Last week Japan finally agreed

To tariffs as they did concede

Now Europe has folded

Their cards as Trump molded

A deal despite pundits’ long screed

So, now this week there’s lots of news

That ought to give markets more cues

Four central banks speak

And late in the week

Inflation and jobs we’ll peruse

All the talk this morning revolves around the announcement yesterday of a US-EU trade deal where the basics are a 15% tariff on all EU exports to the US and an EU promise to buy US energy and defense products totaling some $550 billion. Many have said that the agreement means nothing because for it to become law, it requires both the European parliament and each nation to vote to agree on the deal. As well, we are hearing from various nations how it is a terrible deal (French farmers are furious, German pharmaceutical manufacturers are furious and unions all over the continent are unhappy) and certain politicians (notably Marine Le Pen) are also extremely unhappy.

It is far too early to understand if the deal will be implemented in full, but the precedent has been set that European exports to the US are going to be subject to higher tariffs than any time since prior to WWI and that is true whether the deal is ratified or not. As analyst/trader Andreas Steno Larsen explained well this morning, “The EU vs. US trade deal highlights that the EU primarily exports ‘nice-to-have’ products rather than essential ‘need-to-have’ ones. And if you think about it, arguably the best-known EU companies are luxury goods makers, whether in fashion or autos. So, while there are women who swear they ‘need’ that Birkin bag, the reality is far different.

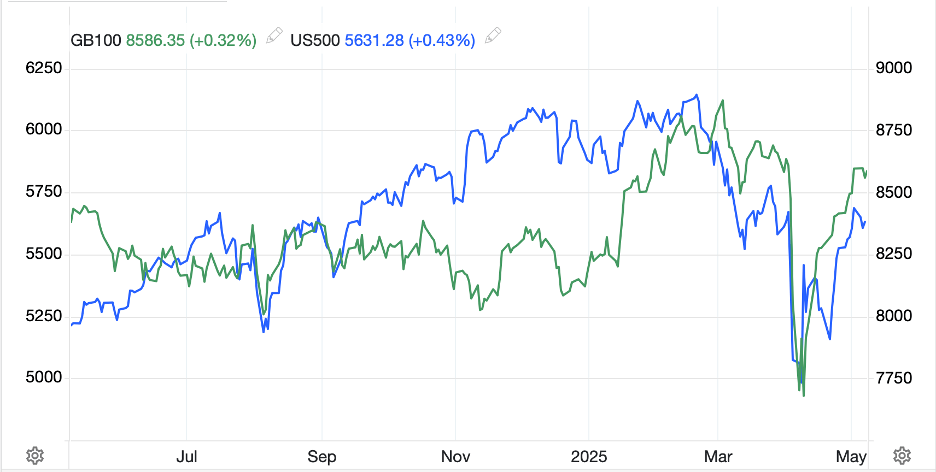

Expect to hear a lot more about this deal going forward, but the market response has been quite positive with European equity markets (IBEX +1.0%, FTSE MIB +0.9%, CAC +0.6%, DAX +0.4%) all higher along with US futures (+0.3%). Interestingly, Asian markets were mixed overnight as Japanese (-1.1%) and Indian (-0.7%) equities suffered, perhaps on the idea that their deals were no longer that special. China (+0.2%) and Hong Kong (+0.7%), though, did well amid news that another meeting was scheduled between the US and China, this time in Stockholm, to continue the trade dialog.

Away from the trade discussion, market focus this week is going to be on a significant amount of news and data to be released as follows:

| Tuesday | Trade Balance | -$98.4B |

| Case Shiller Home Prices | 3.0% | |

| JOLTS Job Openings | 7.55M | |

| Consumer Confidence | 95.8 | |

| Wednesday | ADP Employment | 78K |

| Q2 GDP | 2.4% | |

| Treasury QRA | ||

| BOC Interest Rate Decision | 2.75% (unchanged) | |

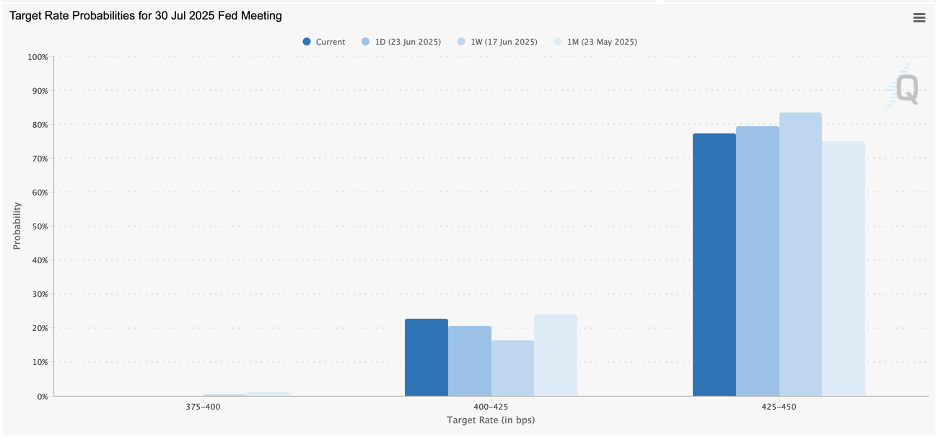

| FOMC Interest Rate Decision | 4.50% (unchanged) | |

| Brazil Interest Rate Decision | 15.0% (unchanged) | |

| Thursday | BOJ Interest Rate Decision | 0.50% (unchanged) |

| Initial Claims | 224K | |

| Continuing Claims | 19660K | |

| Personal Income | 0.2% | |

| Personal Spending | 0.4% | |

| PCE | 0.3% (2.5% Y/Y) | |

| Core PCE | 0.3% (2.7% Y/Y) | |

| Chicago PMI | 42.0 | |

| Friday | Nonfarm Payrolls | 102K |

| Private Payrolls | 86K | |

| Manufacturing Payrolls | 0K | |

| Unemployment Rate | 4.2% | |

| Average Hourly Earnings | 0.3% (3.6% Y/Y) | |

| Average Weekly Hours | 34.2 | |

| Participation Rate | 62.3% | |

| ISM Manufacturing | 49.6 | |

| ISM Prices Paid | 66.5 | |

| Michigan Sentiment | 61.8 |

Source: tradingeconomics.com

In addition to all of this, there are Eurozone GDP and inflation data, Japanese inflation data and PMI data from all around the world. Happily, there is virtually no central bank speaking beyond the post meeting press conferences as I presume all of them will be seeking an escape.

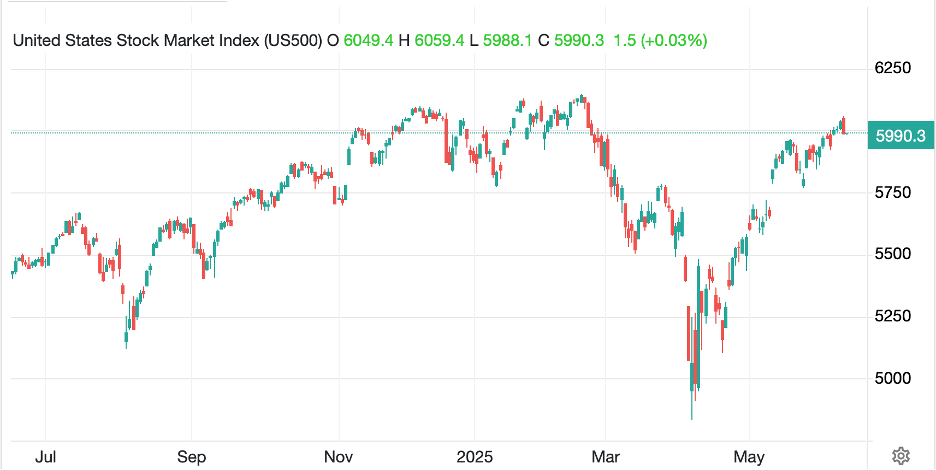

There is far too much data to discuss in any depth this morning, but my take is that President Trump has managed to move the Overton Window significantly over the course of his first 6 months in office. If you recall, it was on “Liberation Day” back in April, when he announced his reciprocal tariffs on the rest of the world, that the global economic community had a collective meltdown and proclaimed the end of the economy as we know it. Equity markets around the world plummeted and the future seemed bleak, at least according to every economist and pundit who could get their views heard. Now, here we are a bit more than three months later and tariffs of 15% on the entire EU as well as Japan, 10% on the UK and higher on other nations is seen as a solid outcome, sidestepping the worst cases promulgated, and the world is moving on.

It appears, at least for the moment, that Mr Trump understood that most nations need to export to the US more than the US needs to export to them. I would contend that is why these deals, which in many eyes seem unfavorable to the US counterparts, are being agreed. It is far too early to ascertain if things will work out as Trump expects, as the naysayers expect or somewhere in between (or entirely different) but thus far, you have to admit that the president has largely gotten his way.

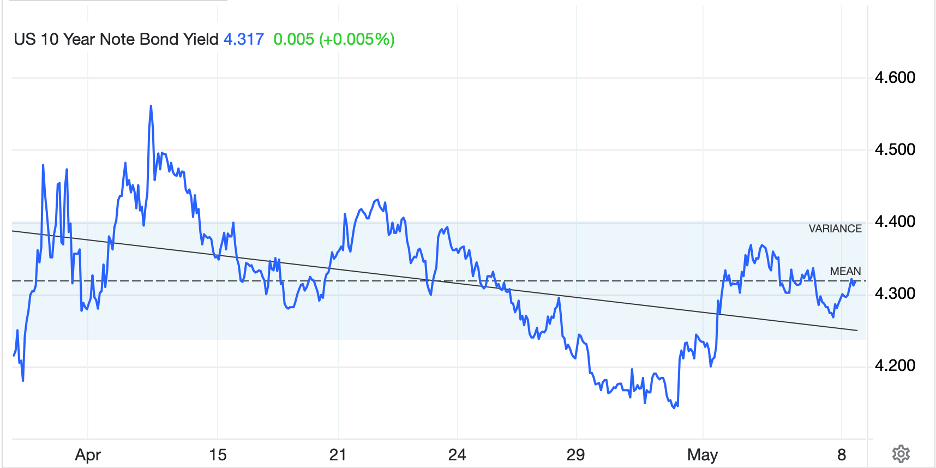

So, as we open the week, we have already seen equity markets are generally in a positive mood. Bond markets are also behaving well, with Treasury yields edging higher by 1bp, still glued to that 4.40% level, while European sovereign yields have mostly slipped -2bps or so on the session. And last night, JGB yields fell -4bps. It appears that bond investors are not as concerned about the trade deals as some would have you believe.

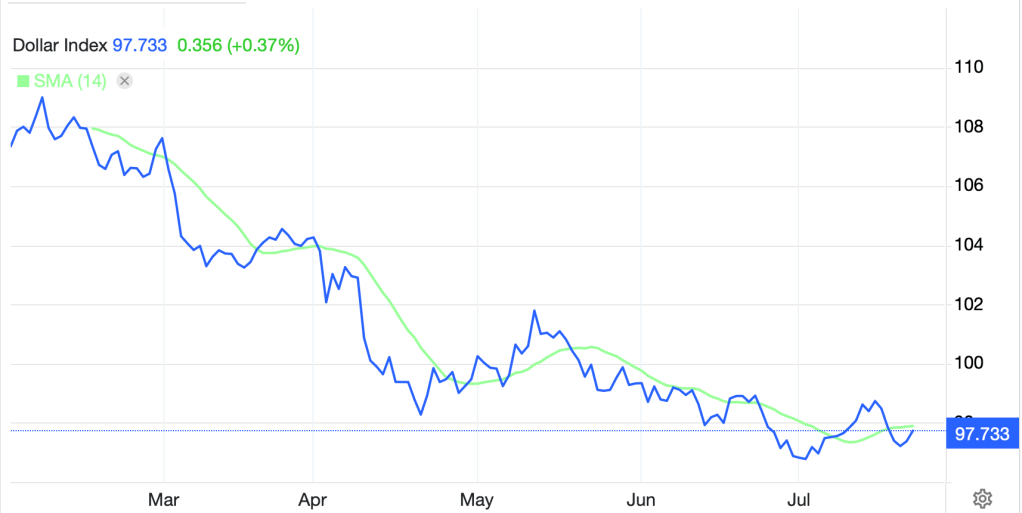

In fact, the market with the biggest reaction overnight has been FX, where the dollar is showing strength against virtually all its counterparts in both G10 and EMG spaces. EUR (-0.8%) is the G10 laggard, although CHF (-0.8%) is right there with the single currency as clearly, Switzerland will be impacted by the EU tariff deal. But AUD (-0.6%), JPY (-0.5%) and SEK (-0.65%) are all under pressure as well as the DXY (+0.6%) continues its bounce.

Source: tradingeconomics.com

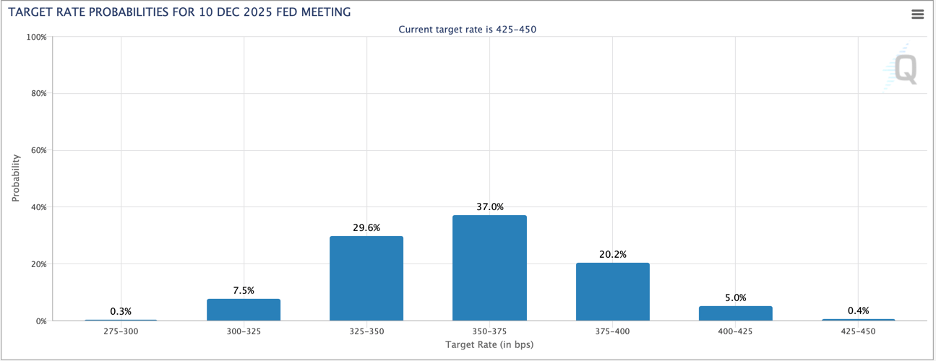

I continue to read about all the reasons why the dollar is losing its luster in the global community, because of tariffs, because of the Treasury’s actions freezing Russian assets after the invasion of Ukraine, because China and the BRICS are seeking other payment means to eliminate the dollar from their economies, because American exceptionalism is dead, and yet, while I am no market technician, I cannot help but look at the chart of the DXY above and see a broken downward trendline, indicating a move higher, and a bottoming in the moving average, also indicating further potential gains. I am confident that if the FOMC cuts rates (which full disclosure I don’t believe makes sense given the current amount of available liquidity and global equity market performance) that the dollar will decline further. But all those traders who are short dollars (and it is a very crowded position) are paying away between 25bps (long GBP) and 450bps (long CHF) on an annual basis so need to see the dollar’s previous downtrend resume pretty quickly. (see current overnight rates across major economies below from tradingeconomics.com)

The market is pricing just a 2% probability of a rate cut on Wednesday, and about 60% of a September cut. Unless this week’s data screams recession, I am having a hard time seeing the case for the dollar to fall much further, at least in the short and medium term. And this includes the fact that it is pretty clear President Trump would like to see a lower dollar to help US export competitiveness.

Finally, a look at commodities shows that while oil (+1.3%) is having a solid session, it remains in the middle of its trading range for the past several weeks. Meanwhile, metals prices (Au -0.1%, Ag -0.2%, Cu -0.4%) are feeling a little strain from the dollar’s strength but generally holding up well overall. Too, while there has historically been a strong negative correlation between the dollar and metals, given the large short dollar positions that are outstanding, it would not be hard to see both cohorts rally in sync for a while going forward.

And that’s really all for today. The data doesn’t really start until tomorrow, and as its summer, trading desks are already lightly staffed. Look for a quiet session today and the potential for choppiness this week if the data is away from expectations.

Good luck

Adf