For one day the markets expected

That tariffs were roundly rejected

But late yesterday

Trump said the delay

Was short with two nations affected

The upshot is all of that hope

That saw the buck slide down a slope

Has largely reversed

As dollar shorts cursed

That tariffs are not a Trump trope

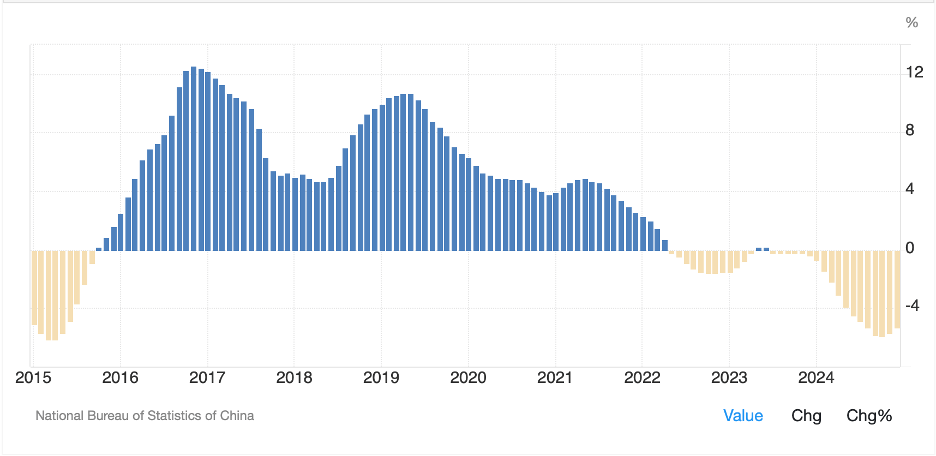

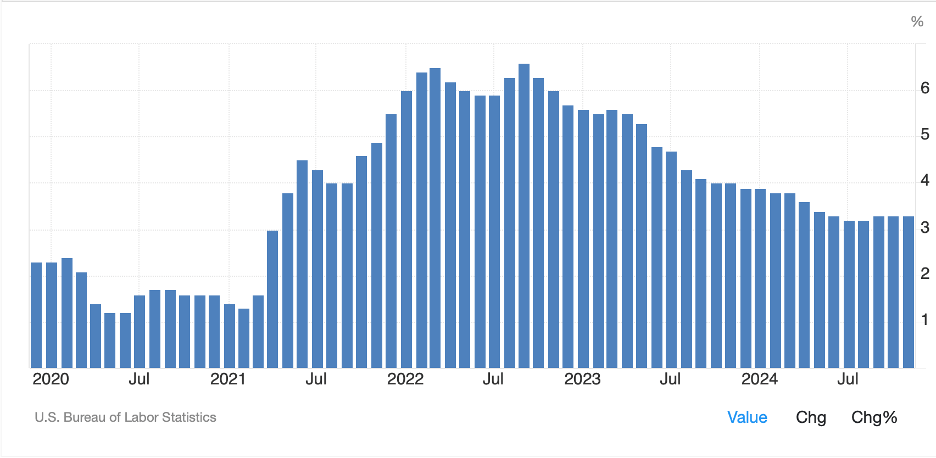

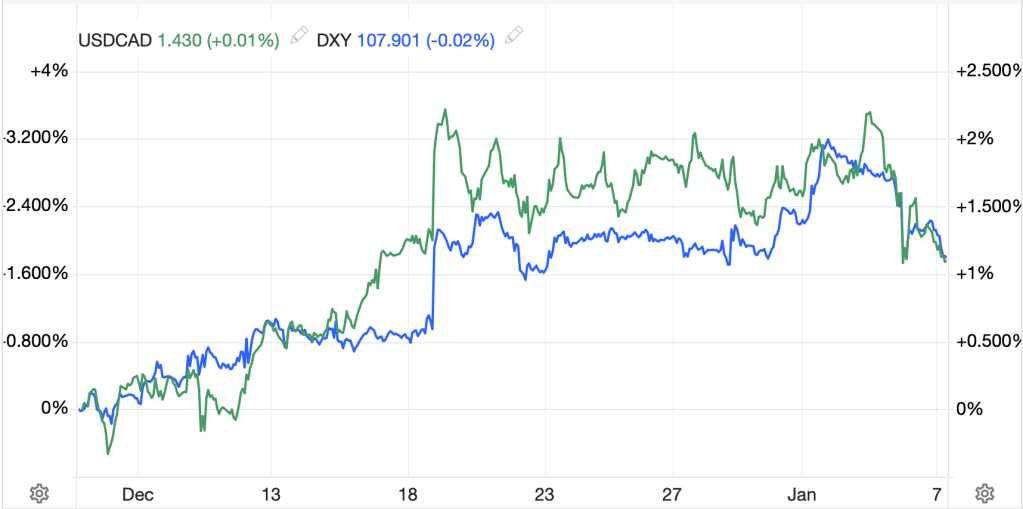

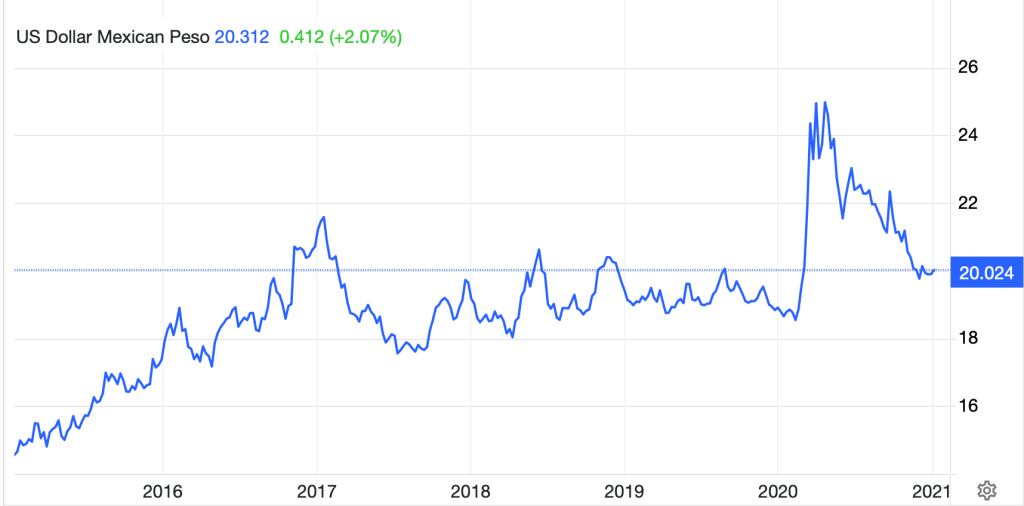

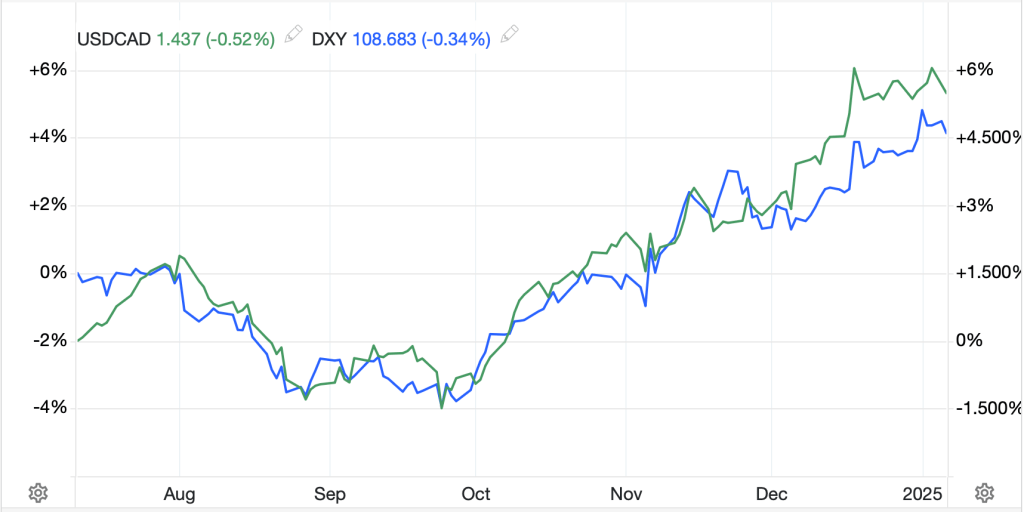

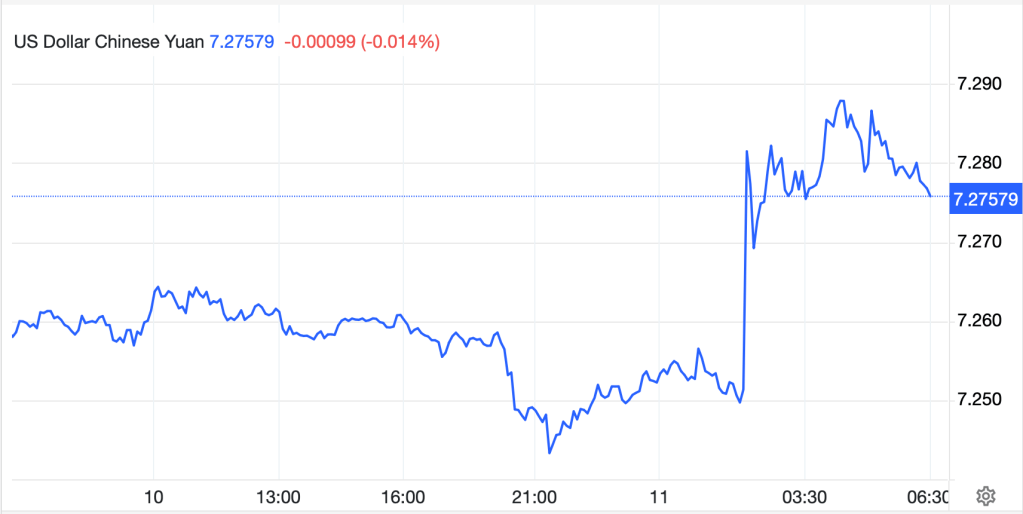

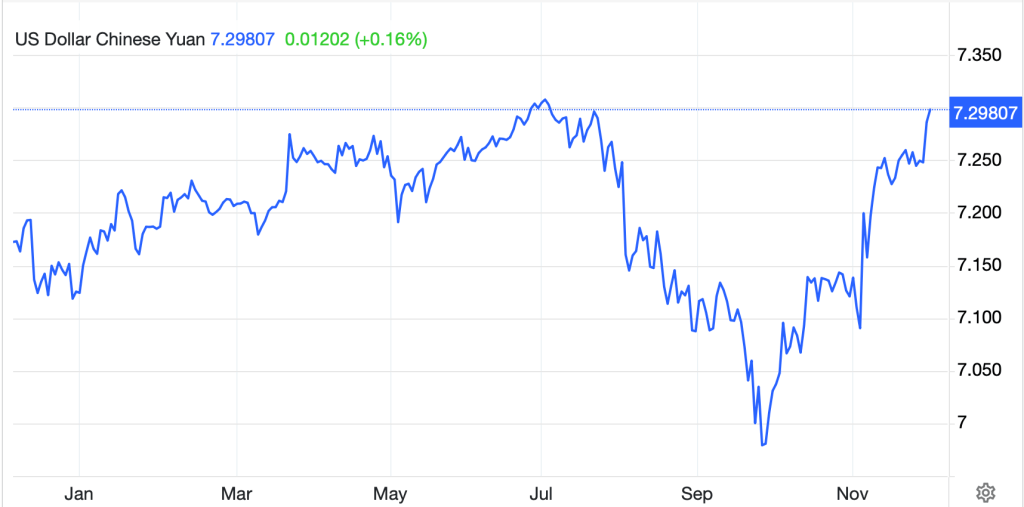

This poet feels vindicated in not trying to anticipate what President Trump is going to do that might impact markets after yesterday’s events. Early in the day there was a story that tariffs would be delayed and were seen as negotiating tools, not punishment. FX traders (mis)read the room and sold the dollar aggressively, with the greenback suffering declines of more than 1% against some currencies, notably MXN. Then, Mr Trump was inaugurated, made a speech, where he promised to make many changes within the operating system of the US, signed a load of Executive Orders and mentioned in a press conference much later in the evening that 25% tariffs on Mexico and Canada would be coming on February 1st. The chart of USDMXN below shows the price action with the peso having given back the bulk of yesterday’s gains.

Source: tradingeconomics.com

Once again, if we learned nothing from Trump’s first term, it is that anticipation of his moves is a very fraught and dangerous way to manage market risk. Now, will those tariffs actually be implemented? Will they be universal if they are? Or does he anticipate changes from behavior by both nations in the next 10 days? The answer is, nobody knows, probably not even Trump. The upshot is if you have financial market risk, hedging is critical to maintaining acceptable outcomes. And, oh by the way, look for implied volatility of all financial products to rise as market makers also have no idea what is going to happen so will require hedgers to pay up for protection.

In Davos, the world’s glitterati

Are meeting, and though they are haughty

They’re losing their splendor

And edicts they render

Are sinking in value like zloty

While there is a great deal more that President Trump has promised to do immediately, the bulk of it seems likely to only have potential longer-term impacts on financial markets. Meanwhile, in Davos, the World Economic Forum is under way and the main message that I can discern from what I’ve read is that, the members really liked it when everybody listened to what they said and are now really unhappy that President Trump is essentially raining on their parade and devaluing their views and comments. With Trump withdrawing from the Paris Climate Accords and the WHO, key global initiatives are severely hamstrung, which means the WEF is less important. And all their pronouncements regarding the need free trade and global cooperation has far less impact if the US has decided to focus on itself rather than the world at large. My forecast is that by the end of Mr Trump’s term, the WEF will be a sideshow, not a headline event.

And really, at this point, that is pretty much what is happening. Yes, UK Unemployment rose to 4.4% while wages rose 5.6%, but this has simply put the BOE in a tougher spot. The Old Lady has only an inflation mandate, but if Unemployment is rising, they cannot ignore that, and the market is now far more convinced (82% probability) that they will be cutting the base rate by 25bps at their meeting the first week of February. While the pound (-0.8%) is lower this morning, that seems much more about the dollar’s overall strength than this weaker than expected data point as since the release, the pound has fallen only another 0.2%.

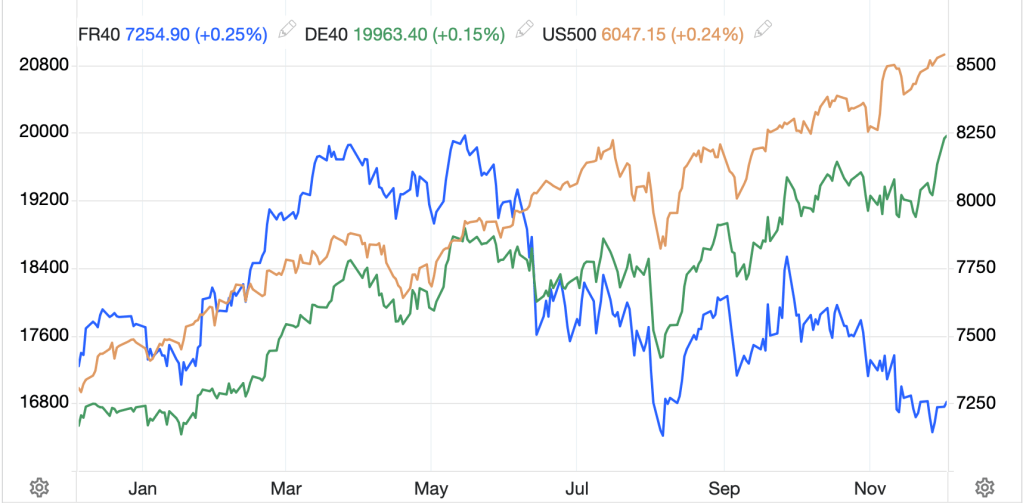

So, let’s look around the world and see how markets responded to Trump 2.0. Equity markets in Asia were largely in the green as neither Japan nor China were mentioned on the immediate tariff list, although the late-night proclamation regarding Canada and Mexico implies that this story has not yet been completed. Nonetheless, gains in Japan (+0.3%), Hong Kong (+0.9%) and China (+0.1%) showed the way for most of the region with only India (-1.6%) really suffering during the session on a variety of fears regarding tariffs and interest rates despite no mentions by Trump. In Europe, only Spain’s IBEX (-0.5%) is showing any movement of note and that appears to be specific to some slightly softer than expected corporate earnings results. Surprisingly, Germany and the rest of the continent are little changed, as is the UK. As to US futures, at this hour (7:10) they are pointing higher by about 0.4% in anticipation of more earnings reports today and a generally positive attitude from the new president.

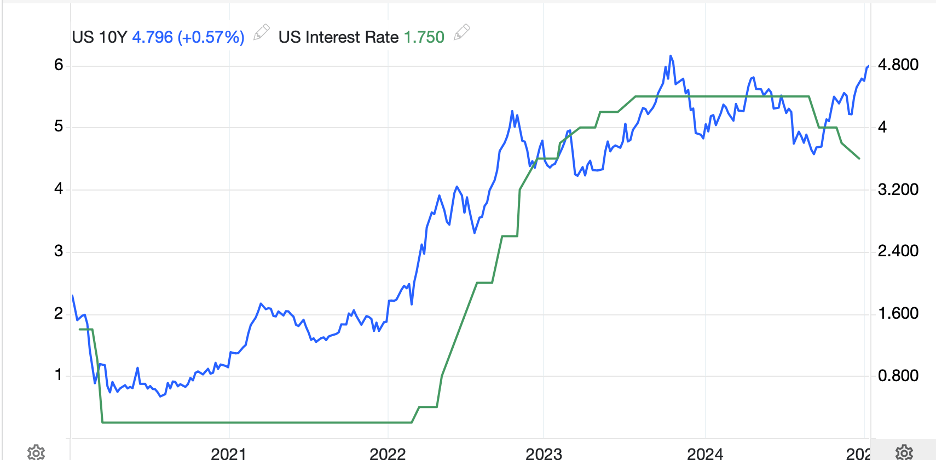

In the bond market, Treasury yields have fallen 5bps overnight, seemingly on the idea that because Trump announced the government would do all it can to reduce prices, and therefore inflation, it would magically work. While I am optimistic things will get better, that is a heavy lift in my opinion and the Fed will need to be far more emphatic on its inflation fighting actions to see this through. In Europe, yields are basically unchanged across the board and similarly, there was no movement in Asia overnight. Once again, the world is looking toward the US for directional cues.

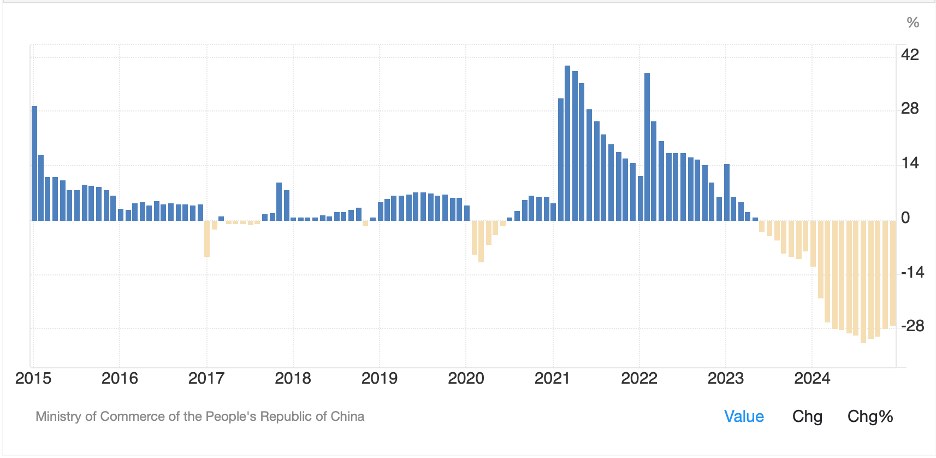

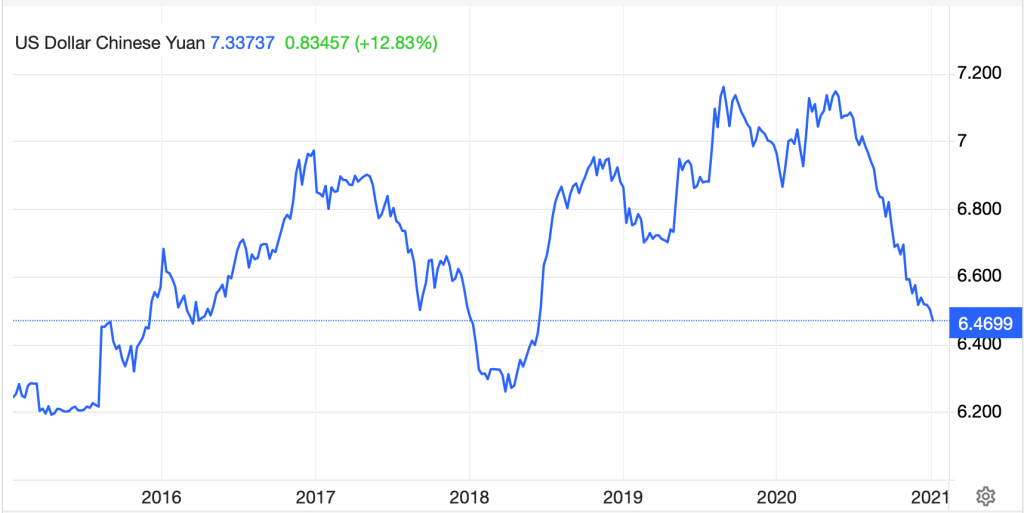

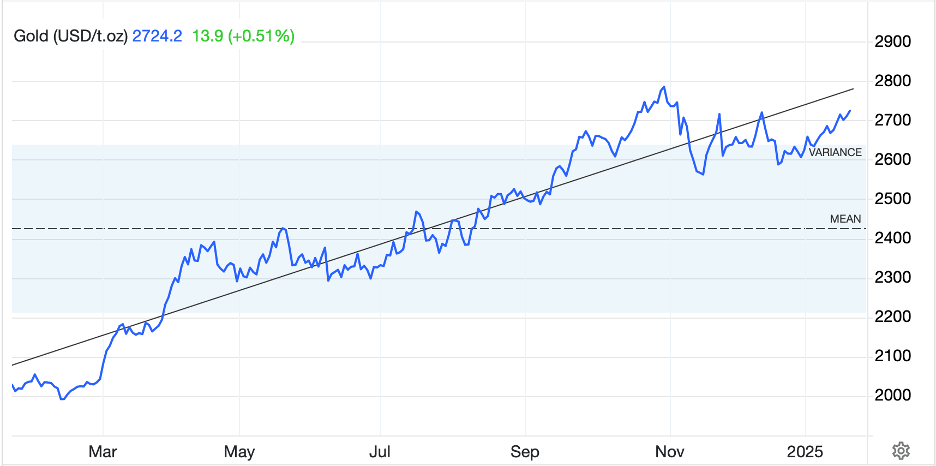

In the commodity markets, oil (-1.3%) is sliding back as Trump’s promise to open up more drilling spaces on federal land as well as his overall encouragement of ‘drill, baby, drill’ has traders concerned that supply is going to come around more quickly than demand. Last January I wrote about my view that there is plenty of oil and it is merely political will that prevents it from being accessed. I have a feeling that is what we are going to begin to see, a change in that political will which means potentially lower prices and increased demand accordingly. In the metals markets, gold (+0.5%) is continuing to climb as we approach month end. There are many in this market who believe the technical picture (see chart below) is pointing to a break to new all-time highs soon. However another, and perhaps more accurate narrative, is that there is an arbitrage between the NY, London and Shanghai exchanges for physical metal and metal is flowing into NY for delivery which begins next Friday. (H/T Alyosha)

Source: tradingeconomics.com

As to the other metals, they are little changed this morning.

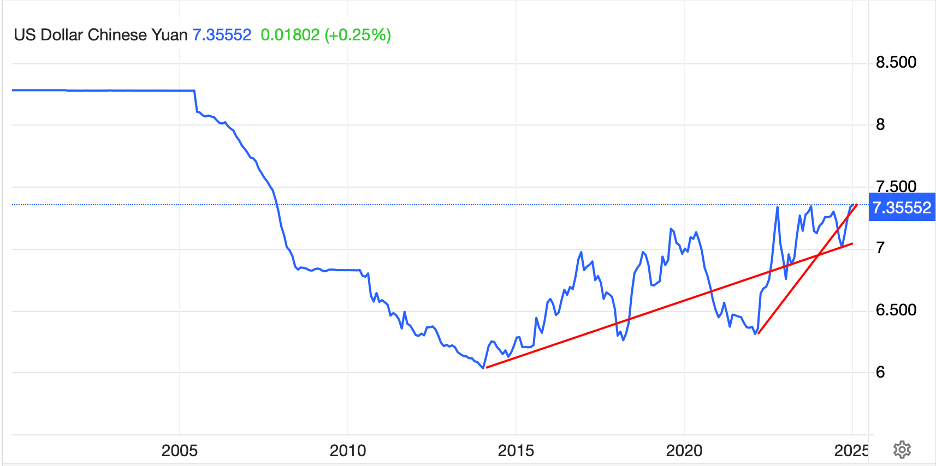

Finally, as mentioned at the top, the dollar is much firmer across the board this morning with the peso and NOK (-1.0%) leading the way lower although most currencies seem to be down by at least -0.5%. (Yes, PLN is weaker by -0.6%). This is all dollar-driven with no other idiosyncrasies of note right now. We shall see how this evolves over time.

On the data front, the rest of the week looks like the following:

| Wednesday | Leading Indicators | 0.0% |

| Thursday | Initial Claims | 218K |

| Continuing Claims | 1860K | |

| Friday | Flash Manufacturing PMI | 49.6 |

| Flash Services PMI | 56.6 | |

| Existing Home Sales | 4.16M | |

| Michigan Sentiment | 73.2 |

Source: tradingeconomics.com

The Fed is in its quiet period so with the lack of data, I suspect that markets will have heightened awareness to every Trump pronouncement with volatility the new normal. Remember, consistency is not his strong suit, at least when it comes to commentary about how he may respond to things.

From the market’s perspective, as long as tariffs are still seen as the likely outcome, look for the dollar to remain well bid while equities will see a mixed performance depending on the nature of the company/industry with importers likely suffering.

Good luck

Adf