The world is a wonderful place

We know this because of the chase

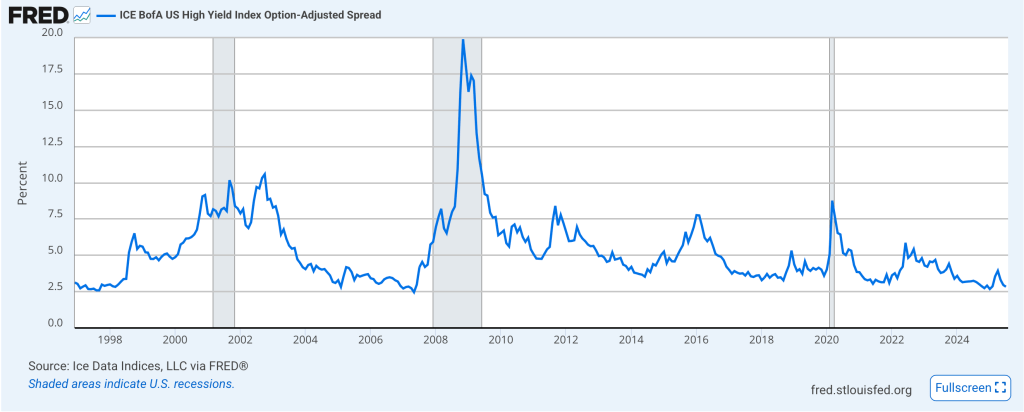

For more and more risk

Though Washington’s fisc

Continues, more debt, to embrace

Investors can’t get enough stocks

And bonds have found buyers in flocks

But havens like gold

Are actively sold

As though they’ve come down with a pox

I’m old enough to remember when there was trouble all around the world; war in Ukraine was escalating, anxiety over a more serious fracture in the trade relationship between the US and China was growing, and President Trump was building a ballroom at the White House! Ok, the last one is hardly a problem. But just two weeks ago, risk assets were struggling and havens seemed the best place for investors to hide. But that is sooooo last week.

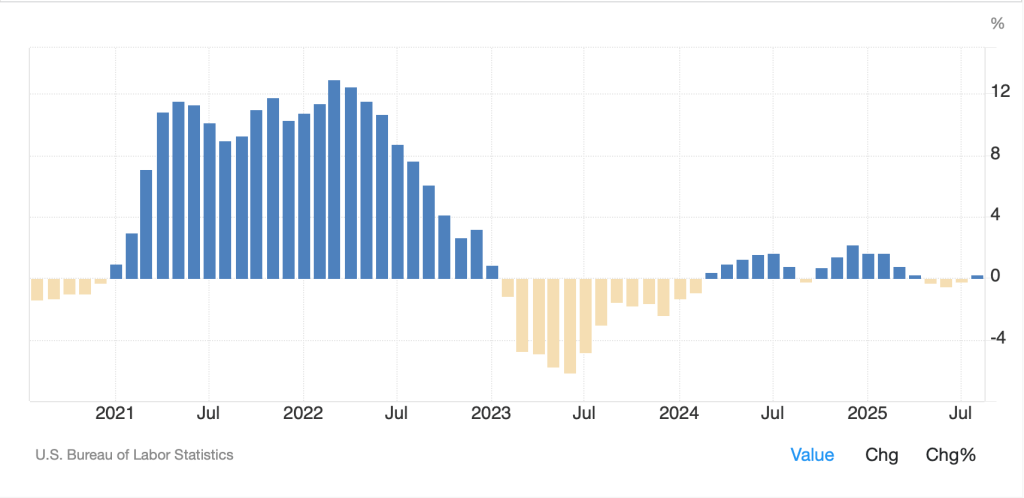

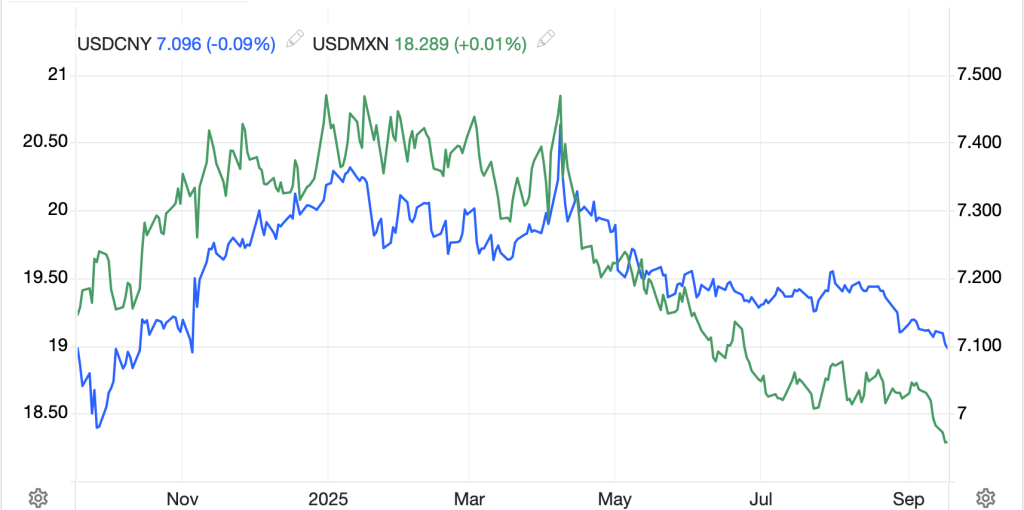

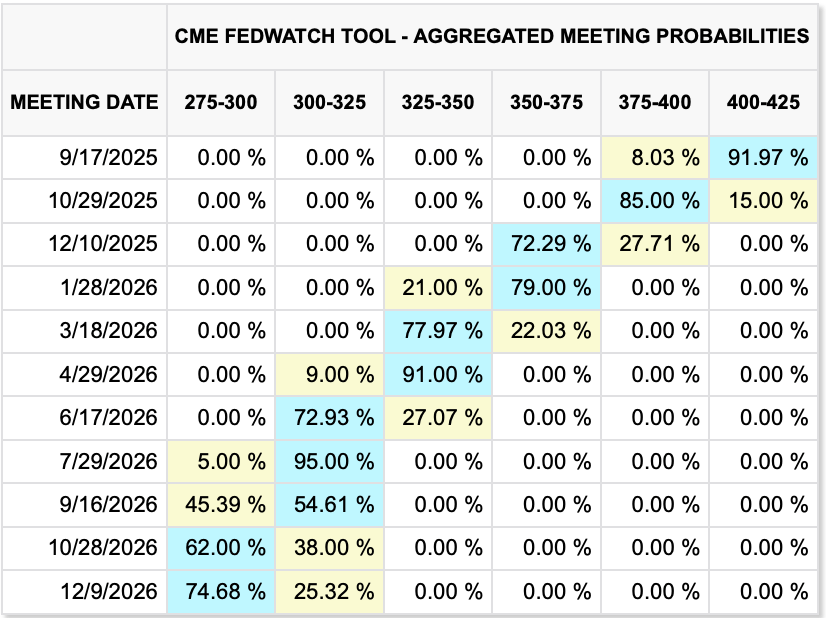

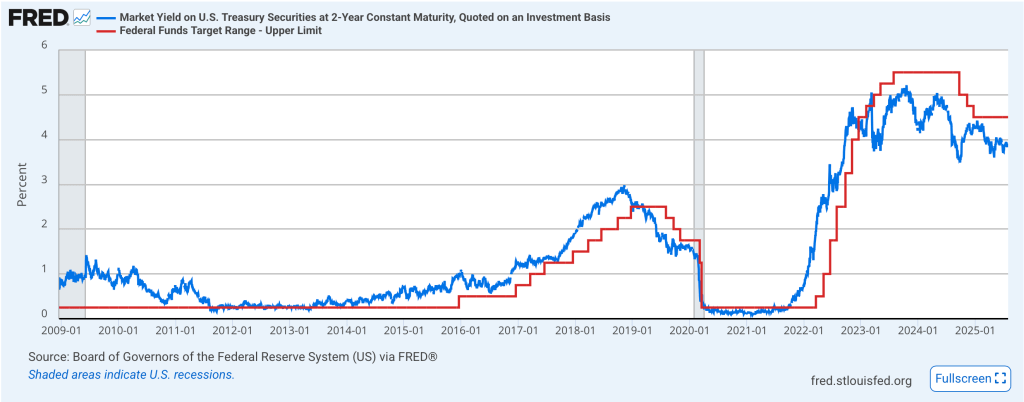

By now you are all aware that the delayed CPI report on Friday came in on the soft side, thus reinforcing the Fed’s plans to cut rates tomorrow. While Fed funds futures pricing, as seen below, has not changed very much at all, with virtual certainty of cuts tomorrow and in December, plus two more by the April meeting next year, the punditry is starting to float the idea that even more cuts are coming because of concern over the employment situation and the fact that inflation appears under control.

Source: cmegroup.com

Now, it is a viable question, I believe, to ask if inflation is truly under control, but the problem with this concern is that Chairman Powell told us, back in September, that they are not really focused on that anymore. The fact that the official payroll data has not been released allows the Fed to avoid specific scrutiny, but literally everything I read tells me that the employment situation is getting worse. The latest highlight was Amazon’s announcement yesterday that they would be reducing corporate staff by about 14,000 folks in the coming months as, apparently, AI is reducing the need for headcount.

In fact, I would contend the answer to the question; if the economy is doing so well, why does the Fed need to cut rates, is there is a growing concern over the employment situation which has been masked by the lack of data.

But we all know that the economy and the stock market behave very differently at times, and this appears to be one of those times. Yesterday, yet again, equity markets in the US closed at record highs as earnings releases were strong virtually across the board. Adding to the impetus was the news that Treasury Secretary Bessent announced a framework for trade between the US and China had been reached with the implication that when Presidents Trump and Xi meet later this week, a deal will be signed.

Putting it all together and we see the concerns that were driving the “need” for owning havens last week have virtually all dissipated. While the Russia/Ukraine situation remains fraught, I don’t believe that equity markets anywhere in the world have paid attention to that war in the past two years. Oil markets, sure, but not equity markets.

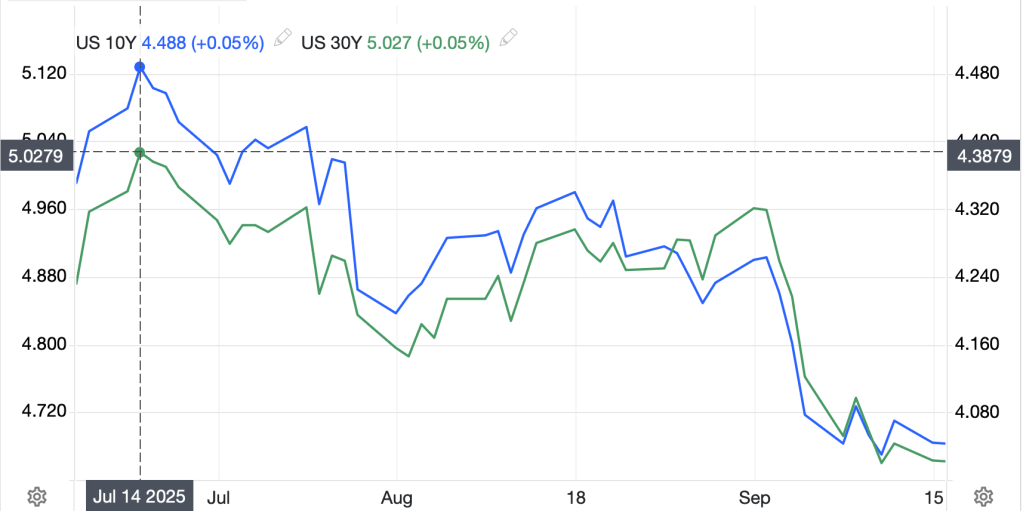

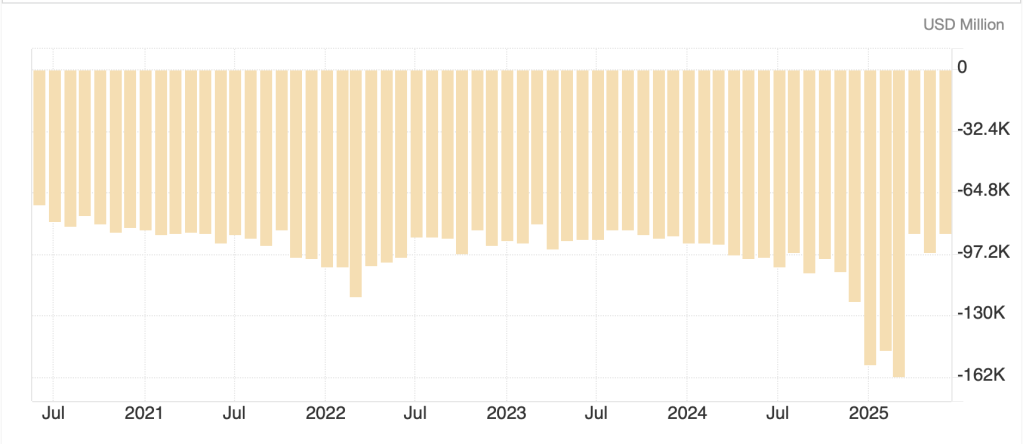

There is a fly in this ointment, though, and one which only infrequently gets much airtime. The US is continuing to run substantial fiscal deficits. Lately, as evidenced by the fact that 10-year yields have slipped back to their lowest level this year, and as you can see below, are clearly trending lower, this doesn’t seem to be an issue. But ever-increasing federal deficits cannot last forever, and if the Trump plans to boost growth significantly does not work out, there will be a comeuppance. I have described before my view that the plan is to ‘run it hot’ and nothing we have seen lately has changed that sentiment. I sure hope it works for all our sakes!

Source: tradingeconomics.com

Ok, let’s see if the euphoria evident in the US markets has made its way around the world. The answer is, no. Interestingly, despite a high-profile meeting between President Trump and Japanese PM Takaichi, where Trump was effusive in his support for the new PM and her plans to increase defense spending, Japanese equities were under pressure all evening, slipping -0.6%. Too, both China (-0.5%) and HK (-0.3%) could find no traction despite the news that a trade deal was imminent. In fact, the entire region was under pressure with losses in Korea, Taiwan, Australia and virtually every market there. Was this a sell the news event? That seems unlikely to me, but maybe. As to Europe, pretty much every major index is modestly softer this morning, down between -0.1% and -0.2%, so not terrible, but clearly not following the US. As to US futures, at this hour (7:30), they are little changed to slightly higher.

Global bond markets are quiet this morning, with almost all unchanged or seeing yields slip -1bp. While US yields have been trending lower, in Europe, I would say things are more that yields have stopped rising and, perhaps, topped, but are not yet really declining in any meaningful fashion yet. Germany’s bund market, pictured below, exemplifies the recent price action.

Source: tradingeconomics.com

One interesting note is that JGB yields slipped -3bps overnight, despite PM Takaichi reaffirming that the defense budget was going up with no funding mentioned. Like I said, the world is a better place this morning!

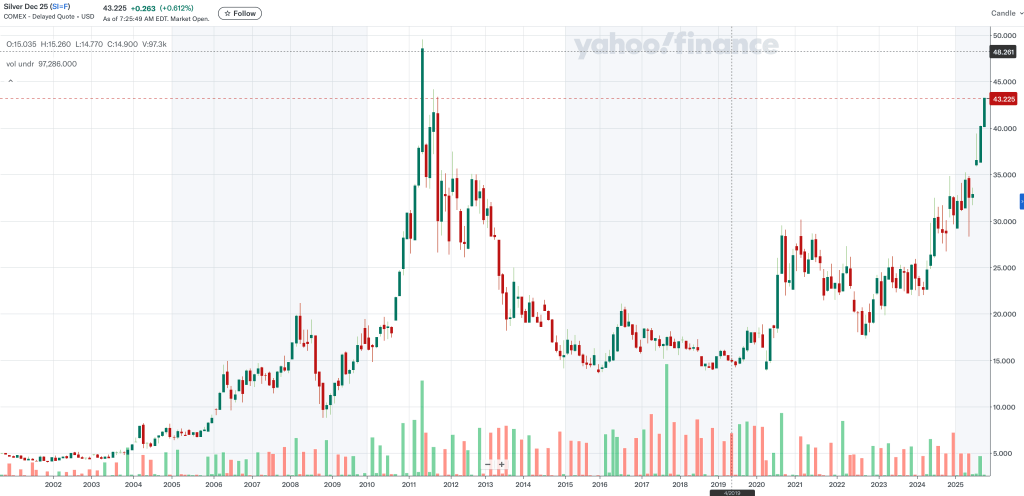

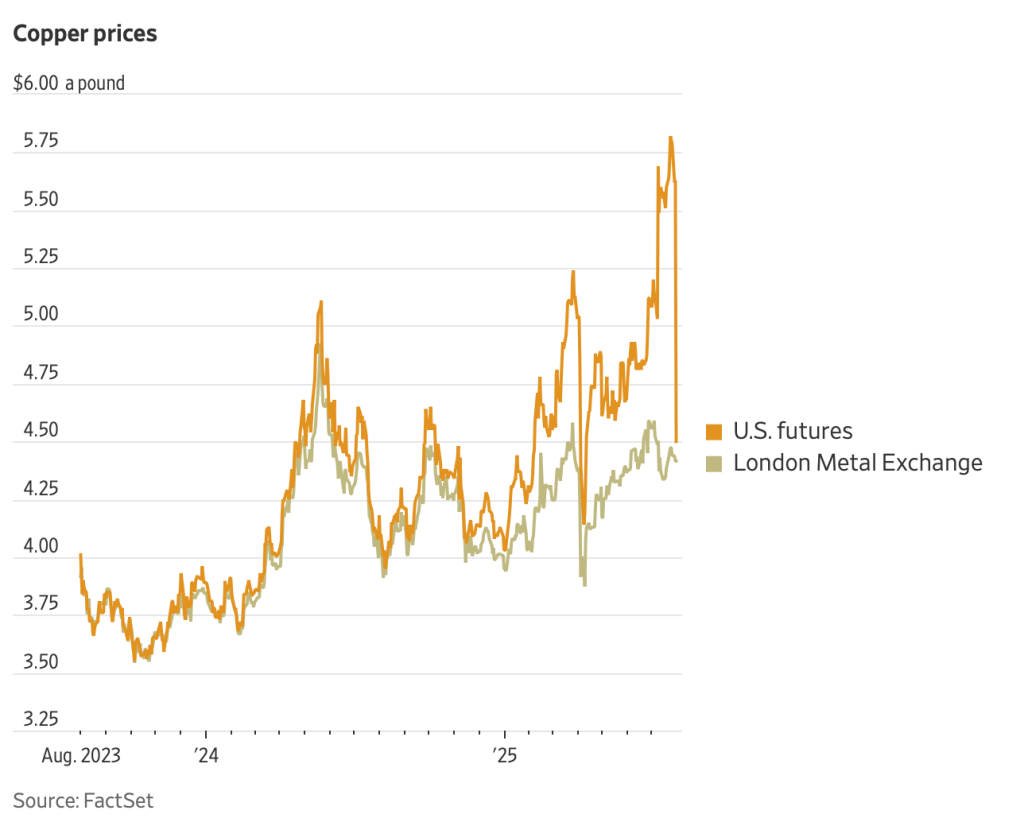

In the commodity markets, gold (-1.5%) continues to get punished as all those who were chasing the haven story have been stopped out. The price went parabolic two weeks ago, and price action like that cannot hold for any length of time. This has taken silver (-1.1%) and copper (-0.5%) lower as well, and I suspect that there could well be further to decline. Oil (-1.1%) meanwhile seems far less concerned about the sanctions on Lukoil and Rosneft this morning. The conundrum here is if the economy is performing well, that would seem to be a positive demand driver. I have not seen word of major new oil sources being discovered to increase supply dramatically, but if you think back to last week, the narrative was all about a glut. I guess we will learn more with inventory data this week.

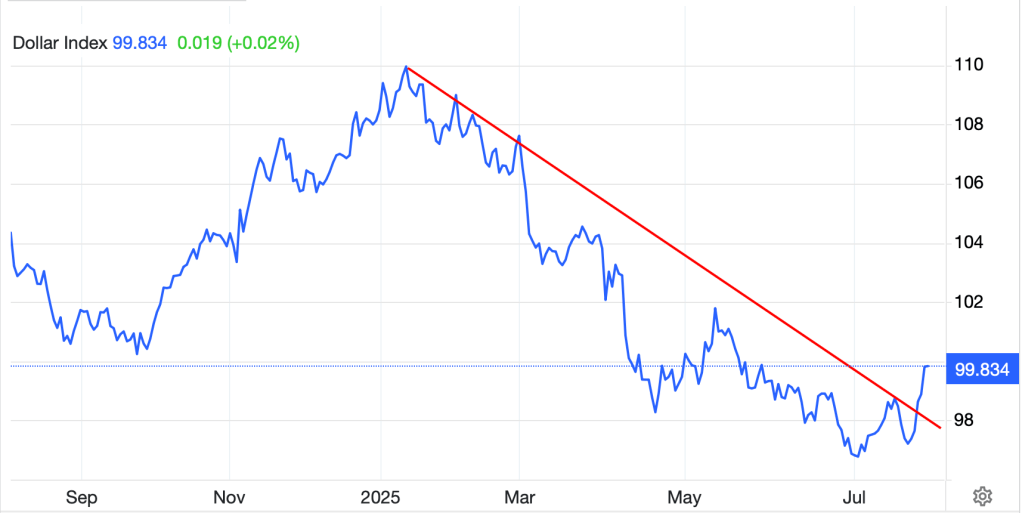

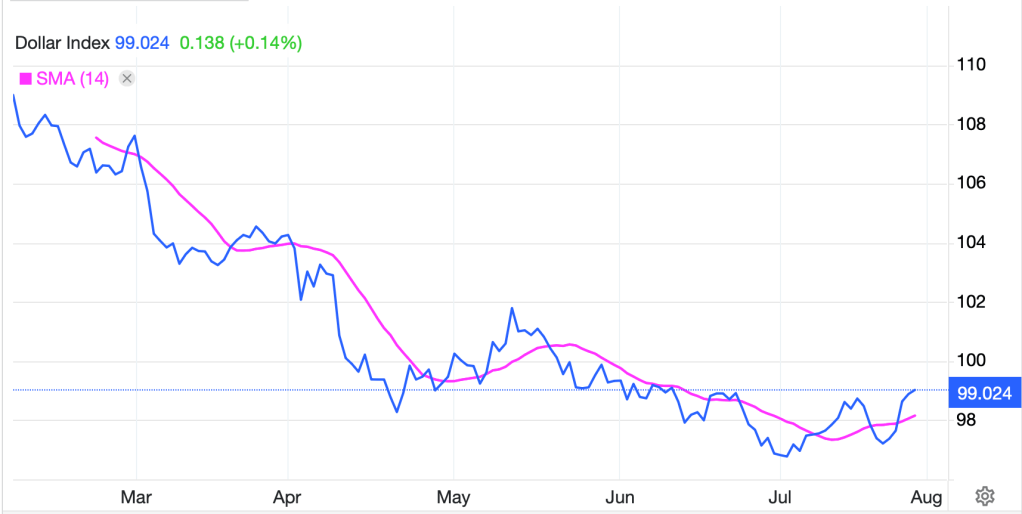

Finally, the dollar… well nobody really seems to care. As you can see from the below chart of the DXY, it is approaching six months where the index has traded in a very narrow range, and we are pretty close to the middle. I don’t know the catalyst that will be needed to change this story, but frankly, I suspect that nobody (other than FX traders) is unhappy with the current situation.

Source: tradingeconomics.com

It’s not that there aren’t currencies that move around on a given day, but there is no broad trend in place here.

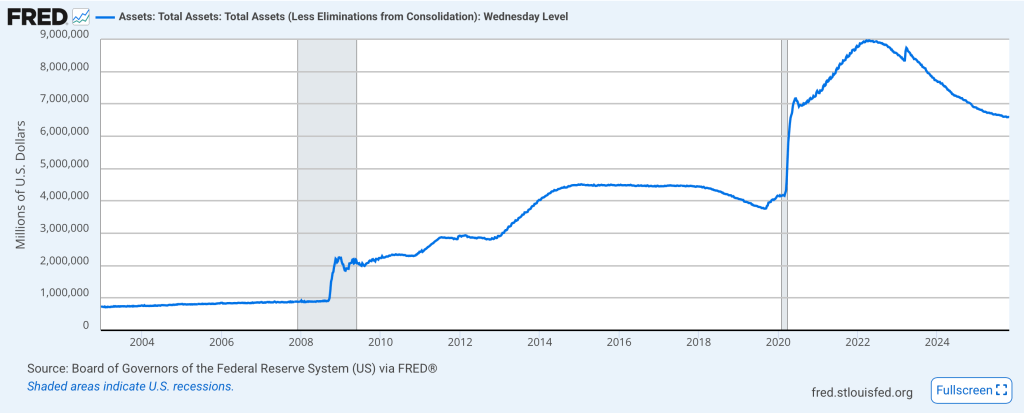

On the data front, the key release today is the Case-Shiller Home Price Index (exp 1.9%) and then the Richmond Fed Manufacturing Index (-14) is also due later this morning. However, all eyes are on tomorrow’s FOMC outcome with the focus likely to be more on QT and its potential ending, than on the rate cuts, which are universally expected. One other thing, with the government shutdown ongoing, GDP and PCE data, which were originally scheduled for this week, will not be released.

Life is good! That is the only conclusion I can draw right now based on the ongoing strength in risk assets, at least US risk assets. Keynes was the one who said, markets can remain irrational longer than you can remain solvent, and I have a feeling that we are approaching some irrationality. But for now, enjoy the ride and if FX is your arena, I just don’t see a reason for any movement.

Good luck

Adf