There once was a poet that wrote

‘Bout bonds and the fact they got smote

So, yields, they did rise

And to his surprise

Most pundits, this news did promote

Now turning to stories today

The biggest one, I’d have to say

Is how, in Japan

Ishiba’s grand plan

Has failed, thus he’ll be swept away

The number of stories this morning regarding the synchronous rise of long-dated bond yields around the world has risen dramatically. While yesterday, I highlighted this fact, I certainly didn’t expect it to be the key narrative this morning. But such is life, and virtually every news outlet is focusing on the subject as both a reason for the poor equity performances yesterday as well as a way to highlight government profligacy. I do find it interesting, though, that the same publications that push for more spending for their preferred causes have suddenly become worried about too much government spending. But double standards are nothing new. A smattering of examples show Reuters, Bloomberg and the WSJ all feigning concern over too much government spending.

I say they are feigning concern because all these publications are perfectly willing to support excess government spending if it is spent on the things they care about. Regardless, the fact that this has become one of today’s key talking points is evidence that some folks are starting to recognize that trees cannot grow to the sky. Even though almost every major central bank is in easing mode, long-term yields keep rising. Alas, the almost certain outcome here, albeit likely still well into the future, is some form of yield curve control as central banks will be forced to prevent yields from rising too high lest their respective governments go bust. I expect that the initial stages will be regulations requiring banks and insurance companies, and maybe private, tax-advantaged accounts like IRA’s and 401K’s, to hold a certain percentage of Treasuries. But I suspect that eventually, only central banks will have the wherewithal to prevent runaway yields. Welcome to the future; got gold?

However, you can read about this everywhere, and after all, I touched on it yesterday so let’s move on. Government stability/fragility is the topic du jour in this poet’s eyes. We already know that the French government is set to fall on Monday when PM Bayrou loses a confidence vote. It is unclear what comes next, but French finances are in bad shape and getting worse and they don’t print their own currency. This tells me that we could see a lot more social unrest in France going forward given the French penchant for nationwide strikes.

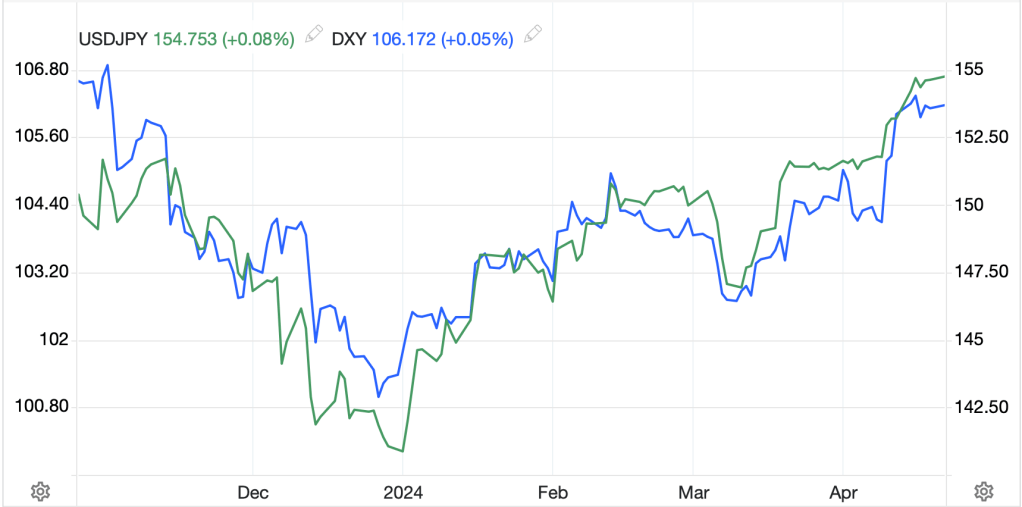

But a story that has gotten less press is in Japan, where PM Ishiba saw the LDP majority decimated in the Upper House two weeks ago and is now heading a minority government as the LDP does not have a majority in either house in the Diet. One of the key members of the LDP, and apparently the glue that was holding together the fragile coalition was Hiroshi Moriyama, the LDP Secretary General, and he is now resigning along with several of his lieutenants, so it appears that Japan’s government is about to fall as well. The upshot here is that the BOJ seems unlikely to raise interest rates given the political uncertainty, which is not only pressuring long-dated JGB’s but also the yen. (see chart below from tradingeconomics.com)

While I have not written extensively about the UK’s government, the situation there is quite similar, with massive fiscal problems driving yields higher while the government focuses on removing the right of free speech amongst its people if that speech is contra to the government’s policies. While the next UK election need not be held for another 4 years, my take is it will be much sooner as PM Starmer has destroyed his legitimacy with recent policy decisions and will soon be unable to govern. It will only be a matter of time before his own party turns on him.

The governments in Japan, France and the UK are all under increasing pressure as their policy prescriptions have not tackled the key problems in their respective economies. Inflation in Japan and the UK and benefits in France need to be addressed, but it is abundantly clear that the current leadership will not be able to do so effectively. Once again, please explain why people are so bearish the dollar, at least in the long run. While inflation will be higher worldwide and fiat currencies will all suffer vs. real assets, on a relative basis, the dollar doesn’t appear so bad after all.

Ok, let’s move on to the overnight activity as it gets too depressing highlighting all the government failures around the world. While US stocks closed above their worst levels of the session, they were all lower yesterday. That bled into Asia with Japan (-0.9%), Hong Kong (-0.6%) and China (-0.7%) all falling with worse outcomes in some other parts of the region (Australia -1.8%, Philippines -0.75%) although there were winners as well (Korea, India, Taiwan) albeit in less impressive fashion. Perhaps the surprise was Chinese underperformance after PMI Services data there printed at its highest level since May 2024.

But whatever the negativity that existed in Asia was, it did not translate to European shares as they are all higher (CAC +1.0%, DAX +0.8%, FTSE 100 +0.55%, IBEX +0.2%). Now, clearly it is not confidence in government activity that has investors excited. The only data of note was Services PMI, which was mostly as expected except in Germany where it fell to 49.3, far lower than the initial estimate of 50.1 and based on the chart below, seemingly trending lower.

Source: tradingeconomics.com

US futures, too, are higher this morning, with gains of 0.5% to 0.75% for the S&P and NASDAQ.

You won’t be surprised that bond yields continue to drift higher, even in the 10-year space with Treasuries higher by 2bps, although most European sovereign yields have edged down by -1bp in the 10-year space. It is the longer dated yields that continue to see the most pressure with 30-year yields across the US, Europe and Japan all pushing to new highs for the move, and in the case of Japan, new all-time highs.

Source: tradingeconomics.com

This, of course, is the underlying story for virtually all markets right now.

In the commodity markets, oil (-2.1%) has given back yesterday’s gains after reports that OPEC+, which is meeting this weekend, will be raising their output yet again. Whatever the situation is in Russia, whether Ukrainian attacks are reducing supply or not, it seems clear that OPEC is unperturbed and wants to pump as much as possible. In the metals markets, gold (+0.3%) has set another new all-time high and appears to be breaking out from its recent consolidation pattern. I am no market technician (I’m a poet after all), but a consensus seems to be forming that $3700 is coming soon and $4000 will be achieved by early next year.

Source: tradingeconomics.com

The rest of the metals space is little changed this morning with silver holding at its 11-year highs and copper treading water at the levels that existed pre-tariff threats.

Finally, the currency markets, which saw the dollar rally sharply yesterday, are taking a breather with the dollar giving back some of those gains amid a consolidation. In the G10, movement is 0.2% or less, so really nothing and in the EMG bloc, HUF (+0.6%), KRW (+0.5%) and ZAR (+0.3%) are the biggest gainers, with the latter following gold, while traders see the central bank in Hungary maintaining higher rates to fight still, too high inflation of 4.3%. As to Korea, better than expected GDP data helped drive inflows to the currency.

On the data front today, we see JOLTs Job Openings (exp 7.4M) and Factory Orders (-1.4%) this morning and the Fed’s Beige Book is released at 2:00pm. We also hear from two Fed speakers, which given the row over Governor Cook’s tenure at the Fed, may be interesting to see. The market continues to price a 92% probability of a 25bp cut in two weeks’ time, but I suspect that Friday’s NFP data may be the ultimate arbiter there.

I cannot look at the world and conclude that the US is the biggest problem around. However, if we do see weak data on Friday and the market starts to price 50bps of cuts by the Fed, the dollar will decline in the near term. But longer term, the more I read, the more bullish I get on the greenback, at least relative to other currencies.

Good luck

Adf