Get ready to hear ‘bout kurtosis

An idea what very few knows is

In this case they’ll say

Fat tails did hold sway

Be careful, though, ere there’s psychosis

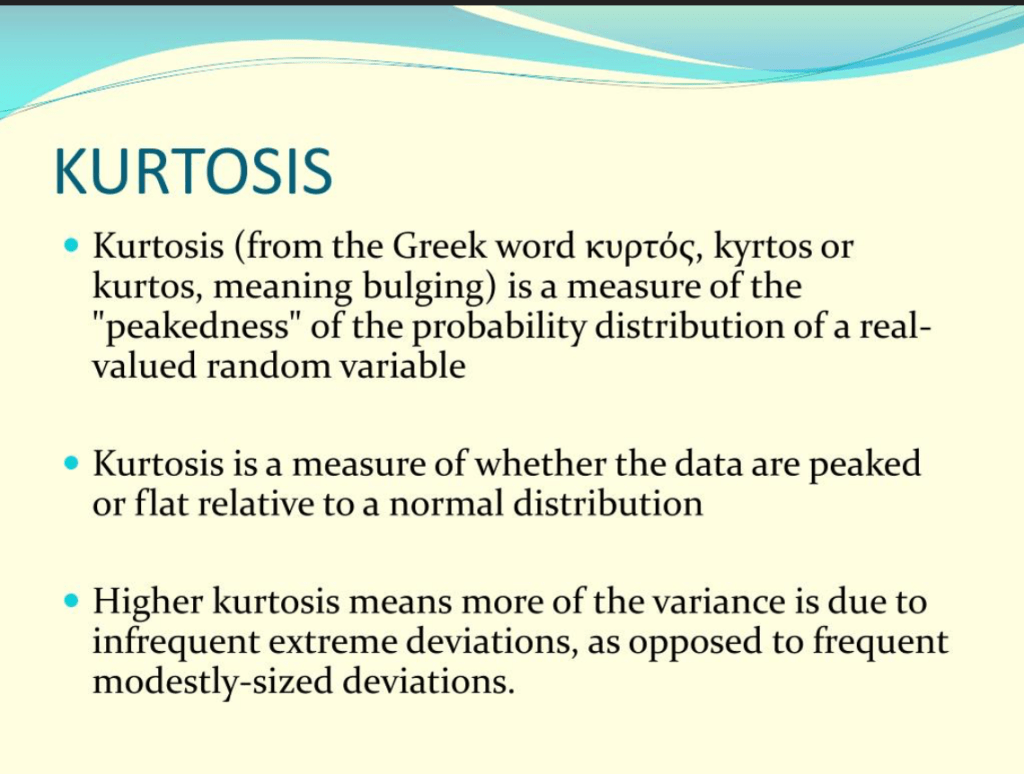

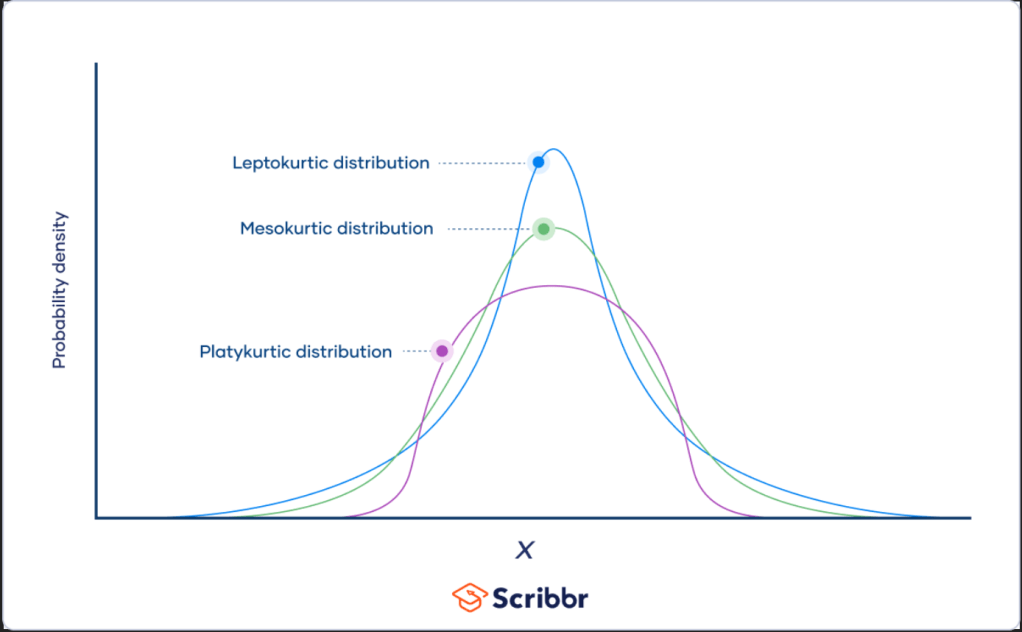

This definition from slideserve.com is probably the most comprehensible one that I have seen around, so thought it would be useful to understand. And below, is a chart that shows the shape of distributions of outcomes. Markets live on the blue line below.

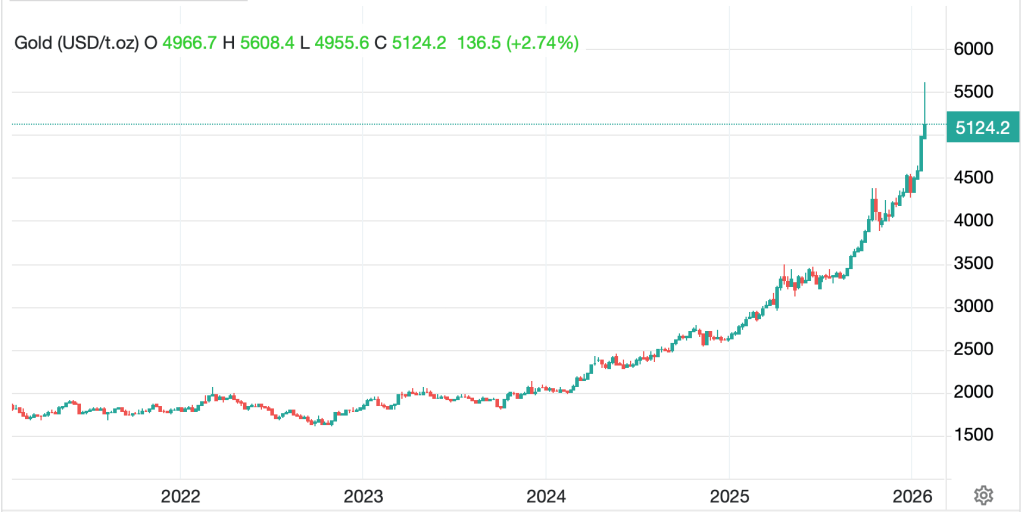

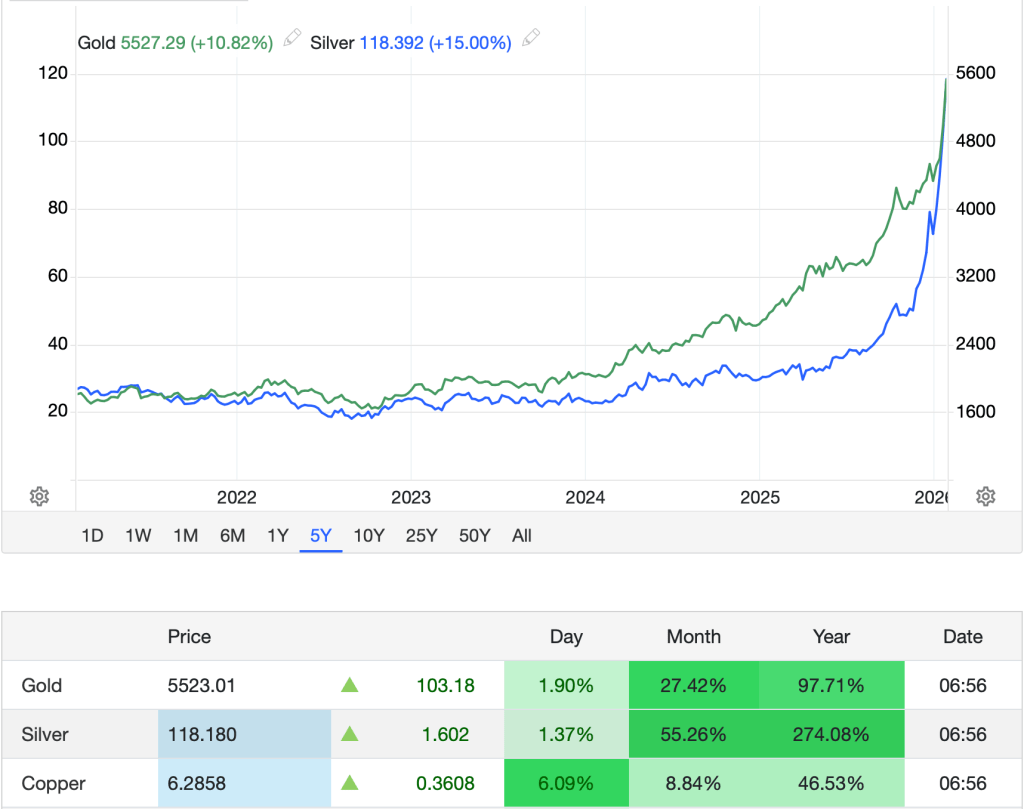

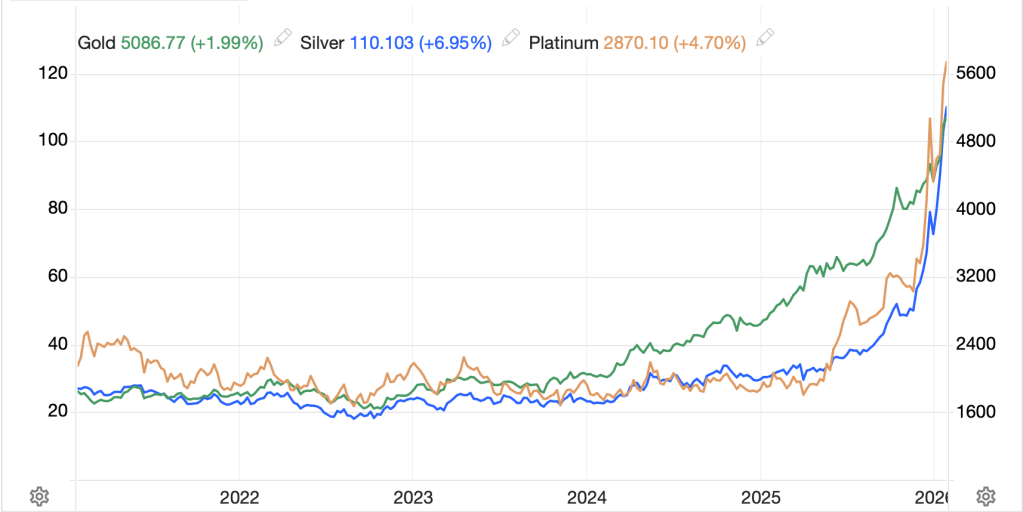

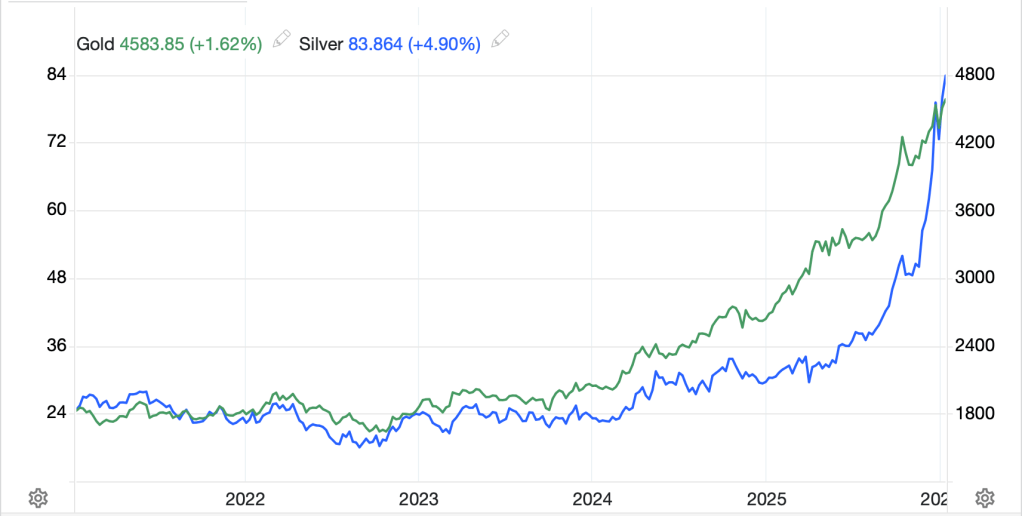

The reason this is important was made evident on Friday given the extraordinary movement seen in markets. It is important to understand that both commodity and financial markets have always demonstrated leptokurtosis in their behavior. This means that the tails are fatter than a normal distribution’s tails. In other words, there are far more large movement events than a normal probability distribution would expect or predict. So, while I have read that Friday’s decline in gold and silver prices were anywhere between a 5SD and 12SD move (it doesn’t really matter for our purposes, just suffice it to say it was quite large), there is nothing to say it cannot happen again tomorrow. You will undoubtedly read from some that this movement shouldn’t have occurred during the life of the universe it was so statistically improbable, but that is based on a normal distribution.

Understand, too, that market makers, especially in options markets which rely on the basic math of the normal distribution, are well aware that tails are fat. It is why volatility curves in all markets have smiles or smirks, as these are an effort to take account of those fat tails. It turns out the math for fat tail distributions is incredibly complex, so traders are happy with the smile approximations.

Which brings us to the question of what really happened and why did it happen on Friday? The answer is, nobody really knows. I have seen several writeups that certainly make sense, and are likely to have been part of the process, but in markets, given the millions of variables that are part of the market process (consider how many individuals trade the stuff in addition to things like economic variables and supply/demand information for commodities), it is difficult to pinpoint an exact catalyst.

Many are pointing to the naming of Kevin Warsh as Fed Chair, on the surface a more hawkish pick than had been expected earlier in the week, although on Thursday, his Kalshi odds were already above 90%, so would seem to have been priced.

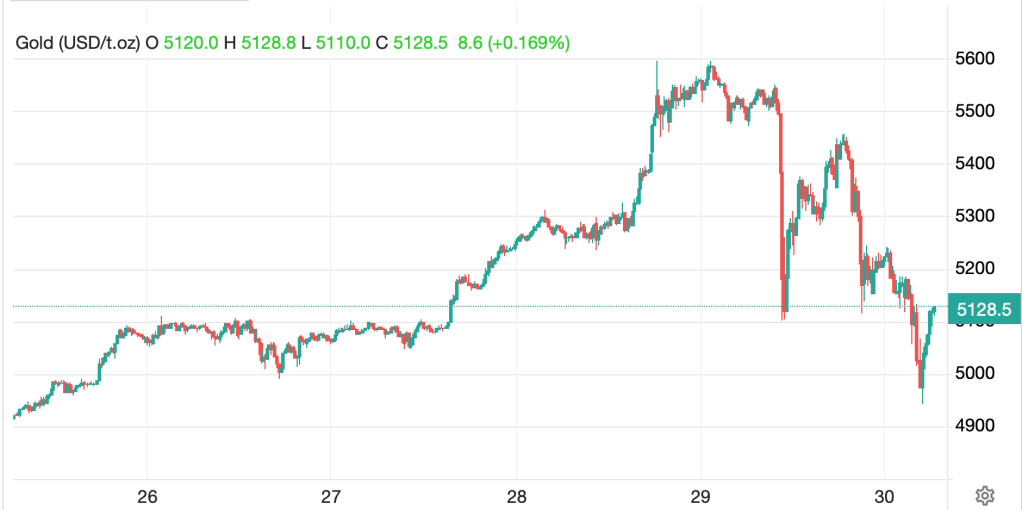

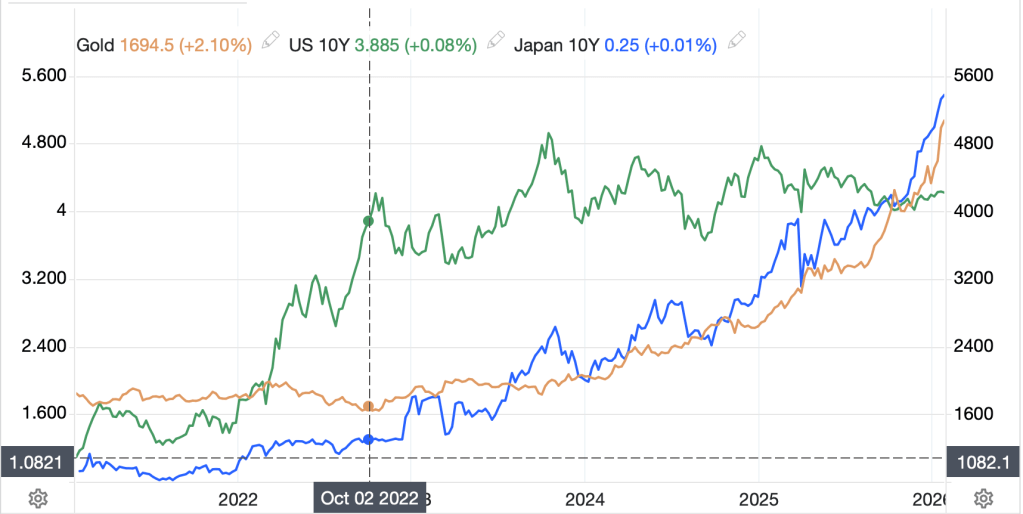

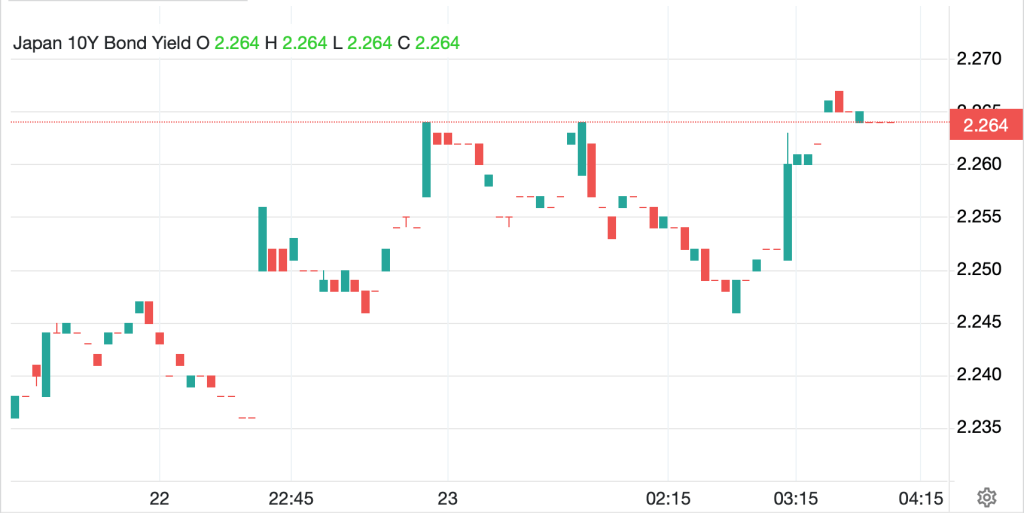

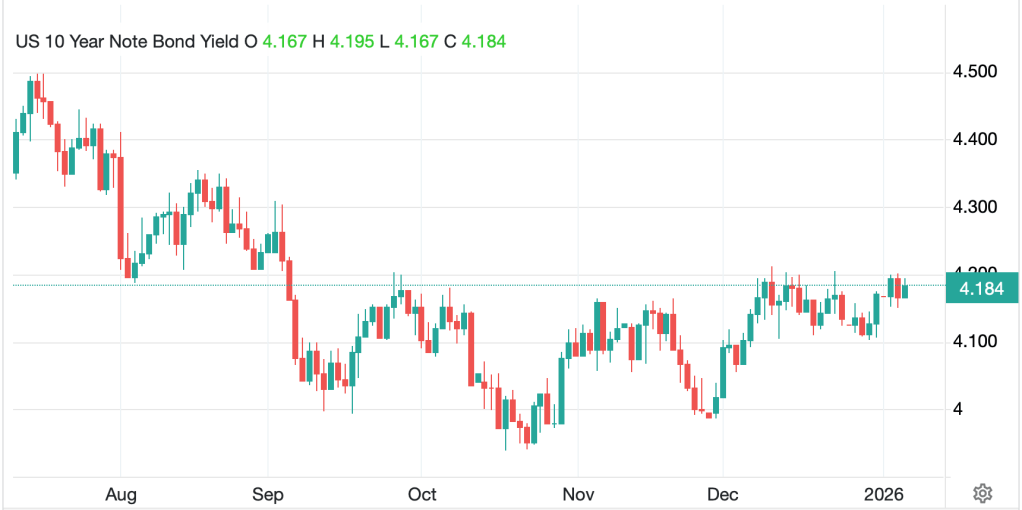

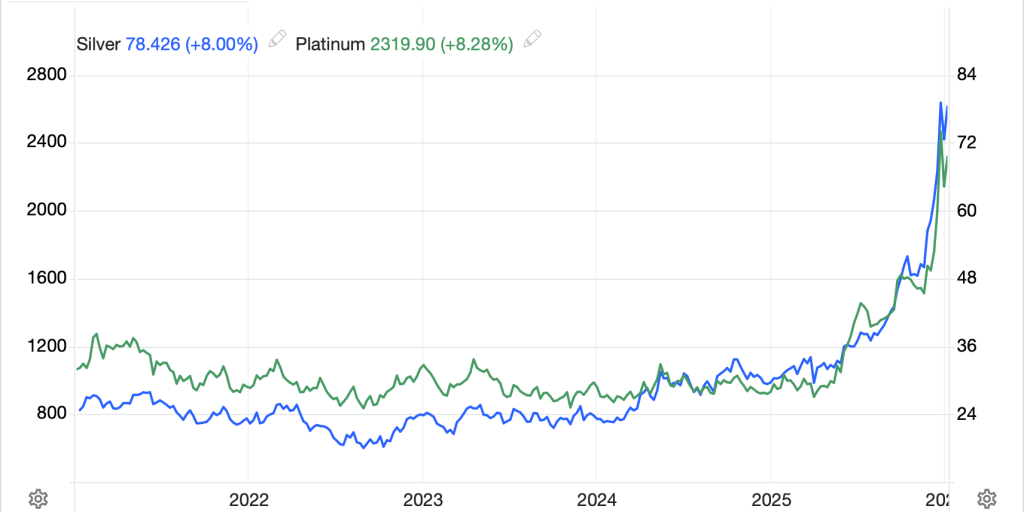

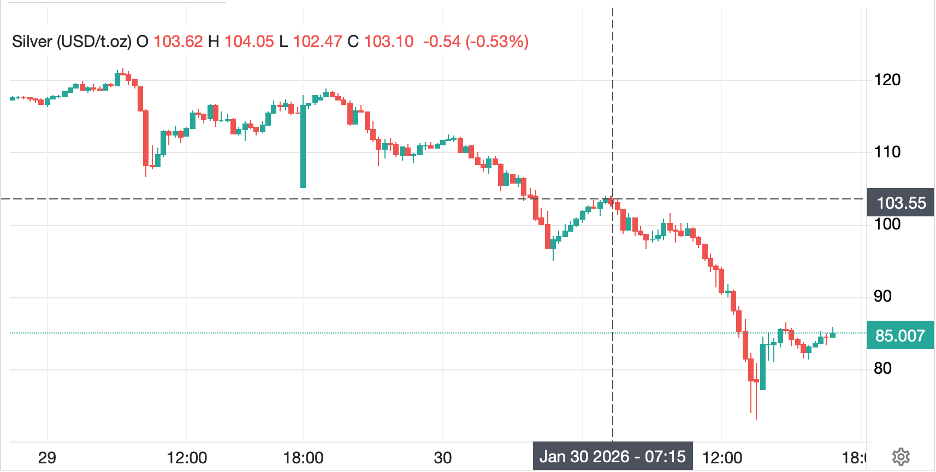

What we do know is that leverage was high and that prices were massively extended on technical indicators. Parabolic moves tend to crash in the same way they rise. Certainly, once things got going, margin calls were rampant and there was a great deal of forced selling. The chart below shows just how extensive the move was, and I highlighted the opening of the NY session.

Source: tradingeconomics.com

The great thing about moves like this are the conspiracy theories that arise as an explanation. Here’s the thing about conspiracy theories, once there are more than two people involved, it tends towards a leak.

So, what do we know? Comex futures prices when Asia opens tonight are going to be a lot lower than when they went home on Friday. But…Chinese licensing restrictions remain in place; no new silver mines have been discovered let alone gone into production; both individuals and central banks in Asia continue to buy the stuff; and the premium for physical metal in Shanghai remains steep. The fundamentals have not changed with regard to the metals themselves.

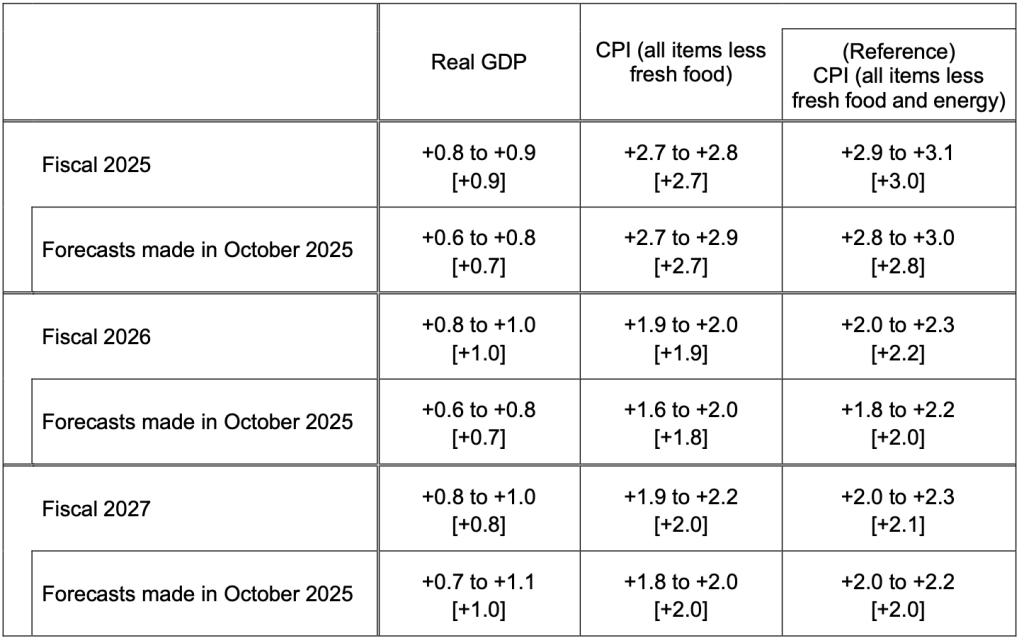

How about the financing questions? Is Warsh a hawk? My take is he is going to work hand in glove with Scott Bessent to address the economic issues in the nation. So, I would look for support (i.e. QE) for issuance, although it is entirely realistic that when (if) Warsh sits down in the chair, there will be fewer Fed fund rate cuts than might have been seen with another choice. Warsh is going to essentially join the Cabinet, as they work to implement their vision of how to overcome the debt and deficit issues.

Is this, more hawkish view, the rationale behind the moves on Friday? It probably played a role, but it is difficult to ascribe movement of that nature, especially given its self-generated response to positioning, to a single data point.

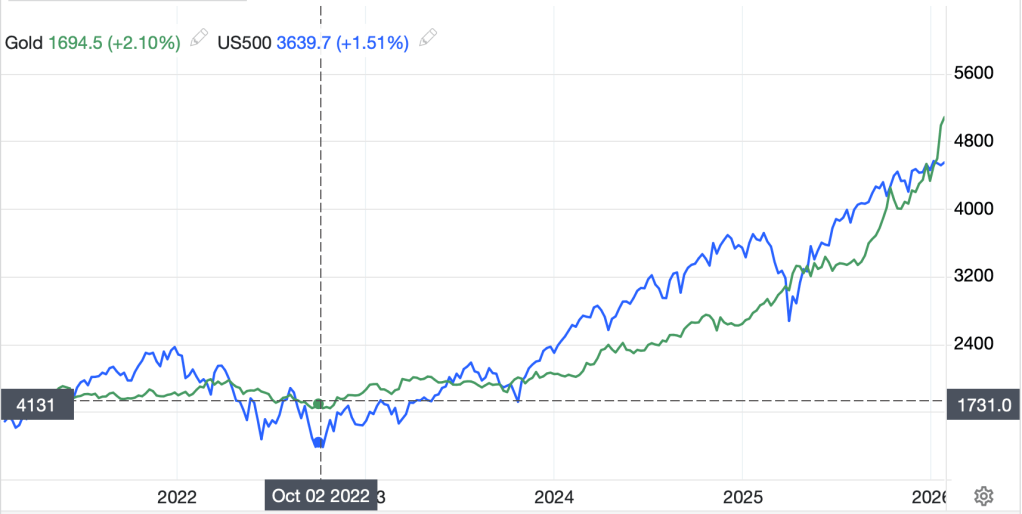

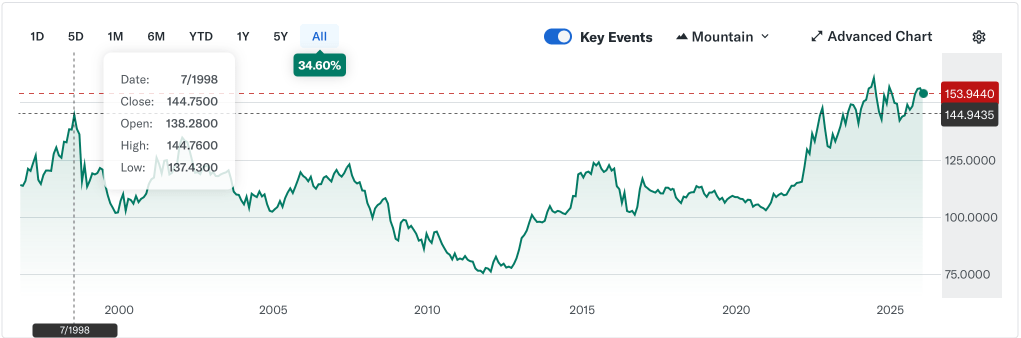

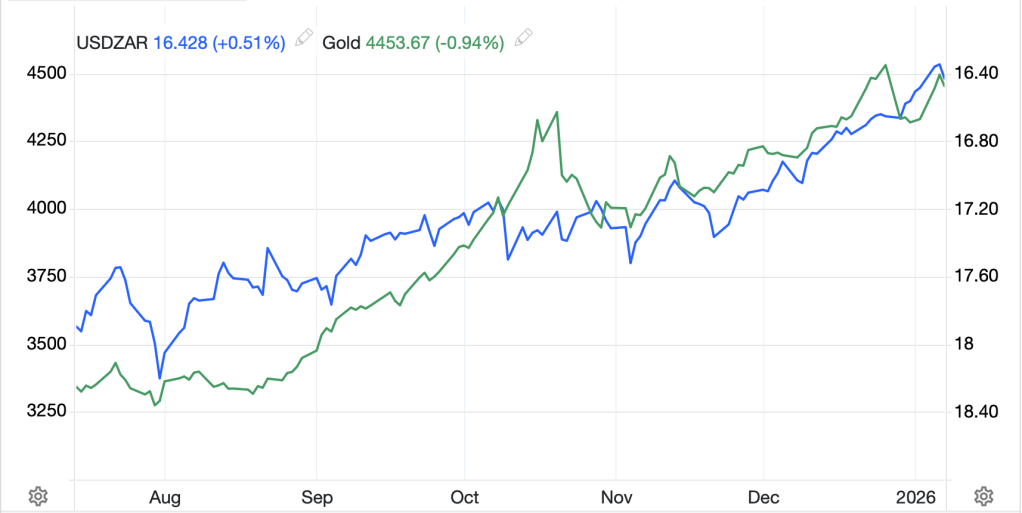

One other thing to note was that the dollar, which was set to collapse according to so many, rebounded sharply alongside the precious metals’ declines, albeit not quite as far.

Source: tradingeconomics.com

I never looked at the screens on Friday because I know that when moves like that happen, it’s easy to regret the trades you make. But the underlying thesis remains unchanged. I was not counting on the dollar’s decline to drive precious metals’ prices higher, and that relationship has broken down to a large extent anyway. It is not clear to me that having a perfect understanding of the drivers of Friday’s markets is critical. If I hearken back to Black Monday in October 1987, when the S&P 500 fell 22%, Ace Greenberg, then chairman at Bear Stearns, said it best when asked about what happened. His reply was, “Markets move, next question.”

Remember that, markets move.

Good luck

Adf