Said Powell, we’re not in a hurry

To cut after last year’s late flurry

Instead, wait and see

Is likely to be

The future lest ‘flation hawks worry

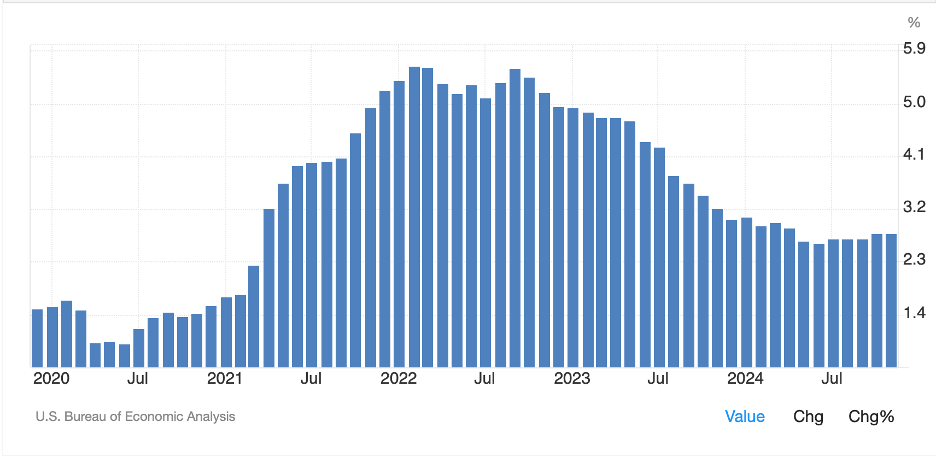

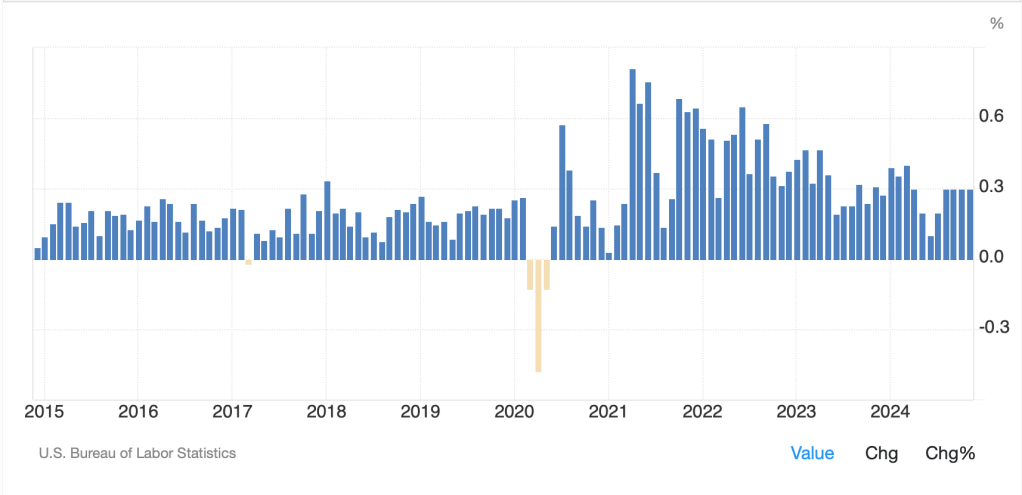

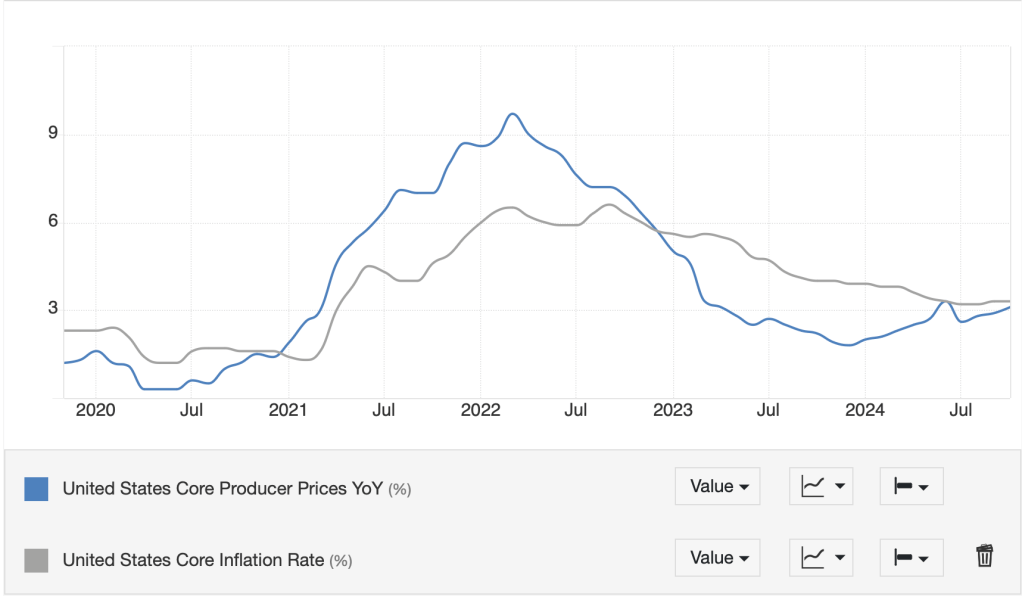

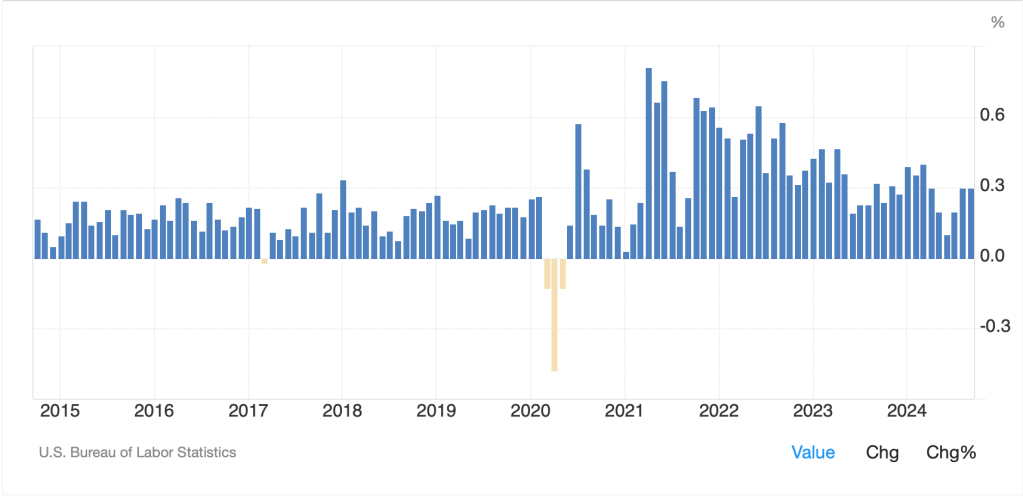

The opening paragraph of the FOMC Statement was concise as they acknowledge that things aren’t too bad right now. “Recent indicators suggest that economic activity has continued to expand at a solid pace. The unemployment rate has stabilized at a low level in recent months, and labor market conditions remain solid. Inflation remains somewhat elevated.”

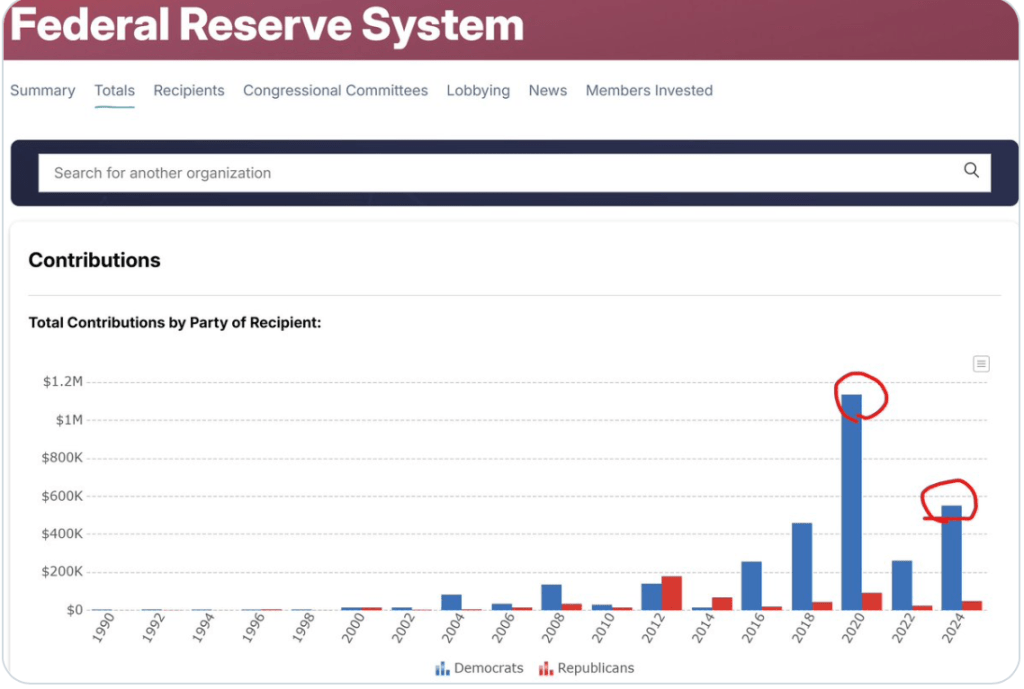

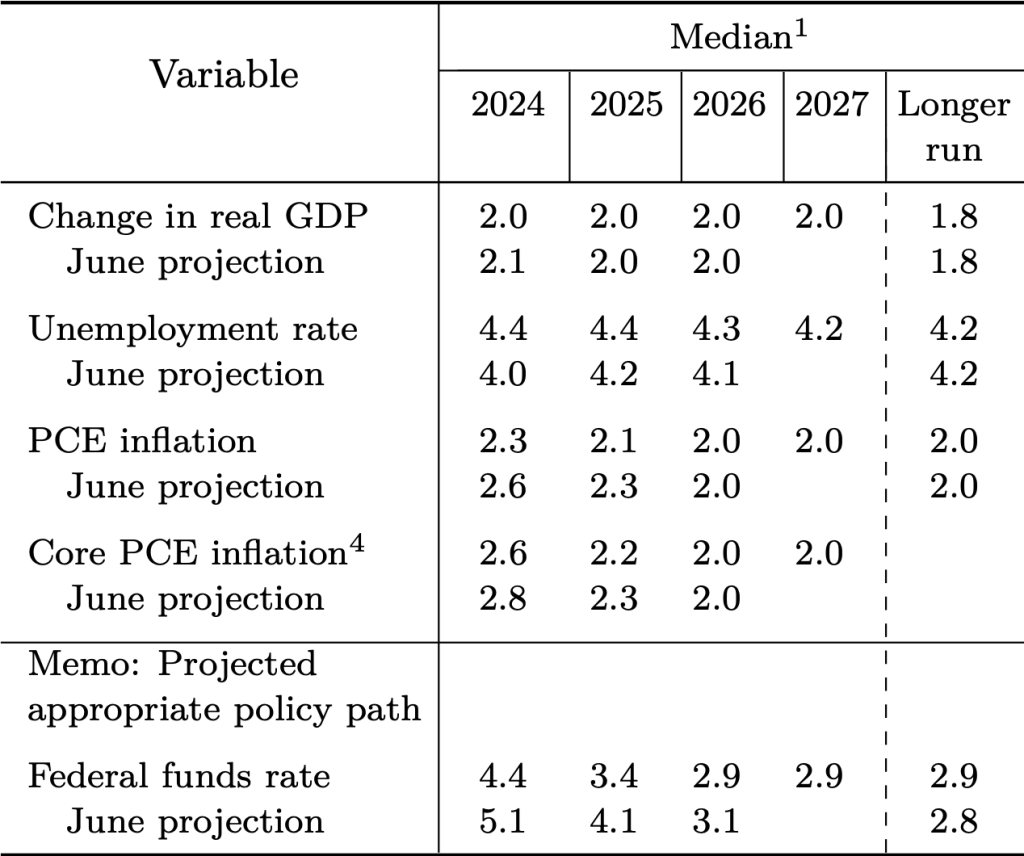

Of course, that didn’t stop Chairman Powell from still describing rates as restrictive or “meaningfully above” the neutral rate, although in fairness, he did explain “We do not need to be in a hurry to adjust our policy stance.” When asked about the impact of President Trump’s mooted policies regarding tariffs and trade, he explained, “The committee is very much in the mode of waiting to see what policies are enacted. We need to let those policies be articulated before we can even begin to make a plausible assessment of what their implications for the economy will be.”

In the end, I don’t believe very much changed with respect to expectations for the Fed with the futures market still pricing in a total of 46 basis points of cuts for the rest of the year with just an 18% probability of a cut in March. Certainly, nothing we heard or saw today changed my view of rates remaining here and potentially going higher before the end of 2025. But for now, I don’t think there is much else to say on the subject.

In Europe, the data was bleak

As growth there remains awful weak

Today they’ll cut rates

And on future dates

A base rate much lower they’ll seek

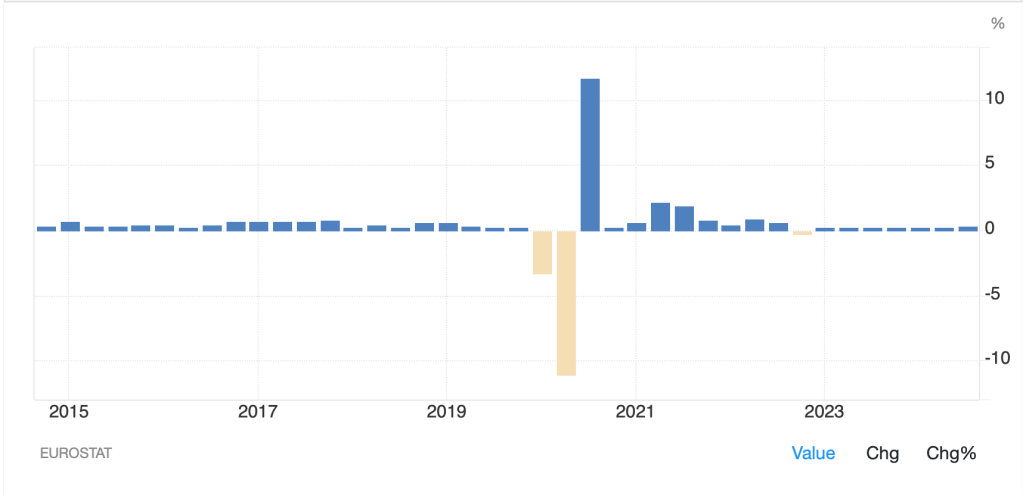

As we await the ECB’s meeting announcement later this morning, where Madame Lagarde is virtually certain to cut their interest rate structure by 25bps, we were entertained by GDP data from the Eurozone as well as several of its members. The numbers were disappointing even compared to weak forecasts. For instance, in Q4, France (-0.1%) and Germany (-0.2%) both saw declining activity while Italy (0.0%) managed to not fall. Not surprisingly, the Eurozone, as a whole, also saw a result of 0.0% GDP growth in Q4. In every case, the annual number is below 1.0%. Of course, if just looking at this data, it would be easy to say the ECB needs to cut rates further. However, inflation remains uncomfortably higher than target and as evidenced by Spanish data this morning, showing it rose to 3.0% Y/Y in January, Madame Lagarde cannot ignore the sole ECB mandate of stable prices at 2.0%.

Under the rubric a picture is worth a thousand words, I think the chart below of quarterly GDP activity in Germany and the Eurozone speak volumes of how things are progressing on the continent.

Source: tradingeconomics.com

The current policy mix in Europe is clearly not getting the job done, assuming the job is to grow the economy in a non-inflationary manner. While the ECB can continue to cut rates in their effort to support growth, the problems on the continent have far more to do with energy policy than anything else. The focus on ending the use of fossil fuels has resulted in the highest energy costs of any region which has led to the steady deindustrialization of the continent. It doesn’t really matter where interest rates are if companies cannot power their operations and that is the crux of the ECB’s problems. No matter what Lagarde and her friends do, it cannot reverse this decline. If you were wondering why so many, including this poet, are negative on the euro’s prospects going forward, this is it in a nutshell.

Ok, let’s turn to the overnight market activity. First, a moment’s thought for the tragedy that took place in Washington DC last night where a commuter jet collided with a military helicopter near Reagan National Airport. As I write, it is not known how many fatalities occurred, but the word is there were 60 passengers plus crew on board the plane and 4 on the helicopter.

Yesterday’s US session was less positive than many had hoped with the specter of DeepSeek still haunting many investors but the situation in Asia was a bit more upbeat with the Nikkei (+0.25%) and Australia (+0.55%) both showing gains. I read an entire X post as to why the next Chinese stimulus package was really going to change things and support the economy there although I continue to remain skeptical. (As an aside, it is Chinese New Year, the year of the snake, so markets in China and Hong Kong are closed for a few days.). Meanwhile, in Europe, all markets are higher as traders anticipate not only today’s ECB rate cut, but clearly more in the future as economic activity continues to wane. So, gains across the board of between 0.35% (DAX) and 0.7% (IBEX). US futures, too, are higher this morning, up by 0.4% at this hour (6:50).

In the bond market, yields are sliding as Treasuries (-3bps) are sitting right on 4.50% after Chairman Powell seemed to indicate they actually do care about inflation. Meanwhile, European sovereign yields are all lower by between -6bps and -7bps ahead of the ECB announcement and responding to the weak GDP data. Clearly, investors on the continent are convinced there are more rate cuts coming. On the other side of that rate coin, JGB’s saw yields climb 2bps as Deputy BOJ Governor Himino indicated that further rate hikes would be appropriate given Japanese real interest rates remain negative. Not only did that support JGB yields, but the yen (+0.5%) was also a beneficiary. Finally, I would be remiss to ignore the Brazilian central bank, which hiked rates 100bps last night, taking their SELIC rate to 13.25%! (And equity investors in the US complain rates are too high!)

In the commodity space, oil (-0.1%) is little changed this morning although remains near the bottom of its recent trading range. There is so much discussion regarding what will happen here, whether Trump will be able to encourage more drilling in the US, how OPEC is going to respond to both Trump and the market, and what is going to happen in the Russia/Ukraine war, that it is very difficult to get a good handle on things. Nothing has changed my long-term view that there is plenty of oil around and it is a political decision, not a technical nor geological one, that will determine the price. As to metals markets, gold (+0.65%) continues to perform well and edges closer to the all-time high levels reached back in late October. There is much discussion about the arbitrage between COMEX and LME gold with many deliveries apparently due in NY and not enough 100toz bars available. This may be driving prices higher as those with short positions scramble to either roll their positions are get ready for delivery. As to silver (+0.4%) and copper (+0.2%), they are both along for the ride.

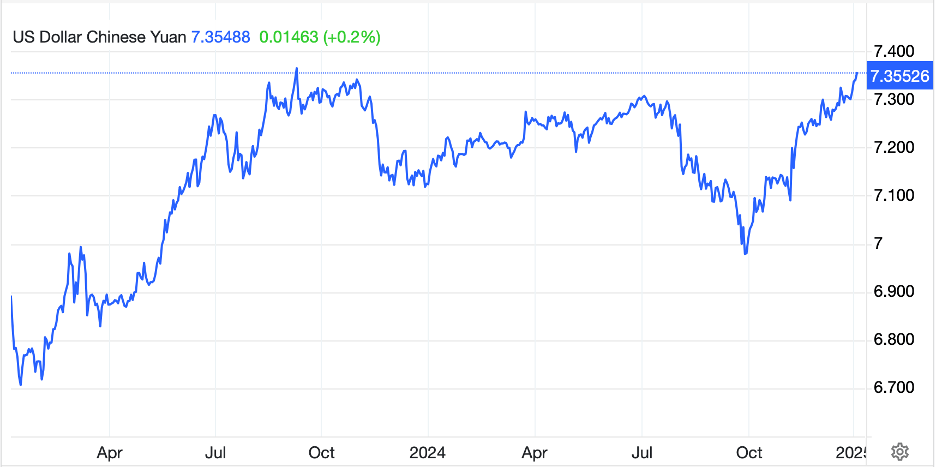

Finally, the dollar is mixed this morning as while it is modestly stronger vs. some G10 counterparts (EUR -0.2%, SEK -0.2%), the yen’s strength is moderating the overall movement. Versus its EMG counterparts, BRL (-0.8%) is the most notable mover as traders take profit after the BCB’s rate hike last night. It was widely assumed to occur and real rates in Brazil are now nearly 9%, a very attractive level that has helped the currency appreciate more than 6% in the past month. However, elsewhere, the movement is basically random.

On the data front, aside from the ECB rate decision, we see the weekly Initial (exp 220K) and Continuing (1890K) Claims data and the first look at Q4 GDP (exp 2.6%). Yesterday’s Goods Trade Balance was a record deficit of -$122.1 Billion as it appears many companies were ordering stuff to get ahead of the threatened tariffs. Also, yesterday the BOC cut rates by 25bps, as widely expected, but nobody really noticed. With the Fed sidelined for now, I suspect that we will continue to follow the equity stories more closely than the macro ones, although we do see PCE tomorrow, so a big surprise there could certainly impact the narrative. But for now, it remains difficult to be too bearish the dollar.

Good luck

Adf