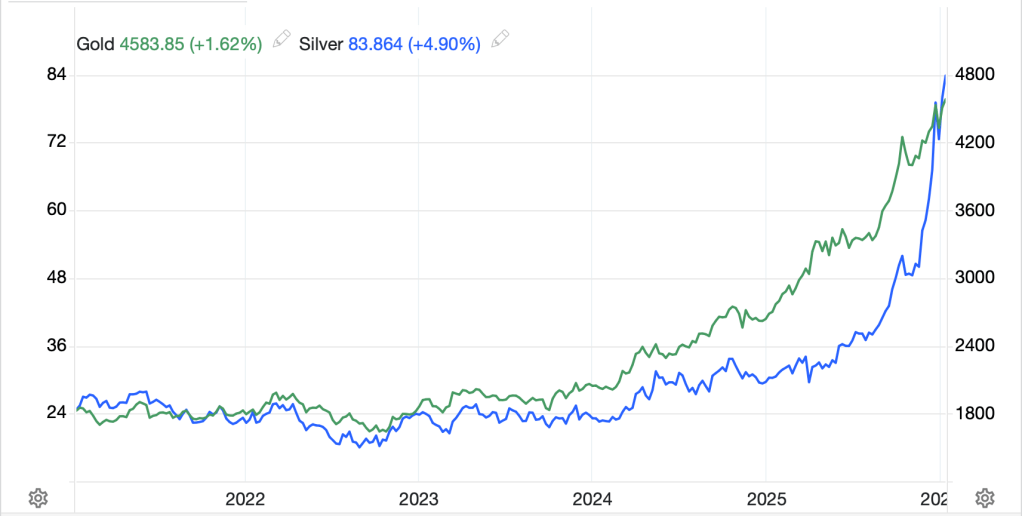

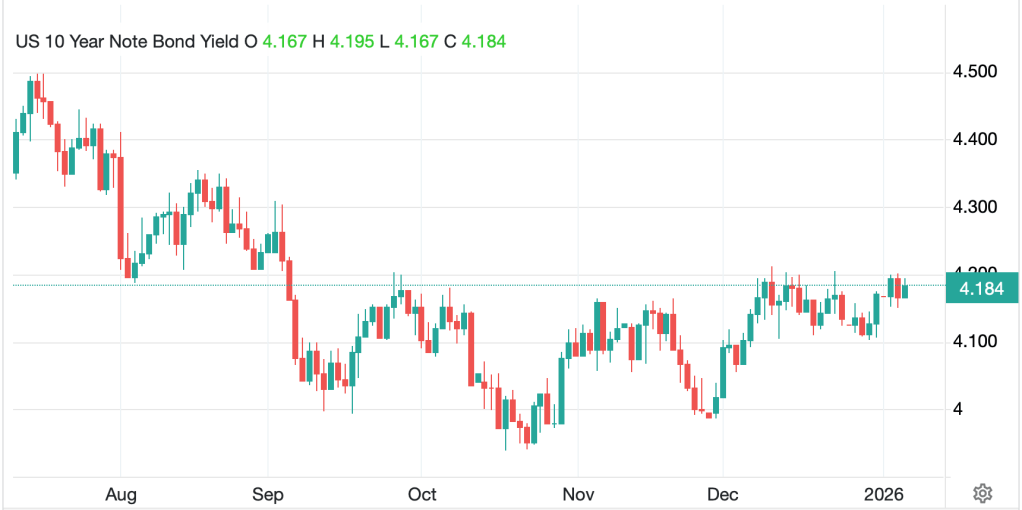

Meanwhile, despite all the angst, equity markets rebounded all day to close higher, bond markets absorbed a 10-year auction with little concern and yields were within 1bp of the morning levels while the dollar, which had initially fallen about -0.4% to -0.5% on the news, clawed back a part of that loss, and is slightly firmer this morning. The only real outlier here were the precious metals markets where both gold and silver had monster days trading to new highs. Such was yesterday.

Takaichi-san

Like a hungry boa, wants

To tighten her grip

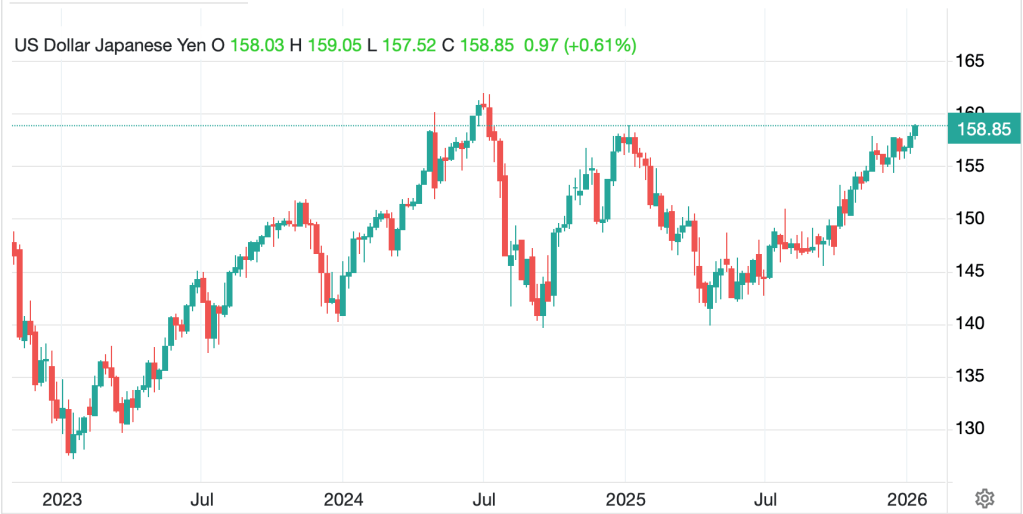

First, my error in yesterday’s note regarding the Japanese stock market on Monday, which was actually closed for Coming of Age Day, but overnight did jump 3.1% on the news that PM Takaichi, she of the 70+% approval rating, is going to call for snap elections to try to consolidate her power more effectively in the Lower House of the Diet. While the announcement has not officially been made, it has been widely reported that on January 23rd, she will dissolve parliament and seek an election on either February 8th or 15th.

The market response here was quite clear. Aside from the jump in equity prices based on more government support for her fiscal spending, the yen (-0.5%) fell to its lowest point in more than a year and now, trading near 159, is seen as entering the ‘intervention range’. A look at the chart below shows that in July of last year, the last time the yen weakened to this level, we did see the BOJ enter the market and it was quite effective in the short run. If I recall correctly, there was a great deal of discussion then about the end of the carry trade. Of course, that didn’t happen, and even though the BOJ has increased rates to 0.75% in the interim, I assure you, the carry trade is still out there in very large size.

Source: tradingeconomics.com

I expect that this evening we will hear more from the FinMin and her deputies regarding concerns over ‘one-sided’ moves and the need for the yen to represent fundamentals, but I sincerely doubt that there will be any activity before 160 trades, and maybe even 165.

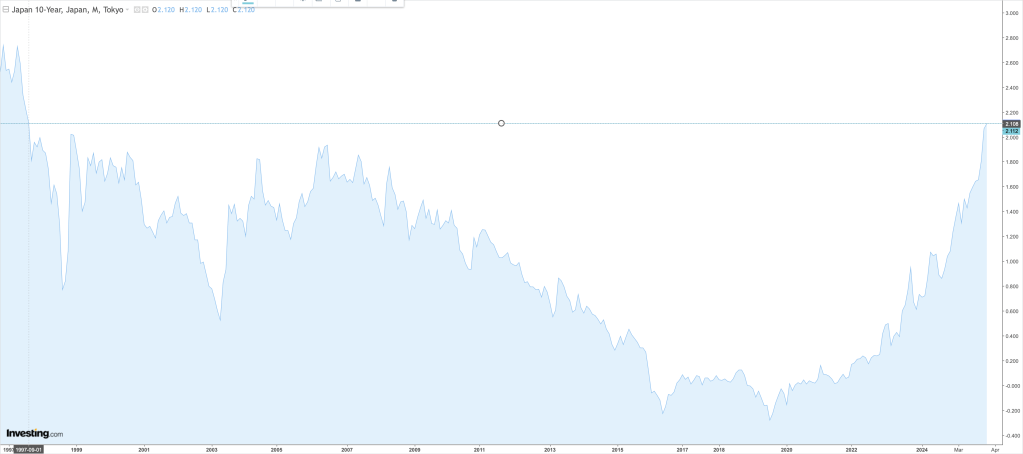

Perhaps of greater concern for Takaichi-san is that JGB yields rose sharply on the news with the 10yr (+7bps) rising to a new high for this move, while the super long 40-year traded to 3.80%, higher by 9bps and a new all-time high for the bond. Japan has serious financing issues and has had them for quite some time. However, two decades of ZIRP and NIRP hid the problems as financing costs were virtually nil. As a net creditor nation, they also have inherent strengths with respect to international finance, although it remains to be seen if the population there will accept the idea that their savings need to be used to pay down government debt.

As we have seen across many markets, the old rules and relationships don’t seem to apply these days. The fact that Japanese yields are climbing far more quickly than US yields, with the spread narrowing dramatically, in the past would have seen a much stronger yen. As well, rising yields tend to undermine equity markets, and yet, they sit at record highs. This is not the world in which many of us grew up.

Ok, as we await this morning’s CPI data, let’s see how other markets behaved overnight. While yesterday’s US gains were modest across the board, they were gains after a terrible start. Meanwhile, in addition to Tokyo’s rally, we saw HK (+0.9%), Korea (+1.5%), Taiwan (+0.5%) and Australia (+0.6%) all rally although both China (-0.6%) and India (-0.3%) lagged. It appears the latter two suffered from some profit-taking (although Indian shares have not really performed that well) while the gainers all benefitted from the US rally and ongoing excitement over tech shares. In Europe, though, every major market is softer this morning although only Paris (-0.6%) is showing any substance in the decline. Elsewhere, declines of -0.1% to -0.3% are the order of the day, hardly groundbreaking, and given most of these markets have had a good run, it seems there has been some profit-taking ahead of this morning’s CPI data. As to US futures, at this hour (7:00) they are basically unchanged.

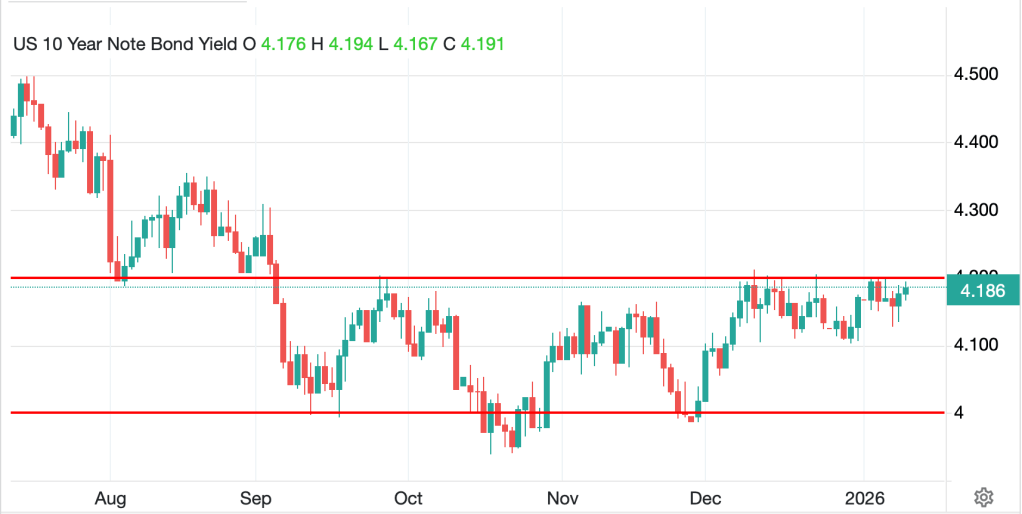

In the bond market, this morning yields are edging higher everywhere with Treasury yields (+2bps) now touching the top of its forever range at 4.20%. European sovereign yields are uniformly higher by 2bps as well although there has been no data of note nor commentary to really offer a rationale. Of course, 2bps is hardly earth shattering.

In the commodity markets, while precious metals (Au -0.2%, Ag +0.75%, Pt -1.1%, Cu +0.5%) have been the headline story, the oil market has taken a back seat. Quickly, on the metals side, it seems that the supply scarcity remains the main driver overall, and the fact that there is limited new exploration, let alone new mines coming online, ongoing, my take is these have further to climb.

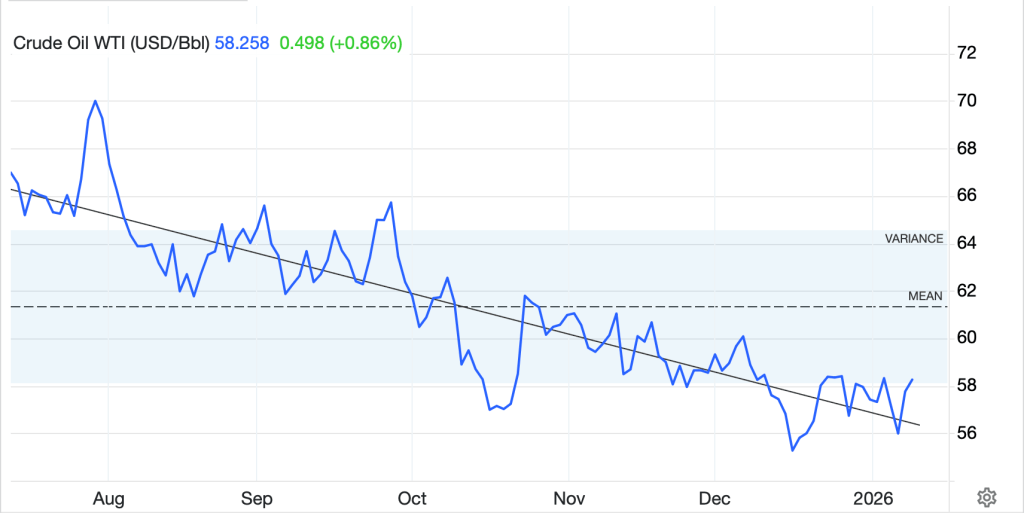

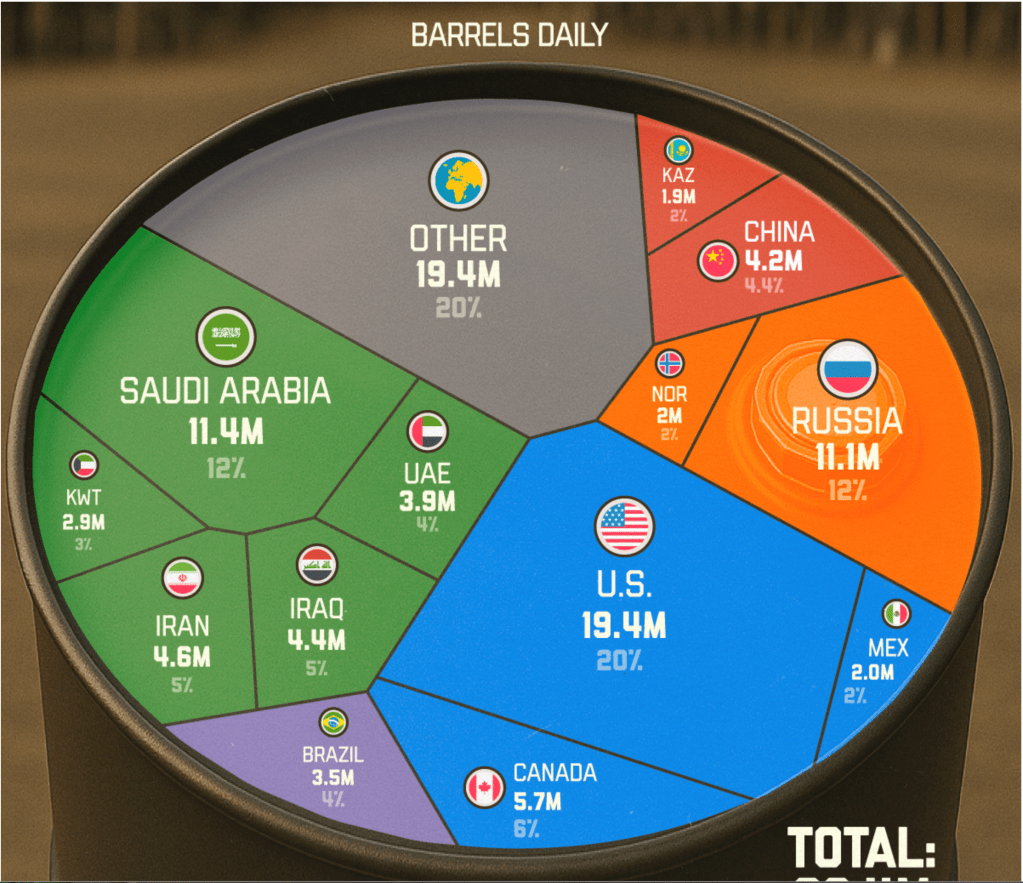

But oil is quite interesting. You all know my view that the trend remains lower, but today, it is bucking that trend with WTI (+1.9%) up nicely and back above $60/bbl for the first time since mid-November. A look at the chart below shows that using my, quite imperfect, crayon if I ignore the massive Operation Midnight Hammer spike, even after a few solid up days, oil remains well within its down trend. I am no technician, so others will draw lines as they see fit, but I am looking at longer term views, not day-to-day or intraday.

Source: tradingeconomics.com

My take is that the Venezuela story has evolved into increased production from there will take quite a long time, so ought not pressure prices lower. Rather, I would lean toward the ongoing uprising in Iran as the proximate cause for today’s recent gains. After all, if the regime falls, and the Mullahs exit for Moscow, it is unclear who will fill the power vacuum and what will come next. As such, it is easy to anticipate a reduction in Iranian supply, which is currently about 3.2mm to 3.5mm barrels/day (according to Grok), and if that goes missing, or even is cut in half, would have a significant short-term impact on the price.

Regarding this situation, obviously I have no special insight. However, the most interesting thing I read, and why I believe this will indeed be the end of the theocracy, is that the protestors have burned down 350 mosques, a direct attack on the belief system of the Ayatollah. This appears quite widespread, and it would not surprise me if the regime falls before the end of the month. Good luck to the people of Iran.

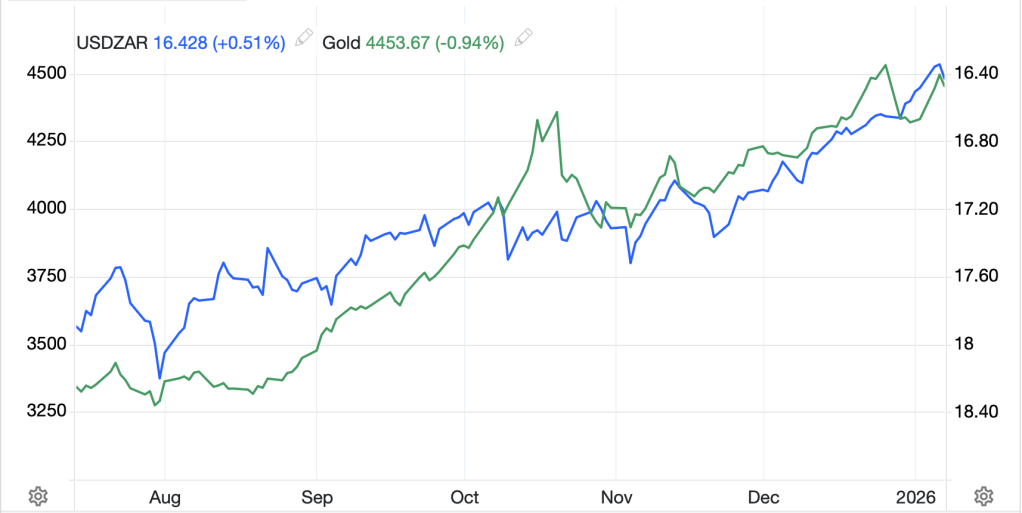

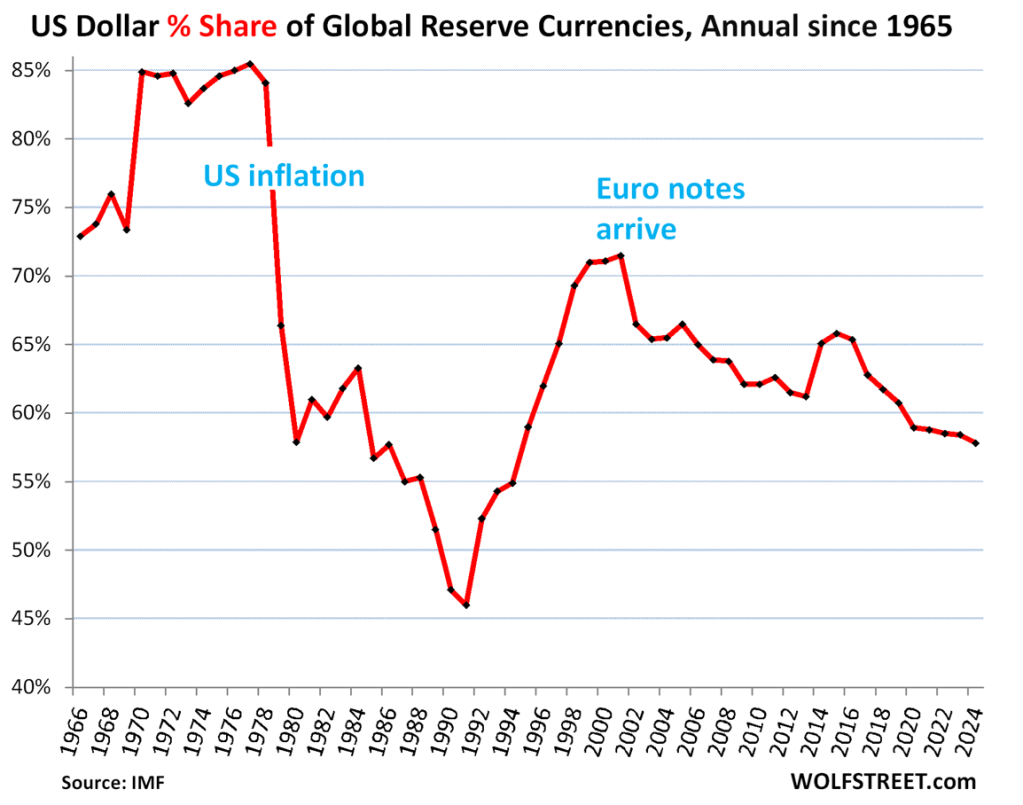

Finally, the dollar is little changed this morning other than against the yen. For the dollar bearish crowd, which is quite large as doom porn about the end of the dollar’s hegemony remains quite popular, yesterday’s decline was tiny. In fact, if we use the DXY as our proxy, it is higher by 0.1% this morning and trading just below 99.00 as I type. Once again, if we look at the chart below, it has been 9 months since the DXY has traded outside the 97/100 range in any substantive manner and we are basically right in the middle. Nobody really cares right now.

Source: tradingeconomics.com

Turning to the data this morning, CPI (Exp 0.3%, 2.7% Y/Y) for both headline and core leads the list. This is December data, so as up to date as we will get. We also see stale New Home Sales data, but it is hard to get excited about that. The NFIB Small Business Optimism Index already printed right at expectations of 99.5.

It’s funny, despite all the discussion of the Fed regarding the Powell subpoena, Fed speakers don’t seem to be getting much traction. Yesterday, three speakers indicated that rates seemed to be in a good place, and, not surprisingly, all defended Chairman Powell. My view at the beginning of the year was that the Fed was going to become less important to the market dialog and in truth, that remains my view. Rate cut probabilities have fallen to 5% for this month with the next cut priced for June. Obviously, that is a long time from now and much can happen, but if the data showing GDP is accurate, it seems hard to understand why there would be a cut at all. Too, remember one of the key theses behind dollar weakness was Fed dovishness. If the Fed is not so dovish, tell me again why the dollar should decline.

It’s a crazy world in which we live. Hedgers, stay hedged. The rest of you, play it close to the vest.

Good luck

Adf