The story that’s tripping off lips

Is whether the buildup in ships

And aircraft we’ve seen

Is likely to mean

A war with Iran’s in the scripts

But markets are not all in sync

As equities clearly don’t think

That war would be trouble

While bond traders’ double

Their bets war will drive stocks to drink

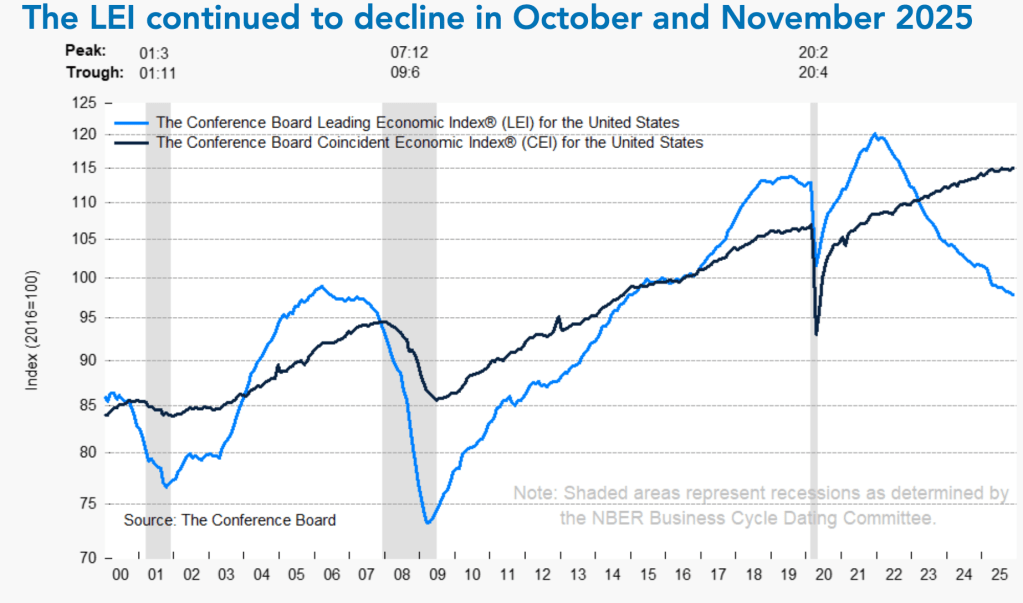

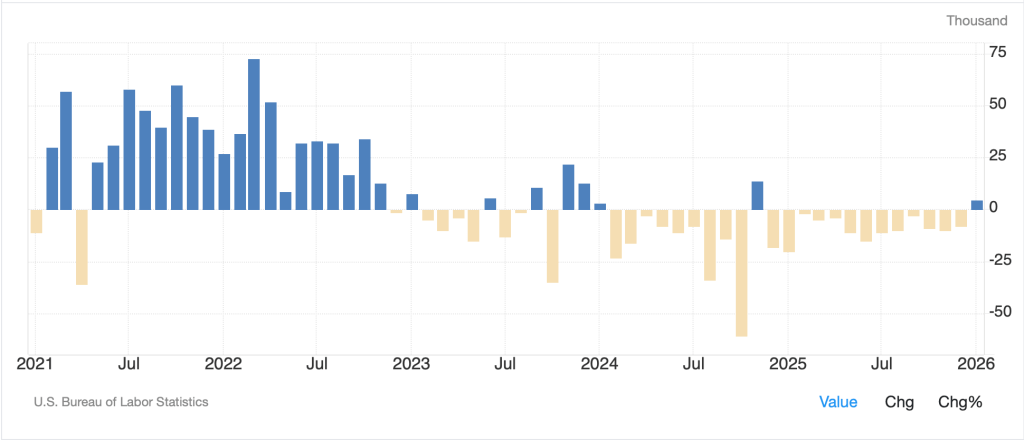

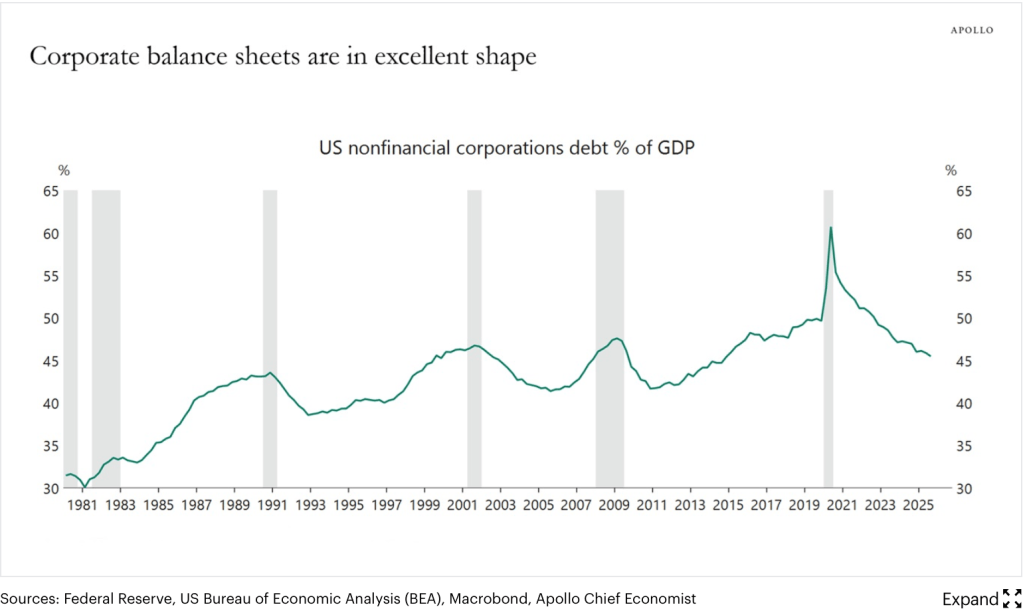

Economic data is clearly not a key driver of market movement these days, arguably because we continue to get mixed outcomes, with some things looking good (Initial Claims, Philly Fed) while others are less positive (Trade Balance, Leading Indicators), although granted, it is not clear to me what the Leading Indicators purpose is anymore. My point, though, is that we have not seen unambiguous strength or weakness across the data set for several months. This allows every pundit to frame the economic situation through their own personal lens, whether bullish or bearish. A perfect example is the dichotomy between the strength of US corporate balance sheets, as per Torsten Slok and seen below,

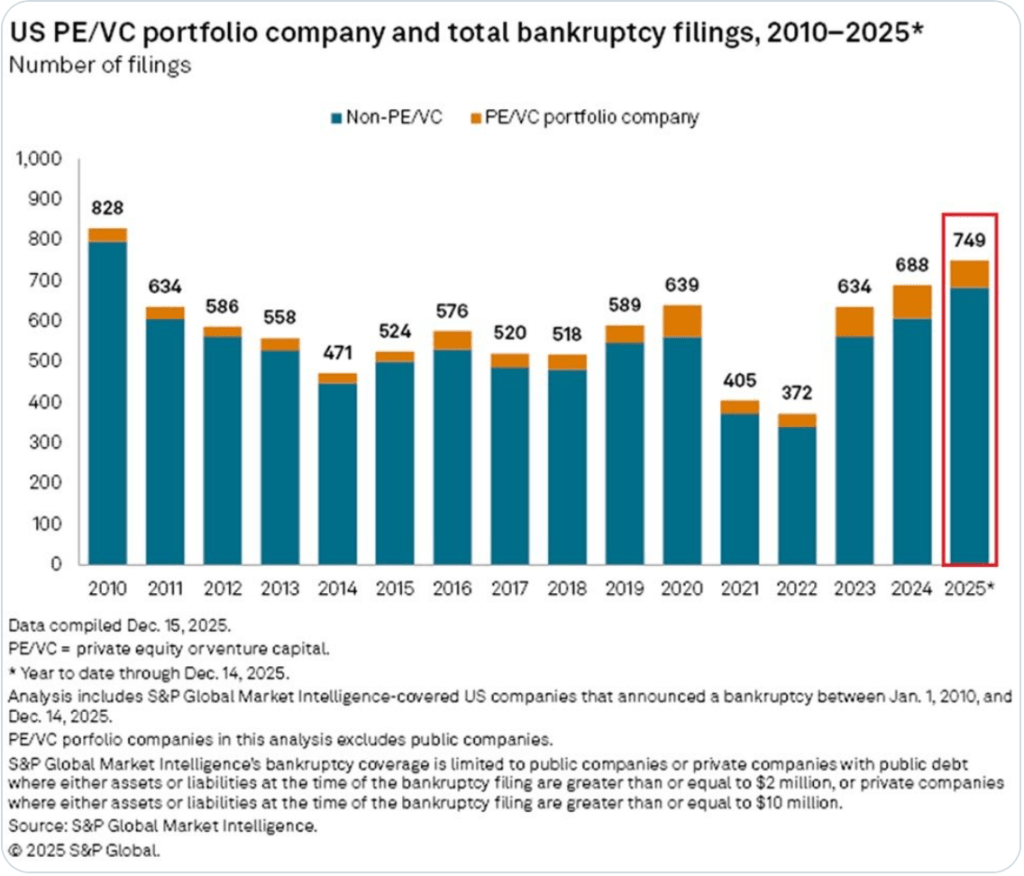

and the rise in corporate bankruptcies as per this X post from The Kobeissi Letter (a great follow on X) which shows the following chart.

So, which is it? Are things good or bad? My understanding is that strong balance sheets and a high number of bankruptcies are not typically correlated, but I could be wrong.

Given the lack of direction, markets have turned their focus to other things, with most headlines currently garnered by the ongoing buildup of US military power in the Middle East as President Trump tries to pressure Iran into ceding its nuclear and missile programs. (Of course, the announcement that all information on UAP’s (fka UFO’s) has many excited, and of course, the Epstein files continue to garner attention, as does the SAVE Act, but none of those are even remotely related to financial markets.)

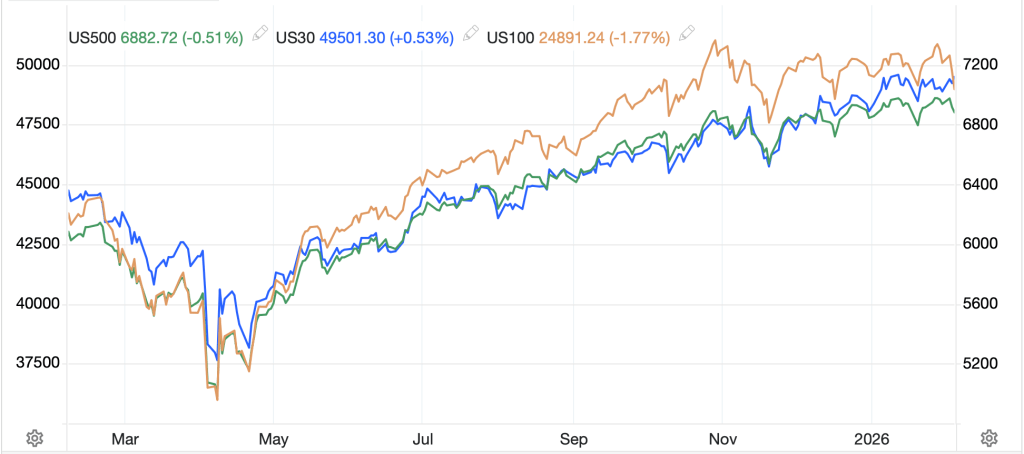

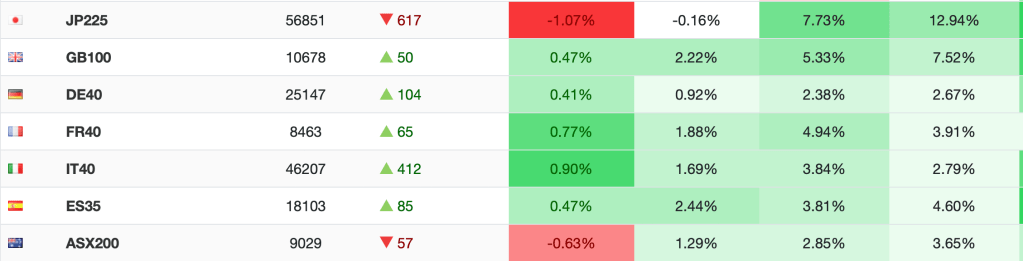

But even here, we are seeing very different responses by the financial markets. For instance, equity markets continue to perform pretty well, even though Tokyo and Australia sank a bit last night. Look at the monthly and YTD returns in Europe, Japan and Australia below:

Daily Weekly Monthly YTD

Source: tradingeconomics.com

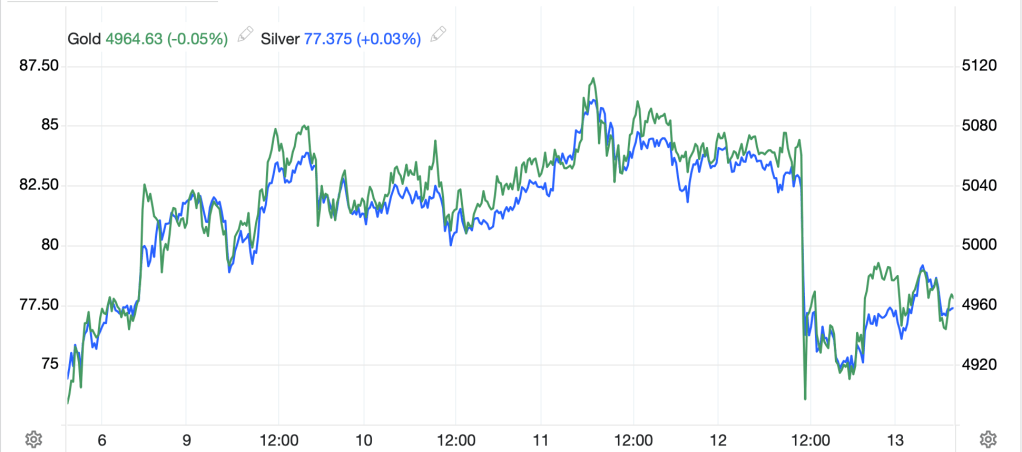

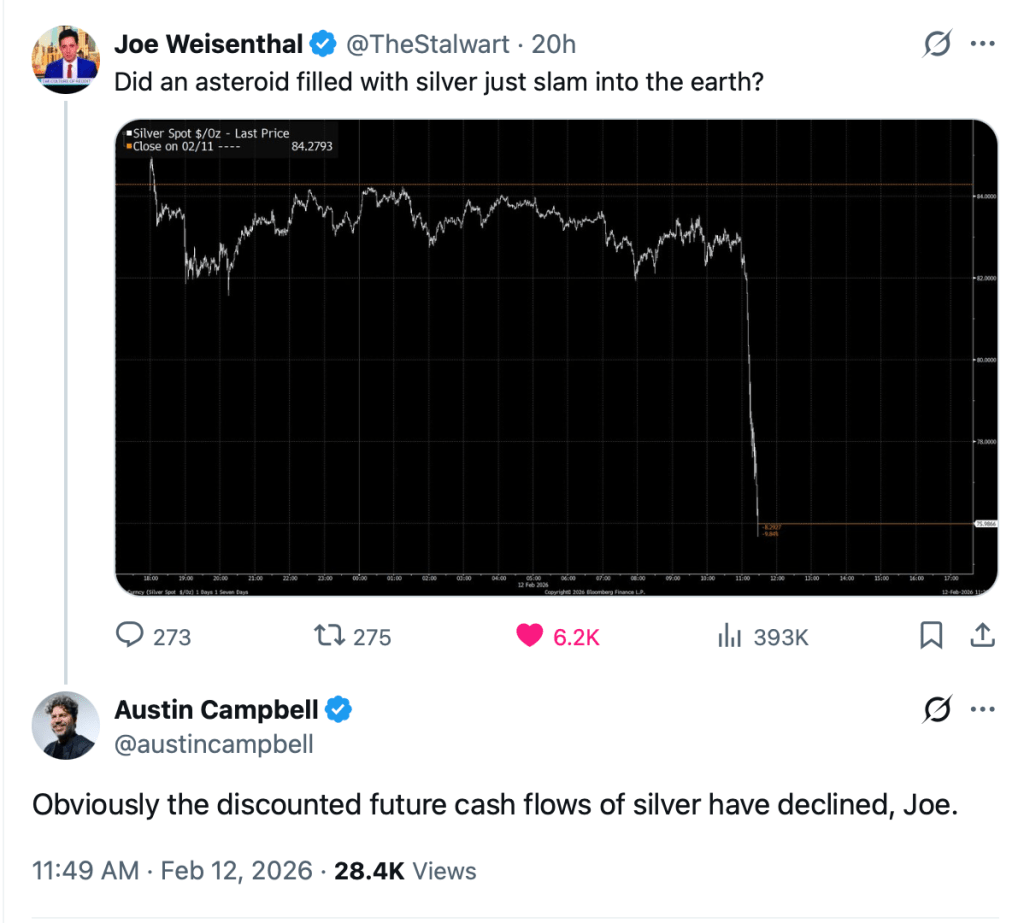

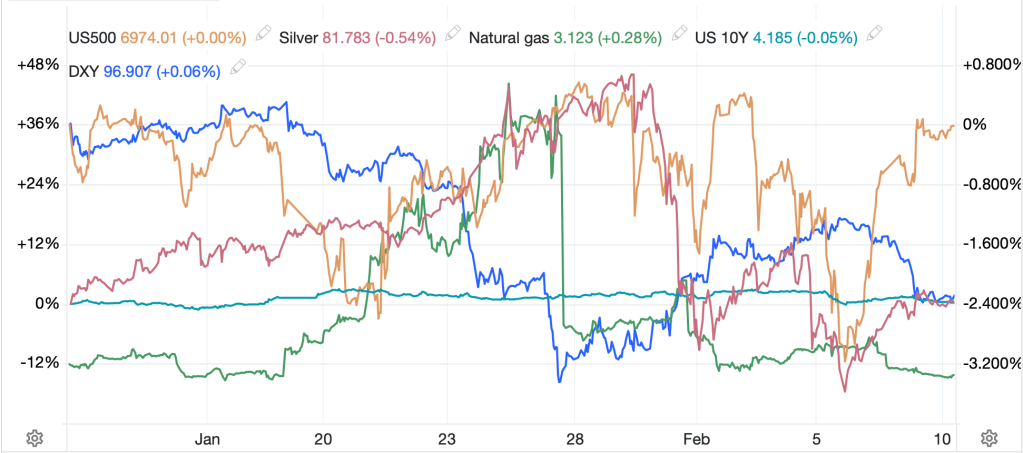

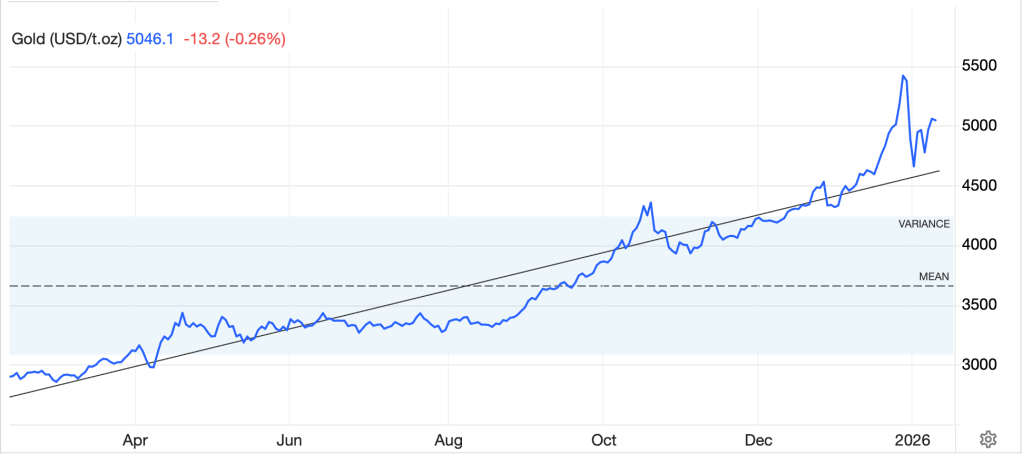

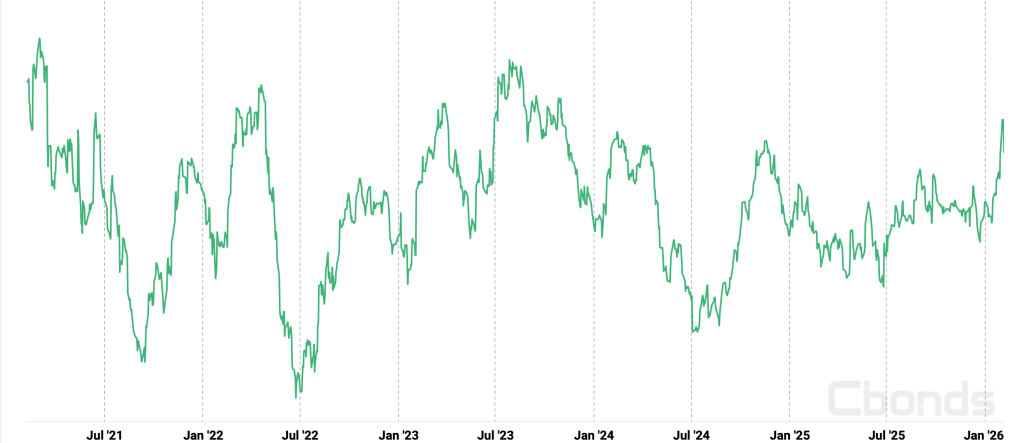

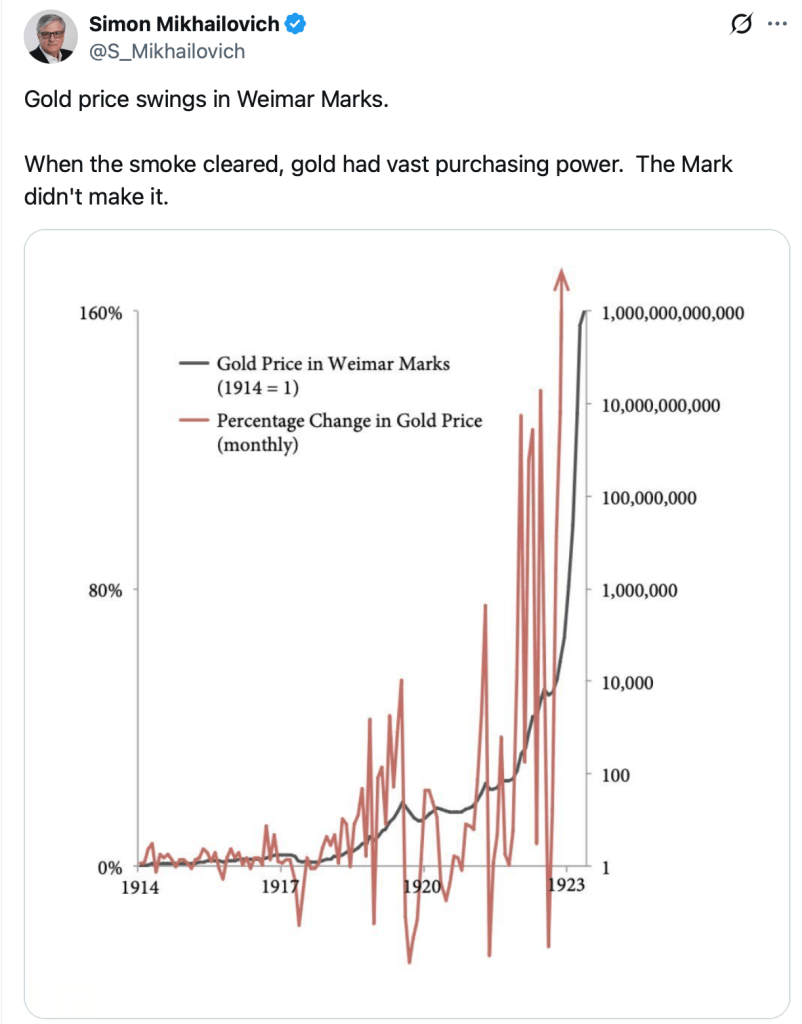

It strikes me that if war was a major concern, investors wouldn’t be stocking up on risk assets. Rather, havens would be in more demand, which we are also seeing with gold (+0.4%) and silver (+3.3%) rising overnight as despite extreme volatility in the precious metals space, there is clearly underlying demand for these havens.

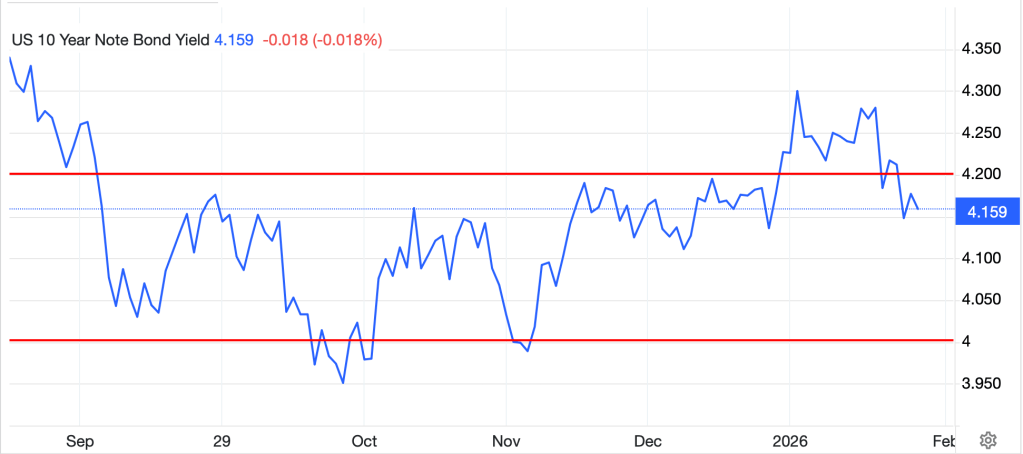

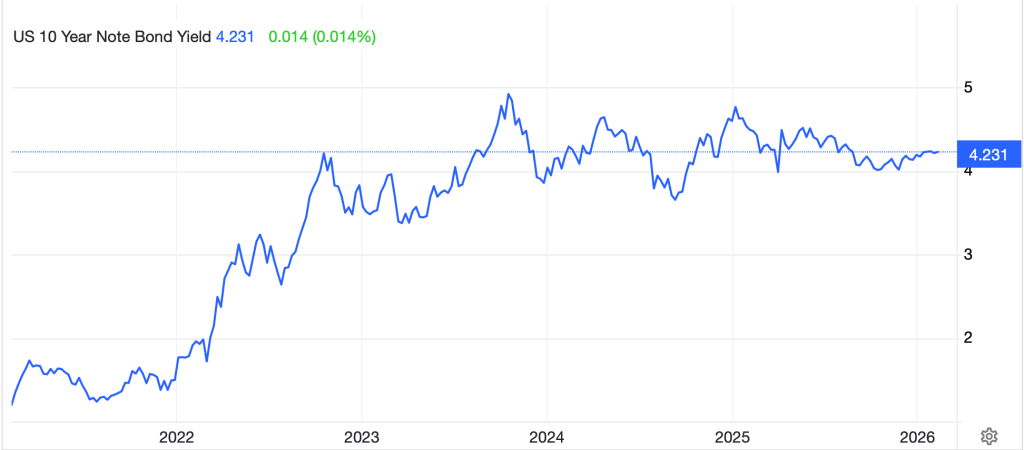

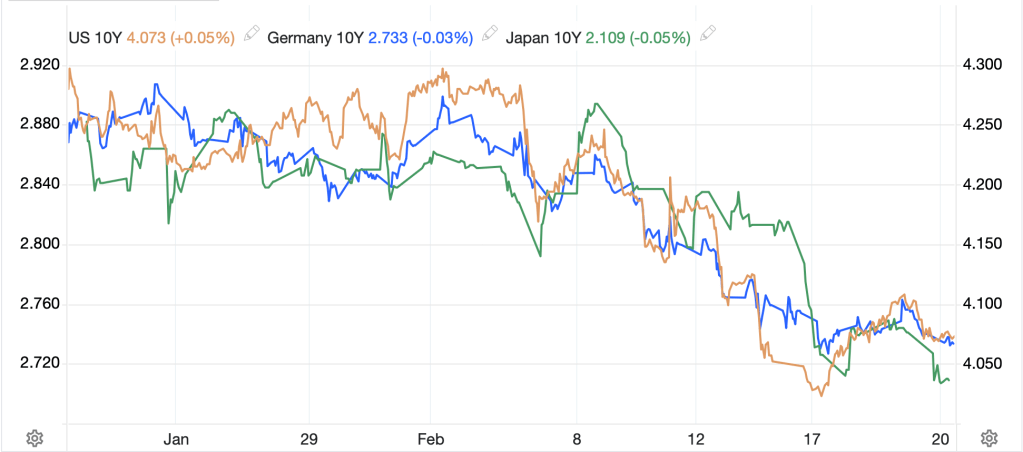

Bond yields over the past month have declined, indicating that despite ongoing deficit spending, investors are seeking their perceived safety whether in Treasuries, Bunds or JGBs as per the below chart of all three.

Source: tradingeconomics.com

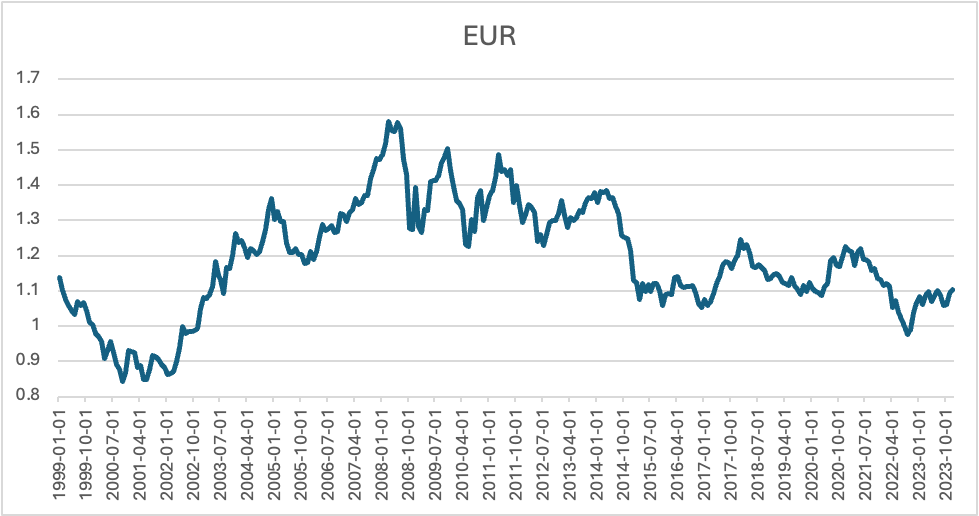

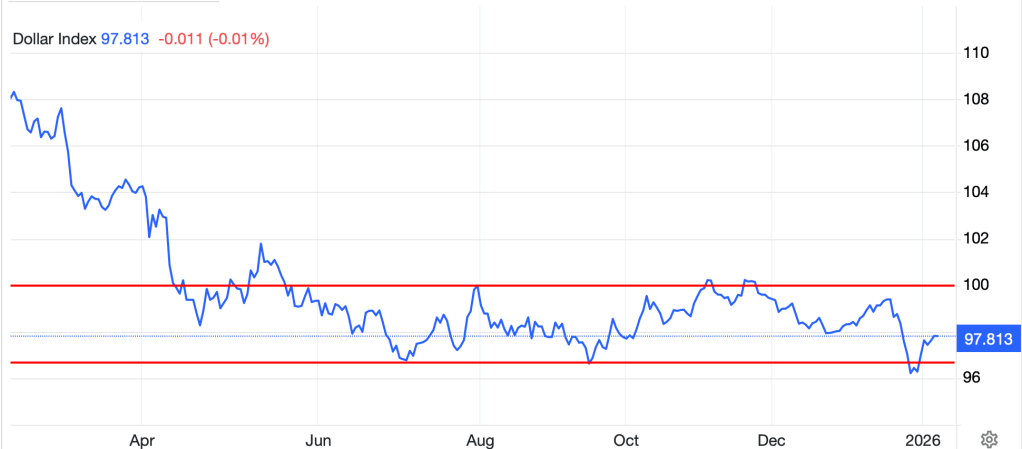

Finally, the dollar, despite frequent calls for its death, has been edging higher in a classic risk-off response as no matter how much some may hate the dollar philosophically, when bad things happen, its massive legal and liquidity advantages outweigh virtually everything else. Once again, the DXY has moved back to the middle of its trading range, just below 98.00 this morning, and to my eyes, shows no signs of an imminent collapse. Rather, if hostilities do break out in Iran, I expect the greenback to rally to at least the top of this trading range at 100, and depending on the situation, it could easily go higher.

Source: tradingeconomics.com

All this is to point out that nobody knows nothing. Narrative writers continue to try to keep up with the action, and it is increasingly difficult to do so as things change on the ground so rapidly. Let me be clear when I say I have zero inside information regarding any of this, I am merely an observer. However, my observations are that there will be some type of military action in Iran as to build up this much fire power in a concentrated area and not use it would be remarkable and I can see no way in which the Ayatollah can accept the terms being offered as it would end his leadership if he does. I guess we will find out soon enough as President Trump has put a 10-day timeline on things.

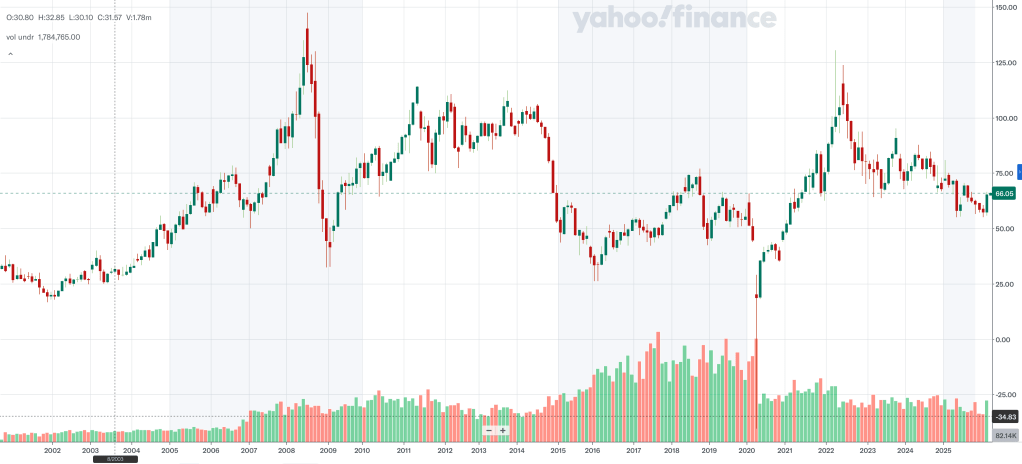

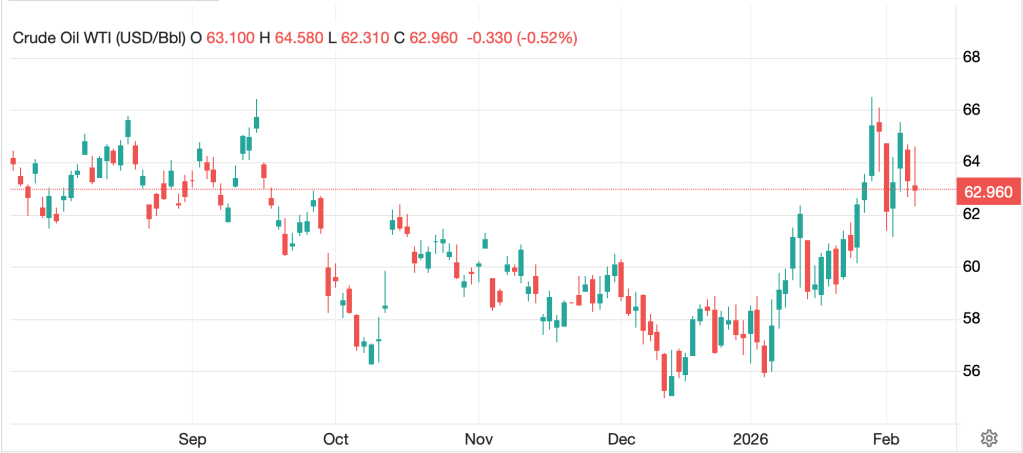

Arguably, the only market I didn’t mention here was oil (-0.5%) which is consolidating after a 20% rise in the past two months. Remember, if military activity is directed at oil production or transport, we could see a sharp spike here and that will not help equities or economic data, although both gold and the dollar are likely to benefit.

Source: tradingeconomics.com

I don’t think there is anything else to discuss market wise so let’s turn to the data. This morning brings a bunch of important stuff as follows:

| Personal Income | 0.3% |

| Personal Spending | 0.4% |

| PCE | 0.3% (2.8% Y/Y) |

| -ex food & energy | 0.3% (2.9% Y/Y) |

| Q4 GDP | 3.0% |

| Flash Manufacturing PMI | 52.6 |

| Flash Services PMI | 53.0 |

| Michigan Sentiment | 57.3 |

| New Home Sales | 730K |

Source: tradingecomomics.com

We also hear from two more Fed speakers, but at this point, they are all singing from the same hymnal explaining policy is in a good place and unless there are major changes in the data, there is no reason to change.

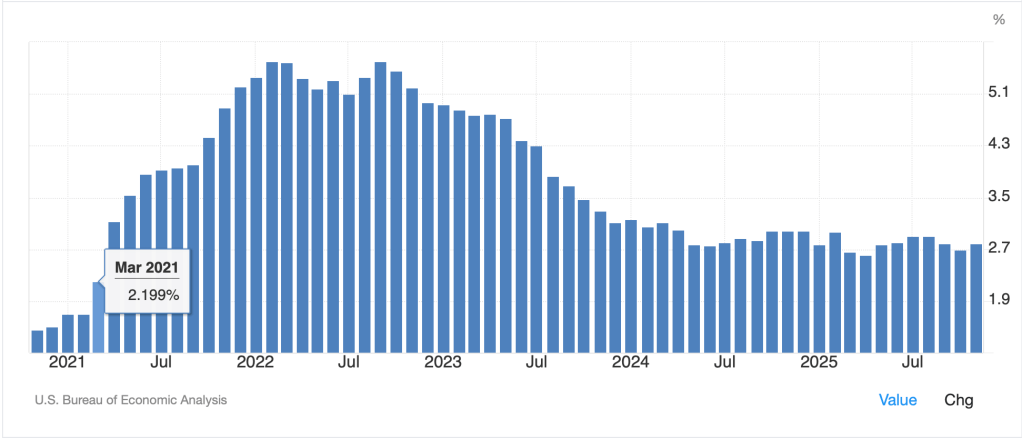

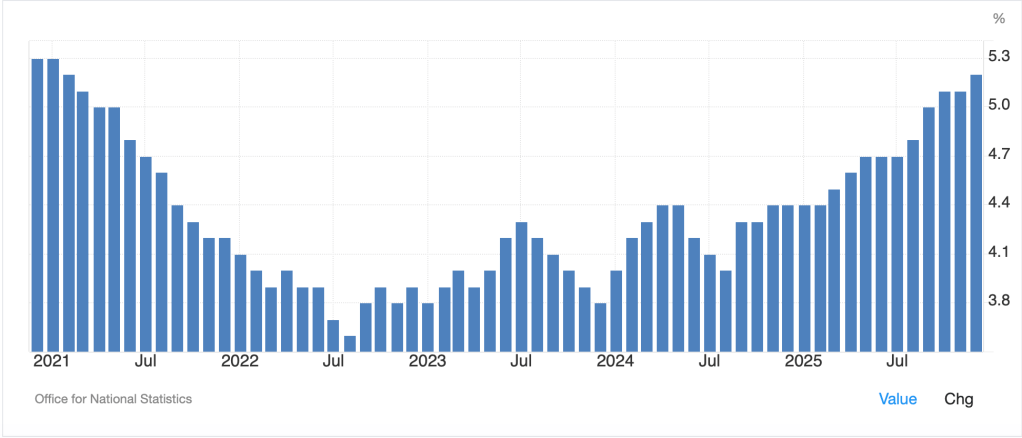

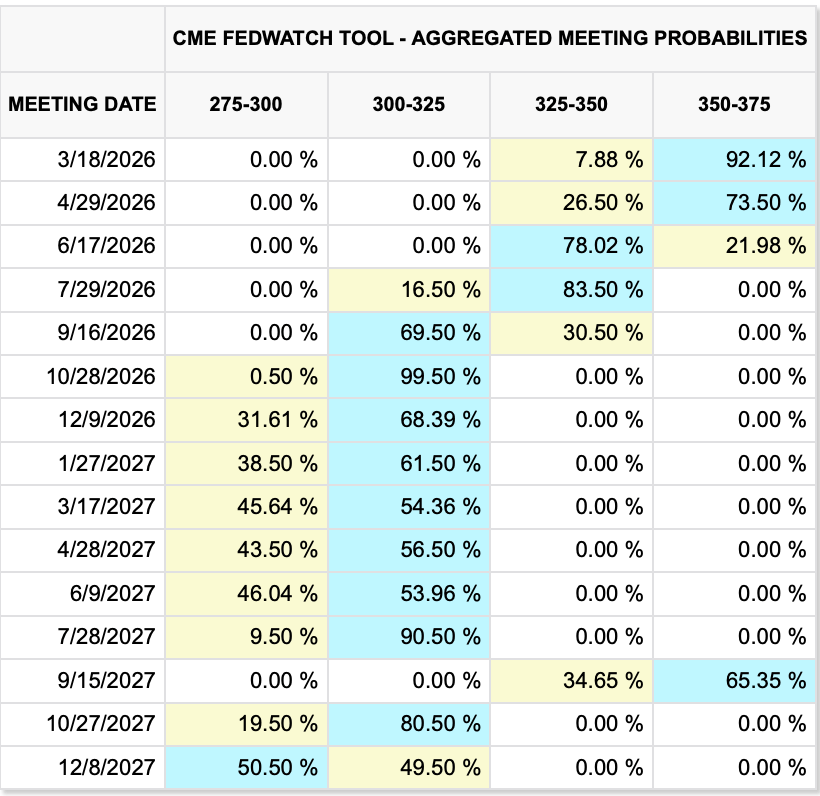

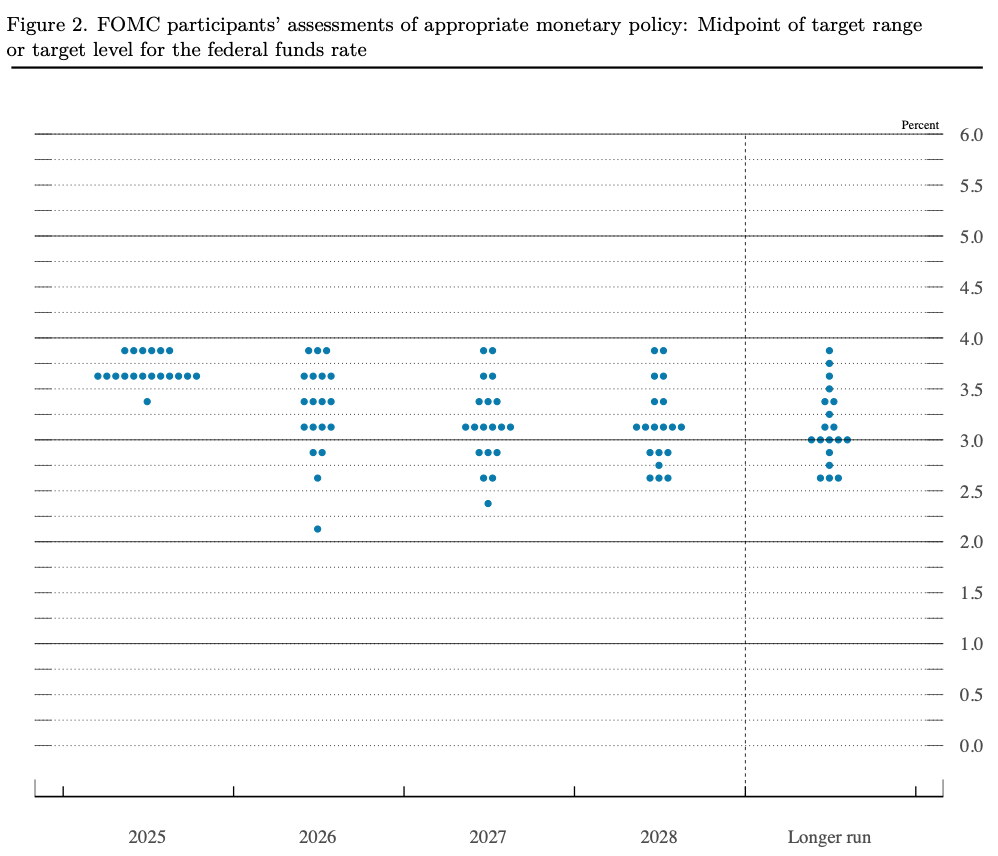

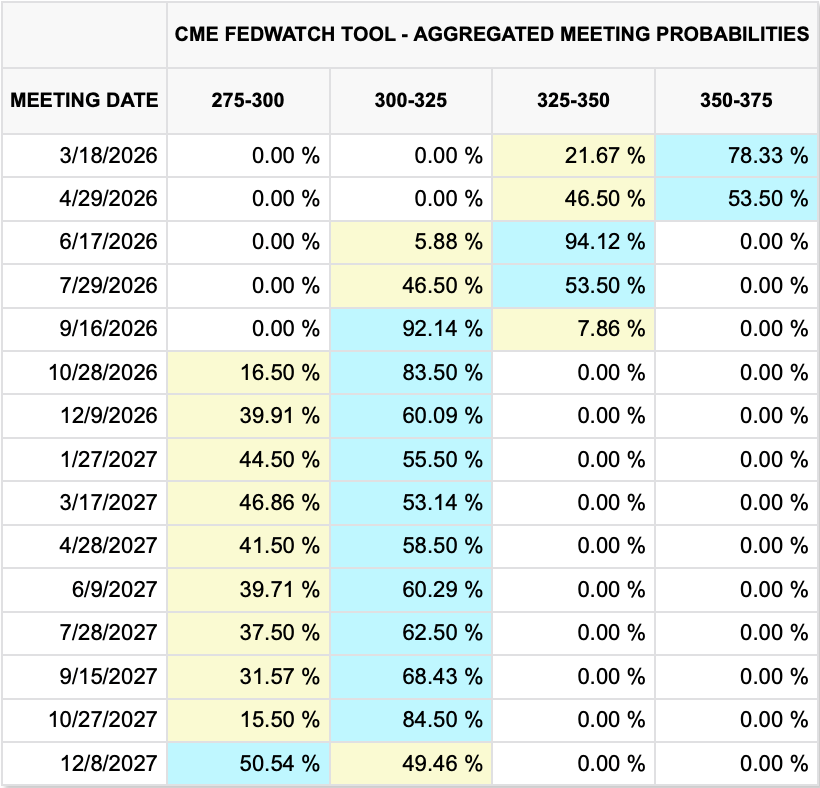

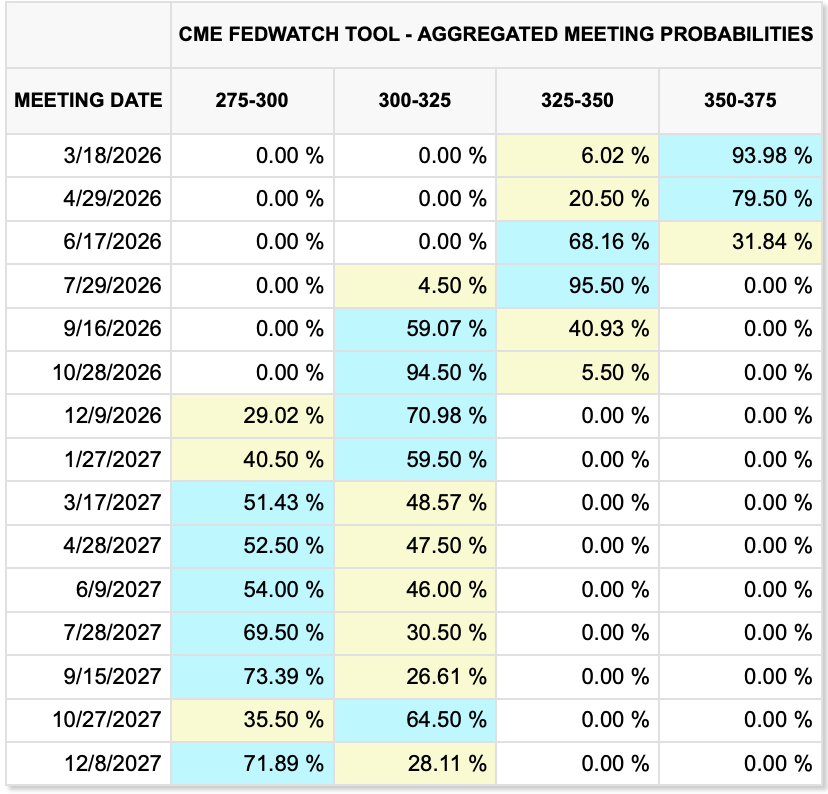

Arguably, the PCE data is the key for markets here as if it continues to run hotter than target, hopes for further rate cuts will continue to dissipate. In fact, the next cut is now priced in for July with a second for October.

Source: cmegroup.com

Remember, too, at that point it will be Kevin Warsh’s Fed, not Jay Powell’s, and Warsh has a very different idea about the way things need to be done. Interestingly, as this 4th Turning proceeds and old institutions come under increasing pressure, their efforts to fight back and maintain the status quo is no longer behind the scenes as evidenced by this Bloomberg article this morning.

As I have written before, President Trump is the avatar of the 4th Turning and the institutions that are going to change are desperate to maintain the status quo. This is, truly, the big fight that will continue through the end of the decade in my view. Every institution that has been overseeing the global situation, whether politically, financially or militarily, is coming under pressure as income and wealth inequality have driven an ever wider disparity of outcomes. As much power as the rich have, there are a lot more people who are not rich. Ask Louis XVI how much being rich helped him.

On a lighter note, I watched the gold medal skating performance of Alysa Liu and it was truly magical. A much better thought for the weekend!

Good luck and good weekend

Adf