The market absorbed CPI

And equities started to fly

Though Core prices rose

T’was Headline, I s’pose

Encouraged investors to buy

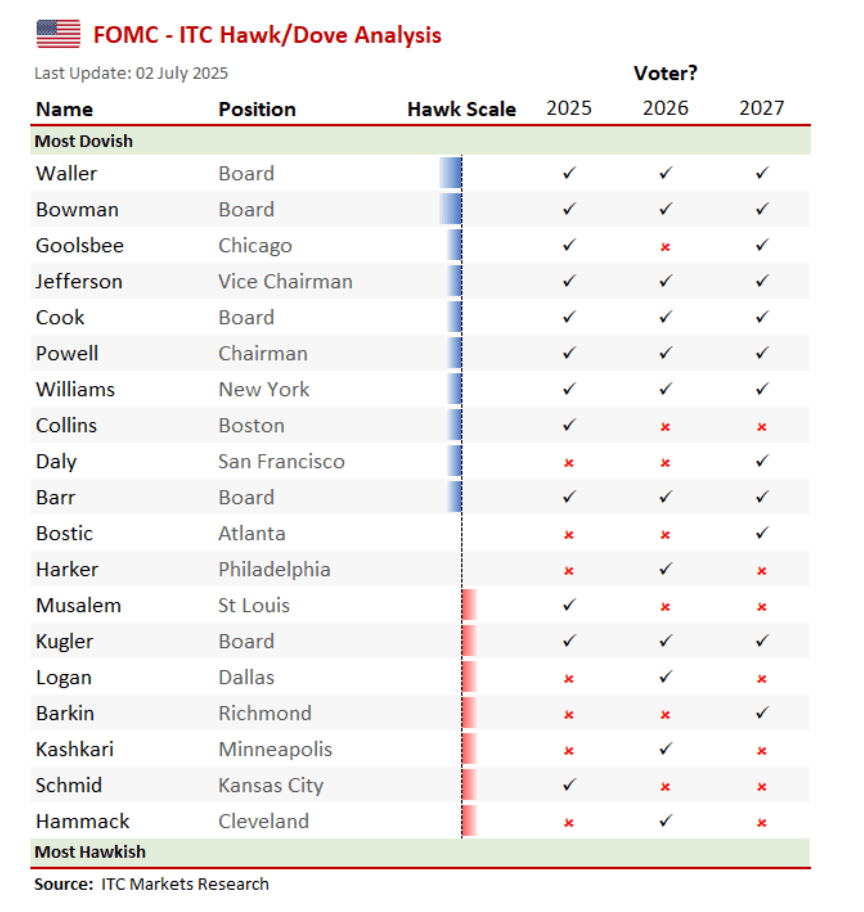

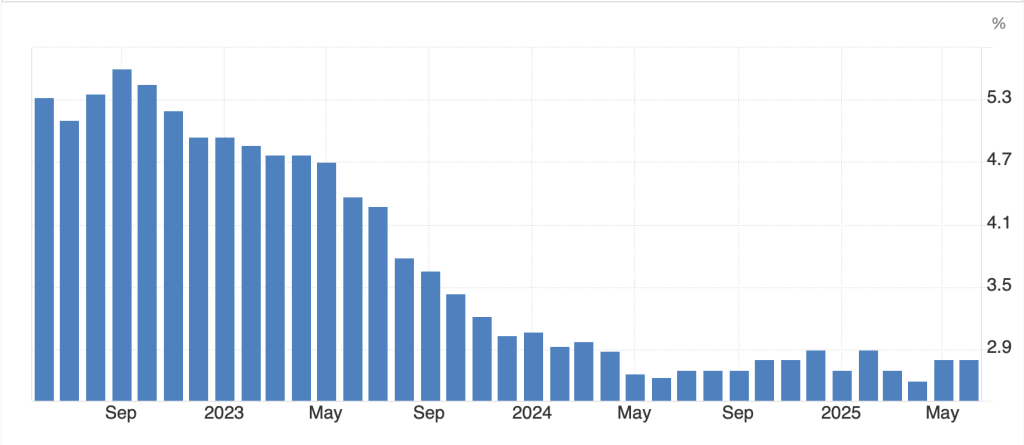

As well, Fed funds futures now price

The Fed will cut rates this year thrice

The upshot’s the buck

Is down on its luck

Beware though, lest ‘flation has spice

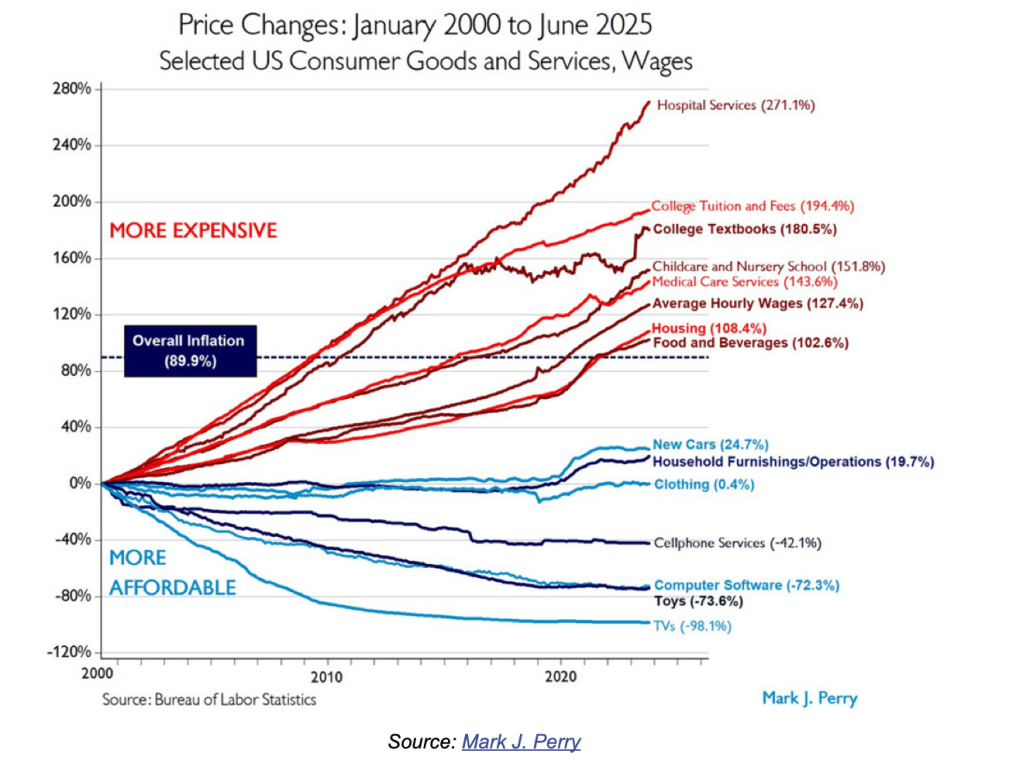

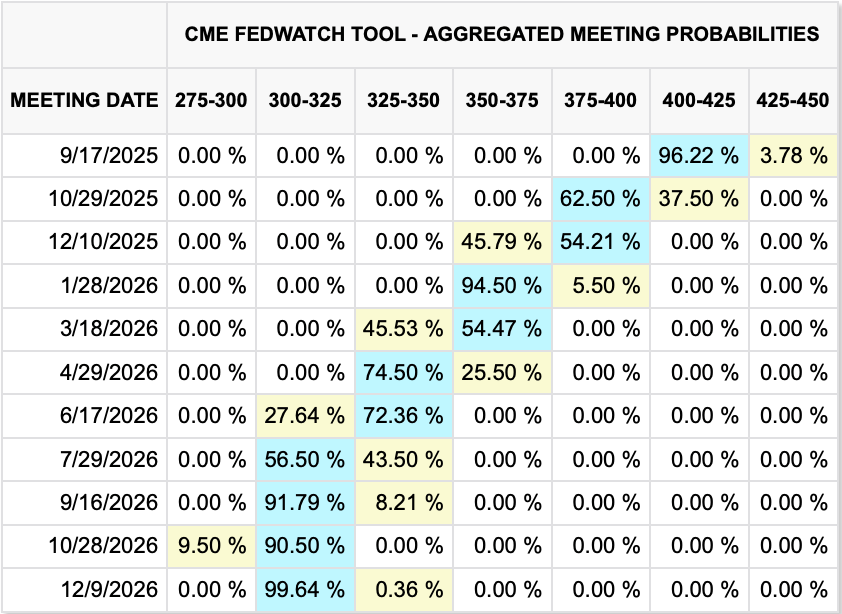

Core prices rose a bit more than forecast in yesterday’s CPI report although the headline numbers were a touch softer. The problem for the Fed, if they are truly concerned about the rate of inflation, is that the strength of the numbers came from core services less shelter, so-called Supercore, a number unimpeded by tariffs, and one that has begun to rise again. As The Inflation Guy™ makes clear in his analysis yesterday, it is very difficult to look at the data and determine that 2% inflation is coming anytime soon. I know the market is now virtually certain the Fed is going to cut in September, but despite President Trump’s constant hectoring, I must admit the case for doing so seems unpersuasive to me.

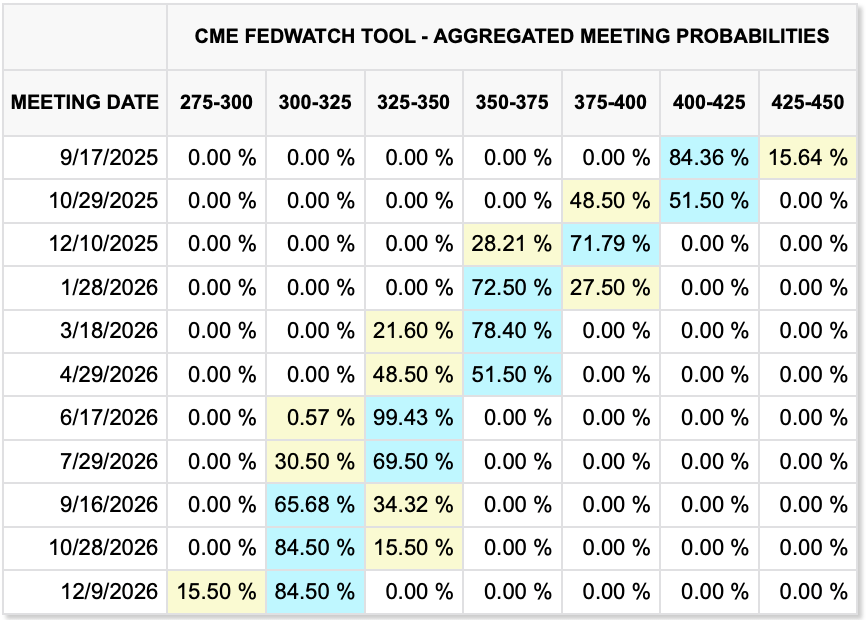

Here are the latest aggregated probabilities from the CME and before you say anything, I recognize the third cut is priced in January, but you need to allow me a little poetic license!

However, since I am just a poet and neither institutions nor algorithms listen to my views, the reality on the ground was that the lower headline CPI number appeared to be the driver yesterday and into today with equities around the world rallying in anticipation of Fed cuts. As well, the dollar is under more severe pressure this morning on the same basis. However, it remains difficult for me to look at the situation in nations around the world and conclude that the US economy is going to underperform in any meaningful way over time.

So, to the extent that a currency’s relative value is based on long-term economic fundamentals, it is difficult to accept that the dollar’s relative fiat value will decline substantially, and permanently, over time. I use the euro as a proxy for the dollar, which is far better than the DXY in my opinion as the Dollar Index is a geometric average of 6 currencies (EUR, JPY, GBP, CAD, SEK and CHF) with the euro representing 57.6% of the basket. And I assure you that in the FX markets, nobody pays any attention to the DXY. Either the euro or the yen is seen as the proxy for the “dollar” and its relative value. At any rate, if we look at a long-term chart of the euro below, we see that the twenty-year average is above the current value which pundits want to explain as a weak dollar. Too, understand that back in 1999, when the euro made its debut, it started trading at about 1.17 or so, remarkably right where it is now!

Source: finance.yahoo.com

My point is that the dollar remains the anchor of the global financial system, and given the current trends regarding both economic activity and the likely ensuing central bank policies, as well as the ongoing performance of US assets on a financial basis, while short-term negativity on the dollar can be fine, I would be wary of expecting it to lose its overall place in the world.

Speaking of short-term views, especially regarding central bank activities, it appears clear that the market is adjusting the dollar’s value on this new idea of the Fed cutting more aggressively. If that is, in fact, what occurs, I accept the dollar can decline relative to other currencies, but I really would be concerned about its value relative to things like commodities. And that has been my view all along, if the Fed does cut rates, gold is going to be the big beneficiary.

Ok, let’s review how markets have absorbed the US data, as well as other data, overnight. Yesterday’s record high closings on US exchanges were followed by strength in Tokyo (+1.3%), Hong Kong (+2.6%), China (+0.8%) despite the weakest domestic lending numbers in the history of the series back to 2005. In fact, other than Australia (-0.6%) every market in Asia rallied. The Australian story was driven by bank valuations which some feel are getting extreme despite the RBA promising further rate cuts, or perhaps because of that and the pressure it will put on their margins. Europe, too, is rocking this morning with gains across the board led by Spain (+1.1%) although both Germany (+0.9%) and France (+0.6%) are doing fine. And yes, US futures are still rising from their highs with gains on the order of 0.3% at this hour (7:45).

In the bond market, Treasury yields have slipped -3bps this morning, with investors and traders fully buying into the lower rate idea. European sovereigns are also rallying with yields declining between -4bps and -5bps at this hour. JGBs are the exception with yields there edging higher by 2bps, though sitting right at their recent “home” of 1.50%. as you can see from the chart below, 1.50% appears to be the market’s true comfort level.

Source: tradingeconomics.com

In the commodity space, oil (-0.6%) continues to slide as hopes for an end to the Russia-Ukraine war rise ahead of the big Trump-Putin meeting on Friday in Alaska. Nothing has changed my view that the trend here remains lower for the time being as there is plenty of supply to support any increased demand.

Source: tradingeconomics.com

Metals, meanwhile, are all firmer this morning with copper (+2.6%) leading the way although both gold (+0.4%) and silver (+1.7%) are responding to the dollar’s decline on the day.

Speaking of the dollar more broadly, its decline is pretty consistent today, sliding between -0.2% and -0.4% vs. almost all its counterparts, both G10 and EMG. This is clearly a session where the dollar is the driver, not any particular story elsewhere.

On the data front, there is no primary data coming out although we will see the weekly EIA oil inventory numbers later this morning with analysts looking for a modest drawdown. We hear from three Fed speakers, Bostic, Goolsbee and Barkin, with the latter explaining yesterday that basically, he has no idea what is going on and no strong views about cutting or leaving rates on hold. If you ever wanted to read some weasel words from someone who has an important role and doesn’t know what to do, the following quote is perfect: “We may well see pressure on inflation, and we may also see pressure on unemployment, but the balance between the two is still unclear. As the visibility continues to improve, we are well positioned to adjust our policy stance as needed.”

And that’s all there is today. The dollar has few friends this morning and I see no reason for any to materialize today. But longer term, I do not believe a dollar weakening trend can last.

Good luck

Adf