Takaichi-san

Alone in the wilderness

No partners will play

In a major blow to Japan’s largest political party, the LDP, their long-time partner, Komeito, has withdrawn from the twenty-five year coalition. Ostensibly, Komeito asked Takaichi for a commitment to address the financing corruption issue that was one of the reasons for the Ichiba government’s collapse and she either could not or would not do so immediately. There seems to be a bit of he said, she said here but no matter, it is a major blow to the LDP. While it remains the largest party in both Houses, it doesn’t have a majority in either one and there is the beginning of talk as to how a coalition of other parties may put forward a PM candidate leaving Ms Takaichi on the outside looking in.

The one thing I have learned over the years is that all politics is temporary, at least when it comes to Western democracies. So, whatever the headlines blare today, the opportunity for Komeito to rejoin the LDP remains wide open. Additionally, after twenty-five years sharing power, I am pretty certain that they are unlikely to simply walk away and cede that benefit. My take, and this is strictly from my observations of how politics works everywhere, is that this spat will be overcome and Takaichi-san will, in fact, become Japan’s first female Prime Minister.

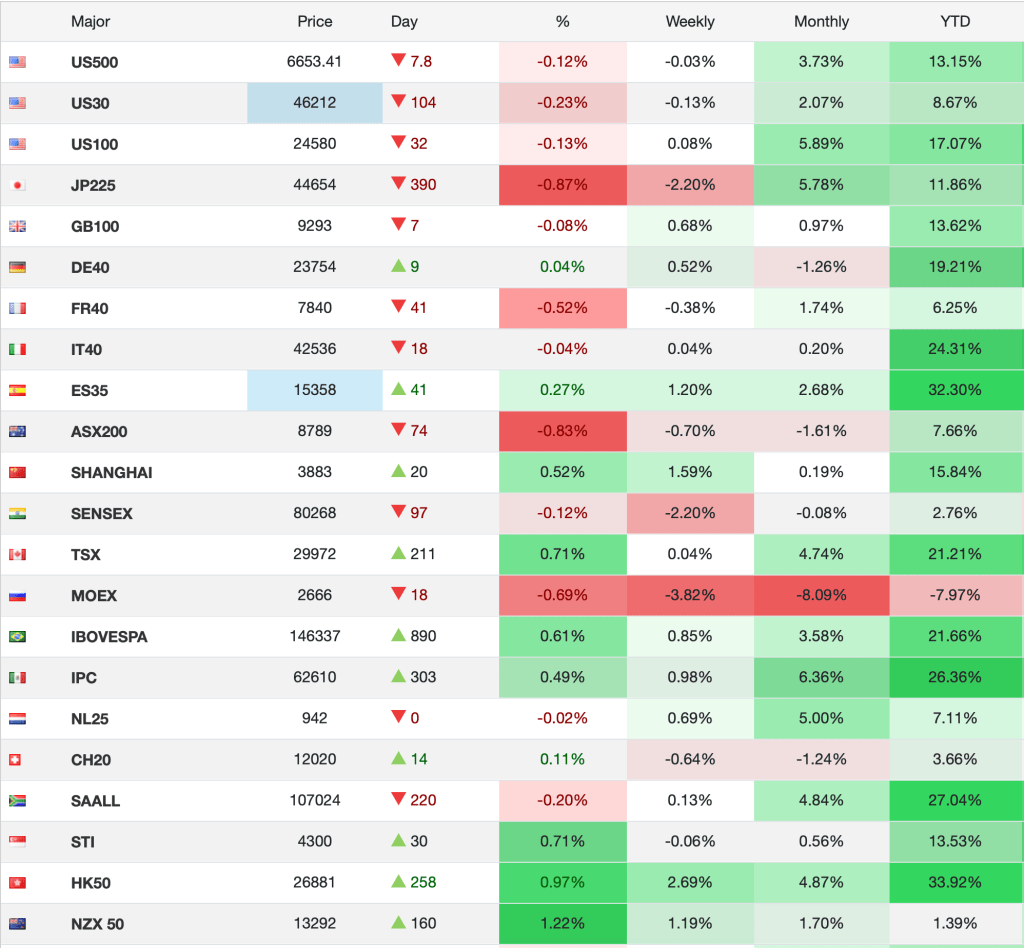

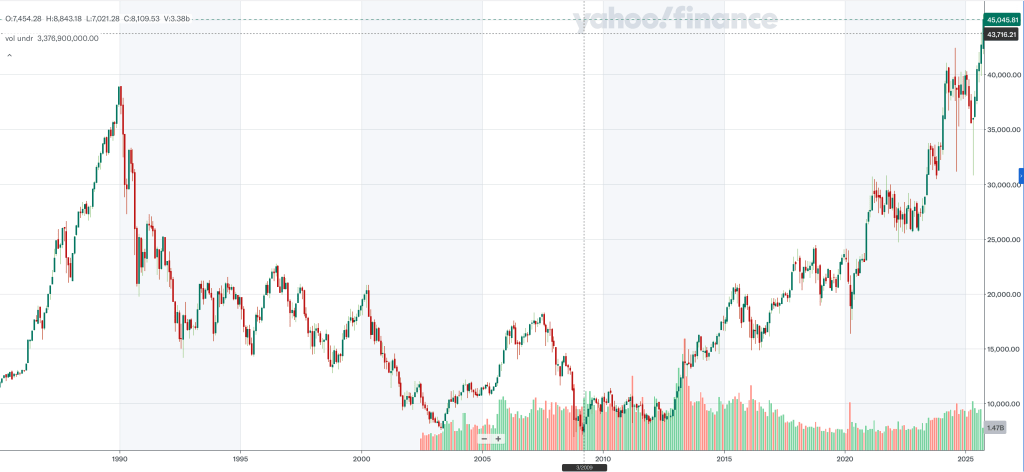

Japanese equity markets (-1.0%) were already closed ahead of the long weekend there (Japan is closed for Sports Day on Monday) when the news hit the tape, so it is not surprising that Nikkei futures fell further, another -1.25% (see chart below from tradingeconomics.com), but if I am correct, by Tuesday, all will be right with the world again. As an aside, Japanese share weakness was a follow on from US equity weakness, and that sentiment was pervasive across all of Asia (China -2.0%, HK -1.7%, Thailand -1.8%) with only Korea (+1.7%) bucking the trend as it reopened for the first time in a week and was catching up to the rally it missed.

The Bureau of Labor Statistics

Though staffed by what often seems mystics

Has called some folks back

So that they can track

Inflation’s key characteristics

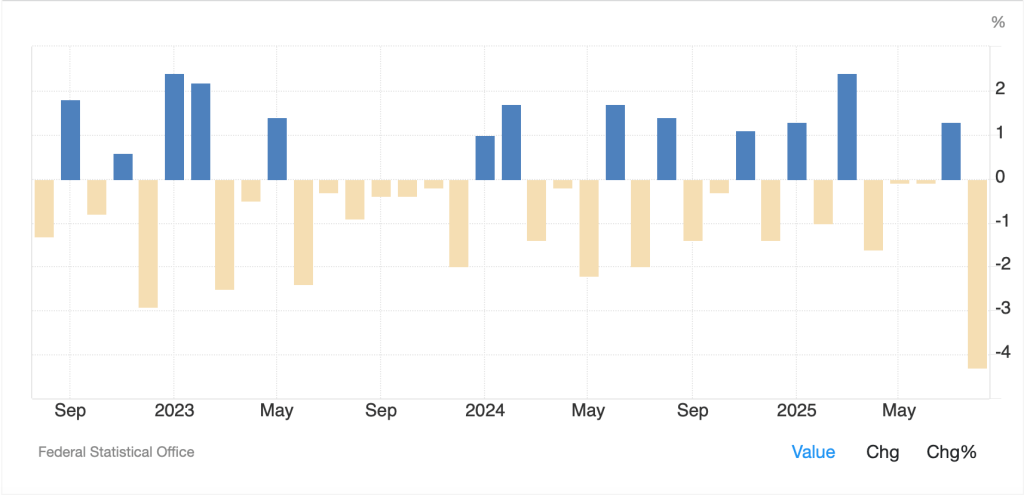

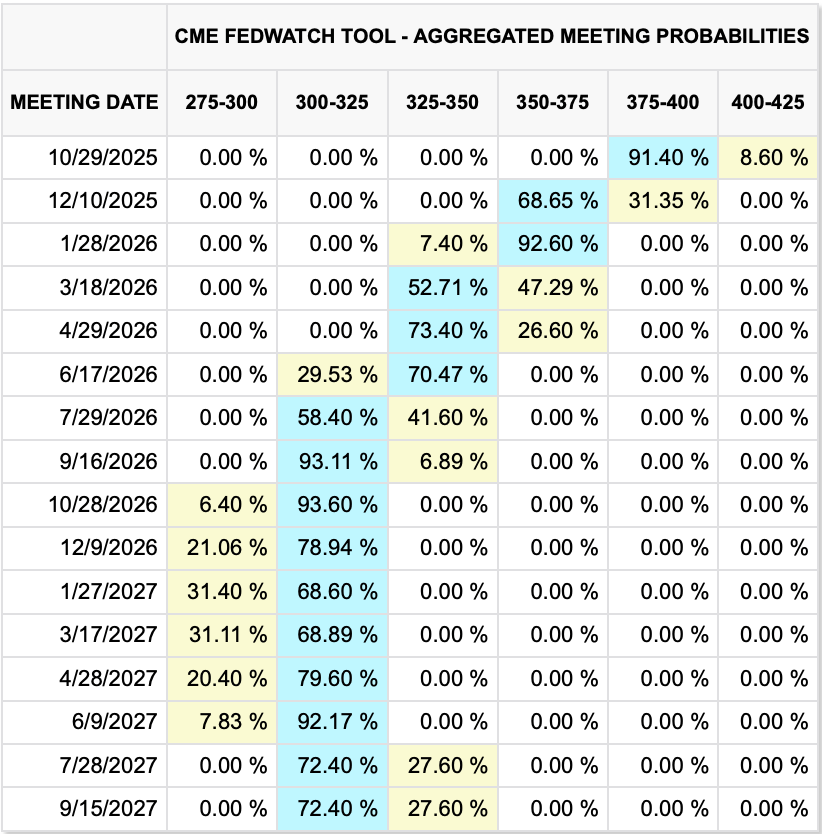

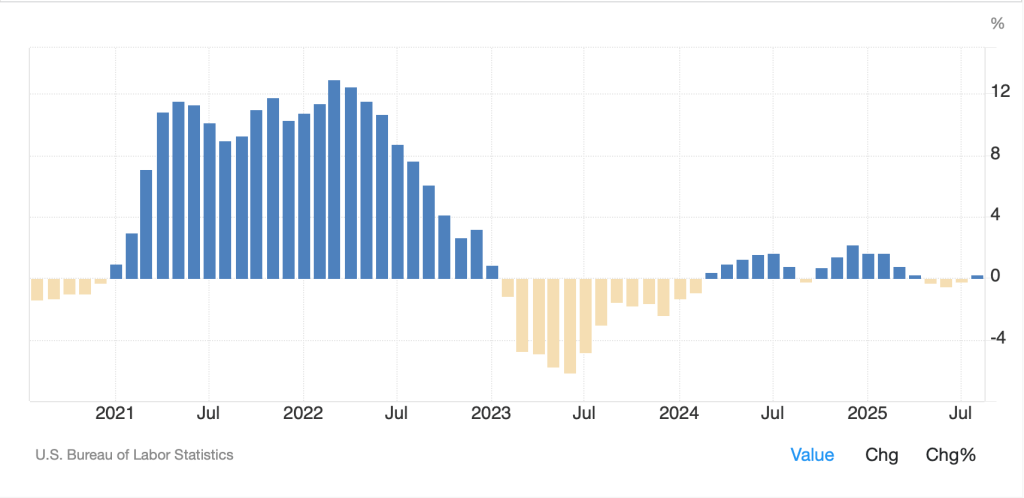

It turns out, the cost-of-living adjustments for Social Security payments are made based on the September CPI data which were originally due to be released on October 15th. Of course, the government shutdown, which now heads into its second week, resulted in BLS employees being furloughed alongside many others. However, it now appears that several of them have been called back into the office in order to prepare the report to be released some time before the end of the month, if not on the originally scheduled date. One added benefit (?) of this is that the Fed, which meets on October 28thand 29th may have the data at the time of their meeting to help with their decision making. Of course, the market continues to price a very high probability of a cut at that meeting, currently 95%, despite a continued mix of comments from Fed speakers. Just yesterday, Governor Barr urged caution on further cuts, although we also have heard from others like Chicago Fed president Goolsbee, that the labor situation is concerning and that further cuts are appropriate. Regarding the Fed, I think the doves outnumber the hawks and a cut is coming, if for no other reason than it is already priced in and they are terrified to surprise markets on the hawkish side.

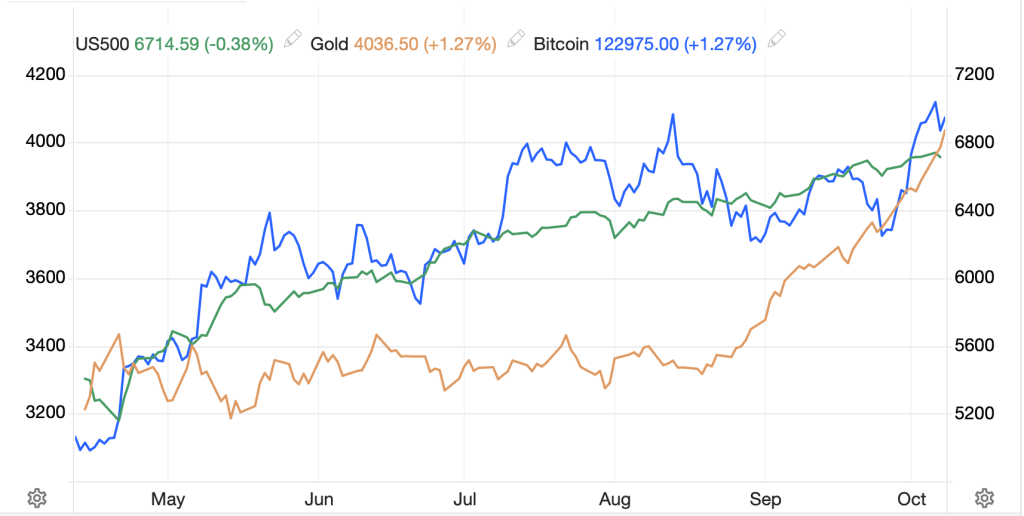

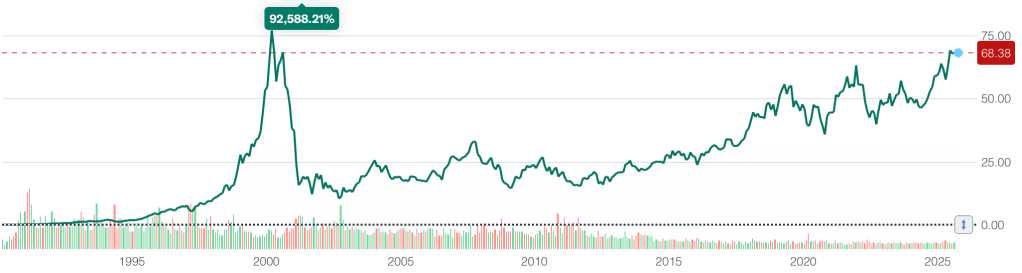

Away from those two stories, all the market talk yesterday was on the early spikes in precious metals (gold touched $4058/oz, silver $50.93/oz) before they fell back sharply on what seemed to be either serious profit-taking or, more likely, a massive attempt to prevent these metals from rallying further. There have long been stories that major banks have been manipulating prices, especially in silver, as they run huge short futures positions in their books. I do not know if those stories are true or apocryphal, but there is no doubt that someone sold a lot during yesterday’s session.

Source: tradingeconmics.com

My friend JJ (Alyosha’s market vibes) made the observation that the price action felt as though suddenly algorithms, which have ignored these markets because they haven’t offered the opportunities that equity markets have, were involved. If that is the case, it is very possible that we are going to see a very different characteristic to metals markets going forward, with much more controlled price action. Food for thought.

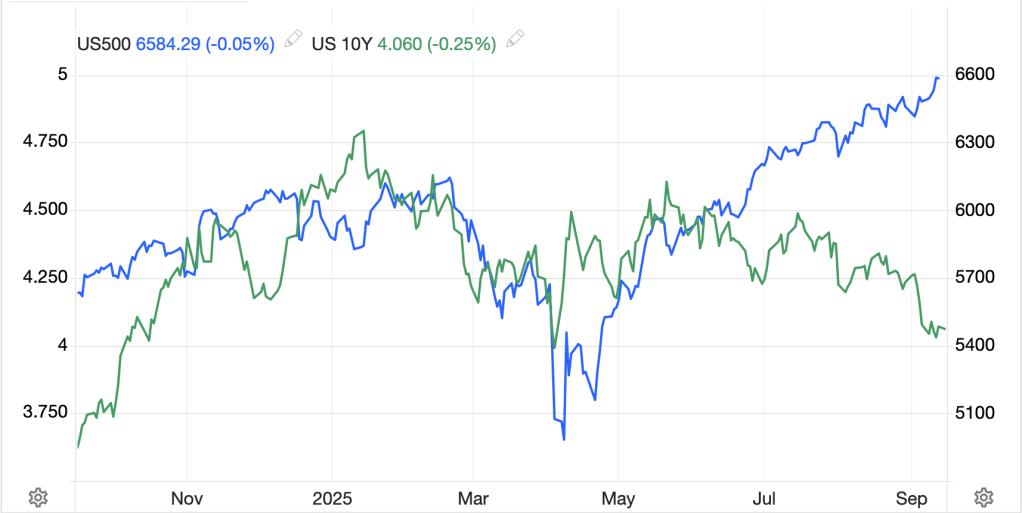

Ok, let’s recap the rest of the markets ahead of the weekend. The US equity declines were early with modest rallies into the close that left the major indices only slightly lower on the day. We have already discussed Asian markets and looking at Europe, price action has been limited although Spain (+0.4%) is having a decent day for no particular reason. Elsewhere, though, +/-0.2% describes the session.

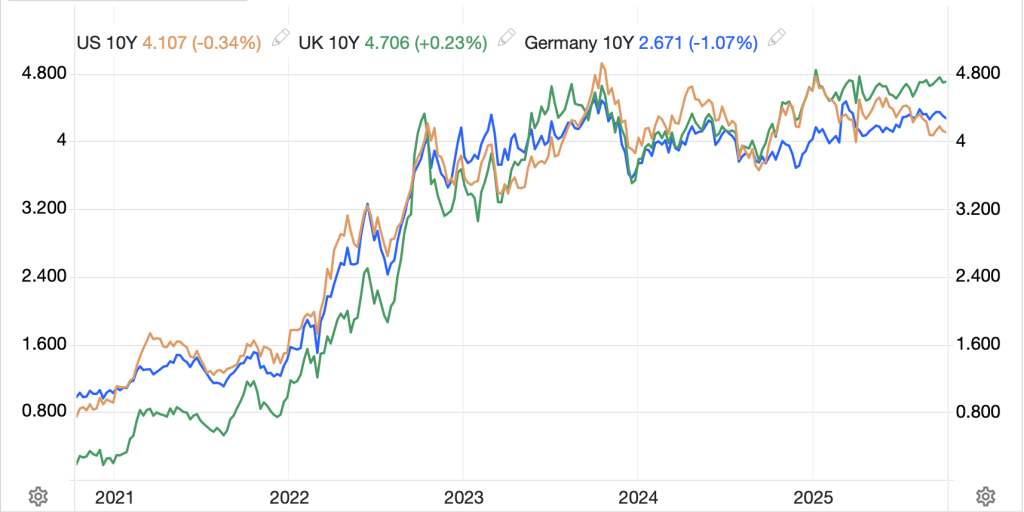

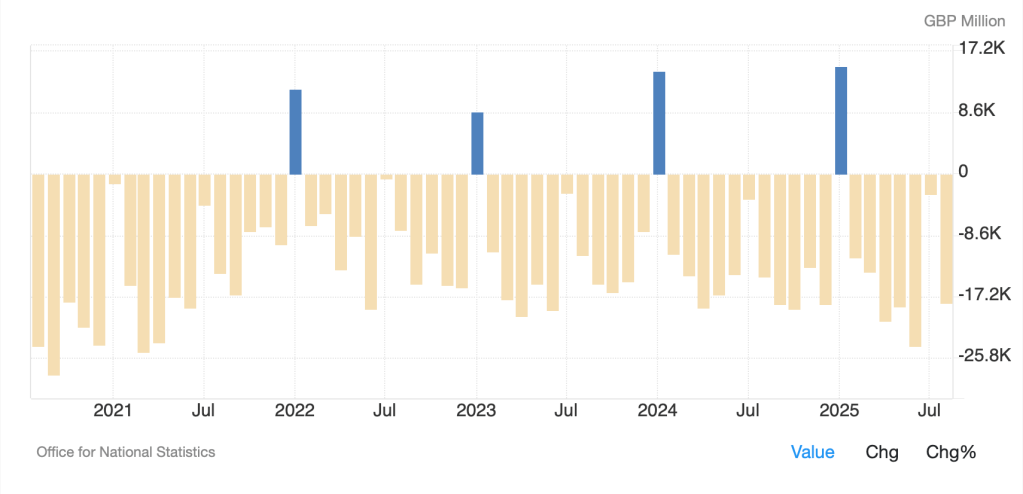

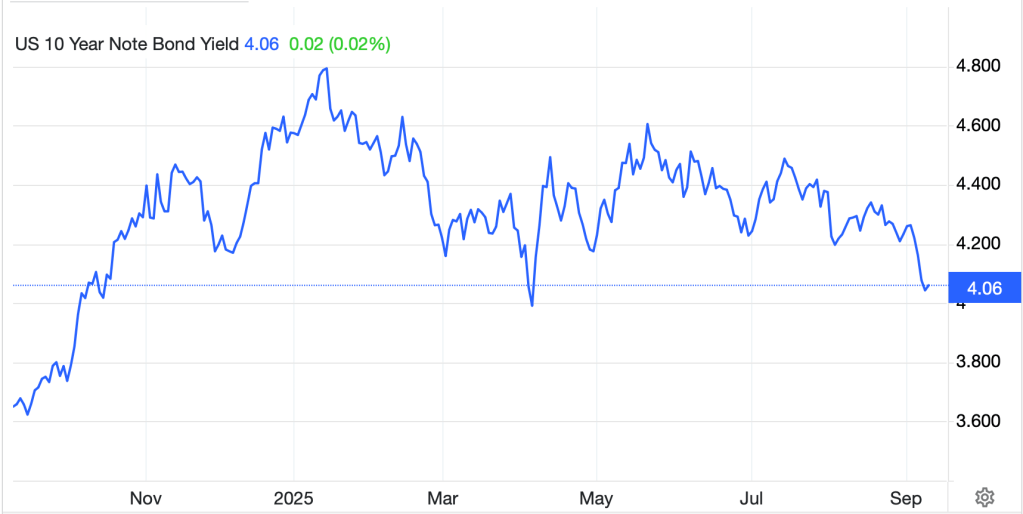

Treasury yields (-3bps) are leading all government bonds higher (yields lower) with all European sovereigns seeing similar yield declines and even JGBs slipping -1bp. The only data from the continent was Italian IP (-2.4%) which seems to be following in the footsteps of Germany. Too, Spanish Consumer Confidence fell to 81.5, which while a tertiary data point, extends its recent downward trajectory. In this light, and finally, the probability of an ECB cut at the end of the month has moved off zero, albeit just to 1%, but prior to today, futures were pricing a small probability of a rate hike!

Oil (-1.2%) has fallen back to the bottom of that trading range ostensibly because the Middle East peace process seems to be holding. This is a wholly unsatisfactory thesis in my mind given my observation that the Israel/Gaza conflict seemed to have no impact on prices for a long time because of its contained nature. Rather, Russia/Ukraine seems like it should have far more impact. But then, I’m just an FX guy, so oil markets are not my forte.

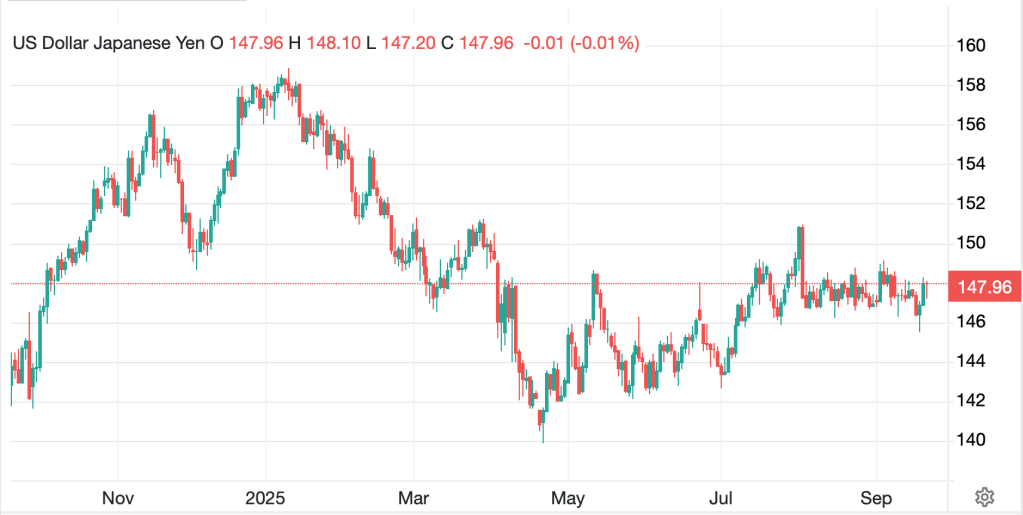

Finally, the dollar, which continues to rally in the face of all the stories about the dollar’s demise, is consolidating today after a pretty strong week. Using the DXY as our proxy, this week’s trend is evident as per the below chart from tradingeconomics.com

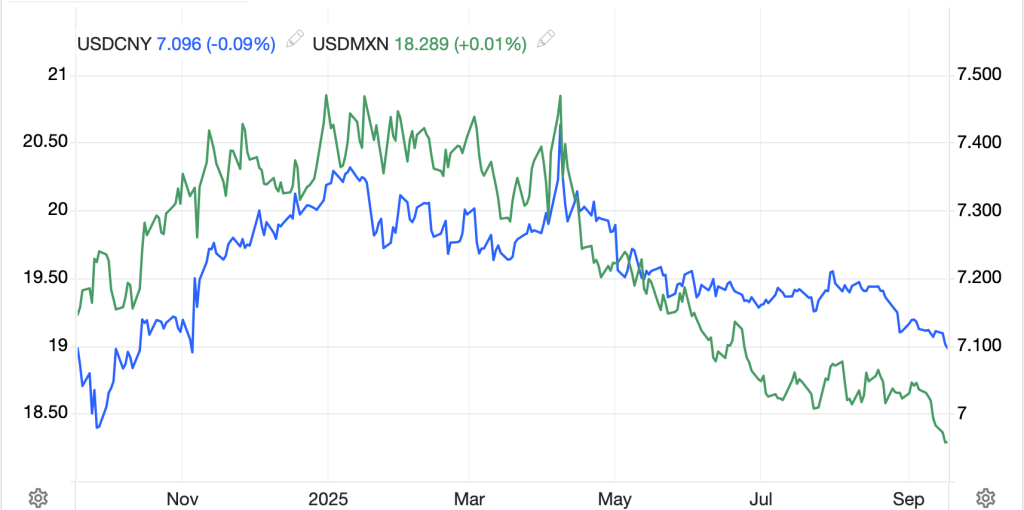

A popular narrative amongst the ‘dollar is doomed’ set is that a look at dollar reserves at central banks around the world shows a continuing reduction in holdings with central banks exchanging dollars for other currencies, (euros, pounds, renminbi, Swiss francs, etc.) or gold. Now, there is no doubt that central banks have been buying gold and that has been a key driver of the rally in the barbarous relic’s price. But the IMF, who is the last word on this issue, makes very clear that any change recently has been due to the FX rate, not the volume of dollars held. As you can see below, in Q2 (the latest data they have) virtually the entire reduction in USD reserves worldwide was due to the dollar’s first half weakness.

There are many problems in the US, and the fiscal situation is undoubtedly a mess, but as of now, there is still no viable alternative to holding dollars, especially given the majority of world trade continues to be priced and exchanged using the buck.

And that’s all for today. We do get the Michigan Confidence number (exp 54.2), which is remarkably low given the ongoing rally in equities. As you can see from the below chart overlaying the S&P 500 (gray line) with Michigan Confidence (blue line), something has clearly changed in this relationship. This appears to be as good an illustration of the K-shaped economy as any, with the top 10% of earners feeling fine while the rest are not as happy.

Source: tradingeconomics.com

As we head into the weekend, with US futures pointing higher, I have a feeling that yesterday will be the anomaly and the current trends will reassert themselves.

Good luck and good weekend

Adf