The Minutes explained that in June

The Fed felt no need to impugn

Their previous view

Of nothing to do

Though two sang an alternate tune

Yesterday’s release of the FOMC Minutes from their June meeting confirmed what we have learned in the interim. Governors Waller and Bowman have been clear that they see tariffs as a one-off impact on the rate of inflation, and not something on which to base policy. If you think about it, tariffs are like food and energy, something that cannot be addressed effectively by monetary policy and which the Fed explicitly excludes from their decision-making process. (For a really good read on the inflationary impact on tariffs, @inflation_guy published this yesterday). To me, the salient comments from the Minutes are below:

“While a few participants noted that tariffs would lead to a one-time increase in prices and would not affect longer-term inflation expectations, most participants noted the risk that tariffs could have more persistent effects on inflation.”

“Participants agreed that although uncertainty about inflation and the economic outlook had decreased, it remained appropriate to take a careful approach in adjusting monetary policy.”

In fact, it is not hard to conclude that the Fed’s intransigence on this issue is politically motivated as well since we have already established that the Fed is clearly political (and partisan). I would estimate part of the reason they do not want to cut rates here is because they don’t want to be seen as caving into President Trump’s demands. But whatever the reason, even the futures market is reducing the probability of a cut with the July probability having fallen from more than 20% two weeks ago to 6.7% as I type this morning. We will need to see some seriously weak economic data to get the Fed to move, I believe, although I expect we will see Governors Waller and Bowman dissent at the July 30th meeting.

However, I would contend that the market has already sussed this out and there will be limited impact on any financial markets after the meeting absent a surprise cut. So, let’s move on.

The target of Trump’s latest ire

Brazil, has now come under fire

The issue’s not trade

Instead, Trump was swayed

By lawfare ‘gainst one he admire(s)

The other news from yesterday (and there has been precious little overnight) was President Trump’s threat of 50% tariffs on all of Brazil’s exports to the US. Now, the US runs a trade surplus with Brazil of about $10 billion, so clearly trade is not the issue here. Rather, it seems that Mr Trump is seeking to help is friend, former Brazilian president Joao Bolsonaro, who is also a right-leaning populist and who is on trial for leading an insurrection after he lost the last election. It is not hard to understand Mr Trump’s concern over the issue given the history in the US and the previous administration’s efforts to imprison Trump himself.

However, this seems, at least to me, a bit over the top. Brazil had been slated to get the minimum 10% tariff prior to yesterday’s outburst. As well, the US is Brazil’s second largest trading partner, so this will have a significant impact on the country if these tariffs are imposed. As such, it is no surprise that the market responded immediately.

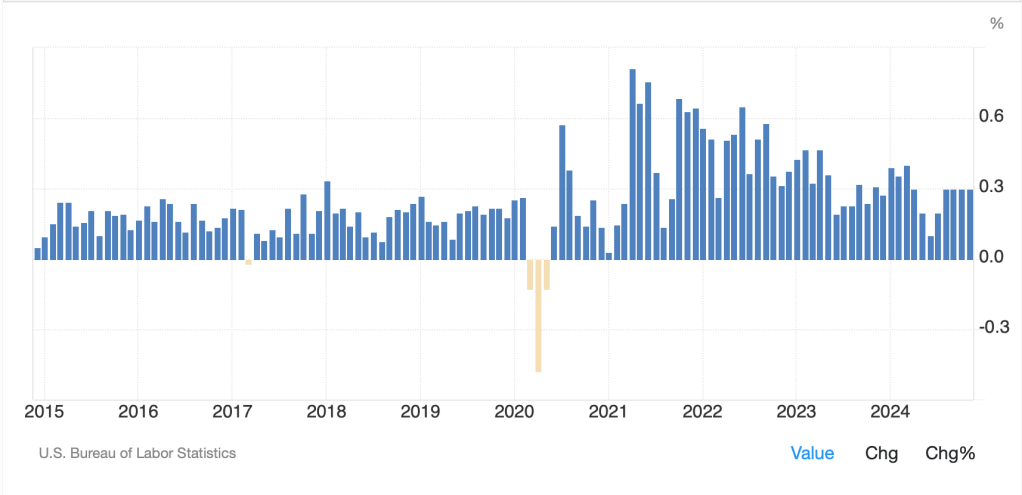

Source: tradingeconomics.com

As you can see from the chart above, the announcement at 1:30 yesterday afternoon had an immediate impact with the real falling -2.5% with minutes of the news. Too, the IBOVESPA stock index fell more than -1.3% yesterday with Embraer, the airplane manufacturer down nearly 10%. Right now, this is a threat, and the immediate Brazilian response was to say they would not be cowed by this action and will continue with their internal legal activities. There is no way I will opine on how this will end, but if these tariffs are put in place, it will be a distinct negative for Brazil’s economy, and I would expect that the real could quickly head back toward 6.00 from its current levels.

Away from those two stories, though, issues impacting financial markets are sparse. With that in mind, let’s see how markets behaved overnight. Yesterday’s US equity rally was followed by a mixed picture in Asia with Japan (-0.4%) slipping a bit but gains in both China (+0.5%) and Hong Kong (+0.6%) after rumors came out that the Chinese government was getting set to add more support to the still-imploding Chinese property market. Other regional bourses saw some gains (Korea, Taiwan, Australia) and some losses (India, Thailand, Philippines). At this point, all eyes remain on the tariff story for most of these nations. Meanwhile, in Europe, the FTSE 100 (+1.1%) is today’s leader on the strength of its mining sector which responded positively to President Trump’s mooted 50% tariffs on copper. Elsewhere, though, things have been less robust with the CAC (+0.7%) having a nice day, the DAX (+0.2%) edging higher after inflation data was released as expected at 2.0% while the IBEX (-0.6%) is moving in the other direction absent a major catalyst. However, remember it has been performing well, so this could just be some profit taking. US futures are essentially unchanged at this hour (7:00).

In the bond market, yesterday’s 10-year auction went well with no tail and yields ultimately slipped 6bps during the session. This morning, that yield has edged back higher by just 1bp. As to European sovereigns, they are +/- 1bp this morning, showing no direction or new views on anything. Readings from Europe this morning have confirmed that the rate of inflation is quiet and near the ECB’s target so there is little reason for investors to worry. As well, the word is that a trade deal between the US and EU is getting close, which will almost certainly be seen as a benefit for markets on the continent.

In the commodity markets, oil (-0.6%) is softer this morning but continues to hug the $68/bbl level despite EIA inventory data showing a net large build of nearly 4 mm barrels. It appears that there is both ample supply and production and there continues to be concern over slowing economic activity, yet oil is in demand. As I often say, sometimes markets are simply perverse. In the metals markets, gold (+0.5%) continues to trade either side of $3350/oz and has done so since mid-April. I continue to read about central banks buying the relic and replacing US Treasuries with gold in their reserve portfolios, but there is obviously enough supply to prevent further price appreciation for now. But gold is leading gains across the entire metals complex (although copper is getting a boost from the tariff talk.)

Finally, in the FX markets, there is no direction this morning. both the euro and pound are slightly softer, but AUD (+0.4%) and NZD (+0.35%) are firmer with the yen and CAD little changed. ZAR (+0.4%) is also having a good day, arguably on the strength in the precious metals markets but otherwise, it is hard to find anything exciting to note.

Turning to this morning’s data, we get the weekly Initial (exp 235K) and Continuing (1980K) Claims and that’s it. We do hear from three Fed speakers, Musalem, Daly and Waller, but since we already know Waller’s views, it will be far more interesting to hear the other two. I do find it interesting that Ms Daly, one of the most dovish FOMC members, is not in the rate cut camp, a situation I attribute entirely to her political views.

And that’s what we’ve got today. Nothing has changed any trends, and it seems highly unlikely that today’s data will. However, if we hear dovish signals from both Daly and Musalem, that may indicate a turn at the Fed and perhaps we will see that narrative change. I am confident the one thing Chairman Powell does not want is to have a 5-4 vote to leave rates unchanged. I would contend that is the most intriguing thing on the horizon right now.

Good luck

Adf