For Fedniks it must be addictive

To say rates are “somewhat restrictive”

It seems like a show

As how can they know

Since R-star is basically fictive

Investors, though, lap up this stuff

In fact, they just can’t get enough

Of comments that hint

There is a blueprint

For policy, though that’s a bluff

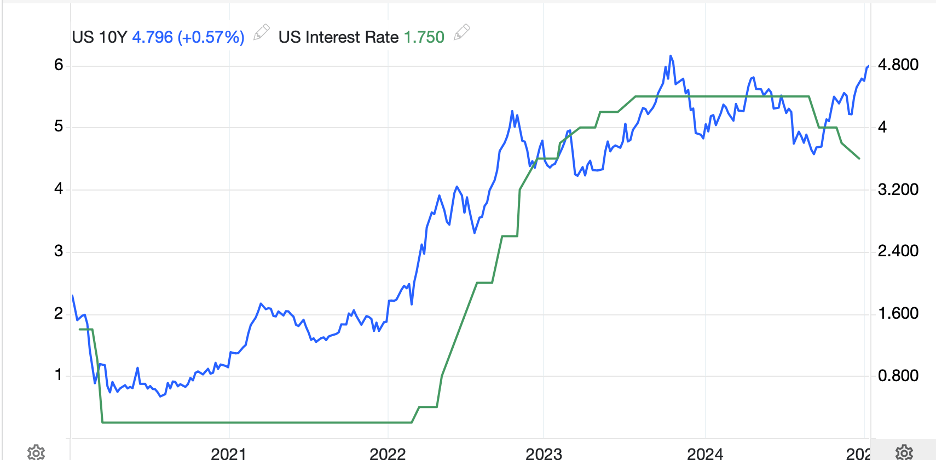

Yesterday, both Richmond Fed president Barkin and Governor Jefferson explained that current Fed policy is “somewhat restrictive”. This takes to seven the number of FOMC members who have used this phrase with Powell, Kugler, Hammack, Schmid and Collins all having used it before, as did Jefferson two weeks ago. And they are all referring to the concept of R-star, the mythical rate at which policy is neither restrictive nor accommodative. In fact, R-star has become the Fed’s north star, with the key difference being, we can actually see the north star while R-star, even they will admit, is unobservable. Of course, that hasn’t stopped them from basing policy decisions on the variable.

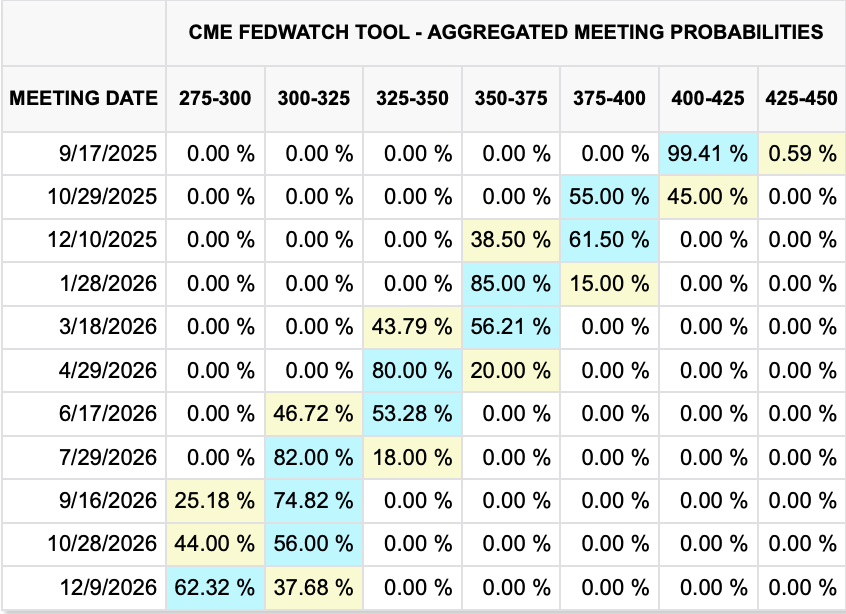

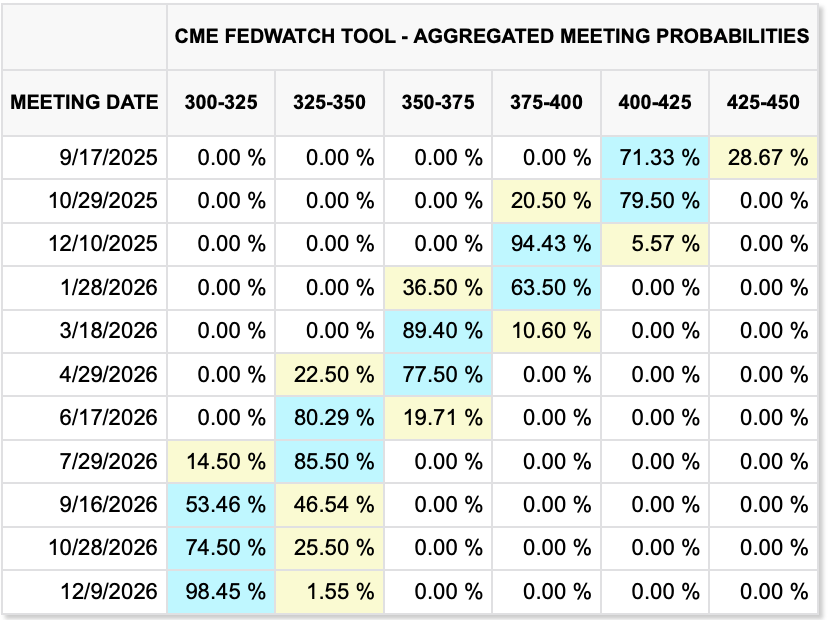

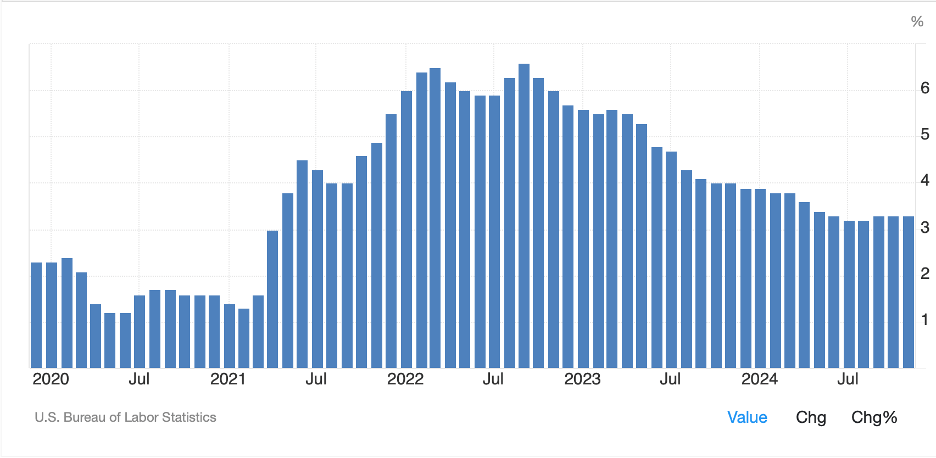

I highlight this because the tone of virtually every one of these speeches has been one of caution, with the implication being they are very close to their nirvana so the last steps will be small. However, we cannot forget that though the last steps may be small, there is still confidence amongst the entire body that the direction of travel is toward lower rates. certainly, as you can see from the aggregated meeting probabilities from the Fed funds futures market below, there is zero expectation that rates will rise anytime during the next two years and a decent chance of another 100bps of cuts over that time.

Source: cmegroup.com

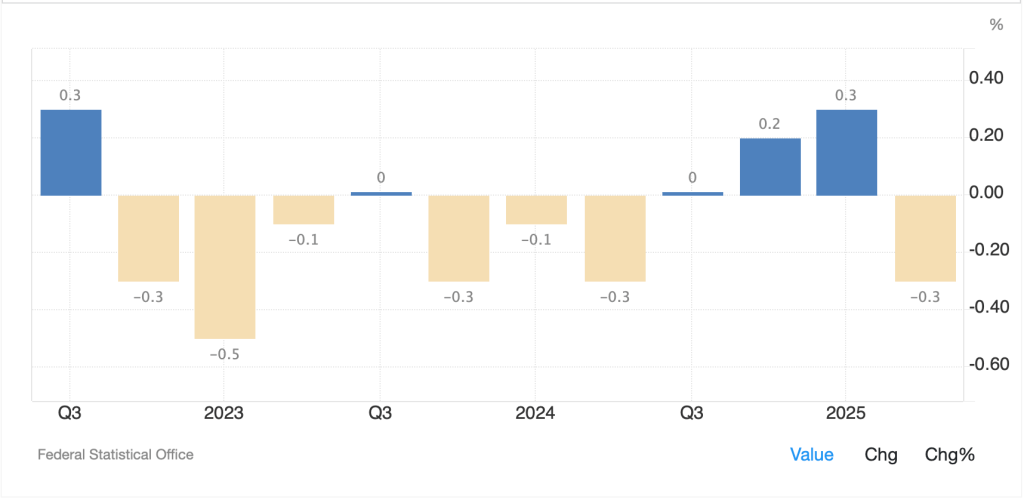

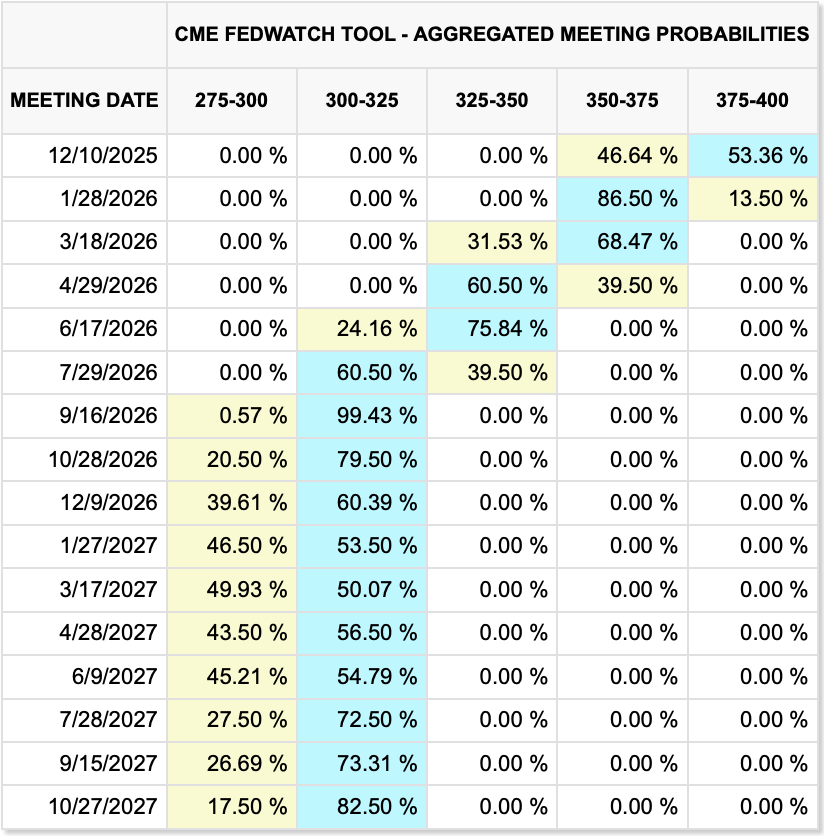

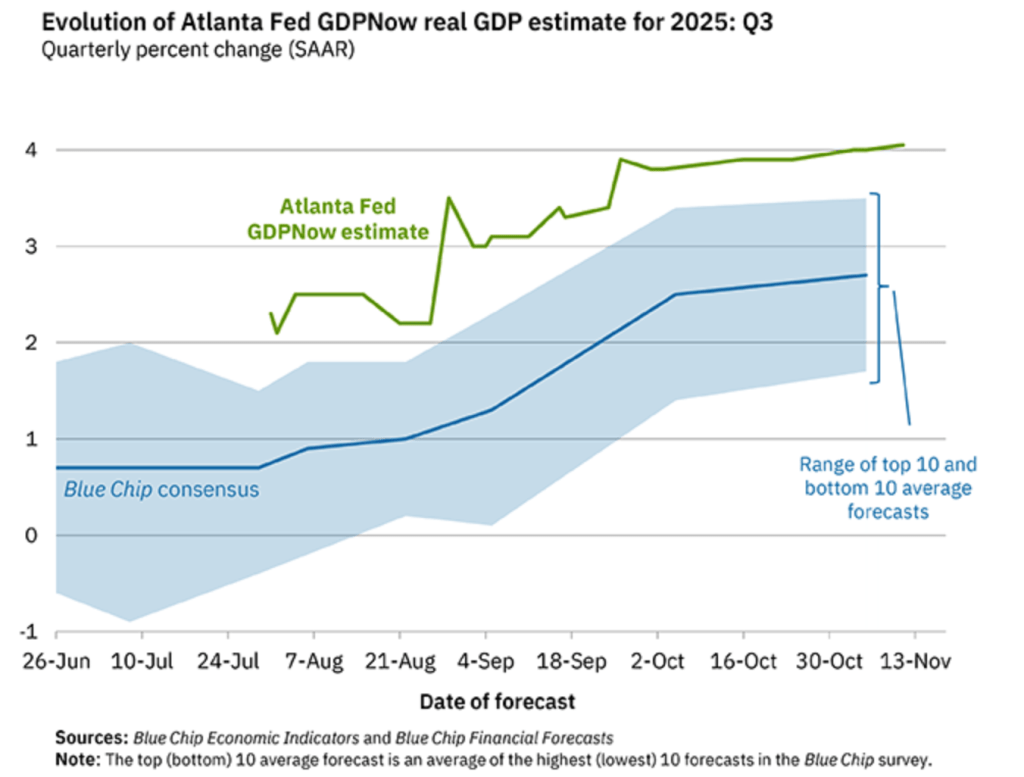

I might contend that is a pretty negative outlook on the US economy by the Fed. Given the Fed’s models assume that a key to lower inflation is slowing economic growth, the idea that rates are going to fall implies slower growth to help them achieve the inflation portion of their mandate. But that seems out of step with both the Atlanta Fed’s GDPNow forecast shown below and currently sitting at 4.1% annualized for Q3 and with earnings forecasts in the equity markets.

Asking Grok, the average current earnings growth forecasts for 2026 for the S&P 500 is somewhere in the 13% – 14% range with revenue growth running at ~6.9%, which is typically in line with nominal GDP growth. (I understand that current forward PE ratios are extremely high at 23x, so be careful that companies hit their targets while their share prices fall anyway.) But if nominal GDP is going to run at nearly 7%, and let’s assume inflation is at 3.5%, which I think is a reasonable possibility, then the math tells us that GDP is growing at 3.5% on a real basis. With Fed funds currently at 4.0%, why would they need to decline further?

Looking back at the Fed’s September Summary of Economic Projections, it appears that the Fed sees a very different economy than the markets see. In fact, you can see that they believe nominal GDP in the long run is going to average <4.0% (sum of longer run GDP and PCE in the table below).

That is a really big difference, one that is the type that can lead to massive policy errors. Now, if those 17 people cloistered in the Marriner Eccles building have a better handle on the economy than everybody else, I can understand why they believe rates need to fall further. But is that the case?

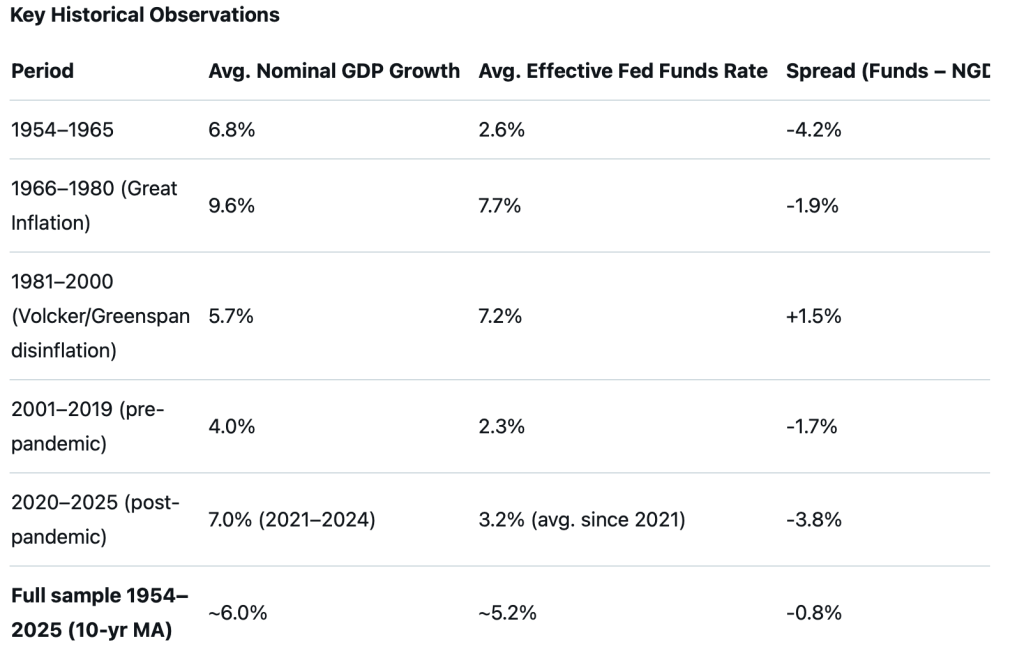

Here’s something else to ponder, I asked Grok about the relationship between nominal GDP and Fed funds and the below table is what it produced:

It is patently obvious how the Fed has developed its models and because of that, why they have been so wrong. In fact, look at the SEP above and compare it to the period from 2001 – 2019, they are essentially identical. But I would argue, and I’m not alone, that the economy from the dot.com crash up to the pandemic is no longer the reality on the ground. The Fed’s backward-looking models seem set to make yet more errors going forward.

And with those cheery thoughts, let’s look at what happened overnight. Yesterday’s continuation of the US stock decline seems to be finding a bottom, at least temporarily as Asian markets were mixed (Nikkei -0.3%, Hang Seng -0.4%, CSI 300 +0.4%) with the rest of the region showing a similar mixture of gainers (India, Malaysia, Indonesia, Philippines) and losers (Korea, Taiwan, Australia) as it appears the entire world is awaiting Nvidia’s earnings after the US close today.

Similarly, European bourses are edging higher this morning with the rout seemingly over for now. This morning Spain (+0.5%) is leading the way higher followed by Germany (+0.3%) with the rest of the markets little changed overall, although leaning higher. As to US futures, at this hour (7:30) they are pushing higher by about 0.4%.

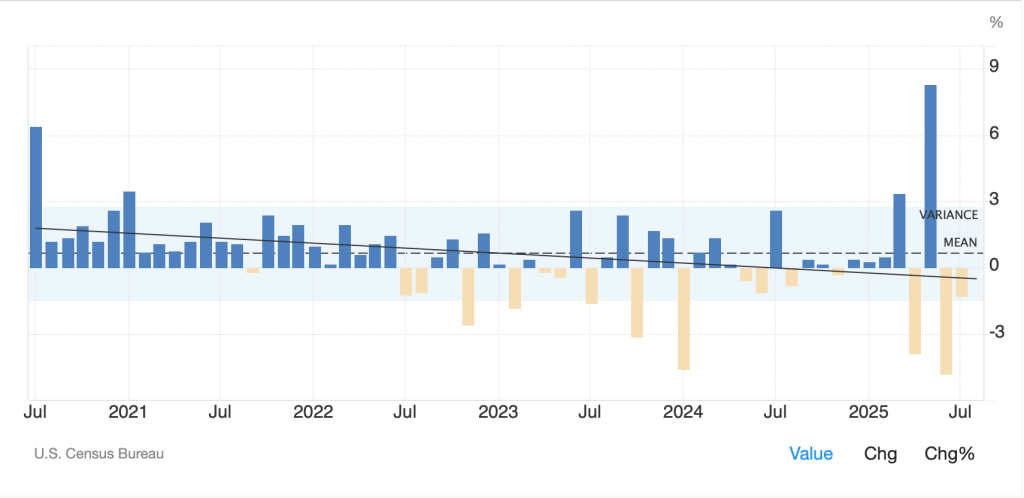

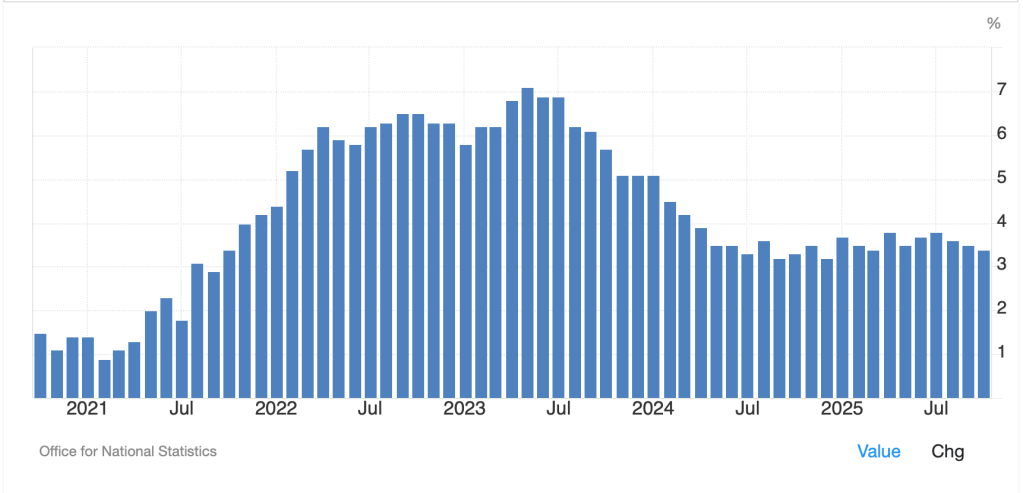

In the bond market, Treasury yields are unchanged this morning, still sitting right around that 4.10% level while European sovereigns have seen demand with yields slipping -2bps to -3bps across the continent. The UK is the outlier here, with yields unchanged after releasing inflation data that was bang on expectations, and below last month’s readings, though remains well above their 2.0% target. I guess if I look at the chart below, I might be able to make the case that core UK CPI is trending lower, but similarly to the Fed, the last time they were at their target was July 2021.

Source: tradingeconomics.com

I would be remiss if I didn’t mention that JGB yields have moved higher by 3bps, pushing their decade long highs further along as concerns grow over the Japanese fiscal situation.

Oil prices (-2.4%) are falling this morning, slipping to the low side of $60/bbl after API inventories showed a surprise build of 4.4 million barrels. However, I would contend that there is very little new here. Perhaps the dinner last night where President Trump hosted Saudi Prince MbS has some thinking OPEC will increase production more aggressively going forward. In the metals markets, they are all shining this morning led by silver (+3.1%) and platinum (+3.0%) with gold (+1.3%) and copper (+1.3%) lagging, although remember the latter two are much larger markets so need more interest to rise as quickly.

Finally, the dollar continues to find support, despite the precious metals gains, and this morning we see the DXY (+0.15%) pushing back toward that psychological 100.00 level. JPY (-0.5%) has traded through 156 and certainly seems like it wants to push back to its YTYD highs of 158.80. Interestingly, there was no Japanese commentary of note last night, but I presume if this continues, the MOF will be out warning of potential future action. Another interesting fact is that while the dollar is firmer against virtually all G10 currencies, the EMG bloc is holding its own this morning led by HUF (+0.6%), PLN (+0.25%) and ZAR (+0.15%) with the rand obviously benefitting from gold’s rally. The forint has benefitted from the central bank maintaining policy on hold at 6.5%, one of the highest available rates in Europe and that has helped drag the zloty along for the ride.

On the data front, this morning we see the August Trade Balance (exp -$61.0B) and then the EIA oil inventories where a small draw is expected. We also get the FOMC Minutes at 2:00pm and hear from NY Fed president Williams this afternoon.

I cannot help but look at the difference between the Fed’s very clear view and the markets expectations and feel like the Fed is on the wrong side of the trade. It is for this reason I fear higher inflation and ultimately, a much lower likelihood of further rate cuts. If that is the case, the dollar will find even more support. Interesting times.

Good luck

Adf