Recession is tripping off tongues

And pundits ain’t twiddling their thumbs

Political shades

Are driving tirades

And screams at the top of their lungs

But are we that likely to see

A minus in our ‘conomy?

We certainly could

And probably should

But life doesn’t always agree

The major discussion point over the weekend has been recession, and how likely we are to see one in the US in the coming months. Of course, this matters to the punditry not because of any concern over the negative impacts a recession has on the population, but ‘more importantly’ because recessions tend to result in sharp declines in equity values. And let’s face it, do you honestly believe that the editors of the New York Times or the Wall Street Journal are remotely interested in the condition of the majority of the population? Me neither.

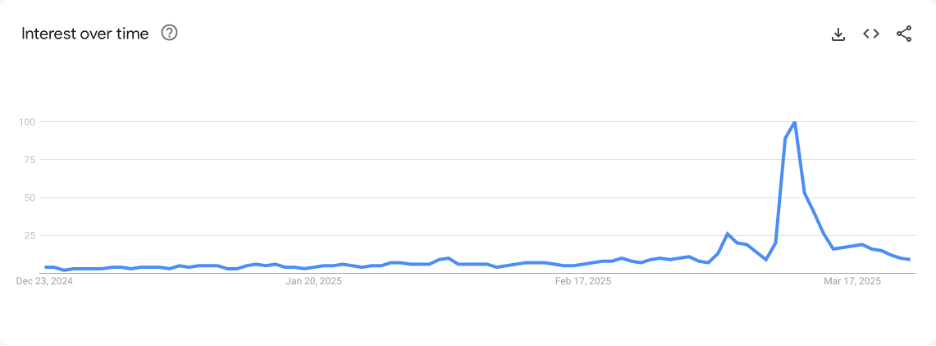

However, if they can call out something that they believe can impede President Trump, or detract from his current high ratings, they will play that over and over and over. Funnily enough, when I went to Google Trends, I looked up “recession” over the past 90 days with the result below:

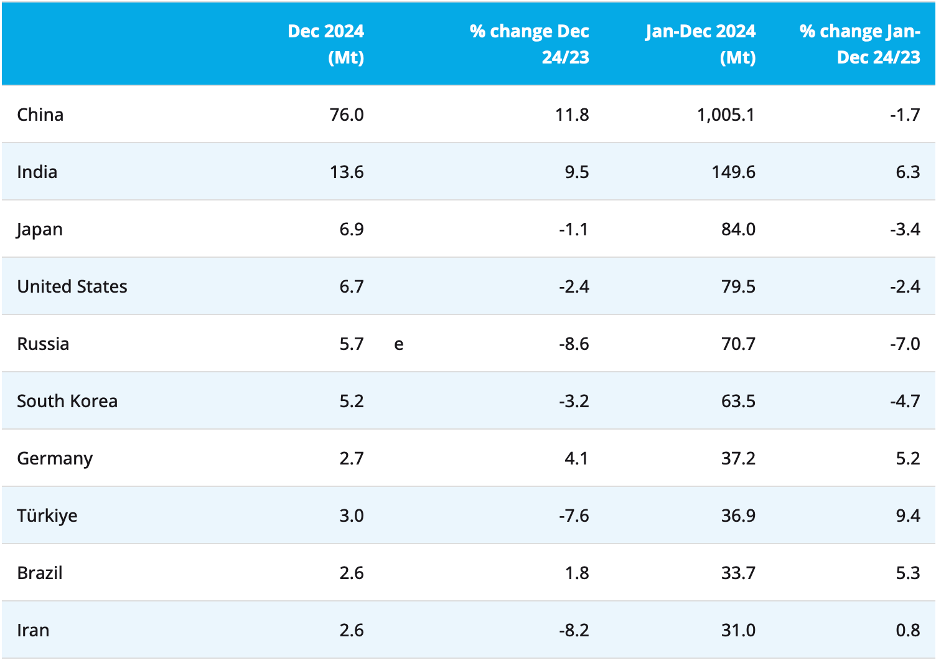

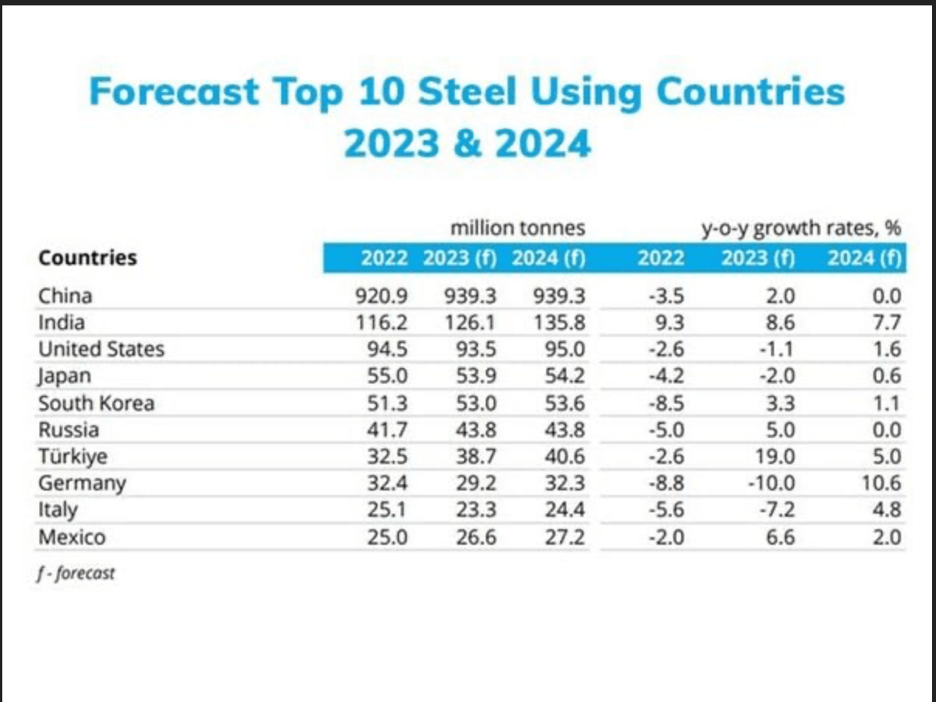

That peak was on March 11 although there was no data of note that day compared to a reading of 9 today. Looking at the news of that day, even CNN had a hard time finding bad news with the four top stories being 1) the Continuing Resolution vote in the House being passed, 2) the Department of Education announcing a 50% RIF, 3) 25% tariffs on steel and aluminum being imposed and 4) Ukraine accepting terms for a 30-day ceasefire. From an economic perspective, the tariffs clearly will have an impact, but it seems a leap that the average American can go from 25% tariffs on imported steel and aluminum to recession in one step. And based on the positive responses that continue to be seen regarding President Trump’s efforts to reduce the size of government, I doubt the DOE cuts were seen as the beginning of the end of the economy.

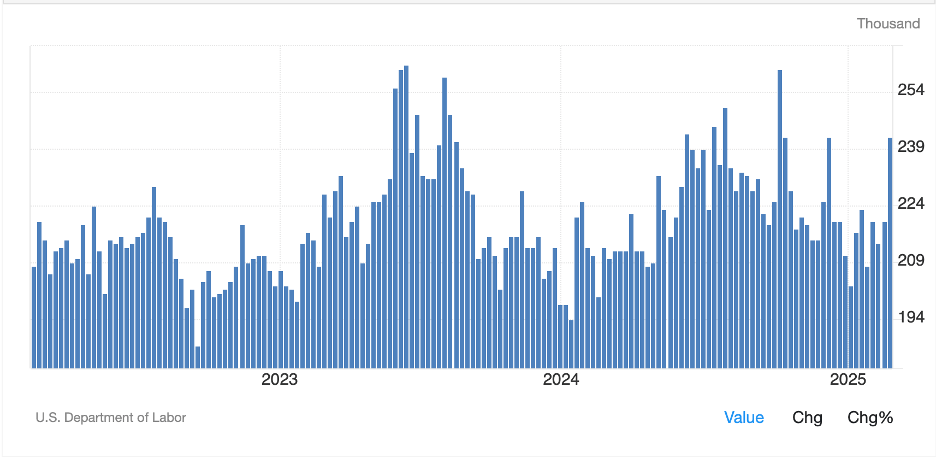

And yet, recession was the talk of the punditry this weekend. To try to better understand why this is the case, I created the following table of several major economic indicators and their evolution since December, prior to President Trump’s inauguration.

| Key indicators | Dec | Jan | Feb |

| NFP | 323 | 125 | 151 |

| Unemployment Rate | 4.10% | 4.00% | 4.10% |

| CPI | 2.90% | 3.00% | 2.80% |

| Core CPI | 3.20% | 3.30% | 3.10% |

| PCE | 2.60% | 2.50% | |

| Core PCE | 2.90% | 2.60% | |

| IP | 1.10% | 0.30% | 0.70% |

| Capacity Utilization | 77.60% | 77.70% | 78.10% |

| ISM Mfg | 49.2 | 50.9 | 50.3 |

| ISM Services | 54 | 52.8 | 53.5 |

| Retail Sales | 0.70% | -1.20% | 0.20% |

Source: tradingeconomics.com

Once again, while I am certainly no PhD economist, this table doesn’t strike me as one demonstrating a clear trend in worsening data, certainly not on an across-the-board basis. Rather, while you might say January was soft, the February data has largely rebounded. My point is that despite ABC, NBC, Bloomberg, the BBC and CNN all publishing articles or interviews on the topic this weekend, I’m not yet convinced that is the obvious outcome.

My good friend the Inflation Guy™, Mike Ashton, made an excellent point in a recent podcast of his that is very well worth remembering. The breadth of the US economy is extraordinarily wide and covers areas from manufacturing to agriculture to finance to energy and technology along with the necessary housing markets as well as the entire population consuming both goods and services. Added to the private sector, the government sector is also huge, although President Trump and Elon Musk are trying hard to shrink it. But the point is that it is not merely possible, but likely, that while some areas of the economy may go through weak patches, that doesn’t mean the entire economy is going to sink into the abyss.

If we think back to the last two recessions, the most recent was Covid inspired, which resulted from the government literally shutting down the economy for a period of several months, while giving out money. Net, things weakened, but even then, there were stronger parts and weaker parts. Go back to the GFC and the housing bubble popped and dragged banks along with it. That was the problem because banking weakness inhibits the free flow of money and that will impact everyone.

The question to be asked now, I would suggest is, are we likely to see another catalyst that will have such widespread impacts? Higher tariffs are not going to do the trick. Shrinking government, although I believe it is critical for a better long-term trajectory for the economy, will have a short-term impact, but it is not clear to me that it will negatively impact the economy writ large. Certainly, the Washington DC area, but will it impact the Rocky Mountain area? Or Texas and Florida?

Now, a recession could well be on the way. Running 7% budget deficits was capable of papering over many holes in the economy and pumping lots of liquidity into it as well. If those deficits shrink, meaning spending shrinks, the pace of activity will slow. But negative? It seems a stretch to me, at least based on what we have seen so far. One last thing here, is how might this potential weakening economic growth impact inflation? Now, we all ‘know’ that a recession causes inflation to decline, don’t we? Hmmm. While that makes intuitive sense, and we hear it a lot, perhaps the Inflation Guy™ can help here as well. Back in February he wrote a very good explanation about how that is not really the case at all, at least based on the macroeconomic data. The truth is economic growth and inflation have very little correlation at all.

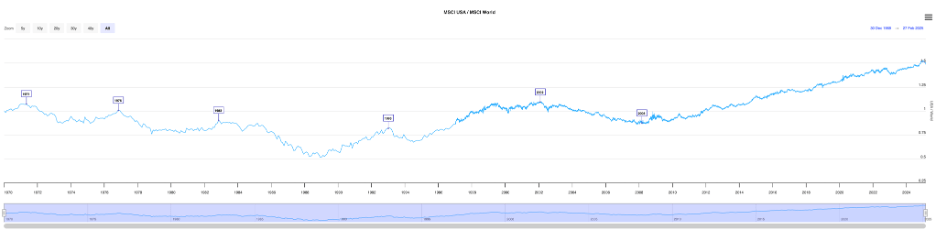

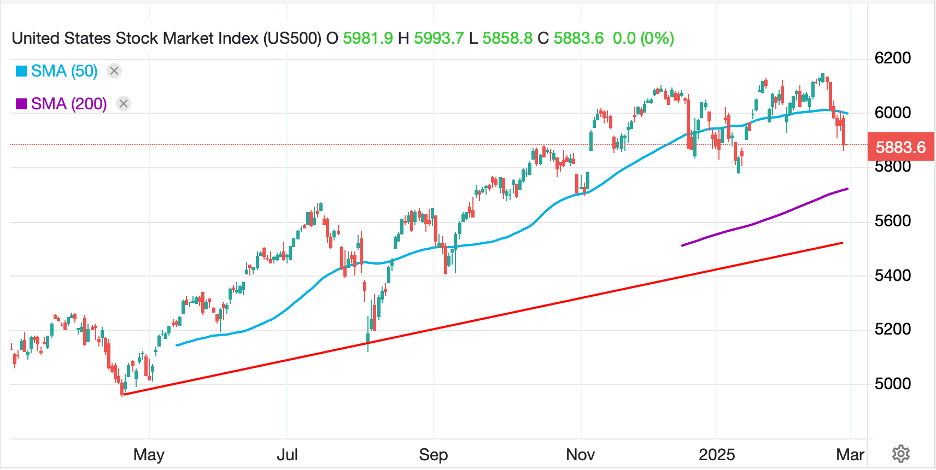

Of course, perhaps the most critical issue for the punditry is, will a recession drive stock prices lower? Here the news is far less sanguine if you are a shareholder and believe there is going to be a recession. As you can see from the below chart of the S&P 500, pretty much every recession for the last 100 years has resulted in a decline in stock market indices.

Source: macrotrends.net

This is a log chart so some of those dips don’t seem that large, but the average downturn during a recession is about 30%, although that number can vary widely. To sum it up, while the data doesn’t scream recession to me, it cannot be ruled out. As well, both President Trump and Secretary Bessent have indicated that weakness is likely going to be a result of their early actions, although the idea is to pave the way for a more stable economic performance ahead. As I have written repeatedly, volatility is likely the only thing of which we can be certain as all these changes occur. Hedge your exposures!

Ok, let’s look at the overnight activity.

The rumor is Trump may delay

His tariffs as he tries to weigh

How much he should charge

And how much, writ large,

These nations are going to pay

Equity futures in the US are higher this morning as the big story is that President Trump is considering narrowing the scope of nations who will have tariffs imposed on April 2nd. Apparently, his administration has identified the “dirty fifteen” nations with the largest bilateral imbalances and they will be first addressed. The telling comment in the WSJ article I read was when Trump said, “Once you give exemptions for one company, you have to do that for all. The word flexibility is an important word. Sometimes there’s flexibility, there’ll be flexibility.” To my ear, the final plans are not in place, but my sense is he will impose then remove tariffs, rather than avoid them initially. Interestingly, that story was written last night, yet Asian equity markets were not that ebullient. Japan (-0.2%) saw no benefit although Chinese shares (HK +0.9%, CSI 300 +0.5%) fared better. Things elsewhere in the region were mixed with both gainers (India, Thailand) and laggards (Korea, Taiwan, Indonesia) with many bourses little changed overall.

In Europe, green is the predominant color this morning but movement is modest with Spain’s IBEX (+0.4%) the leader and lesser gains elsewhere. While US futures are all higher by about 1% or more at this hour (6:45) apparently the Europeans aren’t as excited at the tariff delay process.

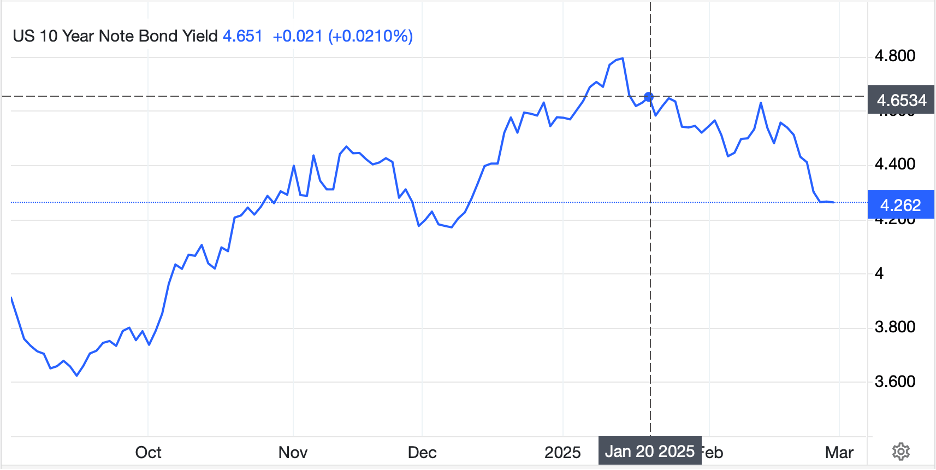

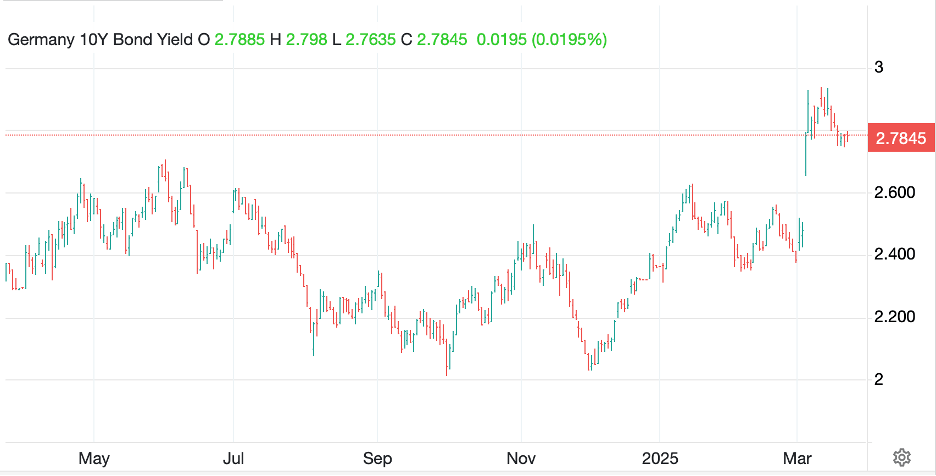

In the bond market, yields have backed up virtually across the board with Treasuries (+4bps) leading the way higher and most European sovereigns showing yields rising by 1bp or 2bps. It’s interesting, while there has been much discussion regarding German yields having traded substantially higher in the wake of the effective end of the debt brake and anticipation of much further issuance, a look at the chart below tells me that after that gap higher on the news, concerns over German finances have not deteriorated at all. And after all, the difference is about 25bps higher, hardly the end of the world.

Source: tradingeconomics.com

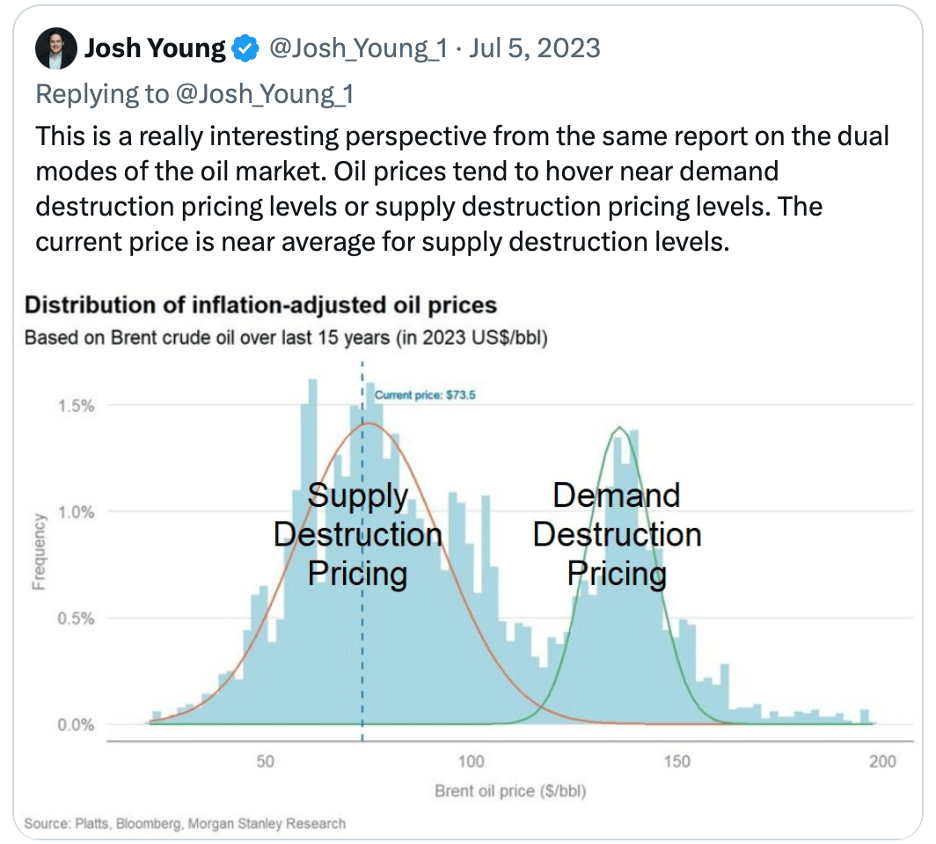

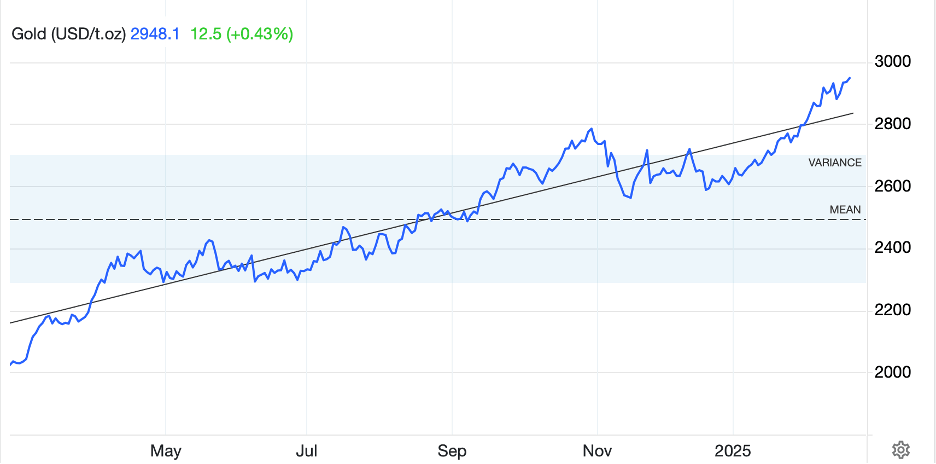

In the commodity markets, oil (+0.7%) is continuing its gradual rebound from the lows seen on, ironically, March 11th. Arguably, what this tells us is that despite the weekend barrage of recession focused articles, the market doesn’t really see that outcome. In the metals, strength is the word, again, with copper (+1.25%) making new all-time highs on the back of China’s stated goals of growing its strategic stockpile. Not surprisingly, both gold (+0.2%) and silver (+0.6%) are also climbing this morning alongside copper as commodities remain in greater demand than a recession would indicate.

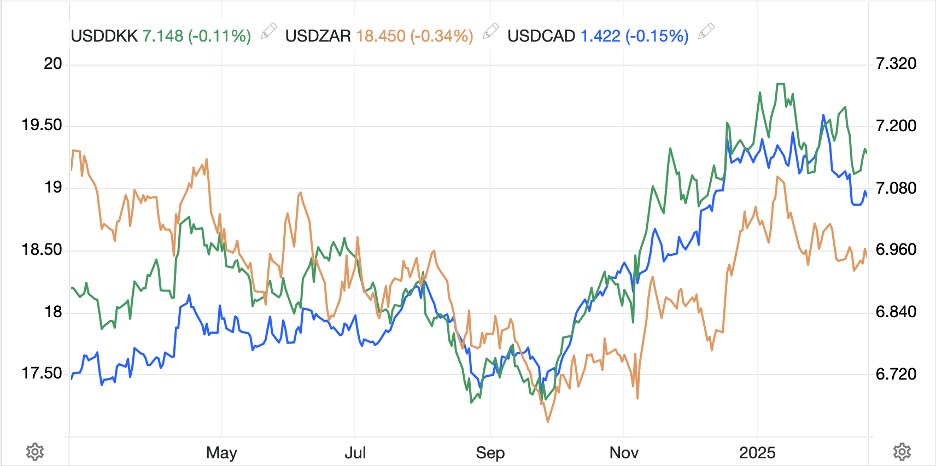

Finally, the dollar is a bit softer despite rising Treasury yields with both the euro (+0.3%) and pound (+0.4%) bouncing after last week’s modest declines. And this is despite lackluster Flash PMI readings this morning out of Europe. The biggest winner is NOK (+0.6%) which given the dollar’s broad weakness and oil’s rebound makes perfect sense. Otherwise, while the dollar’s weakness is broad, it is no deeper than the aforementioned currencies.

Given the length of this note already (my apologies) and the dearth of data to be released, with only the Chicago Fed National Activity Index (exp +0.08), I will cover data tomorrow as we do end the week with GDP and PCE data.

Headline bingo remains the key concern for all market participants, but ultimately, my altered view of a softer dollar and higher commodities remains intact.

Good luck

Adf