The FX Poet will be in Nashville at the AFP Conference October 21-22, speaking about effective ways to use FX options in a hedging program. Please come to the presentation on Monday at 1:45 in Grand Ballroom C1 if you are there. I would love to meet and speak.

This morning the ECB’s meeting

And no doubt they will be repeating

The idea inflation

Is near its cessation

So, high rates will now be retreating

As well, we will learn the details

Of what’s occurred in Retail Sales

If strength’s what we see

The FOMC

Rate cutters may turn into snails

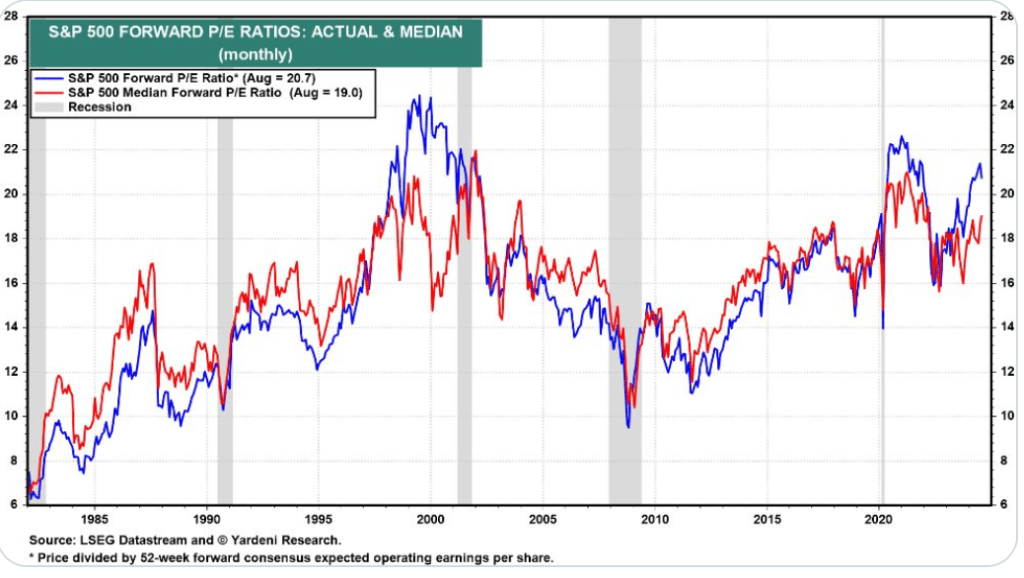

Yesterday was generally very quiet as investors appear to be turning their focus to the US presidential election and trying to determine the outcome and what it will mean for markets going forward. (FWIW, this poet is not going to attempt to determine how things will play out at this stage given the fact that whatever claims or promises are made by either candidate, at least economically, they can only be accomplished through Congress, so are really just wishes right now). The upshot is that the volume of activity is likely to remain modest until the election. Of course, that doesn’t mean prices won’t move, just that there won’t be much conviction behind the moves.

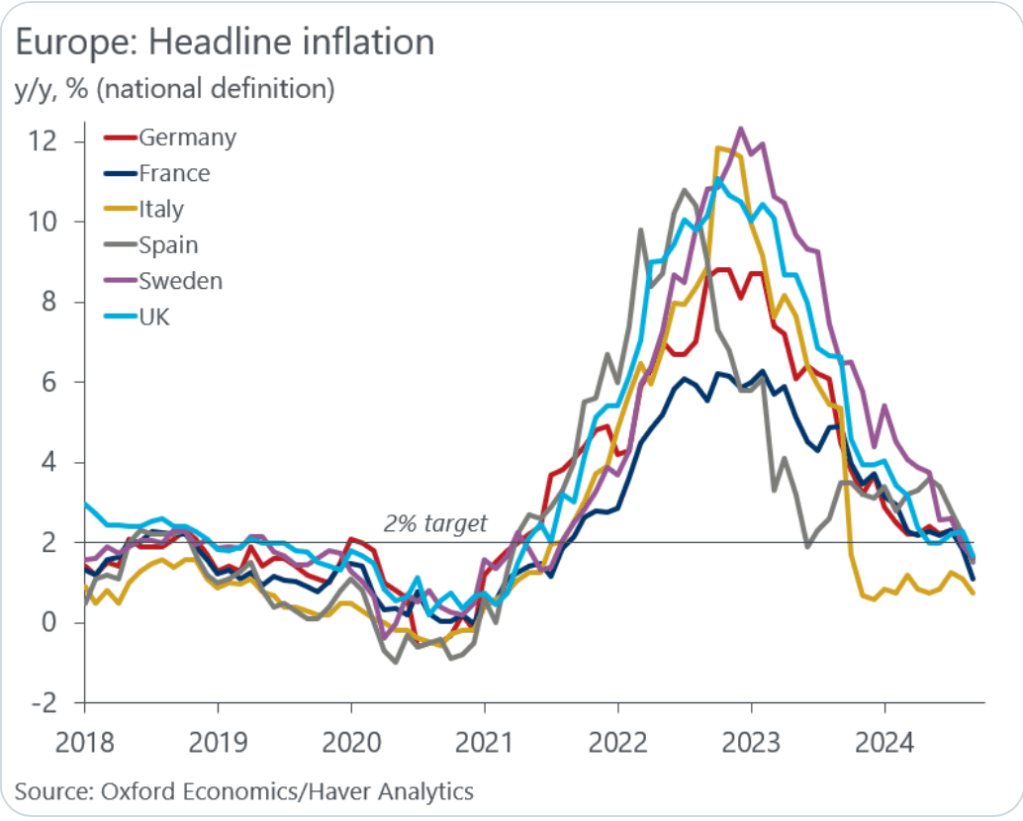

In the meantime, central banks remain at the forefront of every market conversation and today is no different with Madame Lagarde set to regale us with the news of an ECB rate cut of 25bps later this morning. Inflation data from the Eurozone this morning was revised down further with the headline falling to 1.7% Y/Y in September, the lowest print since April 2021. However, the core rate, at 2.7%, remains well above their target. Now, the ECB mandate targets headline inflation specifically, unlike the Fed which has determined by itself that core PCE is the proper metric, so a rate cut can easily be justified. Adding to the story is the fact that Germany remains mired in recession and economic activity in the Eurozone overall remains desultory at best. The problem the ECB has is that services inflation remains sticky, still printing near 4% and money supply is growing again which is a strong indicator that inflation is going to rise in the future. But as we have learned over the past decades, the future is now when it comes to central banks, and they will respond to the moment.

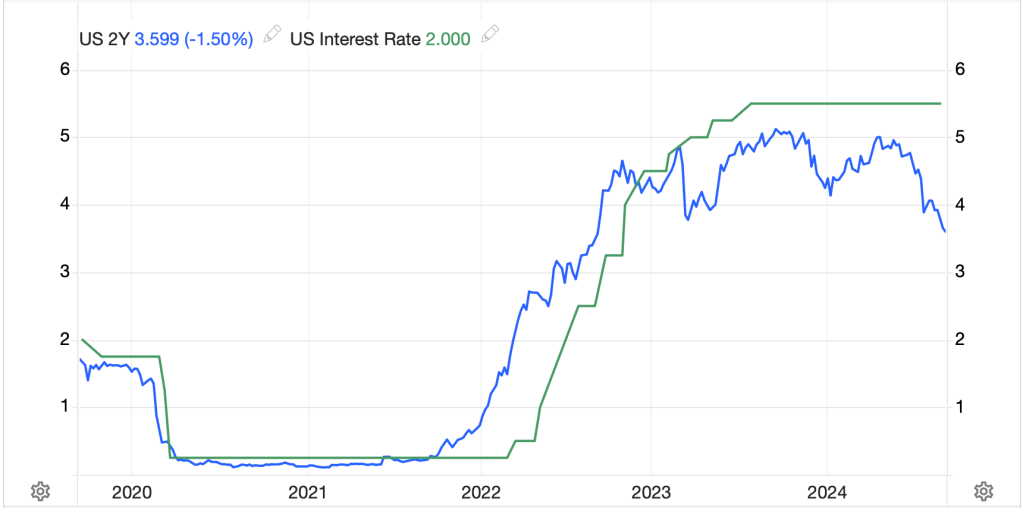

One of the problems for the ECB, though, is that despite the Fed’s mistaken 50bp rate cut, the data in the US we have seen since indicates that the economy continues to motor along fairly well. This means that although the Fed seems likely to cut 25bps in November, I think it will be doing so reluctantly. After all, if they didn’t cut, it would basically be an admission that they made a mistake with the 50bp cut in September, and you know as well as I that they will never admit a mistake.

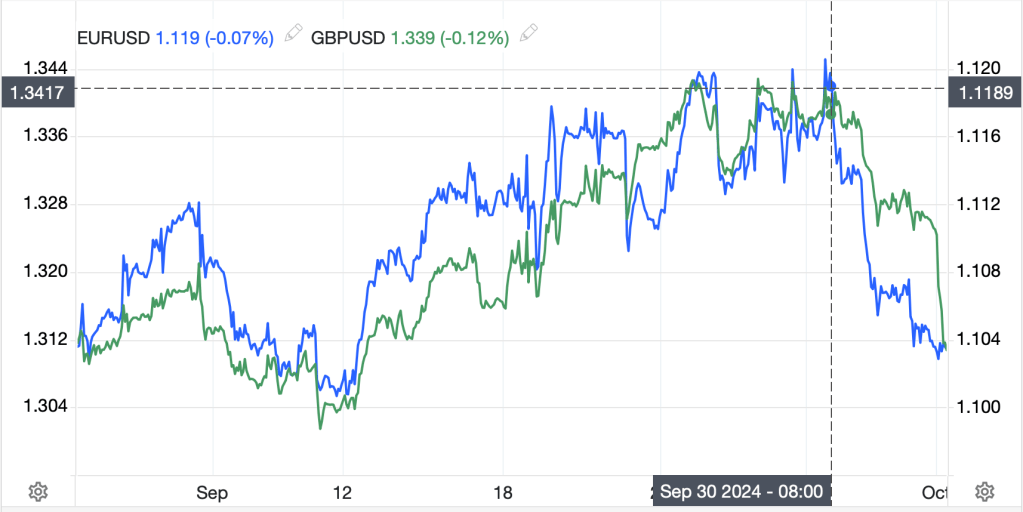

My point is that with the ECB feeling greater pressure to cut with their inflation reading below target and growth slowing, and the Fed likely to back away from an aggressive rate cutting path, the euro is likely to continue to suffer. For instance, this morning, though it is unchanged, it sits below the 1.09 level (last seen in August) and certainly appears as though it is in a strong downtrend as per the below chart. If I were to guess, I think a move toward 1.06 is in the cards as a measured move around that long-term 1.09 pivot level.

Source: tradingeconomics.com

The problem for the ECB is that a weakening currency is likely to add upward inflation pressures before it helps the exporters in Europe expand market share, and boosts growth. Stagflation is such an ugly word, but one that may well come to describe the Eurozone. As an aside, when the US was in stagflation in the late 1970’s, that is when the dollar was at its weakest point historically.

Of course, this also makes this morning’s Retail Sales (exp 0.3%, 0.1% ex autos) so important. You may recall that last month, this number beat expectations and was another in the list of surprisingly strong US data releases. Another strong print will really cement the difference between the US and the Eurozone, to the dollar’s advantage I believe.

But will any of this really matter to markets? Certainly, Lagarde’s comments can have an impact on Eurozone markets, but my take is we will not see major investment swings, regardless of the data, ahead of the election.

Ok, let’s see how things played out overnight. Despite the rebound in the US yesterday, Asia was having none of it with most markets in the red. Japan (-0.7%) fell despite the US strength and the yen’s weakness (JPY pushing back to 150 for the first time since August) and China continues to see the recent bubble of stimulus expectations deflate (CSI 300 -1.1%, Hang Seng -1.0%). Elsewhere in the region, the results were mixed with some gainers (Australia, New Zealand, Singapore) and some laggards (India, Korea, Philippines). In Europe, though, green is today’s theme with gains across the board, led by the CAC (+1.2%) but strength everywhere as investors are betting on a more dovish ECB. In the US futures market, we are all green as well, with strong gains (+0.5% or more) at this hour (7:30).

In the bond markets, after dipping back to the 4.0% level yesterday, 10-year Treasuries are 2bps higher this morning and we are seeing similar price action across all the European sovereign markets. This seems like a classic risk-on move. In Japan, JGB yields edged higher by 1bp and are now at 0.95%, perhaps as the market anticipates the BOJ is set to get more aggressive with the yen steadily falling for the past several months. I don’t believe 150 is a line in the sand, but it cannot be making Ueda-san feel any better about things.

Turning to commodities, the one truism is that gold (+0.5%) continues to rally. The number of different storylines (central bank buying, reduced mining activity, western investors waking up, Asian investors accelerating) about the shiny metal continues to increase and every one of them is bullish. This continues to help Silver, although copper (-0.6%) remains far more reliant on a positive economic story, something that remains in doubt. As to oil (+0.25%) it is holding that $70/bbl level although its grip does seem tenuous at times. However, I would contend there is virtually no war premium in the price at this point.

Finally, the dollar has net softened a bit this morning, but that is in the context of a more than 3-week long steady rally. So, AUD (+0.5%) is the big winner this morning in the G10 and as I am typing, GBP (+0.2%) has recaptured the 1.30 level, but those trends remain lower. In the EMG markets, KRW (-0.55%) is today’s laggard although we are seeing weakness in both ZAR (-0.3%) and MXN (-0.3%) despite that metals strength. Remember, FX markets are perverse.

In addition to the Retail Sales data, we see Initial (exp 260K) and Continuing (1870K) Claims and Philly Fed (3.0) at 8:30 with IP (-0.2%) and Capacity Utilization (77.8%) at 9:15. Also, because of the holiday Monday, we see EIA oil inventory data this morning as well with a slight draw expected. Only one Fed speaker is on the docket (Goolsbee) who will undoubtedly explain that more cuts are coming.

While the dollar may be under modest pressure this morning, I see upward pressure overall for the time being until policies change.

Good luck

Adf