The evidence, so far, we’ve seen

Is nobody’s terribly keen

To stop all the shooting

In wars, or the looting

In riots, at least so I glean

But can stocks and bonds still maintain

The heights they consistently gain

Or will, one day soon

Risk assets all swoon

As traders turn to their left-brain?

I am old enough to remember when Israel’s attack on Iranian nuclear facilities was considered a risk to global financial assets. Equity prices fell around the world as investors scrambled to find havens to protect their assets. Alas, these days, the only haven around seems to be gold as Treasury yields, after an initial slide, rebounded which implies investors may have questioned their safety and the dollar, after a slight bump, slipped back.

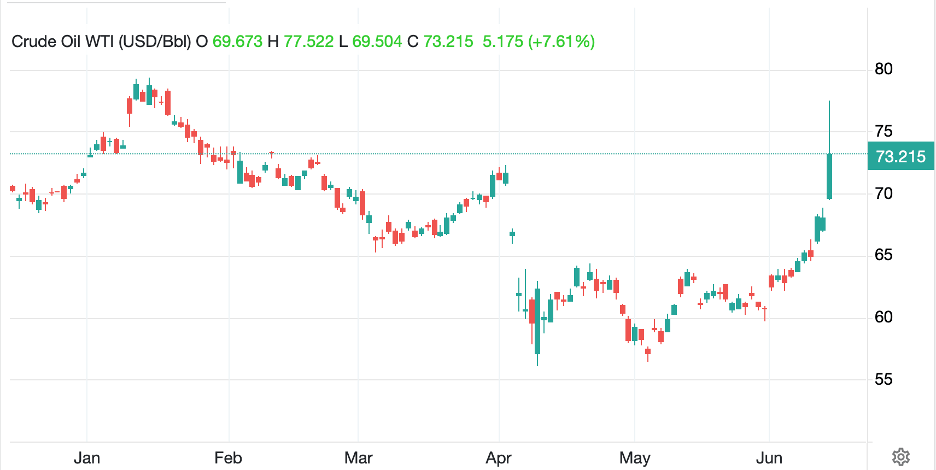

But that is clearly old-fashioned thinking as evidenced by the fact that fear is already ebbing in markets with equities rebounding this morning, the dollar under pressure and both gold and oil slipping slightly. Now, it is early days but a look at the chart below of oil shows that it took about 9 months for oil prices to retrace to their pre-Russia invasion levels. Obviously, this situation is different than that from the perspective that prior to Russia’s invasion, there were no energy market sanctions while Iran has been subject to sanctions for years. However, the larger point is that the market, at least right now, seems to have adjusted to what it believes is the appropriate level to account for changes in production.

Source: tradingeconomics.com

Now, as of January 2025, at least as per the data I could find, Russia produces 10.7 million barrels/day while Iran clocks in at just under 4 million. As well, given the sanctions, much of Iran’s production has a limited market, with China being the largest importer. I’m simply trying to highlight that Russia’s production was much larger and more critical to the oil market overall, so a larger impact would be expected. However, the fact that Israel continues to destroy Iranian infrastructure, and has targeted oil infrastructure as well as nuclear infrastructure, suggests there could easily be more impacts to come. This is especially true if Iran seeks to close the Strait of Hormuz, a key bottleneck exiting the Persian Gulf and where some 20% of global oil production transits daily.

But the market is sanguine about these risks, at least for now. There is no indication that Israel has completed what they see as their mission, and that means things could well escalate from here. In that case, I would expect another jump in oil prices, but overall, it is not hard to believe that we have seen the bulk of any movement. It strikes me that we will need substantially stronger economic activity to push oil prices much higher from here, and that seems unlikely right now.

Meanwhile, near Banff there’s a meeting

Where heads of state are all competing

To help convince Trump

There will be a slump

Unless tariff pressures are fleeting

The other noteworthy story this morning is the G-7 meeting that is being held in Kananaskis, Alberta, near Calgary and Banff and how all the other members of the club, as well as invitees from Mexico, Brazil, South Africa, India and South Korea, will be trying to convince the president that his tariffs are going to be too damaging and need to be adjusted or removed, at least for their own nations.

Anyone who indicates they know how things will evolve is offering misinformation as Trump’s mercurial nature precludes that from being the case. However, it would not be inconceivable for some headway to be made by some of these nations in certain areas although President Trump does appear to strongly believe tariffs are a benefit by themselves. I am not counting on any major breakthroughs here, but small victories are possible.

One last thing before the market recap though, and this was a Substack piece I read this weekend from The Brawl Street Journal, that, frankly, shocked and scared me regarding the ECB and some plans they are considering. While President Trump has consistently called the climate hysteria a hoax and his administration is doing everything it can to remove Net Zero promises and CO2 reduction from anything the government does, the opposite is the case in Europe. The frightening part is that the ECB is considering adding effective mandates to lending criteria such that loans to support agriculture or fossil fuel production will require banks to hold more capital, making them more expensive. The very obvious result is there will be less loans in this space, and things like agriculture and fossil fuel production will become scarcer in Europe than elsewhere.

Yes, this is suicidal, but then we have already seen Germany (and the UK) attempt to commit economic suicide with its energy policy, and while many in Europe would suffer the consequences, I assure you the members of the ECB would not be in that group. But my point, overall, is that if this plan is enacted, and the target date appears to be this autumn, it is a cogent reason for the euro to begin a structural decline to much lower levels. This is not for today, but something to remember if you hear that the NVaR (Nature Value at Risk) plan is enacted. Tariffs will be their last concern as the continent enters a long-term economic decline as a result. The blackout in Spain in April will become the norm, not the unusual circumstance.

Ok, let’s see how little investors are concerned about war and escalation. While equity markets were lower around the world on Friday, that is just not the case anymore. Asia saw the Nikkei (+1.3%) lead the way higher with the Hang Seng (+0.7%) and CSI 300 (+0.25%) also gaining as well as strength in Korea (+1.8%) and India (+0.8%) as hopes rise some positive news will come from the G-7. Europe, too, has seen gains across the board led by Spain (+0.9%) and France (+0.7%) with most other markets rising between 0.3% and 0.5%. As to US futures, at this hour (6:50) they are higher by about 0.5% with the NASDAQ leading the way.

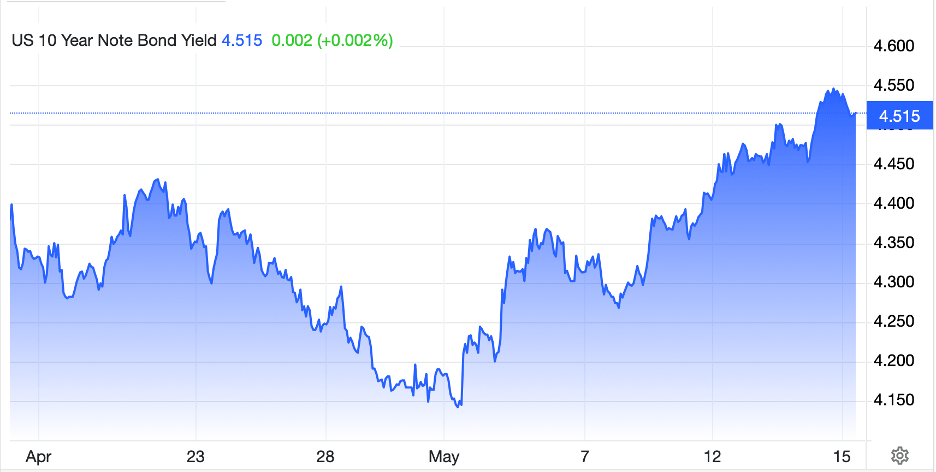

In the bond market, Treasury yields are backing up a further 3bps this morning but are still just above 4.40%. European yields are +/- 1bp across the board as investors try to decipher ECB commentary about the next rate move. The universal belief is there will be another cut, although Bundesbank president Nagel tried to pour cold water on that thesis this morning calling for caution and a meeting-by-meeting approach going forward.

Commodity markets, are of course, the real surprise this morning with oil (-1.1%) looking like it has put in at least a short-term top. In the metals market, gold (-0.4%) is giving back some of last week’s gains although both silver (+0.2%) and copper (+1.1%) are rebounding after tougher weeks. Metals prices seem to be pointing to less fear and more hope for economic rebound.

Finally, the dollar is under some pressure this morning, slipping vs. most of its counterparts in both the G10 and EMG blocs. The euro (+0.25%) is having a solid session although both AUD (+0.4%) and NZD (+0.5%) are leading the G10 pack. Even NOK (+0.1%) is rallying despite oil’s pullback. In the EMG bloc, ZAR (+0.8%) is the leader right now, partially on continued gains in platinum and gold’s overall recent performance, and partially on hopes that their presence at the G-7 will get them some tariff relief. Elsewhere, the gains have been less impressive with KRW (+0.5%) also benefitting from tariff hopes while the CE4 see gains of 0.3% or so. No tariff hopes there.

It is an important data week with Retail Sales and housing data, but also because the FOMC leads a series of central bank decisions.

| Today | Empire State Manufacturing | -5.5 |

| Tuesday | BOJ Rate Decision | 0.50% (no change) |

| Retail Sales | -0.7% | |

| -ex autos | 0.1% | |

| IP | 0.1% | |

| Capacity Utilization | 77.7% | |

| Wednesday | Riksbank Rate Decision | 2.0% (-25bps) |

| Housing Starts | 1.36M | |

| Building Permits | 1.43M | |

| Initial Claims | 245K | |

| Continuing Claims | 1940K | |

| FOMC Rate Decision | 4.5% (no change) | |

| Thursday | SNB Rate Decision | 0.00% (-25bps) |

| BOE Rate Decision | 4.25% (no change) | |

| Friday | Philly Fed | -1.0 |

Source: tradingeconomics.com

So, Sweden and Switzerland are set to cut rates again, while the rest of the world waits. Chairman Powell’s comments seem unlikely to stray from the concept of too much uncertainty given current fiscal policies so no need to do anything. Thursday is a Federal holiday, Juneteenth, hence the early release of Claims data. I have to say the Claims data is starting to look a bit worse with the trend clearly climbing of late as per the below chart.

Source: tradingeconomics.com

I continue to read stories about the cracks in the labor market and how it will eventually show itself as weaker US economic activity, but the process has certainly taken longer to evolve than many analysts had forecast. One other thing to remember is that Congress is still working on the BBB which if/when passed is likely to help support the economy overall. The target date there is July 4th, but we shall see.

Summarizing the overall situation, many things make no sense at all, and others make only little sense, at least based on more historical correlations and relationships. I think there is a real risk of another sell-off in risk assets, but I do not see a major collapse. As to the dollar, the trend remains lower, but it is a slow trend.

Good luck

Adf