While headlines are all ‘bout elections

And some have discussed stock corrections

The dollar keeps climbing

As some think pump priming

By Jay will find no real objections

The punditry, though, remains split

One side claims things have turned to sh*t

The other side, though

Is really gung-ho

And weakness they will not admit

The Democrats had a good election, sweeping the big three races in NYC, NJ and Virginia and many down ticket ones as well. One spin is this is all a vote against President Trump but given that those three venues are all heavily Democratic to begin with, that may be an exaggeration. Of the three, my concern turns to NYC as having lived there prior to Mayor Rudy Giuliani’s cleanup of the city, I can tell you, things were not fantastic. Mayor-elect Mamdani’s stated plans have failed every time they have been tried around the world and I suspect that will be the situation here as well. Alas, that will not prevent him from trying. Ironically, regarding high rents, it is possible that the increased outmigration from the city by those in the center and on the right will reduce housing demand and arguably housing costs. We will all watch as it unfolds.

But will that directly impact markets? Of that I am far less concerned. I read that JPMorgan already had more employees in Texas than NY prior to the election and given that the concept of a physical exchange has basically disappeared, trading can relocate quickly. My take is, this will get the talking heads quite excited for a while but will have a minimal impact on markets.

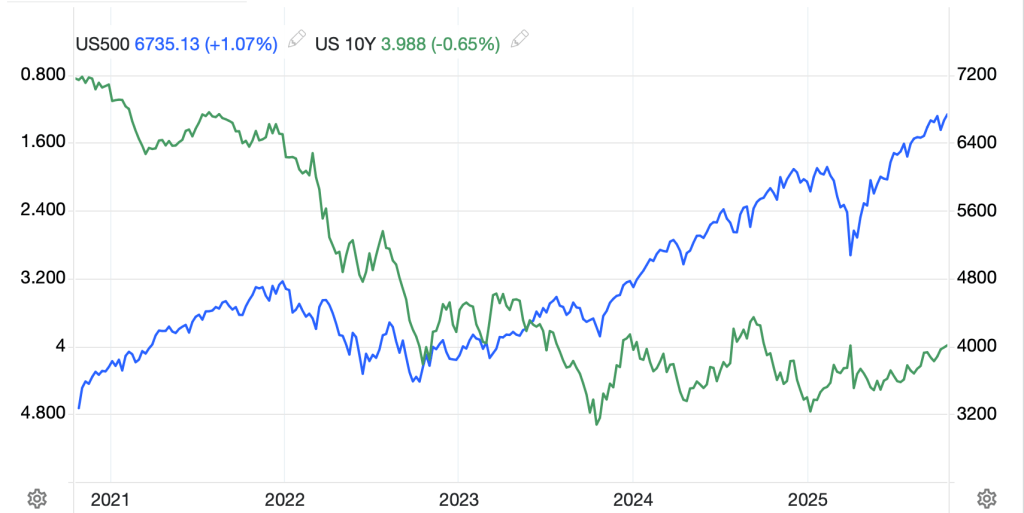

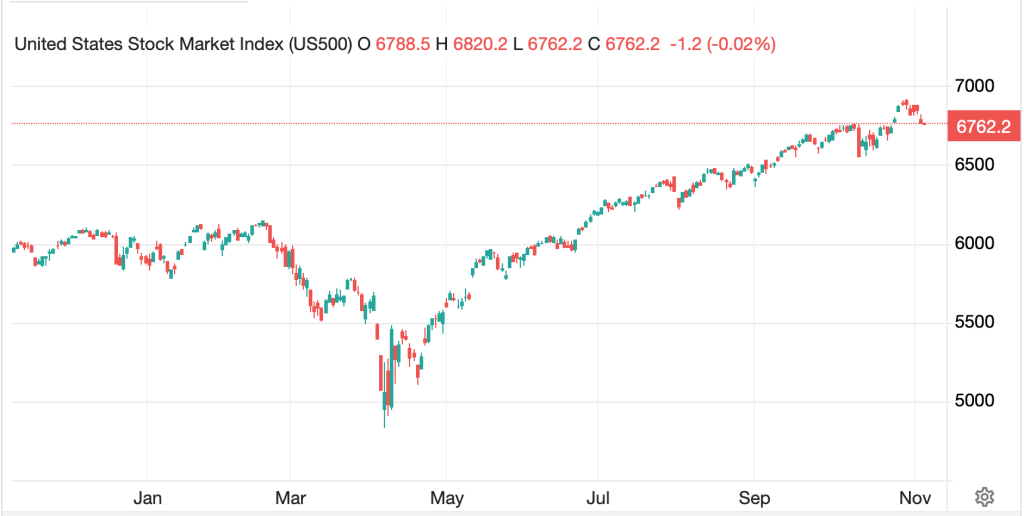

Which takes us to yesterday’s price action and its drivers. First off, one might have thought that we experienced another Black Monday based on some of the hysteria in commentaries, but in the end, US equity indices only fell between -0.5% (DJIA) and -2.0% (NASDAQ). In fact, using the S&P 500, a look at the chart shows that the decline over the past several sessions amounts to just -2.3% there, hardly calamitous!

Source: tradingeconomics.com

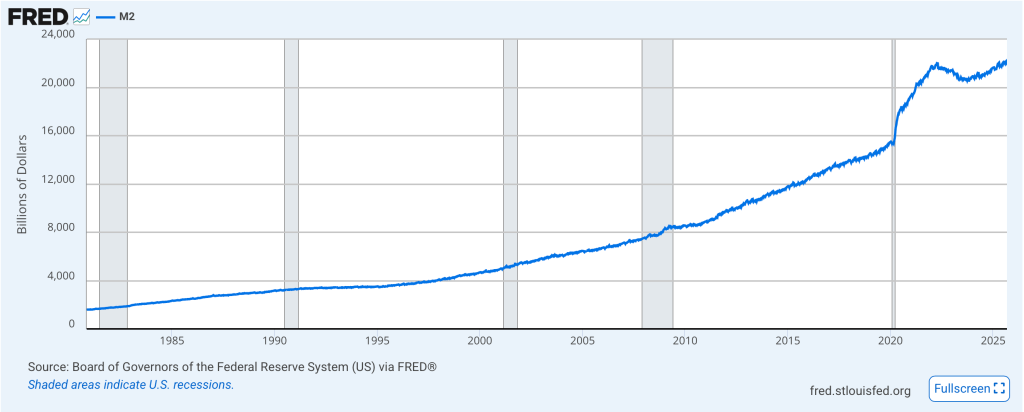

I continue to read about the K-shaped economy with the massive split between the top 10% of income/wealth representing 87% of spending and enjoying life while the bottom 90% struggle immensely. This has been made possible by the ongoing support of financial assets by the Fed (and other central banks) which has accrued to asset holders, i.e. the top 10%. In fact, this is a far more likely rationale for Zoran Mamdani’s victory yesterday, he has promised to help those who are struggling by freezing rents, offering free stuff and taking over the grocery stores to remove the profit motive and lower prices. And when it comes to elections, the bottom 90% have a lot more votes!

Here is as good an explanation of the forces driving this narrative as any:

While equity and asset prices continue to climb, the working class is finding life increasingly difficult as job opportunities seem to be shrinking. This latter issue seems only to be exacerbated by the growth in AI spending and the announcements by numerous companies that they will be reducing staffing because of the efficiencies created by AI in their operations.

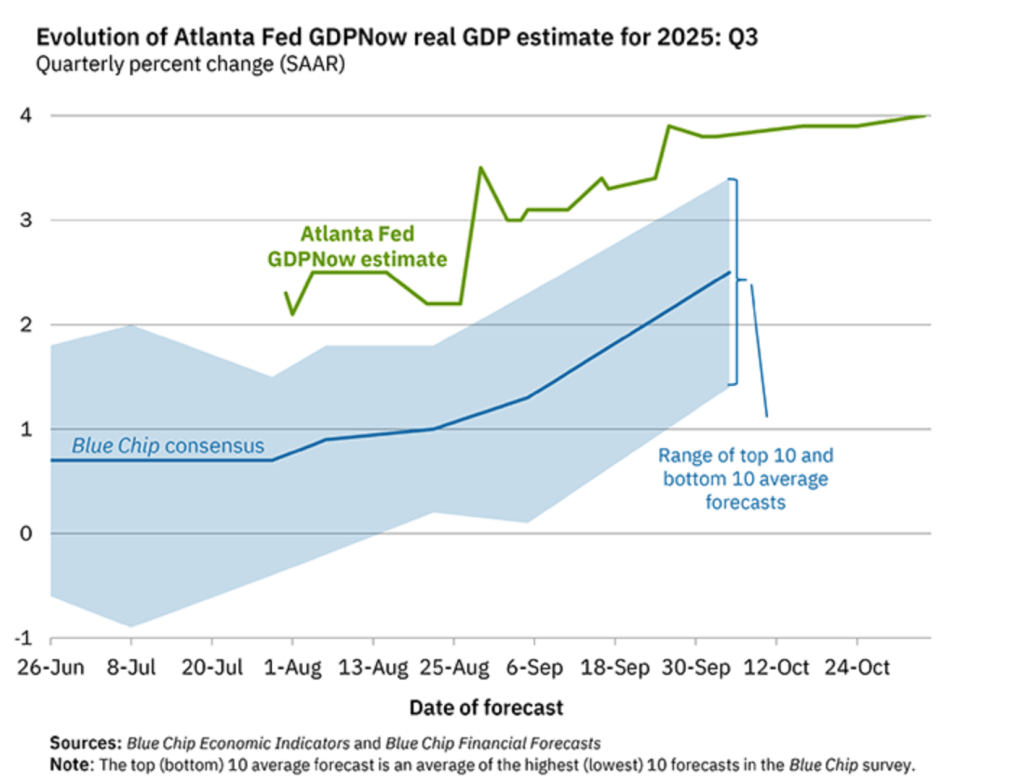

Arguably, the reason we have seen such a large dichotomy between analyst views is that some are focused on data that represents the bottom leg of the ‘K’ and see a recession around the corner, if not already upon us. Meanwhile, others see the arm of the ‘K’ and see good times ahead. Certainly, if we look at the broad-based GDP readings, at least based on the Atlanta Fed’s GDPNow forecast, Q3 was remarkably strong at real GDP growth of 4.0% annualized (see below chart). Calling for a recession with that as backdrop is a very difficult case to make, in my view, but that won’t stop some analysts from trying.

Net, while nobody likes to see their portfolios’ value shrink, the declines so far have been very modest. It is entirely reasonable to expect a correction of 10% – 15%, especially if we look at the chart at the top showing a 36% rally with limited drawdowns over the past 6 months. It feels too early to panic.

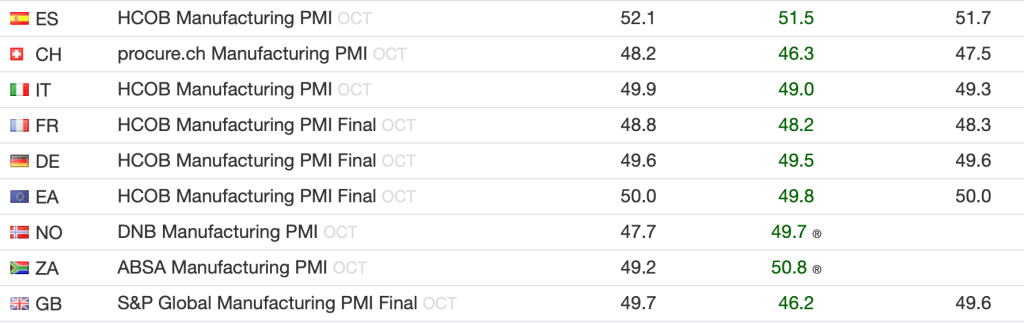

And with that in mind, let’s see how markets behaved overnight. Asian markets followed US ones lower with Tokyo (-2.5%) leading the way, although that was well off the early session lows which touched -4.0%. Korea (-2.9%) and Taiwan (-1.4%) both suffered as well although the rest of the region was far less impacted. Both China and HK were little changed and other gains and losses were on the order of +/-0.5% or less. European bourses are all in the red as well this morning, although the one thing of which we can be sure is it is not related to the tech selloff given Europe has no tech industry of which to speak. But Spain (-0.9%) and Germany (-0.75%) are both down despite reasonable Services PMI data from both nations and better than expected German Factory Orders (+1.1%). UK equities are unchanged, and the rest of the continent is somewhere between unchanged and Spain. Negative sentiment has clearly carried over, but there have been no strong reasons to sell aggressively.

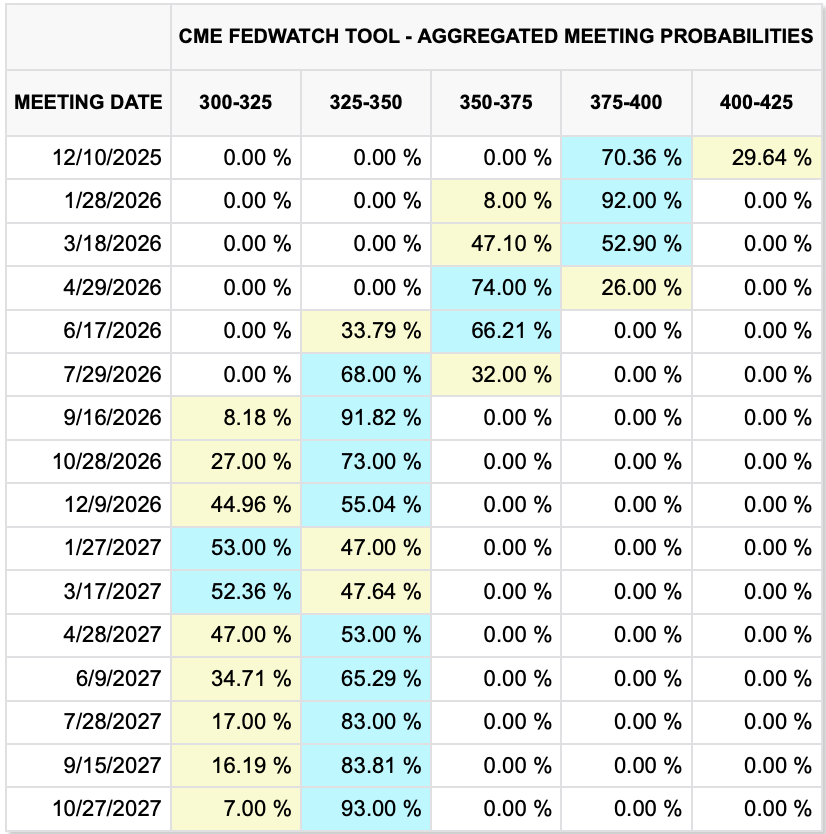

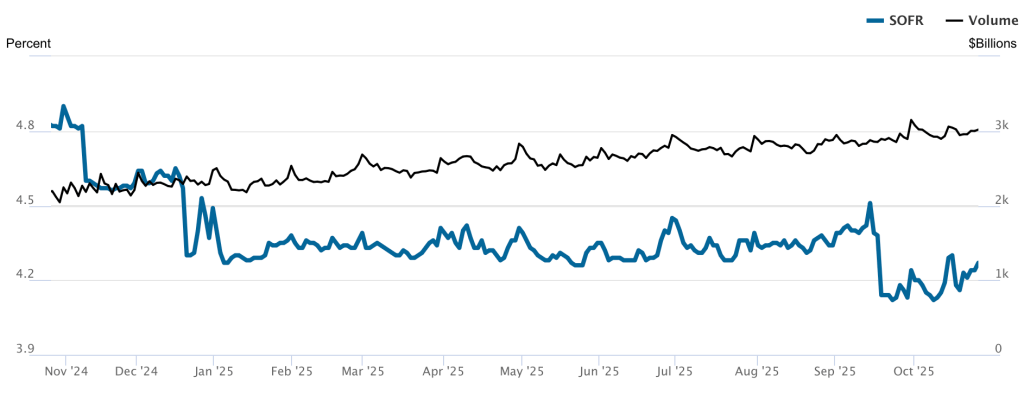

In the bond market, Zzzzzz is today’s message. Every major government bond is within 1bp of yesterday’s close, and yesterday’s price action was only worth 1bp to 2bps. In fact, as you can see from the chart below, since the FOMC and Powell’s hawkish press conference, nothing has changed. This is true from Fed funds futures as well, with a 71% probability still price for a December cut.

Source: tradingeconomics.com

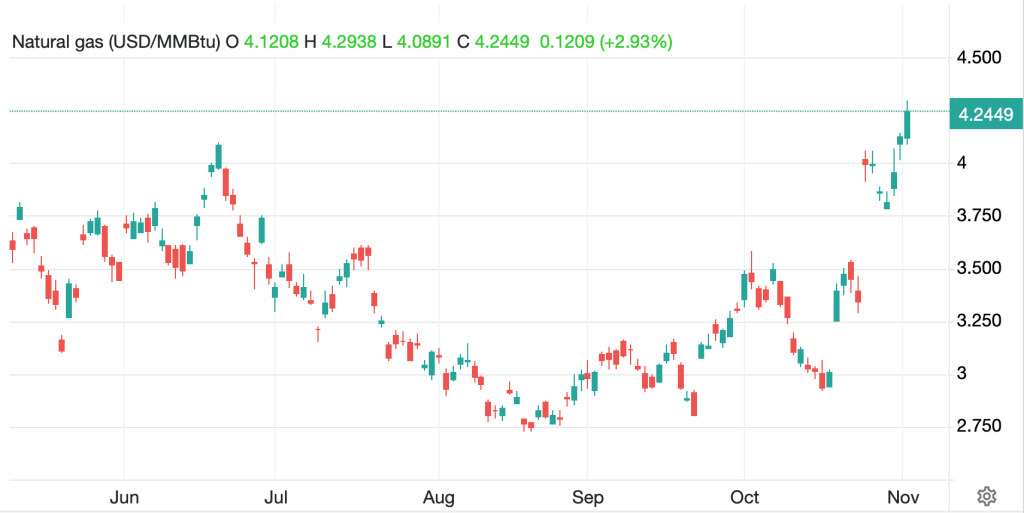

In the commodity space, oil (-0.3%) seems to be lower every morning when I write, but continues to trade in a narrow range around $60/bbl. Perhaps the most interesting thing I read this morning was Javier Blas’ op-ed in Bloombergregarding the rationale for a US-led regime change in Venezuela given it is the nation with the largest known oil reserves. If you are President Trump and seeking to get oil prices lower, that could be a very effective source of the stuff. As to the metals markets, yesterday saw a sharp decline in precious metals and this morning they are rebounding with both gold and silver higher by 0.9%. Copper (+0.25%), too is rising a bit, although remains well off the highs seen when gold peaked.

Finally, the dollar continues to impress. While this morning it is little changed against most of its counterparts, it is, apparently, consolidating its recent gains. The DXY remains above 100.00, which many have seen as a key resistance level. The pound (+0.2%) while bouncing slightly this morning is hovering just above 1.30, a level last seen on Liberation Day, and certainly appears to be working its way lower from its summer peak. If I consider the fiscal problems and the energy policy in the UK, it is very difficult to expect a significant amount of demand for the pound.

Source: tradingeconomics.com

Elsewhere, ZAR (+0.4%) is responding to the rise in gold prices and otherwise, +/-0.2% is today’s trading story. Over time, given the promised investments into the US based on trade deals that have been signed, I expect there will be consistent demand for the greenback. And as I wrote yesterday, the idea of a two-currency world in the future cannot be dismissed.

We do have data today with ADP Employment (exp 25K), ISM Services (50.8) and then the EIA oil inventory data where limited net change is expected although the API data yesterday showed a large build of 6.5mm barrels. Remarkably, there are no scheduled Fed speakers, but that story remains caution but a tendency toward cutting.

For all the election hype, I don’t perceive that things have changed very much at all. Perhaps the Supreme Court hearings on the legality of President Trump’s tariffs are the real story today, but regardless of the hearings, no verdict will be rendered for many weeks. Which leaves us with a world in which tech is still dominant in equity markets and the US is still dominant in tech. With the perception of the Fed being somewhat more hawkish, I don’t see a good reason to sell dollars.

Good luck

Adf